Best Day Trading Platforms In 2026

The best brokers for day trading offer competitive fees, excellent charting tools, reliable execution, access to global markets, margin trading, have accessible minimum deposits, and are trusted. Dig into our choice of the top day trading platforms that meet these criteria.

Top 6 Platforms For Day Trading 2026

After performing hands-on tests of 140 brokers as of February 2026, these are the 6 best platforms for day trading:

-

1

Interactive Brokers

Interactive Brokers -

2

NinjaTrader

NinjaTrader -

3

eToro USAeToro USA LLC and eToro USA Securities Inc.; Investing involves risk, including loss of principal; Not a recommendation

eToro USAeToro USA LLC and eToro USA Securities Inc.; Investing involves risk, including loss of principal; Not a recommendation -

4

Plus500USTrading in futures and options involves the risk of loss and is not suitable for everyone.

Plus500USTrading in futures and options involves the risk of loss and is not suitable for everyone. -

5

OANDA USCFDs are not available to residents in the United States.

OANDA USCFDs are not available to residents in the United States. -

6

FOREX.com

FOREX.com

What Makes These Brokers The Best For Day Trading?

Here’s a rundown of why these day trading platforms topped our rankings:

- Interactive Brokers is the best broker for day trading in 2026 - Interactive Brokers (IBKR) is a premier brokerage, providing access to 150 markets in 33 countries, along with a suite of comprehensive investment services. With over 40 years of experience, this Nasdaq-listed firm adheres to stringent regulations by the SEC, FCA, CIRO, and SFC, amongst others, and is one of the most trusted brokers for trading around the globe.

- NinjaTrader - NinjaTrader is a US-headquartered and regulated brokerage that specializes in futures trading. There are three pricing plans to suit different needs and budgets, as well as ultra-low margins on popular contracts. The brand's award-winning charting software and trading platform also offers a high-degree of customization and superb technical analysis features.

- eToro USA - eToro is a social investing platform that offers short-term and long-term trading on stocks, ETFs, options and crypto. The broker is well-known for its user-friendly community-centred platform and competitive fees. With FINRA and SIPC oversight and millions of users across the world, eToro is still one of the most respected brands in the industry. eToro securities trading is offered by eToro USA Securities, Inc.

- Plus500US - Plus500US is a well-established broker that entered the US market in 2021. Authorized by the CFTC and NFA, it provides futures trading on forex, indices, commodities, cryptocurrencies, and interest rates. With a 10-minute sign-up, a manageable $100 minimum deposit, and a straightforward web platform, Plus500 continues to strengthen its offering for traders in the US.

- OANDA US - OANDA is a popular brand offering exceptional execution, low deposit requirements and advanced charting and trading platform features. The top-rated brand has over 25 years of experience and is regulated by trusted agencies, including the NFA/CFTC. Around the clock support is available for short-term traders, alongside flexible contract sizes and automated trade executions.

- FOREX.com - Founded in 1999, FOREX.com is now part of StoneX, a financial services organization serving over one million customers worldwide. Regulated in the US, UK, EU, Australia and beyond, the broker offers thousands of markets, not just forex, and provides excellent pricing on cutting-edge platforms.

Top Day Trading Platforms Comparison

Find the best day trading platform for you with our side-by-side comparison of the areas vital to active traders:

| Broker | Fast Execution | Margin Trading | ECN Trading |

|---|---|---|---|

| Interactive Brokers | ✔ | ✔ | ✘ |

| NinjaTrader | ✔ | ✔ | ✘ |

| eToro USA | ✔ | ✔ | ✘ |

| Plus500US | ✔ | ✔ | ✘ |

| OANDA US | ✔ | ✔ | ✘ |

| FOREX.com | ✔ | ✔ | ✔ |

How Safe Are These Platforms For Day Trading?

See how the best day trading providers help safeguard your funds:

| Broker | Trust Rating | Guaranteed Stop Loss | Negative Balance Protection | Segregated Accounts |

|---|---|---|---|---|

| Interactive Brokers | ✘ | ✔ | ✔ | |

| NinjaTrader | ✘ | ✘ | ✘ | |

| eToro USA | ✘ | ✘ | ✔ | |

| Plus500US | ✘ | ✘ | ✔ | |

| OANDA US | ✔ | ✘ | ✘ | |

| FOREX.com | ✘ | ✔ | ✘ |

Mobile Day Trading Comparison

See how good these brokers are for day trading on mobile following our app evaluations:

| Broker | Mobile Apps | iOS Rating | Android Rating | Smart Watch App |

|---|---|---|---|---|

| Interactive Brokers | iOS & Android | ✔ | ||

| NinjaTrader | iOS & Android | ✘ | ||

| eToro USA | iOS & Android | ✘ | ||

| Plus500US | iOS & Android | ✘ | ||

| OANDA US | iOS & Android | ✘ | ||

| FOREX.com | iOS & Android | ✘ |

Are The Top Day Trading Brokers Good For Beginners?

Beginners should choose brokers that allow day trading in a demo account with other features new traders need:

| Broker | Demo Account | Minimum Deposit | Minimum Trade | Education Rating | Support Rating |

|---|---|---|---|---|---|

| Interactive Brokers | ✔ | $0 | $100 | ||

| NinjaTrader | ✔ | $0 | 0.01 Lots | ||

| eToro USA | ✔ | $100 | $10 | ||

| Plus500US | ✔ | $100 | Variable | ||

| OANDA US | ✔ | $0 | 0.01 Lots | ||

| FOREX.com | ✔ | $100 | 0.01 Lots |

Are The Top Day Trading Brokers Good For Advanced Traders?

Experienced traders should look for value-add features to enhance the day trading experience:

| Broker | Automated Trading | VPS | AI | Pro Account | Leverage | Low Latency | Extended Hours |

|---|---|---|---|---|---|---|---|

| Interactive Brokers | Capitalise.ai, TWS API | ✘ | ✔ | ✘ | 1:50 | ✔ | ✔ |

| NinjaTrader | NinjaScript or via Automated Trading Interface | ✘ | ✘ | ✘ | 1:50 | ✔ | ✘ |

| eToro USA | ✘ | ✘ | ✘ | ✘ | - | ✔ | ✔ |

| Plus500US | - | ✘ | ✘ | ✘ | Variable | ✔ | ✘ |

| OANDA US | Expert Advisors (EAs) on MetaTrader | ✘ | ✔ | ✘ | 1:50 | ✔ | ✘ |

| FOREX.com | Expert Advisors (EAs) on MetaTrader | ✔ | ✔ | ✘ | 1:50 | ✔ | ✘ |

Compare The Ratings Of Top Day Trading Platforms

See how the top brokers for day trading scored in every key area in our hands-on tests:

| Broker | Trust | Platforms | Assets | Mobile | Fees | Accounts | Research | Education | Support |

|---|---|---|---|---|---|---|---|---|---|

| Interactive Brokers | |||||||||

| NinjaTrader | |||||||||

| eToro USA | |||||||||

| Plus500US | |||||||||

| OANDA US | |||||||||

| FOREX.com |

Compare Day Trading Fees

The cost of active trading can add up over time - here's how our top providers stack up on pricing:

| Broker | Cost Rating | Fixed Spreads | Inactivity Fee |

|---|---|---|---|

| Interactive Brokers | ✘ | $0 | |

| NinjaTrader | ✘ | $25 | |

| eToro USA | ✔ | $10 | |

| Plus500US | ✘ | $0 | |

| OANDA US | ✘ | $0 | |

| FOREX.com | ✘ | $15 |

How Popular Are These Day Trading Platforms?

Many active traders prefer the most popular day trading firms, i.e those with the most clients:

| Broker | Popularity |

|---|---|

| Interactive Brokers | |

| eToro USA | |

| NinjaTrader | |

| FOREX.com |

Why Day Trade With Interactive Brokers?

"Interactive Brokers is one of the best brokers for advanced day traders, providing powerful charting platforms, real-time data, and customizable layouts, notably through the new IBKR Desktop application. Its superb pricing and advanced order options also make it highly attractive for day traders, while its diverse range of equities is still among the best in the industry."

Christian Harris, Reviewer

Interactive Brokers Quick Facts

| Demo Account | Yes |

|---|---|

| Instruments | Stocks, Options, Futures, Forex, Funds, Bonds, ETFs, Mutual Funds, CFDs, Cryptocurrencies |

| Regulator | FCA, SEC, FINRA, CFTC, CBI, CIRO, SFC, MAS, MNB, FINMA, AFM |

| Platforms | Trader Workstation (TWS), IBKR Desktop, GlobalTrader, Mobile, Client Portal, AlgoTrader, OmniTrader, TradingView, eSignal, TradingCentral, ProRealTime, Quantower |

| Minimum Deposit | $0 |

| Minimum Trade | $100 |

| Leverage | 1:50 |

| Account Currencies | USD, EUR, GBP, CAD, AUD, INR, JPY, SEK, NOK, DKK, CHF, AED, HUF |

Pros

- There's a vast library of free or paid third-party research subscriptions catering to all types of traders, plus you can enjoy commission reimbursements from IBKR if you subscribe to Toggle AI.

- While primarily geared towards experienced traders, IBKR has made moves to broaden its appeal in recent years, reducing its minimum deposit from $10,000 to $0.

- IBKR continues to deliver unmatched access to global stocks with tens of thousands of equities available from 100+ market centres in 24 countries, most recently the Saudi Stock Exchange.

Cons

- IBKR provides a wide range of research tools, but their distribution across trading platforms and the web-based 'Account Management' page lacks consistency, leading to a confusing user experience.

- Support can be slow and frustrating based on tests, so you might find it challenging to reach customer service representatives promptly or encounter delays in resolving issues.

- TWS’s learning curve is steep, and beginners may find it challenging to navigate the platform and understand all the features. Plus500's web platform is much better suited to new traders.

Why Day Trade With NinjaTrader?

"NinjaTrader continues to meet the demands of active futures traders looking for low fees and premium analysis tools. The platform hosts top-rate charting features including hundreds of indicators and 10+ chart types."

Tobias Robinson, Reviewer

NinjaTrader Quick Facts

| Demo Account | Yes |

|---|---|

| Instruments | Forex, Stocks, Options, Commodities, Futures, Crypto |

| Regulator | NFA, CFTC |

| Platforms | NinjaTrader Desktop, Web & Mobile, eSignal |

| Minimum Deposit | $0 |

| Minimum Trade | 0.01 Lots |

| Leverage | 1:50 |

| Account Currencies | USD |

Pros

- Low fees are offered, with $50 day trading margins & commissions from $.09 per micro contract

- NinjaTrader continues to deliver comprehensive charting software for active day traders with bespoke technical indicators and widgets

- You can get thousands of add-ons and applications from developers in 150+ countries

Cons

- Non forex and futures trading requires signing up with partner brokers

- There is a withdrawal fee on some funding methods

- The premium platform tools come with an extra charge

Why Day Trade With eToro USA?

"eToro remains a top pick for traders looking for leading social investing and copy trading services. With a low deposit, zero commissions and an intuitive platform, the broker will meet the needs of newer day traders."

Jemma Grist, Reviewer

eToro USA Quick Facts

| Demo Account | Yes |

|---|---|

| Instruments | Stocks, Options, ETFs, Crypto |

| Regulator | SEC, FINRA |

| Platforms | eToro Trading Platform & CopyTrader |

| Minimum Deposit | $100 |

| Minimum Trade | $10 |

| Account Currencies | USD |

Pros

- eToro USA Securities is a trustworthy, SEC-regulated broker that is a member of FINRA and SIPC

- The low minimum deposit and straightforward account opening process means beginners can get started quickly

- Investors can access Smart Portfolios for a more hands-off approach, covering a range of sectors and markets such as renewable energy and artificial intelligence

Cons

- The proprietary terminal doesn't support trading bots and there are no additional stock market analysis tools

- There's no MetaTrader 4 platform integration for traders who are accustomed to using third-party charting tools

- Average fees may cut into the profit margins of day traders

Why Day Trade With Plus500US?

"Plus500US stands out as an excellent choice for beginners, offering a very user-friendly platform, low day trading margins, and access to the Futures Academy to enhance trading skills. Its powerful tools and reliable service helped it scoop second place in DayTrading.com's annual 'Best US Broker' award."

Michael MacKenzie, Reviewer

Plus500US Quick Facts

| Demo Account | Yes |

|---|---|

| Instruments | Futures on Cryptocurrencies, Metals, Agriculture, Forex, Interest rates, Energy, Equity Index future contracts |

| Regulator | CFTC, NFA |

| Platforms | WebTrader, App |

| Minimum Deposit | $100 |

| Minimum Trade | Variable |

| Leverage | Variable |

| Account Currencies | USD |

Pros

- The trading app provides a terrific user experience with a modern design, a clean layout and mobile-optimized charts

- Plus500 is a publicly traded company with a good reputation, over 24 million traders, and a sponsor of the Chicago Bulls.

- The Futures Academy is an excellent resource for new traders with engaging videos and easy-to-follow articles, while the unlimited demo account is great for testing strategies

Cons

- Plus500US does not offer social trading capabilities, a feature available at alternatives like eToro US which could strengthen its offering for aspiring traders

- The proprietary platform is user-friendly but lacks advanced technical analysis tools found in third-party solutions like MetaTrader 4

- Although support response times were fast during tests, there is no telephone assistance

Why Day Trade With OANDA US?

"OANDA remains an excellent broker for US day traders seeking a user-friendly platform with premium analysis tools and a straightforward joining process. OANDA is also heavily regulated with a very high trust score."

Jemma Grist, Reviewer

OANDA US Quick Facts

| Demo Account | Yes |

|---|---|

| Instruments | Forex, Crypto with Paxos (Cryptocurrencies are offered through Paxos. Paxos is a separate legal entity from OANDA) |

| Regulator | NFA, CFTC |

| Platforms | OANDA Trade, MT4, TradingView, AutoChartist |

| Minimum Deposit | $0 |

| Minimum Trade | 0.01 Lots |

| Leverage | 1:50 |

| Account Currencies | USD, EUR, GBP, CAD, AUD, JPY, CHF, HKD, SGD |

Pros

- The broker offers a transparent pricing structure with no hidden charges

- There's a strong selection of 68 currency pairs for dedicated short-term forex traders

- The proprietary OANDA web platform continues to deliver a highly competitive charting environment, including 65+ technical indicators powered by TradingView

Cons

- There's only a small range of payment methods available, with no e-wallets supported

- The range of day trading markets is limited to forex and cryptos only

- It's a shame that customer support is not available on weekends

Why Day Trade With FOREX.com?

"FOREX.com remains a best-in-class brokerage for active forex traders of all experience levels, with over 80 currency pairs, tight spreads from 0.0 pips and low commissions. The powerful charting platforms collectively offer over 100 technical indicators, as well as extensive research tools."

Christian Harris, Reviewer

FOREX.com Quick Facts

| Demo Account | Yes |

|---|---|

| Instruments | Forex, Stock CFDs, Futures, Futures Options |

| Regulator | NFA, CFTC |

| Platforms | WebTrader, Mobile, MT4, MT5, TradingView |

| Minimum Deposit | $100 |

| Minimum Trade | 0.01 Lots |

| Leverage | 1:50 |

| Account Currencies | USD, EUR, GBP, CAD, AUD, JPY, CHF, PLN |

Pros

- There’s a wealth of educational resources including tutorials, webinars, and a stacked YouTube channel to help you get educated in the financial markets.

- With over 20 years of experience, excellent regulatory oversight, and multiple accolades including runner-up in our 'Best Forex Broker' awards, FOREX.com boasts a global reputation as a trusted brokerage.

- FOREX.com offers industry-leading forex pricing starting from 0.0 pips, alongside competitive cashback rebates of up to 15% for serious day traders.

Cons

- FOREX.com's MT4 platform offers approximately 600 instruments, significantly fewer than the over 5,500 available on its non-MetaTrader platforms.

- Funding options are limited compared to leading alternatives like IC Markets and don’t include many popular e-wallets, notably UnionPay and POLi.

- There’s no negative balance protection for US clients, so you may find yourself owing more money than your initial deposit into your account.

How We Rate Day Trading Platforms

Below, we explain the key factors our team, and you, should consider when choosing a broker for day trading.

Trust

Choosing a trustworthy day trading broker is the most important consideration. This will help protect you from scams and unfair trading practices while safeguarding your funds.

We only recommend day trading platforms that we trust, an assessment we continuously make by considering the quality of regulatory licenses, the broker’s years in the industry, and their reputation.

You can see which bodies regulate our best brokers below.

| Interactive Brokers | NinjaTrader | eToro USA | Plus500US | OANDA US | |

|---|---|---|---|---|---|

| Trust Rating | |||||

| Regulators | FCA, SEC, FINRA, CFTC, CBI, CIRO, SFC, MAS, MNB, FINMA, AFM | NFA, CFTC | SEC, FINRA | CFTC, NFA | NFA, CFTC |

| Visit | Visit | Visit | Visit eToro USA LLC and eToro USA Securities Inc.; Investing involves risk, including loss of principal; Not a recommendation |

Visit Trading in futures and options involves the risk of loss and is not suitable for everyone. |

Visit CFDs are not available to residents in the United States. |

| Review | Review | Review | Review | Review | Review |

Fees

Choosing a broker with low fees is critical when you are day trading because a large volume of trades can lead to significant costs, impacting overall profitability.

Our recommended platforms offer low day trading fees, an evaluation we make year-on-year by recording and comparing trading and non-trading fees.

Importantly, we also weigh costs with the quality of the services provided – if you simply pick the broker with the lowest fees, you might compromise on platform features or face hidden costs later.

You can compare the typical fees you will incur at our best brokers below.

| Interactive Brokers | NinjaTrader | eToro USA | Plus500US | OANDA US | |

|---|---|---|---|---|---|

| Fee Rating | |||||

| EUR/USD Spread | 0.08-0.20 bps x trade value | 1.3 | 0.75 | 1.6 | |

| Oil Spread | 0.25-0.85 | ||||

| Stock Fee | 0.003 | $0 | |||

| Inactivity Fee | $0 | $25 | $10 | $0 | $0 |

| Visit | Visit | Visit | Visit eToro USA LLC and eToro USA Securities Inc.; Investing involves risk, including loss of principal; Not a recommendation |

Visit Trading in futures and options involves the risk of loss and is not suitable for everyone. |

Visit CFDs are not available to residents in the United States. |

| Review | Review | Review | Review | Review | Review |

Platforms

Choosing a broker with a high-quality charting platform is essential for day trading because most intraday traders use technical analysis to identify trading opportunities.

Most brokers offer several platforms to choose from; some will tick the boxes for the average day trader with an intuitive design and user-friendly interface, while others offer more advanced charting packages and analysis tools for the veteran trader.

I recommend using a demo account to make sure the platform works for you.

A demo account will allow you to explore the platform risk-free and assess the broker’s reliability before trading with real money.

Our recommended brokers offer top-rate platforms, an assessment we routinely make by testing the software available and evaluating their usability, charting packages and trading tools.

You can compare the platforms and apps available at our best brokers below.

| Interactive Brokers | NinjaTrader | eToro USA | Plus500US | OANDA US | |

|---|---|---|---|---|---|

| Platform Rating | |||||

| Charting Platforms | Trader Workstation (TWS), IBKR Desktop, GlobalTrader, Mobile, Client Portal, AlgoTrader, OmniTrader, TradingView, eSignal, TradingCentral, ProRealTime, Quantower | NinjaTrader Desktop, Web & Mobile, eSignal | eToro Trading Platform & CopyTrader | WebTrader, App | OANDA Trade, MT4, TradingView, AutoChartist |

| Mobile App | iOS & Android | iOS & Android | iOS & Android | iOS & Android | iOS & Android |

| Automated Trading | Capitalise.ai, TWS API | NinjaScript or via Automated Trading Interface | No | Expert Advisors (EAs) on MetaTrader | |

| Visit | Visit | Visit | Visit eToro USA LLC and eToro USA Securities Inc.; Investing involves risk, including loss of principal; Not a recommendation |

Visit Trading in futures and options involves the risk of loss and is not suitable for everyone. |

Visit CFDs are not available to residents in the United States. |

| Review | Review | Review | Review | Review | Review |

Markets

Choosing a broker that provides trading opportunities on the markets you are interested in is critical, as not every firm offers every asset type.

Our recommended brokers provide access to popular global markets, such as stocks, forex and commodities, something we confirm by signing in to brokers’ platforms to record the assets available.

We also consider the availability of trading vehicles that cater specifically to day traders, such as contracts for difference (CFDs). This derivative allows you to speculate on rising and falling prices without owning the underlying asset.

You can compare the financial markets available at our best brokers below.

| Interactive Brokers | NinjaTrader | eToro USA | Plus500US | OANDA US | |

|---|---|---|---|---|---|

| Markets Rating | |||||

| Day Trading Markets | Stocks, Options, Futures, Forex, Funds, Bonds, ETFs, Mutual Funds, CFDs, Cryptocurrencies | Forex, Stocks, Options, Commodities, Futures, Crypto | Stocks, Options, ETFs, Crypto | Futures on Cryptocurrencies, Metals, Agriculture, Forex, Interest rates, Energy, Equity Index future contracts | Forex, Crypto with Paxos (Cryptocurrencies are offered through Paxos. Paxos is a separate legal entity from OANDA) |

| Visit | Visit | Visit | Visit eToro USA LLC and eToro USA Securities Inc.; Investing involves risk, including loss of principal; Not a recommendation |

Visit Trading in futures and options involves the risk of loss and is not suitable for everyone. |

Visit CFDs are not available to residents in the United States. |

| Review | Review | Review | Review | Review | Review |

Note market access may vary depending on jurisdictional rules.

Order Execution

Choosing a broker with fast execution speeds is crucial for day trading due to the rapid pace of market fluctuations. A delay in order execution could lead to you missing trades or less favorable prices.

Execution quality is also a critical consideration and encompasses factors like speed, price, and the probability of execution, helping to gauge whether you will secure the optimal trade.

Our recommended platforms offer fast and reliable execution, a judgement we make by reviewing execution policies and considering average execution speeds (where data is available).

You can see whether our best brokers meet our execution benchmarks below.

| Interactive Brokers | NinjaTrader | eToro USA | Plus500US | OANDA US | |

|---|---|---|---|---|---|

| Fast Execution | Yes | Yes | Yes | Yes | Yes |

| Visit | Visit | Visit | Visit eToro USA LLC and eToro USA Securities Inc.; Investing involves risk, including loss of principal; Not a recommendation |

Visit Trading in futures and options involves the risk of loss and is not suitable for everyone. |

Visit CFDs are not available to residents in the United States. |

| Review | Review | Review | Review | Review | Review |

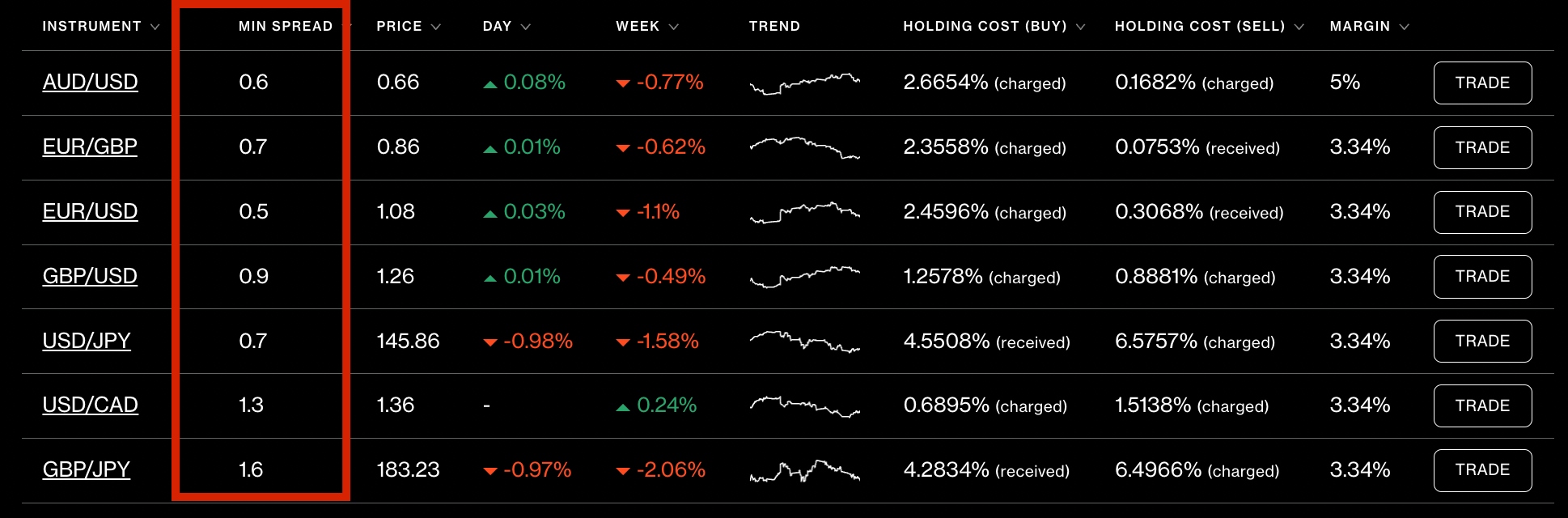

Leverage & Margin Requirements

Choosing a broker with access to leverage trading is an important consideration for day trading, as it can magnify your profits by enabling control of larger positions with less capital.

However, it also escalates the risk of larger losses, so beginners in particular should be very careful. Effective risk management is crucial, alongside an awareness of your broker’s margin requirements which set the minimum capital you need.

You can compare the leverage available at our best brokers below.

| Interactive Brokers | NinjaTrader | eToro USA | Plus500US | OANDA US | |

|---|---|---|---|---|---|

| Margin Trading | Yes | Yes | Yes | Yes | Yes |

| Leverage Available | 1:50 | 1:50 | Variable | 1:50 | |

| Visit | Visit | Visit | Visit eToro USA LLC and eToro USA Securities Inc.; Investing involves risk, including loss of principal; Not a recommendation |

Visit Trading in futures and options involves the risk of loss and is not suitable for everyone. |

Visit CFDs are not available to residents in the United States. |

| Review | Review | Review | Review | Review | Review |

Note leverage may vary depending on jurisdictional rules and the market being traded.

Minimum Deposit

Choosing a broker with a low minimum deposit will be particularly important for new day traders on a budget.

Our recommend day trading platforms have achievable entry requirements, an evaluation we make by weighing the minimum investment with the suitability of accounts for different traders, from beginners through to intermediate and advanced traders.

You can compare the account minimums at our best brokers below.

| Interactive Brokers | NinjaTrader | eToro USA | Plus500US | OANDA US | |

|---|---|---|---|---|---|

| Minimum Deposit | $0 | $0 | $100 | $100 | $0 |

| Minimum Trade | $100 | 0.01 Lots | $10 | Variable | 0.01 Lots |

| Visit | Visit | Visit | Visit eToro USA LLC and eToro USA Securities Inc.; Investing involves risk, including loss of principal; Not a recommendation |

Visit Trading in futures and options involves the risk of loss and is not suitable for everyone. |

Visit CFDs are not available to residents in the United States. |

| Review | Review | Review | Review | Review | Review |

Methodology

To find the best brokers for day trading we considered quantitative data and qualitative insights gathered during our comprehensive brokerage reviews, focusing on seven criteria:

- We verified that brokers are authorized by a trusted regulator

- We recorded and analyzed the fees you will encounter when day trading

- We tested the suitability of the platform for short-term traders

- We compared the markets available for day trading

- We investigated the speed of order executions

- We determined the level of support for leveraged trading

- We checked the minimum deposit required to start trading

Bottom Line

Choosing a broker for day trading is a personal decision that will depend on your individual needs. However, our selection of top-rated platforms is a great place to start. Our exhaustive evaluation process takes into account the key factors that determine a broker’s suitability for short-term trading.

FAQ

What Is Day Trading?

Day trading is a strategy where individuals buy and sell financial instruments within the same trading day, seeking to profit from short-term price movements.

What Are The Benefits Of Day Trading?

Day trading offers the potential for fast profits as traders take advantage of short-term price fluctuations. Additionally, day traders can operate with reduced overnight risk since they often close positions before the market closes.

What Are The Risks Of Day Trading?

Day trading entails several risks. Firstly, there is the risk of financial loss if you make losing trades because of market volatility and emotional decision-making.

There is also the risk of signing up with fraudulent brokers operating scams, making it important to choose a trusted and regulated day trading broker.

Do I Need A Broker To Day Trade?

Yes, you normally need a broker to day trade. Your broker will provide a platform and the infrastructure to execute intraday trades in financial markets.

What Brokers Do Day Traders Use?

We have ranked the best brokers for day traders. In conducting our comparison, we considered multiple factors, from regulatory credentials and fees to the quality of the platform for intraday trading, the speed of order executions, and the minimum deposit to open an account.

How Do I Open A Day Trading Account?

To open a day trading account you will need to sign up with a broker. You usually need to provide basic contact details and information about your trading experience and source of funds, a process which often takes around 15 minutes.

Most regulated day trading brokers also need to verify your identity and address before you can unlock all trading features.

How Much Money Do I Need To Start Day Trading?

Account minimums vary between day trading platforms. Some require thousands of dollars in return for sophisticated features that cater to advanced traders. Alternatively, many brokers have an accessible minimum deposit of less than $500. Some brokerages even have no minimum deposit.