Margin Trading

Trading on margin – using borrowed money from a broker to leverage your trading results – is a speculative practice that multiplies results by some factor. When done successfully it can greatly increase your profits, but it can also be risky as losses are equally magnified.

This guide to margin trading for beginners explains how it works, the pros and cons, plus tips for getting started.

Quick Introduction

- Margin trading involves borrowing money from a brokerage to increase your purchasing power.

- The ‘margin’ is the amount of money you must deposit, which acts as collateral for the loan.

- Trading on margin is also known as trading with leverage, and it can amplify both profits and losses.

- Brokers will issue a margin call if your account falls below the specified level. You will then be required to deposit more funds, otherwise, the firm may sell your securities or liquidate your account.

Best Margin Trading Brokers

These 4 brokers are the best for trading on margin based on rates, rules and safety:

Download our free Margin Trading For Beginners PDF.

What Is Margin Trading?

Margin trading involves opening a position using a deposit that represents a fraction of the full value of the trade. Your broker will then lend you the rest, with your deposit acting as collateral to cover the risk of your exposed position.

For example, if you had $100 in your account and opened a position with 10% margin (or 1:10 leverage), you would gain exposure to a total value of $1000 (10 x $100).

Yet while the central purpose of margin trading is to augment profits, trading should always be considered from a “defensive” perspective, as playing good defence is what will keep you in the game over the long run.

How It Works

Margin trading amplifies both gains and losses. However, margin traders hope that the profit they make will be greater than the cost of borrowing the money.

Firms often charge their own margin rate which is ongoing interest charged on the loan.

Initial Margin

The initial required margin depends on the asset being traded and is normally calculated as a percentage of the asset’s price.

The available margin that you can trade with also depends on your jurisdiction and relevant regulatory rules.

In the EU and UK, margin requirements for CFDs on major forex pairs are typically up to 3.33% (or 1:30 leverage), whilst in a US stock brokerage account, you can borrow up to 50% (or 1:2).

Maintenance Margin

The maintenance margin refers to the amount of money you need in your account to cover the current value of the position including any losses.

If your position moves against you, your brokerage will request funds from you to keep the position open.

Margin Call

The firm will issue a margin call if the capital in your account falls below the minimum amount required to keep the position open.

You will be sent an alert to deposit more funds into the account or close out positions to get the account back up to the required level to cover the losses.

If you do not meet the required margin in the allotted time, the brokerage may automatically liquidate your positions. This is known as the stop-out level.

These thresholds can vary between brands. At XTB, for example, a margin call occurs when the margin level falls below 100% and the platform will begin liquidating positions when the level falls below 50% (the stop-out level).

Importantly, firms often lay out their own rules and have the latitude to modify and adopt stipulations to protect their personal business interests. This can mean enforcing certain minimum equity requirements or restraining the buying power of certain clients.

You should always check with your margin trading provider before signing up to understand what exactly is required and what specific rules might apply.

How To Avoid

A solid risk management strategy is key.

A stop order, for example, is a risk parameter set by the trader which will automatically close a position when it reaches a certain price.

This can be an effective way to decide in advance how much you are willing to risk before losses become too heavy.

There are also other effective options. For example, you can avoid opening too many positions simultaneously and avoid trading too many assets with high volatility, such as cryptocurrency.

Pros & Cons

Pros

- Greater purchasing power – With margin trading, you can gain more market exposure than your capital would otherwise allow

- Larger profits – Any gains made from a collateralized position are based on the full exposure of the trade, not just the initial deposit

- Acceptable risk – Margin trading can be safer than standard cash-only trading when it incentivises a trader to take a low- to moderate-risk strategy – knowing leverage will help increase whatever gains are made – rather than a high-risk strategy to compensate, such as taking large concentrated positions in high-risk securities

Cons

- Larger losses – In the same vein, losses are amplified as they are based on the full value of the position. Without risk management tools in place, losses can be significant

- Fees and interest charges – Many brands charge an ongoing interest (known as the margin rate) on borrowed funds. Fortunately, brokers with the lowest margin rates keep this fee competitive

- Margin calls require additional capital – If your firm initiates an alert, you will be required to deposit further capital to maintain open positions

How To Trade On Margin

1. Open A Margin Trading Account

To get started with the best margin brokers, you will need to complete an online registration form and confirm your identity. You will also be required to put down a minimum deposit to open the account.

Tip for beginners: If you want to practice margin trading before risking real funds, most firms offer demo accounts with a virtual bankroll and flexible leverage.

2. Choose An Instrument

Once you have opened a margin trading account you can pick a market to speculate on.

Some of the most popular asset classes among retail traders are forex, stocks, commodities and cryptocurrencies.

These are normally available as contracts for difference (CFDs), which allows you to go both long and short while trading on margin.

3. Place A Trade

You can now check the margin requirements, choose a position size, apply any risk management parameters such as a stop loss order, and place your trade.

It is important to closely monitor market volatility and any movements. This is so you can act quickly if the market moves against you, and you begin approaching your margin call level.

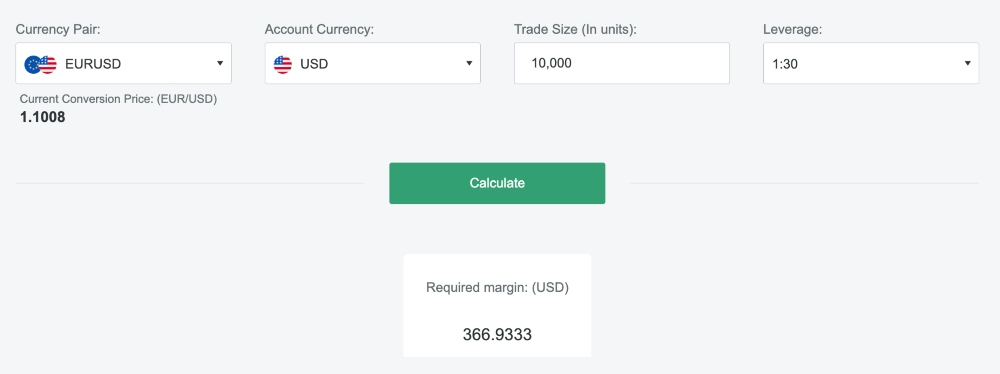

Margin Calculator

Many firms, such as XM, provide margin trading calculators. Take a look at the margin calculator at XM to see what a trade might cost to open.

Bottom Line

Trading on margin can be risky. However, experienced investors with solid trading strategies have the potential to greatly increase their purchasing power.

Whilst this can potentially magnify profits, it can also cause significant losses, so we always recommend a strict risk management system for all trades.

In addition, it is worth registering with recommended brokers that offer competitive margin rates.

FAQ

What Is Margin Trading Good For?

Trading on margin allows individuals and institutions to increase their market exposure and profit potential by essentially taking a loan from their brokerage to open positions they would not otherwise have the capital to open.

While profits can be amplified for successful traders, the risk-to-reward ratio worsens and failed trades can quickly drain portfolios.

Are There Margin Trading Fees?

Margin trading is not a free service provided by platforms; much like taking out a loan, borrowing money for leveraged trading can come with an additional fee on top of the repayment of the loan.

Vantage, eToro and AvaTrade all charge a competitive margin rate between 1% and 3%.

Is Margin Pattern Trading Legal In The US?

Given the risks associated with margin trading, the US SEC and FINRA implemented a regulation requiring automatic margin calls for more than four large day trades in a five-day period.

While not illegal, those flagged as pattern traders must prove they have the capital to cover their risks and maintain enough accessible cash in their trading balance.

Recommended Reading

Article Sources

- Margin Trading Rules, FINRA

- Margin: Borrowing Money to Pay for Stocks, SEC

- What Is A Margin Call? XTB

- FxPro Margin Trading Calculator

- XM Margin Trading Calculator

The writing and editorial team at DayTrading.com use credible sources to support their work. These include government agencies, white papers, research institutes, and engagement with industry professionals. Content is written free from bias and is fact-checked where appropriate. Learn more about why you can trust DayTrading.com