Vantage Review 2026

See the best Vantage alternatives in your location.

Awards

- Most Trusted Broker Global - International Business Magazine Award 2025

- Best Global Broker - Ultimate Fintech Awards LATAM 2025

- Best Forex Affiliate Program - Global Brand Awards 2025

- Best CFD Broker Global - Global Brands Magazine 2024

- Best Trade Execution - Global Forex Awards 2023

- Best Multi-Asset Broker Global - Global Business and Finance Magazine 2023

Pros

- Vantage caters to hands-off investors with beginner-friendly social trading via ZuluTrade & Myfxbook

- Vantage has bolstered its algorithmic trading tools for advanced traders with AutoFibo EA identifying reversal opportunities

- Vantage maintains its high trust score thanks to its strong reputation and top-tier regulation from the FCA and ASIC

Cons

- A steep $10,000 deposit is needed for the best trading conditions, which include the $1.50 commission per side

- It's a shame that some clients will need to register with the offshore entity, which offers less regulatory protection

- The average execution speeds of 100ms to 250ms are slower than alternatives based on tests

Vantage Review

In this Vantage review, I share the key findings from my comprehensive assessment of the broker. I evaluate the firm in all the important categories, including regulation and trust, investment offering, trading fees, account options, and platform functionality. I also compare Vantage to alternatives and explain what could be improved.

Regulation & Trust

Choosing a broker that is licensed by a trustworthy regulator should be a top priority. Strong regulatory oversight helps protect you from scams and gives you access to robust safeguards like negative balance protection and jurisdictional restrictions on leverage.

I have to consider whether I can put my trust in each broker I review. Thankfully, Vantage gets an easy seal of approval and a very high trust score from me.

Founded in 2009, the broker’s long history is a great sign of a well-established business with strong credentials. The firm’s notable reputation is also reinforced by its collection of prestigious awards. Additionally, I didn’t find a history of scams or malpractice at Vantage during my research.

As for licensing, I’m glad to see that many clients will be registered under tier-one-regulated entities. For example, Vantage Global Prime Pty Ltd is regulated by the Australian Securities and Investments Commission (ASIC), whilst Vantage Global Prime LLP is authorized by the UK Financial Conduct Authority (FCA).

As a result, I am reassured to find required security and fund protection measures in place, including negative balance protection and access to compensation schemes in the event the brokerage runs into insolvency issues. As you can see from my comparison table below, Vantage stands up well against two of the most tightly regulated brokers in the industry, Pepperstone and AvaTrade.

Considering the negatives, though, it is a shame that the broker’s global entity, Vantage Global Limited, is regulated offshore by the Vanuatu Financial Services Commission (VFSC). The VFSC is not a highly respected authority and does not offer the same degree of protection for retail traders in my view.

| Vantage | Interactive Brokers | FOREX.com | |

|---|---|---|---|

| Regulator | FCA, ASIC, FSCA, VFSC | FCA, SEC, FINRA, CFTC, CBI, CIRO, SFC, MAS, MNB, FINMA, AFM | NFA, CFTC |

| Segregated Accounts | Yes | Yes | Yes |

| Negative Balance Protection | Yes | Yes | Yes |

| Visit | Visit | Visit | Visit |

| Review | Review | Review | Review |

Accounts & Banking

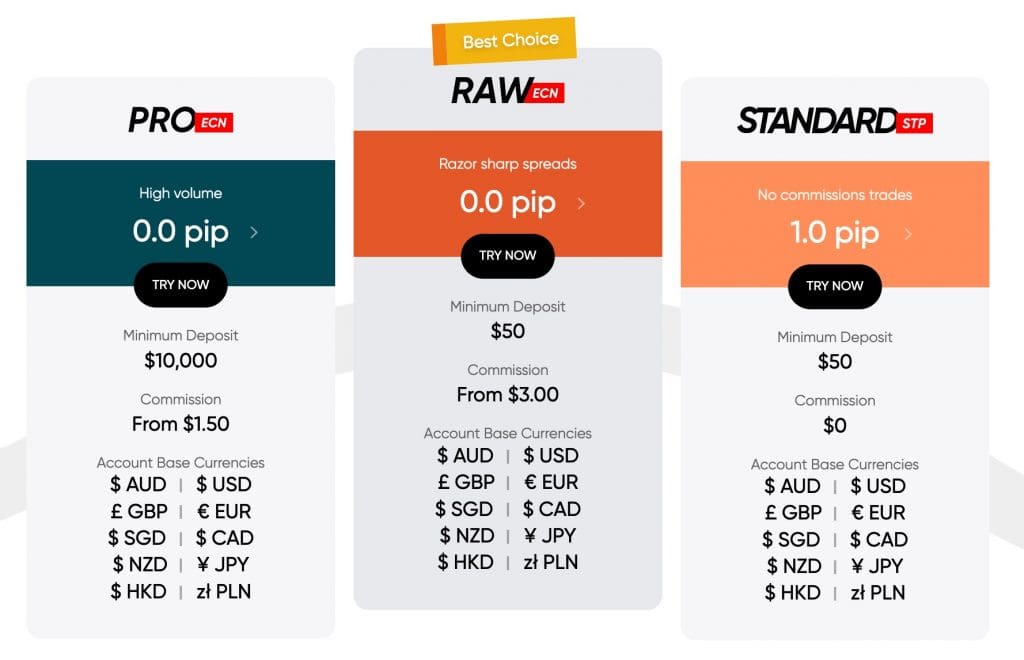

I found that three live accounts are available: Standard STP, RAW ECN and Pro ECN. Some jurisdictions can also access a Cent solution. Importantly, the range of STP and ECN accounts means that different trading styles and preferences are catered to.

The Standard STP account is my pick for beginners – commission-free trading is available with floating spreads from 1.0 pip. The RAW ECN account is better for seasoned traders looking for the tightest spreads with a $3 commission, while Pro ECN is designed for high-volume traders with a very low commission of $1.50 in return for a $10,000 minimum deposit.

I’ve been particularly impressed with the wide range of up to 10 base currencies in the Standard and RAW accounts and the accessible $50 minimum deposit. This makes Vantage a good option for global traders and those with less starting capital.

I also like that all accounts are compatible with the MetaTrader 4 (MT4) and MetaTrader 5 (MT5) platforms, as well as the broker’s full range of assets. This ensures that beginners won’t miss out on the opportunity to trade on the same platforms as experienced traders.

Helpfully for Islamic investors, a swap-free trading solution is available. Additional account options include joint accounts, company trading accounts and trust trading accounts (either as individuals or as a partnership). There are also professional accounts with increased leverage, but fewer safeguards.

While I rate the competitive ECN accounts, I think it’s a shame that some serious traders will miss out on the best trading conditions in the Pro ECN solution. The minimum deposit is pretty steep at $10,000 – more than other pro-level accounts I have reviewed.

How To Open A Vantage Account

Opening a live account at Vantage is relatively easy. I was able to register in 4 steps and log in within a few minutes:

- Enter your email address and personal details in the sign-up form

- Choose the account parameters, including platform and currency

- Submit your ID and address documents

- You will be emailed your login details

| Vantage | Interactive Brokers | FOREX.com | |

|---|---|---|---|

| Minimum Deposit | $50 | $0 | $100 |

| Minimum Trade | 0.01 Lots | $100 | 0.01 Lots |

| Visit | Visit | Visit | Visit |

| Review | Review | Review | Review |

Deposits & Withdrawals

I have no complaints about the wide range of funding methods at Vantage, with plenty of accessible options for global clients. I can deposit using bank wire transfers, credit/debit cards and e-wallets such as Skrill, Neteller and AstroPay. As you can see from my comparison table below, Vantage stands up well against top competitors when it comes to available payment methods.

It’s also good to see that bank transfers, cards and some e-wallets are fee-free. Skrill and Neteller charge their own fees.

Funds deposited via bank cards and most e-wallets are processed instantly. I tested the broker’s processing times using both a Visa card and Neteller and found that my funds were available immediately.

As expected, wire transfers are processed within 1 – 2 business days for domestic transfers and 2 – 5 business days for international transfers.

Withdrawals can be made using the same methods and are processed daily. In most cases, if the withdrawal request is received before 12:00 pm AEST, the withdrawal will take place the same working day, otherwise, it will be processed the next working day. Either way, this is faster than many brokers I have evaluated.

I appreciate that there is no minimum transaction on credit card and international bank transfer withdrawals but there are minimums on most other methods starting from $0.01 for Perfect Money.

Again, Vantage doesn’t charge any internal fees for withdrawals, which is a positive if you make regular withdrawals.

| Vantage | Interactive Brokers | FOREX.com | |

|---|---|---|---|

| Payment Methods | AstroPay, Bitwallet, BPAY, Credit Card, Debit Card, FasaPay, JCB Card, Neteller, PayPal, Skrill, Sticpay, Swift, UnionPay, Visa, Volet, Wire Transfer | ACH Transfer, Automated Customer Account Transfer Service, Cheque, Debit Card, TransferWise, Wire Transfer | ACH Transfer, Credit Card, Debit Card, Mastercard, Neteller, PayNow, Skrill, Visa, Wire Transfer |

| Visit | Visit | Visit | Visit |

| Review | Review | Review | Review |

Bonuses & Promotions

When I used Vantage, I found that clients registering with the offshore entity can access several bonus deals and promotional offers.

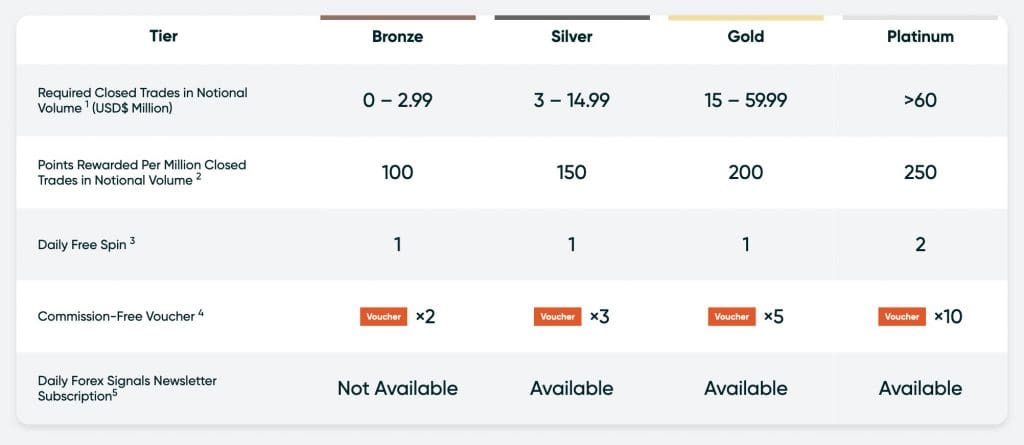

For example, traders can earn V-points in the Vantage Rewards scheme which can be redeemed for cash, deposit rebate vouchers, lucky draws, profit boosters and more.

There is also a deposit bonus scheme where you can earn a 50% credit bonus on deposit amounts from $500 up to $196,000+.

I feel the Vantage Rewards scheme will be most valuable for active traders, though I strongly urge traders to approach any financial incentives with caution. I also don’t recommend picking a brokerage based on their bonus deals.

Demo Account

Traders can access a free demo account at Vantage which gives you $100,000 in virtual funds to practice with.

Importantly, I was very pleased to see that there is no time limit on the demo mode, which is good compared to most online brokers who automatically close paper trading accounts after 30 or 60 days. This ultimately means aspiring investors will always have access to a risk-free environment to test trading systems.

| Vantage | Interactive Brokers | FOREX.com | |

|---|---|---|---|

| Demo Account | Yes | Yes | Yes |

| Visit | Visit | Visit | Visit |

| Review | Review | Review | Review |

How To Open A Demo Account

I found that you can open a demo account directly from the broker’s website, or after opening a live account. Again, the whole process only took me a couple of minutes. To open a demo account from the official site:

- Click on ‘Demo Account’ at the top of the Vantage website

- Enter your email address and hit ‘Next’

- Fill in your personal details including name and mobile number

- Set your demo parameters including platform, currency, account type, leverage and balance

- You will then be emailed your login details

Assets & Markets

Vantage offers a strong suite of trading instruments, with 1000+ CFDs spanning forex, stocks, commodities, indices, bonds and ETFs.

There are excellent diversification opportunities, especially the bond and ETF offerings, which aren’t available at many alternatives based on testing.

My only minor complaint is that the selection of shares is lighter than some brokers like CMC Markets.

I think Vantage could improve its market coverage by introducing Asian share CFDs from exchanges like the Shanghai or Tokyo Stock Exchanges.

You can trade:

- Forex – Speculate on 63 currency pairs including majors, minors and exotics like the EUR/USD and USD/JPY.

- Commodities – CFDs spanning popular precious metals like gold, silver, palladium, platinum and copper, plus 13 soft commodities and 4 energies, including sugar, cocoa, oil and gasoline.

- ETFs – 57 Exchange-Traded Funds (ETF) CFDs such as the Invesco QQQ Trust Series 1 and the SPDR S&P 500 ETF Trust.

- Shares – 825 US, UK, European and Australian stock CFDs including Alphabet, Netflix and Tesla.

- Cryptocurrency – Traders in some jurisdictions can access 54 digital currencies including BTC/USD and ETC/USD.

- Indices – 29 index CFDs including the NASDAQ, FTSE and Dow Jones as well as recent additions like the TWSE and STI.

- Bonds – 7 major US and EU bond CFDs.

As you can see from my comparison of suitable alternatives below, Vantage rivals popular brokers when it comes to the breadth of markets.

| Vantage | Interactive Brokers | FOREX.com | |

|---|---|---|---|

| Instruments | CFDs, Forex, Stocks, Indices, Commodities, ETFs, Bonds | Stocks, Options, Futures, Forex, Funds, Bonds, ETFs, Mutual Funds, Cryptocurrencies | Forex, Futures and Options on Metals, Energies, Commodities, Indices, Bonds, Crypto |

| Visit | Visit | Visit | Visit |

| Review | Review | Review | Review |

Leverage

Vantage offers varying leverage levels depending on local regulations – you can see the amount of leverage offered below.

I want to stress that while leverage can boost potential profits, it can also cause significant losses. I strongly recommend employing risk management tools such as stop-loss orders.

Vantage has an 80% margin call and an automatic stop-out will be triggered when your account reaches less than 50% of the required margin.

| Vantage | Interactive Brokers | FOREX.com | |

|---|---|---|---|

| Leverage | 1:500 | 1:50 | 1:50 |

| Visit | Visit | Visit | Visit |

| Review | Review | Review | Review |

Fees & Costs

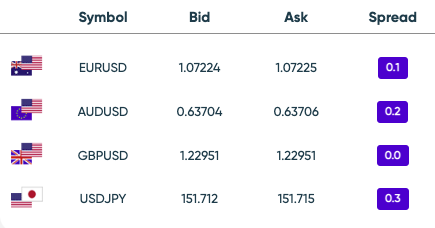

My assessment found that fees at Vantage are competitive, especially in the higher account tiers. The best part is that you only need $50 to access raw spreads in the ECN account, but there are commissions to be aware of.

My conclusion: Vantage is an excellent choice for experienced traders looking for competitive ECN pricing with low entry requirements.

Trading Fees

Based on my tests during normal trading hours, the Standard Account offers an indicative spread of 1.4 pips on the EUR/USD, which is reasonable though not the lowest. For comparison, the same pair at Pepperstone averages 1.1 pips. With that said, the commission-free trading model will serve new traders looking for straightforward pricing.

The Raw account and Pro ECN offer attractive pricing, especially for experienced investors looking for ultra-tight spreads with low commissions from $3 per side.

The $1.50 commission per side per lot in the Pro ECN account is particularly competitive, though note that this comes with a $10,000 minimum deposit and is therefore best for active, high-volume traders.

Non-Trading Fees

Vantage ranks well when it comes to non-trading fees. I was pleased to find no deposit or withdrawal charges, keeping costs down. There are also no inactivity fees, which is a bonus for casual investors.

It is worth noting that swap fees apply to positions overnight. However, this is standard practice and Islamic accounts avoid this charge, though an admin fee is levied instead.

Platforms & Tools

Vantage’s platform selection is strong in my opinion. You can access both the MetaTrader 4 and MetaTrader 5, as well as a proprietary solution: ProTrader.

I’ve tested all options thoroughly and explained my key findings in the sections below, but here’s what I think in a nutshell:

- MT4 is best for beginners looking for a straightforward platform with excellent development opportunities.

- MT5 and ProTrader are suitable for more experienced investors looking for advanced analysis tools.

Importantly, as you can see from my comparison of other brokers below, Vantage also holds its own in terms of access to the best trading platforms.

| Vantage | Interactive Brokers | FOREX.com | |

|---|---|---|---|

| MetaTrader 4 | Yes | No | Yes |

| MetaTrader 5 | Yes | No | Yes |

| cTrader | No | No | No |

| TradingView | Yes | Yes | Yes |

| Auto Trading | Myfxbook AutoTrade, Expert Advisors (EAs) on MetaTrader | Capitalise.ai, TWS API | Expert Advisors (EAs) on MetaTrader |

| Visit | Visit | Visit | Visit |

| Review | Review | Review | Review |

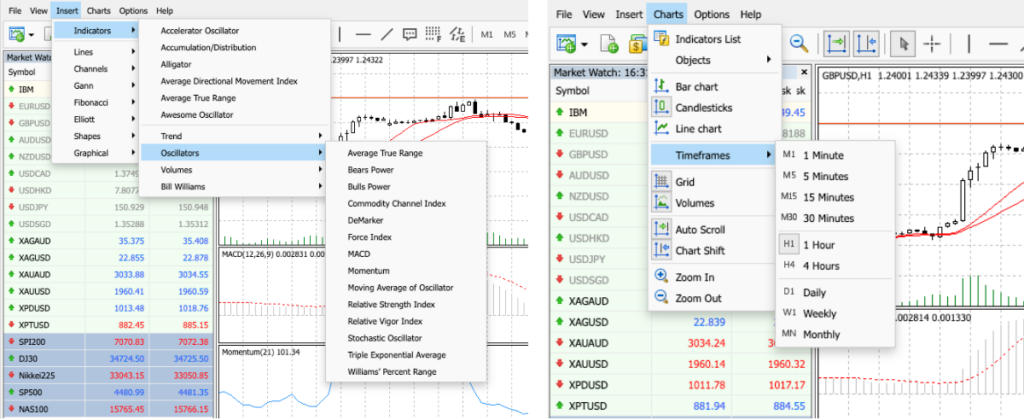

MT4 & MT5

MT4 and MT5 are hugely popular trading terminals that offer powerful charting tools and customizable layouts. Since both platforms are strikingly similar, I found it useful to compare them side by side in the categories below.

Design & Usability

The MetaTrader platforms are well known for their simple, no-frills interface.

For newcomers, the design may feel a little dated compared to some alternatives, but in my experience, the look and feel of the platform is easy to get used to.

The interfaces are well designed, with none of the cluttered layouts or poorly placed widgets that you see in some software.

The best part for me is that both MT4 and MT5 follow the same design, which means there is virtually no learning curve for those who switch from one platform to the other.

Another thing that stands out for me is the level of customizability that I get with the MetaTrader suite. Both platforms feature flexible charts and market watch windows which can be re-sized to my preferences. I can also have multiple charts open simultaneously, which is ideal for active traders.

Four toolbars are built into the window containing indicators, line studies and chart commands, although these are also accessible from the main menu.

As for accessibility, I’m pleased to see that Vantage offers both the web and desktop versions of the platforms. It’s easy to access all options from the client dashboard under the ‘Downloads’ tab.

Looking at the negatives, the user experience of the client dashboard isn’t as seamless as other brokers in my view.

For example, it would have been more convenient if I had direct access to the web platform after logging in, rather than having to navigate through several pages first.

Charting Tools

I’m confident that both beginners and experienced traders will be catered to when it comes to charting and analysis tools.

The MetaTrader platforms come with some of the most comprehensive libraries of technical indicators and drawing tools. Traders can also access several timeframe options and order types.

I’ve summarized the key differences between the two platforms below:

| Technical Indicators | Graphical Objects | Chart Timeframes | Expert Advisors (EAs) | Strategy Testing | |

|---|---|---|---|---|---|

| MT4 | 30 | 31 | 9 | Pre-built in the MetaQuotes marketplace | Single-thread |

| MT5 | 38 | 44 | 21 | Pre-built plus the ability to code your own | Multi-thread |

Order Types

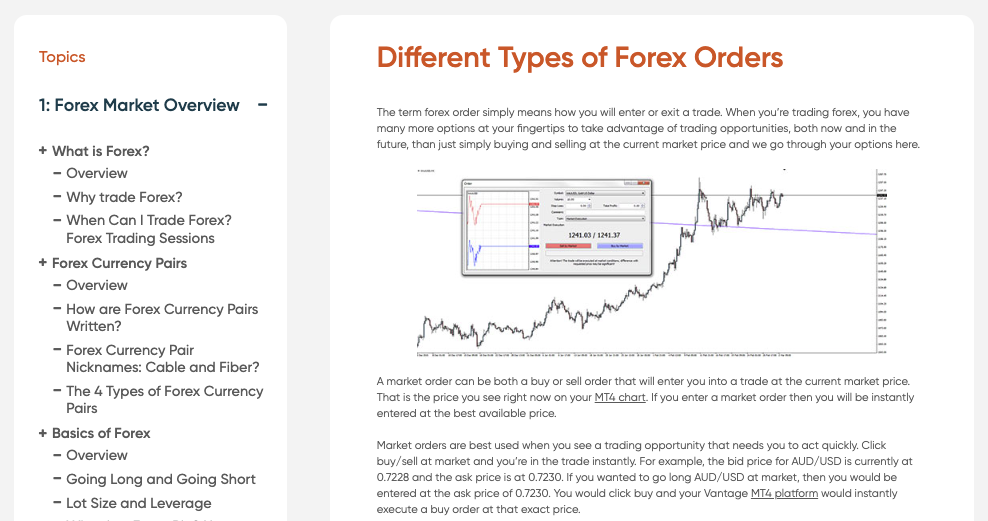

After opening a few positions in both MetaTrader platforms, I’ve found that one of the main differences between the two is how many order types you can execute. Both MT4 and MT5 facilitate the four key types of order (market order, pending order, stop loss, and take profit). These are instructions to your brokerage for when to open and close orders.

There are also four key types of pending orders available in both terminals: buy limit, buy stop, sell limit and sell stop, though I’m pleased to see that the MT5 terminal offers an additional two: buy stop limit and sell stop limit. These are essentially combinations of the buy limit/buy stop and sell limit/sell stop orders.

Pro Tip: To help manage your risk, use a buy stop limit if you anticipate a temporary dip in price, followed by an upswing. Conversely, use a sell stop limit if you expect an upswing followed by a fall in price.

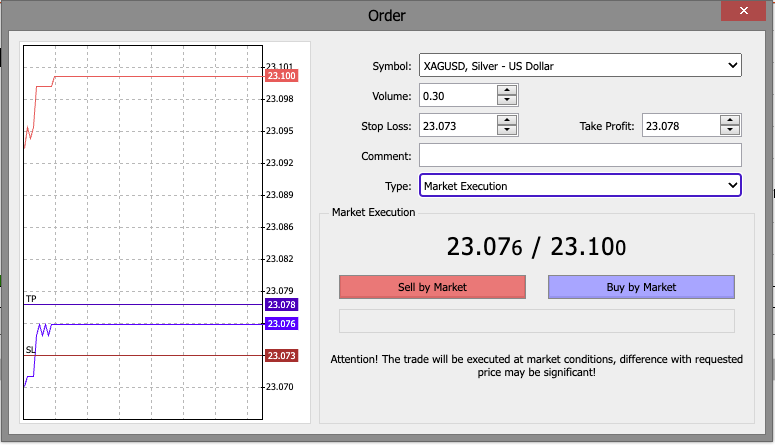

How To Place A Trade

Placing a trade in either of the MetaTrader platforms is extremely straightforward and thankfully, the process is the same in both terminals. Simply:

- Click on the New Order icon in the top toolbar, or right-click on your chosen instrument

- In the new order window, set your trade instructions including volume, stop loss, take profit and order type.

- Select Buy or Sell to complete the order

ProTrader

For an alternative trading experience, I think the ProTrader is a compelling option. It features a modernized interface with an impressive suite of technical tools.

Design & Usability

After signing in to the ProTrader platform, the sleek interface is instantly recognizable for me as the platform is powered by the market-leading TradingView.

In terms of the look and feel, I personally find trading on this software a more enjoyable experience than MT4 and MT5. The default dark mode workspace is easier on the eye, especially when layering color-coded indicators and graphical objects.

As for customization, I had no complaints when testing out the layouts. The workspace can be adjusted to your liking, with movable widgets that can be resized or hidden altogether.

Charting Tools

During my testing, I was pleased to see a strong range of 12 chart types and 8 time frames, plus 100+ technical indicators and over 50 drawing tools.

The only downside is that you don’t get access to a library of additional indicators or trading robots. With this in mind, I think ProTrader terminal is a better choice for intermediate traders or those who aren’t interested in exploring automated trading features.

Order Types

I also found a decent range of order types in the ProTrader terminal, including market order, limit order, stop-loss and trailing stop.

I was also able to execute time limits on my orders, including good ‘til canceled (GTC), good ‘til end of day (GTD) and good ‘til time (GTT).

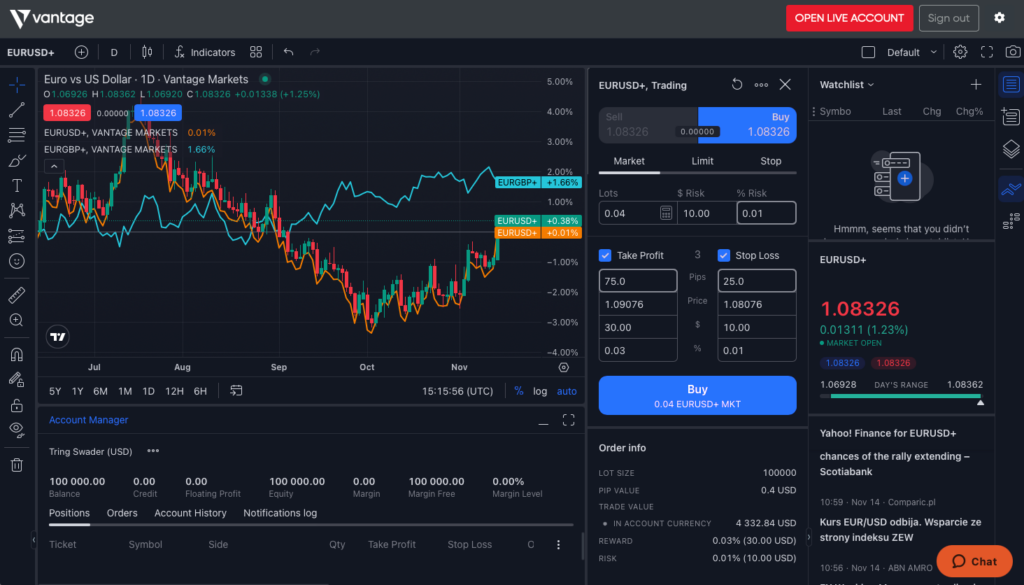

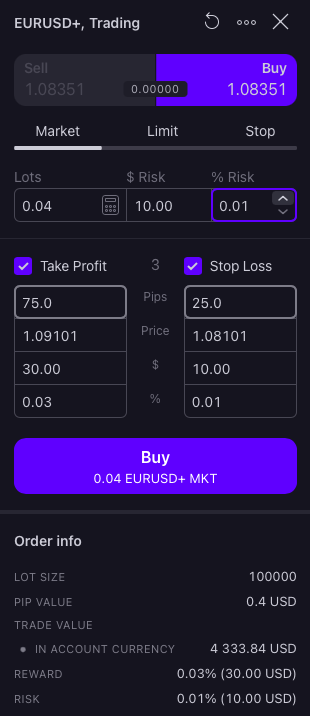

How To Place A Trade

I found opening a position slightly more time-consuming than in the MetaTrader platforms, though the process was still clear and seamless. You can place a trade directly from the integrated order window on the workspace, or by right-clicking on the chart. Then:

- Navigate the ‘Market’, ‘Limit’ and ‘Stop’ tabs and select your order type

- Determine your trade price, quantity and take profit/stop loss parameters

- Click on ‘Buy’/’Sell’ to complete the order.

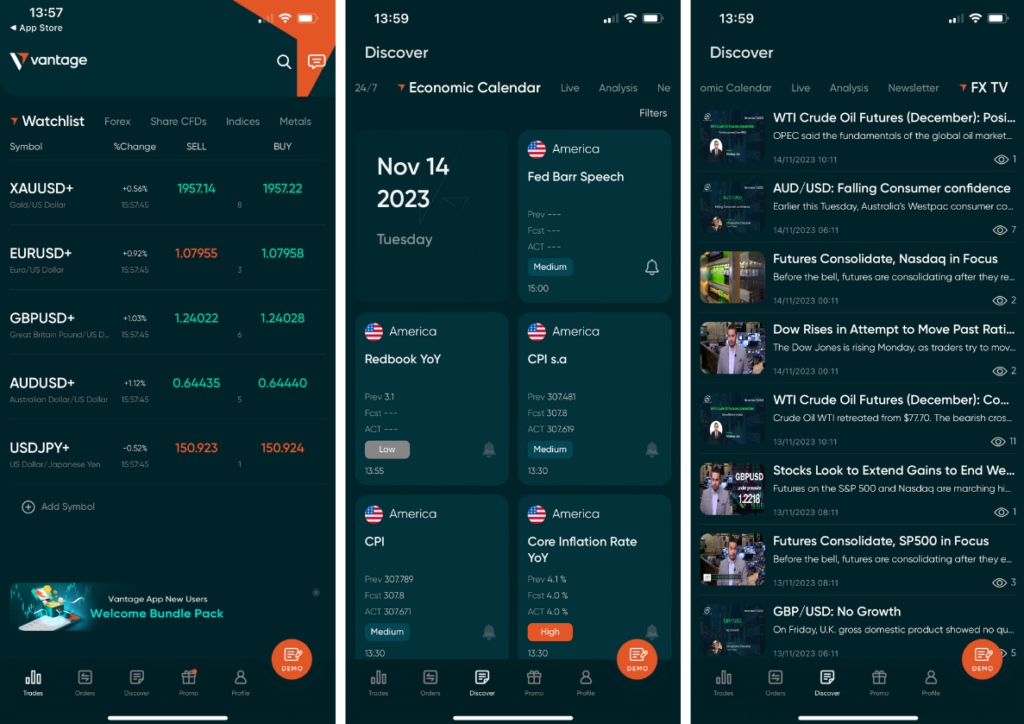

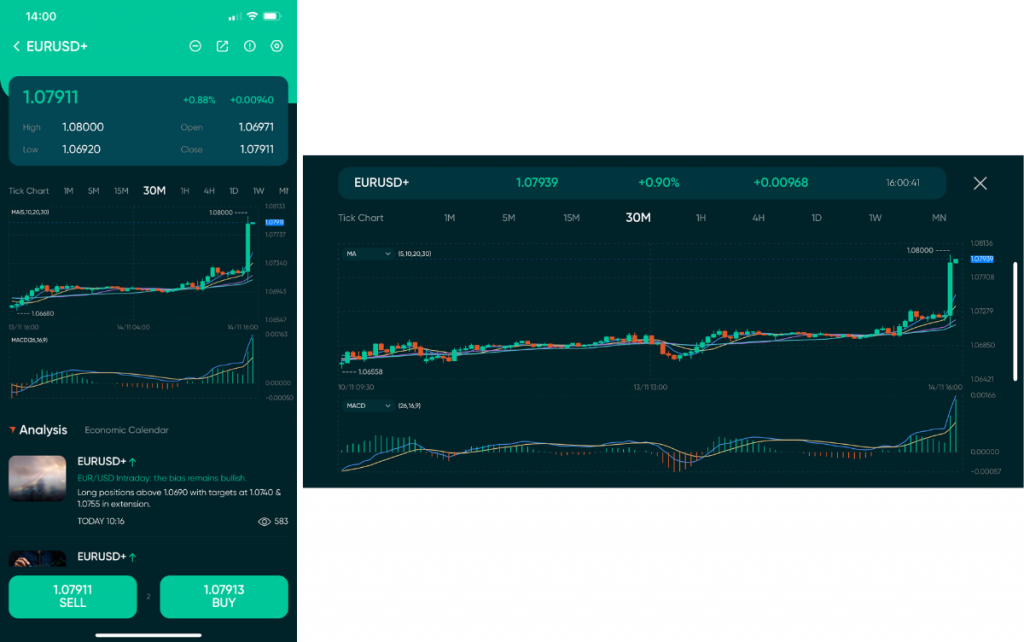

Mobile App

The functionality of Vantage’s mobile app is excellent. I was able to access convenient account management features, as well as trade monitoring.

I’m particularly impressed by the quality of research tools in the app. As you can see from the below screenshots from my account, the ‘Discover’ tab contains 24/7 news updates from reputable sources, as well as an economic calendar, live webinars, technical analysis, a newsletter and live TV.

As with many other mobile apps I’ve tested, you cannot run any detailed technical analysis in the Vantage app since it doesn’t offer any indicators or drawing tools. This isn’t really a major drawback for me as I prefer the wide-screen functionality that you get on the desktop and web platforms.

What you can do, though, is easily view live chart data alongside corresponding analysis and events all on the same page, which I thought was highly intuitive. I also like that clicking on each chart opens it up in full-screen landscape mode, so you can pinch and zoom for a greater level of detail.

So, what’s my verdict on the Vantage app?

Ultimately, I think the app will work well for beginners or anyone looking to stay up to date with market events whilst on the go.

Whilst you clearly won’t get the same experience as the desktop platform, you will get an abundance of real-time data and forex market research straight from the palm of your hand.

Additional Tools

Vantage also doesn’t disappoint when it comes to additional trading tools. I have been particularly impressed with the comprehensive range of third-party social trading platforms, including Myfxbook and ZuluTrade.

Experienced traders will also appreciate the free forex VPS, as well as various advanced plugins for the MetaTrader and ProTrader platforms.

Below is my view on the tools that I think elevate the trading experience.

Myfxbook Autotrade

In addition to copy trading features, Myfxbook Autotrade offers journal features where you can keep track of your trading history.

I also appreciate that strategy providers are more rigorously vetted, with certain performance requirements needing to be met before their positions can be mirrored.

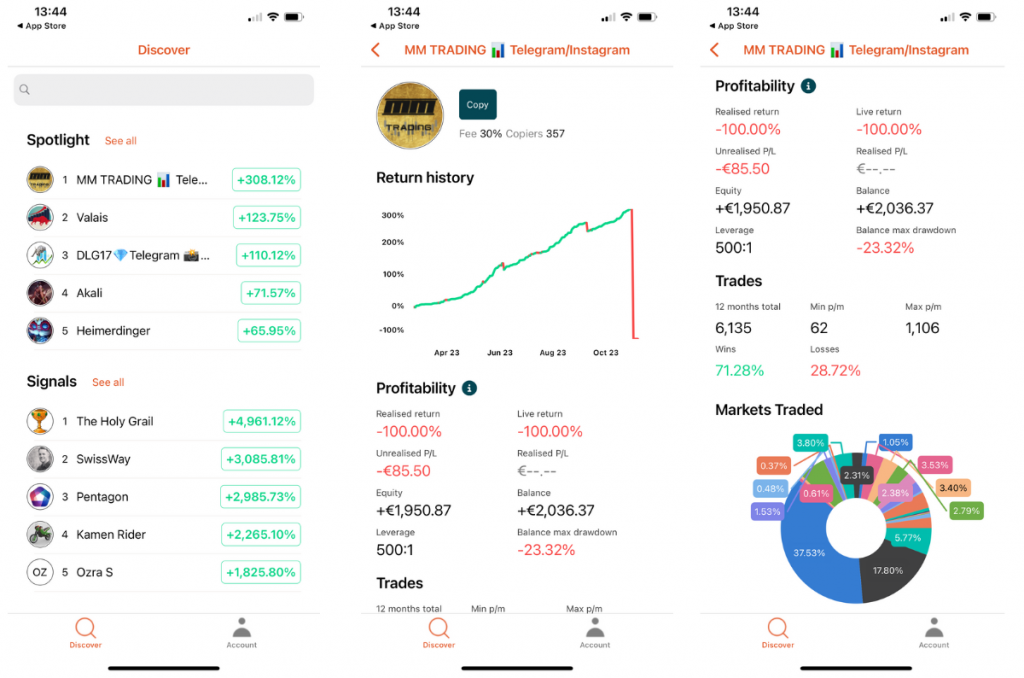

Vantage Copy Trading

The broker’s proprietary copy trading platform is ideal for copy traders looking for additional perks.

The platform’s social trading features allow you to build a following and earn commissions on copied trades. I found that there are five levels (Explorer to Legend), with better returns as you attract more traders.

To get started, simply choose from the list of Spotlight or Signals providers, decide how much you want to trade, and add any risk management parameters. Lastly, select ‘Copy’ within the app.

Forex VPS

Serious algo traders will appreciate the virtual private server (VPS) which is available with a $1,000 deposit. This is competitive compared to other brands I reviewed.

This tool essentially allows you to run your algorithms with 24/7 uninterrupted connectivity, at the fastest possible speeds.

SmartTrader & ProTrader Tools

For a $1,000 minimum deposit, you can also access a range of SmartTrader plugins for the MetaTrader platforms. Upgrades include the Alarm Manager, Correlation Matrix and Correlation Trader.

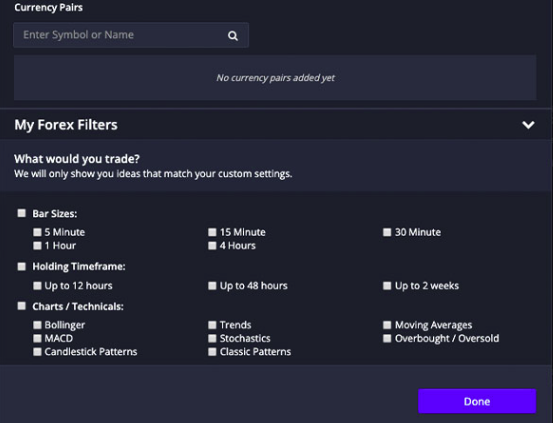

Similarly, ProTrader users can also access a range of tools for just a $200 minimum deposit, making this a more accessible option for newer traders looking to upgrade their package. My favorites are the Market Buzz AI news tool and the Analyst Views feed with live trade set-ups.

Pro Tip: Use the handy custom filters in the Analyst Views tool to get tailored trade ideas based on a specific timeframe or technical analysis style.

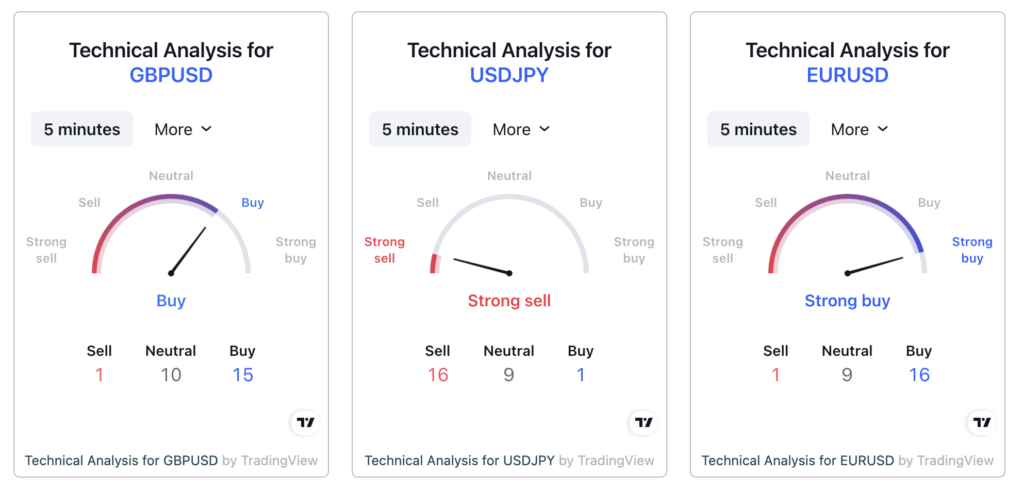

TradingView

Vantage also offers three TradingView memberships for experienced traders: Pro, Pro+ and Premium. I did note that you need at least $500 for the Pro membership, as well as a monthly trading volume of $1 million.

While this is pricey, I think the benefits are worthwhile, since I was able to access custom watchlists, hundreds of technical indicators and daily trade ideas.

Research

After rigorously exploring Vantage’s platform, I found the research tools to be fairly comprehensive.

I particularly enjoyed utilizing the market data alongside the economic calendar, which can be found on the website. With that said, I think it’s a shame that these tools aren’t included in the client area.

Nonetheless, the client area does include the TradingView-powered sentiment indicators which are very useful. These visually display the overall sentiment ratio of long and short positions at Vantage.

Education

For those who are looking to learn as they go, Vantage offers a dedicated Academy packed with market analysis articles, trading guides, platform tutorials and webinars.

Overall, beginners and intermediate traders should find plenty of resources at Vantage, though I would say that the selection is not as comprehensive as other brands like IG.

I think Vantage could improve its education by introducing more interactive learning materials such as courses with quizzes or progress trackers. These would make the resources more engaging, especially for beginners.

Customer Support

I have been thoroughly impressed by the customer support at Vantage. The broker is available 24/7, which is a notable advantage compared to the 24/5 support offered by many competitors.

Help is available via live chat, email or telephone, with waiting times for responses scoring very well. To measure the quality and speed of customer service at Vantage, I tested the live chat feature by asking several trading-based questions at different times of the day. I received helpful and friendly responses to my queries within 1 minute each time.

You can contact Vantage broker using these details:

- Phone number: +1 (345) 7691640

- Email: support@vantagemarkets.com

- Live chat: located in the bottom right-hand corner of the website

There is also a comprehensive FAQ section which covers most of the key topics.

Should You Trade With Vantage?

Based on my first-hand Vantage broker review, the firm is an excellent choice for traders looking for low fees, best-in-class tools and a range of global markets.

For beginner traders, I appreciate the low $50 minimum deposit, unlimited demo account and selection of educational materials. The in-house platform is easy to use and there are hundreds of popular assets to trade.

The competitive pricing in the ECN accounts, additional tools and the rebate scheme also make Vantage a good option for more experienced, high-volume traders. In addition, the VPS and access to the MetaTrader software will serve algo traders.

FAQ

Is Vantage Legit?

Yes, Vantage is a legitimate broker that is authorized by multiple regulators, including the ASIC and FCA. There’s no evidence of scams or malpractice based on my research and the broker segregates client money and offers negative balance protection, so you can’t lose more than your deposit.

Is Vantage Trustworthy?

Vantage is trustworthy based on my thorough background checking and research. The broker’s global user base, strong regulatory oversight and collection of industry awards are reassuring. The firm also uses important safety measures including segregated client accounts.

Is Vantage Good For Beginners?

Vantage is an excellent choice for beginners. The low starting deposit of $50 ensures accessibility for those on a lower budget and the unlimited demo account allows you to practise trading risk-free for as long as you need. There is also an excellent selection of copy trading platforms, though past performance is no guarantee of future performance.

Is Vantage Good For Day Trading?

Vantage is a great broker for day traders. I recommend the Raw ECN or Pro ECN accounts, as these offer ultra-tight spreads. The availability of the MetaTrader platforms and VPS also means that active day traders using automated systems are catered for. Looking at the downsides for day trading, execution speeds at Vantage aren’t the fastest.

Does Vantage Offer Low Fees?

My tests have shown that trading fees at Vantage are fairly competitive but not the lowest I have seen. The STP account does offer zero commissions but wider spreads from 1 pip. The ECN account is a good option for active traders looking for zero-pip spreads and low $3 commissions.

Does Vantage Offer A Good Mobile App?

Yes, Vantage offers a decent mobile app which offers access to account management features and trading tools whilst on the move. The application allows you to place trades, follow market news and create watchlists, but I learned that it isn’t the best for serious charting and technical analysis.

Is Vantage A Market Maker Broker?

No, Vantage is an ECN/STP broker, which means it sources quotes from several external liquidity providers with no dealing desk intervention. It also means spreads are generally lower than market maker brokers.

Best Alternatives to Vantage

Compare Vantage with the best similar brokers that accept traders from your location.

- Interactive Brokers – Interactive Brokers (IBKR) is a premier brokerage, providing access to 150 markets in 33 countries, along with a suite of comprehensive investment services. With over 40 years of experience, this Nasdaq-listed firm adheres to stringent regulations by the SEC, FCA, CIRO, and SFC, amongst others, and is one of the most trusted brokers for trading around the globe.

- FOREX.com – Founded in 1999, FOREX.com is now part of StoneX, a financial services organization serving over one million customers worldwide. Regulated in the US, UK, EU, Australia and beyond, the broker offers thousands of markets, not just forex, and provides excellent pricing on cutting-edge platforms.

Vantage Comparison Table

| Vantage | Interactive Brokers | FOREX.com | |

|---|---|---|---|

| Rating | 4.7 | 4.3 | 4.5 |

| Markets | CFDs, Forex, Stocks, Indices, Commodities, ETFs, Bonds | Stocks, Options, Futures, Forex, Funds, Bonds, ETFs, Mutual Funds, Cryptocurrencies | Forex, Futures and Options on Metals, Energies, Commodities, Indices, Bonds, Crypto |

| Demo Account | Yes | Yes | Yes |

| Minimum Deposit | $50 | $0 | $100 |

| Minimum Trade | 0.01 Lots | $100 | 0.01 Lots |

| Regulators | FCA, ASIC, FSCA, VFSC | FCA, SEC, FINRA, CFTC, CBI, CIRO, SFC, MAS, MNB, FINMA, AFM | NFA, CFTC |

| Bonus | 50% Welcome Deposit Bonus, earn redeemable rewards in the Vantage Rewards scheme | – | VIP status with up to 10k+ in rebates – T&Cs apply. |

| Platforms | ProTrader, MT4, MT5, TradingView, DupliTrade | Trader Workstation (TWS), IBKR Desktop, GlobalTrader, Mobile, Client Portal, AlgoTrader, OmniTrader, TradingView, eSignal, TradingCentral, ProRealTime, Quantower | WebTrader, Mobile, MT4, MT5, TradingView |

| Leverage | 1:500 | 1:50 | 1:50 |

| Payment Methods | 16 | 6 | 9 |

| Visit | – | Visit | Visit |

| Review | – | Interactive Brokers Review |

FOREX.com Review |

Compare Trading Instruments

Compare the markets and instruments offered by Vantage and its competitors. Please note, some markets may only be available via CFDs or other derivatives.

| Vantage | Interactive Brokers | FOREX.com | |

|---|---|---|---|

| CFD | Yes | Yes | No |

| Forex | Yes | Yes | Yes |

| Stocks | Yes | Yes | Yes |

| Commodities | Yes | Yes | Yes |

| Oil | Yes | No | Yes |

| Gold | Yes | Yes | Yes |

| Copper | Yes | No | No |

| Silver | Yes | No | Yes |

| Corn | No | No | No |

| Crypto | Yes | Yes | No |

| Futures | Yes | Yes | Yes |

| Options | No | Yes | Yes |

| ETFs | Yes | Yes | No |

| Bonds | Yes | Yes | No |

| Warrants | No | Yes | No |

| Spreadbetting | Yes | No | No |

| Volatility Index | Yes | No | No |

Vantage vs Other Brokers

Compare Vantage with any other broker by selecting the other broker below.

The most popular Vantage comparisons:

- Exness vs Vantage

- Pacific Union vs VantageFX

- Vantage vs FXCM

- OctaFX vs VantageFX

- IC Markets vs Vantage

- Ultima Markets vs Vantage

- Vantage vs VT Markets

- Vantage vs FOREX.com

- Vantage vs ActivTrades

- Vantage vs XM

Customer Reviews

4.2 / 5This average customer rating is based on 5 Vantage customer reviews submitted by our visitors.

If you have traded with Vantage we would really like to know about your experience - please submit your own review. Thank you.

Submit Your Own Review of Vantage

Article Sources

- Vantage Website

- Check Vantage Global Prime Pty Ltd – ASIC License

- Vantage Markets (Pty) Ltd – FSCA License

- Vantage Global Prime LLP - FCA License

- Check Vantage Global Limited – VFSC License

The writing and editorial team at DayTrading.com use credible sources to support their work. These include government agencies, white papers, research institutes, and engagement with industry professionals. Content is written free from bias and is fact-checked where appropriate. Learn more about why you can trust DayTrading.com

I wanted a regulated broker with trading signals from Trading Central because I know they’re a trusted provider of signals that use TA and AI. Vantage has given me just that. Not all my trades win but the trading platform is smooth and I feel like my funds are secure with them.

I was going to leave Vantage and move my funds to another firm but they’ve made some decent changes. Big one being TradingView integration, so now I can get the cleanest charts for TA. Makret Buzz is also really good if you’re a news trader and the so called Featured Ideas aint bad for sparking the trading juices though the setups aren’t right for my ultra- short term game.

If I were gonna complain and I am – they could do without sending so many marketing emails and texts all the time. I’ll see what’s new etc etc when I log in.

I use Vantage’s social trading app and it’s decent. It only took a few minutes to download and sign in and then you can chat with other traders and mirror strategies in a few clicks.

I use Vantage for day trading forex and have no complaints. Spreads are super tight, execution is fast and reliable, platform is great.

Vantage is a top-tier broker with some of the lowest trading fees I have seen. It’s just a shame the Pro account has a steep $10,000 starting investment.