Best Day Trading Demo Accounts 2026

Having used many demo accounts in recent years, I wanted to create a complete guide to help traders. I share my pick of the best demo trading accounts and answer the most common questions.

The key factors I look at when evaluating demo trading accounts are:

- Does the account have a time limit?

- How much virtual funds are available?

- Does it provide access to a good range of investments?

- Is it easy to sign up and start using the demo trading account?

- Does the demo account accurately simulate live market conditions?

Top 6 Demo Accounts 2026

Based on our latest hands-on tests of their paper trading environments, these are the top day trading demo accounts with easy sign-up requirements:

-

1

Interactive Brokers

Interactive Brokers -

2

NinjaTrader

NinjaTrader -

3

eToro USAeToro USA LLC and eToro USA Securities Inc.; Investing involves risk, including loss of principal; Not a recommendation

eToro USAeToro USA LLC and eToro USA Securities Inc.; Investing involves risk, including loss of principal; Not a recommendation -

4

Plus500USTrading in futures and options involves the risk of loss and is not suitable for everyone.

Plus500USTrading in futures and options involves the risk of loss and is not suitable for everyone. -

5

OANDA USCFDs are not available to residents in the United States.

OANDA USCFDs are not available to residents in the United States. -

6

FOREX.com

FOREX.com

Why Are These the Best Accounts For Demo Trading?

Here is a short summary of why we think these are the top demo accounts with virtual money:

- Interactive Brokers has the best free demo account in 2026 - When we used Interactive Brokers’ demo, it closely replicated the live TWS platform, including access to global markets and advanced order types. Execution speed was realistic, though some slippage was noted in fast-moving assets. Set up required basic details. Virtual balance was $1M, but paper trading was activated only after account approval.

- NinjaTrader - During our tests, NinjaTrader’s demo delivered near-instant execution and low slippage, ideal for futures and active traders. The platform exactly mirrored the live environment, including depth-of-market tools. Set up required email only, and users received $50,000 virtual balance. The demo had no time limit, making it great for long-term strategy testing.

- eToro USA - When we tested eToro USA’s demo, we found execution speeds slower than ECN brokers, but acceptable for social and crypto trading. The platform matched live trading closely, with $100K virtual balance and full access to stocks, crypto, and ETFs. No KYC needed. Slippage was moderate during volatile periods. No demo expiry.

- Plus500US - During our hands-on tests, Plus500’s demo was instantly available with no personal details needed and no expiry. The interface closely matched the live platform, with access to CFDs on forex, stocks, crypto, and indices. Execution was swift, though spreads were wider - EUR/USD averaged 0.8–1.2 pips. $40,000 virtual balance auto-refilled when depleted.

- OANDA US - OANDA is a popular brand offering exceptional execution, low deposit requirements and advanced charting and trading platform features. The top-rated brand has over 25 years of experience and is regulated by trusted agencies, including the NFA/CFTC. Around the clock support is available for short-term traders, alongside flexible contract sizes and automated trade executions.

- FOREX.com - When we tested FOREX.com’s demo trading account, it provided full access to over 80 currency pairs plus crypto, commodities, and indices. Execution speed was solid during our paper trades, with EUR/USD spreads averaging 1.2 pips on standard accounts. The platform matched live conditions well. No personal info was needed, and the $50,000 demo lasted 30 days.

Compare the Best Demo Account Providers In Key Areas

Find the perfect broker providing a virtual trading account for you with our comparison of key features important to aspiring traders:

| Broker | Free Demo Account | Demo Instruments | Platforms | Excellent Education | Regulators |

|---|---|---|---|---|---|

| Interactive Brokers | ✔ | Stocks, Options, Futures, Forex, Funds, Bonds, ETFs, Mutual Funds, Cryptocurrencies | Trader Workstation (TWS), IBKR Desktop, GlobalTrader, Mobile, Client Portal, AlgoTrader, OmniTrader, TradingView, eSignal, TradingCentral, ProRealTime, Quantower | ✔ | FCA, SEC, FINRA, CFTC, CBI, CIRO, SFC, MAS, MNB, FINMA, AFM |

| NinjaTrader | ✔ | Futures, Forex, Stocks, Options, Commodities, Futures, Crypto (non-futures depend on provider) | NinjaTrader Desktop, Web & Mobile, eSignal | ✔ | NFA, CFTC |

| eToro USA | ✔ | Stocks, Options, ETFs, Crypto | eToro Trading Platform & CopyTrader | ✔ | SEC, FINRA |

| Plus500US | ✔ | Futures on Cryptocurrencies, Metals, Agriculture, Forex, Interest rates, Energy, Equity Index future contracts | WebTrader, App | ✔ | CFTC, NFA |

| OANDA US | ✔ | Forex, Crypto with Paxos (Cryptocurrencies are offered through Paxos. Paxos is a separate legal entity from OANDA) | OANDA Trade, MT4, TradingView, AutoChartist | ✔ | NFA, CFTC |

| FOREX.com | ✔ | Forex, Futures and Options on Metals, Energies, Commodities, Indices, Bonds, Crypto | WebTrader, Mobile, MT4, MT5, TradingView | ✔ | NFA, CFTC |

How Safe Are These Demo Account Providers?

Demo accounts are safe in that you only trade with virtual money, but find out how these brokers will protect your funds when you upgrade to real-money trading:

| Broker | Trust Rating | Guaranteed Stop Loss | Negative Balance Protection | Segregated Accounts |

|---|---|---|---|---|

| Interactive Brokers | ✘ | ✔ | ✔ | |

| NinjaTrader | ✘ | ✘ | ✘ | |

| eToro USA | ✘ | ✘ | ✔ | |

| Plus500US | ✘ | ✘ | ✔ | |

| OANDA US | ✘ | ✘ | ✘ | |

| FOREX.com | ✘ | ✔ | ✔ |

Compare Mobile Demo Trading

Find out how good these brokers are for trading with virtual funds on mobile and tablet devices:

| Broker | Mobile Apps | iOS Rating | Android Rating | Smart Watch App |

|---|---|---|---|---|

| Interactive Brokers | iOS & Android | ✔ | ||

| NinjaTrader | iOS & Android | ✘ | ||

| eToro USA | iOS & Android | ✘ | ||

| Plus500US | iOS & Android | ✘ | ||

| OANDA US | iOS & Android | ✘ | ||

| FOREX.com | iOS & Android | ✘ |

Are the Top Demo Account Brokers Good for Beginners?

Brokers with demo accounts are perfect for beginners, but discover how else they cater to newer traders:

| Broker | Demo Account | Minimum Deposit | Minimum Trade | Education Rating | Support Rating |

|---|---|---|---|---|---|

| Interactive Brokers | ✔ | $0 | $100 | ||

| NinjaTrader | ✔ | $0 | 0.01 Lots | ||

| eToro USA | ✔ | $100 | $10 | ||

| Plus500US | ✔ | $100 | Variable | ||

| OANDA US | ✔ | $0 | 0.01 Lots | ||

| FOREX.com | ✔ | $100 | 0.01 Lots |

Compare the Ratings of Top Demo Account Brokers

See how the top brokers with test accounts rate across critical areas following our hands-on tests:

| Broker | Trust | Platforms | Assets | Mobile | Fees | Accounts | Research | Education | Support |

|---|---|---|---|---|---|---|---|---|---|

| Interactive Brokers | |||||||||

| NinjaTrader | |||||||||

| eToro USA | |||||||||

| Plus500US | |||||||||

| OANDA US | |||||||||

| FOREX.com |

How Popular Are These Brokers Offering Practice Trading Accounts?

Many up and coming traders prefer opening paper trading accounts with the most popular brokers, i.e those with the most clients:

| Broker | Popularity |

|---|---|

| Plus500US | |

| Interactive Brokers | |

| eToro USA | |

| NinjaTrader | |

| FOREX.com |

Why Open A Demo Account With Interactive Brokers?

"Interactive Brokers is one of the best brokers for advanced day traders, providing powerful charting platforms, real-time data, and customizable layouts, notably through the new IBKR Desktop application. Its superb pricing and advanced order options also make it highly attractive for day traders, while its diverse range of equities is still among the best in the industry."

Christian Harris, Reviewer

Interactive Brokers Quick Facts

| Demo Account | Yes |

|---|---|

| Instruments | Stocks, Options, Futures, Forex, Funds, Bonds, ETFs, Mutual Funds, Cryptocurrencies |

| Regulator | FCA, SEC, FINRA, CFTC, CBI, CIRO, SFC, MAS, MNB, FINMA, AFM |

| Platforms | Trader Workstation (TWS), IBKR Desktop, GlobalTrader, Mobile, Client Portal, AlgoTrader, OmniTrader, TradingView, eSignal, TradingCentral, ProRealTime, Quantower |

| Minimum Deposit | $0 |

| Minimum Trade | $100 |

| Leverage | 1:50 |

| Account Currencies | USD, EUR, GBP, CAD, AUD, INR, JPY, SEK, NOK, DKK, CHF, AED, HUF |

Pros

- There's a vast library of free or paid third-party research subscriptions catering to all types of traders, plus you can enjoy commission reimbursements from IBKR if you subscribe to Toggle AI.

- Interactive Brokers has launched ForecastTrader, a unique, zero-commission product where users can trade yes/no Forecast Contracts on political, economic, and climate events, with fixed $1 payouts per contract, 24/6 market access, and 3.83% APY on held positions.

- With low commissions, tight spreads and a transparent fee structure, IBKR delivers a cost-effective environment for short-term traders.

Cons

- TWS’s learning curve is steep, and beginners may find it challenging to navigate the platform and understand all the features. Plus500's web platform is much better suited to new traders.

- IBKR provides a wide range of research tools, but their distribution across trading platforms and the web-based 'Account Management' page lacks consistency, leading to a confusing user experience.

- You can only have one active session per account, so you can’t have your desktop program and mobile app running simultaneously, making for a sometimes frustrating trading experience.

Why Open A Demo Account With NinjaTrader?

"NinjaTrader continues to meet the demands of active futures traders looking for low fees and premium analysis tools. The platform hosts top-rate charting features including hundreds of indicators and 10+ chart types."

Tobias Robinson, Reviewer

NinjaTrader Quick Facts

| Demo Account | Yes |

|---|---|

| Instruments | Futures, Forex, Stocks, Options, Commodities, Futures, Crypto (non-futures depend on provider) |

| Regulator | NFA, CFTC |

| Platforms | NinjaTrader Desktop, Web & Mobile, eSignal |

| Minimum Deposit | $0 |

| Minimum Trade | 0.01 Lots |

| Leverage | 1:50 |

| Account Currencies | USD |

Pros

- NinjaTrader is a widely respected and award-winning futures broker and is heavily authorized by the NFA and CFTC

- You can get thousands of add-ons and applications from developers in 150+ countries

- NinjaTrader continues to deliver comprehensive charting software for active day traders with bespoke technical indicators and widgets

Cons

- There is a withdrawal fee on some funding methods

- Non forex and futures trading requires signing up with partner brokers

- The premium platform tools come with an extra charge

Why Open A Demo Account With eToro USA?

"eToro remains a top pick for traders looking for leading social investing and copy trading services. With a low deposit, zero commissions and an intuitive platform, the broker will meet the needs of newer day traders."

Jemma Grist, Reviewer

eToro USA Quick Facts

| Demo Account | Yes |

|---|---|

| Instruments | Stocks, Options, ETFs, Crypto |

| Regulator | SEC, FINRA |

| Platforms | eToro Trading Platform & CopyTrader |

| Minimum Deposit | $100 |

| Minimum Trade | $10 |

| Account Currencies | USD |

Pros

- eToro USA Securities is a trustworthy, SEC-regulated broker that is a member of FINRA and SIPC

- The low minimum deposit and straightforward account opening process means beginners can get started quickly

- Investors can access Smart Portfolios for a more hands-off approach, covering a range of sectors and markets such as renewable energy and artificial intelligence

Cons

- There's a narrower range of day trading instruments available compared to competitors, with only stocks, ETFs and cryptos

- The proprietary terminal doesn't support trading bots and there are no additional stock market analysis tools

- There's no MetaTrader 4 platform integration for traders who are accustomed to using third-party charting tools

Why Open A Demo Account With Plus500US?

"Plus500US stands out as an excellent choice for beginners, offering a very user-friendly platform, low day trading margins, and access to the Futures Academy to enhance trading skills. Its powerful tools and reliable service helped it scoop second place in DayTrading.com's annual 'Best US Broker' award."

Michael MacKenzie, Reviewer

Plus500US Quick Facts

| Demo Account | Yes |

|---|---|

| Instruments | Futures on Cryptocurrencies, Metals, Agriculture, Forex, Interest rates, Energy, Equity Index future contracts |

| Regulator | CFTC, NFA |

| Platforms | WebTrader, App |

| Minimum Deposit | $100 |

| Minimum Trade | Variable |

| Leverage | Variable |

| Account Currencies | USD |

Pros

- Plus500 added prediction markets to its 'Plus500 Futures' platform in February 2026, with event-based trades covering 10 categories, from financials to politics, including short-term opportunities with intraday contracts that expire after just 15 minutes.

- The straightforward account structure, pricing model and web platform offer an easier route into futures trading than rivals like NinjaTrader

- Plus500 is a publicly traded company with a good reputation, over 24 million traders, and a sponsor of the Chicago Bulls.

Cons

- Plus500US does not offer social trading capabilities, a feature available at alternatives like eToro US which could strengthen its offering for aspiring traders

- The proprietary platform is user-friendly but lacks advanced technical analysis tools found in third-party solutions like MetaTrader 4

- Although support response times were fast during tests, there is no telephone assistance

Why Open A Demo Account With OANDA US?

"OANDA remains an excellent broker for US day traders seeking a user-friendly platform with premium analysis tools and a straightforward joining process. OANDA is also heavily regulated with a very high trust score."

Jemma Grist, Reviewer

OANDA US Quick Facts

| Demo Account | Yes |

|---|---|

| Instruments | Forex, Crypto with Paxos (Cryptocurrencies are offered through Paxos. Paxos is a separate legal entity from OANDA) |

| Regulator | NFA, CFTC |

| Platforms | OANDA Trade, MT4, TradingView, AutoChartist |

| Minimum Deposit | $0 |

| Minimum Trade | 0.01 Lots |

| Leverage | 1:50 |

| Account Currencies | USD, EUR, GBP, AUD, JPY, CHF, HKD, SGD |

Pros

- Day traders can enjoy fast and reliable order execution

- The broker offers a transparent pricing structure with no hidden charges

- There's a strong selection of 68 currency pairs for dedicated short-term forex traders

Cons

- The range of day trading markets is limited to forex and cryptos only

- There's only a small range of payment methods available, with no e-wallets supported

- It's a shame that customer support is not available on weekends

Why Open A Demo Account With FOREX.com?

"FOREX.com remains a best-in-class brokerage for active forex traders of all experience levels, with over 80 currency pairs, tight spreads from 0.0 pips and low commissions. The powerful charting platforms collectively offer over 100 technical indicators, as well as extensive research tools."

Christian Harris, Reviewer

FOREX.com Quick Facts

| Demo Account | Yes |

|---|---|

| Instruments | Forex, Futures and Options on Metals, Energies, Commodities, Indices, Bonds, Crypto |

| Regulator | NFA, CFTC |

| Platforms | WebTrader, Mobile, MT4, MT5, TradingView |

| Minimum Deposit | $100 |

| Minimum Trade | 0.01 Lots |

| Leverage | 1:50 |

| Account Currencies | USD, EUR, GBP, CAD, AUD, JPY, CHF, PLN |

Pros

- There’s a wealth of educational resources including tutorials, webinars, and a stacked YouTube channel to help you get educated in the financial markets.

- FOREX.com offers industry-leading forex pricing starting from 0.0 pips, alongside competitive cashback rebates of up to 15% for serious day traders.

- With over 20 years of experience, excellent regulatory oversight, and multiple accolades including runner-up in our 'Best Forex Broker' awards, FOREX.com boasts a global reputation as a trusted brokerage.

Cons

- FOREX.com's MT4 platform offers approximately 600 instruments, significantly fewer than the over 5,500 available on its non-MetaTrader platforms.

- There’s no negative balance protection for US clients, so you may find yourself owing more money than your initial deposit into your account.

- Demo accounts are frustratingly time-limited to 90 days, which doesn’t give you enough time to test day trading strategies effectively.

What Is A Good Demo Trading Account?

Based on my experience testing day trading demo accounts, there are several important factors to consider:

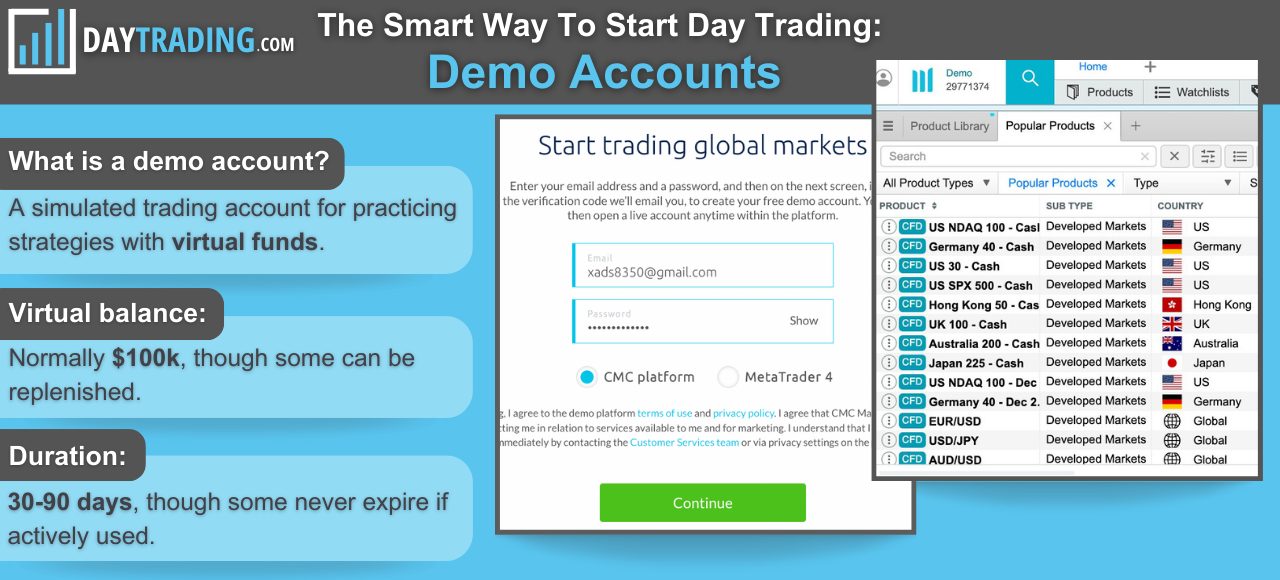

Time Limits

Most online brokers offer access to a demo trading account for up to 30 days. After this, you will normally need to open a real-money account and make a deposit.

However, I prefer brokers that offer unlimited access to demo accounts. These will allow you to continue testing strategies even after you have opened a live account, making them an excellent tool for aspiring traders.

- AvaTrade offers an unlimited demo account with access to MT4, MT5 and its own in-house platform.

Virtual Funds

Having used dozens of demo trading accounts, most brokers offer between $10,000 and $100,000 in virtual funds.

Once you have exhausted this money, you will normally need to open a live account, though some brokers will replenish your bankroll so you can continue practising until the demo account expires.

Importantly, I recommend demo trading in realistic volumes, as this will make the transition to real-money trading easier.

- XM offers $100,000 in virtual funds but can you top up your practice account by contacting customer support.

Trading Instruments

The best demo trading accounts allow you to simulate trading on thousands of instruments spanning popular asset classes, including forex, stocks, indices, commodities and cryptocurrency.

However, the most important thing is to make sure you can practice on the markets you want to trade.

For example, if you want to trade CFDs on the S&P 500, make sure this is available. Equally, if you want to speculate on the EUR/USD, check this is available in demo mode.

- CMC Markets offers one of the largest product portfolios I have seen with over 12,000 instruments, including currency pairs, currency indices, shares, indices, commodities, treasuries, share baskets, and ETFs.

Getting Started

After signing up for multiple demo trading accounts, those with a straightforward sign-up process stand out. In my experience, the best demo trading accounts allow you to register and start trading in less than 5 minutes.

To get started, you will normally need to provide basic contact details, choose your base currency, amount of virtual funds, and trading platform, and agree to the terms and conditions.

You will then be provided with login credentials which you can use to sign into the demo platform.

- XTB offers a demo account that you can sign up for in 2 minutes. I simply had to provide my email, name, phone number and choose my country from a list.

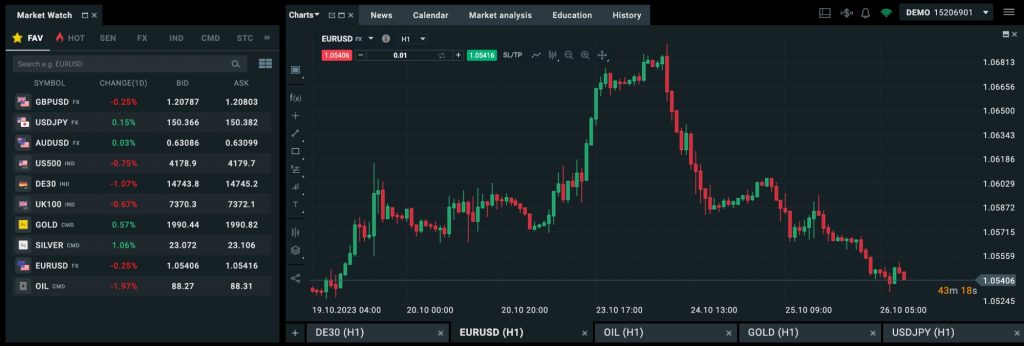

Real Trading Conditions

The best demo trading accounts simulate real market conditions. For me, this means looking for several things.

They should offer live market data and pricing, leverage trading if it’s available in the real-money solution, and access to risk-management tools like stop-loss and take-profit orders. This should help gauge what trading in real-money mode will be like.

That being said, day trading demo accounts cannot fully replicate real-market conditions. For example, in demo mode trades are often executed instantly so you won’t experience the slippage or re-quotes you can see when you trade for real.

Demo trading accounts should also provide access to the same platforms and tools. MetaTrader 4 (MT4), MetaTrader 5 (MT5) and cTrader are among the most popular third-party platforms.

However, I think a demo account is even more important to consider if the broker offers a proprietary platform where you may be unfamiliar with the different features available.

- IC Markets offers demo trading on all three of its platforms; MT4, MT5, and cTrader with pricing conditions that reflect its live accounts.

What Is A Demo Trading Account?

A demo account is a kind of trading simulator, that allows you to practice online trading with a wide range of financial instruments, from stocks, futures, and options to CFDs and cryptocurrencies.

How They Work

Demo accounts are funded with simulated money, allowing you to gain trading experience without risking real capital.

This allows you to craft strategies and build confidence while getting familiar with market conditions.

In addition, they are an effective way to test drive a potential broker and software.

Capabilities

The best demo trading accounts allow you to simulate real trading with the only difference being that you use pretend money.

This way you get the full experience of the markets and the trading platform, without the pressure of risking your actual funds.

- Exploration – Testing different financial markets allows you to get a feel for how they behave while finding the right product for you. Trading stocks will be different to commodities, for example.

- Gain experience – Before you risk real capital, you can practice opening and closing positions, plus applying stops and limits. In addition, you can view margin requirements, as well as track profit and loss.

- Charting – Learn how to interpret and utilize charts, from testing technical indicators to identifying patterns.

- Past performance – You can analyze past performance to correct mistakes and hone your strategy before you put real capital on the line.

- Trading tools – Learn how to interpret and utilize information from news feeds and market data.

- Watchlists – Demo accounts also allow you to identify and monitor financial markets of interest.

Pros And Cons Of Demo Trading Accounts

Pros

- Risk – Because demo accounts are funded with simulated money, mistakes won’t cost you any of your hard-earned capital. In addition, they also allow you to practice day trading while you are still saving for that initial account deposit.

- Price action – The best way to understand price action is to experience it. Stock trading demo accounts, for example, will give you practice reacting to volatile markets and capitalizing on price fluctuations.

- Broker & platform – Online trading with demo accounts is an effective way to test a potential broker and platform. For example, you can check their software has all the charts and tools you need. In addition, do they offer any useful extras, such as trading contests? So, check the overall quality of the broker’s services before you commit real capital.

- Calibration – Demo brokerage accounts are the ideal place to fine-tune your strategy. You can make mistakes and adjustments until your plan is consistent, without losing real capital. Because overtrading, cutting profits short and direction bias are all common mistakes that can prove costly if you don’t make them in practice accounts first.

- Forward testing – Once you have a market and strategy in mind, you can either backtest or forward-test your trading plan. While backtesting can prove useful, it lacks the emotional element. Forward testing enables you to put your plan to trade stocks, for example, into action while battling trading pressures in real time.

- Drawdowns – Regardless of how effective your strategy is, there will be days when the market feels against you. However, investing in a day trading demo account allows you to practice sticking to your plan and perhaps adjusting your position size until things turn around.

Cons

- Execution – Demo accounts often provide better execution than live trading. This is because demo accounts usually fill a market order at the price shown on the screen. However, in a live market, there is slippage. This can result in orders not being filled at the expected price. So, meeting previous profit calculations may prove challenging.

- Increased capital – Normally, demo software allows you to choose how much capital you would like to trade with. As a result, many individuals opt for far more than they will have when they live trade. Greater capital allows for smaller losses to be more easily recouped. You may also find yourself unable to afford the expensive instruments you explored when using demo accounts.

- Spreads – Online forex brokers, for example, often look to impress potential traders with tight spreads in demo accounts. However, in fast-moving markets, in particular, the spread quoted may be far wider.

- Deposits – Although using virtual money, there are some brokers who will require an initial deposit to use their demo accounts. So, this is something to check before you sign up.

- Leverage – Many traders enjoy the increased leverage some brokers offer in demo accounts. Whilst this can result in substantial virtual profits, in live trading it can also lead to significant losses.

- Deal rejection – In demo day trading accounts, trades almost always go through as requested, regardless of certain factors. However, when live trading, price changes between your trade submission and execution can result in rejection. So, be prepared for re-quotes when you upgrade to live trading.

- Trading tools – Free charts and packages you get when you are trading gold in your demo account may well come at an additional cost when you live trade.

- Market movements – Your demo account server may not take into account interest and dividend adjustments, or out-of-hours price movements.

- Emotions – Day trading demo accounts will not expose you to the fear, hope and greed that you may experience when you live trade. The fear of losing your capital can result in costly mistakes. Whilst greed can lead to holding onto a winning position for too long. Unfortunately, you cannot practice controlling these emotions with demo accounts.

- Complacency – Managing risk properly with a practice account is often overlooked. Traders often take more risks than they would if real funds were on the line. This can result in bad habits when you transition to live trading.

- Overtrading – The excitement of trading can cause many with demo accounts to overtrade. After all, why not take that risk when it isn’t real money on the line? This can develop into a habit of overtrading. However, when you move to live trading, you will then need to learn quantity doesn’t always trump quality.

Bottom Line

Demo trading accounts offer a multitude of benefits, from honing a strategy to getting familiar with prospective markets.

However, there are certain limitations, from tackling different emotions to seeing the need for an effective risk management strategy.

But regardless of whether you think using demo accounts is very helpful or not, they remain an effective way to test a potential broker and platform.

FAQ

What Are Demo Trading Accounts?

Demo trading accounts offer a risk-free environment where you can practice trading. They differ from live accounts because they do not use real funds – the broker will provide you with a virtual bankroll. There is no requirement to deposit money.

Which Is The Best Demo Trading Account?

I have listed the best demo trading accounts. These practice accounts offer a straightforward sign-up process, a generous amount of virtual funds to practice trading online, and excellent conditions when you are ready to move to real-money trading.

How Do I Open A Demo Trading Account?

Most demo trading accounts are easy to open. The majority of the time, you will simply have to head over to the broker’s website and fill in a straightforward form.

You will usually be asked for your email address, username, password and location. Often you require no more details than this. Your account login details will then be emailed to you and instructions on the next steps will be given.

You can even find some forex demo accounts that require no registration at all.

Are Demo Trading Accounts Only For Beginners?

Not at all. Demo accounts are also useful for experienced traders looking to develop and test strategies before deploying them in live market conditions.

I find they are particularly useful for brokers with proprietary platforms and in-house tools that you may have not used before.

What Are The Alternatives To Demo Trading?

If you don’t want to use a demo account and are new to trading, I recommend brokers with a low minimum deposit.

The best firms allow you to start trading with a minimum investment of less than $100 with access to high-quality educational materials and training guides.

Recommended Reading

Article Sources

- AvaTrade - Demo Account Details

- XM - Demo Account Details

- CMC Markets - Demo Account Details

- XTB - Demo Account Details

- IC Markets - Demo Account Details

The writing and editorial team at DayTrading.com use credible sources to support their work. These include government agencies, white papers, research institutes, and engagement with industry professionals. Content is written free from bias and is fact-checked where appropriate. Learn more about why you can trust DayTrading.com