Social Trading

Social trading, the dynamic blend of finance and social media, enables individuals to connect, share strategies, and emulate experienced traders. It bridges the gap between seasoned investors and novices, helping to reshape how people engage with financial markets.

This guide explains how social trading works, considering the benefits and risks. We also share our pick of the best social trading platforms.

Quick Introduction

- For newcomers seeking to boost their confidence and acquire real-time insights from experienced traders, social trading can be an excellent choice.

- Communities can interact within a broker’s proprietary trading software, on social media channels and through mobile apps, with chat, comment and sharing features.

- Many brokers also offer copy trading on their social investing platforms, allowing investors to mirror the positions of other users.

- It is important to thoroughly research and evaluate potential traders to follow, assessing their trading history, performance, and consistency.

- Ensure that the social trading platform complies with financial regulations and safeguards your interests, including data security and investor protection.

Best Brokers For Social Trading

Our analysis shows that these 4 brokers offer the most active social trading communities with user-friendly platforms and interactive features:

-

1

eToro USAeToro USA LLC and eToro USA Securities Inc.; Investing involves risk, including loss of principal; Not a recommendation

eToro USAeToro USA LLC and eToro USA Securities Inc.; Investing involves risk, including loss of principal; Not a recommendation -

2

Pionex

Pionex -

3

Exness

Exness -

4

IC Markets

IC Markets

What Is Social Trading?

Social trading is a modern approach to online trading that combines the power of social media and investing. It allows beginner traders to connect with experienced investors and learn from their expertise.

In social trading, you can follow and mimic the trading strategies and actions of these seasoned traders, essentially copying their trades in real-time.

This unique method not only provides you with valuable insights into the world of trading but also allows you to participate actively in financial markets, even if you have limited experience.

Social trading is like having a mentor or a guide as you embark on your trading journey, making it easier for you to make informed decisions and potentially earn profits while you learn from professionals.

Types Of Social Trading

There are three main types of social trading, all of which aim to simplify the trading process by allowing you to follow the strategies of more skilled traders.

- Copy Trading – In this type of social trading, you can automatically replicate the trading activities of experienced traders. When the followed trader opens, modifies, or closes a position, the same actions are mirrored in your account in proportion to your investment. Copy trading is a highly automated form of social investing.

- Mirror Trading – Mirror trading is similar to copy trading but typically allows more flexibility. You can select and implement strategies provided by experienced investors, and while the trades are mirrored, you have more control over risk management and trade parameters.

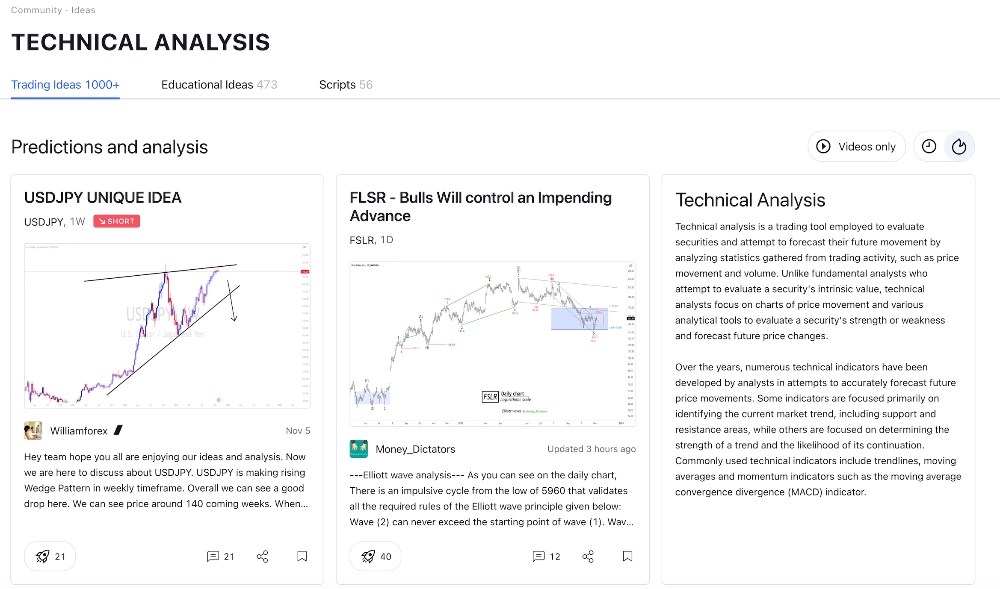

- Social Networking – In addition to copy trading and mirror trading, social trading platforms facilitate interactions among traders. Users can engage in discussions, share insights, and collaborate on trading ideas. While it doesn’t involve direct replication of trades, it fosters a sense of community and knowledge sharing among traders, making it a valuable aspect of social trading.

Social Trading Vs Copy Trading

Social trading and copy trading are related concepts, but they have some key differences. Social trading is more interactive, educational, and hands-on, while copy trading is about directly replicating another trader’s actions in a more passive manner.

The choice between them depends on your trading goals, preferences, and the level of control you want over your trading decisions:

Nature Of Interaction

In social trading, there is a social and interactive aspect to the platform. Traders can communicate, share ideas, and discuss strategies with each other. It’s more like a social network for traders, where information and insights are shared.

Copy trading is more passive. It involves directly copying the trades of a selected trader. There is usually little to no interaction with the trader you are copying. It’s about replicating the chosen trader’s actions automatically.

Level Of Control

In social trading, you have more control over your trading decisions. You can choose to follow or not follow a trader’s advice, and you can also combine information and strategies from multiple sources to make your own trading decisions.

Copy trading is more hands-off. Once you select a trader to copy, your trades will be automatically executed in sync with the trader you’re copying. You typically have less discretion over individual trades.

Learning Vs Passive Investing

Social trading emphasizes learning and education. It allows traders to interact, share knowledge, and discuss strategies, which can be particularly valuable for beginners looking to improve their trading skills.

Copy trading is more about passive investing. It’s a way for you to follow the trading decisions of others without actively engaging in the learning process.

Risk Management

With more control over your trades, you can implement your risk management strategies and adjust your portfolio based on your own analysis of the information available in the social trading network.

Risk management is often more automated in copy trading, as you’re essentially mirroring another trader’s actions.

Pros & Cons Of Social Trading

Pros

- Social trading allows inexperienced traders to access the knowledge and strategies of experienced traders, bridging the gap between novices and experts.

- Social trading platforms typically offer access to a wide range of financial markets, including stocks, forex, cryptocurrencies, and commodities, allowing you to diversify your trades across different asset classes.

- Social trading simplifies trading by automating the process of replicating expert traders’ actions, making it accessible if you have limited time or expertise.

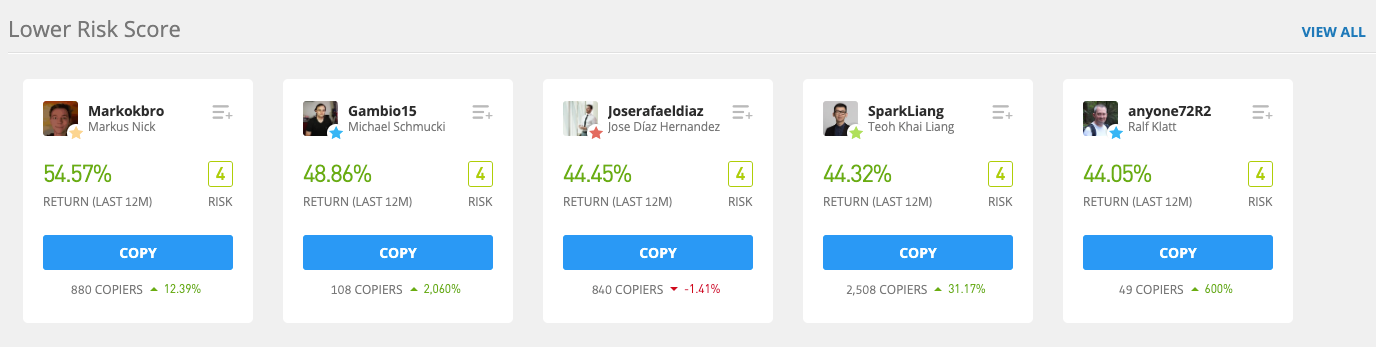

- Social trading platforms often provide transparent performance data and statistics of experienced traders, allowing you to make well-informed decisions about whom to follow and trust.

- It fosters a sense of community among traders, allowing them to discuss ideas, share insights, and collaborate on investment decisions, creating a supportive and engaging environment.

Cons

- Just as social trading can lead to profits, it can also result in substantial losses, especially if the traders you follow make poor decisions or experience market downturns.

- Relying too heavily on the decisions of others can hinder your own development as a trader and may not align with your individual financial goals or risk tolerance.

- Some traders may not fully disclose their strategies or may employ high-risk approaches, which can be difficult to discern before following them.

- When copying trades, you have limited control over the exact timing and parameters of each trade, potentially leading to unintended consequences.

- Social trading platforms often charge fees, such as performance fees or subscription fees, which can erode your overall returns.

How To Start Social Trading

Here is a 10-step process for a new trader with no experience to use social trading to learn from successful traders and gain experience by copying their trades:

1. Select A Social Trading Platform

Begin by choosing a recommended social trading platform that suits your preferences and goals. Look for platforms that offer a wide range of assets and a user-friendly interface.

Create an account on the chosen social trading platform. You may need to provide some personal information and go through a verification process to comply with regulatory requirements.

2. Explore And Research

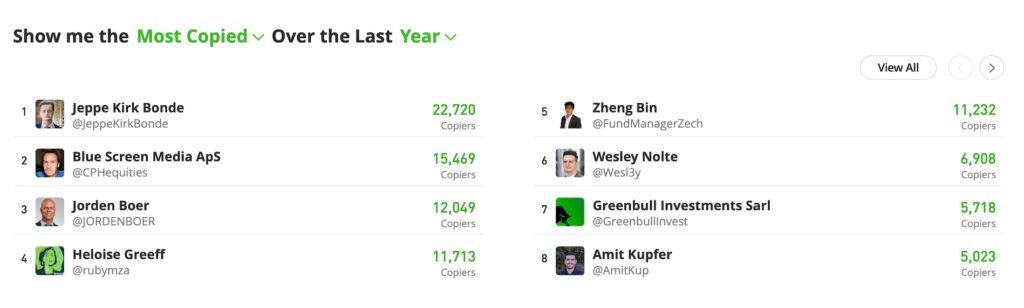

Take your time to explore the social investing platform, browse through the profiles of experienced traders (often referred to as ‘signal’ or ‘strategy’ providers), and conduct in-depth research on their trading history, performance, and risk levels.

Pay attention to traders whose strategies align with your trading objectives and risk tolerance.

3. Follow Experienced Traders

Once you’ve identified traders you’d like to learn from, start following or subscribing to them on the platform.

Following a trader means you’ll receive updates on their activities, but you’ll have control over whether to copy their trades. Subscribing often involves copying their trades automatically.

4. Risk Management

Set your risk management parameters. Determine how much capital you’re willing to allocate for social trading and configure settings for position sizes, stop-loss orders, and risk levels to align with your risk tolerance.

5. Monitor And Learn

As you follow or subscribe to experienced traders, closely monitor their actions and observe their strategies. Pay attention to the logic behind their trades, and learn from their decision-making processes.

Consider their strategies as educational opportunities.

6. Start With A Demo Account

Many social trading platforms offer demo accounts, which allow you to practice social trading with virtual money. These are an excellent way to gain experience and confidence without risking real capital.

7. Diversify And Adapt

To spread risk and gain a broader learning experience, consider following multiple traders with varying strategies. Diversification can help you adapt to different market conditions and trading approaches.

8. Regularly Review And Adjust

Continuously review your social trading activity. Assess the performance of the traders you’re following and make adjustments as needed.

If a trader consistently underperforms or their strategy no longer aligns with your goals, consider unfollowing them.

9. Educate Yourself

While social trading is a valuable learning tool, it’s essential to complement it with your own education. Invest time in learning the fundamentals of trading, technical and fundamental analysis, and risk management techniques.

This knowledge will enhance your ability to make informed decisions.

10. Practice Caution

Remember that while social trading offers valuable learning opportunities, it still involves risks. Never invest more than you can afford to lose, and be cautious of over-reliance on others’ decisions.

Maintain an active role in managing your portfolio.

Bottom Line

Social trading can appear as an appealing option to initiate your trading endeavors, but it’s essential to acknowledge the inherent risks.

Prior to joining a social trading platform, thorough research is imperative. Consider it more as a learning experience to improve your trading skills rather than a fast track to potential profits.

FAQ

How Does Social Trading Work?

Social trading is frequently likened to a social network because it allows traders to engage with one another, observe each other’s trading activities, and gain insights into decision-making processes.

Social trading simplifies access to financial markets, allowing traders of all levels to exchange strategies and replicate each other’s trades. You can opt for comprehensive social trading platforms offering features like copy trading, or you can leverage social trading principles to complement your own strategies by gauging market sentiment and the activity of other traders.

In Which Markets Is Social Trading Available?

Whilst social trading originated in the forex market, today, people use social trading strategies across all asset classes. From forex to cryptos to commodities and stocks.

Is Social Trading Good Or Bad?

Social trading offers both advantages and drawbacks. While it can enhance accessibility to financial markets, it is not a risk-free method and doesn’t eliminate the inherent risks in trading.

It’s important to remember that your trading plan should align with your specific goals and risk tolerance, as copying someone else’s strategy may not always be suitable for your unique circumstances.

Should I Start Social Trading?

Social trading has gained popularity for its ability to provide access to financial markets, allowing traders to mirror the positions of their peers while engaging in interactive communication.

The key advantages of social trading encompass participating in a community that exchanges advice and trade concepts, creating clear buy and sell signals for trades, and developing an understanding of market sentiment.

What Do I Need To Start Social Trading?

First things first, you will need to find a platform you trust. This is arguably the most important step so take your time. Do your research, utilize demo accounts where available and opt for a regulated broker where possible.

Is Social Trading Suitable For Beginners?

Social trading can be a great way for beginners to get valuable exposure. When it comes to online trading, there is so much to learn. Social trading provides an opportunity to learn from some of the industry’s best.

Is Social Trading And Copy Trading The Same Thing?

No, although similar, the key difference between social trading and copy trading is that copy trading is specific to the strategy, whilst social trading is a more general term that applies to the entire trading cycle.

Copy Trading does not amount to investment advice. The value of your

investments may go up or down. Your capital is at risk.

Article Sources

- eToro - Social Trading Platform

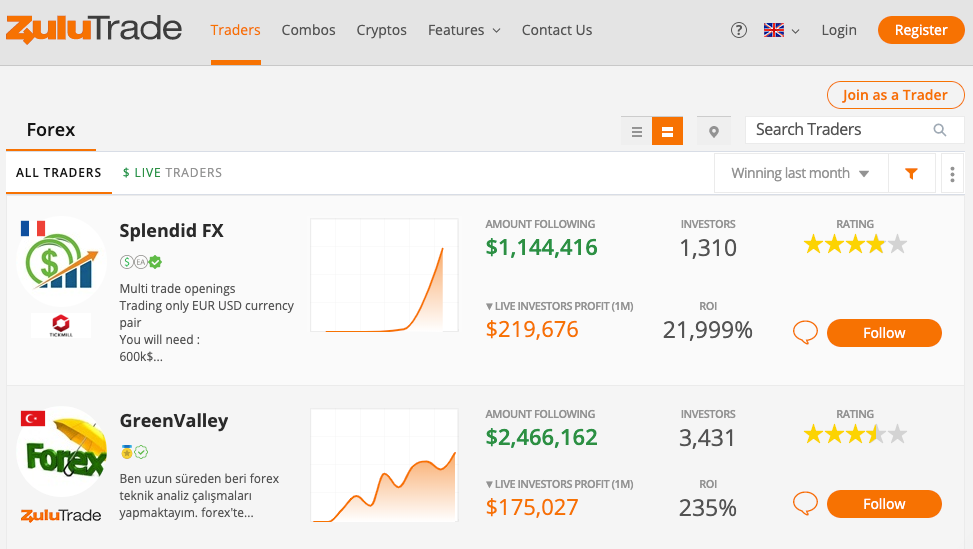

- ZuluTrade - Social Trading Community

- TradingView - Trading Ideas

- Social Trading For Beginners, Jimmy Putnik, 2017

- How to Allocate Your Portfolio Among Traders in Social Trading Platforms, Grega Podvrscek, 2019

The writing and editorial team at DayTrading.com use credible sources to support their work. These include government agencies, white papers, research institutes, and engagement with industry professionals. Content is written free from bias and is fact-checked where appropriate. Learn more about why you can trust DayTrading.com