Halal Trading

Is online trading Halal or Haram, and is there such a thing as an Islamic trading account on the financial markets? With roughly a quarter of the world’s population (about 2 billion people) being Muslim and the development of online trading, the question of where intraday trading fits in with Islamic law is increasingly being asked.

This guide will consider numerous viewpoints and sources in order to answer whether day trading is halal or haram. It will break down forex, stocks and binary options in particular, and try to offer guidance on how to stay halal.

Quick Introduction

- The line between permitted and non-permitted trading activities in Islam is often blurred.

- Trading stocks and forex can be halal if done correctly.

- Halal brokers offer trading accounts that aim to comply with Islamic principles.

- These include the immediate execution of trades, immediate settlement of transaction costs and zero interest rates on trades.

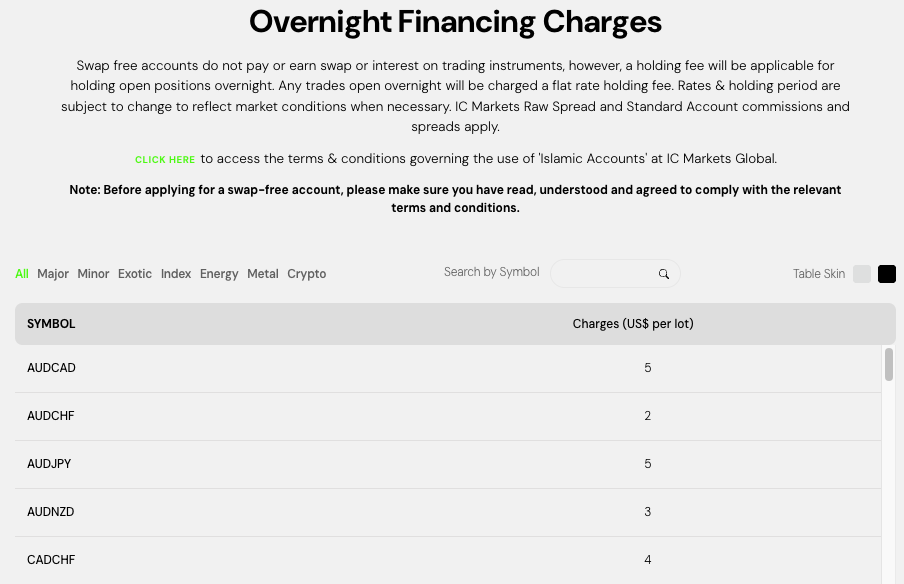

- Halal trading accounts are often marketed as ‘swap-free accounts’, though not every swap-free account is genuinely Shariah-compliant.

Best Halal Brokers

These are the top 4 brokers with Islamic trading accounts:

See all Halal Brokers With Islamic Accounts

Is Day Trading Halal?

Islamic principles govern many aspects of a Muslim’s life, from social to economic matters. All of which are outlined in the Qu’ran and by Sharia Law, which quite literally means ‘pathway to be followed.’ When it comes to day trading, though, black and white lines can quickly become grey.

One of the biggest concerns centres around how risk and profit are shared. In Islamic finance, this is implemented through specific contract types such as mudarabah (profit sharing), musharakah (partnership), murabaha (cost-plus sale), salam, bai‘ muajjal and others.

Please note that this site is not a religious authority on the subject of Islamic day trading. If you want to be certain that your trading activities are Halal, we recommend that you consult with a religious authority that can consider your individual situation.

There will probably always be a divide in opinion as to whether day trading is halal or haram. It must also be noted that despite in-depth research into numerous sources, this page is not trying to offer readers religious advice. Instead, it looks to collate viewpoints and present them in an easy-to-digest format.

While there certainly remains a substantial number of people who conclude Islamic day trading is halal, perhaps the best steps you can take are to choose your broker carefully and evaluate your trade decisions with the parameters of halal in mind.

Is Buying Shares Halal?

Many contemporary scholars consider buying stocks permissible, provided the company’s core business is halal, and its finances meet Shariah screening criteria. These criteria are reflected in international standards such as the Accounting and Auditing Organization for Islamic Financial Institution’s (AAOIFI) Shari’ah Standard No. 21 on financial papers (shares and bonds).

However, you do need to be sure the company in question is not dealing in an un-Islamic manner. Companies like Guinness (alcohol) and Ladbrokes (gambling), for example, would not be allowed.

You can break down companies from an Islamic perspective into three categories:

- Shares from permissible practices – Shipping, manufacturing, clothing, medical equipment, real estate, tools, furniture, supplies and so on are all free from haram practices or transactions, such as cheating and borrowing based on riba (unjustified lending). These companies are also known as ‘clean’ companies.

- Shares based on prohibited practices – Any company that deals in tourism, alcohol, hotels, nightclubs, pornographic materials, riba-based banks, commercial insurance companies, etc, is not permissible. In these circumstances, the stock market is haram.

- Shares based on partly haram practices – Whilst the majority of the work may be permissible, some practices are haram. Transportation companies, for example, hold interest-based bank accounts and are often financed by riba-based loans or individuals through stocks. These types of companies are known as ‘mixed’ companies.

So, what do you do if the company deals in goods and services that do not agree with Islamic law?

You do not invest. If you want to avoid any potential conflict, the easiest decision is to avoid buying and selling shares in the stock at all. Having said that, there remains some wiggle room. In some cases, you may still be able to trade and remain halal.

Small Percentage

Many contemporary Shariah boards allow investing in ‘mixed’ companies if the haram revenue is below a small threshold and the corresponding portion of income is donated to charity. For example, the Fiqh Council of North America permits investment in mixed companies under specific financial ratio thresholds and requires purification of unlawful income.

It is suggested that you simply give away the percentage of the profits that are created by the haram section of the business. So, if 10% of the company’s profits stem from alcohol, you’d donate 10% of your profits to a charity.

However, other scholars and fatwa bodies consider investing in such mixed companies impermissible altogether, even with purification. Muslims should follow the view of scholars they trust.

Interest

The other major area of concern centres around interest. You shouldn’t be trading in interest, so ideally you’d exchange £25 for precisely £25. However, that may not always be feasible. As the stock price varies, you inevitably end up paying more or less than face value for the debt/cash.

For example, if a company has £72,000 of cash and interest-bearing deposits out of total assets of £75,000, and the shares trade at a total market value of £90,000, you are effectively paying more than the face value for what is mostly cash and debt.

Solution

Fortunately, it is relatively straightforward to stick with just halal shares. To avoid excessive interest and cash-heavy balance sheets, most Islamic indices and Shariah boards use explicit financial ratios (for example, interest-bearing debt and non-halal income each below about 30% and 5% thresholds, respectively).

You can actually find Islamic stock screeners that will identify halal stocks for you. However, such software is relatively expensive. Alternatively, most platforms allow you to get a screenshot of the company, highlighting their debt levels and market capitalisation.

For the most part, common sense is your greatest weapon. Avoid heavily leveraged companies that are concerned with the buying and selling of haram goods and services. So, in summary, whether stock trading is halal or haram entirely depends on the companies you opt for and how much profit you retain.

Is Currency Trading Halal?

Forex trading is increasingly accessible, and the potential for quick money draws more traders in every day. On the surface, this looks like one of the halal investment opportunities, as you’re simply buying and selling money. However, dig a little deeper, and you might wonder if forex trading is actually haram.

International bodies such as the International Islamic Fiqh Academy have issued resolutions on currency exchange, futures and margin trading that many contemporary scholars rely on when assessing forex platforms.

If you were to buy £4,000 for $2,500 and sell it six months later when the pound appreciates against the dollar, then this is a halal transaction. But in reality, there remain several issues.

Leverage

To make substantial intraday profits from tiny price movements, you need to invest large sums of money, thousands, if not hundreds of thousands of pounds. So, to alleviate this problem, forex brokers offer you leverage. In effect, allowing you to invest £50 or £75 for every £1 you put up. You can now take much larger positions and increase your profit.

However, this is in effect a loan. In Islam, it is permissible to borrow from someone for the purposes of investing to make a profit and then return that loan interest-free to the creditor.

In margin forex, the broker effectively lends you money (leverage) on condition that you trade through them and they earn from spreads or commissions. Many contemporary scholars consider this problematic, because it combines a loan with a commercial benefit for the lender and often also involves interest-like swap charges — both of which fall under riba.

Solution

Some brokers market ‘Islamic’ or ‘swap-free’ forex accounts that remove overnight interest and instead adjust spreads or fees. A minority of scholars are comfortable with certain carefully structured spot forex arrangements.

However, major fiqh bodies and fatwa councils have repeatedly ruled that most retail margin forex — including many so-called ‘Islamic’ accounts — remains non-compliant because of issues like margin loans tied to broker benefit, lack of true currency delivery, and hidden interest-like charges.

Anyone considering such products should seek a detailed fatwa on the specific structure. A useful reference for how central banks approach these issues is Bank Negara Malaysia’s ‘Shariah Resolutions in Islamic Finance’, which covers rulings on foreign exchange, leverage and other market instruments.

Hand To Hand Exchange

With the interest element out of the way, the next issue relates to the exchange itself. Trading is permissible ‘so long as it (exchanges) is hand to hand’. This shows the Prophet Mohammed obviously had in mind that commodities would be exchanged between two parties, as a natural part of commerce.

In the past, most deals would have been done face-to-face, but with the evolution of e-commerce, what constitutes ‘hand to hand’?

Solution

Many argue that the deal is made between the broker and trader, which would qualify under the definition of two different parties, and therefore, halal.

The condition of ‘hand-to-hand’ means that once a currency trade is executed, both currencies must be delivered on the spot (or its modern electronic equivalent). It does not mean you must close your trade at the same moment. Modern fatwas usually distinguish between spot trades that settle immediately (potentially permissible) and forward/derivative trades that defer delivery (generally impermissible).

Whether stop and limit orders are allowed depends on how the broker’s system handles execution and settlement, not on the mere use of these order types.

Ownership

Another part of the answer to ‘is forex trading legal in Islam?’ centres around ownership. You are merely speculating whether the value of the currency will increase or decrease, so is this halal?

In many retail platforms, what’s called ‘forex trading’ is actually trading contracts for difference (CFDs) or similar derivatives where you never own the underlying currencies. Many fiqh councils and fatwa bodies regard these structures as impermissible, regardless of branding.

Solution

Many are in agreement with several factors surrounding forex that may answer the question. Islam recognises the need for humans to want to improve their lives, including their financial situation. We all must consider implications when confronted with choices and use intelligence to respond in such situations.

So, whilst we know gambling is strictly haram, there may be some halal forex brokers who have made every effort to keep any activities strictly within the confines of Islamic law, though these need to be examined on a case-by-case basis.

Regulators also stress that leveraged forex and CFDs are high-risk products; for example, the UK Financial Conduct Authority regularly warns about consumer harm from CFDs, and US regulators such as the CFTC publish advisories on forex and binary options fraud.

Is Trading Binary Options Halal?

Unlike other forms of trading, binary options offer more straightforward trades than a lot of other instruments, such as stocks and forex. The option will either pay out a fixed amount of compensation if the option expires in the money, or it will pay out nothing if the option expires out of the money.

If the trader has little knowledge of what and how to trade, then to trade binaries would be a form of gambling, and not halal.

On top of that, because each contract must have a winner and a loser, this is arguably not halal. Not every party can profit or extract value from the trade. So, it’s worth noting that many consider binary options fundamentally haram. From a regulatory perspective, European authorities have also taken a hard line: ESMA introduced EU-wide measures prohibiting the marketing, distribution or sale of binary options to retail investors.

The dominant view among contemporary scholars and fiqh councils is that conventional binary options are haram regardless of the trader’s experience, because the contract structure itself resembles gambling and involves excessive uncertainty. Individual understanding of technical analysis does not change the underlying ruling. In parallel, US regulators such as the SEC and CFTC have issued joint investor alerts about fraud and heavy retail losses on online binary options platforms.

Read more about Halal Binary Options

Islamic Trading Accounts

It is clear that halal online trading will depend partly on your actions and partly on the broker you opt for. For a trading account to be genuinely Shariah-compliant, widely-used standards (such as those of the AAOIFI) require more than just ‘no swaps’:

- Immediate spot settlement and real or constructive possession of the asset.

- No interest (including disguised or conditional benefits from margin loans).

- Underlying assets and activities must be halal.

- Avoidance of prohibited derivatives and contracts (e.g. many CFDs and options).

Many ‘Islamic’ or ‘swap-free’ accounts marketed by brokers still fail one or more of these tests, so it’s important to look at the detailed structure and, ideally, at the fatwa behind the product.

Retail traders should also be aware of secular regulatory protections; for instance, the UK FCA has introduced and updated product-intervention measures for CFDs and binary options to reduce harm to retail consumers.

See the list of halal brokers and Islamic trading accounts.

Further Reading

- Buying and selling stocks on the same trading day on IslamWeb

- Ruling on currency trading on IslamQA

- Ruling on options contracts on IslamQA