Automated Trading

Automated trading systems allow trades to be executed swiftly and precisely using a computer algorithm. Once an individual determines the criteria for entering and exiting trades, these will be punched into a computer so that they can be performed automatically without the need for human assistance.

This guide for beginners will explain what these trading systems are and how they work, outline the different types of systems that traders can use, and discuss the advantages and disadvantages of automated trading.

Quick Introduction

- Automated trading systems use computer programs to carry out trades faster and more efficiently than a person can.

- Algorithmic systems will scan the market and can execute trades based on technical and fundamental factors.

- Individuals have a wide range of automated-based trading platforms to choose from.

- Building an automated trading system is also possible using programming languages like Python or C++.

Best Automated Trading Brokers

These brokers offer the best automated trading platforms based on our tests:

-

1

Interactive Brokers

Interactive Brokers -

2

NinjaTrader

NinjaTrader -

3

OANDA USCFDs are not available to residents in the United States.

OANDA USCFDs are not available to residents in the United States. -

4

FOREX.com

FOREX.com

All Brokers with Automated Trading

What Are Automated Trading Systems?

Automated trading systems use computers to create buy and sell orders based on a trader’s preferred strategy. They monitor the markets and utilize mathematical algorithms to place trades according to particular pre-determined criteria.

After being fed with exact entry and exit rules, the automated system will watch the market for investing opportunities and execute them using technical and fundamental analysis. Technical indicators such as moving averages, the relative strength index (or RSI) and Bollinger Bands are commonly used in auto trading.

When it comes to fundamental analysis, these trading systems can use a wide range of data to make decisions. Commonly studied news items include earnings reports, economic datasets, interest rate decisions, industry-specific news and geopolitical events (such as election results or international conflicts).

The speed of automated systems means traders can more effectively exploit trading signals as they emerge. Algo-based trading can be especially useful in highly liquid, fast-moving markets.

System trading can also be a great way for market participants to manage risk. This is because protective measures like stop losses, trailing stops and profit targets are generated that allow traders to limit losses and book gains.

The Rise Of Automated Trading

The rapid advancement of technology means that computers now dominate trading on financial markets. Although it is difficult to get an exact figure, it is estimated that around three-quarters of all trades on US stock markets are carried out by machines using pre-fed instructions.

Automated trading is especially popular in the United States, although the use of bots is growing rapidly across the globe. One report suggests that the automated system trading market will expand at a compound annual growth rate of 13.6% between 2021 and 2030. By the end of the decade, it is predicted to have an estimated value of $31.3 billion.

Automated trading strategies can be used across a variety of asset classes, including forex, stocks, cryptocurrencies, futures, and options.

Pros and Cons Of Using Automated Trading Systems

Pros

- Trading speed – Rapidity of thought and execution means that bots can exploit trading opportunities as they arise better than humans can. The benefit can be particularly acute for traders who use short-term trading strategies like scalping and day trading.

- Time Benefits – Whilst trading activity should always be monitored for technical problems, the use of bots frees up time that can be used for other investing-related activities like analysis or setting up further trades.

- Emotion is removed – Individuals will often place trades that are based on rash decision-making, which in turn often leads to large losses. Employing a machine that only acts on strict, pre-determined rules eliminates this danger.

- Backtesting benefits – Most automated systems allow traders to test their rules and strategy against historical data. This allows them to evaluate their performance and make necessary adjustments before implementing them in the real world. Institutional trading research emphasizes that efficient simulation engines for backtesting and forward testing are critical for designing automated trading systems that can be reliably deployed at scale.

- Improved diversification – Bots are excellent at trading and managing multiple strategies, assets, or markets at the same time. This provides diversification and thus reduces an investor’s risk exposure.

- Strong risk management – Automated trading systems provide a safety net by alerting traders when specific conditions are met or when it is time to act. They also allow traders to use tools like stop-loss and take-profit orders to limit potential losses. In fact, the CFTC requires algorithmic traders to implement pre-trade risk controls including maximum order size limits, price parameters, and order cancellation systems .

- to prevent market disruption on regulated futures exchanges.

Cons

- Over-optimization – Also known as ‘curve fitting,’ this refers to a backtesting situation where users excessively tailor their trading strategies to perform well based on historical data. Such fine-tuning means a strategy may not perform strongly in live trading as it fails to adapt well to real-world conditions. Research shows that strategies developed with excessive degrees of freedom in optimization can generate satisfactory results during the optimization period while failing during real trading – a critical threat requiring walk-forward analysis and strict testing protocols.

- Technical complexity – Setting up and managing a customized, auto-based trading system can require technical skills in areas including programming, data handling, backtesting and security. If trading through a regulated broker, know that brokers must have comprehensive supervision and testing programs for algorithmic strategies under SEC Rule 3110, which reflects how seriously regulators treat this complexity.

- Mistakes can be costly – Errors at the testing and configuration stages can leave a trading strategy in tatters. In August 2012, a faulty algorithm used by trading firm Knight Capital resulted in millions of unintended trades in less than an hour. It ended up costing the company a staggering $440 million.

- Stability issues – Automated trading systems only work when the technology underpinning them is running smoothly. Software bugs, hardware problems, and/or connectivity issues are all common problems that can scupper an individual’s investing plans.

Getting Started With Automated Trading

First Steps

The first step on an individual’s investing journey is the same regardless of whether they decide to use bot-based trading.

They will need to decide which financial markets they want to trade in (forex, stocks, commodities etc.); which financial instruments they wish to use (for example futures, options, shares and contracts for difference (CFDs)); and come up with a specific trading strategy depending on their investing goals and personality traits (including their attitude to risk).

There is a wealth of information and resources out there to help novice investors get started, from books, webinars and online courses through to Quantopian.com – a website for researching historic stock price data and writing trading algorithms that can be backtested on that data.

Only when they’ve mastered this stage should they take the next step and ask whether machine learning is the best option. This again will require in-depth reading to get to know the ins and outs, and the pros and cons, of machine-assisted dealing.

If an individual decides to use a scalping trading strategy, which involves executing a large volume of trades over a very short period, using an automated trading system has obvious advantages for them.

However, this person may still prefer to stick to conventional trading methods if they are concerned about ceding control. These are just a few important things to consider.

Choosing A Platform

Let’s say that an investor has decided to take the plunge and try out automated trading. The next thing to do is to choose a trading platform that supports automated-based dealing.

Some of the most popular ready-made automated systems available today are:

Algorithmic trading platforms are not universally compatible with all brokerages, however. Automated systems use protocols called Application Programming Interfaces (APIs) to connect and trade via a financial intermediary.

So a trader who has a particular broker in mind may want to check that their technology is compatible with the platform they are considering using, and vice versa.

Some automated platforms are also only designed for certain asset classes. Wyden, for instance, is an institutional-grade platform that facilitates the trading of digital assets like Bitcoin.

Some brokerages will provide an option for traders to download an automated platform once they sign up. This option often incurs fees that the company will directly charge the user.

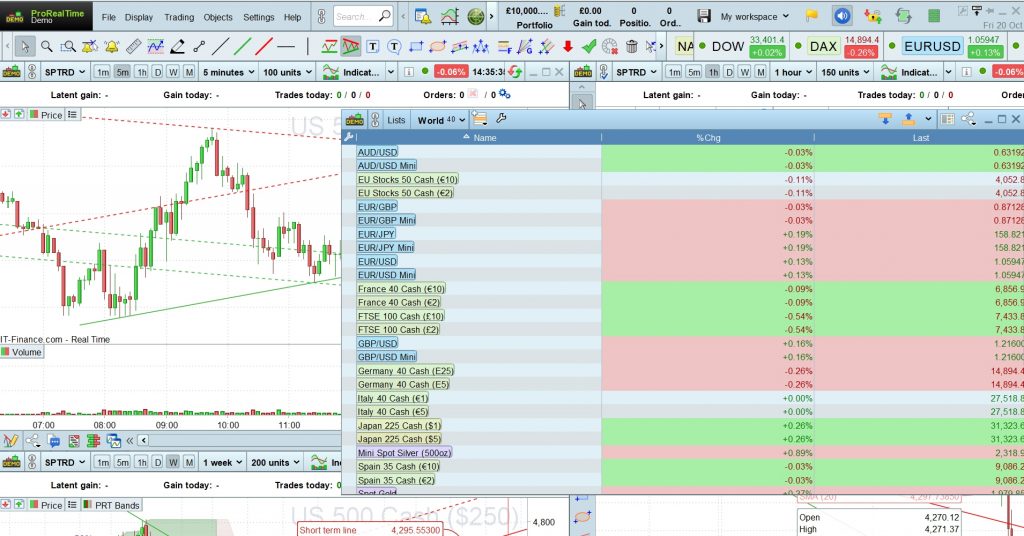

IG, for example, allows traders to use the ProRealTime platform that it charges $40 a month for. However, the fee is waived if four or more monthly trades are made.

There are key criteria that a trader needs to consider when choosing which trading platform and broker to use. This stays the same regardless of whether they go down the automated trading route or not.

Considering trading fees and subscription costs is essential, as is making sure their chosen brokerage is properly regulated.

It is also important to consider how easy to use the platform is, whether or not it offers advanced tools and features (such as artificial intelligence), and if it allows you to trade on the go using a mobile app.

Simple Or Complex?

Automated trading comes with varying degrees of complexity. Some platforms come packed with pre-built algorithms or trading strategies that can be easy to set up and use without the need for excessive customization.

For example, TradingView offers thousands of community-created strategies in its Strategy Library, while MetaTrader 5‘s MQL5 Code Base provides ready-to-use Expert Advisors.

Traders will select from a list of widely used technical indicators, and input other key data like entry and exit conditions and position sizes. Using these previously engineered algorithms means traders don’t have to spend time learning how to program.

Another popular option is copy trading, considered to be the simplest automated trading method of them all. It involves copying the trading decisions and strategies of another investor (commonly known as the ‘master investor’ or ‘signal provider’). All the user has to do is select which investor they wish to replicate and then sit back.

Brokers Offering Copy Trading

We have opened accounts and tested multiple automated copy trading platforms and these are the best:

-

1

eToro USAeToro USA LLC and eToro USA Securities Inc.; Investing involves risk, including loss of principal; Not a recommendation

eToro USAeToro USA LLC and eToro USA Securities Inc.; Investing involves risk, including loss of principal; Not a recommendation -

2

Pionex

Pionex -

3

RoboForex

RoboForex -

4

XM

XM

More experienced and confident traders often choose to develop their own automated trading software and code their own systems. This approach allows users to build faster and more personalized platforms, and to put in place more complex and niche trading strategies.

One downside, however, is that the software a trader produces may be bug-ridden and expensive to create. A trader will also have to learn a programming language to get the platform off the ground like Python, Java, or C++.

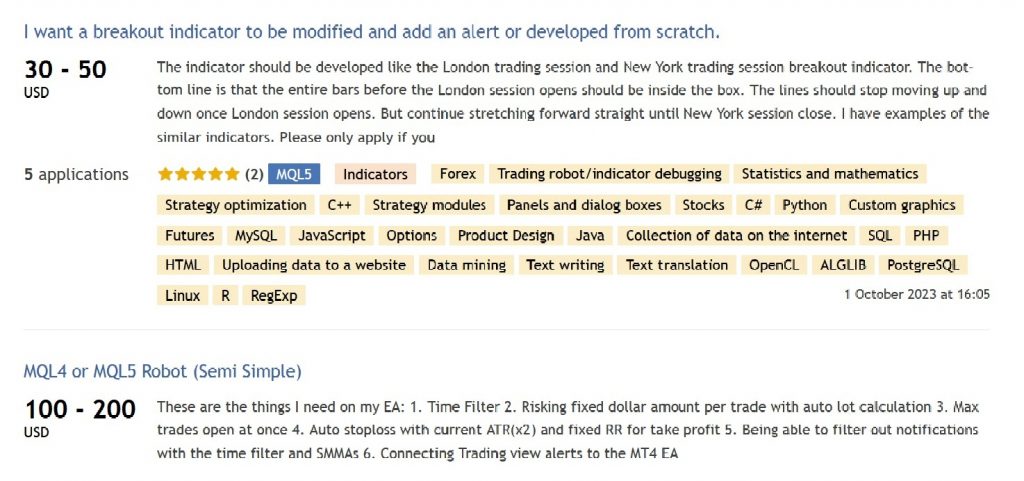

Traders can avoid some of these problems by farming this task out to a freelance developer. However, their services don’t always come cheap, and functionality problems can still occur (for example, if the software specialist fails to input all of their client’s desired functions).

The MetaTrader Market can be a great place to find experienced developers who sell their services.

Preparing To Launch

Once a trader has devised their automated trading strategy and set their algorithms, the next stage is for them to backtest their approach. This involves the use of historical data to help them understand how their strategy would have performed in the past.

A user can tweak their specifications based on these results. But be warned that while a strategy may appear to be a winner during backtesting, things can go very differently in the real world.

Setting up a demo account, then, is a good idea for new traders. It allows individuals to see how their strategy (or strategies) would perform in real time without risking their hard-earned cash. Only after this stage should an investor consider putting their capital on the line.

Automated trading strategies should be reviewed regularly and amended if necessary. Market conditions are always changing and periodic adjustments may be required to boost trading performance.

Bottom Line

The good news is that you don’t have to be a technical whizz to trade the markets with an algorithm-based system. As automated trading has become more popular with retail traders, the number of brokerages offering automated dealing solutions has naturally increased.

Using robots has obvious advantages, like speed, consistency, and the elimination of rash, emotion-based decision-making. Combined, these can have a significant impact on a trader’s prospects.

But automated trading systems also have some specific drawbacks, and individuals still need to regularly monitor trades in case problems occur.

FAQ

What Is An Automated Trading System?

An automated trading system uses computer algorithms to carry out trades based on a user’s pre-selected trading preferences. They allow trading to take place more quickly compared to manual trading and without emotion.

Is Automated Trading Legal?

Automated-based trading is legal around the world, though not all brokerages offer this option to their customers. Our list of top brokers for automated trading supports the use of such systems.

Are Automated Trading Systems Expensive?

The fees users can expect depend on which trading platform and broker they select. Subscription charges may be paid monthly, annually, or a one-off payment can often be made.

Do I Need Programming Skills For Automated Trading?

No, as many trading platforms allow traders to specify their trading criteria using tools like checkboxes and drop-down boxes. However, those who wish to create their own software applications will have to learn a programming language.

Am I Required To Monitor My Automated Trades?

It is true that an automated trading strategy isn’t as hands-on as traditional investing methods. You are using a machine to carry out buy and sell orders, after all. However, individuals still need to regularly monitor what is happening in case of technical problems, and to check that their trading strategy is still working effectively based on market conditions.

Is Automated Trading The Right Strategy For Me?

If you’re looking for an approach that enables you to trade according to predetermined limits, that offers flexibility and utilizes the latest technology, then automated trading strategies might be a good option for you.

Is Automated Trading Difficult?

Trading is never easy, no matter how long you have been in the game for. Automated trading does offer some benefits, such as removing some of the high-pressure last-minute decision-making. It also offers traders more flexibility compared to other strategies as it does not require such close monitoring. But as with any strategy, to succeed you will need to dedicate time and effort.

Can You Automate Day Trading?

Yes, traders can adopt automated systems for day trading. Some traders develop their own systems whilst others use third-party platforms. There are lots of options available to traders of all levels but make sure you research a provider thoroughly to ensure they offer all the features you are looking for. Alternatively, use our list of the best brokers with automated day trading software.

Do Automated Traders Make Money?

Some automated investors will make money and some won’t. There are so many factors that contribute to long-term trading success but a method you understand and have confidence in is a good place to start.