Best cTrader Brokers In 2026

Searching for the perfect cTrader broker? Explore DayTrading.com’s selection of the best brokers with cTrader, personally tested and rated by our experts which includes longtime users of the platform.

Top 6 Brokers With cTrader

As of our latest hands-on tests in March 2026, these are the 6 top brokers that support cTrader:

-

1

IC Markets

IC Markets -

2

IC Trading

IC Trading -

3

Pepperstone75-95% of retail investor accounts lose money when trading CFDs

Pepperstone75-95% of retail investor accounts lose money when trading CFDs -

4

Fusion Markets

Fusion Markets -

5

BlackBull

BlackBull -

6

GO Markets

GO Markets

Here is a short summary of why we think each broker belongs in this top list:

- IC Markets - IC Markets’ cTrader stands out with razor-thin spreads from 0.0 pips and a low $7 commission per standard lot. When we tested the software, execution was consistently swift, with deep liquidity. Its advanced features include customizable algos and one-click trading, ideal for scalpers and professionals.

- IC Trading - IC Trading’s cTrader provides tight spreads from about 0.1 pips with low commissions starting near $6 per lot. When we tested its cTrader software, execution was reliable and fast, supported by robust liquidity. The platform’s advanced risk management tools and automated trading capabilities stood out for active traders.

- Pepperstone - Pepperstone’s cTrader delivers ultra-fast execution and tight spreads - often around 0.0-0.2 pips on majors - with low commissions from $7 per round turn. When we used it, order routing was seamless, no minimum deposit restrictions applied, and advanced charting plus algorithmic trading tools enhanced usability for active traders.

- Fusion Markets - Fusion Markets’ cTrader impressed us with ultra-low spreads from 0.0 pips and a $7 commission per round turn. During our hands-on testing, execution was quick and stable. Advanced features like customizable indicators and smart order types enhance trading for all skill levels.

- BlackBull - BlackBull Markets’ cTrader delivers tight spreads from 0.0 pips with competitive commissions around $6–$7 per lot. When we tested it, execution speed was consistently fast, supported by deep liquidity. Features like automated trading and customizable interface make it a strong choice for active and professional traders.

- GO Markets - GO Markets’ cTrader provides a reliable environment for serious traders, made better with tight spreads from 0.0 pips with low commissions around $6–$7 per lot. When we used it, orders went through fast, supported by deep liquidity. Advanced features like automated trading, one-click orders, and customizable charting make it ideal for active traders.

Best cTrader Brokers In 2026 Comparison

| Broker | cTrader Integration | Demo Account | Trading Instruments | Broker Regulators | Minimum Deposit |

|---|---|---|---|---|---|

| IC Markets | ✔ | ✔ | CFDs, Forex, Stocks, Indices, Commodities, Bonds, Futures, Crypto | ASIC, CySEC, CMA, FSA | $200 |

| IC Trading | ✔ | ✔ | CFDs, Forex, Stocks, Indices, Commodities, Bonds, Cryptos, Futures | FSC | $200 |

| Pepperstone | ✔ | ✔ | CFDs, Forex, Currency Indices, Stocks, Indices, Commodities, ETFs, Crypto, Spread Betting | FCA, ASIC, CySEC, DFSA, CMA, BaFin, SCB | $0 |

| Fusion Markets | ✔ | ✔ | CFDs, Forex, Stocks, Indices, Commodities, Crypto | ASIC, VFSC, FSA | $0 |

| BlackBull | ✔ | ✔ | CFDs, Stocks, Indices, Commodities, Futures, Crypto | FMA, FSA | $0 |

| GO Markets | ✔ | ✔ | CFDs, Forex, Stocks, Indices, Commodities, Bonds, ETFs, Crypto | ASIC, CySEC, FSC, FSA | $0 |

IC Markets

"IC Markets offers superior pricing, exceptionally fast execution and seamless deposits. The introduction of advanced charting platforms, notably TradingView, and the Raw Trader Plus account, ensures it remains a top choice for intermediate to advanced day traders."

Christian Harris, Reviewer

IC Markets Quick Facts

| Demo Account | Yes |

|---|---|

| Instruments | CFDs, Forex, Stocks, Indices, Commodities, Bonds, Futures, Crypto |

| Regulator | ASIC, CySEC, CMA, FSA |

| Platforms | MT4, MT5, cTrader, TradingView, TradingCentral, DupliTrade, Quantower |

| Minimum Deposit | $200 |

| Minimum Trade | 0.01 Lots |

| Leverage | 1:30 (ASIC & CySEC), 1:1000 (FSA) |

| Account Currencies | USD, EUR, GBP, CAD, AUD, NZD, JPY, CHF, HKD, SGD |

Pros

- IC Markets offers among the tightest spreads in the industry, with 0.0-pip spreads on major currency pairs, making it especially cost-effective for day traders.

- IC Markets offers fast and dependable 24/5 support based on firsthand experience, particularly when it comes to accounts and funding issues.

- You have access to over 2,250 CFDs across various markets, including forex, commodities, indices, stocks, bonds, and cryptocurrencies, allowing for diversified trading strategies.

Cons

- Interest isn't paid on unused cash, an increasingly popular feature found at alternatives like Interactive Brokers.

- The breadth and depth of tutorials, webinars and educational resources still need work, trailing alternatives like CMC Markets and reducing its suitability for beginners.

- There are fees for certain withdrawal methods, including a $20 wire charge, which can eat into profits, especially for frequent withdrawals.

IC Trading

"With superior execution speeds averaging 40 milliseconds, deep liquidity, and powerful charting software, IC Trading delivers an optimal trading environment tailored for scalpers, day traders, and algorithmic traders. "

Christian Harris, Reviewer

IC Trading Quick Facts

| Demo Account | Yes |

|---|---|

| Instruments | CFDs, Forex, Stocks, Indices, Commodities, Bonds, Cryptos, Futures |

| Regulator | FSC |

| Platforms | MT4, MT5, cTrader, AutoChartist, TradingCentral |

| Minimum Deposit | $200 |

| Minimum Trade | 0.01 Lots |

| Leverage | 1:500 |

| Account Currencies | USD, EUR, GBP, CAD, AUD, NZD, JPY, CHF, HKD, SGD |

Pros

- IC Trading offers unusual flexibility in its accounts, enabling traders to open up to 10 live and 20 demo accounts, meaning you can run separate profiles for different activities, such as manual trading and algo trading.

- Trading Central and Autochartist are valuable tools for in-depth technical summaries and actionable trading ideas and are accessible from within the account area or the cTrader platform.

- The simplified and digital account opening process saves time and effort, allowing traders to start trading sooner without extensive paperwork, taking just minutes during testing.

Cons

- The educational resources are greatly in need of improvement, unless you navigate to the IC Markets website, posing a limitation for beginners in search of a comprehensive learning journey, especially compared to category leaders like eToro.

- Customer support performed woefully during testing with multiple attempts to connect via live chat and no one available to assist, plus unanswered emails, raising concerns about its ability to address urgent trading concerns.

- Despite being part of the trusted IC Markets group, IC Trading is authorized by a weak regulator - the FSC of Mauritius, with limited financial transparency and regulatory safeguards.

Pepperstone

"Pepperstone stands out as a top choice for day trading, offering razor-sharp spreads, ultra-fast execution, and advanced charting platforms for experienced traders. New traders are also welcomed with no minimum deposit, extensive educational resources, and exceptional 24/7 support."

Christian Harris, Reviewer

Pepperstone Quick Facts

| Demo Account | Yes |

|---|---|

| Instruments | CFDs, Forex, Currency Indices, Stocks, Indices, Commodities, ETFs, Crypto, Spread Betting |

| Regulator | FCA, ASIC, CySEC, DFSA, CMA, BaFin, SCB |

| Platforms | Pepperstone Trading Platform, MT4, MT5, cTrader, TradingView, AutoChartist |

| Minimum Deposit | $0 |

| Minimum Trade | 0.01 Lots |

| Leverage | 1:30 (Retail), 1:500 (Pro) |

| Account Currencies | USD, EUR, GBP, CAD, AUD, NZD, JPY, CHF, HKD, SGD |

Pros

- There’s support for a range of industry-leading charting platforms including MT4, MT5, TradingView, and cTrader, catering to various short-term trading styles, including algo trading.

- Pepperstone has greatly improved the deposit and withdrawal experience in recent years, adding Apple Pay and Google Pay in 2025, as well as PIX and SPEI for clients in Brazil and Mexico in 2024.

- Pepperstone emerges as a low-cost broker, especially for serious day traders with spreads from 0.0 in the Razor account and rebates up to 30% (index and commodities) and $3/lot (forex) through the Active Trader program.

Cons

- Pepperstone’s demo accounts are active for only 60 days, which may not be not long enough to familiarize yourself with the different platforms and test trading strategies.

- Pepperstone does not support cTrader Copy, a popular copy trading feature built into the excellent cTrader platform and available at alternatives like IC Markets, though it has introduced an intuitive copy trading app.

- Despite enhancements to its range of markets, crypto offerings are relatively limited compared to other brokers who focus on this area, with no option to invest in real coins.

Fusion Markets

"Fusion Markets is a standout option for forex traders looking for excellent pricing with spreads near zero, industry-low commissions and recently TradingView integration. It’s a particularly good broker for Australian traders where the company is headquartered and regulated by the ASIC."

Jemma Grist, Reviewer

Fusion Markets Quick Facts

| Demo Account | Yes |

|---|---|

| Instruments | CFDs, Forex, Stocks, Indices, Commodities, Crypto |

| Regulator | ASIC, VFSC, FSA |

| Platforms | MT4, MT5, cTrader, TradingView, DupliTrade |

| Minimum Deposit | $0 |

| Minimum Trade | 0.01 Lots |

| Leverage | 1:500 |

| Account Currencies | USD, EUR, GBP, CAD, AUD, NZD, JPY, CHF, HKD, SGD |

Pros

- The range of charting platforms and social trading features is excellent, with MT4, MT5, cTrader and more recently TradingView, catering to a wide range of trader preferences.

- Fusion Markets continues to impress with its pricing that provides tight spreads with below-average commissions that will appeal to active day traders.

- The market analysis features, Market Buzz and Analyst Views, are great tools for discovering opportunities and conveniently integrated into the client dashboard.

Cons

- While the selection of currency pairs trumps most rivals, the broker's alternative investment offering is average with no stock CFDs beyond the US.

- There is no proprietary trading platform or app built with beginners in mind, a notable drawback compared to AvaTrade.

- The demo account expires after 30 days, limiting its potential as a useful trading tool alongside a real-money account.

BlackBull

"After improving its trading infrastructure with Equinix servers in New York, London, and Tokyo, reducing latency for traders, BlackBull is an obvious choice if you want to day trade stock CFDs with ECN pricing."

Christian Harris, Reviewer

BlackBull Quick Facts

| Demo Account | Yes |

|---|---|

| Instruments | CFDs, Stocks, Indices, Commodities, Futures, Crypto |

| Regulator | FMA, FSA |

| Platforms | BlackBull Invest, BlackBull CopyTrader, MT4, MT5, cTrader, TradingView, AutoChartist |

| Minimum Deposit | $0 |

| Minimum Trade | 0.01 Lots |

| Leverage | 1:500 |

| Account Currencies | USD, EUR, GBP, CAD, AUD, NZD, JPY, ZAR, SGD |

Pros

- With three ECN-powered accounts (Standard, Prime, and Institutional), BlackBull accommodates beginners, experienced traders, and professionals, offering flexibility based on trading needs and capital.

- BlackBull is a much greater fit for aspiring traders following the overhaul of its ECN Prime account, now featuring improved spreads averaging 0.16 on EUR/USD and a more accessible minimum deposit of $0 compared to the old $2,000.

- BlackBull offers every ingredient for day traders; fast execution speeds of <100ms, leverage up to 1:500, and tight spreads from 0.0 pips.

Cons

- Although the Education Hub now features improvements like webinars and tutorials, the courses we’ve explored need more focus on explaining the wider economic factors influencing prices.

- BlackBull lacks a proprietary platform, relying on MetaTrader, cTrader and TradingView. While these are excellent, other brokers' exclusive platforms, notably eToro’s, often have unique features for beginner traders.

- Unlike most top brokers, BlackBull charges an irritating $5 withdrawal fee, which can detract from the overall cost-effectiveness, especially for active traders who frequently move funds.

GO Markets

"GO Markets is best suited to active CFD traders who prioritize low spreads, transparent pricing, and fast execution on powerful charting platforms like MT4, MT5, cTrader, and more recently TradingView. Its GO Plus+ account, with raw spreads from 0.0 pips and low commissions, is a particularly great fit for scalpers and high-frequency traders."

Christian Harris, Reviewer

GO Markets Quick Facts

| Demo Account | Yes |

|---|---|

| Instruments | CFDs, Forex, Stocks, Indices, Commodities, Bonds, ETFs, Crypto |

| Regulator | ASIC, CySEC, FSC, FSA |

| Platforms | GO TradeX™, MT4, MT5, cTrader, TradingView |

| Minimum Deposit | $0 |

| Minimum Trade | 0.01 Lots |

| Leverage | 1:500 |

| Account Currencies | USD, EUR, GBP, CAD, AUD, NZD, CHF, HKD, SGD |

Pros

- The introduction of PAMM accounts and multiple copy trading services cater to both beginner and advanced traders, while the rebate program rewards high-volume day traders looking to reduce costs.

- GO Markets excels in making complex topics digestible and fostering a community-like learning environment. Its educational suite stands out with courses, webinars, podcasts, and even weekly live coaching sessions - ideal for newer traders.

- GO Markets has bolstered its offering, introducing 1000+ new stock CFDs in 2024 and localized payment solutions for traders in Latin America in 2025, including Pago Efectivo in Peru and Paynet in Mexico.

Cons

- During testing, we found that GO Markets restricts TradingView access in demo mode unless you first register a live account - a limitation that jars with firms offering full platform access in demo from the outset.

- GO Markets' research tools are relatively basic, lacking the depth and frequency seen with larger competitors who offer daily insights, analyst commentary, and advanced forecasting tools.

- Despite reasonable multi-asset coverage, our tests showed a limited choice in categories like commodities and indices, with only around 15 indices and 10 commodities.

How Did We Choose The Top cTrader Brokers?

To curate our list of the best brokers that support cTrader, we:

- Took our dynamic directory that currently stands at 139 online brokers;

- Pinpointed the growing number that provide cTrader on desktop, web or mobile devices;

- Sorted those firms by their rating, combining 200+ data points with the direct findings of our testers to pinpoint the absolute best.

What Is cTrader?

cTrader is an online platform for forex trading and CFD trading which was developed by the Spotware Systems Group.

Since its 2011 debut with FxPro, cTrader has soared in popularity with active traders, now integrating with dozens of brokers worldwide.

In particular, we saw interest spike after MetaTrader 4 (MT4) and MetaTrader 5 (MT5) were pulled from app stores in September 2022, with Blackbull Markets, FP Markets and Fusion Markets all adding the platform in the months that followed.

Its popularity is largely due to its impressive charting power and straight through processing (STP) and electronic communication network (ECN) capabilities which help ensure fast execution with minimal slippage – crucial for short-term trading strategies.

What Devices Can I Use cTrader on?

Today, cTrader is offered as a downloadable application for Windows, Mac OS or Linux operating systems, plus as a convenient web trader version.

Reflecting the rising number of mobile traders, there’s also a cTrader app, which can be downloaded to all major devices, including Apple and Android.

What Markets Can I Trade On cTrader?

You can trade various assets on cTrader, depending on the instruments available at your chosen brokerages.

From our investigations, this typically includes currency pairs, stocks, indices, commodities, high-risk cryptos and even spread betting at some partner brokers, such as Pepperstone.

Spotware has made notable improvements to its platform over the years. The result is a powerful, user-friendly platform that caters to active traders at every level.Recent upgrades include the addition of overlay indicators in cTrader desktop and the Market Replay feature in 2023, plus optimization upgrades to cBots and enhanced backtesting performance in 2024.

Key Features

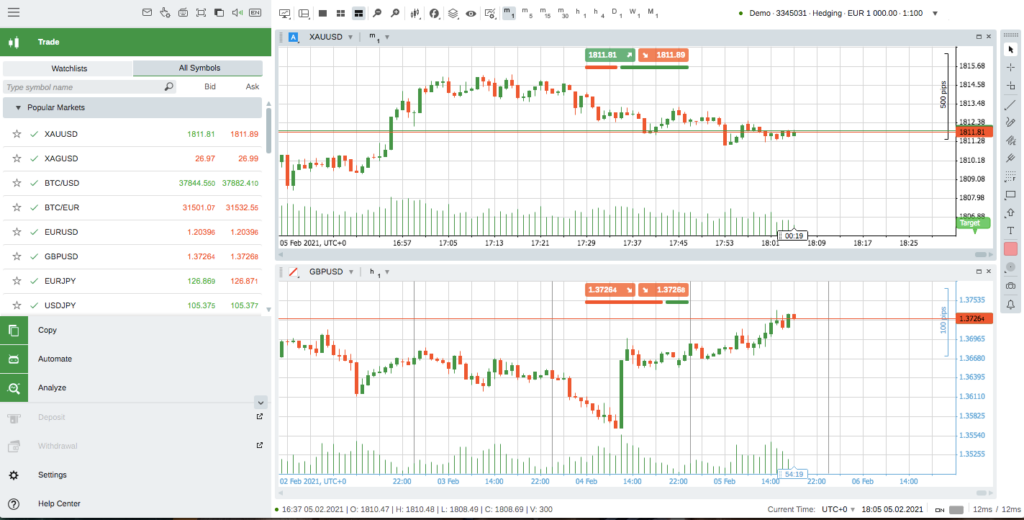

Interface

cTrader offers a clean, modern and visually appealing layout, especially compared to alternatives like MetaTrader.

There are different layouts you can choose and you can also detach charts and customize them as needed. Additionally, there’s the option to switch between dark and light themes, which is a nice touch.

I appreciate the user interface on cTrader. It’s clean and intuitive, and it makes navigating through charts, order types, and account settings straightforward. Everything feels well-organized, which makes my trading sessions smoother.

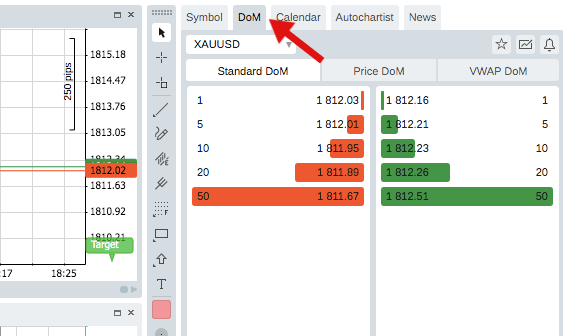

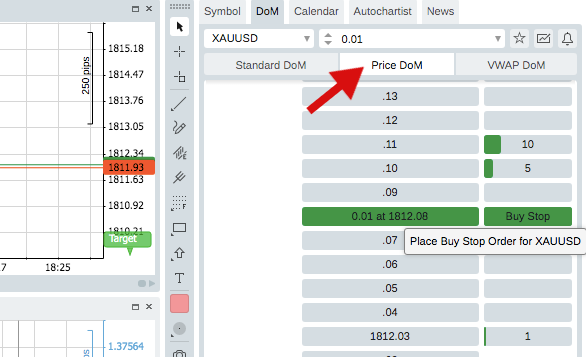

Market Depth Functionality

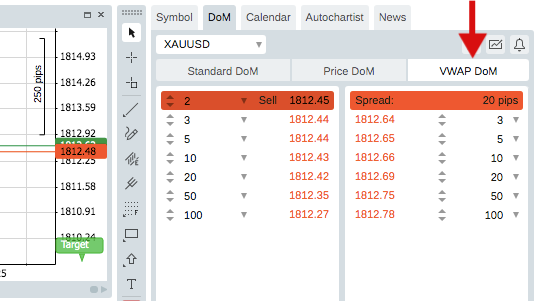

Contrary to only one kind of market depth offered by MetaTrader 5, cTrader displays three types of market depth and level 2 pricing:

- Standard Depth of Market – Displays the price and amount of liquidity available at that price. Note that standard DoM allows viewing but not trading.

- Price Depth of Market – Allows for precise trading with more details available, including selling and buying volumes. Price DoM is ideal for scalping trading.

- VWAP Depth of Market – Volume-Weighted Average Price allows you to view expected VWAP prices against adjustable volumes. Orders are therefore filled against the full order book. VWAP DoM is ideal for trading large volumes.

Charting

cTrader’s charting features are both intuitive and user-friendly, with excellent customization options to suit different preferences.

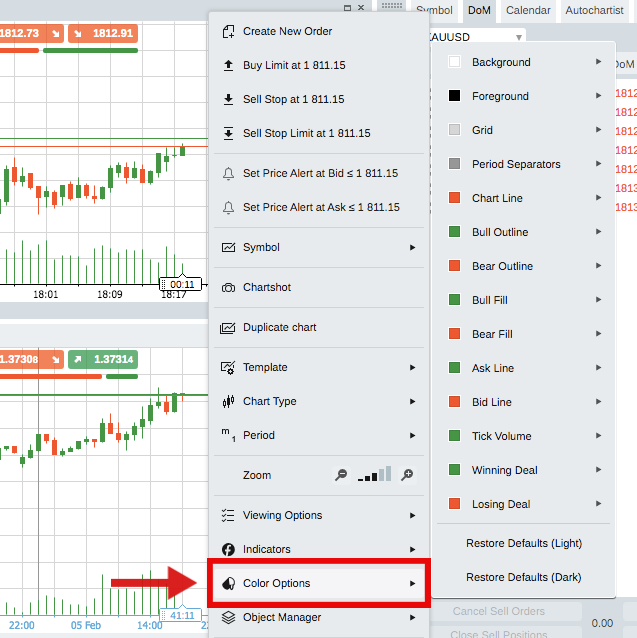

- Chart Modes & Colour Schemes – You can choose between single-chart, multi-chart, or free-chart mode, plus resizing options. You can also customize any colours, from the chart background to the colour of your candles: simply right click on the chart window and click ‘Colour Options’, or click on the ‘Colour’ button in the chart toolbar.

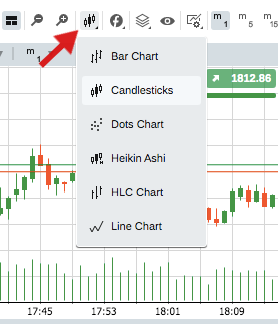

- Timeframes & Chart Views – cTrader offers 54 timeframes across 6 different chart types, including Candlesticks, Heiken Ashi, Renko and Bar charts. You can also adjust the zoom level from the main toolbar at the top.

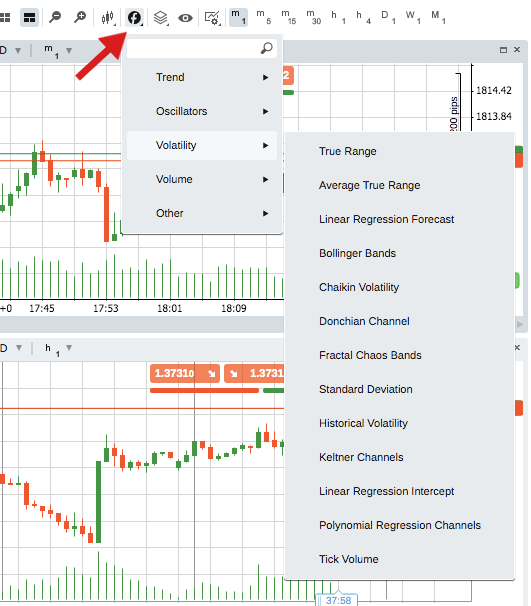

- Technical Analysis – You can use over 70 pre-installed technical indicators, objects and drawing tools directly from the chart. Popular tools include Exponential Moving Average (EMA), Fibonacci Retracements, Bollinger Bands, Pivot Points, support and resistance and volume profile indicators.

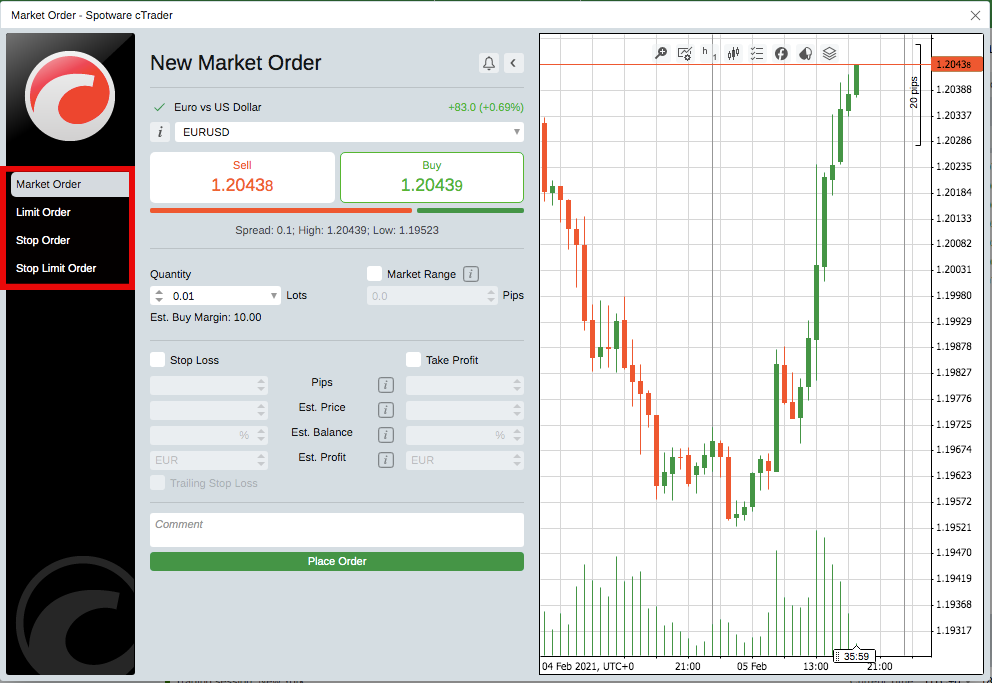

Order Types

You can execute four order types: market, limit, stop and stop limit.

For each one, a window will appear where you can adjust your parameters, set price alerts, choose the market range and expiry dates. You will then need to utilize the risk management parameters and set the stop loss and take profit levels.

You can edit or cancel a open pending order by clicking on the ‘Modify’ button next to the instrument in your TradeWatch panel. Here you can edit the entry price, expiry date, stop loss and take profit, as well as trailing stop.

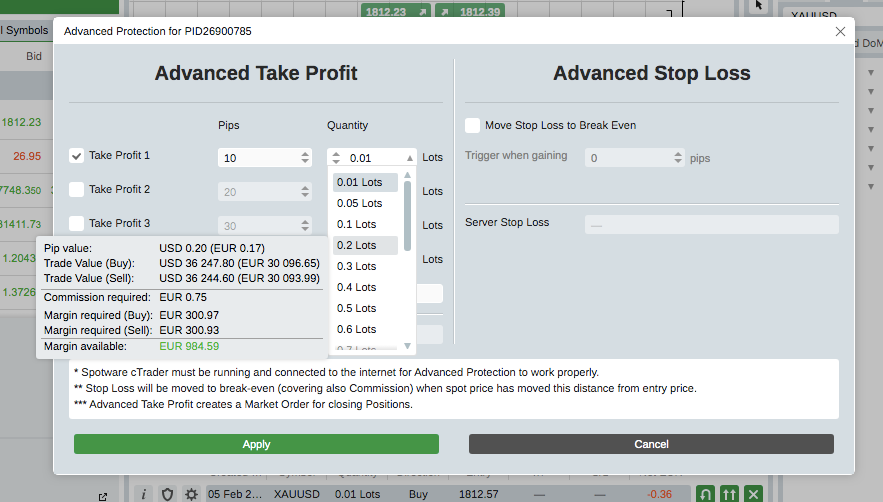

TradeWatch

Located at the bottom of your screen, the TradeWatch panel allows you to enter or leave trades, view and modify positions, and manage transactions. You can also set advanced take profit and stop loss levels for a position, by clicking on the ‘Advanced Protection’ settings.

Advanced take profit will automatically initiate a partial close on a position when it reaches the desired profit level. The advanced stop-loss allows for more precise control over pip movements at the stop loss point.

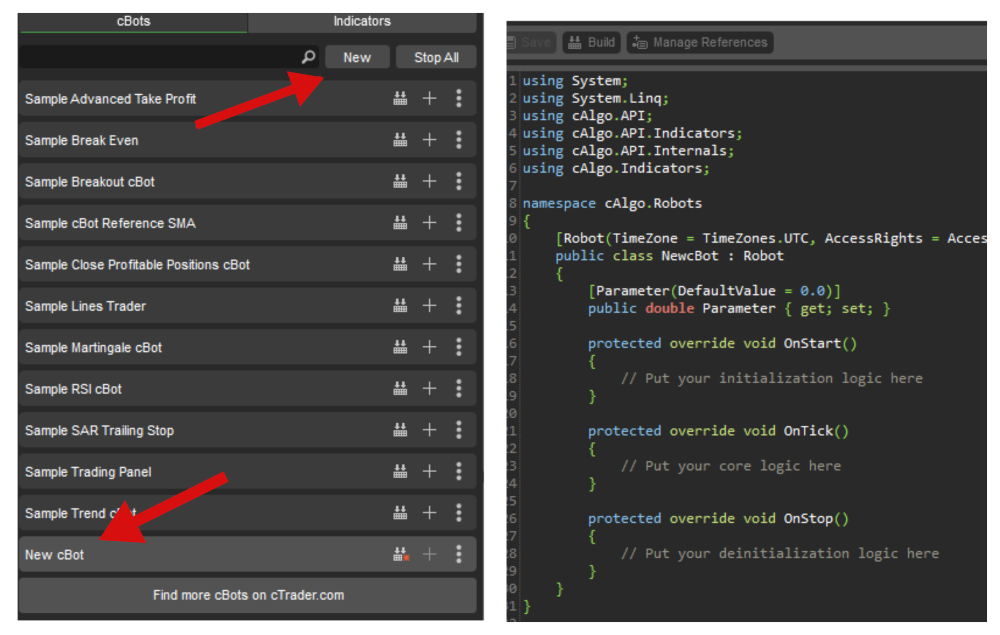

cTrader Automate

cTrader Automate (formerly known as cAlgo) allows traders to build their own automated trading robots (cBots) and custom indicators using the C# programming language on the cTrader open API.

The integrated solution supports manual backtesting in replay mode against historical data, an in-built code editor and a deal map.

The main advantage of cBots is that trades can be entered more precisely and quickly than a human can process manually. Indicators can be used for manual trading but can also be integrated into cBots to indicate trends and provide signals. Some popular cBots include the scalping or moving average bot, as well as the TradingView charting package bot.

To create and run a cBot or indicator, click on ‘New’ from inside the ‘cBots’ or ‘Indicator’ tab where a new template will be created with a default code. The user guide online contains instructions on how to optimise the codes, as well as other sample codes.

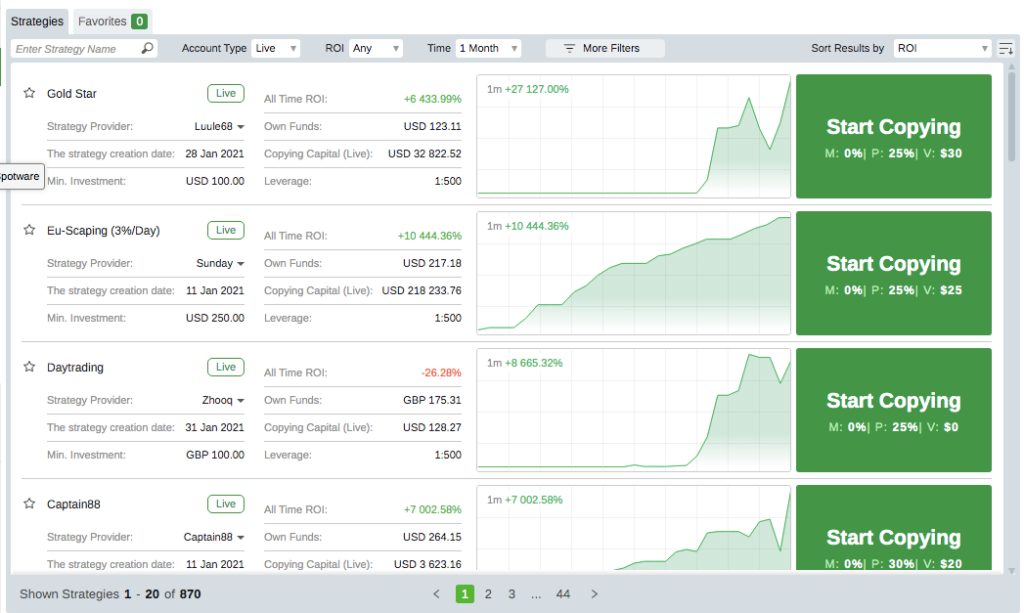

Copy Trading

cTrader Copy is fully integrated within the platform and allows for a variety of copy trading strategies.

You can access the feature by clicking on the ‘Copy’ tab in the main left-hand window. This allows you to check available strategies, compare history and fees, and start copying in just a few clicks.

You can easily search Strategy Providers and filter by age, fee amount, number of trade copiers, or the capital amount. Once you have chosen a provider, click on their cTrader ID to expand additional information such as average profit and total own funds.

Note that you can copy any strategy with a demo account if the strategy provider has selected ‘allow copying for Demo.’ The strategy provider can also ‘allow copying for Live’ (real money) copiers.

Once you have selected a provider, your allocated funds will be converted into a copy trading account and all the open positions of the strategy are opened for you with the current market rates. You can stop copying and restart again at any time by going into the copy trading account settings.

If you’re unsure whether copy trading is for you, there are a number of online reviews you can check out. It’s also worth comparing the copy trading function against other popular services such as eToro or ZuluTrade.

cTrader’s copy trading and automated features are really impressive. They’ve allowed me to test automated strategies and even follow other traders’ strategies, which has been a great learning tool and a simple way to diversify.

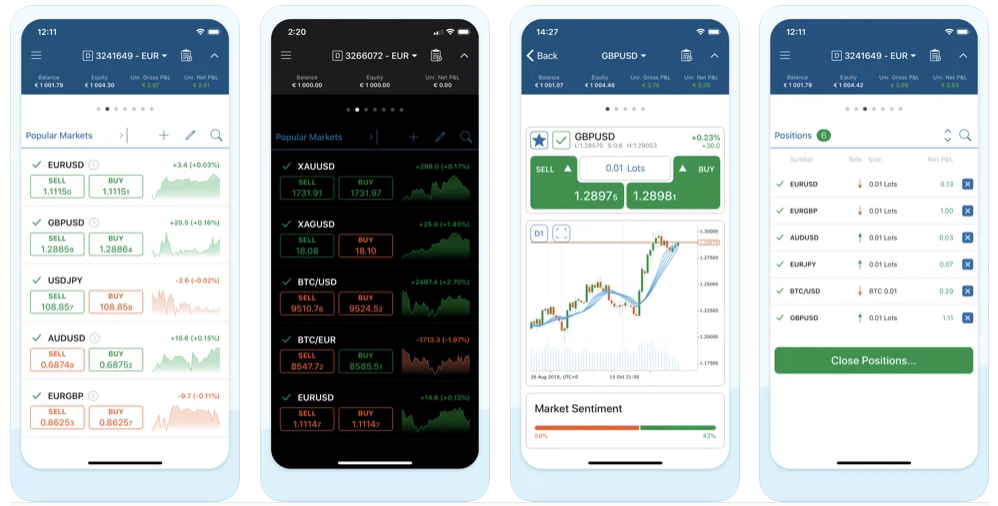

Mobile App

Available for smartphones and tablets, including Apple iOS and Google Android devices, the cTrader mobile app features fluid and responsive charts on an attractive and customizable design.

As with the desktop version, you can switch between dark or light mode to suit your preferences. There are also intuitive mobile-adapted features to make trading on-the-go easy and seamless, such as zoom and scroll functionality and QuickTrade mode.

The app supports 5 chart rendering types (bar, candlestick, dots, line and area charts) plus 4 chart types (standard, tick, Renko and range).

Impressively, cTrader Mobile also comes with all 65 technical indicators and 8 drawing tools, as well as a news feed, live market sentiment, price alerts and trade statistics.

You can also fully manage your account transactions and settings straight from the easy-to-navigate dashboard, plus configure your own push and email notifications.

Yet while I love the desktop version, the mobile app can sometimes be frustrating. It sometimes lags, especially when I’m checking trades or trying to make adjustments on the go. It’s reliable enough but could use some improvement on stability.

cTrader Mobile is available in 22 languages and you can download it in seconds from the App Store for iOS devices, or Google Play for Android phones.

Additional Features

Other impressive features that you will find include:

- QuickTrade – Allows traders to respond quickly to the markets by opening, closing and modifying orders within one or two clicks from every platform section. You can also hover over the red and green bars to view the live market sentiment indicator.

- Hotkeys & Keyboard Shortcuts – Traders can create handy shortcuts from within the settings panel for speed, comfort and convenience when trading.

- cTrader Automate – Formerly known as cAlgo, cTrader Automate is the platform’s algorithmic trading solution, where you can build robots and customise indicators such as the Hull Moving Average or Harmonic Pattern indicator.

- Copy Trading – cTrader Copy allows strategy providers to earn through multiple fee types, including performance, management, and volume-based fees. Investors can automatically replicate the trades of strategy providers by paying fees set by the strategy provider, ranging from 0 to 30%.

- Economic Calendar & News – Accessible from the Active Symbol Panel (ASP), the economic calendar displays significant market events, whilst the news tab offers the latest developments from a range of top sources.

- cTrader Store – Includes thousands of developers offering custom bots, tools, heatmaps and indicators. For example, you can download a session indicator, a risk-reward tool, indicator alerts, or even a lot, position or risk size calculator.

- Community – The platform offers an active community forum, plus a library of tools shared by fellow traders, a help centre and automated trading consultants.

- ChartShots – Individuals can share ideas and strategies with other traders, with options to share to social media platforms or embed into their own web pages.

- Chart Templates – Up to 50 chart templates can be saved for future use, which can accommodate a variety of strategies, timeframes or chart types.

- Autochartist – Integrated into the TradeWatch panel, Autochartist is a third-party market-scanning tool designed to highlight the best trading opportunities in real-time.

- Trading Central – Trading Central, a third-party real-time market scanner integrated into the TradeWatch panel, automatically detects potential trading entries and exits (‘Targets’) across multiple instruments.

- Export data – You can export historical data in Excel or HTML format, straight from the TradeWatch window.

cTrader Vs MetaTrader 4

If you’re wondering whether to choose cTrader or MetaTrader 4 (MT4) and how the platforms compare, we’ve weighed up the key criteria:

- Interface & Ease of Use – We love cTrader for its modern and uncluttered design, with light and dark themes and detachable windows. MetaTrader 4 is more outdated, though is arguably more familiar to experienced traders. Beginners may therefore prefer cTrader, though it is entirely down to personal preference.

- Technical Analysis – cTrader includes over 70 built-in indicators and drawing tools, whilst MetaTrader 4 offers over 50. For this reason, cTrader does have the edge over MT4 in terms of the manual trading capabilities.

- Charts – There are 9 timeframes available in MetaTrader 4, whereas cTrader offers over 50 across 9 chart types. cTrader also offers an additional chart type compared to MT4 (the dot chart) plus a chart-linking feature and detachable windows.

- Automated Trading – cTrader uses the C# programming language for cBots, whereas MetaTrader 4 uses the native MQL4 language for Expert Advisors (EAs). Overall, MetaTrader 4 is still the favourite for the wider range of automated tools and the more established online community.

- Market Depth – cTrader’s DoM is available in three types: standard depth, price depth and VWAP depth, which is an excellent and sought-after feature. The basic version of MT4, however, does not support depth of market.

- Order Types – With cTrader, you can place pending orders even when the market is closed, which is not allowed in MetaTrader 4. cTrader also offers advanced take profit and stop loss and also displays more detailed order tickets, compared to MT4.

cTrader Vs MetaTrader 5

If you’re choosing between cTrader or MetaTrader 5 (MT5), consider the following:

- Interface & Ease of Use – Whilst MetaTrader 5 did include some cosmetic updates, it does still follow the old-school design that many traders are used to. Again, it is entirely down to personal preference, but some newbies are likely to find the cTrader interface more attractive and easy to navigate.

- Technical Analysis – Both cTrader and MetaTrader 5 have an almost equal number of indicators, though MT5 offers a few more objects, such as Gann and Channel tools. Overall, the two platforms perform well in this area.

- Charts – cTrader has chart-linking and detachable charts, which allows traders more flexibility to spread charts across multiple monitors. MT5, on the other hand, does not offer this feature. Furthermore, cTrader boasts over double the number of time frames than MT5, which has 21.

- Automated Trading – When it comes to algorithmic trading, both platforms are very different, with cTrader using the common C# coding language and MetaTrader 5 using MQL5. Nonetheless, MT5 was not received as well as MT4, which already offered the core functionalities that traders need. For this reason, cTrader is a favourable choice over MT5 in this area.

- Market Depth – MT5 only offers one type of market depth, whilst cTrader offers three. cTrader’s highly sophisticated DoM tool responds to many short-term traders’ desires to view the full depth of bids and offers at each price. For day traders who deal in large volumes, cTrader is the better choice for market depth functionality.

- Order Types – Apart from the ability to place pending orders when the market is closed in cTrader, there is not a great deal of difference between the two platforms when it comes to order types. Nonetheless, cTrader does make it easier to optimise order protection settings before entering the market, showing clear risk and reward figures, for example.

One limitation is that not as many brokers support cTrader as they do MetaTrader. I’ve had to search for brokers that offer it, sometimes restricting my choice of finding the best trading conditions.

Bottom Line

cTrader is no doubt a strong contender against industry giant, MetaTrader 4, with a vast range of technical indicators, Depth of Market options, and competitive web integrations.

Novices may be drawn to the attractive design and automated trading capabilities, though MT4 is likely to remain the overall favourite for experienced traders already familiar with MetaQuotes software.

To get started, use DayTrading.com’s pick of the top cTrader brokers.

FAQ

Which Is The Best cTrader Broker?

This will depend on your specific needs. But see our choice of the best brokers with cTrader, updated for 2026, to see our favorite picks following extensive tests and analysis.

Recommended Reading

Article Sources

The writing and editorial team at DayTrading.com use credible sources to support their work. These include government agencies, white papers, research institutes, and engagement with industry professionals. Content is written free from bias and is fact-checked where appropriate. Learn more about why you can trust DayTrading.com