Best ECN Brokers In 2026

True electronic communication network (ECN) brokers use advanced technology to connect traders directly to liquidity providers, enabling faster executions, tighter spreads, and greater transparency – ideal for short-term trading strategies that thrive on speed and efficiency.

Dig into our selection of the best ECN brokers – we put each and every one through their paces, running tests, assigning ratings, and compiling a final ranking.

Top 6 ECN Brokers 2026

We have personally tested 139 brokers and these are the 6 best ECN brokers:

Why Are These Brokers the Best for ECN Trading?

Here's a snapshot of why these are the top pure ECN providers:

- FOREX.com is the best ECN broker in 2026 - In our ECN-style testing with FOREX.com’s account, execution averaged 40ms with moderate slippage during fast market moves. Spreads on EUR/USD started near 0.1 pips, plus a $6 commission per lot. Liquidity was deep but slightly fragmented during off-hours. Best suited for experienced traders using limit-order dependent strategies.

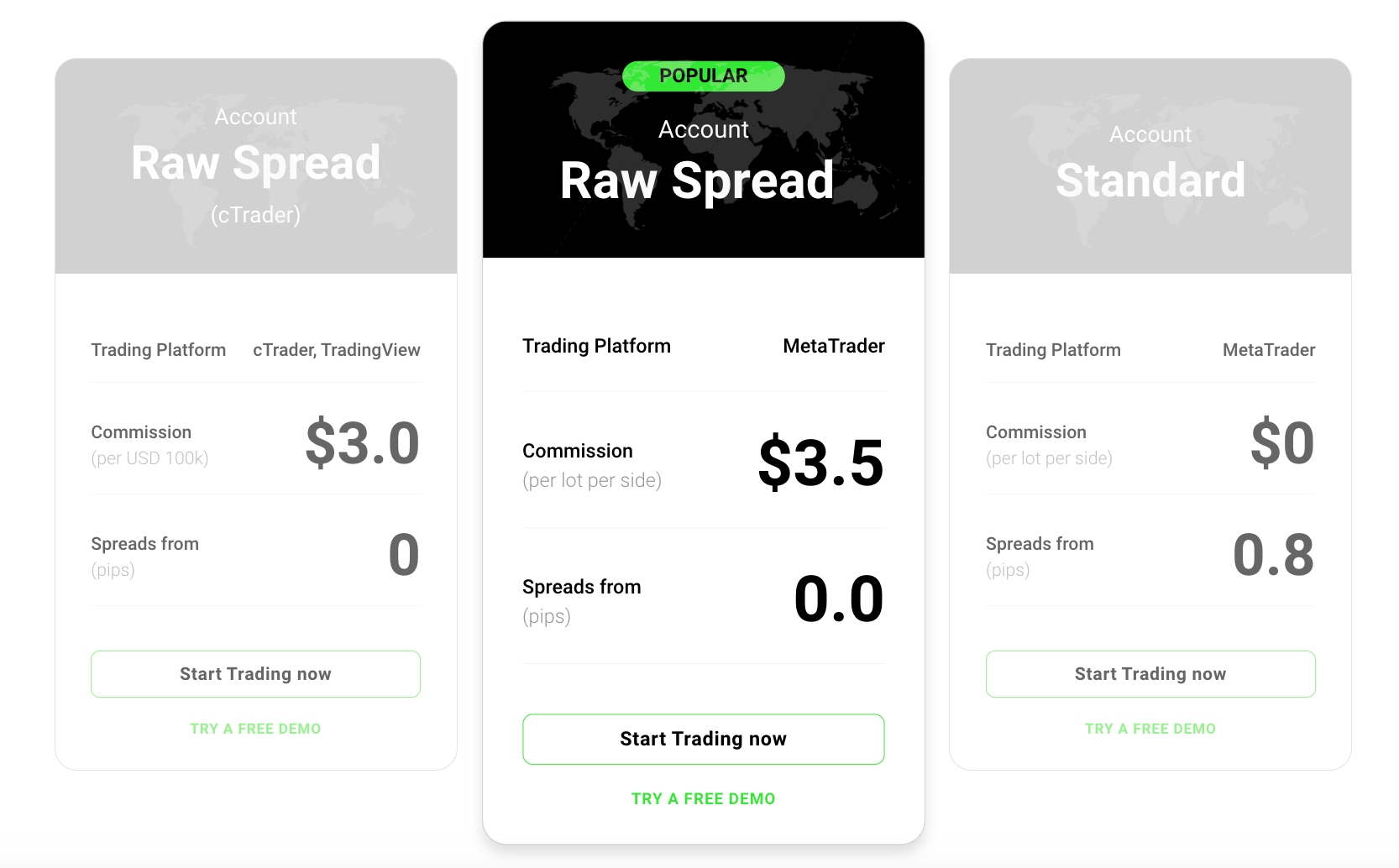

- VT Markets - When we evaluated VT Markets’ ECN Raw account, execution speeds averaged 35–40ms with consistently low slippage. Spreads on major pairs like EUR/USD often hit 0.0 pips, paired with a $6 round-turn commission. Liquidity was reliable across sessions, making it a solid option for day trading and automated trading systems.

- Tickmill - Tickmill is a global broker authorized by trusted regulators including the CySEC and the FCA. Hundreds of thousands of traders have opened an account with the firm with more than 530 million trades executed. Advanced trading tools, educational content and low fees make this broker stand out from competitors.

- JustMarkets - JustMarkets is a multi-asset broker with both CySEC-regulated and offshore branches. Offering ultra-low spreads, copy-trading services, 170+ tradeable instruments and MetaTrader support, JustMarkets has a lot to offer both beginner and experienced traders.

- PU Prime - PU Prime is a forex and CFD broker offering direct market access on forex, commodities, stocks, bonds, indices, and ETFs. With four account types (Cent, Standard, Prime, ECN) and multiple platforms, from MetaTrader to its own PU Prime app, it’s built for active traders at every level.

- FXGT - Established in 2019, FXGT is an offshore broker providing CFD trading on 185+ instruments. Through MT4, MT5 and FXGT Trader (added in 2024), alongside a choice of five accounts (Mini, Standard+, ECN Zero, PRO and Optimus), FXGT caters to a broad spectrum of short-term traders.

Compare the Best ECN Brokers Across Key Areas

Zero in on the right true ECN broker for you with our comparison of key features important to active traders:

| Broker | Minimum Deposit | Leverage | Platforms | Regulators |

|---|---|---|---|---|

| FOREX.com | $100 | 1:50 | WebTrader, Mobile, MT4, MT5, TradingView | NFA, CFTC |

| VT Markets | 50 - 500 USD | 1:500 | VT Markets App, Webtrader, Web Trader+, MT4, MT5, TradingCentral | ASIC, FSCA, FSC |

| Tickmill | $100 | 1:1000 | Tickmill Webtrader, MT4, MT5, TradingView | FCA, CySEC, FSA, DFSA, FSCA |

| JustMarkets | $1 | 1:3000 | MT4, MT5 | CySEC, FSA |

| PU Prime | $20 | 1:1000 | PU Prime App, PU Web Trader, PU Social, MT4, MT5, AutoChartist | ASIC, FSCA, CMA, FSA, FSC |

| FXGT | $5 | 1:5000 | FXGT Trader, FXGT App, MT4, MT5 | FSCA, FSA |

How Safe Are These ECN Trading Providers?

Here's how our top ECN brokers protect your funds:

| Broker | Trust Rating | Guaranteed Stop Loss | Negative Balance Protection | Segregated Accounts |

|---|---|---|---|---|

| FOREX.com | ✘ | ✔ | ✔ | |

| VT Markets | ✘ | ✔ | ✔ | |

| Tickmill | ✘ | ✘ | ✔ | |

| JustMarkets | ✘ | ✔ | ✔ | |

| PU Prime | ✘ | ✔ | ✔ | |

| FXGT | ✘ | ✔ | ✔ |

Compare Mobile ECN Trading

Here's how these brokers measure up if you want ECN trading capabilities on your mobile:

| Broker | Mobile Apps | iOS Rating | Android Rating | Smart Watch App |

|---|---|---|---|---|

| FOREX.com | iOS & Android | ✘ | ||

| VT Markets | iOS & Android | ✘ | ||

| Tickmill | ✔ | ✘ | ||

| JustMarkets | iOS & Android | ✘ | ||

| PU Prime | iOS & Android | ✘ | ||

| FXGT | iOS & Android | ✘ |

Are the Top ECN Brokers Good for Beginners?

Beginners should use ECN brokers that allow trading with virtual money (a demo account) and have other features that new traders require:

| Broker | Demo Account | Minimum Deposit | Minimum Trade | Education Rating | Support Rating |

|---|---|---|---|---|---|

| FOREX.com | ✔ | $100 | 0.01 Lots | ||

| VT Markets | ✔ | 50 - 500 USD | 0.01 Lots | ||

| Tickmill | ✔ | $100 | 0.01 Lots | ||

| JustMarkets | ✔ | $1 | 0.01 Lots | ||

| PU Prime | ✔ | $20 | 0.01 Lots | ||

| FXGT | ✔ | $5 | 0.01 Lots |

Are the Top ECN Brokers Good for Advanced Traders?

Seasoned traders need sophisticated features to elevate the ECN trading environment:

| Broker | Automated Trading | VPS | AI | Pro Account | Leverage | Low Latency | Extended Hours |

|---|---|---|---|---|---|---|---|

| FOREX.com | Expert Advisors (EAs) on MetaTrader | ✔ | ✔ | ✘ | 1:50 | ✔ | ✘ |

| VT Markets | Expert Advisors (EAs) on MetaTrader | ✘ | ✘ | ✘ | 1:500 | ✘ | ✘ |

| Tickmill | ✔ | ✘ | ✘ | ✘ | 1:1000 | ✘ | ✘ |

| JustMarkets | Expert Advisors (EAs) on MetaTrader | ✔ | ✘ | ✘ | 1:3000 | ✘ | ✘ |

| PU Prime | Expert Advisors (EAs) on MetaTrader | ✔ | ✘ | ✘ | 1:1000 | ✔ | ✘ |

| FXGT | Expert Advisors (EAs) on MetaTrader | ✔ | ✘ | ✘ | 1:5000 | ✘ | ✘ |

Compare the Ratings of Our Top ECN Brokers

See how the top ECN brokers rate side-by-side in every critical area from our hands-on tests:

| Broker | Trust | Platforms | Assets | Mobile | Fees | Accounts | Research | Education | Support |

|---|---|---|---|---|---|---|---|---|---|

| FOREX.com | |||||||||

| VT Markets | |||||||||

| Tickmill | |||||||||

| JustMarkets | |||||||||

| PU Prime | |||||||||

| FXGT |

Compare Trading Fees

Discover the most cost-efficient ECN brokers in the market:

| Broker | Cost Rating | Fixed Spreads | Inactivity Fee |

|---|---|---|---|

| FOREX.com | ✘ | $15 | |

| VT Markets | ✘ | $0 | |

| Tickmill | ✘ | $0 | |

| JustMarkets | ✘ | $5 | |

| PU Prime | ✘ | $0 | |

| FXGT | ✘ | $0 |

How Popular Are These ECN Account Brokers?

Lots of traders prefer the most popular brokers with ECN accounts (those with the most users):

| Broker | Popularity |

|---|---|

| JustMarkets | |

| FOREX.com | |

| PU Prime | |

| VT Markets |

Why Open An ECN Account With FOREX.com?

"FOREX.com remains a best-in-class brokerage for active forex traders of all experience levels, with over 80 currency pairs, tight spreads from 0.0 pips and low commissions. The powerful charting platforms collectively offer over 100 technical indicators, as well as extensive research tools."

Christian Harris, Reviewer

FOREX.com Quick Facts

| Demo Account | Yes |

|---|---|

| Instruments | Forex, Futures and Options on Metals, Energies, Commodities, Indices, Bonds, Crypto |

| Regulator | NFA, CFTC |

| Platforms | WebTrader, Mobile, MT4, MT5, TradingView |

| Minimum Deposit | $100 |

| Minimum Trade | 0.01 Lots |

| Leverage | 1:50 |

| Account Currencies | USD, EUR, GBP, CAD, AUD, JPY, CHF, PLN |

Pros

- With over 20 years of experience, excellent regulatory oversight, and multiple accolades including runner-up in our 'Best Forex Broker' awards, FOREX.com boasts a global reputation as a trusted brokerage.

- The in-house Web Trader continues to stand out as one of the best-designed platforms for aspiring day traders with a slick design and over 80 technical indicators for market analysis.

- FOREX.com offers industry-leading forex pricing starting from 0.0 pips, alongside competitive cashback rebates of up to 15% for serious day traders.

Cons

- There’s no negative balance protection for US clients, so you may find yourself owing more money than your initial deposit into your account.

- Demo accounts are frustratingly time-limited to 90 days, which doesn’t give you enough time to test day trading strategies effectively.

- FOREX.com's MT4 platform offers approximately 600 instruments, significantly fewer than the over 5,500 available on its non-MetaTrader platforms.

Why Open An ECN Account With VT Markets?

"VT Markets is a great choice for regular traders who are looking for very tight spreads and powerful charting software. The broker's share CFD offering is particularly strong, with hundreds of commission-free assets spanning multiple global markets."

Tobias Robinson, Reviewer

VT Markets Quick Facts

| Demo Account | Yes |

|---|---|

| Instruments | CFDs, Forex, Commodities, Stocks, Indices |

| Regulator | ASIC, FSCA, FSC |

| Platforms | VT Markets App, Webtrader, Web Trader+, MT4, MT5, TradingCentral |

| Minimum Deposit | 50 - 500 USD |

| Minimum Trade | 0.01 Lots |

| Leverage | 1:500 |

| Account Currencies | USD, EUR, GBP, CAD, AUD |

Pros

- Traders can access a range of analysis tools supplied by reputable providers, including Trading Central’s Market Buzz AI tool and a customizable economic calendar

- There’s a strong range of payment methods, including bank wire, credit cards and e-wallets, plus 5 base currencies to choose from

- Market-leading MetaTrader 4 and MetaTrader 5 charting platforms are offered, with advanced technical capabilities and access to Expert Advisors (EAs)

Cons

- The broker’s bonus schemes have stringent terms and conditions, including restrictions on minimum deposits and payment methods used

- Unlike similar brands like Fusion Markets, VT Markets does not offer crypto trading

Why Open An ECN Account With Tickmill?

"Tickmill is a stellar choice for day traders, especially if you opt for the Raw account which delivers near-zero pip spreads and impressively fast order execution during testing. "

Christian Harris, Reviewer

Tickmill Quick Facts

| Demo Account | Yes |

|---|---|

| Instruments | Forex, CFDs, stocks, indices, commodities, cryptocurrencies, futures, options, bonds |

| Regulator | FCA, CySEC, FSA, DFSA, FSCA |

| Platforms | Tickmill Webtrader, MT4, MT5, TradingView |

| Minimum Deposit | $100 |

| Minimum Trade | 0.01 Lots |

| Leverage | 1:1000 |

| Account Currencies | USD, EUR, GBP, ZAR |

Pros

- Tickmill’s multiple licenses with authorities like the FCA and CySEC aren’t just paperwork - they translate to real-world benefits. Your money is kept separate in secure accounts, and the broker offers negative balance protection. In practice, this means you won’t be on the hook for more than you deposit, providing peace of mind when markets get volatile.

- When using the Raw Spread account, you’ll notice how tight the spreads are - sometimes even zero pips - paired with a transparent per-trade commission. This setup helps keep your overall trading costs low, which is a significant advantage when you’re making frequent trades and want to avoid hidden fees that cut into your profits.

- Based on our actual trading experience, Tickmill consistently processes orders quickly - averaging ~59 milliseconds - with very few instances of slippage or requotes. For a day trader, that means you can trust your entry and exit prices without worrying about delays that might cost you money in fast markets.

Cons

- Tickmill’s demo accounts don’t support all platforms (like its proprietary one), which can make practicing your strategies less seamless. That’s a hassle if you want to thoroughly test your skills before going live, especially with newer Tickmill tools.

- If you’re used to cTrader’s modern layout and sophisticated order types, you’ll miss that here. Tickmill sticks with MetaTrader 4 and 5, as well as TradingView and its own proprietary platform, so there’s no cTrader option. This might slow down traders who rely on cTrader’s workflow or specific tools, such as cTrader Copy.

- Tickmill primarily focuses on forex pairs, select stock CFDs, indices, and a few commodities. If you like switching between many different asset classes, like crypto or a broader range of stocks, you’ll find the choices limited compared to brokers with thousands of instruments.

Why Open An ECN Account With JustMarkets?

"With some of the most affordable pricing in the game and access to the powerful MT4 and MT5 platforms, JustMarkets is a good choice for any investor."

Tobias Robinson, Reviewer

JustMarkets Quick Facts

| Demo Account | Yes |

|---|---|

| Instruments | Forex, CFDs, indices, shares, commodities, cryptocurrencies, futures |

| Regulator | CySEC, FSA |

| Platforms | MT4, MT5 |

| Minimum Deposit | $1 |

| Minimum Trade | 0.01 Lots |

| Leverage | 1:3000 |

| Account Currencies | USD, EUR, GBP, ZAR, MYR, IDR, AED, NGN, THB, VND, KWD, CNY |

Pros

- Trustworthy and regulated by CySEC

- MetaTrader 4 integration

- 170+ trading instruments

Cons

- Limited availability with clients not accepted from the US, UK, Japan, Germany and other countries

- Non-forex asset list is light with just 65 stocks plus a handful of indices and commodities

Why Open An ECN Account With PU Prime?

"PU Prime is a great fit for experienced, high-volume traders with its ECN account offering tight spreads from 0.0 pips and low commissions from $1/side. The addition of an easy-to-use copy trading app, alongside the stacked Trading Academy with progression levels, also makes PU Prime a strong option for aspiring traders. "

Tobias Robinson, Reviewer

PU Prime Quick Facts

| Demo Account | Yes |

|---|---|

| Instruments | CFDs, Forex, Stocks, Indices, Commodities, Metals, Crypto, Bonds, ETFs |

| Regulator | ASIC, FSCA, CMA, FSA, FSC |

| Platforms | PU Prime App, PU Web Trader, PU Social, MT4, MT5, AutoChartist |

| Minimum Deposit | $20 |

| Minimum Trade | 0.01 Lots |

| Leverage | 1:1000 |

| Account Currencies | USD, EUR, GBP, CAD, AUD, NZD, JPY, HKD, SGD |

Pros

- There’s a great suite of tools for short-term traders, from practical margin and position sizing calculators to economic calendars and strong technical insights via Autochartist.

- PU Prime has upped its game over the years, including launching its PU Social app in 2022, securing ASIC authorization for its Australian entity in 2025, and adding over 200 trading instruments, bringing the total to 1,000+.

- The platform lineup is strong, with the PU Prime Web Trader and app especially smooth to use with a modern design, easy-to-configure order tickets and responsive charts for fast entries and exits.

Cons

- Getting through to customer support can be fiddly and slow to reach a human – in our latest checks we had to navigate multiple chatbot menus and questions then enter contact details before getting to an agent.

- The in-house market updates are useful for a quick read, but they’re generally high-level and don’t go deep enough for serious strategy building or advanced analysis.

- The ECN account’s $10,000 minimum deposit puts the best pricing out of reach for some active retail traders who may end up paying more for spreads and commissions on Prime, Standard or Cent accounts.

Why Open An ECN Account With FXGT?

"FXGT, especially with its Optimus account, targets day traders seeking extremely high leverage of up to 1:5000, offering the potential for amplified profits and losses, though at the cost of robust regulatory protections."

Christian Harris, Reviewer

FXGT Quick Facts

| Demo Account | Yes |

|---|---|

| Instruments | CFDs, Forex, Stocks, Indices, Commodities, Crypto |

| Regulator | FSCA, FSA |

| Platforms | FXGT Trader, FXGT App, MT4, MT5 |

| Minimum Deposit | $5 |

| Minimum Trade | 0.01 Lots |

| Leverage | 1:5000 |

| Account Currencies | USD, EUR, JPY |

Pros

- FXGT stands out after introducing access to over 30 popular cryptocurrencies such as Bitcoin, Ethereum, etc. This is advantageous for traders interested in diversifying into digital assets and provides an additional market to explore beyond traditional forex and stocks.

- Five account types are available to suit different trading needs, including accounts for beginner and advanced traders, plus the Optimus account, which was built for day traders and now offers the highest leverage we've seen up to 1:5000 (amplifying profit and loss).

- FXGT supports multiple platforms, including MT4, MT5, and its proprietary FXGT Trader, added in 2024, catering to different trading styles, such as MetaTrader's automated trading with Expert Advisors (EAs).

Cons

- While FXGT offers some research, such as its market analysis section and an economic calendar, they are not as extensive as those provided by brokers like IG. Traders looking for detailed analysis, in-depth reports, or third-party research will find FXGT's resources woeful.

- FXGT offers a subpar selection of around 185 assets, which is limited compared to category-leading brokers like Saxo with its 72,000+ instruments. In particular, FXGT does not provide access to a wide range of stocks from international markets.

- FXGT is regulated by regional authorities like the Seychelles FSA and South Africa’s FSCA, but still does not hold licenses from ‘green tier’ regulators such as the UK’s FCA or Australia’s ASIC. This means that traders may not benefit from the higher investor protections, stringent oversight, and dispute resolution mechanisms.

How DayTrading.com Chose The Best ECN Trading Brokers

To find the top brokers with ECN trading, we ran in-depth tests on 25+ platforms, focusing specifically on their ECN accounts.

Each broker was rated from 1 to 100 (higher being better) based on their performance in key areas during our evaluations: execution speed, slippage, spreads, commissions, and liquidity. We analyzed how each ECN setup handled fast-paced strategies used by day traders.

Our final rankings reflect both hard data and hands-on experience, pinpointing the brokers with the most reliable, low-latency ECN environments for active traders.

How To Choose A Broker For ECN Trading

Based on our tests, these are the key factors to consider when choosing a reliable ECN broker, complete with standout performers in each area:

- Execution Speed & Slippage: Look for brokers with sub-40ms execution and minimal slippage during volatile sessions. Top pick: IC Markets averaged 25–30ms execution with near-zero slippage during our tests, even during major news events.

- Trading Fees & Commission: Prioritize brokers offering raw spreads near 0.0 pips and low commissions per lot. Top pick: Fusion Markets delivered spreads from 0.0 pips and a $4.50 round-turn commission, the lowest we recorded.

- Liquidity Depth: Deep liquidity supports stable fills, even under pressure from scalping or algorithmic trading. Top pick: Dukascopy offered exceptional liquidity and consistent execution, with a tiered commission model for high-volume traders.

- Regulation: Ensure the broker is licensed by a trusted financial authority such as the SEC (US), FCA (UK), ASIC (Australia), or CySEC (Cyprus). Top pick: Pepperstone is fully regulated by both the FCA and ASIC, with a transparent ECN model via its Razor account.

- Accessibility: Some brokers cannot serve specific countries due to regulatory restrictions. Top pick for US traders: FOREX.com is one of the few leading ECN-style brokers regulated and available in the United States.

- Platform Availability: Choose a broker that supports platforms you’re comfortable with (we enjoy using MT4, MT5, or cTrader). Top pick: Eightcap supports both MT4 and MT5 with full ECN access through its Raw account.

- Deposit & Withdrawal Speed: Fast and reliable funding methods are important for active traders. Top pick: GO Markets delivered smooth funding and prompt withdrawals during our time using the broker.

- Customer Support: Responsive support is key, especially when dealing with live markets and fast execution. Top pick: Vantage offered fast and helpful support with detailed guidance on ECN setup and usage.

- Demo Account Access: A demo trading account lets you test ECN conditions and pricing risk-free before committing funds. Top pick: Exness provides full-featured demos with accurate ECN-style pricing and order execution.

What Is An ECN Broker?

An ECN (Electronic Communication Network) broker connects traders directly to a pool of liquidity providers, including banks, hedge funds, and other traders, and all without using a dealing desk.

This means that your trades are matched electronically with real market participants, not internalized or routed through a market maker taking the opposite side.

We’ve seen that ECN brokers are particularly popular with short-term traders, such as scalpers and day traders, due to their tight spreads, fast execution speeds, and increased transparency.

They are also among the fastest growing brokerage models globally based on our research, and are often sought out by forex traders.

How ECN Trading Works: A Day Trading Example

I’m using an ECN broker and place a 1 lot EUR/USD buy order at 1.08500 during a volatile London session:

- My broker scans its liquidity network (which may include 15+ providers) for the best available price.

- A matching sell order is found at 1.08500 from a liquidity provider (e.g. a bank).

- My trade is filled in ~30 milliseconds with 0.0 pip spread, and I’m charged a $6 commission.

- Minutes later, I closes the trade at 1.08540.

- My net profit is 40 pips minus $6 commission, with no further broker markups or interference.

ECN Brokers Vs STP Brokers

ECN and STP (Straight Through Processing) brokers both operate without a dealing desk, but there are key distinctions:

- STP brokers route orders to a select group of liquidity providers, often including their own in-house sources. The broker may add a small markup to the spread.

- ECN brokers act as a neutral hub, connecting traders to a wider, decentralized network of institutions and participants, typically offering raw spreads plus a fixed commission.

Another difference is trade size. ECN brokers generally require a minimum lot size of 0.1 due to institutional liquidity constraints, making them better suited to more experienced or higher-volume traders.

Both models offer fast execution, but we’ve found true ECN accounts generally provide deeper liquidity, tighter raw spreads, and a more direct connection to the market.

Pros Of ECN Brokers

- Execution speed: ECN brokers such as IC Markets or Fusion Markets delivered 25–35ms execution speeds in our tests (among the fastest in the industry).

- Transparency: Trades are matched on real-time market pricing. ECN brokers don’t take the opposite side of your trade, reducing conflict of interest.

- Low spreads: ECN brokers offer raw interbank spreads, often from 0.0 pips, which is ideal for scalping and other short-term strategies.

- After-hours access: Some ECN brokers allow trading during extended market hours, useful for reacting to after-hours news or economic data.

- Scalping compatible: Because of fast order matching and raw pricing, ECN brokers are really suited to forex scalping, although not all brokers allow this so check before opening an account.

- Oversight: Many top ECN brokers are regulated by ‘green tier’ agencies in our Regulation & Trust Rating (including SEC, FCA, ASIC, CySEC), helping to safeguard your funds. See our list of top ECN brokers for licensed platforms.

Cons Of ECN Brokers

Downsides to trading with an ECN broker include:

- Commissions: Our research shows ECN brokers typically charge a fixed commission, often ranging from $4.50 to $7.00 per round-turn lot. For lower-volume or micro-account traders, this may make costs proportionally higher.

- Variable spreads during volatility: While base spreads are tight, ECN pricing is dynamic. During major market events, spreads may spike temporarily based on actual market liquidity – a key consideration for short-term traders.

- Higher minimum deposits: Some ECN brokers require larger deposits, such as $200 at IC Markets, to open an account, especially when offering raw spreads and institutional-grade access. In contrast, elsewhere we’re seeing a growing number of no deposit brokers.

FAQ

How Do ECN Brokers Make Money?

ECN brokers typically make money from commissions charged to the customer on each trade. This is in contrast to market maker models that generally take their cut from the spread.

What Is The Difference Between A Market Maker And ECN Broker?

Market makers help ensure there’s enough liquidity so trades can be executed seamlessly. Market maker brokers typically take the opposing side of a trade. In contrast, ECN brokers connect buyers and sellers, drawing on various liquidity providers.

ECN brokers usually offer tighter spreads, faster order execution and increased transparency.