Best MetaTrader 5 (MT5) Brokers In 2026

Launched in 2010, MetaTrader 5 (MT5) is an all-in-one toolkit that’s proven a hit with active traders, and has been integrated by hundreds of online brokers.

But which of these providers offers the best MetaTrader 5 experience? We’ve done the legwork for you – discover DayTrading.com’s pick of the top MT5 brokers following our hands-on tests.

As a veteran MT5 user, I’ll also share my pro tips for getting the most out of the latest software from MetaQuotes.

6 Top MetaTrader 5 Brokers

We’ve put 139 brokers through their paces as of February 2026, and these are the 6 best brokers with MetaTrader 5 integration:

This is why we think these brokers are the best in this category in 2026:

- FOREX.com - In our hands-on testing, FOREX.com’s MT5 delivered reliable execution with typical spreads around 0.8 pips on EUR/USD and competitive commissions on their RAW accounts ($5 per side). MT5 asset range covers forex, indices, commodities, and cryptocurrencies with solid platform stability.

- xChief - When we used XChief’s MT5 software, execution was solid with spreads starting around 0.5 pips on majors and low commissions. The platform handled high volatility well, with no minimum deposit or inactivity fees. Asset selection focuses mainly on forex and metals, offering a straightforward MT5 experience without advanced extras.

- Optimus Futures - Established in 2004, Optimus Futures specializes in low-cost, customizable futures trading. It provides access to a growing suite of around 70 futures markets spanning micro E-minis, energies, metals, grains, and cryptos. With commission tiers starting at $0.25 per side for micros and the option to choose your own clearing firm (e.g. Ironbeam, StoneX, Phillip Capital), the brokerage offers flexibility. Optimus Futures has also introduced excellent features like multi-bracket orders and journaling, giving active traders more control.

- Focus Markets - During our tests, Focus Markets’ MT5 delivered low spreads from 0.2 pips on major forex pairs with competitive commissions around $3 per side. Execution was smooth with minimal slippage. The MT5 platform supports a solid range of assets including forex, indices, and commodities, catering well to active traders.

- Exness - In testing, Exness’ MT5 offered ultra-tight spreads from 0.0 pips on Raw accounts with $3.50 per side commissions. Execution was consistently fast, even during high volatility with full access to the software's expert advisors for automated trading.

- IC Markets - When we tested IC Markets’ MT5, execution was among the fastest we've seen, ideal for scalping and high-frequency trading. Raw spreads hit 0.0 pips on majors, with $3.00 per side commissions. No inactivity fee, no deposit minimum, and a vast CFD lineup - forex, crypto, indices, and commodities all covered.

Best MetaTrader 5 (MT5) Brokers In 2026 Comparison

| Broker | MT5 Integration | MT5 Demo | Automated Trading | Instruments | Regulators | Minimum Deposit |

|---|---|---|---|---|---|---|

| FOREX.com | ✔ | ✔ | Expert Advisors (EAs) on MetaTrader | Forex, Futures and Options on Metals, Energies, Commodities, Indices, Bonds, Crypto | NFA, CFTC | $100 |

| xChief | ✔ | ✔ | Expert Advisors (EAs) on MetaTrader | CFDs, Forex, Metals, Commodities, Stocks, Indices | ASIC | $10 |

| Optimus Futures | ✔ | ✔ | TradingView Pine Script, API Features | Futures on Indices, Metals, Energies, Softs, Bonds, Cryptos, Options on Futures, Event Contracts | NFA, CFTC | $500 |

| Focus Markets | ✔ | ✔ | Expert Advisors (EAs) on MetaTrader | CFDs, Forex, Stocks, Indices, Commodities, Crypto | ASIC, SVGFSA | $100 |

| Exness | ✔ | ✔ | Expert Advisors (EAs) on MetaTrader | CFDs on Forex, Stocks, Indices, Commodities, Crypto | FCA, FSCA, CMA, FSA, CBCS, BVIFSC, FSC, JSC | Varies based on the payment system |

| IC Markets | ✔ | ✔ | Expert Advisors (EAs) on MetaTrader, cBots on cTrader, Myfxbook AutoTrade | CFDs, Forex, Stocks, Indices, Commodities, Bonds, Futures, Crypto | ASIC, CySEC, CMA, FSA | $200 |

FOREX.com

"FOREX.com remains a best-in-class brokerage for active forex traders of all experience levels, with over 80 currency pairs, tight spreads from 0.0 pips and low commissions. The powerful charting platforms collectively offer over 100 technical indicators, as well as extensive research tools."

Christian Harris, Reviewer

FOREX.com Quick Facts

| Demo Account | Yes |

|---|---|

| Instruments | Forex, Futures and Options on Metals, Energies, Commodities, Indices, Bonds, Crypto |

| Regulator | NFA, CFTC |

| Platforms | WebTrader, Mobile, MT4, MT5, TradingView |

| Minimum Deposit | $100 |

| Minimum Trade | 0.01 Lots |

| Leverage | 1:50 |

| Account Currencies | USD, EUR, GBP, CAD, AUD, JPY, CHF, PLN |

Pros

- With over 20 years of experience, excellent regulatory oversight, and multiple accolades including runner-up in our 'Best Forex Broker' awards, FOREX.com boasts a global reputation as a trusted brokerage.

- The in-house Web Trader continues to stand out as one of the best-designed platforms for aspiring day traders with a slick design and over 80 technical indicators for market analysis.

- FOREX.com offers industry-leading forex pricing starting from 0.0 pips, alongside competitive cashback rebates of up to 15% for serious day traders.

Cons

- There’s no negative balance protection for US clients, so you may find yourself owing more money than your initial deposit into your account.

- Demo accounts are frustratingly time-limited to 90 days, which doesn’t give you enough time to test day trading strategies effectively.

- FOREX.com's MT4 platform offers approximately 600 instruments, significantly fewer than the over 5,500 available on its non-MetaTrader platforms.

xChief

"xChief continues to prove popular with investors looking to trade highly leveraged CFDs on the popular MetaTrader platforms. The broker's rebate scheme and investment accounts will particularly appeal to seasoned traders. However, the lack of top-tier regulatory oversight is a major drawback."

William Berg, Reviewer

xChief Quick Facts

| Demo Account | Yes |

|---|---|

| Instruments | CFDs, Forex, Metals, Commodities, Stocks, Indices |

| Regulator | ASIC |

| Platforms | MT4, MT5 |

| Minimum Deposit | $10 |

| Minimum Trade | 0.01 Lots |

| Leverage | 1:1000 |

| Account Currencies | USD, EUR, GBP, JPY, CHF |

Pros

- The broker offers a turnover rebate scheme geared towards active investors, as well as trading credits and several other occasional bonuses

- The broker offers several account types to suit different traders, including a Cent account for beginners and pro-level hedging/netting accounts

- The low minimum deposit of $10 will appeal to beginners, as well as the beginners’ guides in the Library

Cons

- The broker trails competitors when it comes to research tools and educational resources

- The total range of 150+ assets is much lower than most competitors who typically offer hundreds

- Fees and minimums are imposed on most withdrawal methods, including a €60 minimum for SWIFT bank transfers

Optimus Futures

"Optimus Futures is best for active futures day traders who want low per-contract costs and the flexibility to build a custom trading setup across platforms like Optimus Flow, TradingView, and Sierra Chart. Its fast order-routing, low day trading margins, depth-of-market and footprint analysis tools, plus the ability to select your own clearing firm, make it especially suited to high-volume traders focused on U.S. and global futures markets."

Christian Harris, Reviewer

Optimus Futures Quick Facts

| Demo Account | Yes |

|---|---|

| Instruments | Futures on Indices, Metals, Energies, Softs, Bonds, Cryptos, Options on Futures, Event Contracts |

| Regulator | NFA, CFTC |

| Platforms | Optimus Flow, Optimus Web, MT5, TradingView |

| Minimum Deposit | $500 |

| Minimum Trade | $50 |

| Account Currencies | USD |

Pros

- Optimus Futures has added event contracts from CME Group, allowing traders to express a daily market view with a simple yes-or-no position on major futures markets. Only offered by a handful of brokers, these fixed-risk products provide a straightforward way to speculate on a short-term basis.

- Optimus Futures stands out with ultra-low day trading margins on micro futures, starting at just $50 per contract and a $100 minimum balance, giving small accounts serious buying power.

- Product and service upgrades, notably multi-bracket orders, an integrated trade journal, and a broader futures lineup, show Optimus Futures is making a clear effort to support active traders.

Cons

- There's no true 'all-in-one' account management dashboard - key functions like risk settings, software downloads, and subscriptions are split across different sections or platforms, so it required extra digging to set everything up during testing.

- There are limited payment options and no toll-free numbers for international support, while withdrawals cost $20 to $60, potentially making frequent withdrawals costly for active traders.

- Live chat support is handled entirely by a bot, so despite several attempts in our tests, it wasn't possible to get access to a human agent, which can be frustrating when urgent or complex questions arise.

Focus Markets

"Focus Markets is perfect for experienced traders familiar with MetaTrader 5, offering flexible crypto transactions (USDT and BTC) and access to over 90 cryptocurrencies for seamless speculation, deposits, and withdrawals."

Christian Harris, Reviewer

Focus Markets Quick Facts

| Demo Account | Yes |

|---|---|

| Instruments | CFDs, Forex, Stocks, Indices, Commodities, Crypto |

| Regulator | ASIC, SVGFSA |

| Platforms | MT5 |

| Minimum Deposit | $100 |

| Minimum Trade | 0.01 Lots |

| Leverage | 1:500 |

| Account Currencies | USD, EUR, GBP, CAD, AUD, NZD, JPY, SGD |

Pros

- Focus Markets excelled in the deposit and withdrawal category during testing, offering more base currencies than most competitors, including USD, CAD and EUR - and a range of traditional and popular crypto payment options, including BTC and USDT.

- While its meagre four commodities won’t meet the needs of some serious traders interested in softs and metals, Focus Markets offers a huge suite of 90+ cryptos, providing short-term opportunities on high-reward, high-risk assets.

- Focus Markets’ MT5 platform delivered fast, seamless trade execution during testing with advanced charting, multiple timeframes, and useful tools like Depth of Market (DOM). Its clean interface made navigation easy, while clear risk/reward ratios ensures precise trading.

Cons

- Focus Markets’ 24/5 support lacks direct phone help and unresponsive live chat, while email replies took a full business day during our latest tests. This slow support is a major drawback for active traders who need quick resolutions.

- A significant drawback of Focus Markets is the lack of platform variety. It only support MT5, excluding popular platforms like MT4, cTrader, and TradingView, plus it hasn't developed its own software that could better meet the needs of beginners.

- Regulatory protection is a location lottery at Focus Markets – Australian traders benefit from strong ASIC oversight, but those using the SVGFSA-registered entity face limited recourse options in disputes.

Exness

"After slashing its spreads, improving its execution speeds and support trading on over 100 currency pairs with more than 40 account currencies to choose from, Exness is a fantastic option for active forex traders looking to minimize trading costs."

Christian Harris, Reviewer

Exness Quick Facts

| Demo Account | Yes |

|---|---|

| Instruments | CFDs on Forex, Stocks, Indices, Commodities, Crypto |

| Regulator | FCA, FSCA, CMA, FSA, CBCS, BVIFSC, FSC, JSC |

| Platforms | Exness Trade App, Exness Terminal, MT4, MT5, TradingCentral |

| Minimum Deposit | Varies based on the payment system |

| Minimum Trade | 0.01 Lots |

| Leverage | 1:Unlimited |

| Account Currencies | USD, EUR, GBP, CAD, AUD, NZD, INR, JPY, ZAR, MYR, IDR, CHF, HKD, SGD, AED, SAR, HUF, BRL, NGN, THB, VND, UAH, KWD, QAR, KRW, MXN, KES, CNY |

Pros

- Fast and dependable 24/7 multilingual customer support via telephone, email and live chat based on hands-on tests.

- Exness Terminal offers a streamlined experience for beginners with dynamic charts while setting up watchlists is a breeze.

- Highly competitive spreads, reduced for USOIL and BTCUSD in 2024, are available from 0 pips with low commissions from $2 per side.

Cons

- MetaTrader 4 and 5 are supported, but TradingView and cTrader still aren’t despite rising demand from active traders and integration at alternatives like Pepperstone.

- Apart from a mediocre blog, educational resources are woeful, especially compared to category leaders like IG which provide a more complete trading journey for newer traders.

- Retail trading services are unavailable in certain jurisdictions, such as the US, UK and EU, limiting accessibility compared to top-tier brokers like Interactive Brokers.

IC Markets

"IC Markets offers superior pricing, exceptionally fast execution and seamless deposits. The introduction of advanced charting platforms, notably TradingView, and the Raw Trader Plus account, ensures it remains a top choice for intermediate to advanced day traders."

Christian Harris, Reviewer

IC Markets Quick Facts

| Demo Account | Yes |

|---|---|

| Instruments | CFDs, Forex, Stocks, Indices, Commodities, Bonds, Futures, Crypto |

| Regulator | ASIC, CySEC, CMA, FSA |

| Platforms | MT4, MT5, cTrader, TradingView, TradingCentral, DupliTrade, Quantower |

| Minimum Deposit | $200 |

| Minimum Trade | 0.01 Lots |

| Leverage | 1:30 (ASIC & CySEC), 1:500 (FSA), 1:1000 (Global) |

| Account Currencies | USD, EUR, GBP, CAD, AUD, NZD, JPY, CHF, HKD, SGD |

Pros

- You have access to over 2,250 CFDs across various markets, including forex, commodities, indices, stocks, bonds, and cryptocurrencies, allowing for diversified trading strategies.

- IC Markets offers fast and dependable 24/5 support based on firsthand experience, particularly when it comes to accounts and funding issues.

- IC Markets offers among the tightest spreads in the industry, with 0.0-pip spreads on major currency pairs, making it especially cost-effective for day traders.

Cons

- Interest isn't paid on unused cash, an increasingly popular feature found at alternatives like Interactive Brokers.

- Despite four industry-leading third-party platforms, there is no proprietary software or trading app built with new traders in mind.

- While IC Markets offers a selection of metals and cryptos for trading via CFDs, the range is not as extensive as brokers like eToro, limiting opportunities for traders interested in these asset classes.

How We Chose The Best MT5 Brokers

To compile a list of the best brokers that support MT5, we:

- Took our evolving directory that today stands at 139 online brokers,

- Pinpointed the approximately 70+ firms that have MT5 on desktop, web or mobile,

- Sorted those providers by their overall rating, combining 200+ data points with the personal views of our testers to find the very best.

How To Choose A MetaTrader 5 Broker

When selecting an MT5 broker, here are six key factors to consider:

1. Device Compatibility

Virtually every MT5 broker we’ve evaluated provides access to the software on desktop, mobile and web:

- The desktop terminal is best for advanced traders needing custom features and fast execution.

- The web solution is more beginner-friendly but can be slower and sometimes lack certain tools.

- The mobile app is perfect for on-the-go trading and is highly rated (above 4.5/5) on both iOS and Android, with iOS slightly ahead.

- Pepperstone has impressed us for years, providing a first-class trading environment on MT5’s desktop, web and mobile platforms. It’s also scooped our annual ‘Best Forex Broker’ award twice, plus our ‘Best Overall Broker’ and ‘Best Trading App’.

2. Available Trading Instruments

Unlike its predecessor MT4, which was built for forex trading, MT5 offers multi-asset trading opportunities on popular global markets spanning stocks, commodities, indices, cryptocurrencies, and CFDs.

- BlackBull continues to offer the most extensive range of instruments for trading on MT5 that we’ve seen, with over 26,000 markets covering forex, stocks, indices, commodities and more.

3. Trading Costs

Look for brokers with low spreads and minimal commissions, especially if you’re a day trader making frequent transactions.

Advanced traders may even prefer an ECN broker, which often offer spreads from 0.0 pips, low commissions, and even rebates to high-volume traders.

- IC Markets tops our rankings for pricing, with its raw spread account featuring terrific spreads averaging 0.1 pips on EUR/USD. IC Markets has also scooped our ‘Best MetaTrader Broker’ annual award in recent years.

4. Demo Account Availability

Over 95% of brokers we’ve tested offer MT5 demo accounts, allowing you to practice with virtual funds.

Great for beginners, these accounts typically last between 14 to 30 days, but some providers even offer unlimited demo access for ongoing practice of day trading strategies.

- XM impresses with its MT5 demo account that we customized with a whopping $5,000,000 in account equity. You can also keep the demo mode open alongside your live account – ideal for beginners.

5. Trustworthiness

Choose an MT5 provider with a clean track record and most importantly, authorization from a respected regulator to ensure your funds are protected.

We’ve built a proprietary Regulation & Trust Rating, putting regulators into four tiers – green, yellow, orange and red – to help you understand which regulatory licenses indicate a trustworthy brokerage.

- FOREX.com continues to earn our trust, sporting over 20 years in our industry and authorization from 9 ‘green tier’ regulators, ensuring it’s held to the highest regulatory standards in multiple jurisdictions worldwide.

6. MT5 Add-Ons

Some brokers provide advanced tools for technical analysis and risk management features through MetaTrader add-ons, taking the trading experience up a notch for serious investors.

What Is MetaTrader 5?

MetaTrader 5 is an online trading platform that connects retail investors, primarily active traders, to the financial markets.

Think of MT5 as the bigger, more advanced sibling of MetaTrader 4 (MT4). While MT4 focuses on forex trading, MT5 goes further, opening doors to other markets like stocks, commodities, and even futures.

It’s ideal for those who want to explore diverse trading opportunities without switching platforms.

Whether you’re just starting out or already an experienced pro, MT5 packs a punch with its modern features, user-friendly design, and powerful tools.

Here are the highlights:

- Multi-Asset Trading: Access to a wide range of markets beyond forex.

- Advanced Charting: Over 80 built-in technical indicators and 21 timeframes to analyze trends.

- Algorithmic Trading: Automate strategies using Expert Advisors (EAs).

- Economic Calendar: Stay updated on market-moving events directly in the platform.

- Fast Execution: Designed for speed, MT5 ensures trades are executed quickly, ideal for day trading.

- Market Watch: This is your dashboard for monitoring various instruments and their prices.

- Chart Window: Where the magic happens; analyze price movements, add indicators, or apply templates here.

- Toolbox: Your command centre for monitoring trades, account history, alerts, and more.

Getting Started With MT5

Step 1: Download & Install

- Where to Get It: Download MT5 from your broker’s website or the official MetaQuotes MT5 download.

- Compatibility: It’s available for Windows, Mac, web browsers, and mobile devices (iOS/Android).

Step 2: Set Up Your Account

- Create a demo account to practice risk-free or log in with your broker-provided credentials for live trading.

Step 3: Navigate Like A Pro

- Market Watch: Right-click to add/remove instruments.

- Navigator: Access accounts, indicators, EAs, and scripts here.

- Toolbox: Track trades, account history, alerts, and news.

Step 4: Usability Tips

- Learn the Interface: Spend time clicking around in a demo account. MT5 is intuitive, but I know from firsthand experience that familiarity makes a huge difference.

- Test Features: Whether it’s using one-click trading or adding indicators, don’t be shy to experiment.

Key Features

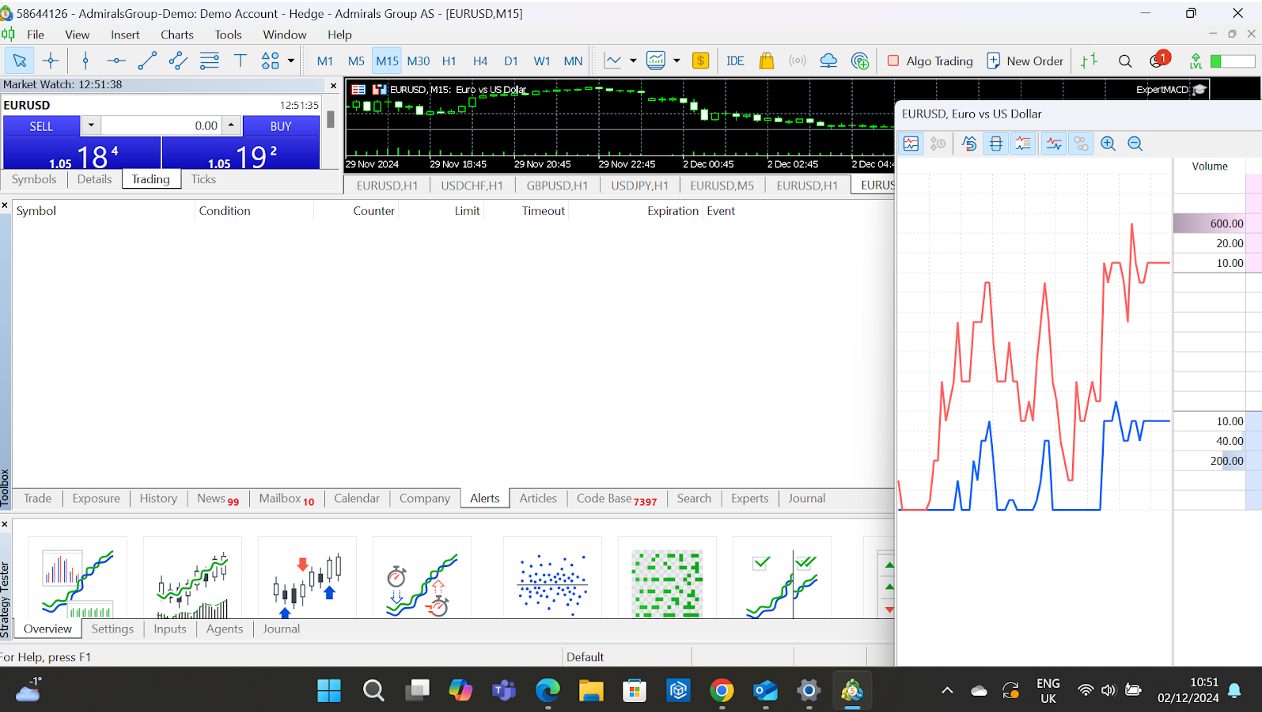

Let’s unpack three essential parts of the MetaTrader 5 (MT5) platform: Market Watch, Navigator, and Toolbox.

Each one plays a critical role in helping you monitor markets, manage tools, and keep track of your short-term trades.

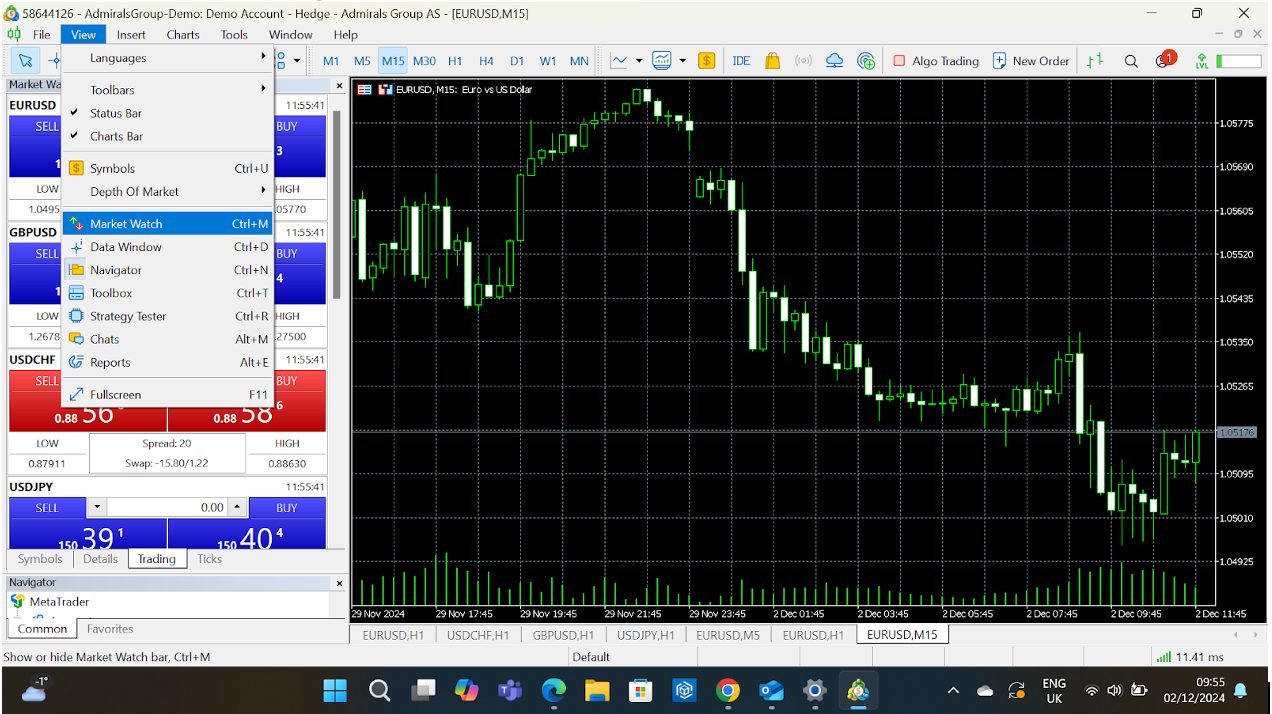

Market Watch

What Is It?

Market Watch is the command centre for all the instruments you can trade (forex pairs, stocks, indices, commodities, etc). It gives you real-time price quotes and quick access to charts and order windows.

How Does It Work?

- Price Quotes: See Bid and Ask prices for selected instruments at a glance.

- Tick Charts: Double-click an instrument to open a real-time price movement tick chart.

- Add/Remove Instruments: Customize the list to focus on the assets you actually trade.

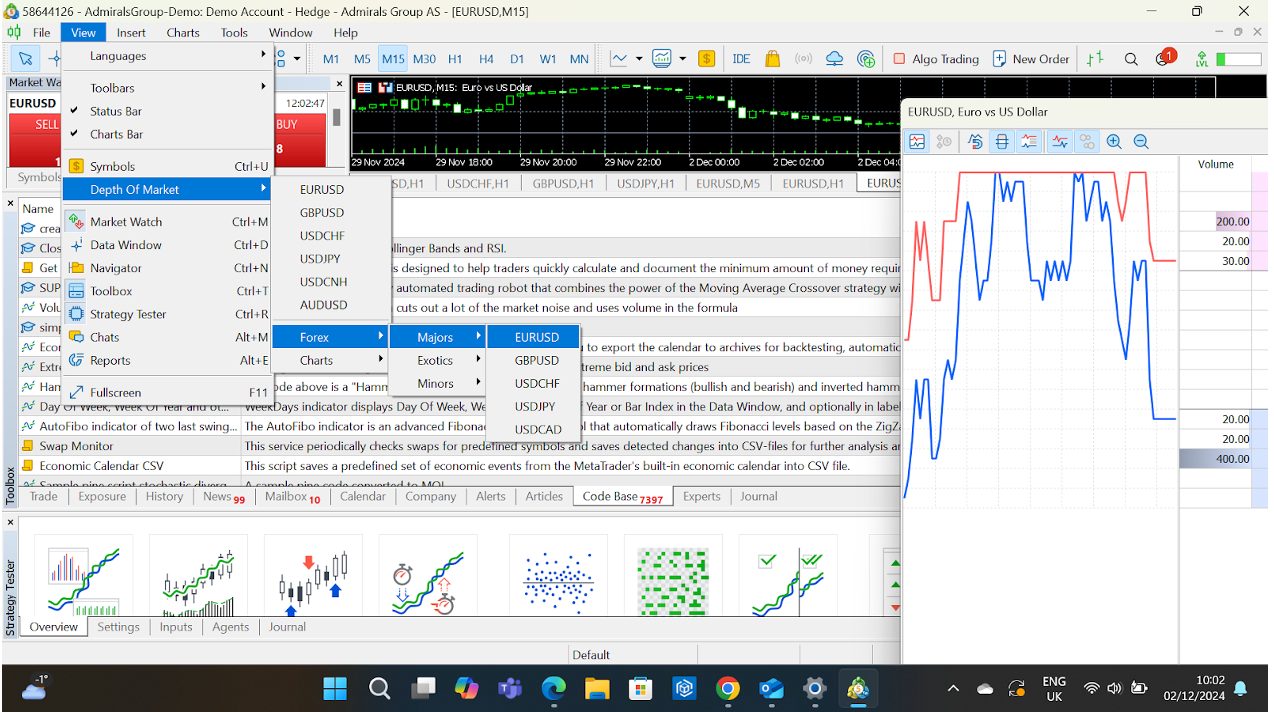

- Depth Of Market (DOM): Right-click an instrument and select Depth of Market for a detailed view of liquidity and order book.

How To Navigate Market Watch

- Open Market Watch: If it’s not visible, press Ctrl+M or go to View > Market Watch.

- Add Instruments: Right-click anywhere in the Market Watch panel > Symbols. From here, browse categories (eg forex, indices) and double-click to add/remove assets.

- Customize Columns: Right-click > Columns. Choose what you want to display, like Spread, High/Low, or Volume.

My pro tip is to use Sets to save different groups of instruments. I find it great for switching between trading forex pairs and stocks.

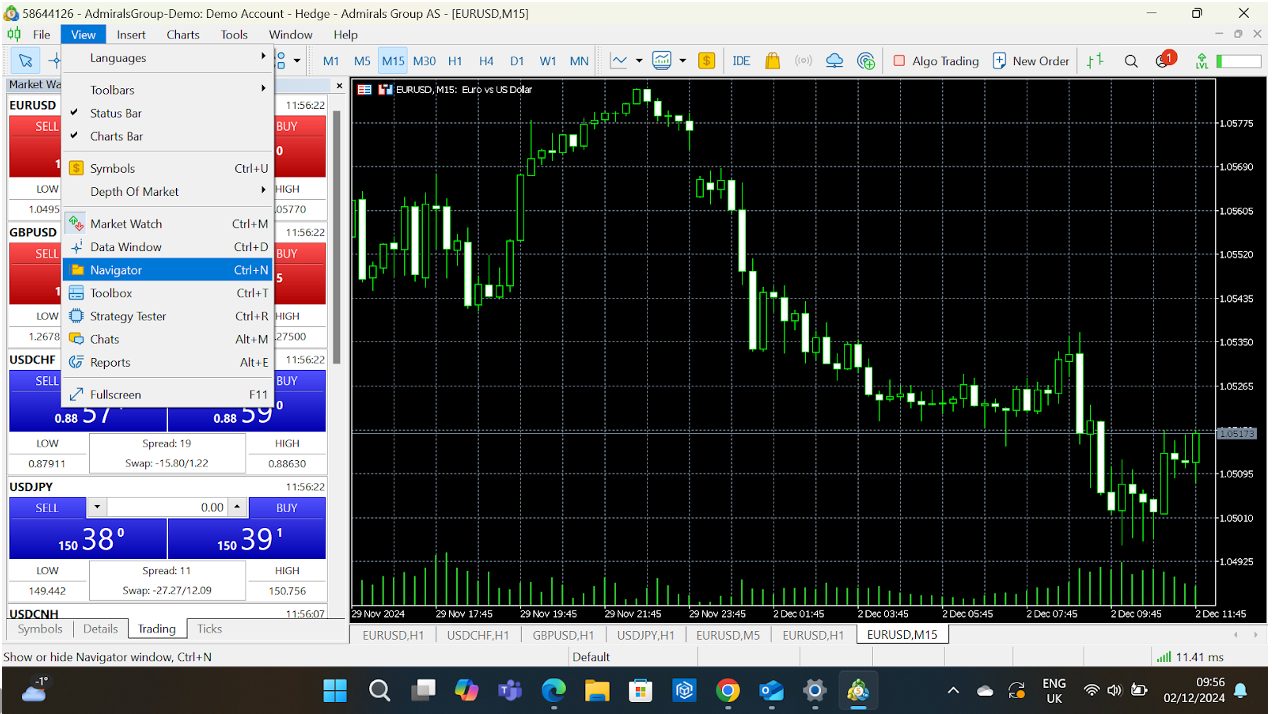

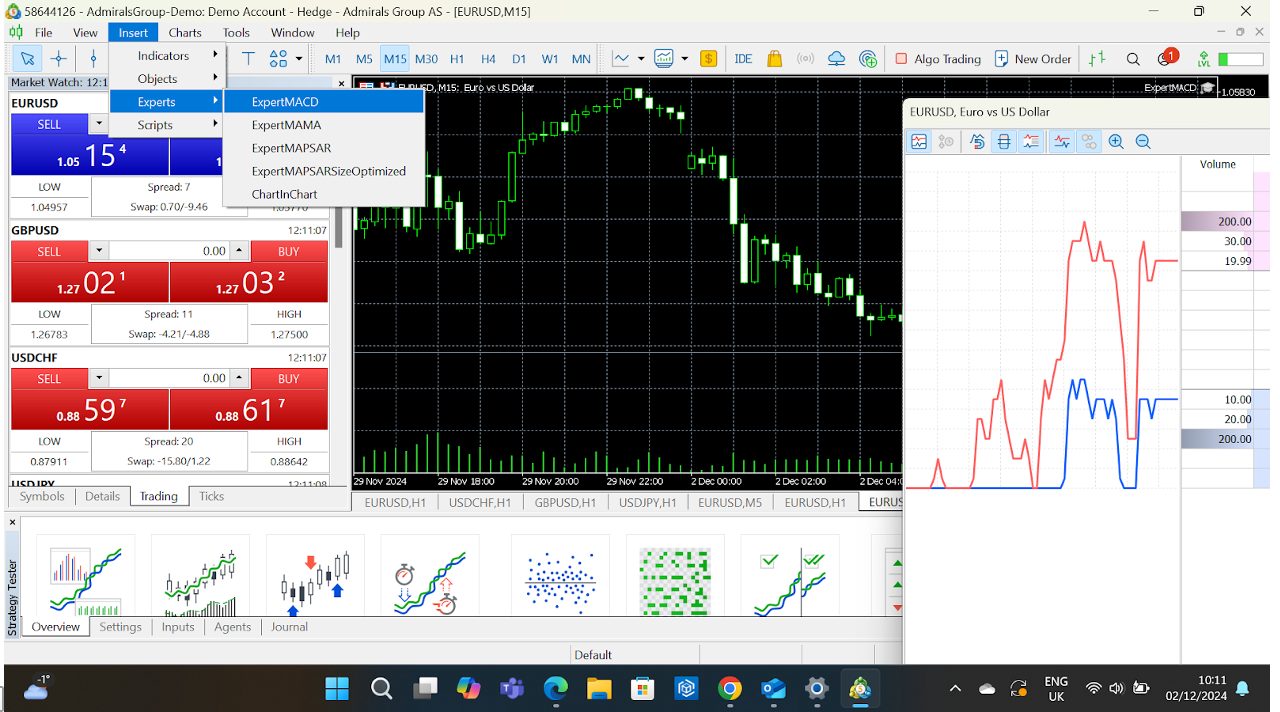

Navigator

What Is It?

The Navigator is where you manage all your trading accounts, indicators, scripts, and Expert Advisors (EAs). Think of it as your control panel for everything customizable on MT5.

How Does It Work?

- Accounts Management: Easily switch between demo and live accounts or log into a new account.

- Indicators: Access built-in technical indicators like Moving Averages, Relative Strength Index (RSI), and Bollinger Bands.

- EAs and Scripts: Manage your automated trading tools and run quick tasks using scripts.

How To Navigate Navigator

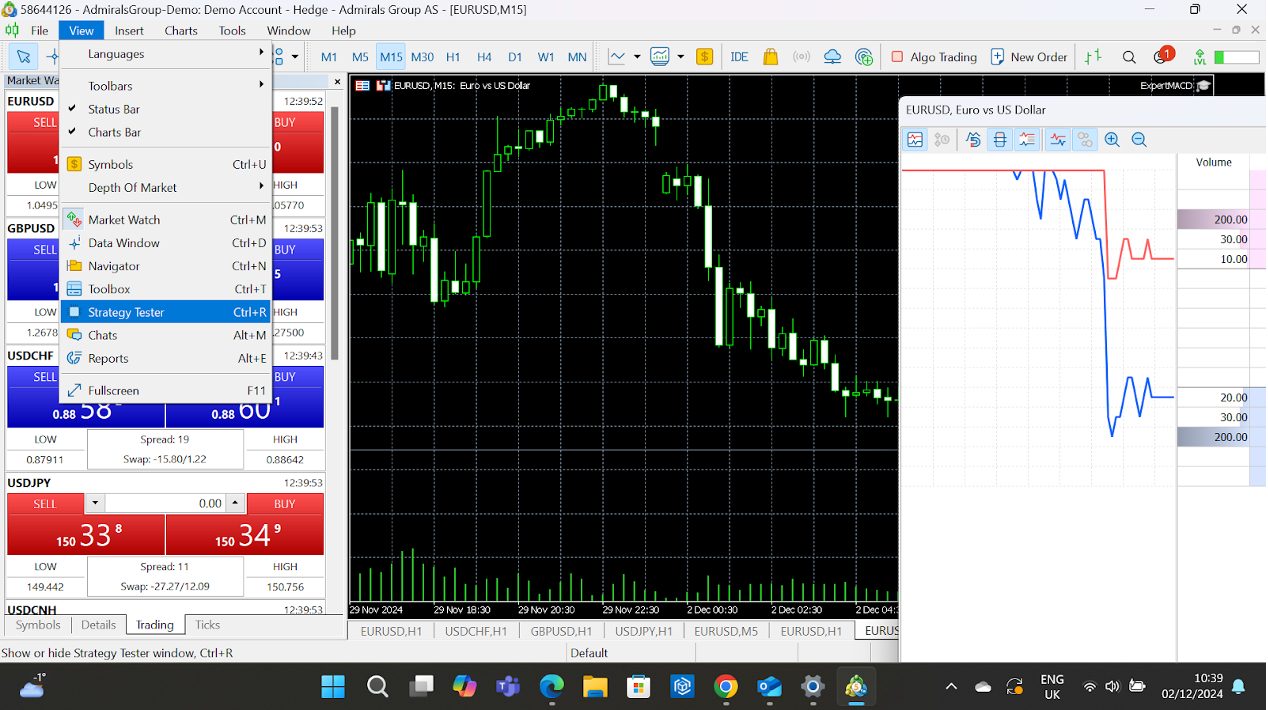

- Open Navigator: Press Ctrl+N or go to View > Navigator.

- Log In to Accounts: Double-click Accounts, then select your account or log into a new one using credentials.

- Apply Indicators: Drag an indicator from the list and drop it onto a chart. Adjust settings to match your strategy.

- Run EAs: Drag an EA onto the chart to activate it. Be sure to enable automated trading via the toolbar or Ctrl+E.

When I have a lot of custom indicators and scripts, I organize them into folders for quick access.

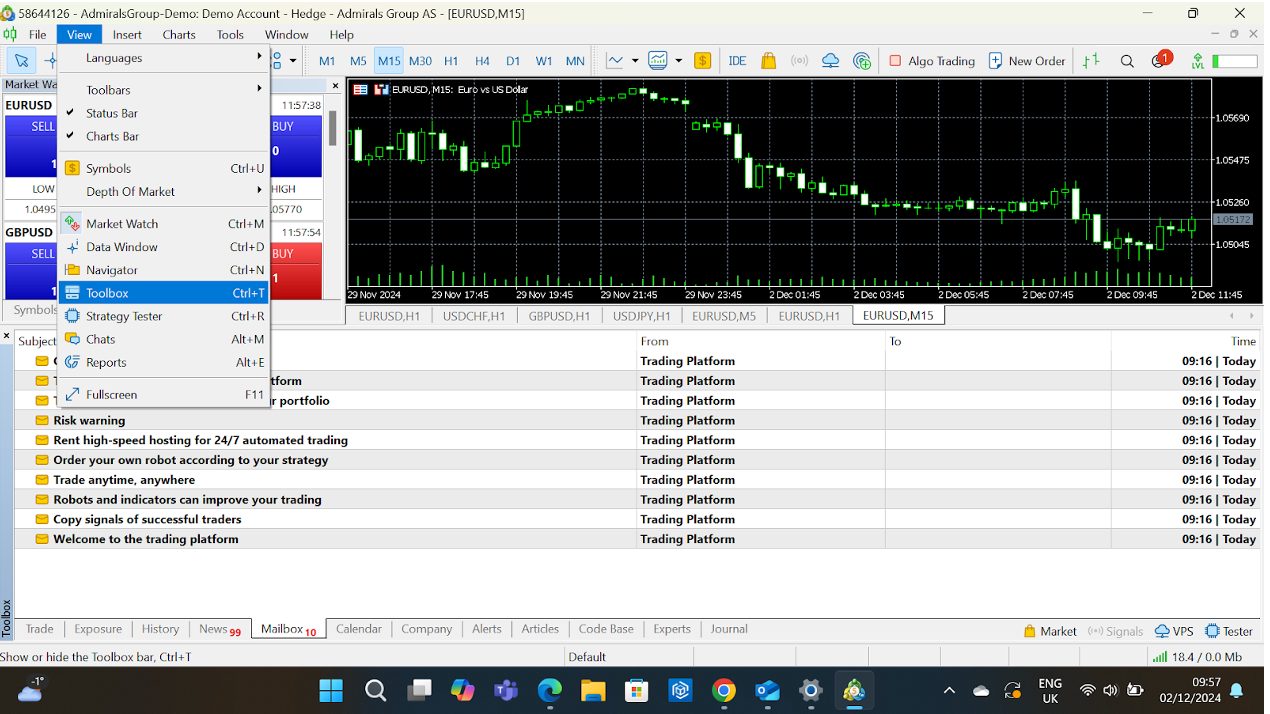

Toolbox

What Is It?

The Toolbox is your all-in-one tracker for open trades, account history, news, alerts, and more. It’s where you monitor the status of your trading activities and manage notifications.

How Does It Work?

- Trade Tab: Shows your current open positions, pending orders, and overall account balance.

- History Tab: A detailed log of all your closed trades – great for reviewing your performance.

- News Tab: Keeps you updated with market news from your broker.

- Alerts Tab: Manage alerts you’ve set for price levels or economic events.

- Mailbox Tab: Receive essential messages from your broker.

- Journal Tab: Tracks all platform activities, such as login history or order executions.

How To Navigate Toolbox

- Open Toolbox: Press Ctrl+T or go to View > Toolbox.

- Switch Tabs: Click the tabs at the bottom of the Toolbox window (eg Trade, History).

- Set Alerts: Go to the Alerts tab, right-click, and choose Create. Set conditions like when EUR/USD hits 1.1000.

- View Performance: Use the History tab to filter trades by day, week, or month to analyze your results.

Monitor your real-time profit/loss and margin usage on the Trade tab. I find it crucial for managing my risk.

Besides these three core features, there are several notable tools that will also appeal to active traders:

Multi-Asset Trading

Many day traders love variety, and MT5 delivers big time. You can trade forex, stocks, indices, commodities, and futures from one platform.

Real-life perk: Suppose you’re trading EUR/USD in the morning and eyeing US tech stocks in the afternoon. With MT5, there’s no need to switch platforms.

I use the Market Watch panel to monitor multiple markets simultaneously and create groups to keep things tidy.

Advanced Charting

MT5 takes charting to the next level with 21 timeframes (from 1 minute to 1 month) and over 80 built-in indicators.

- Chart settings: Save your favorite chart settings as templates to apply them across instruments instantly.

I once spent hours perfecting a Fibonacci retracement setup on MT5’s chart, and the precise tools made it so much easier to spot critical levels.

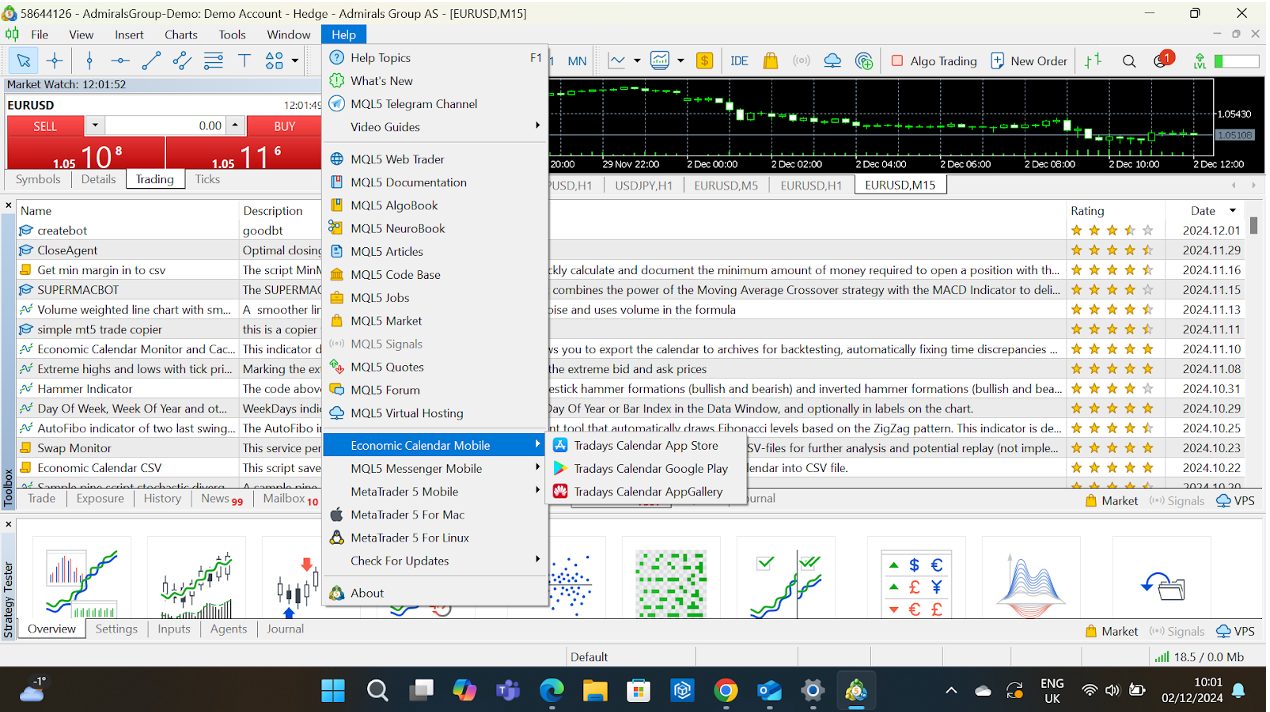

Algorithmic Trading With Expert Advisors (EAs)

MT5’s support for automated trading strategies makes it a dream come true for tech-savvy traders.

You can write your programmes in MQL5 or download pre-built EAs.

- Switching to MT5 for EA testing can be a game-changer. The backtesting speed alone saves hours.

- Use MT5’s strategy tester to backtest your EA on historical data before deploying it live.

I use EAs for heavy lifting by automating repetitive trading tasks.

Built-In Economic Calendar

Stay ahead of market-moving events without leaving the platform. The economic calendar, which you won’t find in MT4, highlights key reports and forecasts.

- MT5 links the calendar to charts to see how past events affected price movements.

- Combine the calendar with alerts to get notified about upcoming events that matter to your trades.

Fast Execution & Depth Of Market (DOM)

For scalpers and day traders, speed and pricing transparency are crucial. MT5’s DOM shows the real-time order book.

Seeing the depth of market helps me gauge liquidity before placing big orders – it’s an absolute lifesaver for my trading strategy.

How To Customize MT5

MT5 gives you total control over how your workspace looks and functions:

- Dockable Panels: Rearrange panels like Market Watch, Navigator, and Toolbox to create your perfect setup.

- Custom Indicators: Beyond the built-ins, you can add custom indicators downloaded from the MQL5 marketplace.

- Shortcuts: Set hotkeys for frequent actions; this is a massive time-saver for active traders.

Create different profiles for different trading strategies. For example, I can have one for scalping with smaller timeframes and another for swing trading with higher ones.

Let’s break it all down:

Chart Customization

Charts are the heart of any platform for day traders, and MT5 offers a ton of ways to tweak them to your liking.

Change Chart Styles

- Options: Choose from three chart types: Line, Bar, or Candlestick.

- How-To: Right-click on the chart > Properties > Choose your style under Common.

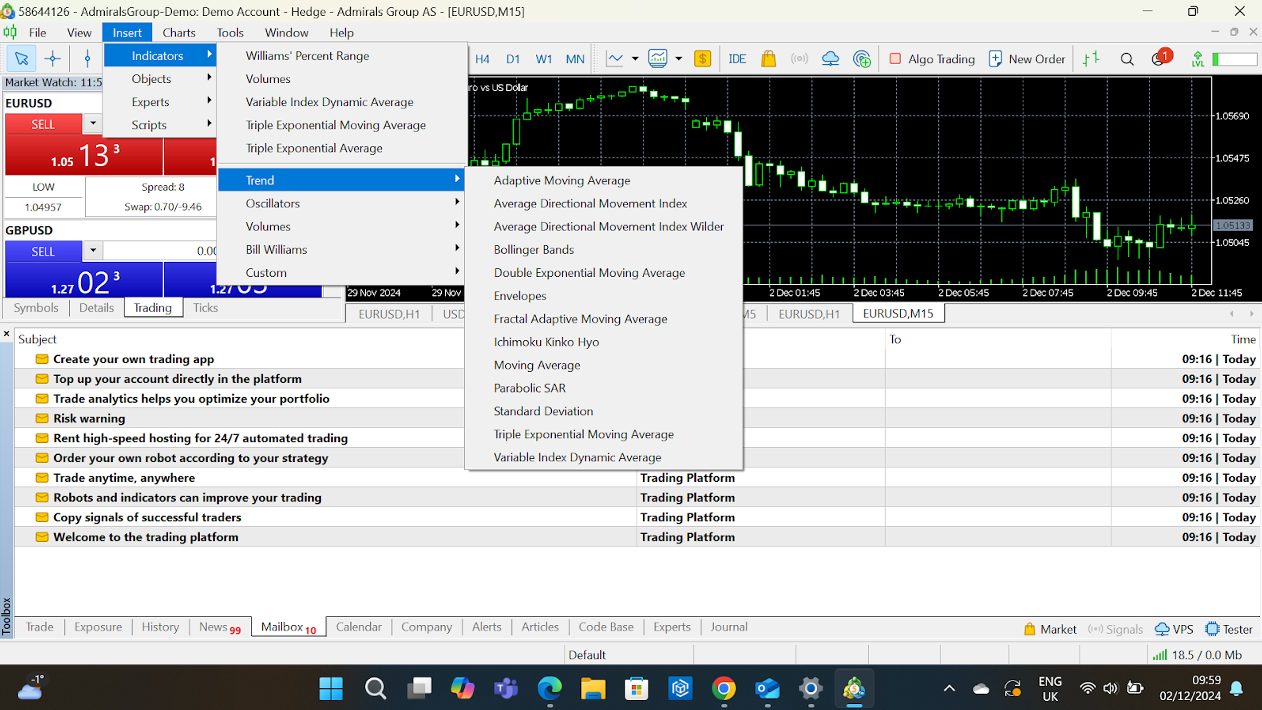

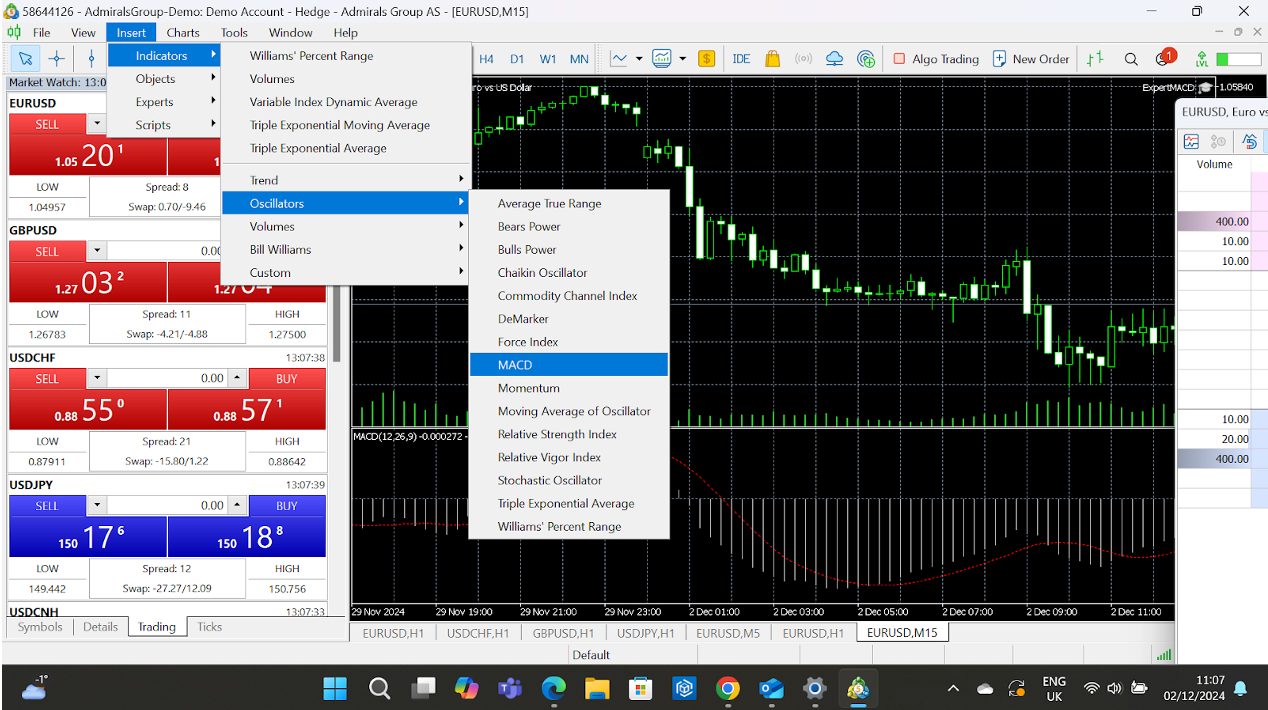

Add Indicators

- Options: MT5 comes preloaded with 80+ indicators (eg Moving Averages, RSI, Bollinger Bands), and you can add custom indicators too.

- How-To: Drag indicators from the Navigator to your chart or download custom ones from the MQL5 marketplace.

I often stack multiple indicators in the same sub-window (e.g., RSI and MACD) to save space and get a combined view.

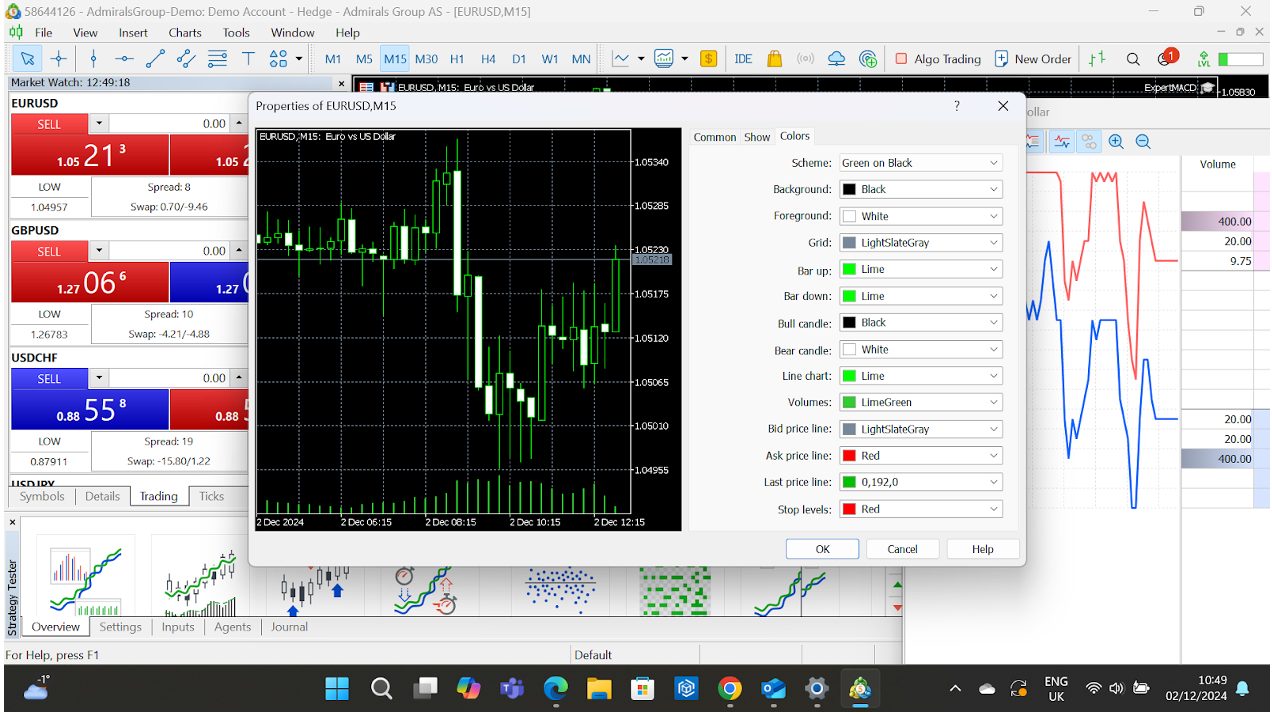

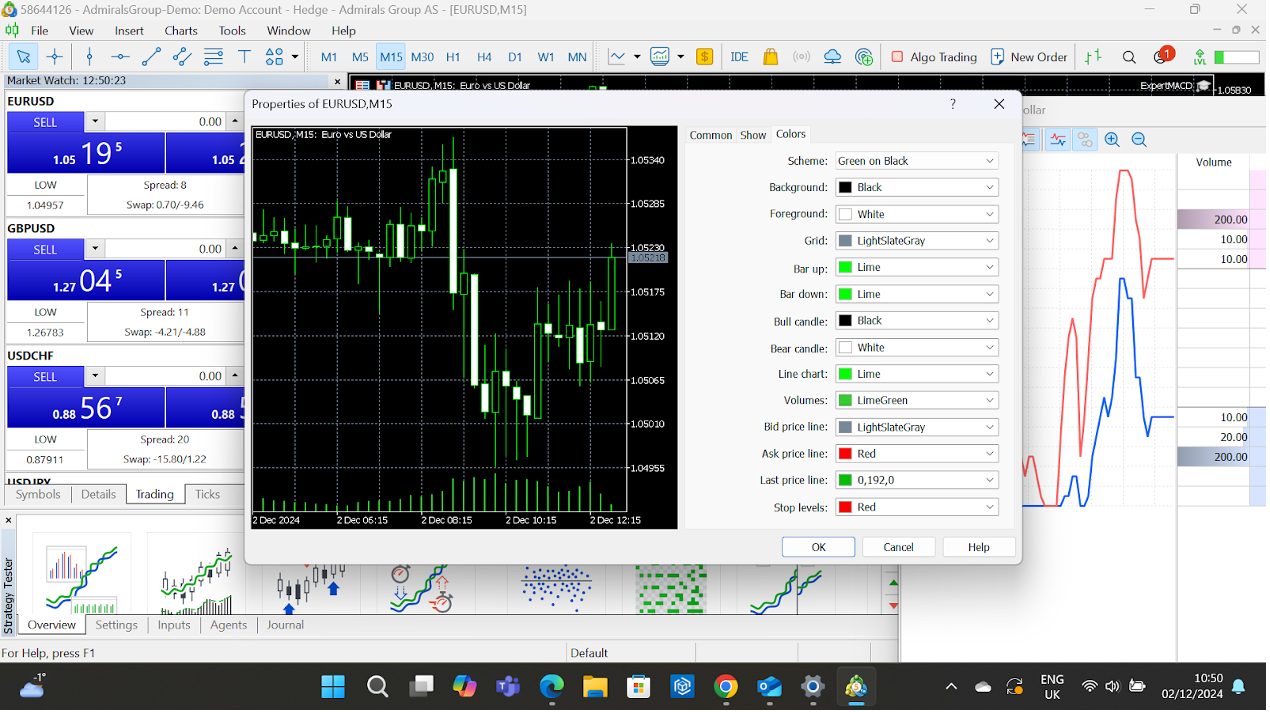

Customize Chart Appearance

- Colours: Adjust the colour of candles, gridlines, backgrounds, and more.

- How-To: Right-click > Properties > Colors tab.

- Templates: Save your preferred chart style (timeframe, indicators, colours) as a template.

- How-To: Right-click > Template > Save Template.

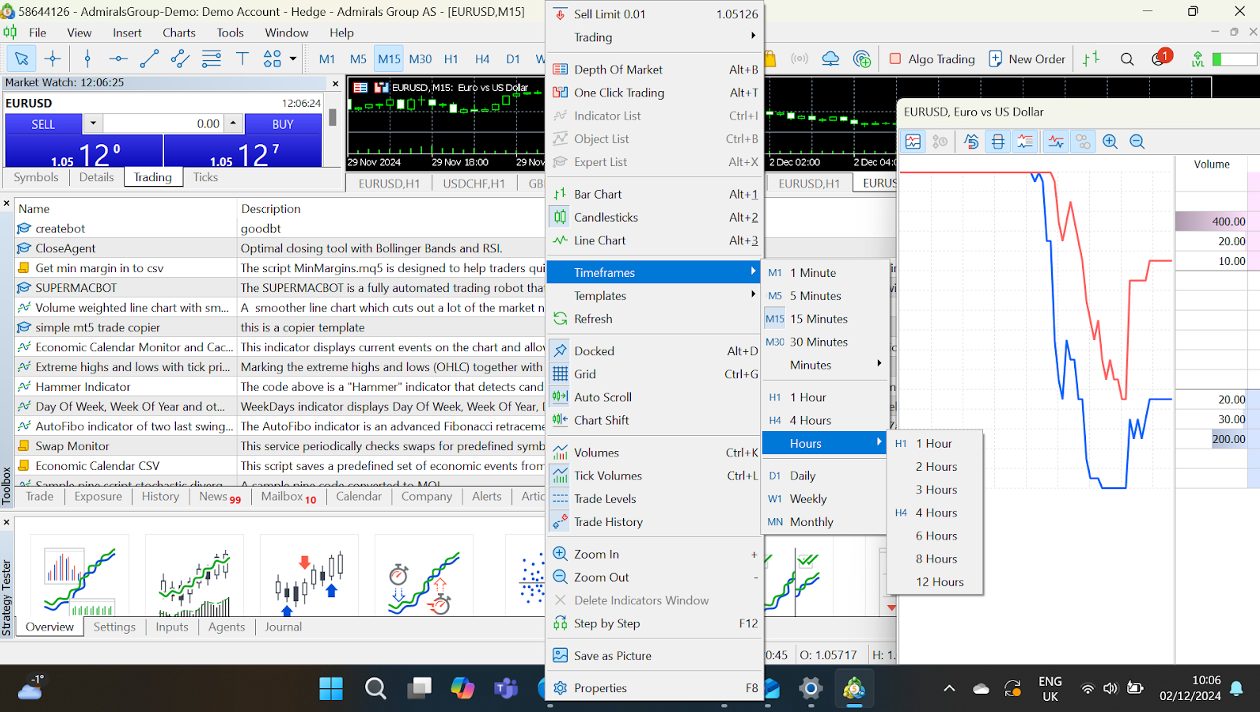

Use Multiple Timeframes

- Why It’s Beneficial: Analyze trends across timeframes with just a click; great for strategy building.

- How-To: Right-click on the chart > Timeframes > Select from 1-minute to 1-month views.

Workspace Customization

Dockable Panels

MT5 lets you rearrange panels like Market Watch, Navigator, and Toolbox to suit your style.

- How-To: Drag and drop any panel to dock it in a new position or leave it floating.

Multiple Monitors

If you’re juggling multiple markets, spread your charts across several monitors.

- How-To: Right-click on the chart tab > Detach Window.

Custom Profiles

Set up different profiles for various trading strategies or markets. For example:

- A forex profile with charts for EUR/USD, GBP/USD, and USD/JPY.

- A stocks profile with S&P 500 and Nasdaq charts.

- How-To: Go to File > Profiles > Save Profile As.

Keyboard Shortcuts & Hotkeys

MT5 is a hotkey lover’s dream. You can assign shortcuts for nearly every action.

- Default Shortcuts:

- Ctrl+T: Show/Hide Toolbox.

- Ctrl+M: Show/Hide Market Watch.

- F9: Open the trading order window.

- Alt+T: Activate one-click trading.

- Custom Hotkeys:

- Go to Tools > Options > Hotkeys tab.

Use shortcuts for actions like switching timeframes or closing charts; this helps me save precious seconds during fast markets.

Market Watch Customization

This is where you monitor all the instruments you can trade.

- Add/Remove Symbols: Right-click in the Market Watch window > Symbols > Search and select/deselect instruments.

- Create Custom Groups: Organize instruments into categories like forex pairs, commodities, and indices.

- Tick Chart Display: Double-click any instrument to see its tick chart – ideal for scalpers.

Depth Of Market (DOM) Settings

Active traders using DOM can customize their views.

- Options: Switch between Standard, Market Depth, and Price Ladder styles.

- How-To: Right-click in the DOM window > Settings.

I use the DOM for precise entry/exit planning, especially in highly liquid markets.

Alerts & Notifications

Stay on top of price changes without constantly watching the screen.

- Set Alerts:

- Right-click on the Price Line or in Toolbox > Alerts tab > Create.

- Example: Alert when EUR/USD hits 1.1000.

- Get Push Notifications: Sync MT5 with the mobile app to receive alerts on your phone.

- How-To: In Tools > Options > Notifications, enter your MetaQuotes ID.

Expert Advisors (EAs) & Scripts

Automation is king on MT5, and the platform makes it easy to implement your trading bots.

- Install EAs: Drag and drop your EA file into the Experts folder (accessible via File > Open Data Folder).

- Customize EA Parameters: Adjust inputs to fine-tune the bot to your needs once added to the chart.

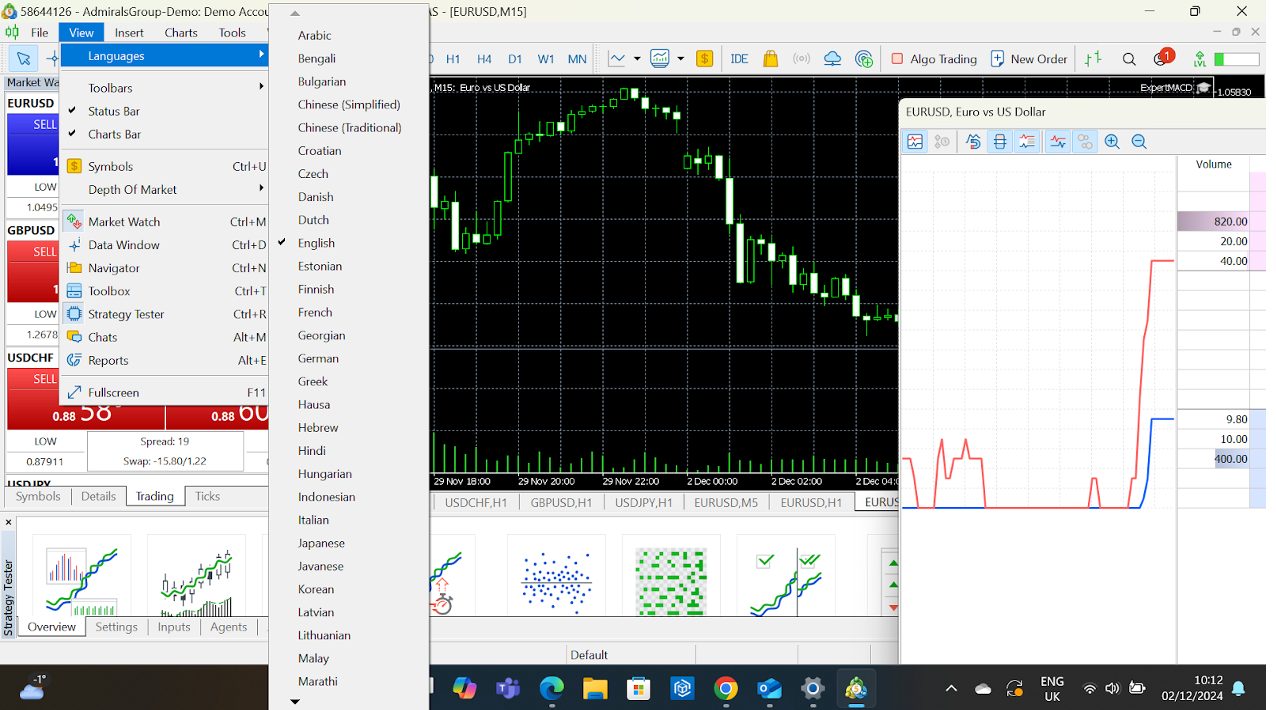

Language & Regional Settings

If English isn’t your preferred language, switch the platform’s language.

- How-To: Go to View > Languages, select your choice, and restart MT5.

The beauty of MT5 is its adaptability. It can be as straightforward or as complex as you want. Spend time playing around with these options and quickly discover what works best for you.Start small, explore its features step by step, and watch your trading experience evolve.

Bottom Line

MetaTrader 5 (MT5) isn’t just a trading platform; it’s a powerhouse that caters to active traders of all levels.

Whether you’re a beginner looking for a user-friendly way to start trading or an experienced trader ready to dive into multi-asset strategies, MT5 has the tools to make it happen.

That’s partly why it’s the second most widely offered third-party platform offered by online brokers based on our analysis, trailing just its predecessor, MT4.

That said, since its app was briefly removed from the Apple App Store in September 2022, it’s facing increasing competition from other third-party platforms, notably TradingView and cTrader, which are now more widely supported at brokerages.

To get started, find the right provider for your needs from our selection of the best MetaTrader 5 brokers.

Article Sources

The writing and editorial team at DayTrading.com use credible sources to support their work. These include government agencies, white papers, research institutes, and engagement with industry professionals. Content is written free from bias and is fact-checked where appropriate. Learn more about why you can trust DayTrading.com