Regulation & Trust Rating

Choosing a trustworthy broker is critical to safeguard your funds. However, with the risk of scams and unfair trading practices, it can be difficult to know who you can put your confidence in.

That’s why we’ve developed a straightforward way to score brokers, which:

- Informs our broker testing process, and;

- Helps traders understand what to look for in a trustworthy brokerage.

We call this our Regulation & Trust Rating.

What We Consider

Our Regulation & Trust Rating takes into account several considerations:

- Regulatory status: Is the broker licensed by Green Tier regulators?

- History: Does it have a clean record with no regulatory breaches?

- Transparency: Is the broker open about its trading conditions?

- Internal opinion: How much trust does our team have in the broker?

Application

Our findings in each of these areas contribute to an overall score of up to 5 – with the most trusted brokers scoring between 4 and 5.

Interactive Brokers, for example, earns a high trust score of 4.5 due to its regulation by reputable bodies like the US CFTC and UK FCA, plus its over 40 years of industry experience.

In contrast, Cronika receives a very low trust score of 1 due to its lack of regulation by a trusted financial body and its limited track record, having cropped up in 2025.

Regulators

The most important factor we take into account is a broker’s regulatory status.

This is because reputable regulators ensure brokers operate a fair and transparent trading environment, helping to safeguard your investments.

When we assign our ratings, we are interested in:

- How many licenses a broker holds, and critically;

- Whether they are from trusted regulators.

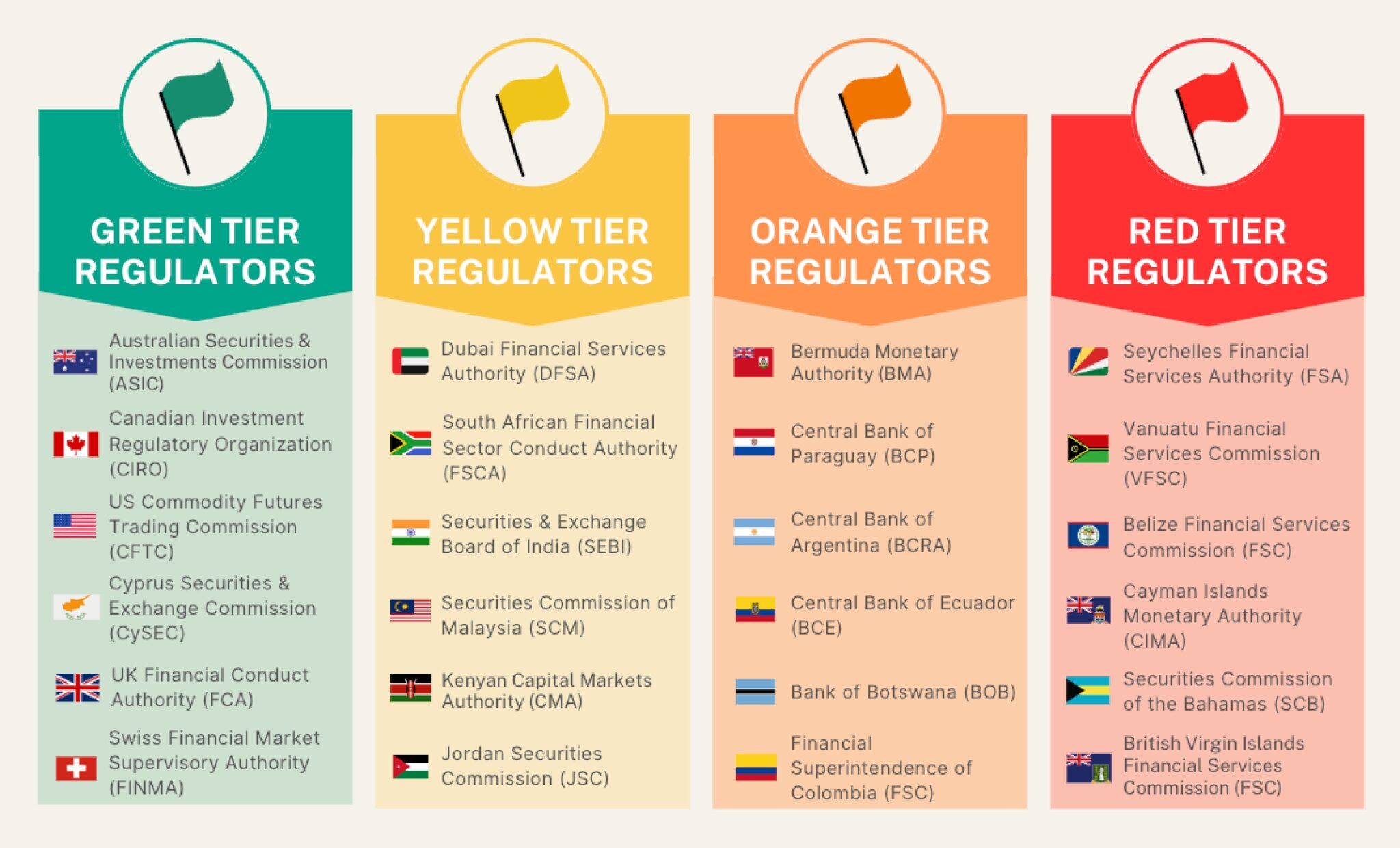

To determine whether a regulator is high-risk or low-risk, we’ve developed 4 classifications:

- Green Tier: Very low risk. The best investor protection.

- Yellow Tier: Low risk. Strong investor protection.

- Orange Tier: High risk. Limited investor protection.

- Red Tier: Very high risk. Little to no investor protection.

Green Tier Regulators

Green Tier regulators are the gold standard when it comes to regulatory oversight, and we apply the highest scores to brokers that hold one or more licenses from Green Tier regulators.

A Green Tier regulator ensures adherence to strict industry safety standards, instilling confidence even if specific jurisdictional protections, like investor compensation in case of broker bankruptcy, are unavailable to you.

- US Commodity Futures Trading Commission (CFTC) – US

- US National Futures Association (NFA) – US

- US Securities & Exchange Commission (SEC) – US

- Financial Crimes Enforcement Network (FinCEN) – US

- Australian Securities and Investments Commission (ASIC) – Australia

- Australian Prudential Regulation Authority (APRA) – Australia

- Australian Transaction Reports and Analysis Centre (AUSTRAC) – Australia

- Reserve Bank of Australia (RBA) – Australia

- UK Financial Conduct Authority (FCA) – UK

- Canadian Investment Regulatory Organization (CIRO) – Canada

- Alberta Securities Commission Canada (ASC) – Canada

- Autorité des marchés financiers (AMF Québec) – Canada

- Bank of Canada – Canada

- British Columbia Securities Commission (BCSC) Canada – Canada

- Canadian Deposit Insurance Corporation (CDIC) – Canada

- Canadian Securities Administrators (CSA) – Canada

- Financial and Consumer Affairs Authority of Saskatchewan (FCAA) – Canada

- Financial and Consumer Services Commission (FCNB New Brunswick) – Canada

- Financial Transactions and Reports Analysis Centre (FinTRAC) – Canada

- Manitoba Securities Commission (MSC) – Canada

- Northwest Territories Office of the Superintendent of Securities – Canada

- Nova Scotia Securities Commission (NSSC) – Canada

- Nunavut Securities Office – Canada

- Office of the Superintendent of Financial Institutions (OSFI) – Canada

- Office of the Superintendent of Securities Prince Edward Island – Canada

- Office of the Yukon Superintendent of Securities – Canada

- Ontario Securities Commission (OSC) – Canada

- Cyprus Securities & Exchange Commission (CySEC) – Cyprus

- Central Bank of Cyprus – Cyprus

- Japanese Financial Services Agency (JFSA) – Japan

- Bank of Japan – Japan

- Monetary Authority of Singapore (MAS) – Singapore

- Hong Kong Securities Futures Commission (SFC) – Hong Kong

- German Federal Financial Supervisory Authority (BaFin) – Germany

- Deutsche Bundesbank – Germany

- Spanish National Securities Market Commission (CNMV) – Spain

- New Zealand Financial Markets Authority (FMA) – New Zealand

- Reserve Bank of New Zealand (RBNZ) – New Zealand

- Swiss Financial Market Supervisory Authority (FINMA) – Switzerland

- Central Bank of Ireland (CBI) – Ireland

- French Financial Markets Authority (AMF) – France

- Autorité de contrôle prudentiel et de résolution (ACPR) – France

- Banque de France – France

- Danish Financial Supervisory Authority (DFSA) – Denmark

- Danmarks Nationalbank – Denmark

- Italian Organismo Agenti e Mediatori (OAM) – Italy

- Banca d’Italia – Italy

- Commissione Nazionale per le Società e la Borsa (CONSOB) – Italy

- Istituto per la Vigilanza sulle Assicurazioni (IVASS) – Italy

- Swedish Financial Supervisory Authority (Finansinspektionen) – Sweden

- Financial Supervisory Authority of Norway (Finanstilsynet) – Norway

- National Bank of Hungary (MNB) – Hungary

- Polish Financial Supervision Authority (KNF) – Poland

- Narodowy Bank Polski (NBP) – Poland

- Czech National Bank (CNB) – Czech Republic

- Netherlands Authority for the Financial Markets (AFM) – Netherlands

- De Nederlandsche Bank (DNB) – Netherlands

- Luxembourg Commission de Surveillance du Secteur Financier (CSSF) – Luxembourg

- Banque centrale du Luxembourg (BCL) – Luxembourg

- Portuguese Comissão do Mercado de Valores Mobiliários (CVMV) – Portugal

- Autoridade de Supervisão de Seguros e Fundos de Pensões (ASF) – Portugal

- Banco de Portugal – Portugal

- Malta Financial Services Authority (MFSA) – Malta

- Central Bank of Malta – Malta

- European Securities and Markets Authority (ESMA) – European Union

- Austrian Financial Market Authority (Finanzmarktaufsichtsbehörde) – Austria

- Austrian National Bank (Oesterreichische Nationalbank) – Austria

- Belgium Financial Services & Markets Authority (FSMA) – Belgium

- National Bank of Belgium (NBB) – Belgium

- Bulgarian National Bank (BNB) – Bulgaria

- Bulgarian Financial Supervision Commission (FSC) – Bulgaria

- Croatian Financial Services Supervisory Agency (HANFA) – Croatia

- Croatian National Bank (HNB) – Croatia

- Eesti Pank (Bank of Estonia) – Estonia

- Finantsinspektsioon (FSA) – Estonia

- Bank of Finland (Suomen Pankki) – Finland

- Finanssivalvonta (FIN-FSA) – Finland

- Bank of Greece – Greece

- Hellenic Capital Market Commission (HCMC) – Greece

- Bank of Latvia (Latvijas Banka) – Latvia

- Bank of Lithuania (Lietuvos bankas) – Lithuania

- Autoritatea de Supraveghere Financiară (ASF) – Romania

- National Bank of Romania (BNR) – Romania

- National Bank of Slovakia (NBS) – Slovakia

- Bank of Slovenia – Slovenia

- Securities Market Agency (ATVP) – Slovenia

- Bank of Spain (Banco de España) – Spain

Yellow Tier Regulators

Yellow Tier regulators should provide strong investor protection, but it may not be as robust as those provided by Green Tier regulators. Regulatory scrutiny may be less rigorous for example.

That said, we still consider brokers authorized by Yellow Tier regulators trustworthy.

- Central Bank of Bahrain (CBB) – Bahrain

- Banco Central do Brasil (BCB) – Brazil

- Conselho de Controle de Atividades Financeiras (COAF) – Brazil

- Superintendência Nacional de Previdência Complementar (PREVIC) – Brazil

- Superintendência de Seguros Privados (SUSEP) – Brazil

- China Securities Regulatory Commission (CSRC) – China

- Hong Kong Monetary Authority (HKMA) – Hong Kong

- Insurance Authority (IA Hong Kong) – Hong Kong

- Mandatory Provident Fund Schemes Authority (MPFA) – Hong Kong

- National Administration of Financial Regulation (NAFR) – China

- People’s Bank of China (PBC) – China

- State Administration of Foreign Exchange (SAFE) – China

- Insurance Regulatory and Development Authority of India (IRDAI) – India

- International Financial Services Centres Authority (IFSCA) – India

- Pension Fund Regulatory and Development Authority (PFRDA) – India

- Reserve Bank of India (RBI) – India

- Bank of Israel – Israel

- Capital Market, Insurance and Savings Authority (CMISA) – Israel

- Israel Securities Authority (ISA) – Israel

- Central Bank of Kuwait (CBK) – Kuwait

- Bank Negara Malaysia (BNM) – Malaysia

- Labuan Financial Services Authority (LFSA) – Malaysia

- Capital Market Authority (CMA Oman) – Oman

- Central Bank of Oman – Oman

- Qatar Central Bank (QCB) – Qatar

- Qatar Financial Centre Regulatory Authority (QFCRA) – Qatar

- Qatar Financial Markets Authority (QFMA) – Qatar

- Saudi Central Bank (SAMA) – Saudi Arabia

- Prudential Authority – South African Reserve Bank (SARB) – South Africa

- South African Reserve Bank (SARB) – South Africa

- Bank of Korea – Korea

- Financial Services Commission (FSC Korea) – Korea

- Financial Supervisory Service (FSS Korea) – Korea

- Central Bank of the UAE (CBUAE) – United Arab Emirates

- Securities and Commodities Authority (SCA) – United Arab Emirates

- Financial Services Regulatory Authority (FSRA, ADGM) – Abu Dhabi

Orange Tier Regulators

We urge caution if a broker only holds an Orange Tier license. These regulators are less reputed and may provide limited investor protection or recourse channels in the event your broker faces financial difficulties or you have a dispute.

- Da Afghanistan Bank (DAB) – Central bank & financial supervision – Afghanistan

- Albanian Financial Supervisory Authority (AFSA) – Albania

- Bank of Albania – Albania

- Bank of Algeria – Algeria

- Commission d’Organisation et de Surveillance des Opérations de Bourse (COSOB) – Algeria

- Autoritat Financera Andorrana (AFA) – Andorra

- Banco Nacional de Angola (BNA) – Angola

- Comissão do Mercado de Capitais (CMC) – Angola

- Comisión Nacional de Valores (CNV) – Argentina

- Superintendencia de Seguros de la Nación (SSN) – Argentina

- Central Bank of Armenia (CBA) – Armenia

- Central Bank of the Republic of Azerbaijan (CBAR) – Azerbaijan

- Bangladesh Bank – Bangladesh

- Central Bank of Barbados – Barbados

- Financial Services Commission (FSC Barbados) – Barbados

- Ministry of Finance – Securities Department – Belarus

- National Bank of the Republic of Belarus – Belarus

- Central Bank of West African States (BCEAO) – Benin

- Regional Council for Public Savings and Financial Markets (CREPMF) – Benin

- Royal Monetary Authority of Bhutan (RMA) – Bhutan

- Autoridad de Supervisión del Sistema Financiero (ASFI) – Bolivia

- Banco Central de Bolivia – Bolivia

- Central Bank of Bosnia and Herzegovina – Bosnia and Herzegovina

- Republika Srpska Securities Commission – Bosnia and Herzegovina

- Securities Commission of the Federation of Bosnia and Herzegovina – Bosnia and Herzegovina

- Autoriti Monetari Brunei Darussalam (AMBD) – Brunei Darussalam

- Central Bank of West African States (BCEAO) – Burkina Faso

- Regional Council for Public Savings and Financial Markets (CREPMF) – Burkina Faso

- Banque de la République du Burundi – Burundi

- Banco de Cabo Verde (BCV) – Cabo Verde

- National Bank of Cambodia (NBC) – Cambodia

- Securities and Exchange Regulator of Cambodia (SERC) – Cambodia

- Bank of Central African States (BEAC) – Cameroon

- Commission de Surveillance du Marché Financier de l’Afrique Centrale (COSUMAF) – Cameroon, Central African Republic, Chad, Congo, Gabon, Equatorial Guinea

- Bank of Central African States (BEAC) – Central African Republic, Chad, Congo

- Banco Central de Chile – Chile

- Superintendencia de Pensiones (SP) – Chile

- Banco de la República (Central Bank of Colombia) – Colombia

- Banco Central de Costa Rica (BCCR) – Costa Rica

- Superintendencia General de Entidades Financieras (SUGEF) – Costa Rica

- Superintendencia General de Valores (SUGEVAL) – Costa Rica

- Superintendencia de Pensiones (SUPEN) – Costa Rica

- Banco Central de Cuba (BCC) – Cuba

- Czech National Bank (CNB) – Czechia

- Central Bank of West African States (BCEAO) – Côte d’Ivoire

- Regional Council for Public Savings and Financial Markets (CREPMF) – Côte d’Ivoire

- Autorité de Régulation et de Contrôle des Assurances (ARCA) – Democratic Republic of the Congo

- Autorité des Marchés Financiers de la République Démocratique du Congo (AMF-RDC) – Democratic Republic of the Congo

- Central Bank of Congo (Banque Centrale du Congo, BCC) – Democratic Republic of the Congo

- Central Bank of Djibouti (Banque Centrale de Djibouti) – Djibouti

- Eastern Caribbean Central Bank (ECCB) – Dominica

- Eastern Caribbean Securities Regulatory Commission (ECSRC) – Dominica

- Financial Services Unit (FSU Dominica) – Dominica

- Banco Central de la República Dominicana (BCRD) – Dominican Republic

- Superintendencia de Bancos de la República Dominicana (SIB) – Dominican Republic

- Superintendencia de Pensiones (SIPEN) – Dominican Republic

- Superintendencia de Seguros (SIS) – Dominican Republic

- Superintendencia del Mercado de Valores (SIMV) – Dominican Republic

- Banco Central del Ecuador – Ecuador

- Superintendencia de Bancos (SBS Ecuador) – Ecuador

- Superintendencia de Compañías, Valores y Seguros (SCVS) – Ecuador

- Central Bank of Egypt (CBE) – Egypt

- Financial Regulatory Authority (FRA Egypt) – Egypt

- Banco Central de Reserva de El Salvador (BCR) – El Salvador

- Superintendencia del Sistema Financiero (SSF) – El Salvador

- Bank of Central African States (BEAC) – Equatorial Guinea

- Bank of Eritrea – Eritrea

- Central Bank of Eswatini – Eswatini

- Ethiopian Capital Market Authority (ECMA) – Ethiopia

- National Bank of Ethiopia (NBE) – Ethiopia

- Reserve Bank of Fiji (RBF) – Fiji

- Bank of Central African States (BEAC) – Gabon

- Central Bank of The Gambia – Gambia

- Insurance State Supervision Service of Georgia (ISSSG) – Georgia

- National Bank of Georgia (NBG) – Georgia

- Eastern Caribbean Central Bank (ECCB) – Grenada

- Eastern Caribbean Securities Regulatory Commission (ECSRC) – Grenada

- Grenada Authority for the Regulation of Financial Institutions (GARFIN) – Grenada

- Superintendencia de Bancos de Guatemala (SIB Guatemala) – Guatemala

- Central Bank of Guinea (BCRG) – Guinea-Bissau

- Central Bank of West African States (BCEAO) – Guinea-Bissau

- Regional Council for Public Savings and Financial Markets (CREPMF) – Guinea-Bissau

- Bank of Guyana – Guyana

- Guyana Securities Council (GSC) – Guyana

- Banque de la République d’Haïti (BRH) – Haiti

- Autorità di Supervisione e Informazione Finanziaria (ASIF) – Holy See (Vatican City)

- Banco Central de Honduras – Honduras

- Comisión Nacional de Bancos y Seguros (CNBS) – Honduras

- Bank Indonesia – Indonesia

- Otoritas Jasa Keuangan (OJK) – Indonesia

- Central Bank of the Islamic Republic of Iran (CBI) – Iran

- Central Insurance of Iran (CII) – Iran

- Iraq Securities Commission (ISC) – Iraq

- Bank of Jamaica – Jamaica

- Central Bank of Jordan – Jordan

- Agency for Regulation and Development of the Financial Market (ARDFM Kazakhstan) – Kazakhstan

- Astana Financial Services Authority (AFSA) – Kazakhstan

- National Bank of Kazakhstan – Kazakhstan

- Capital Markets Authority (CMA Kenya) – Kenya

- Central Bank of Kenya (CBK) – Kenya

- Insurance Regulatory Authority (IRA Kenya) – Kenya

- Retirement Benefits Authority (RBA Kenya) – Kenya

- SACCO Societies Regulatory Authority (SASRA) – Kenya

- Ministry of Finance & Economic Development (Kiribati) – Kiribati

- National Bank of the Kyrgyz Republic – Kyrgyzstan

- State Service for Regulation and Supervision of the Financial Market (Kyrgyz Republic) – Kyrgyzstan

- Bank of the Lao P.D.R. (BOL) – Laos

- Lao Securities Commission Office (LSCO) – Laos

- Banque du Liban (BDL) – Lebanon

- Capital Markets Authority (CMA Lebanon) – Lebanon

- Central Bank of Lesotho – Lesotho

- Central Bank of Liberia – Liberia

- Central Bank of Libya – Libya

- Financial Market Authority Liechtenstein (FMA Liechtenstein) – Liechtenstein

- Central Bank of Madagascar (Banky Foiben’i Madagasikara, BFIM) – Madagascar

- Reserve Bank of Malawi (RBM) – Malawi

- Maldives Monetary Authority (MMA) – Maldives

- Central Bank of West African States (BCEAO) – Mali

- Regional Council for Public Savings and Financial Markets (CREPMF) – Mali

- Banking Commission of the Republic of the Marshall Islands – Marshall Islands

- Central Bank of Mauritania (Banque Centrale de Mauritanie) – Mauritania

- Banco de México (Banxico) – Mexico

- Comisión Nacional Bancaria y de Valores (CNBV) – Mexico

- Comisión Nacional de Seguros y Fianzas (CNSF) – Mexico

- Comisión Nacional del Sistema de Ahorro para el Retiro (CONSAR) – Mexico

- Banking Board of the Federated States of Micronesia – Micronesia

- National Bank of Moldova – Moldova

- National Commission for Financial Markets (NCFM Moldova) – Moldova

- Commission de Contrôle des Activités Financières (CCAF) – Monaco

- Bank of Mongolia – Mongolia

- Financial Regulatory Commission of Mongolia (FRC Mongolia) – Mongolia

- Central Bank of Montenegro – Montenegro

- Capital Market Authority of Montenegro (Komisija za Tržište Kapitala) – Montenegro

- Autorité Marocaine du Marché des Capitaux (AMMC) – Morocco

- Autorité de Contrôle des Assurances et de la Prévoyance Sociale (ACAPS) – Morocco

- Bank Al-Maghrib – Morocco

- Autoridade de Supervisão de Seguros e Fundos de Pensões de Moçambique (ASFPM) – Mozambique

- Banco de Moçambique – Mozambique

- Central Bank of Myanmar (CBM) – Myanmar

- Securities and Exchange Commission of Myanmar (SECM) – Myanmar

- Bank of Namibia – Namibia

- Namibia Financial Institutions Supervisory Authority (NAMFISA) – Namibia

- Beema Samiti (Insurance Board of Nepal) – Nepal

- Nepal Rastra Bank (NRB) – Nepal

- Banco Central de Nicaragua – Nicaragua

- Superintendencia de Bancos y de Otras Instituciones Financieras (SIBOIF) – Nicaragua

- Central Bank of West African States (BCEAO) – Niger

- Regional Council for Public Savings and Financial Markets (CREPMF) – Niger

- Central Bank of Nigeria (CBN) – Nigeria

- National Insurance Commission (NAICOM) – Nigeria

- National Pension Commission (PenCom) – Nigeria

- National Bank of the Republic of North Macedonia (NBRNM) – North Macedonia

- Agency for Supervision of Fully Funded Pension Insurance (MAPAS) – North Macedonia

- Securities and Exchange Commission of North Macedonia – North Macedonia

- Securities and Exchange Commission of Pakistan (SECP) – Pakistan

- State Bank of Pakistan (SBP) – Pakistan

- Financial Institutions Commission (FIC Palau) – Palau

- Palestine Capital Market Authority (PCMA) – Palestine State

- Superintendencia de Bancos de Panamá (SBP) – Panama

- Superintendencia del Mercado de Valores (SMV Panamá) – Panama

- Bank of Papua New Guinea – Papua New Guinea

- Securities Commission of Papua New Guinea (SCPNG) – Papua New Guinea

- Comisión Nacional de Valores (CNV Paraguay) – Paraguay

- Banco Central de Reserva del Perú (BCRP) – Peru

- Superintendencia de Banca, Seguros y AFP (SBS Perú) – Peru

- Superintendencia del Mercado de Valores (SMV Perú) – Peru

- Bangko Sentral ng Pilipinas (BSP) – Philippines

- Insurance Commission (IC Philippines) – Philippines

- Philippine Deposit Insurance Corporation (PDIC) – Philippines

- Securities and Exchange Commission (SEC Philippines) – Philippines

- Capital Market Authority of Rwanda (CMA Rwanda) – Rwanda

- National Bank of Rwanda (BNR) – Rwanda

- Eastern Caribbean Central Bank (ECCB) – Saint Kitts and Nevis

- Eastern Caribbean Securities Regulatory Commission (ECSRC) – Saint Kitts and Nevis

- Financial Services Regulatory Commission (FSRC St Kitts and Nevis) – Saint Kitts and Nevis

- Central Bank of Samoa (CBS) – Samoa

- Central Bank of San Marino (Banca Centrale della Repubblica di San Marino) – San Marino

- Banco Central de São Tomé e Príncipe (BCSTP) – Sao Tome and Principe

- Central Bank of West African States (BCEAO) – Senegal

- Regional Council for Public Savings and Financial Markets (CREPMF) – Senegal

- National Bank of Serbia (NBS) – Serbia

- Securities Commission of the Republic of Serbia – Serbia

- Bank of Sierra Leone (BSL) – Sierra Leone

- Securities and Exchange Commission Sierra Leone (SEC Sierra Leone) – Sierra Leone

- Central Bank of Solomon Islands (CBSI) – Solomon Islands

- Central Bank of Somalia – Somalia

- Bank of South Sudan – South Sudan

- Central Bank of Sri Lanka (CBSL) – Sri Lanka

- Securities and Exchange Commission of Sri Lanka (SEC Sri Lanka) – Sri Lanka

- Central Bank of Sudan – Sudan

- Financial Markets Regulatory Authority (Sudan) – Sudan

- Central Bank of Suriname (CBvS) – Suriname

- Central Bank of Syria (CBS) – Syria

- Syrian Commission on Financial Markets and Securities (SCFMS) – Syria

- National Bank of Tajikistan – Tajikistan

- Bank of Tanzania (BoT) – Tanzania

- Banco Central de Timor-Leste (BCTL) – Timor-Leste

- Central Bank of West African States (BCEAO) – Togo

- Regional Council for Public Savings and Financial Markets (CREPMF) – Togo

- National Reserve Bank of Tonga (NRBT) – Tonga

- Central Bank of Trinidad and Tobago (CBTT) – Trinidad and Tobago

- Trinidad and Tobago Securities and Exchange Commission (TTSEC) – Trinidad and Tobago

- Central Bank of Tunisia (BCT) – Tunisia

- Financial Market Council (CMF Tunisia) – Tunisia

- Banking Regulation and Supervision Agency (BDDK) – Turkey

- Capital Markets Board of Turkey (CMB/ SPK) – Turkey

- Central Bank of the Republic of Türkiye (CBRT) – Turkey

- Central Bank of Turkmenistan – Turkmenistan

- Bank of Uganda (BoU) – Uganda

- Insurance Regulatory Authority of Uganda (IRA Uganda) – Uganda

- National Bank of Ukraine (NBU) – Ukraine

- National Commission for State Regulation of Financial Services Markets (NCFS Ukraine) – Ukraine

- Banco Central del Uruguay (BCU) – Uruguay

- Capital Market Development Agency of Uzbekistan (CMDA) – Uzbekistan

- Central Bank of the Republic of Uzbekistan – Uzbekistan

- Financial Information and Supervision Authority (ASIF) – Vatican City

- Banco Central de Venezuela (BCV) – Venezuela

- Superintendencia Nacional de Valores (SUNAVAL) – Venezuela

- State Bank of Vietnam (SBV) – Vietnam

- State Securities Commission of Vietnam (SSC) – Vietnam

- Central Bank of Yemen – Yemen

- Bank of Zambia – Zambia

- Pensions and Insurance Authority (PIA Zambia) – Zambia

Red Tier Regulators

We consider these regulators very high risk – with little to no investor protection available. Membership requirements are often lax and regulators may not actively monitor and enforce safety measures, such as restrictions on misleading promotions.

Brokers that are only authorized by Red Tier regulators, with no additional oversight from more reputable agencies, may be operating scams.

- Eastern Caribbean Securities Regulatory Commission (ECSRC) – Antigua and Barbuda

- Financial Services Regulatory Commission (FSRC) – Antigua and Barbuda

- Central Bank of The Bahamas – The Bahamas

- Insurance Commission of The Bahamas (ICB) – The Bahamas

- Central Bank of Belize – Belize

- International Financial Services Commission (IFSC Belize) – Belize

- Cayman Islands Monetary Authority (CIMA) – Cayman Islands

- Central Bank of the Comoros (BCC) – The Comoros

- Bank of Mauritius – Mauritius

- Financial Services Commission (FSC) – Mauritius

- Nauru Financial Services Regulatory Commission (FSRC) – Nauru

- Eastern Caribbean Central Bank (ECCB) – Saint Lucia

- Eastern Caribbean Securities Regulatory Commission (ECSRC) – Saint Lucia

- Financial Services Regulatory Authority (FSRA Saint Lucia) – Saint Lucia

- Central Bank of Seychelles (CBS) – Seychelles

- Financial Services Commission (FSC Tuvalu) – Tuvalu

- Reserve Bank of Vanuatu (RBV) – Vanuatu

- International Financial Services Authentication (IFSA) – Unknown

Bottom Line

Choosing a well-regulated broker is one of the best ways to safeguard your trading funds. That said, there have been instances where even brokers licensed by trusted regulators have acted against clients and faced financial difficulties.

As a result, our Regulation & Trust Rating cannot guarantee the safety of your funds.

Only risk what you can afford to lose.