Best Stock Brokers For Day Trading 2026

Want to buy shares or speculate on stock prices but don’t know which brokerage to use? We’ve reviewed, compared and rated the best stock brokers and platforms for day trading stocks.

Top 6 Stock Brokers for Day Trading

Our comprehensive analysis of 139 brokers, conducted as of February 2026, reveals the following day trading platforms as the top choices for stock traders:

-

1

Interactive Brokers

Interactive Brokers -

2

eToro USAeToro USA LLC and eToro USA Securities Inc.; Investing involves risk, including loss of principal; Not a recommendation

eToro USAeToro USA LLC and eToro USA Securities Inc.; Investing involves risk, including loss of principal; Not a recommendation -

3

NinjaTrader

NinjaTrader -

4

FOREX.com

FOREX.com -

5

Optimus Futures

Optimus Futures -

6

xChief

xChief

Why Are These Brokers the Best for Stock Trading?

Here is a quick overview of why we think these are the best stock brokers:

- Interactive Brokers is the best stock broker for day trading in 2026 - IBKR provides access to an unparalleled array of equity products originating from 24 diverse countries. Whether seeking capital appreciation, dividends, or voting rights, you can directly invest in stocks. Alternatively, you can engage in speculative trading on price movements through CFDs, futures and more than 13,000 ETFs. IBKR also enhanced its European equity derivatives offering in 2024 by adding trading on CBOE Europe Derivatives (CEDX).

- eToro USA - You can trade 3000+ popular US stocks and ETFs at eToro US, with zero commissions and fractional shares available. The broker remains an excellent choice for beginner stock traders, thanks to its comprehensive eToro Academy and user-friendly stock market research features.

- NinjaTrader - Stocks can be traded by connecting the NinjaTrader platform to supporting brokers. The firm also provides access to a range of index futures via standard and micro contracts, including the E-Mini S&P 500 Index Futures and E-Mini Russell 2000 Index Futures.

- FOREX.com - FOREX.com provides access to a wide array of US, EU, and UK stock CFDs, featuring spreads as narrow as 1 point. This enables you to speculate on established household names and emerging IPOs, fostering ample opportunities for diversification within stock portfolios. US stocks are accessible from as low as 1.8 cents per share.

- Optimus Futures - Optimus Futures offers Micro E-mini S&P 500, Nasdaq-100, Dow, and Russell 2000 with $50–$100 day trading margins, which we found fast and reliable for active day traders wanting smaller, precise index exposure. It also supports full-size E-mini and global indices (e.g. ES, NQ, YM, RTY, DAX, EURO STOXX 50) with the same direct exchange execution.

- xChief - xChief offers 100 US company stock CFDs for MT4 DirectFX and Classic+ account holders. Alongside popular multinationals like Apple and Coca-Cola, you can also speculate on several major stock indices with spreads from 2.

Best Stock Brokers For Day Trading 2026 Comparison

Uncover the top stock broker for your needs with our comparison of features essential for active stock traders:

| Broker | Stock Fee | ESG Stocks | Spot Trading | Financial Regulator |

|---|---|---|---|---|

| Interactive Brokers | 0.003 | ✔ | ✔ | FCA, SEC, FINRA, CFTC, CBI, CIRO, SFC, MAS, MNB, FINMA, AFM |

| eToro USA | $0 | ✔ | ✘ | SEC, FINRA |

| NinjaTrader | - | ✘ | ✔ | NFA, CFTC |

| FOREX.com | 0.14 | ✘ | ✔ | NFA, CFTC |

| Optimus Futures | - | ✘ | ✘ | NFA, CFTC |

| xChief | 50 | ✘ | ✔ | ASIC |

How Safe Are These Stock Brokers?

How reliable are the top stock brokers and do they have tools that help protect your funds?

| Broker | Trust Rating | Guaranteed Stop Loss | Negative Balance Protection | Segregated Accounts |

|---|---|---|---|---|

| Interactive Brokers | ✘ | ✔ | ✔ | |

| eToro USA | ✘ | ✘ | ✔ | |

| NinjaTrader | ✘ | ✘ | ✘ | |

| FOREX.com | ✘ | ✔ | ✔ | |

| Optimus Futures | ✘ | ✘ | ✔ | |

| xChief | ✘ | ✘ | ✔ |

Mobile Stock Trading Comparison

Are these brokers good for stock trading on mobile?

| Broker | Mobile Apps | iOS Rating | Android Rating | Smart Watch App |

|---|---|---|---|---|

| Interactive Brokers | iOS & Android | ✔ | ||

| eToro USA | iOS & Android | ✘ | ||

| NinjaTrader | iOS & Android | ✘ | ||

| FOREX.com | iOS & Android | ✘ | ||

| Optimus Futures | iOS & Android | ✘ | ||

| xChief | iOS & Android | ✘ |

Are the Top Stock Brokers Good for Beginners?

Stock trading beginners should use providers that provide trading with virtual money (demo accounts) and have other features that new traders need.

| Broker | Demo Account | Minimum Deposit | Minimum Trade | Education Rating | Support Rating |

|---|---|---|---|---|---|

| Interactive Brokers | ✔ | $0 | $100 | ||

| eToro USA | ✔ | $100 | $10 | ||

| NinjaTrader | ✔ | $0 | 0.01 Lots | ||

| FOREX.com | ✔ | $100 | 0.01 Lots | ||

| Optimus Futures | ✔ | $500 | $50 | ||

| xChief | ✔ | $10 | 0.01 Lots |

Compare Advanced Stock Trader Features

Are these stock trading platforms good for advanced traders?

| Broker | Automated Trading | VPS | AI | Pro Account | Leverage | Low Latency | Extended Hours |

|---|---|---|---|---|---|---|---|

| Interactive Brokers | Capitalise.ai, TWS API | ✘ | ✔ | ✘ | 1:50 | ✔ | ✔ |

| eToro USA | ✘ | ✘ | ✘ | ✘ | - | ✔ | ✔ |

| NinjaTrader | NinjaScript or via Automated Trading Interface | ✘ | ✘ | ✘ | 1:50 | ✔ | ✘ |

| FOREX.com | Expert Advisors (EAs) on MetaTrader | ✔ | ✔ | ✘ | 1:50 | ✔ | ✘ |

| Optimus Futures | TradingView Pine Script, API Features | ✘ | ✘ | ✘ | - | ✘ | ✘ |

| xChief | Expert Advisors (EAs) on MetaTrader | ✘ | ✘ | ✘ | 1:1000 | ✘ | ✘ |

Compare the Ratings of Top Stock Brokers

Find out how the top stock brokers score in all core areas following our hands-on tests.

| Broker | Trust | Platforms | Assets | Mobile | Fees | Accounts | Research | Education | Support |

|---|---|---|---|---|---|---|---|---|---|

| Interactive Brokers | |||||||||

| eToro USA | |||||||||

| NinjaTrader | |||||||||

| FOREX.com | |||||||||

| Optimus Futures | |||||||||

| xChief |

Compare Stock Trading Fees

The cost of trading stocks with a brokerage may have a large impact over time:

| Broker | Cost Rating | Fixed Spreads | Inactivity Fee |

|---|---|---|---|

| Interactive Brokers | ✘ | $0 | |

| eToro USA | ✔ | $10 | |

| NinjaTrader | ✘ | $25 | |

| FOREX.com | ✘ | $15 | |

| Optimus Futures | ✘ | $0 | |

| xChief | ✘ | - |

How Popular Are These Stock Brokers?

Some traders prefer the most popular stock brokers (those with the most signed up clients).

| Broker | Popularity |

|---|---|

| Interactive Brokers | |

| eToro USA | |

| NinjaTrader | |

| xChief | |

| FOREX.com |

Why Trade Stocks With Interactive Brokers?

"Interactive Brokers is one of the best brokers for advanced day traders, providing powerful charting platforms, real-time data, and customizable layouts, notably through the new IBKR Desktop application. Its superb pricing and advanced order options also make it highly attractive for day traders, while its diverse range of equities is still among the best in the industry."

Christian Harris, Reviewer

Interactive Brokers Quick Facts

| Fractional Shares | Yes |

|---|---|

| Demo Account | Yes |

| Regulator | FCA, SEC, FINRA, CFTC, CBI, CIRO, SFC, MAS, MNB, FINMA, AFM |

| Platforms | Trader Workstation (TWS), IBKR Desktop, GlobalTrader, Mobile, Client Portal, AlgoTrader, OmniTrader, TradingView, eSignal, TradingCentral, ProRealTime, Quantower |

| Minimum Deposit | $0 |

| Automation | Yes |

| Account Currencies | USD, EUR, GBP, CAD, AUD, INR, JPY, SEK, NOK, DKK, CHF, AED, HUF |

Stock Exchanges

Interactive Brokers offers trading on 18 stock exchanges:

- Abu Dhabi Securities Exchange

- Borsa Italiana

- CAC 40 Index France

- Chicago Mercantile Exchange

- Euronext

- IBEX 35

- Japan Exchange Group

- Korean Stock Exchange

- London Metal Exchange

- London Stock Exchange

- Nairobi Securities Exchange

- Nasdaq

- Nasdaq Nordic & Baltics

- New York Stock Exchange

- Russell 2000

- Shenzhen Stock Exchange

- Tadawul

- Toronto Stock Exchange

Pros

- Interactive Brokers has been named Best US Broker for 2025 by DayTrading.com, recognizing its long-standing commitment to US traders, ultra-low margin rates, and global market access at minimal cost.

- The new IBKR Desktop platform takes the best of TWS while adding bespoke tools like Option Lattice and Screeners with MultiSort to create a genuinely impressive trading experience for day traders at every level.

- While primarily geared towards experienced traders, IBKR has made moves to broaden its appeal in recent years, reducing its minimum deposit from $10,000 to $0.

Cons

- You can only have one active session per account, so you can’t have your desktop program and mobile app running simultaneously, making for a sometimes frustrating trading experience.

- IBKR provides a wide range of research tools, but their distribution across trading platforms and the web-based 'Account Management' page lacks consistency, leading to a confusing user experience.

- Support can be slow and frustrating based on tests, so you might find it challenging to reach customer service representatives promptly or encounter delays in resolving issues.

Why Trade Stocks With eToro USA?

"eToro remains a top pick for traders looking for leading social investing and copy trading services. With a low deposit, zero commissions and an intuitive platform, the broker will meet the needs of newer day traders."

Jemma Grist, Reviewer

eToro USA Quick Facts

| Fractional Shares | Yes |

|---|---|

| Demo Account | Yes |

| Regulator | SEC, FINRA |

| Platforms | eToro Trading Platform & CopyTrader |

| Minimum Deposit | $100 |

| Automation | Yes |

| Account Currencies | USD |

Stock Exchanges

eToro USA offers trading on 3 stock exchanges:

- Dow Jones

- New York Stock Exchange

- S&P 500

Pros

- The low minimum deposit and straightforward account opening process means beginners can get started quickly

- The online broker offers an intuitive social investment network with straightforward copy trading on cryptos

- A free demo account means new users and prospective day traders can try the broker risk-free

Cons

- The proprietary terminal doesn't support trading bots and there are no additional stock market analysis tools

- There's no MetaTrader 4 platform integration for traders who are accustomed to using third-party charting tools

- There's a narrower range of day trading instruments available compared to competitors, with only stocks, ETFs and cryptos

Why Trade Stocks With NinjaTrader?

"NinjaTrader continues to meet the demands of active futures traders looking for low fees and premium analysis tools. The platform hosts top-rate charting features including hundreds of indicators and 10+ chart types."

Tobias Robinson, Reviewer

NinjaTrader Quick Facts

| Fractional Shares | No |

|---|---|

| Demo Account | Yes |

| Regulator | NFA, CFTC |

| Platforms | NinjaTrader Desktop, Web & Mobile, eSignal |

| Minimum Deposit | $0 |

| Automation | Yes |

| Account Currencies | USD |

Stock Exchanges

NinjaTrader offers trading on 2 stock exchanges:

- Chicago Mercantile Exchange

- New York Stock Exchange

Pros

- Low fees are offered, with $50 day trading margins & commissions from $.09 per micro contract

- NinjaTrader is a widely respected and award-winning futures broker and is heavily authorized by the NFA and CFTC

- You can get thousands of add-ons and applications from developers in 150+ countries

Cons

- The premium platform tools come with an extra charge

- Non forex and futures trading requires signing up with partner brokers

- There is a withdrawal fee on some funding methods

Why Trade Stocks With FOREX.com?

"FOREX.com remains a best-in-class brokerage for active forex traders of all experience levels, with over 80 currency pairs, tight spreads from 0.0 pips and low commissions. The powerful charting platforms collectively offer over 100 technical indicators, as well as extensive research tools."

Christian Harris, Reviewer

FOREX.com Quick Facts

| Fractional Shares | No |

|---|---|

| Demo Account | Yes |

| Regulator | NFA, CFTC |

| Platforms | WebTrader, Mobile, MT4, MT5, TradingView |

| Minimum Deposit | $100 |

| Automation | Yes |

| Account Currencies | USD, EUR, GBP, CAD, AUD, JPY, CHF, PLN |

Stock Exchanges

FOREX.com offers trading on 14 stock exchanges:

- Australian Securities Exchange (ASX)

- Borsa Italiana

- CAC 40 Index France

- DAX GER 40 Index

- Dow Jones

- Euronext

- FTSE UK Index

- Hang Seng

- Hong Kong Stock Exchange

- IBEX 35

- Japan Exchange Group

- Nasdaq

- S&P 500

- SIX Swiss Exchange

Pros

- There’s a wealth of educational resources including tutorials, webinars, and a stacked YouTube channel to help you get educated in the financial markets.

- With over 20 years of experience, excellent regulatory oversight, and multiple accolades including runner-up in our 'Best Forex Broker' awards, FOREX.com boasts a global reputation as a trusted brokerage.

- FOREX.com offers industry-leading forex pricing starting from 0.0 pips, alongside competitive cashback rebates of up to 15% for serious day traders.

Cons

- Demo accounts are frustratingly time-limited to 90 days, which doesn’t give you enough time to test day trading strategies effectively.

- There’s no negative balance protection for US clients, so you may find yourself owing more money than your initial deposit into your account.

- FOREX.com's MT4 platform offers approximately 600 instruments, significantly fewer than the over 5,500 available on its non-MetaTrader platforms.

Why Trade Stocks With Optimus Futures?

"Optimus Futures is best for active futures day traders who want low per-contract costs and the flexibility to build a custom trading setup across platforms like Optimus Flow, TradingView, and Sierra Chart. Its fast order-routing, low day trading margins, depth-of-market and footprint analysis tools, plus the ability to select your own clearing firm, make it especially suited to high-volume traders focused on U.S. and global futures markets."

Christian Harris, Reviewer

Optimus Futures Quick Facts

| Fractional Shares | No |

|---|---|

| Demo Account | Yes |

| Regulator | NFA, CFTC |

| Platforms | Optimus Flow, Optimus Web, MT5, TradingView |

| Minimum Deposit | $500 |

| Automation | Yes |

| Account Currencies | USD |

Stock Exchanges

Optimus Futures offers trading on 8 stock exchanges:

- Chicago Mercantile Exchange

- DAX GER 40 Index

- Dow Jones

- Euronext

- FTSE UK Index

- Nasdaq

- Russell 2000

- S&P 500

Pros

- Optimus Futures stands out with ultra-low day trading margins on micro futures, starting at just $50 per contract and a $100 minimum balance, giving small accounts serious buying power.

- Optimus Futures has expanded its suite of software, with a variety of futures trading platforms, including its own Optimus Flow, CQG, MetaTrader 5, and TradingView, making it easy to find the right fit for charting, order management, and execution.

- Product and service upgrades, notably multi-bracket orders, an integrated trade journal, and a broader futures lineup, show Optimus Futures is making a clear effort to support active traders.

Cons

- Live chat support is handled entirely by a bot, so despite several attempts in our tests, it wasn't possible to get access to a human agent, which can be frustrating when urgent or complex questions arise.

- There's no true 'all-in-one' account management dashboard - key functions like risk settings, software downloads, and subscriptions are split across different sections or platforms, so it required extra digging to set everything up during testing.

- There are limited payment options and no toll-free numbers for international support, while withdrawals cost $20 to $60, potentially making frequent withdrawals costly for active traders.

Why Trade Stocks With xChief?

"xChief continues to prove popular with investors looking to trade highly leveraged CFDs on the popular MetaTrader platforms. The broker's rebate scheme and investment accounts will particularly appeal to seasoned traders. However, the lack of top-tier regulatory oversight is a major drawback."

William Berg, Reviewer

xChief Quick Facts

| Fractional Shares | No |

|---|---|

| Demo Account | Yes |

| Regulator | ASIC |

| Platforms | MT4, MT5 |

| Minimum Deposit | $10 |

| Automation | Yes |

| Account Currencies | USD, EUR, GBP, JPY, CHF |

Stock Exchanges

xChief offers trading on 14 stock exchanges:

- Australian Securities Exchange (ASX)

- CAC 40 Index France

- DAX GER 40 Index

- Deutsche Boerse

- Dow Jones

- Euronext

- FTSE UK Index

- Hang Seng

- Hong Kong Stock Exchange

- IBEX 35

- Japan Exchange Group

- Nasdaq

- New York Stock Exchange

- S&P 500

Pros

- xChief offers STP/ECN execution with low spreads from 0.0 pips and low commission rates starting from $2.50 per side

- The low minimum deposit of $10 will appeal to beginners, as well as the beginners’ guides in the Library

- xChief delivers a high-quality day trading environment via the MT4 and MT5 platforms, with market-leading charts, indicators and tools

Cons

- The broker trails competitors when it comes to research tools and educational resources

- Fees and minimums are imposed on most withdrawal methods, including a €60 minimum for SWIFT bank transfers

- The Classic+ and Cent accounts provide access to fewer instruments than the other account types, at 50+ and 35+, respectively

How Did DayTrading.com Choose The Best Brokers For Day Trading Stocks?

We exhaustively evaluated each stock broker, assigning them an overall rating that served as the basis for our platform rankings. This rating is a culmination of:

- Quantitative metrics: We scrutinized over 200 data points across 8 core categories, carefully documented by our experts.

- Qualitative insights: Our extensive testing process yielded valuable observations that further informed our evaluation.

Below are the key considerations that shaped our stock broker ratings. We recommend you take these factors into account when choosing an online stock broker.

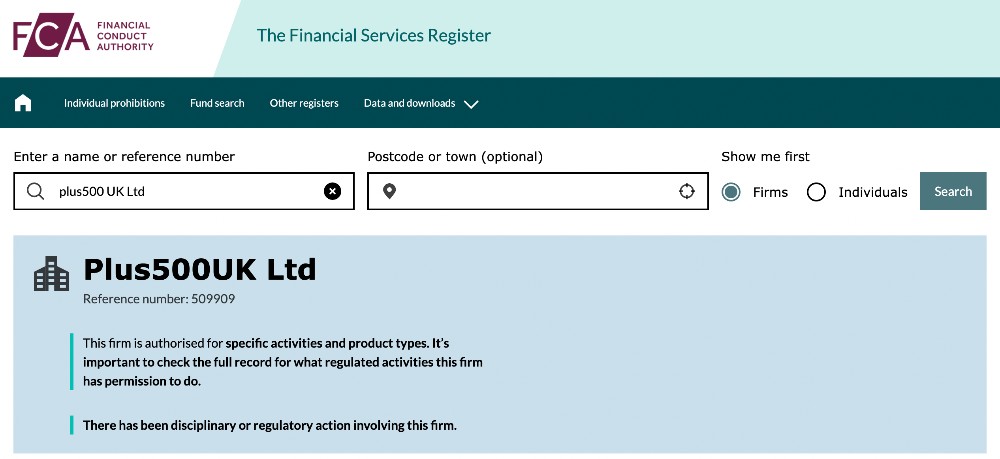

Regulation and Trust

We prioritized online stock brokers that are authorized by trusted financial regulators like the US Securities & Exchange Commission (SEC), UK Financial Conduct Authority (FCA), and Australian Securities & Investments Commission (ASIC).

That’s because top-tier regulators ensure stock brokerages provide measures that can help protect your capital from business failure. The UK’s Financial Services Compensation Scheme (FSCS), for example, protects investments up to £85,000.

Leading regulators also enforce restrictions on leveraged stock trading for retail investors, typically set at 1:5. Leveraged trading is particularly common among short-term traders and it’s regulated to curb potential losses, offering protection in case the stock markets move against you.

- Plus500 maintains its position as one of the most heavily regulated stock brokers (via CFDs) we’ve tested with real money, earning our trust with 7 licenses and a listing on the London Stock Exchange.

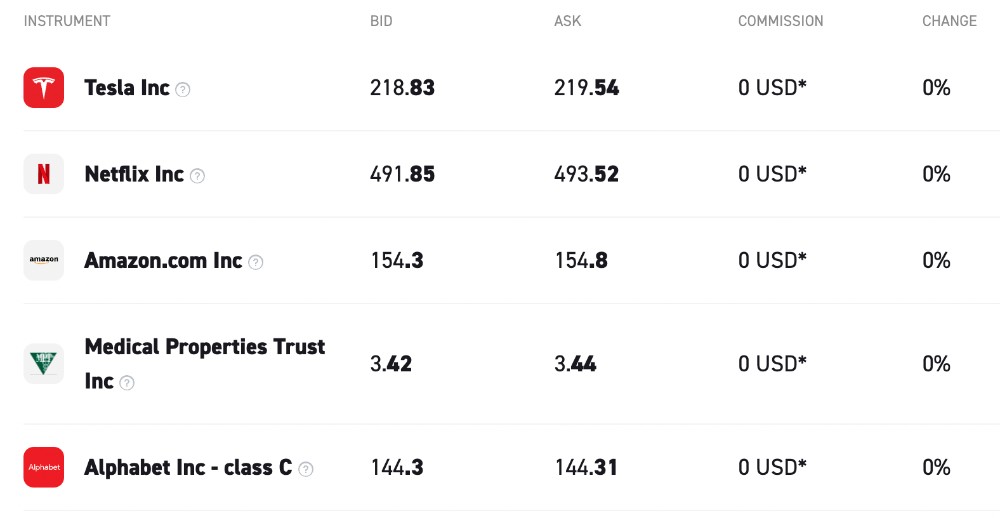

Stock Trading Fees

We chose brokers that offer low stock trading and non-trading fees, taking into account commissions on popular shares, margin fees, plus any deposit/withdrawal and inactivity charges.

Picking a brokerage account with low trading fees is especially important if you are day trading stocks, as a large volume of transaction fees can cut into profit margins.

- XTB continues to stand out for its low stock trading fees after introducing zero commissions on shares and charging a competitive 0.5% conversion fee. It’s also one of a limited number of stock brokers we’ve tested to offer high interest on uninvested cash (up to 4.9%).

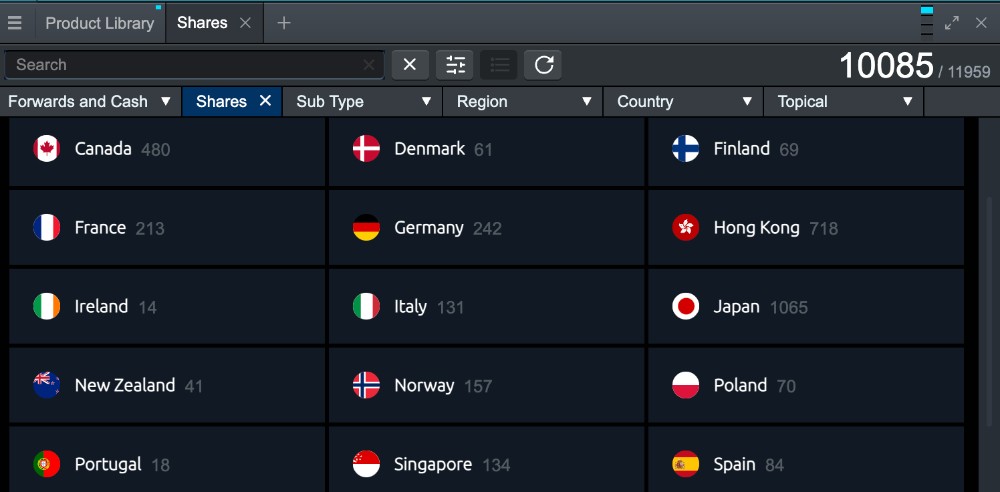

Stock Market Access

We favored brokers with access to a wide range of stock exchanges, providing short-term trading opportunities across a selection of markets and industries.

Importantly, stock market trading is centralized, meaning that shares in most large companies are sold through national exchanges, such as the New York Stock Exchange (NYSE), National Association of Securities Dealers Automated Quotations (NASDAQ), and London Stock Exchange (LSE).

Companies will not be listed on all exchanges, therefore, you should look for a broker with a global reach, especially if you want to build a diverse portfolio.

Also, some brokers specialize in buying and selling company shares directly, while others only allow you to speculate on stocks as the underlying assets using products like CFDs. These derivatives can be an excellent option for day traders looking for leveraged vehicles to profit from shorter-term price movements.

- Year after year, we’ve been impressed with CMC Markets, which offers an almost unrivalled suite of 10,000+ shares including major stocks in technology, banking, finance, plus consumer and retail sectors.

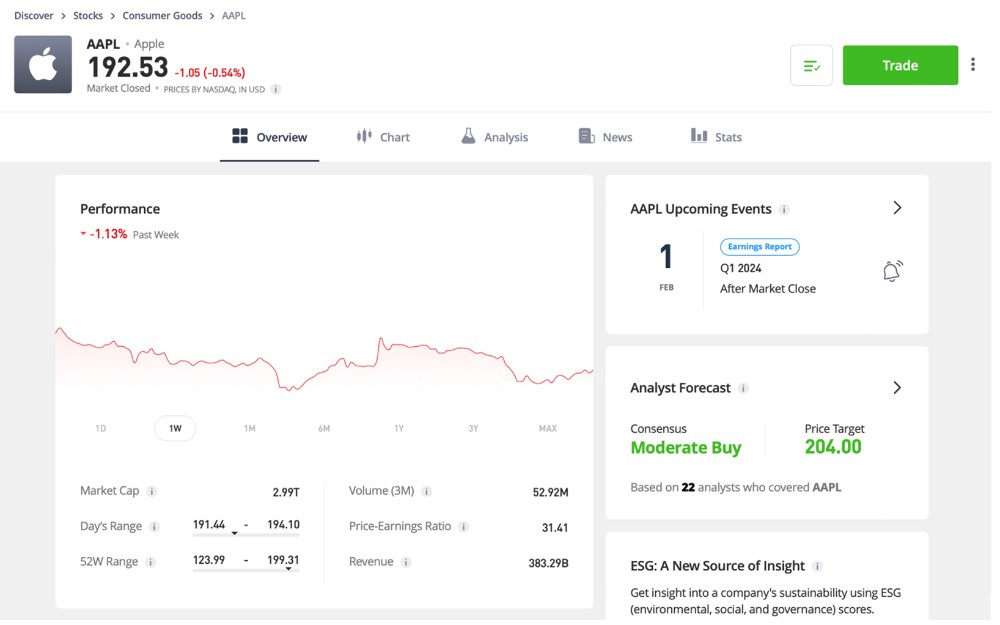

Stock Trading Platforms and Apps

We selected brokers with excellent stock trading platforms and apps that have clearly been designed with ease of use in mind for beginner traders, alongside helpful stock screeners and sophisticated analysis tools for advanced investors.

That’s because a user-friendly platform ensures smooth navigation, timely execution of trades, and provides valuable tools and insights to inform stock trading decisions.

- eToro’s stock trading platform and app stood out during testing for its simple interface that will appeal to new traders. It also provides intuitive charting and in-built indicators that will serve day traders, as well as integrated research and news feeds, trading calendars and expert commentary.

What Is A Stock Broker?

An online stock broker allows you to purchase company stocks and shares, or trade related derivatives like CFDs, via a website, desktop platform or mobile app, using just the internet.

These brokers will have connections to the stock market and will purchase the stock on your behalf. Trades can be executed at the click of a button, in real-time via their online platforms.

How Do Stock Brokers Make Money?

Stock brokers make money through several avenues. Often you will pay a commission, which is a flat fee per transaction. That said, we’re increasingly seeing online stock brokers, such as XTB, move to commission-free models.

In these instances, stock brokers may make money through a markup on the spread, which is the difference between the price a buyer is willing to pay (bid) and the price a seller is willing to accept (ask) for a particular stock, representing the transaction cost and liquidity in the market.

Some stock brokers are also market makers meaning they create liquidity by taking the other side of your trade. Sometimes, brokers can make money this way if a stock trader makes a loss.

How Do I Start Trading Stocks?

The first step is to open an account with a stock brokerage.

You will find a wide assortment of online stock brokers and trading platforms available online, but choosing the best one for you depends on the stocks you want to trade, your trading strategy and your personal preferences.

You will then need to deposit the minimum amount, which typically ranges from $0 to $500. We’ve learned that depositing more upfront can often provide access to better quality stock trading tools and market research.

After that, you can log into the stock trading platform or app to find opportunities and place trades.

If you are new to stock trading, I recommend starting with a demo account. They simulate real-life market conditions, but any orders placed are with ‘paper money’. This means you can explore a platform and practice day trading stocks before risking real money.

FAQ

Are Online Stock Brokers Safe?

The best way to stay safe is to choose a trustworthy stock broker. The most reliable sign of a trustworthy stock broker is authorization from one or more respected regulators, such as the SEC in the US, the ASIC in Australia, the FCA in the UK, or the CySEC in Europe.

We regularly verify the licenses of our recommended stock brokers on the respective regulator’s database to ensure they are authorized by the financial bodies they claim to be.

Our team is also comprised of industry experts who keep abreast of major security incidents and unfair trading practices – marking such stock brokerages down where appropriate. This was the case with Robinhood when its trading practices were found to be harmful to retail investors.