eToro USA Review 2026

Pros

- Investors can access Smart Portfolios for a more hands-off approach, covering a range of sectors and markets such as renewable energy and artificial intelligence

- The online broker offers an intuitive social investment network with straightforward copy trading on cryptos

- The low minimum deposit and straightforward account opening process means beginners can get started quickly

Cons

- There's no MetaTrader 4 platform integration for traders who are accustomed to using third-party charting tools

- Average fees may cut into the profit margins of day traders

- The proprietary terminal doesn't support trading bots and there are no additional stock market analysis tools

eToro USA Review

eToro USA is a top-rated online trading broker and social investment network. The company offers multi-asset trading opportunities on proprietary platforms with reliable technology. The investment firm also provides a wealth of educational materials, alongside copy trading, a rewards scheme and a crypto wallet.

This 2026 review will cover trading fees and commissions, mobile investing apps, how to buy and sell instruments like Bitcoin, analysis features, and more. Find out where our experts placed eToro USA Securities in our broker rankings.

Company History & Overview

The eToro global brokerage was launched in 2007. After successful growth, including a valuation of $2.5 billion and reported revenues of $1.2 billion in 2021, the company launched in the United States in 2022.

The brand is available in 47 states, providing retail investors with opportunities on stocks, ETFs, options, and cryptos.

eToro USA Securities is authorized and regulated by the Securities and Exchange Commission (SEC) and is a member of the Financial Industry Regulatory Authority (FINRA). The company is also registered with the Securities Investor Protection Corporation (SIPC), which provides insurance coverage for securities (not cryptos) in the case of business insolvency.

The broker has its headquarters in Hoboken, New Jersey.

Instruments & Markets

The brokerage offers 4000+ instruments spanning stocks, ETFs, cryptos, and options.

You can use the firm’s investment app to trade stocks, ETFs and cryptos. To trade options, you will need to download the eToro Options app and log in with your existing credentials.

Unfortunately, the broker does not offer forex, commodities or futures, which is a drawback vs some competitors.

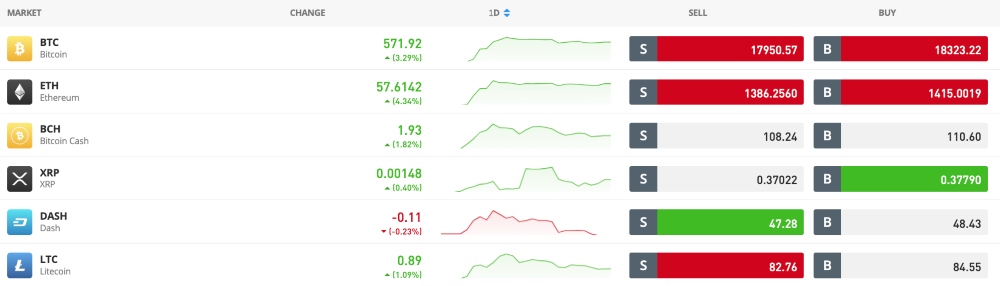

Cryptocurrencies

Buy, sell and invest in 24 digital currencies including Bitcoin (BTC), Ethereum (ETH), and Monero (XMR).

Crypto investors can also store digital assets in the eToro Money app.

Fees

It is free to open a live account. However, trading fees vary by instrument and asset class:

Cryptocurrency

There is a 1% fee to buy or sell cryptocurrency. This will be shown as a loss in the P&L.

eToro US does not charge to send and receive digital currency coins. However, our experts were disappointed to see that there is a 2% transfer fee when moving digital assets from the eToro investment app to the eToro Money crypto wallet.

Other Charges

An inactivity fee of $10 per month applies for dormant accounts after 12 months. Open positions will not be closed to cover these charges.

Daily rollover fees also apply for positions held overnight.

Trading Platform

Traders get access to the eToro USA Securities investment platform. The solution is available as a web trader via major browsers or can be downloaded for free to desktop devices, including Windows and Mac.

The eToro USA Securities trading platform provides a modern and intuitive dashboard. Some investors may prefer this over the dated displays of MetaTrader 4 and MetaTrader 5.

On the downside, when we used eToro USA Securities, the platform didn’t offer the same range of technical and fundamental analysis tools found on MT4/MT5.

Functionality includes:

- View portfolio performance including a risk score rating

- Access to ProCharts to display graphs across various timeframes

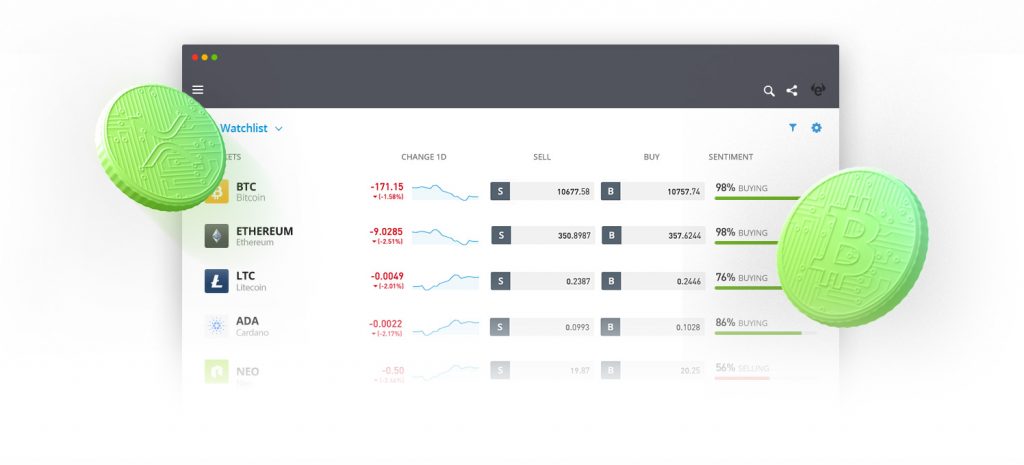

- Create, customize and track instruments via watchlists with live price quotes

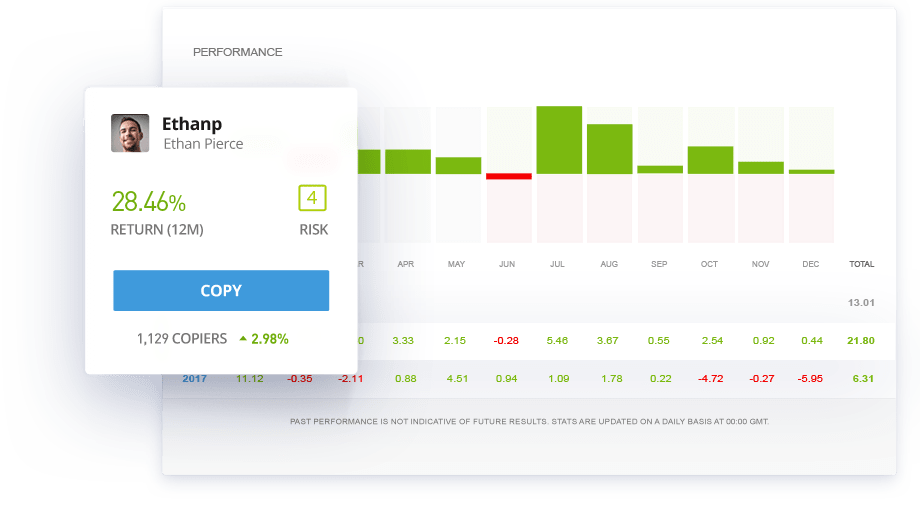

- Duplicate the positions of the top 10 to 100 traders using the Copy Trader feature (crypto only)

- Access an in-depth economic calendar and track upcoming IPOs with daily filters and market sentiment

- Explore all assets through the Trade Markets function. Discover top market movers, popular stocks, and newly listed assets

- Navigate the social networking channel. Share trading opportunities and discuss strategy ideas in online community forums

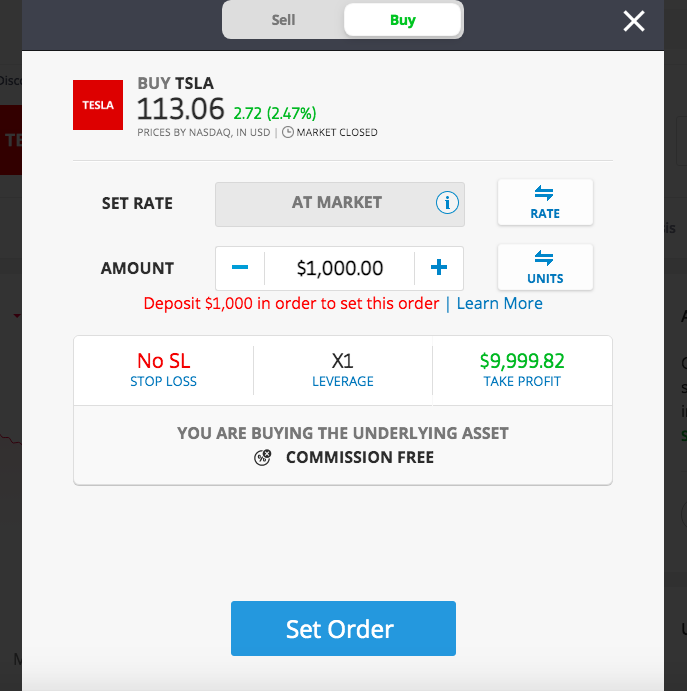

How To Place A Trade

- Find the asset you would like to trade using the ‘Discover’ or ‘Watchlist’ menus

- Select ‘Invest’ in the asset trading window

- Enter the order details, including trade volume and stop loss/take profit parameters

- Click ‘Select Order’

Traders can add investments in either units or value amounts in USD. Users can toggle between these options using the units widget.

eToro USA Securities App

eToro USA Securities offers a popular mobile app. It can be downloaded to iOS and Android devices, including smartphones and tablets. Simply search ‘eToro’ via Google Play or the Apple App Store to get started.

The applications automatically sync with desktop actions, meaning you can pick up orders and trade where you left off. You can filter by share price, market cap, and new stock availability. Additionally, investors can view customizable price charts and portfolio overviews. Copy trading services and watchlists are also available within the app.

When we used eToro USA Securities, we were impressed with how easy it was to navigate with straightforward views of popular instruments and associated metrics. We could also set up price alerts and notifications with ease. Other user reviews are also positive, with a 4.1/5 rating on Google Play.

Note, there are separate mobile apps for options trading and the crypto wallet.

Payment Methods

Deposits

The minimum deposit requirement for new eToro USA Securities traders is $100. The broker does not charge any fees to make a deposit, however, third-party charges may apply.

eToro USA Securities accepts deposits via:

- PayPal – $10 minimum deposit, $10,000 maximum limit per transaction. Instant processing

- ACH Transfer – $10 minimum deposit, $10,000 maximum limit per day. Instant processing

- Debit Card (Visa & Mastercard) – $10 minimum deposit, $40,000 maximum limit per transaction. Instant processing

- Wire Transfer – $500 minimum deposit, $1,000,000 maximum limit per transaction. Four to seven working days processing

Clients can also set recurring deposits following a successful debit card payment. The frequency can be set to weekly, biweekly, or monthly.

Note, deposits cannot be made if your account is pending verification.

How To Make A Deposit With A Debit Card

- Log in to the eToro USA Securities client dashboard

- Select ‘Deposit Funds’ from the side menu bar

- Enter the payment value

- Select ‘Debit Card’ as the payment method

- Input the payment details including card number and the registered cardholder’s name

- Click ‘Deposit’

Note, Bitcoin payments, e-wallets like Neteller, plus credit cards are not currently accepted.

Withdrawals

The minimum withdrawal amount is $30.

eToro USA Securities customers can withdraw funds via the payment methods listed above. Withdrawals take up to seven working days, however, account verification must have been completed to prevent delays. Traders can view the transaction status within the withdrawal dashboard.

On the downside, all withdrawals come with a $5 fee, which is a notable drawback vs some competitors, who offer fee-free payments.

Live Account

eToro USA Securities does not provide multiple account types. This is a disadvantage vs some alternatives, which reward active traders with volume discounts and other perks (though the eToro Club is available to high-volume investors – more details below).

On the plus side, a single account simplifies the investing experience. Clients can manage all online trading activity in one portfolio and account view.

The minimum investment amount for US traders is $10.

A halal, Islamic-friendly account can also be requested from the broker’s customer service team.

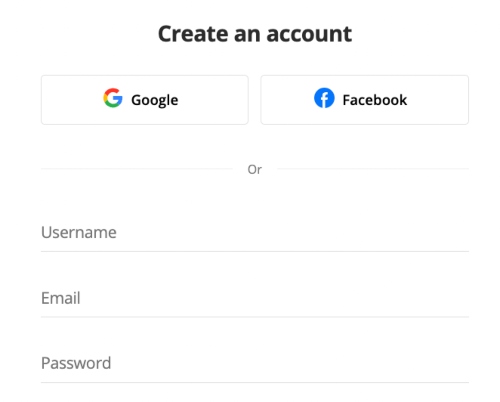

How To Open A live Account

Our experts found it quick and easy to register for a new eToro USA Securities account:

- Follow the ‘Visit’ button at the top or bottom of this review

- Enter a username, add your email address and create a password

- Review the terms and conditions and tick the acceptance boxes

- Select ‘Create Account’

- A verification code will be sent to the registered email address

- Insert the code and press ‘Verify’

- You will now have access to the eToro USA Securities client portal

You can also register with an existing Facebook or Google account.

Note, all users must comply with the broker’s AML and KYC rules and submit copies of identity documents for account verification. Customers cannot deposit into a live account until this has been actioned. Requests are typically approved within one business day.

Demo Account

eToro USA Securities provides new and existing users with access to a free demo account.

The practice profile is loaded with $100,000 in virtual funds so aspiring investors can develop their trading skills. Users can practice trading and building a portfolio with stocks, ETFs, and cryptos. Demo account holders can also access all the tools and features of a live account, including the copy trader function, advanced market analysis, and real-time trends.

How To Open A Demo Account

- Register for an eToro USA Securities account via the ‘Sign Up’ icon top right of the homepage

- Log in to the client dashboard with your registered credentials

- Ensure ‘Virtual Portfolio’ is selected in the left menu

- Start trading in demo mode

Users can also toggle between a ‘real’ and ‘virtual’ account using the icon in the bottom-left corner of the account dashboard.

Bonuses & Promotions

While using eToro USA Securities, we got a $10 bonus when we deposited $100. This is a good way to boost your starting capital.

The brand also occasionally offers a referral scheme with rewards available when users invite friends.

eToro Club

The eToro Club is a reward-based scheme for high-volume investors. It is a five-tier program, from Silver to Diamond. Membership status is determined by account balance as of midnight each day. All customers are automatically assigned Bronze badges at the time of registration.

Higher-tier members benefit from access to exclusive features and perks based on realized equity. This includes free subscriptions to financial content, access to live webinars, a dedicated account manager, in-person event invitations, and priority customer service.

Membership levels and respective thresholds:

- Silver Account – $5000 account balance

- Gold Account – $10,000 account balance

- Platinum Account – $25,000 account balance

- Platinum+ Account – $50,000 account balance

- Diamond Account – $250,000 account balance

Regulation & License

The online brokerage and investing app operate with top-tier regulatory oversight:

- eToro USA Securities Inc – Securities trading is offered by this entity, which is a member of FINRA and SIPC, and a self-directed broker-dealer that does not provide recommendations or investment advice.

- eToro USA LLC – Registered as a Money Services Business (MSB). It is not a broker-dealer, nor does it hold FINRA or SIPC membership. This entity hosts all cryptocurrency trading and holdings offered by the brand. There is no FDIC insurance associated with digital currency investments.

eToro USA LLC retail investors benefit from FDIC-insured cash holdings up to the value of $250,000. The firm also has an additional customer insurance policy via Apex Clearing Corporation. This offers client protection for funds held in a brokerage account up to $150 million.

The firm also operates in line with the Financial Crimes Enforcement Network (FinCEN) to combat money laundering and other financial crimes. All new account registrations are subject to identity verification requirements including the provision of social security numbers and proof of address.

Trading services are available in the majority of states, including Alabama, California, Illinois, Mississippi, and Washington. At the time of writing, the brand was unavailable to residents in New York.

Tax

The payment of taxes based on profits and earnings is the responsibility of investors.

Fortunately, clients can turn to the user-friendly eToro Account Statement function to generate proof of transactions. This includes details of closed positions, drawdown percentage, account activity, and a financial summary of performance such as profit & loss and any fees.

To use the service:

- Log in to the client dashboard

- Select ‘Settings’ from the menu down the side

- Click on the ‘Accounts’ section

- Below ‘Documents’, select ‘Account Statement’ and then ‘View’

- Choose a timeframe and click ‘Create’

- Download the report via Excel or PDF using the relevant icons

Additional Tools

Copy Trader

eToro US offers a user-friendly Copy Trader platform (crypto investments only). This is a major benefit, particularly for beginners looking for a hands-off approach to investing.

The minimum deposit required to copy a trader is $200. Users can choose up to 100 traders to follow and copy simultaneously. Clients can also pause, stop, or add and remove funds at any time.

The platform is free to open, though standard trading fees, such as commissions and spreads, will be charged when positions are opened and closed.

To get started:

- Review master traders and analyze their performance history

- Select traders most suited to your investment goals and risk appetite

- Enter a value to invest (if you choose more than one trader to copy, the investment amount will be split equally)

- Select ‘Copy’ to start copying positions automatically

For other traders to copy your positions, you must be accepted into the broker’s Popular Investor Program. Monthly earnings are based on the number of followers and profit breakdown. Eligibility requirements also include a minimum of $100 invested equity, at least two months of investments, and only trading crypto.

Note, customers are only permitted to copy other US traders at this time.

Success is not guaranteed regardless of previous performance.

Education

The eToro Academy is an excellent resource. It provides a wealth of articles, tutorials, integrated videos, and user guides.

Traders can view either beginner or advanced resources. Starter topics include how to buy and sell stock, trade long or short positions, keyword glossaries, and how to deposit and withdraw funds to and from an eToro USA Securities account. Advanced themes include understanding blockchain, Bitcoin and Ethereum price fluctuations, long-term investment strategies, and using volume-based technical indicators.

Market news and analysis posts are also published on a weekly basis. This includes crypto forecasts, copy trader tips, and inflation predictions. These resources can also be filtered by popular categories.

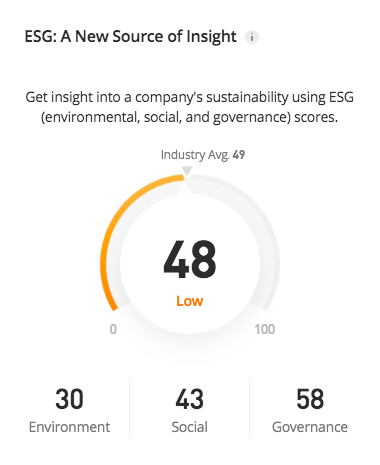

ESG Scoring

eToro USA Securities uses a simple ‘traffic light’ color coding system to rank 2000+ assets by their exposure to environmental, social, and governance factors. This can help users identify companies that follow sustainable and ethical supply chain practices, for example.

This detail can be found on the individual assets overview page:

Crypto Wallet

The eToro US wallet supports multiple digital currencies, including Bitcoin, Bitcoin Cash, Ethereum, Litecoin, Stellar, and Tron. Users can transfer, exchange, receive, buy and convert crypto.

There are minimum and maximum transaction limits, which vary by digital asset. This includes a maximum of $2,999 worth of BTC per transaction. Funds sent from the investment app to the money crypto wallet will also be liable for a capped fee. For example, Litecoin transactions will incur a 2% charge, though this is capped at $100. Additional blockchain fees may also apply when transferring funds from the mobile app wallet.

The digital wallet is relatively safe and secure. It uses customers’ existing login credentials alongside multi-signature sign-in. Additionally, the app offers DDoS protection and security standardization protocols.

The mobile application is available to download on iOS and Android (APK) devices.

Opening Hours

Typical market trading hours are 9:30 AM to 4 PM (ET time zone) Monday to Friday. You can still manage your eToro USA Securities account, update your watchlist, and view potential trade opportunities whilst the market is closed. You can also close a trade whilst the market is not open, however, this action won’t be completed until the market re-opens. The order will show as ‘Pending Close’.

Cryptos are available to trade 24/7 with no downtime, including public holiday closures.

Customer Support

Our experts were disappointed with the lack of customer support options. Although there is an online chat service and comprehensive help center, a downside of eToro USA Securities is the lack of a support email address or helpline phone number. Customers are directed to a ticket-based contact system with a rigid dropdown menu and limited flexibility to submit specific queries.

On a more positive note, when we tested the live chat function, we got a response within minutes, although it’s only available during business hours, Monday to Friday.

Outside of these hours, head to the detailed help center which contains hundreds of common questions and answers organized by category. This includes what to do if you face login problems, the withdrawal policy, why you are unable to open or close a position, and how to set or remove a trailing stop loss or take profit limit order.

Security & Safety

There is the option to activate 2-factor authentication (2FA) on accounts which provides an additional layer of security. Also, users can apply account operation limits on login requests or withdrawal attempts.

eToro US takes a multi-tiered approach to safeguarding crypto instruments. This includes hot storage online wallets and offline cold storage. In addition, the company employs technologically advanced fraud detection systems. There have been no recorded security breaches or official reports of the firm being hacked.

All customers’ personal information and data transmissions are guarded through encrypted transport layer security (TLS). A specialist team monitors all servers and activities 24/7.

On the downside, negative balance protection is not provided.

eToro USA Securities Verdict

The firm launched in the USA in 2022 following a strong global reputation and a presence in 140+ countries. Investors can build personal equity using a wealth of educational materials, access to copy trading services, and an intuitive social network. 2000+ instruments are also available, alongside commission-free trading opportunities and a $100 minimum deposit.

Overall, eToro USA Securities is an excellent fit for aspiring traders, particularly beginners interested in stocks and cryptos.

Securities trading offered by eToro USA Securities, Inc. (“the BD”), member of FINRA and SIPC. Cryptocurrency offered by eToro USA LLC (“the MSB”) (NMLS: 1769299) and is not FDIC or SIPC insured. Investing involves risk, and content is provided for educational purposes only, does not imply a recommendation, and is not a guarantee of future performance. DayTrading.com is not an affiliate and may be compensated if you access certain products or services offered by the MSB and/or the BD.

FAQ

Is eToro USA Securities Safe?

eToro USA Securities operates a secure website, trading platform, and mobile app. All personal information and data transmissions are shielded with an encrypted transport layer security (TLS). Specialist teams also monitor the brand’s servers and website for fraudulent activities and potential hacking threats 24/7.

With that said, retail trading is risky and many investors lose money. With that in mind, never risk more than you can afford to lose.

Is eToro USA Securities A Legit Or Scam Broker?

eToro USA Securities is a legitimate online broker. Part of an established global organization, the firm’s history dates back to 2007 with tens of thousands of active clients spanning more than 140 countries.

There have been no major reported concerns of scams or hacks relating to eToro USA Securities. The brokerage is also regulated by the SEC and is a member of FINRA and SIPC.

Is eToro USA Securities Good For Day Trading?

eToro USA Securities does not support pattern day trading securities. As a result, day trading capabilities and strategies will be limited. In addition, the broker charges higher spreads than some competitors, which may cut into the small profit margins of an intraday trader.

Consider suitable alternatives if you plan to day trade.

How Does eToro USA Money From Traders?

eToro USA Securities and eToro US generate revenue from retail investors’ through trading and non-trading fees. This includes commission charges for cryptocurrency trades, for example, and spreads on other investments.

Importantly, the broker has a transparent pricing model with no hidden fees.

How Do I Short Sell Stock On The eToro USA Securities Platform?

Find the relevant company page within the client dashboard. Select the ‘Invest’ icon and choose ‘Sell’. Decide on the amount to invest and add any risk-management parameters if desired. Then select ‘Open Trade’.

Is eToro USA Securities A Trustworthy Broker?

eToro USA Securities is a trustworthy brokerage. The US entity is authorized and regulated by the US Securities and Exchange Commission (SEC) and trades are covered by the brand’s membership with FINRA and SIPC. The award-winning global broker also has a loyal customer base with 15+ years of experience.

Best Alternatives to eToro USA

Compare eToro USA with the best similar brokers that accept traders from your location.

- Interactive Brokers – Interactive Brokers (IBKR) is a premier brokerage, providing access to 150 markets in 33 countries, along with a suite of comprehensive investment services. With over 40 years of experience, this Nasdaq-listed firm adheres to stringent regulations by the SEC, FCA, CIRO, and SFC, amongst others, and is one of the most trusted brokers for trading around the globe.

- Firstrade – Firstrade is a US-headquartered discount broker-dealer with authorization from the SEC. The company is also a member of FINRA/SIPC. With welcome bonuses, powerful tools and apps, plus commission-free trading, Firstrade Securities is a popular and top-tier online brokerage. It is also quick and easy to open a new account.

eToro USA Comparison Table

| eToro USA | Interactive Brokers | Firstrade | |

|---|---|---|---|

| Rating | 3.4 | 4.3 | 4 |

| Markets | Stocks, Options, ETFs, Crypto | Stocks, Options, Futures, Forex, Funds, Bonds, ETFs, Mutual Funds, CFDs, Cryptocurrencies | Stocks, ETFs, Options, Mutual Funds, Bonds, Cryptos, Fixed |

| Demo Account | Yes | Yes | No |

| Minimum Deposit | $100 | $0 | $0 |

| Minimum Trade | $10 | $100 | $1 |

| Regulators | SEC, FINRA | FCA, SEC, FINRA, CFTC, CBI, CIRO, SFC, MAS, MNB, FINMA, AFM | SEC, FINRA |

| Bonus | Invest $100 and get $10 | – | Deposit Bonus Up To $4000 |

| Platforms | eToro Trading Platform & CopyTrader | Trader Workstation (TWS), IBKR Desktop, GlobalTrader, Mobile, Client Portal, AlgoTrader, OmniTrader, TradingView, eSignal, TradingCentral, ProRealTime, Quantower | Firstrade Invest 3.0, TradingCentral |

| Leverage | – | 1:50 | – |

| Payment Methods | 4 | 6 | 4 |

| Visit | Visit | Visit | Visit |

| Review | – | Interactive Brokers Review |

Firstrade Review |

Compare Trading Instruments

Compare the markets and instruments offered by eToro USA and its competitors. Please note, some markets may only be available via CFDs or other derivatives.

| eToro USA | Interactive Brokers | Firstrade | |

|---|---|---|---|

| CFD | No | Yes | No |

| Forex | No | Yes | No |

| Stocks | Yes | Yes | Yes |

| Commodities | No | Yes | No |

| Oil | No | No | No |

| Gold | No | Yes | No |

| Copper | No | No | No |

| Silver | No | No | No |

| Corn | No | No | No |

| Crypto | Yes | Yes | Yes |

| Futures | No | Yes | No |

| Options | Yes | Yes | Yes |

| ETFs | Yes | Yes | Yes |

| Bonds | No | Yes | Yes |

| Warrants | No | Yes | No |

| Spreadbetting | No | No | No |

| Volatility Index | Yes | No | No |

eToro USA vs Other Brokers

Compare eToro USA with any other broker by selecting the other broker below.

Customer Reviews

4.5 / 5This average customer rating is based on 2 eToro USA customer reviews submitted by our visitors.

If you have traded with eToro USA we would really like to know about your experience - please submit your own review. Thank you.

Available in United States

Available in United States

What I love about eToro is that they offers easy to understand ESG scores through their traffic light system. This is exactly what I needed because I want to make halal investments that align with my views. The app is also really easy to use – it didn’t take long at all to get familiar with it and the notifications you can customize so they’re actually useful and you’re not just bombared with alerts you don’t need.

eToro is easily the best social trading platform I’ve used. There are tons of traders you can follow and the risk score means you can find people that align with your risk tolerance. The social feed is also useful for finding trading ideas. The only thing I find frustrating is the withdrawal fee.