Dukascopy Review 2026

Awards

- Best Online Bank Switzerland 2024 - Brands Review Magazine

- Best Multi-Asset Trading Platform Switzerland 2024 - Brands Review Magazine

- Best Cryptocurrency Trading Platform Switzerland 2024 - Brands Review Magazine

- Best White Label Solutions Provider Switzerland 2024 - Brands Review Magazine

- Leading Bank Broker Switzerland 2024 - World Business Outlook

- JForex4—Most User-Friendly Trading Experience at Rimini IT Forum 2023 - itorum.it

Pros

- Dukascopy offers tight spreads starting from 0.1 pips, leverage up to 1:200 (depending on the jurisdiction), and volume-based commissions that reward high-frequency traders.

- Dukascopy features some of the best research we’ve seen, even a professional TV studio in Geneva covering financial news, market analysis, and daily insights from professionals.

- Dukascopy is regulated by the Swiss Financial Market Supervisory Authority (FINMA) as both a broker and a bank, ensuring top-tier financial security and adherence to strict standards.

Cons

- While Dukascopy provides some educational resources and 24/7 support, the complexity of its platforms and tools required extensive testing and may overwhelm newer traders.

- Some account types, such as the MT4/MT5 accounts, require a higher minimum deposit of $1,000, which may not be ideal for traders with smaller budgets.

- While JForex is feature-rich, it has a steep learning curve, making it less suitable for beginner traders who might prefer simpler platforms.

Dukascopy Review

Regulation & Trust

Dukascopy Bank SA is a multi-regulated Swiss bank and online broker that’s highly trusted.

The firm has several subsidiaries, authorized by ‘green tier’ bodies in DayTrading.com’s Regulation & Trust Rating:

- Switzerland: ‘Dukascopy Bank SA’ is regulated by the Financial Market Supervisory Authority (FINMA) as a bank and a securities firm. Its commercial register ID is CHE-112.086.322. Furthermore, Dukascopy is a member of the Swiss Bankers Association and the International Swaps and Derivatives Association (ISDA).

- Latvia: The Financial and Capital Market Commission (FCMC) regulates ‘Dukascopy Europe IBS AS’.

- Japan: ‘Dukascopy Japan K.K’ is regulated by the Financial Services Agency (JFSA).

FINMA’s protections are among the strictest globally and include deposit protection of up to CHF 100,000. However, subsidiaries regulated under other jurisdictions offer different levels of protection, depending on the local regulatory framework.

For example, Dukascopy Europe IBS AS clients are insured under the Investor Compensation Fund (ICF) for up to EUR 20,000. Dukascopy Japan K.K. does not have a compensation scheme.

Maximum leverage also differs significantly. Dukascopy Bank SA offers leverage up to 1:200 (restrictions may apply), whereas Dukascopy Europe IBS AS is restricted to 1:30 due to EU regulations, and Dukascopy Japan K.K limits it to 1:25.

| Dukascopy | AZAforex | World Forex | |

|---|---|---|---|

| Regulation & Trust Rating | |||

| Regulators | FINMA, JFSA, FCMC | SVGFSA | |

| Visit | Visit | Visit | Visit |

| Review | Review | Review | Review |

Accounts & Banking

Live Accounts

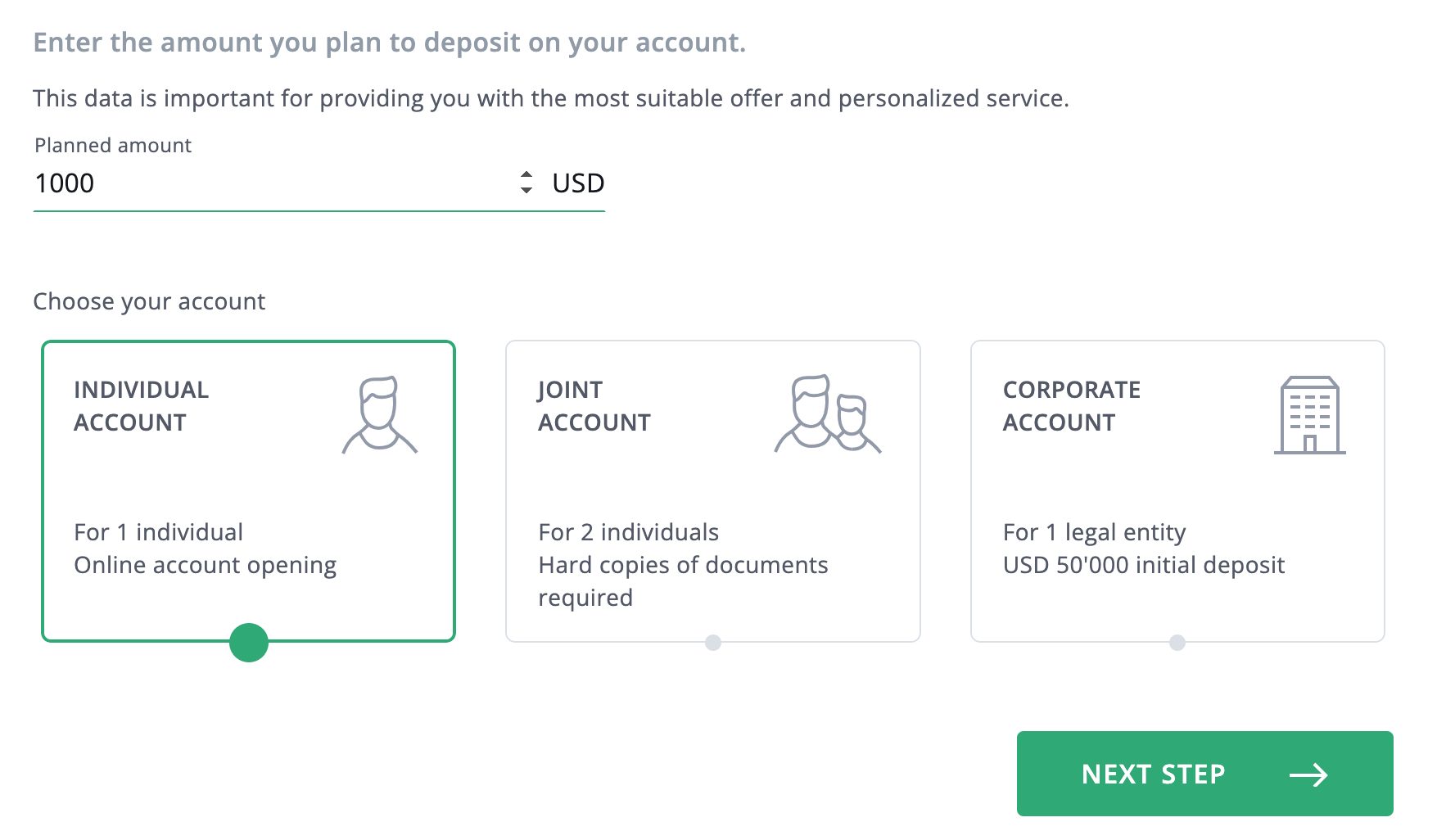

Dukascopy offers three account types categorized based on the platforms they are associated with.

There is also a swap-free account for Islamic traders and managed accounts with a Percent Allocation Management Module (PAMM).

As Dukascopy is a bank, it’s fairly unique in that you can open a bank account and utilize a multi-currency account, streamlining your banking and trading operations.

JForex Account (ECN)

- Minimum Deposit: $100

- Leverage: Up to 1:200

- Spreads: Variable, starting from 0.1 pips

- Commission: $35 per $1 million traded

- Additional Features: Eligible for bonuses and promotions

MT 4/5 Account

- Minimum Deposit: $1,000

- Leverage: Up to 1:100

- Spreads: Variable, starting from 0.1 pips

- Commission: $50 per $1 million traded

- Additional Features: Not eligible for certain bonuses

Binary Options Account

- Minimum Deposit: $100

- Leverage: N/A (binary options are fixed-return instruments)

- Trading Style: Based on predicting price movement within a set timeframe

- Additional Features: Access to binary options trading tools on the JForex platform

Although there is no tiered account system with progressively enhanced benefits such as reduced commissions or tighter spreads, the current system simplifies the decision-making process by providing clear, straightforward account options.

Additionally, the availability of volume-based bonuses does allow day traders to benefit from reduced costs, making the system more efficient if you meet higher trading thresholds.

My main criticism is the $1,000 minimum deposit required for MT4/5 accounts, which is really steep compared to many brokers like XTB and Pepperstone, which require no minimum deposit.

Demo Accounts

Signing up for a free demo account with Dukascopy is a snap and is the ideal way to test strategies on JForex, MT4, and MetaTrader 5 platforms before committing real capital.

After setting up a demo account – which didn’t require me to go through the whole process of setting up a live account – I was automatically assigned a £10,000 balance to start practicing trading. I could manually top up from my client area and alter leverage.

It’s worth remembering that demo trading may not perfectly mirror the nuances of live trading. We’ve found demos typically boast very fast execution speeds due to the simulated nature of trades and the absence of real-world factors like liquidity, slippage, and order processing delays, which can impact results, particularly during periods of high volatility or low liquidity.

My biggest disappointment with Dukascopy’s demo accounts is the 14-day limit, which isn’t long enough to get to grips with the platforms and their tools. By comparison, brokers like Vantage have unexpiring demo accounts.

However, I found a workaround – opening a real trading account gives me access to a permanent demo account.

Deposits & Withdrawals

Dukascopy offers a superb range of funding options for accounts that can be opened in a choice of 25+ currencies including USD, CHF, EUR, GBP, AUD, CAD, CZK, DKK, HKD, HUF, ILS, JPY, MXN, NOK, NZD, PLN, RON, CNH, SEK, SGD, TRY, XAU, AED, SAR and ZAR, ideal for traders from around the world:

- Bank Transfers: You can deposit funds via bank wire transfers in various currencies, including recent additions like United Arab Emirates Dirham (AED) and Saudi Arabian Riyal (SAR). Funds are usually received within 1-2 business days and are free from fees, but withdrawals can cost up to $35.

- Credit/Debit Cards: Accepted cards include Mastercard, Visa, Maestro, and Visa Electron. The minimum deposit is $100 and for security, the maximum amount per transaction is $18,000. Funds are typically credited to your account within minutes but incur a 1.5% fee for EEA cards and 2.5% for non-EEA cards.

- E-Wallets: Popular e-wallets Apple Pay, Skrill, and Neteller are supported. These offer a fast, secure, and convenient way to fund your accounts, but they incur up to a 2.5% transaction fee for both deposits and withdrawals.

- Cryptocurrencies: Trading accounts opened as ‘crypto-fundable’ can fund and withdraw funds via Bitcoin (BTC), Ethereum (ETH), or Tether (USDT). Deposits are free, but there’s a $30 withdrawal fee, and the same tokens are accepted as deposits.

Dukascopy’s withdrawal fees are disappointing, which apply across every withdrawal method except Apple Pay and are higher than most competitors we’ve tested. For example, Pepperstone doesn’t charge for deposits or withdrawals. This may deter some clients, especially those who make frequent withdrawals.

| Dukascopy | AZAforex | World Forex | |

|---|---|---|---|

| Accounts & Banking Rating | |||

| Payment Methods | Bitcoin Payments, Credit Card, Debit Card, Ethereum Payments, Maestro, Mastercard, Neteller, Skrill, Visa, Wire Transfer | Bitcoin Payments, Credit Card, Debit Card, Ethereum Payments, Maestro, Mastercard, Neteller, Paybis, Perfect Money, QIWI, Skrill, Visa, Volet, Wire Transfer | Bitcoin Payments, Credit Card, Debit Card, Mastercard, Visa, Volet, Wire Transfer |

| Minimum Deposit | $100 | $1 | $1 |

| Visit | Visit | Visit | Visit |

| Review | Review | Review | Review |

Assets & Markets

Dukascopy offers a diverse trading environment with over 1,500 instruments (mainly CFDs, not real assets) across eight major classes.

Including binary options on 15+ currency pairs further distinguishes Dukascopy from many competitors, providing an all-or-nothing bet on the direction of instruments.

You can trade:

- Forex: Over 60+ currency pairs, including majors (USD/EUR, GBP/USD), minors (AUD/JPY, GBP/JPY), and exotics (USD/TRY, EUR/HUF).

- Stocks: Access 1,000+ popular worldwide stocks like Nvidia, Swatch Group, and Tesla for potential exposure to established companies.

- Indices: Speculate on market movements with 20+ global indices including the S&P 500, IBEX 35, and S&P/ASX 200.

- Commodities: Trade gold, copper and palladium and diversify your portfolio with oil (Brent and Crude) and natural gas.

- Cryptocurrencies: Capitalize on the volatility and growth potential of 18+ cryptos including Bitcoin (BTC), Ethereum (ETH), and Litecoin (LTC).

- ETFs: Over 85+ including SPDR S&P 500 ETF, iShares Silver Trust and Vanguard REIT.

- Bonds: Speculate on German Govt. Bond, US Govt. Bond and UK Govt. Bond.

While Dukascopy offers 1,000+ popular stocks, this is considerably less than the range available at top brokers like Interactive Brokers (with access to over 7,000 stocks).

Dukascopy also offers a decent range of ETFs, but brokers like Saxo have access to thousands of ETFs worldwide, providing more flexibility for investors seeking diverse portfolios.

| Dukascopy | AZAforex | World Forex | |

|---|---|---|---|

| Assets & Markets Rating | |||

| Trading Instruments | CFDs, Forex, Stocks, Indices, Commodities, Crypto, Bonds, Binary Options | CFDs, Forex, Stocks, Indices, Commodities, Crypto, Binary Options | Digital Contracts, Forex, CFD Stocks, Metals, Energies, Cryptos |

| Margin Trading | Yes | Yes | Yes |

| Leverage | 1:200 | 1:1000 | 1:1000 |

| Visit | Visit | Visit | Visit |

| Review | Review | Review | Review |

Fees & Costs

Dukascopy’s fee structure is multifaceted, which I don’t like. It will certainly be challenging to understand if you’re a beginner seeking straightforward pricing.

The broker employs a commission-based model with rates that vary based on factors such as net deposits, account equity, and trading volume:

- Spreads: Spreads are competitive. Major pairs like EUR/USD and USD/JPY typically have 0.3/0.4 pips spreads. A default commission of 0.7 pips brings the total cost to about one pip, comparable to industry standards. Day traders can also benefit from tiered pricing with lower spreads and commissions based on your trading volume.

- Commissions: Commissions for currency pairs start at $35 per million USD traded, while commodities, indices, precious metals, cryptocurrencies, and bonds begin at $52.50 per million USD. These rates can decrease significantly with higher net deposits or trading volumes, potentially dropping to as low as $5 per million USD for currency pairs and $7.50 per million USD for other instruments.

- MetaTrader Platforms: Trading on MetaTrader 4 and MetaTrader 5 platforms incurs an additional fee of $0.5 per lot, equating to $5 per million USD traded. On MT4 accounts, this commission is charged on opening trades, while on MT5 accounts, commissions are applied separately upon opening and closing positions.

- Stocks & ETFs: Commissions for CFDs on stocks and ETFs vary by market. The fee for UK-listed securities denominated in GBP is 0.10% of the trade value, with a minimum charge of £7. The commission is $0.02 per share for US equities, subject to a $10 minimum.

- Custody Fees: Clients holding gold positions are subject to custody fees calculated at 1.5% per annum of the average gold balance, assessed monthly.

- Swap Rates: Positions held overnight incur swap fees, which vary depending on the asset and the position’s direction (long or short). For instance, the GBP/USD currency pair has a rollover rate of -0.116 pips for long positions and -0.294 pips for short positions.

- Inactivity Fees: Accounts that remain inactive for 180 consecutive calendar days may be subject to inactivity fees, with a maximum charge of CHF 100. The exact fee can vary, potentially increasing based on the costs associated with maintaining the account. Furthermore, a dormancy fee of at least 500 CHF may be charged to accounts with unresolved issues if Dukascopy cannot contact the client for two months. This fee cannot exceed the account balance.

It’s important to note that Dukascopy also charges currency conversion fees ranging from 0.05% to 1.00% when transactions involve different currencies. Deposit and withdrawal fees may also apply, depending on the method used.

You should carefully review Dukascopy’s comprehensive fee schedule to fully understand the costs associated with your trading activities. Many other brokers, notably IC Markets and Fusion Markets, offer more straightforward and lower-cost fees.

| Dukascopy | AZAforex | World Forex | |

|---|---|---|---|

| Fees & Costs Rating | |||

| EUR/USD Spread | 0.1 | Variable | From 0.6 |

| FTSE Spread | 100 | Variable | NA |

| Oil Spread | 0.1 | Variable | NA |

| Stock Spread | 0.1 | Variable | From 0.03 |

| Visit | Visit | Visit | Visit |

| Review | Review | Review | Review |

Platforms & Tools

Dukascopy offers a variety of trading platforms to accommodate different trading styles and preferences, but our hands-on tests show the options are geared toward experienced traders:

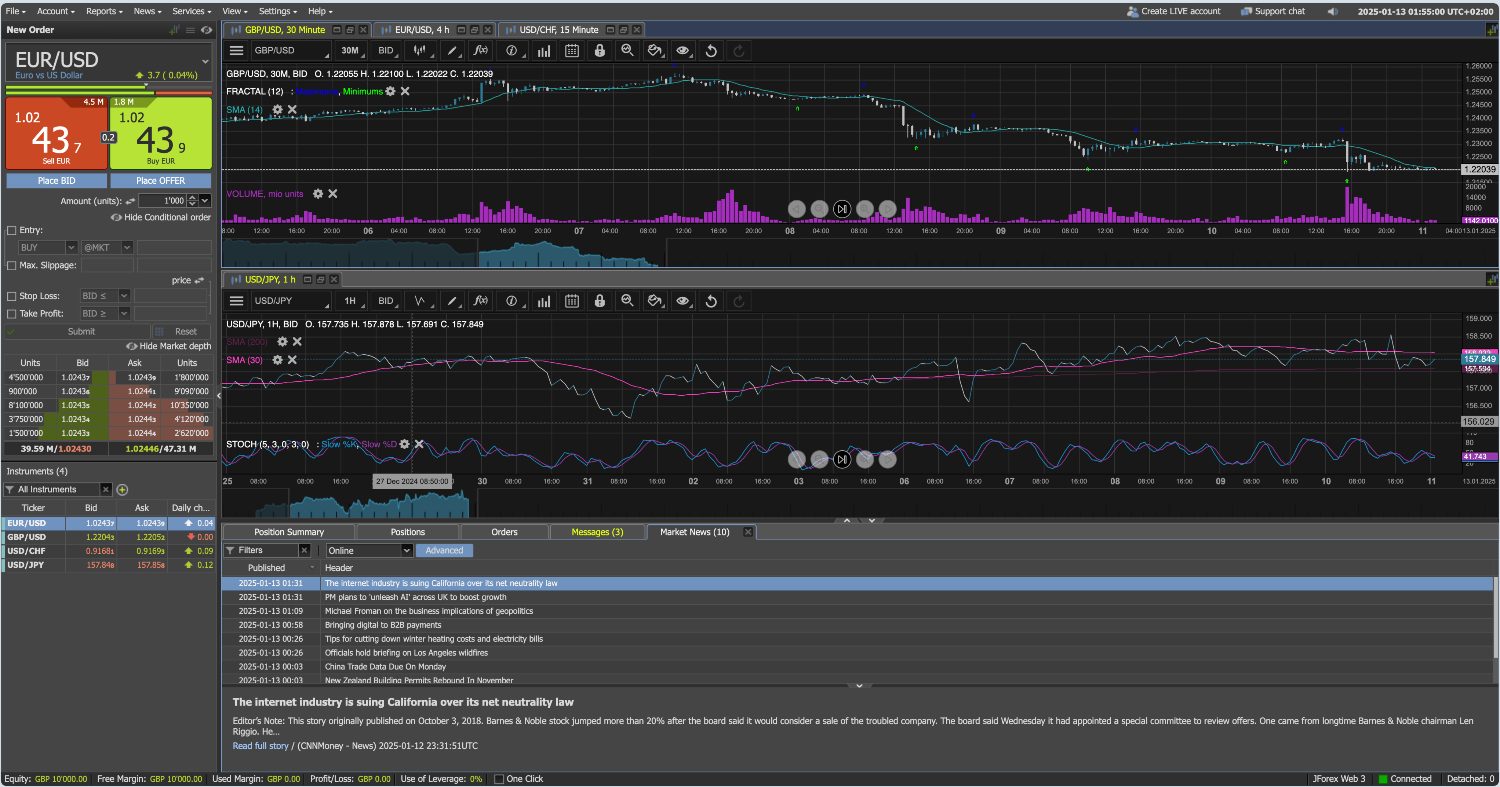

- JForex 4: Dukascopy’s powerful proprietary platform is designed for manual and automated trading and will suit more advanced traders. It supports over 270 technical indicators, 40+ drawing tools, and 11+ chart types (including Renko), which I find fantastic for technical analysis. I also really like the uncluttered and customizable interface that lets me move and resize windows to my personal preference, as well as the ability to save chart objects, which can be linked to specific instruments. The platform is compatible with Windows, macOS, Linux, iOS, and Android operating systems, ensuring accessibility across various devices. It also features an economic calendar, news integration, and supports multiple order types, including Market, Limit, Stop Loss, and Trailing-Stop.

- JForex Web 3: This web-based version of the JForex platform provides instant market access without installation. It is optimized for quick access and features 68 indicators and chart studies. The platform supports manual and chart trading, live market news, economic calendars, and workspace saving on JCloud. Its low technical requirements make it accessible from various devices with Internet connectivity.

- MetaTrader 4 (MT4): A widely recognized platform in the trading community, MT4 offers a range of technical analysis tools, including numerous indicators and charting capabilities. It supports automated trading through Expert Advisors (EAs) using the MQL4 programming language and is available on Windows, macOS, iOS, and Android platforms, facilitating trading on desktop and mobile devices.

- MetaTrader 5 (MT5): Introduced by Dukascopy in June 2024, MT5 is an advanced trading platform that builds upon the features of MT4. It offers an expanded set of technical indicators and timeframes for more comprehensive analysis, integration of an economic calendar to keep you informed of financial events, and a Depth of Market (DOM) view for deeper insights into market dynamics. MT5 supports a broader range of asset classes and includes enhanced manual and automated trading tools.

While Dukascopy’s platform offerings are robust, there is room for enhancement. Integrating more user-friendly interfaces, especially for beginners, could make the platforms more accessible to a broader audience.

Thankfully, the broker provides video tutorials and a manual explaining how to start with JForex.

The platform also provides access to a comprehensive suite of trading features, including a professional-grade API and Visual JForex, a tool for developing MetaTrader EAs without the necessity of coding expertise.

| Dukascopy | AZAforex | World Forex | |

|---|---|---|---|

| Platforms & Tools Rating | |||

| Platforms | JForex, MT4, MT5 | Mobius Trader 7 | MT4, MT5 |

| Mobile App | iOS & Android | iOS & Android via APK | iOS & Android via mobile web trader |

| Visit | Visit | Visit | Visit |

| Review | Review | Review | Review |

Research

Dukascopy provides a raft of high-quality text – and video-based research tools, which I find extremely helpful for making informed trading decisions.

Highlights include:

- DukascopyTV: Professional TV studio in Geneva that provides financial news, market analysis, and insights from professionals throughout the trading day.

- Market News & Insights: Regular updates on financial markets, including technical and fundamental analysis and trade ideas.

- Economic Calendar: A detailed calendar tracking global economic events, forecasts, and outcomes.

- Pivot Point Levels: This tool automatically calculates key support and resistance levels based on the previous trading period’s high, low, and close prices to help you identify potential price reversal points.

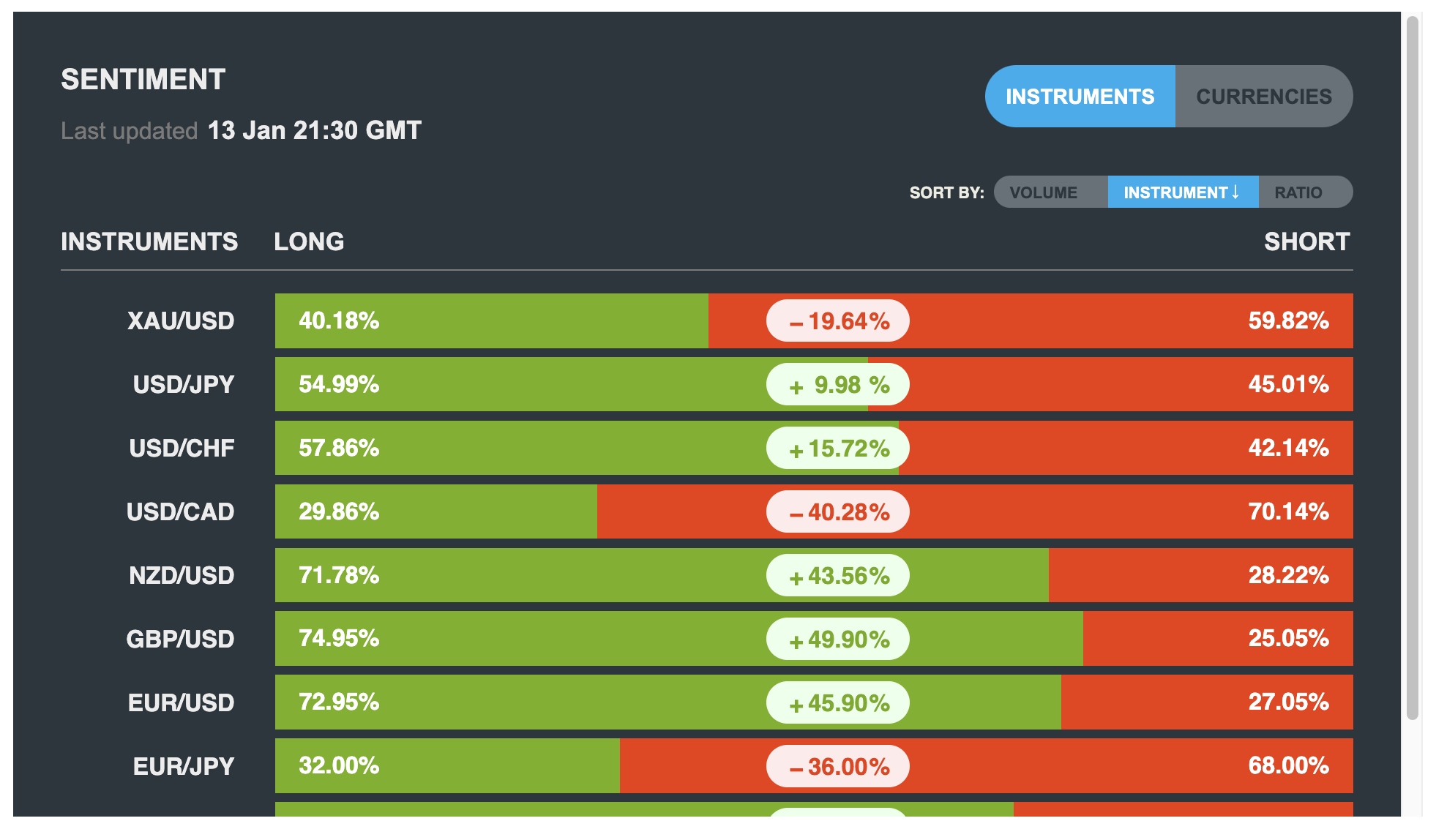

- SWFX Sentiment Index: This tool shows trader sentiment by providing data on long and short positions within Dukascopy’s liquidity network, offering insight into market trends.

- Position Size Calculator: This tool calculates pip values and margin requirements to help you optimize position sizing and better manage risk.

Together, these research tools provide a comprehensive framework for analyzing market dynamics, especially in reaction to key economic reports.

By combining real-time analysis (DukascopyTV, online news) with technical and risk management tools (position size calculator and pivot point levels), I find it easier to make more informed decisions in volatile conditions following significant economic events like the release of jobs data.

While Dukascopy provides a comprehensive suite of research tools, the lack of adequate educational resources might hinder beginner traders from effectively utilizing them and maximizing their trading potential.

| Dukascopy | AZAforex | World Forex | |

|---|---|---|---|

| Research Rating | |||

| Visit | Visit | Visit | Visit |

| Review | Review | Review | Review |

Education

Dukascopy’s educational resources don’t cater to absolute beginners. They include:

- Written Articles: A small library of written articles covering topics such as forex basics, chart patterns, and popular trading strategies.

- Webinars: Regular webinars covering trading strategies, platform tutorials, and market analysis.

- Video Tutorials: Step-by-step guides on using the JForex platform and understanding trading concepts, technical indicators and popular chart patterns such as the cup and handle.

Although Dukascopy’s video content is excellent, I’m surprised the broker doesn’t offer structured courses tailored to new traders, covering basic concepts like leverage, risk management, and order types.I’d also like to see Dukascopy publish more in-depth tutorials for MT4 and MT5 users, as most educational resources currently focus on the broker’s own JForex platform.

| Dukascopy | AZAforex | World Forex | |

|---|---|---|---|

| Education Rating | |||

| Visit | Visit | Visit | Visit |

| Review | Review | Review | Review |

Customer Support

Dukascopy offers an excellent range of 24/7 multilingual customer support options to assist clients:

- Phone: Provides round-the-clock assistance for trading and support inquiries.

- Email: You can reach out to ‘support@dukascopy.bank’ for various concerns, ensuring a written record of communication.

- Online Contact Form: This form is available for submitting inquiries on the ‘Contact Us’

- Live Chat: An online chat service is available 24/7, offering immediate assistance through the website or within the JForex platform.

- Call-Back Request: You can request a call-back by selecting a relevant topic, ensuring targeted support at a time that suits you.

- Issue Reporting: A dedicated form lets you report any issues with services, helping to ensure concerns are addressed promptly.

- FAQs: This section covers a wide range of topics, such as account management, trading platforms, fees, and funding, to help you find answers to common questions without contacting support directly.

- Social Media: Platforms like X, YouTube, Facebook and LinkedIn respond to client inquiries and share real-time company updates.

My experience with Dukascopy’s customer support has generally been positive. Representatives are polite and equipped to handle a wide range of inquiries, including bank and platform login issues.Although my email inquiries have generally been replied to in a couple of hours, my experience with live chat has been a little hit-and-miss. It has been characterized by excessive wait times and many instances of no response. This is a shame, as everything else is on point.

| Dukascopy | AZAforex | World Forex | |

|---|---|---|---|

| Support Rating | |||

| Visit | Visit | Visit | Visit |

| Review | Review | Review | Review |

Should You Day Trade With Dukascopy?

Whether you should day trade with Dukascopy depends on your trading experience and preferences.

If you’re an experienced trader seeking advanced platforms, competitive spreads, and strong regulatory protection, Dukascopy could be a good fit.

However, beginners might find its complex platforms challenging, and the relatively high withdrawal fees could be a drawback for those needing frequent funds access.

It’s a reliable and reputable broker, but it may not be the best choice for everyone, especially those looking for low-funding options and a simple trading platform.

FAQ

Is Dukascopy Legit Or A Scam?

Dukascopy is a legitimate broker and a fully licensed bank, regulated by top-tier financial authorities, including the Swiss Financial Market Supervisory Authority (FINMA) and the Financial Services Authority (FSA) in Japan.

As a regulated bank and broker established in 2004, Dukascopy provides a reliable and trustworthy trading and financial services environment.

However, as with any financial institution, carefully reviewing terms and conditions before trading is essential.

Is Dukascopy Suitable For Beginners?

Dukascopy may not be the most beginner-friendly broker, as it primarily caters to experienced traders with its advanced platforms, such as JForex, MT4, and MT5.

While it offers educational resources and 24/7 customer support, the complexity of its platforms and trading tools may be overwhelming for newcomers.

Beginners might find more straightforward brokers like eToro with more user-friendly platforms and extensive educational support better suited to their needs. However, those willing to learn and explore could still find value in Dukascopy’s offerings.

Best Alternatives to Dukascopy

Compare Dukascopy with the best similar brokers that accept traders from your location.

- AZAforex – Established in 2016, AZAforex is an offshore broker offering short-term trading on 235+ global financial markets, including through binary options with payouts of up to 90%. Three accounts (Start, Pro and VIP) offer unique features, but all provide access to the broker’s Mobius Trader 7 platform, which has benefited from performance upgrades over the years.

- World Forex – World Forex is an offshore broker registered in St Vincent and the Grenadines, offering commission-free trading with a $1 minimum deposit and 1:1000 leverage. Digital contracts are also available, offering beginners a straightforward way to speculate on popular financial markets.

Dukascopy Comparison Table

| Dukascopy | AZAforex | World Forex | |

|---|---|---|---|

| Rating | 3.6 | 3.4 | 4 |

| Markets | CFDs, Forex, Stocks, Indices, Commodities, Crypto, Bonds, Binary Options | CFDs, Forex, Stocks, Indices, Commodities, Crypto, Binary Options | Digital Contracts, Forex, CFD Stocks, Metals, Energies, Cryptos |

| Demo Account | Yes | Yes | Yes |

| Minimum Deposit | $100 | $1 | $1 |

| Minimum Trade | $1 (Binaries), 0.01 Lots (Forex/CFD) | 0.0001 Lots | $1 (Binaries), 0.01 Lots (Forex/CFDs) |

| Regulators | FINMA, JFSA, FCMC | – | SVGFSA |

| Bonus | 100% Anniversary Bonus | 30% Crypto Deposit Bonus, 120% Loyalty Bonus, 30% Spread Rebate, Certificate of Deposit Bonus | 100% Deposit Bonus |

| Platforms | JForex, MT4, MT5 | Mobius Trader 7 | MT4, MT5 |

| Leverage | 1:200 | 1:1000 | 1:1000 |

| Payment Methods | 10 | 14 | 7 |

| Visit | Visit | Visit | Visit |

| Review | – | AZAforex Review |

World Forex Review |

Compare Trading Instruments

Compare the markets and instruments offered by Dukascopy and its competitors. Please note, some markets may only be available via CFDs or other derivatives.

| Dukascopy | AZAforex | World Forex | |

|---|---|---|---|

| Binary Options | Yes | Yes | Yes |

| Expiry Times | 3 minutes – 1 day | 30 seconds – 1 day | 1 minute – 7 days |

| Ladder Options | No | No | No |

| Boundary Options | No | No | No |

| CFD | Yes | Yes | Yes |

| Forex | Yes | Yes | Yes |

| Stocks | Yes | Yes | Yes |

| Commodities | Yes | Yes | Yes |

| Oil | Yes | Yes | Yes |

| Gold | Yes | Yes | Yes |

| Copper | Yes | Yes | No |

| Silver | Yes | Yes | Yes |

| Corn | No | No | No |

| Crypto | Yes | Yes | Yes |

| Futures | No | No | No |

| Options | No | No | No |

| ETFs | Yes | No | No |

| Bonds | Yes | No | No |

| Warrants | No | No | No |

| Spreadbetting | No | No | No |

| Volatility Index | Yes | No | No |

Dukascopy vs Other Brokers

Compare Dukascopy with any other broker by selecting the other broker below.

The most popular Dukascopy comparisons:

Customer Reviews

4 / 5This average customer rating is based on 1 Dukascopy customer reviews submitted by our visitors.

If you have traded with Dukascopy we would really like to know about your experience - please submit your own review. Thank you.

Available in United States

Available in United States

Yup, I’ve been using Dukascopy and can say it’s a good one for active traders. I’ve spent all my time in their JForex platform, wbhich if you switch to the dark blue theme looks snazzy. I work with dual charts (one top, one bottom) and do some heavy TA on tick charts and the M1 and M5. One gripe I do have though is that you really need multiple screens set up because if you need to use the live chat, open the economic calendar, set up alerts etc, then you get taken out of the software and into a new window, which is mildly irritating. Why can’t I do all these things within my charting view still?