CFD Day Trading

CFDs are generally not available to retail traders in the US under SEC and CFTC rules. Most CFD brokers do not accept US residents. As an alternative, consider exchange-traded futures or options.

Contracts for difference (CFDs) are popular with day traders looking to trade at low cost and with leverage to maximize profits. CFDs are high-risk, high-return derivatives whereby the trader does not own the underlying asset they are speculating on.

This guide to CFD day trading for beginners will explain how they work, discuss the pros and cons of using them, and provide a rundown on how traders can get started.

Quick Introduction

- A contract for difference is an agreement between two parties to pay the difference between the opening and closing price of an asset.

- They are flexible instruments that allow traders to profit (or lose) from changes in asset values without having to own the underlying security.

- CFDs can be used to gain exposure to a variety of asset classes including stocks, commodities, forex and, at some brokers and in some jurisdictions, cryptocurrencies.

- Traders have the option of opening both long and short positions, thus allowing them to make profits even when markets fall.

- CFD brokers tend to offer leverage, providing traders with the opportunity to make larger profits (or conversely bigger losses if things go wrong).

Top 4 CFD Brokers

These brokers offer the best selection of CFDs with low fees, attractive leverage, powerful trading platforms and strong regulatory oversight:

Download DayTrading.com’s CFD Day Trading PDF

What Are Contracts For Difference?

CFDs provide traders with the opportunity to speculate on price movements across a diverse range of asset classes.

Critically, holders of these contracts do not own the underlying asset themselves (such financial instruments are known as derivatives). They simply aim to make money on any price changes. They also risk losing money if prices move against them.

These instruments are an agreement between two parties – the trader and the broker – to pay the difference between the opening and closing price of an asset. These can include stocks, currencies, commodities and cryptocurrencies.

CFDs were introduced in the early 1990s as a way for hedge funds, institutional investors and professional traders to gain exposure to equities on the London Stock Exchange. Over time, the market opened up to retail investors and has steadily evolved, resulting in the rapid industry growth of the last decade.

CFD trading is popular across the globe. However, retail investors in some territories, including the US, generally cannot trade over-the-counter CFDs under local rules. In other markets, such as Hong Kong, CFDs are typically restricted to professional investors rather than the general public. Regulators there highlight the combination of leverage, complex OTC structures and the fact that some platforms operate outside local law as key risks.

For example, in the EU, ESMA’s product intervention measures on CFDs restrict leverage and marketing to retail investors, while in the US, the CFTC’s guidance on off-exchange leveraged trading highlights why similar products are generally not available to retail clients.

How Do CFDs Work?

CFDs are typically traded over the counter (OTC) as bilateral derivative contracts between traders and brokers, rather than on a centralized exchange.

In other words, there is no centralized exchange where they are traded like stocks, commodities and futures contracts, for example. Instead, they tend to be offered directly to traders by brokers and financial institutions.

Individuals can choose to go long (speculating on the price going up) or short (speculating on a falling price) when trading CFDs.

They can also decide whether or not to use leverage to multiply their potential returns (or losses when a position goes the wrong way!).

Long Versus Short

CFDs allow traders to speculate on rising and falling asset prices. This is because they do not transfer ownership of the underlying asset when the trade is executed.

If an investor thinks the market will rise, they will go long and buy a CFD from their broker. If the price of the underlying asset increases, they close the position at the higher price, and the broker pays them the difference; if it falls, they pay the difference to the broker.

Conversely, if an investor believes prices are going to fall, they open a short CFD position by placing a sell order with their broker. If the underlying asset’s price then drops, they profit from the difference between the opening and closing prices; if it rises instead, they must pay that difference to the broker. No borrowing of the CFD or the underlying asset takes place – it’s a cash-settled derivative contract between the trader and the provider.

The Leverage Factor

Many people are drawn to CFD trading because they have a chance to use leverage to pump up their potential returns, though the risk of losing money also increases.

The use of funds borrowed from an online broker allows individuals or entities to control a larger position than if they used just their own funds. This increases both reward and risk.

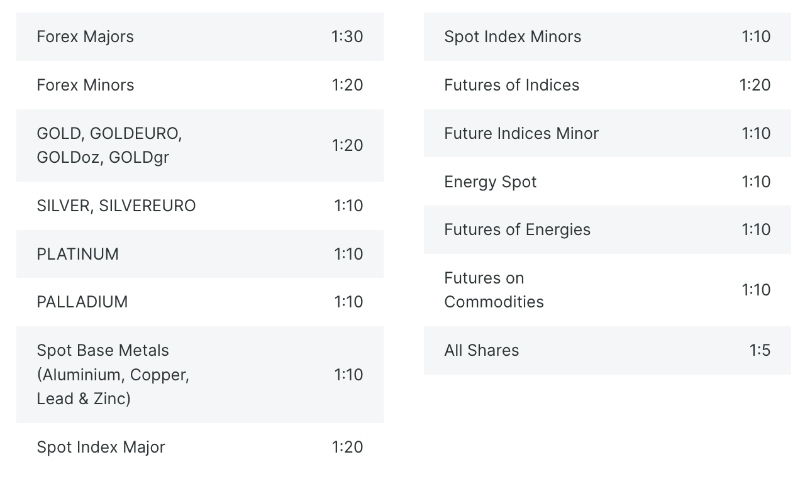

It is common for CFDs to offer higher leverage than most other financial markets. There are several factors that determine how much leverage one can access, including the brokerage used, the asset being traded, and the rules laid down by the relevant regulator. Those rules can be strict: ESMA’s intervention measures cap leverage for retail CFD traders in the EU, while in Australia, ASIC’s CFD product intervention order sets similar leverage limits and conditions.

To use leverage, traders need to put down a portion of the total value of the investment, known as margin. The balance is borrowed from the broker.

If the trade moves against them, an investor may be required to deposit additional funds to cover potential losses. This is known as a margin call.

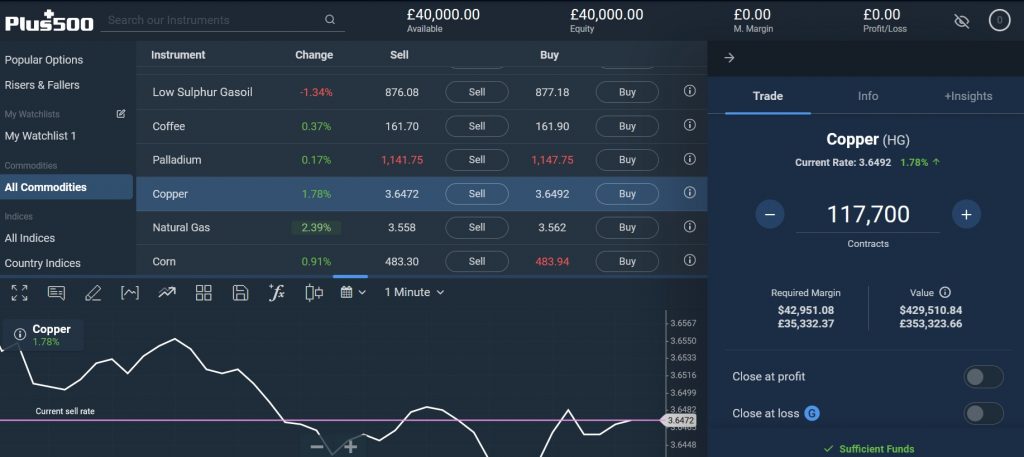

Here you can see the maximum leverage that FxPro offers CFD traders for different asset classes. A leverage ratio of 1:5 (or a margin rate of 20%) means that a trader can control a position size of $5,000 with just $1,000 of their own capital.

Whilst the use of leverage can supercharge a trader’s earnings, massive losses can be racked up if markets move in an unexpected direction. The number of people who end up making a negative return is significant.

Managing Leverage Risk

This is why taking a sensible approach to leverage is essential when CFD trading. It is a good idea for beginners to use low leverage or even no leverage at all.

Leverage of 1:2 or 1:3 can help new traders take part in the market without exposing themselves to monster levels of risk.

When your CFD trading strategy is paying off, it can be hard to resist racking up higher levels of leverage in the pursuit of bigger profits. But keeping a level head (and especially at the beginning) in this situation is critical. One highly leveraged loss can wipe out all the success you’ve had leading up to that point, as emphasized by major regulators, including ESMA’s FAQ on its CFD measures.

It is also important for traders to use tools like stop loss orders to help them establish strong risk management protocols. These particular functions automatically close a position when the market plunges to a price level that the trader has pre-selected, which in turn helps to minimize losses.

Take profit orders are another weapon that successful CFD traders frequently use. They work in a similar way to stop losses in that they close a position when prices reach a certain level, in this case, when the market has risen to a point previously identified by the investor.

Not only do take profit orders allow profits to be locked in before the opportunity passes. They help minimize the emotional aspect of the CFD day trading process, thus preventing traders from chasing bigger profits based on unsound reasoning.

Trading Fees

When it comes to trading costs, the primary thing to consider is the bid and ask spread. Individuals will trade at the buy (or ask) price if they wish to take a long position, and will trade at the sell (or bid) price if they want to go short.

Brokerages make money by offering CFDs at a slightly wider spread than the actual market spread.

Higher spreads can substantially eat into a trader’s profits, so it’s important to keep a close eye on this.

Some firms also charge a flat fee, known as a commission. Serious day traders looking to keep costs down may opt for a raw spread account with ultra-tight spreads and a low, fixed commission.

Finally, CFD traders should be aware that there may be a fee if they hold positions open overnight. This is known as a swap fee.

A CFD Trade In Action

Let’s say that a trader expects the share price of Tony’s Tyre Store to increase. They choose a broker and decide to buy some CFDs in the company. The tyre retailer’s shares are at that time trading at $50.

The investor deposits $1,000 with a broker that offers maximum leverage of 1:5. This allows them to control a position of up to $5,000 (5 x $1,000).

Using that $1,000 as the initial deposit, they decide to buy 100 CFDs in Tony’s Tyre Store, thereby creating a position that maxes out that total allowance of $5,000 (100 CFDs x $50).

Now, let’s assume that the retailer’s share price has gone up to $55 over the next week. The trader has made a $5 profit per CFD, meaning their total profit on the trade stands at $500 (100 CFDs x $5). At this point, they decide to close out their position and book those profits.

So, what return has the person made on their initial margin? This can be calculated by dividing the profit ($500) by the initial margin ($1,000) and then multiplying the resulting figure by 100.

The trader above has made a cool 50% return on their initial margin, which is far higher than they could have expected had they simply bought shares in Tony’s Tyre Company.

Had the individual spent their initial $1,000 to buy 20 shares (at $50 a piece) in the retailer, they’d have made a far-lower profit of $100 and an inferior return of 10% on their investment.

Pros and Cons of CFD Trading

Pros

- High flexibility: Traders can choose to speculate on a variety of asset classes and across many different markets, almost around the clock during the trading week, although trading hours still depend on the underlying market and the broker’s schedule.

- The leverage factor: These derivatives allow traders to do business with more money than they typically would in traditional investment markets. So individuals can control larger positions than if they had used just their own cash, providing an opportunity to make better returns.

- Low costs: CFD day trading can be cost-effective for short-term traders because many brokers charge low, or even zero, commissions (although total costs still include other fees such as spreads and overnight fees).

- Strong liquidity: In popular markets, CFD trading volumes are high, which allows investors to open and close positions simply and quickly. It also helps keep bid and ask spreads tighter, which is an important feature in keeping costs down.

- No ownership of the underlying asset: This allows short-term traders to go long or short, allowing them to make money even if markets fall. In some jurisdictions, such as the UK, this structure also means that trades in share CFDs are not subject to Stamp Duty or Stamp Duty Reserve Tax, although other taxes may still apply.

Cons

- Risk of large losses: While trading on margin can turbocharge profits, using lent funds from a broker is also highly risky. This is especially dangerous in the CFD market due to the elevated levels of leverage that are available.

- Counterparty risk: CFDs are transacted over the counter and not through an exchange, meaning that traders leave themselves at the mercy of the creditworthiness and integrity of the counterparty. Transparency is also weaker with OTC instruments like CFDs, and information on prices and trading volumes can be harder to source.

- Regulatory differences: The regulation of CFDs varies by jurisdiction. In regions such as the EU, UK and Australia, CFDs are subject to strict product-intervention rules, including leverage caps, margin-closeout rules and negative balance protection for most retail clients. In other places, protections may be weaker, particularly when trading with offshore or lightly regulated brokers.

How To Trade CFDs

It’s pretty straightforward to get started with trading CFDs. This is one reason for their soaring popularity in recent years. But as is the case with speculating using any financial instrument or on any asset class, mastering it is an art form and takes a lot of time and discipline.

Here are some of the key considerations for beginners starting their CFD trading journey.

1. Research

This is a no-brainer, really. As well as researching the particulars of how CFDs themselves work, a broader knowledge of financial markets and what moves them is essential.

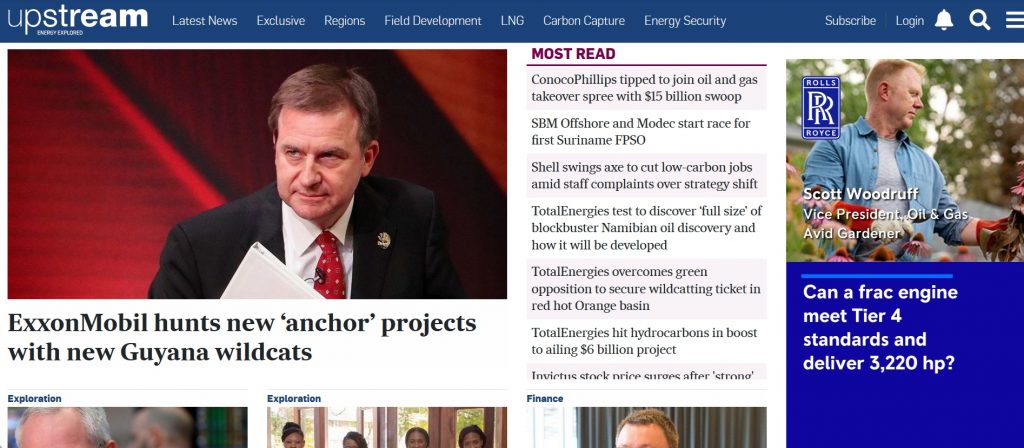

Fortunately, a wealth of CFD trading resources exists online for beginners to get up to speed, including educational websites and financial news sources.

At this stage, a trader will also get an idea of what underlying assets they may like to speculate on using CFDs. Of course, this will require them to expand their knowledge still further.

For instance, traders who wish to bet on oil need to understand how supply and demand-side factors interact to influence prices.

Key things to acknowledge include OPEC+ production levels and geopolitical conditions in the Middle East, economic data like GDP and factory output reports, and changes in the value of the US dollar.

A trader will also need to consider which trading strategies to use when buying or selling CFDs.

Key things to think about at this point include how frequently they wish to trade and what time of day, their attitude to risk, and whether they prefer to use fundamental or technical analysis.

2. Open An Account

Selecting which brokerage to use is the next step for new investors. The firm they eventually decide to use will depend on a wide variety of features, including:

- How easy-to-use and stable the trading platform is, and whether or not sophisticated tools (like advanced charts, news feeds and automated trading) are available.

- The range of underlying assets that can be speculated on using CFDs.

- The availability (and potential levels) of leverage.

- Margin requirements, and whether these suit the trader’s risk tolerance and trading strategy.

- Educational resources and other useful CFD day trading materials for beginners.

- Whether or not a demo account is available that can help new CFD traders get up to speed.

- Regulatory status and reputation with customers and market experts.

- Spreads and fees.

3. Buy Or Sell

If you buy, you go long. If you sell, you go short.

Bring up the trading ticket on your platform, and you will be able to see the current price. The first price will be the bid (sell price). The second price will be the offer (buy price).

The price of your CFD is based on the price of the underlying instrument. If you have a reason to believe the market will increase, you should buy. If you believe it will decline, you should sell.

4. Trade Size

You now need to select the size of CFDs you want to trade. With a CFD, you control the size of your investment. So although the price of the underlying asset will vary, you decide how much to invest.

Brokerages will, however, have minimum margin requirements – or more simply, a minimum amount that is required in order for the trade to be opened.

This will vary asset by asset. It will always be made clear, however, as will the total value (or your exposure) of the trade.

Volatile assets such as cryptocurrency normally have higher margin requirements. So a position with exposure to $2,000 worth of Bitcoin might need a 50% margin of $1,000, for example.

A well-traded stock, however, may only need a 20% margin. So a $2,000 position on Meta, may only require $400 of account funds.

5. Add Stops & Limits

This will help you secure profits and limit any losses. As explained above, most CFD trading strategies for beginners and experienced traders will employ the use of stop losses and/or limit orders.

They tie in with your risk management strategy. Once you have defined your risk tolerance, you can place a stop loss to automatically close a trade once the market hits a pre-determined level.

This will help you minimize losses and keep your accounts in the black – leaving you to fight another day on subsequent trades.

A limit order will instruct your platform to close a trade at a price that is better than the current market level.

If you opt for a trading bot they will use pre-programmed instructions like these to enter and exit trades in line with your CFD trading plan. These can be good for closing trades near resistance levels, without having to constantly monitor all positions.

6. Monitor & Close

Once you have placed your trade and stop or loss limits, the trade will shift along with the market price. You can view the market price in real time, and you can add or close new trades.

This can be done on most online platforms or through mobile apps.

If your stop loss or limit order hasn’t been activated, you can close it yourself. Simply select ‘close position’ from the positions window. You will be able to see your profit or loss almost instantly in your account balance.

Taxes

Although you can trade CFDs all over the world, where you’re based and the market you’re trading in can throw an expensive spanner in the works. CFD trading in Brazil will be different to that in the UK, Australia, India, South Africa, and Singapore.

This is mainly because of CFD taxes.

Tax treatment of CFDs varies widely between countries. In some places, related products such as financial spread bets may be classed as gambling and exempt from certain taxes, whereas CFD profits are usually taxed in the same way as investment or trading income.

In the UK, for example, most individuals are taxed on CFD profits under the capital-gains regime (and in some cases as trading income), rather than enjoying gambling-style tax exemptions.

Although you may get an annual exemption, any profits that exceed that could be taxed. This means you should keep a detailed record of transactions so you can make accurate calculations at the end of the tax year.

So, before you start CFD day trading, find out whether you will pay personal income tax, business tax, capital gains tax, or if you’re lucky, no tax. Once you know what type of tax obligation you will face you can incorporate that into your money management strategy.

Bottom Line

The use of leverage means CFDs can be an attractive way for short-term investors, such as day traders, to make large returns. There is a good selection of CFD brokers to choose from and a variety of asset classes for them to speculate on.

However, trading these financial instruments shouldn’t be taken lightly and may not be suited for beginners with a low risk tolerance. Losses can get out of control quickly, and so a disciplined approach is essential.

FAQ

What Is A CFD?

A contract for difference, also known as a CFD, is a financial instrument that allows traders to speculate on rising and falling prices without owning the underlying asset.

CFDs are popular with short-term retail traders and can often be traded with leverage, allowing investors to take a much larger position than their balance would otherwise allow, increasing returns and losses.

Is CFD Trading Legal?

CFD trading is legal in many jurisdictions, including the UK, Australia and much of Europe. In some countries, such as the US, retail investors generally cannot trade over-the-counter CFDs under current rules, so major brokers do not offer CFD accounts to local residents.

You can check the latest rules and regulations on the respective regulator’s website.

Are CFDs Suitable For Day Trading?

CFDs are popular with day traders. They can be more cost-effective than traditional investing vehicles like share dealing. The availability of leverage also means traders can amplify their buying power and potential returns.

With that said, CFD day trading is also risky. An effective risk and wallet management strategy is essential.

Is CFD Trading A Good Idea For Beginners?

Low margin rates and the fact that traders never own the underlying asset can make CFD trading attractive to new investors.

With that said, it’s highly risky, which is why major jurisdictions like the US have tightly restricted CFD products. At many regulated brokers, retail clients have negative balance protection, but you can still lose all the money in your account very quickly, and in some setups (for example, professional or offshore accounts), losses can exceed your initial deposit.

As a beginner, consider trialling your strategies on a demo account before investing real cash.

Recommended Reading

For Specific Countries

Article Sources

- CFDs Made Simple: A Beginner’s Guide To Contracts For Difference Success - Jeff Cartridge & Ashley Jessen, 2011

- Making Money From CFD Trading - Catherine Davey, 2011

- Basics Of CFD Trading In Forex - Martin Maga, 2020

- Leverage Trading: A professional approach to trading FX, stocks on margin, CFDs, spread bets and futures for all traders - Robert Carver, 2019

- Contracts For Difference (CFD) - ESMA

The writing and editorial team at DayTrading.com use credible sources to support their work. These include government agencies, white papers, research institutes, and engagement with industry professionals. Content is written free from bias and is fact-checked where appropriate. Learn more about why you can trust DayTrading.com