Trading Education

Education is key to successful trading, and there are a wealth of options available. This guide shares our pick of the best educational tools for beginners to advanced traders, covering different markets, trading styles and budgets.

Quick Introduction

- Trading education provides insights into risk management, helping you understand potential pitfalls and how to mitigate losses.

- Educational tools help in crafting effective trading strategies, honing skills, and adapting to different market conditions.

- Education fosters confidence, enhancing your prospects for sustainable success in trading while minimizing costly mistakes.

- The key is finding high-quality trading training tools that align with your experience level, budget, and in a format that suits your style of learning.

Brokers With The Best Education

These are the 4 best brokers with educational resources for beginners:

-

1

Interactive Brokers

Interactive Brokers -

2

NinjaTrader

NinjaTrader -

3

eToro USAeToro USA LLC and eToro USA Securities Inc.; Investing involves risk, including loss of principal; Not a recommendation

eToro USAeToro USA LLC and eToro USA Securities Inc.; Investing involves risk, including loss of principal; Not a recommendation -

4

Plus500USTrading in futures and options involves the risk of loss and is not suitable for everyone.

Plus500USTrading in futures and options involves the risk of loss and is not suitable for everyone.

The Best Brokers For Beginners

The Importance Of A Good Education

Getting educated before diving into online trading is like laying a sturdy foundation for a building. It’s crucial because it equips you with the tools, knowledge, and frameworks necessary to navigate the complexities of the financial markets.

Understanding market dynamics, different asset classes, risk management strategies, and various analysis tools is akin to having a map before embarking on a journey.

This knowledge not only minimizes the potential for substantial losses but also enhances the ability to make informed trading decisions amid the ever-shifting landscape of the markets.

However, education in trading isn’t a one-time endeavor, it’s an ongoing journey. Even experienced traders benefit from continuous learning and staying updated with market trends, new strategies, and evolving technologies.

Keeping abreast of new trading methodologies, refining existing skills, and embracing evolving market trends will help you to navigate the intricate nuances of online trading.

Best Educational Tools

We have rounded up our pick of the top training tools for aspiring traders:

IG Academy

IG Academy is an award-winning education resource with over 40 years of experience in the trading sector.

With a focus in trading through leverage, CFDs and spread betting, IG helps you trade in a number of markets such as forex, stocks, indices and commodities.

IG Academy provides a number of free courses which include video tutorials, interactive exercises and quizzes.

They also offer live trading webinars for those who sign up to their website. In addition, they have a free chat room (although you must be a member to post) with over 60,000 members.

In the long run, what IG Academy encourage is that you sign up to use their trading platform, which continues to offer support and education to you as you trade for yourself.

IG makes its money by charging commission on your trades.

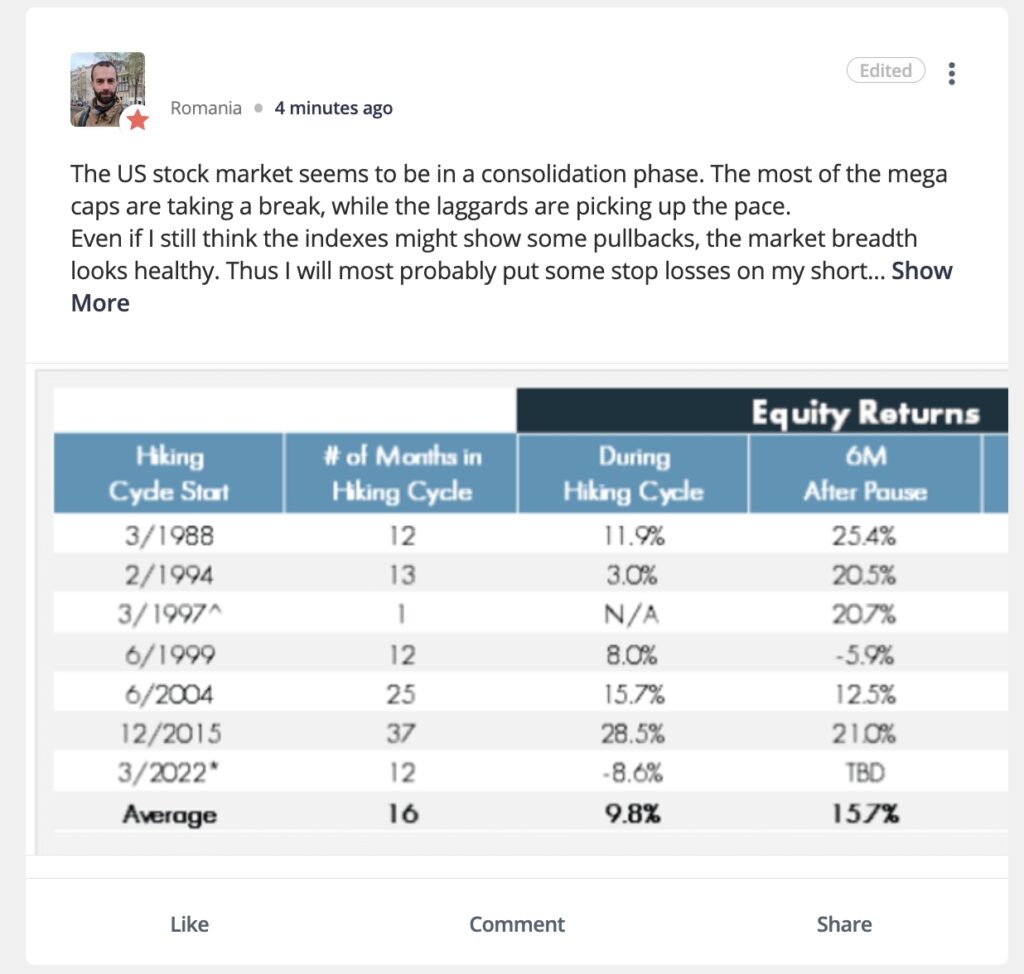

Social Trading

An increasingly popular way to learn and engage in the financial markets is through social trading. These platforms are home to active communities where investors can share ideas, discuss strategies and even copy each other’s trades.

eToro offers a particularly strong social trading solution. The award-winning social investment network has more than 30 million users from over 140 countries.

Strong points are the user-friendly web platform and community chat. Here, you can find market insights and discussions about popular asset classes from stocks and forex to commodities and crypto. Over time, you can build a newsfeed that’s tailored to your trading interests.

The other useful element is copy trading. You can find, follow and mirror the trades of more experienced investors – sharing in their profits (and losses). This has proven to be a popular way to learn about online trading.

You can choose master traders based on their risk score, location, returns and more. However, it’s important to remember that past performance is no guarantee of future results.

Demo Accounts

One of the best resources to complement your trading education is a demo account.

Funded with virtual funds, you can practice what you learn from books, videos, podcasts and courses, including analyzing trends, identifying entry and exit points, and employing risk management tools like stop-loss orders.

The key elements we recommend looking for are paper trading accounts with no time limit, so you can continue developing strategies in a risk-free setting alongside a real-money account, a large virtual bankroll, and an environment that accurately mirrors live market conditions.

AvaTrade is a good option here. The multi-regulated broker offers an unlimited demo account with $10,000 in virtual funds and access to over 1,250 instruments on MetaTrader 4, MetaTrader 5 and their proprietary platform.

Live Trading Sessions

Live trading sessions can also be a handy way to see real-time market analysis and trade planning, talked through by experienced traders as price action unfolds.

Several brokers and platforms offer this kind of content: IG’s ‘Trade Live with IG‘ runs weekday morning shows with market commentary and trade ideas, while ActivTrades hosts interactive sessions with guest traders.

If you prefer YouTube-style learning, FOREX.com shares daily market updates and technical outlooks, while eToro mixes news, analysis and education.

You can also study live and historic trade ideas from the wider community on TradingView via Community – Trade Ideas. Thousands of chart setups are posted and often explained step by step.

How To Compare Trading Education

Considering Costs

When exploring trading education options, cost naturally becomes a significant factor to consider. There’s seldom a genuinely free offering, and most platforms or courses that initially tout free access eventually introduce paid features or advanced services.

The objective lies in discovering a trustworthy, top-tier resource that delivers considerable value for the investment. Determining what comprises this value depends on your individual aspirations and situation.

Consider these aspects when evaluating options:

- Know what you want: Before hastily entering your payment information on the initial site promising financial liberation, be sure to clarify your objectives. Are you inclined towards stocks or forex trading? Assess your investment capacity, whether a modest sum suffices or a more substantial investment is feasible. Determine your preferred learning style, whether through reading or visual aids, and decide if you prefer comprehensive guidance or are comfortable using indicators independently.

- Do your homework: Certain websites transparently disclose their course or educational package costs, while others necessitate deeper investigation. When a course advertises ‘free’ education, it often implies that payment commences after a certain number of lessons. These subsequent costs might not be prominently displayed, so it’s advisable to review the fine print or inquire in advance about any potential future expenses that might be requested.

- Budget: The prices of courses and indicators span a broad spectrum, ranging from as low as $20 to as high as $10,000 and more, while subscriptions can vary between $10 monthly to over $200. Opting for a premium course entails a significant commitment, so ensure it aligns with your financial capacity and that the value you derive from it justifies the investment.

Finding Your Level

Trading education courses often categorize themselves into different levels, such as Beginner, Intermediate, or Pro, usually aligning their prices on a sliding scale. The beginner courses are typically the most affordable, and the advanced ones are more expensive.

When seeking the best trading education, it’s advisable to realistically assess your proficiency level as a trader. Jumping straight into a premium or gold-level trading room without basic knowledge might not yield the desired results.

For those who have some experience in stock trading and seek advancement or exploration in other trading areas, an intermediate course may be better.

Advanced education should be reserved for seasoned full-time traders seeking mentoring to refine their strategies and stay updated.

Paying For Quality

The quality and variety of resources in trading education vary significantly. Caution is advised with trading school founders claiming courses were born from frustration with ineffective systems and indicators, as an expensive course doesn’t always guarantee reliability.

The kind of services or resources you might expect to find offered as part of a trading education package might include:

- Indicators: Programs that use various calculations to analyze and indicate the direction of asset prices.

- Webinars/Tutorials/Live Classes: Live online lessons or tutorials with experienced traders.

- Mentoring: One-on-one support from an expert trader.

- Downloadable Materials: This might include PDF booklets or interactive quizzes that explain trading in greater depth.

- Weekly/Daily E-mails: These might provide you with a certain trader’s insights or market advice for the day.

- Demo Accounts: These allow you to practice trading using a simulation platform and virtual funds.

- eBooks: eBooks are occasionally available free to generate interest in a more detailed, paid course.

The primary gauge of a package’s quality lies in the credibility of the trader endorsing it. Only consider investing if the trader boasts a track record of at least 10 years with visible success. Expertise in trading is built through direct experience. Those lacking substantial experience might not offer worthwhile insights.

The training materials themselves should emphasize self-reliance in trading. A credible trading mentor empowers students to trade independently.

Platforms requiring ongoing payments for continued access might hinder your ability to develop the mindset necessary for self-sufficient trading success.

Trading education is like assembling the pieces of a puzzle. Each lesson adds another piece, gradually revealing the bigger picture of market mastery.

Bottom Line

Getting educated before trading online is crucial because it equips you with the knowledge and skills necessary to navigate the complexities of the financial markets.

Even experienced traders should never stop educating themselves as it fosters confidence, sharpens critical thinking, and enables them to adapt to ever-changing market conditions, ultimately increasing their prospects for success and long-term sustainability in trading.

FAQ

What Are The Essential Topics To Cover In A Trading Education?

Key topics include market analysis (technical and fundamental), risk management, trading psychology, strategies for different markets (stocks, forex, cryptocurrencies, etc.), and practical application through simulated or real trading experiences.

What Should You Consider Before Choosing A Trading Course?

Before selecting a trading course, consider your trading goals, preferred learning style, course content, reputation of the educator or platform, and cost versus value proposition.

How Do You Know If A Trading Education Provider Is Reputable?

Look for training materials backed by experienced traders or institutions, check reviews and testimonials from past students, assess the transparency of the content and methodology, and ensure the resources align with your specific trading interests.

Is Live Mentoring Or Interaction Important In Trading Education?

Live mentoring or interaction can significantly benefit traders, providing opportunities for real-time guidance, Q&A sessions, and the chance to apply learned concepts under supervision, fostering a better understanding of trading nuances.

How Should You Continue Your Trading Education Once You’ve Completed A Course?

Continuous learning is crucial in trading. After a course, stay updated with market trends, read relevant books or articles, engage in trading communities or forums, attend webinars or seminars, and consider advanced courses or workshops to refine skills further.

What Are The Best Online Trading Educational Videos?

We have listed the most popular YouTube videos that provide educational materials. However, it’s important to note that while they offer value, navigating them can be tricky. Don’t solely rely on flashy graphics or catchy titles. Assess if the presenter holds substantial trading experience.

Also consider whether they are genuinely imparting knowledge for free, or is it a tactic to sell unnecessary products? Can the complexity of day trading, for example, be adequately conveyed in a 5 or 10-minute YouTube tutorial?

Recommended Reading

Article Sources

- AvaTrade Education Center

- XTB eBooks

- CMC Markets Learn Hub

- IG Academy

- Pepperstone Education Center

- eToro Social Trading

- AvaTrade Demo Account

- The Complete Day Trading Education for Beginners, Neil Hoechlin, 2017

The writing and editorial team at DayTrading.com use credible sources to support their work. These include government agencies, white papers, research institutes, and engagement with industry professionals. Content is written free from bias and is fact-checked where appropriate. Learn more about why you can trust DayTrading.com