Copy Trading For Beginners

Copy trading is replicating another trader’s positions using a copy trading platform. It can be a great way for beginners to start trading and learning with minimal effort, as it allows them to observe first-hand the actions of more experienced traders. However, it also involves risks and some loss of control, so while there are many success stories, it’s not guaranteed to work for everyone all the time.

This guide for beginners will cover what copy trading is, how it works, and how to get started. We will also look at the pros and cons, plus list the best copy trading platforms on the market where you can start trying it out for yourself.

Key Takeaways

- Copy Trading allows investors to copy more experienced traders and benefit from their knowledge and success.

- It is very easy to get started, and you can start trading with as little as $10.

- Copy trading can be done on most markets, including the stock market, forex market and crypto market.

- The copying trader chooses how much risk he wants to expose himself to by selecting which traders to copy.

- It is always best to diversify and copy more than one trader to lower risk.

Top 4 Copy Trading Brokers

These 4 brokers offer award-winning copy trading platforms with transparent fees and low entry requirements:

-

1

eToro USAeToro USA LLC and eToro USA Securities Inc.; Investing involves risk, including loss of principal; Not a recommendation

eToro USAeToro USA LLC and eToro USA Securities Inc.; Investing involves risk, including loss of principal; Not a recommendation -

2

xChief

xChief -

3

Pionex

Pionex -

4

InstaTrade

InstaTrade

Download DayTrading.com’s Copy Trading For Beginners PDF

What is Copy Trading?

Copy trading is a type of trading where you copy the trades performed by another, more experienced trader. It can be manual, semi-automatic or fully automatic.

Copy trading allows individuals to automatically copy another trader’s positions when they are opened or closed. Experienced traders communicate their positions using signals via social networks or forums, where followers can copy the methods.

The definition of copy trading is closely linked to mirror trading, although the difference with copy trading is that traders blindly copies rather than replicate top strategies.

Traders can copy positions in many markets, including forex, stocks and CFDs. You can also copy trades on popular crypto coins, including Bitcoin (BTC) or major precious metals such as Gold or Platinum.

Copy trading can be a good way to start trading, but it is important to understand that you will not become rich overnight. Any attempt to rush, and you will have to copy very high-risk trades, and you will likely end up losing your money.

All types of trading involve risk, so traders should always carry out their own research and understand how it works before committing capital.

How Does Copy Trading Work?

Copy trading allows you to connect a part of your portfolio with someone else’s, where any opened trades and future actions are automatically copied to your account. This can be a great way to diversify your investments; for example, a trader might consider following a long-term investor in the stock market.

Followers can choose how much funds to allocate to copying a certain trader. You can adjust this amount later depending on the trader’s success.

When a trade is copied into your account, it will normally be an exact copy of the trade performed in the master account (albeit sized to fit your budget). The trade will be replicated with the same stop loss (SL) and take profit (TP) as the original trade.

The transaction price will be mirrored as exactly as the market conditions allow. The transaction price can sometimes vary slightly in fast-moving markets.

The purchased instruments will be held in your account until the master account chooses to close his position or until the stop loss (SL) or take profit (TP) is triggered.

Note that whilst some platforms may allow you to have some control over your funds, some may operate on a fixed system. A fixed system will allow you to stop copying a trader, but you are unlikely to have much control elsewhere.

A fixed system will not allow you to close a position early while still following the master account.

Types of Trading

Below you will find guides that will help you if you want to start with a particular type of copy trading.

How to Start Copy Trading

It is very easy to start copy trading. You can get started in just a few minutes.

- Choose a broker

- Open an account

- Deposit money to your account

- Choose a trader to copy

- Choose how much money to use

- Start trading

You can read more about each step further down on the page. You can choose to copy more than one trader. To do so, increase your diversification and reduces risk.

Choose a Broker

There is a vast range of copycat trading brokers offering both proprietary and third-party copy-trading platforms. The list of copy trading brokers allows you to compare all of them on the features that are important to you. Remember that it’s always important to do your own research to find which one would be best for you.

Open an Account

To open a trading account, you must sign up for a live account with your broker. Check your broker’s regulation status beforehand, as this will determine the level of security and fund safety provided.

Opening an account is very quick and can be done in a few minutes.

Deposit Money to Your Account

Once you have opened an account with a broker, you need to deposit money into your account. Most brokers offer a wide selection of ways to deposit money into your account. Most brokers allow you to use bank transfers, Credit Cards and a number of e-wallets. Some brokers even allow you to deposit money through Crypto. Make sure the broker you choose accepts the payment method you want.

How much money you need to start copy trading varies between different brokers. The amount is usually rather low. Some brokers require as little as $10 in your account for you to be able to start trading. Other brokers require a little more, but the amount is seldom more than a couple hundred dollars.

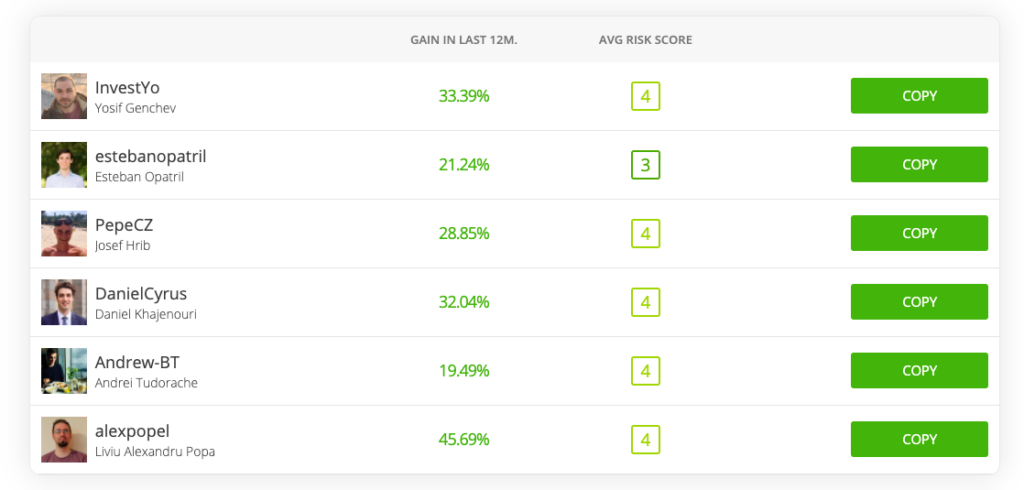

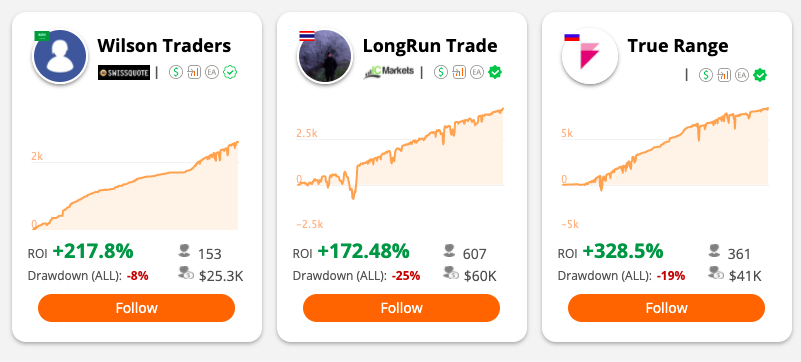

Choose a Trader to Copy

You will need to choose which account or accounts you want to follow. It is always better to follow more than one master account. This allows you to earn money even if one account underperforms.

Make sure to personally evaluate an account before you decide to subscribe to that account.

Make sure that the accounts you follow use a trading risk strategy that you feel comfortable with. The best accounts to follow will vary depending on your risk tolerance and investment goals.

Choose How Much Money to Use

You will need to decide how much money you want to allocate to copying the traders of each trader you follow. You can use the entire account balance to copy a single trader.

This is generally not a good idea since you will expose yourself to significant levels of risk. It is better to subscribe to 10 different traders and allocate each account 10% of the money in your portfolio.

It can also be a good idea to weigh the allocated money based on the risk profile of the copied trader. Allot a lower amount to traders with a high-risk profile that can generate high returns and a larger amount to lower-risk traders that will produce lower returns but are less likely to lose your money.

Only you can decide how to allot your money and how much risk you want to expose yourself to.

Start Trading

The platform will start trading for you as soon as you have chosen a trader to follow and allocated funds to copy that trader automatically. There is nothing else you need to do.

Now you have to keep track of the results of the trading in your account. You might want to stop a subscription if you feel that it is under performing or you might want to allocate more money to a trader that does exceptionally well.

Pros & Cons

Pros

- Good for beginners – one of the main benefits is the convenience of having someone else do the work, which means you don’t have to be a copy trader guru or expert to take part. It’s also great for any trader who doesn’t have the time to commit to full-time day trading.

- Demo accounts – some brokers offer demo copy trading accounts, which are ideal for new traders who want to browse the platforms first. Demo accounts are free of charge, risk-free and often provide access to useful research tools.

- Authorised practice – copy trading is generally recognised by key regulatory frameworks, including CySEC, ESMA, MiFID and the FCA. Choosing a licensed and reputable broker will ensure your funds are safe and not exposed to scams.

- Portfolio diversification – traders can gain exposure to opportunities or trends that they wouldn’t usually consider without the help of another trader’s expertise.

Cons

- Risk – the risks can be high even if you choose an experienced trader to copy. If a strategy is unsuccessful, the risk will also translate onto a follower’s account and can result in a financial loss.

- Control – one of the main disadvantages is the lack of control a trader will have once they begin copying an account; traders are essentially entrusting their portfolio to a stranger.

- Fees – depending on the broker, copy trading may involve fees. For example, OctaFX clients pay a Masters’ commission which is specified individually and charged in USD per lot of traded volume. There will also be a minimum deposit amount to invest in a trader. At eToro for example, the minimum amount is $200.

- Not widely available in the United States (US) – copy trading is generally not available to US residents due to the Dodd-Frank Act, which puts restrictions on lenders to protect US consumers from abusive practices.

Risk

All types of trading are associated with risk. You always risk losing part or all of your investment. Never invest money you can not afford to lose. The risk associated with copy trading depends on the type of asset or security you choose to copy trade.

Copying the trades of a trader that trades high-risk assets such as Forex, Crypto or binary options will be high risk. Copying the trades of a trader that trades low-risk securities such as blue chip stocks will be low risk.

You should follow a trader that trades using a risk profile that you feel comfortable with. Many platforms will give you a risk indicator for each trader you can choose to copy, but it is always best to manually inspect their trade history and see if you feel comfortable with their trading strategies and risk profile.

When in doubt, choose a broker with a lower-risk profile. You can increase your risk exposure later on, but if you choose a high-risk strategy and lose money, it will be too late to move that money to a lower-risk option since the money is already lost.

A common beginner’s mistake is only copying one trader. A profitable trading history does not guarantee future returns. All traders can produce a period of poor returns or losses. It is always best to split your money and follow more than one trader. This will give you better diversification and will allow you protect your balance even if one trader has a bad month or year. Diversification will reduce the risk associated with all types of trading and is one of the most basic types of risk management. All beginner traders should try to diversify their investment portfolio.

Other risks associated with copy trading include:

- Unrealistic expectations: Beginners might expect unrealistic profits from their investments. This can cause them to feel unsatisfied with the results they achieve or cause them to copy extremely high-risk strategies that have a high chance of losing all their money.

- No independent perspective: Beginners might assume more risk than they realise by unknowingly following trading accounts with high-risk strategies. This risk is mitigated on platforms with 3rd party information about the master accounts that they can follow. MetaTrader is a good example of this since MetaTrader provides a risk indicator for all signal subscriptions.

- No diversification: Many beginners choose only to mirror one trader. It is always best to follow multiple accounts.

- Poor risk management: Traders who use copy trading without much knowledge of the markets might lack the necessary risk management knowledge to use this type of trading safely.

Is Copy Trading Legal?

Yes, Copy trading is legal in the US and most other jurisdictions. You can check if Copy trading is legal in your country below.

Is copy trading legal in?

| United States: | ✔️ Yes* |

|---|---|

| Canada: | ✔️ Yes |

| United Kingdom: | ✔️ Yes |

| Australia: | ✔️ Yes |

| New Zealand: | ✔️ Yes |

| South Africa: | ✔️ Yes |

| European Union: | ✔️ Yes |

| India: | ✔️ Yes |

| Singapore: | ✔️ Yes |

| Kenya: | ✔️ Yes |

| Hong Kong: | ✔️ Yes |

*It is legal in the united states but is subject to stricter regulations than it is in most other countries.

Copy trading is legal in most other countries as well. Regardless, it is always best that you check local law before you start trading. Laws that restrict trading usually regulate brokers, not individual traders who want to start trading.

Vs Social Trading

Social trading focuses more on gaining ideas and insights from different websites and services in order to develop new strategies, share tips and invest in tools. Copy trading is more focused on replicating trades and copying the trades and results only.

Beginners or new traders may want to start with social trading to help them understand market behaviours and trends before committing to copy trading. Companies such as Liteforex for example, offer comprehensive networking tools which provide valuable exposure to complex strategies and market research.

Copy Trading Cryptocurrency

Cryptocurrencies are a relatively new entrant to the financial markets, offering volatility and profit potential. Many providers are quickly working to offer cryptocurrency copy trading on leading crypto coins, including Bitcoin, Ethereum and Litecoin. Much like you would copy forex positions, users can mirror trades on crypto only pairs plus crypto and fiat currency pairs.

Leading providers, such as eToro, offer copy trading on cryptocurrencies, along with dedicated crypto platforms, such as Coinmatics and 3Commas. The latter two offer intelligent crypto copy trading robots that quickly execute market positions in real-time. Clients benefit from a user-friendly dashboard to follow their investment.

Strategy

It’s important to consider how your own trading strategy aligns to that of the providers you wish to copy. This will help to ensure there isn’t a major disparity in risk tolerance, for example.

Important strategy considerations include:

- Risk – Quantify your risk appetite – how much market volatility are you willing to accept and what alerts and tools will you put in place to manage your risk?

- Markets – What financial markets do you want to invest in? Forex, stocks, indices, commodities and cryptocurrencies are all popular markets. It’s important to understand the market you wish to invest your money in.

- Fixed or flexible – How much control do you want to have over your capital? Fixed and fully-automated copy systems will see you mirror trades with minimal control or input. Those wanting more influence and control may want to opt for a more open and flexible system.

- Research – There is a danger with copy trading that clients won’t do their due diligence before investing large sums of money. It’s important to not only carefully research providers before you sign up, but also to regularly monitor trading performance once your capital is on the line.

- Leverage – Leveraged copy trading lets you increase your position sizes with small capital outlay. This means you can increase your profit potential and diversify your portfolio by mirroring the trades of multiple providers. Leverage rates vary depending on your jurisdiction, CySEC regulated providers, for example, cannot offer more than 1:30 leverage.

Trading Signals

As the name suggests, signals are essentially indicators that followers can use to take a position on the markets. Once you’ve received a signal, you can then edit your settings and trading parameters in line with your strategy. Signals tend to offer more flexibility than fixed and automated copy trading. You may want to edit your trade size, stop loss and take profit levels before you execute trades.

MetaTrader 4 and MetaTrader 5 are two leading signal providers, with thousands of top traders offering free and paid alerts.

History

Early History

Internet trading platforms have made copy trading very easy, but copying other traders predate the internet. You used to be able to subscribe to trading signals through phone and regular mail. These services were often expensive and were commonly scams that provided little value to investors. The services were usually advertised in regular newspapers to target less sophisticated investors. You were required to make the recommended transactions yourself once you received the signal. Signals sent through the mail were usually several days old when they arrived at the subscriber.

Early Internet Trading

Copy trading online can trace its roots to subscriber newsletters and IRQ chat rooms. Individual traders shared their trades by writing about them in the chat room or by sending out a newsletter to their subscribers. Traders later started to use private forums in the same way.

Investors who wanted to copy trades needed to read the announcement as soon as possible and manually execute the trade. They did not receive any notifications if they did not visit the chat room or read the newsletter. Copying the trades required effort by the copying trader.

Some newsletters, chat rooms and forums were free, but most required you to pay a monthly fee to access the information posted. Traders were often able to comment on the trade and post questions to the people they copied.

The fact that traders needed to execute all trades manually created a large barrier to entry for traders who wanted to use these services. It was not possible to be a passive copy trader. If you wanted to copy another trader, you needed to monitor the trades shared actively and manually perform the transactions.

Automated Trading

Some traders realized that improved internet technology opened the door to improve this type of trading by creating trading software to replicate online trades automatically. The first fully automated trading solutions were introduced to the market in the middle of the noughties.

An example of one of the first automatic trading systems for copy trading was called Mirror Trader. Mirror Trader was introduced by Tradency in 2005. Mirror trader enabled connecting your own trading account to the software to automate the trading fully.

Mirror Trader also allowed traders to host their own trading strategy on the system, and other users could choose to copy the trades generated by that strategy. Mirror Trading recorded and displayed the trading records of each trading strategy. This allowed traders to make an informed decision before they chose to mirror another trader’s strategy. This made Mirror Trader by Tradency a much safer alternative than many other services that provided their own, often fraudulent, trading history.

Mainstream Popularity

Copy trading became an increasingly popular service, and many online trading platforms and brokers added some type of copying feature. Most of them added this feature after 2010. Some brokers have since retired these services. FXPro is an example of this. They shut down their Supertrader feature in 2017.

This type of trading has traditionally been most prevalent on the Forex market, but regulatory bodies have instituted stricter rules which have caused it to become less popular. the trade has, at the same time, become increasingly popular among stock traders and other types of traders as well. Etoro has played a large role in making copy trading as popular as it is today. They introduced and trademarked their system in 2012. Copy trader now has more than 135 000 different traders that you can choose to copy.

FAQ

What is the Best Copy Trading Platform in 2026?

An overall favourite among traders is the award-winning brokerage, eToro, which has been cited by numerous online reviews. For those who wish to use popular third-party platforms, AvaTrade or Pepperstone are also good choices.

Use our list of top brokers to compare all platforms.

Is Copy Trading Halal?

Some brokers offers Islamic (swap-free) live accounts, which comply with Sharia law. You can get in touch with your broker to find out if this type of trading is supported in your account.

Is Copy Trading Good for Beginners?

Copy trading can be very good for beginners since it is one of the best and easiest ways to become an active trader without having to know much about the market by copying the transactions of another successful trader. Copy trading can also be an excellent way for a beginner to learn more about trading.

Is Copy Trading a Good Idea?

Copy trading can be a good idea if you copy a skilled trader and are aware of the risk associated with copy trading. All types of trading can result in losses.

Whether or not it is beneficial for you depends on your financial situation and what type of copy trading you want to engage in. I recommend that you look at the pros and cons of copy trading and the risk associated with copy trading to determine for yourself if copy trading is right for you.