Best Binary Options Copy Trading Platforms In 2026

Binary options copy trading lets you automatically mirror the trades of another trader on a binary platform. But short expiries mean timing, pricing, and execution all matter. Even small delays or differences between accounts can change outcomes. That’s why copying in binaries shouldn’t be a “set and forget” solution.

We’ve listed the best brokers for binary options copy trading. We also explain how these systems work, and where they can break down – essentials to know before trusting another trader’s strategy.

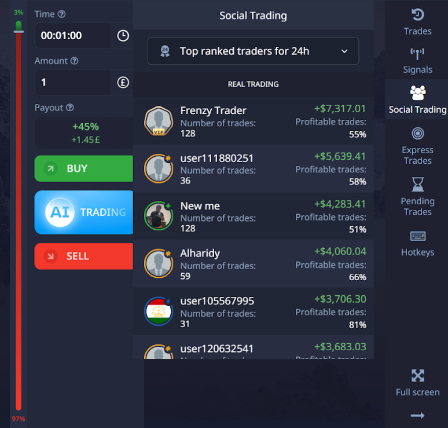

Top Binary Options Copy Trading Platforms

After investigating and evaluating their copy trading offerings, these brokers topped our tests. Note that just because a provider may accept residents from your country, it does not mean they are regulated - you may not receive any local legal protections.

Here is a short overview of each broker's pros and cons

- IQCent - A copy trading service is pre-integrated into the IQCent's web platform, where you can follow and replicate the trades of up to 10 established traders. Where it's great is how easy it is to use - you simply decide how much you want to invest and hit 'copy'. Our gripe is that the pool of master traders is narrower and you get more limited data on past performance than most other binary firms in our rankings, making it less reliable.

- Videforex - Videforex offers an integrated copy trading service where users can automatically or manually replicate the positions of other traders. Win rates for some ‘Top Traders’ were as high as 100% in our latest tests, but we recommend checking the total number of trades the win rate is for, which you can track in the copy trading interface. It’s also worth using the ‘watching’ feature for a while before copying binary traders.

- RaceOption - RaceOption has a well thought-through copy trading service, available to live account holders. In our last assessment, we really liked the level of stats you get on traders before you hit copy, including profitability, total profit, total turnover, balance, win rate, and total trades. Being able to set your own copy trading rules also adds important flexibility we’ve not seen at some other firms in this list.

- BinaryCent - BinaryCent offers a slick copy trading experience, with a ‘Top Traders’ leaderboard that you can filter by daily, weekly or monthly (we prefer monthly as it indicates more reliability in the long-term). Copying traders is also intuitive in our experience - you simply select the proportion to copy in percentage terms, plus the minimum and maximum trade amounts, then hit ‘Copy’. Results from copied trades are visible in the platform so you can track trades.

- World Forex - Use copy trading signals on MT4 to replicate strategies in your own live account. No additional fees apply and the platform is available via downloadable software plus a web-accessible solution.

- Deriv - Deriv stands out in this toplist as our most trusted binary broker for copy trading. The platform lets you replicate the positions of experienced traders through signals on DMT5. From our time testing the service, you receive signals in real-time and then decide whether to action trades in your own account. The best part is that the process of copying is still automated, which is ideal for those seeking a hands-off approach.

Comparison of Copy Trading Features at Top Brokers

Some binary brokers let you purely copy/ mirror trades, others provide social trading features where you can interact with followed traders too, and some offer signals with alerts to positions you can then choose to copy along with the parameters.

| Broker | Copy Trading | Social Trading | Binary Signals |

|---|---|---|---|

| IQCent | ✔ | ✔ | - |

| Videforex | ✔ | ✔ | ✔ |

| RaceOption | ✔ | ✔ | - |

| BinaryCent | ✔ | ✔ | - |

| World Forex | ✔ | ✘ | - |

| Deriv | ✔ | ✘ | ✔ |

IQCent

"IQCent is great for traders wanting bespoke binary assets, with a growing roster of 150+ products, including ‘Hype Pool’ contracts, which track trending events. Short-term expiries from 5 seconds, payouts that can hit 95% (with up to a 3% boost), and a TradingView charting package with 100+ indicators, also make it ideal for serious, fast-paced traders."

Jemma Grist, Reviewer

IQCent Quick Facts

| Demo Account | Yes |

|---|---|

| Instruments | Binary Options, CFDs, Forex, Indices, Commodities, Crypto |

| Platforms | Online Platform, TradingView |

| Minimum Deposit | $250 |

| Minimum Trade | $0.01 |

| Leverage | 1:500 |

| Account Currencies | USD, EUR |

Pros

- CFD trading fees are competitive based on tests, including 0.7 pips on major forex pairs such as EUR/USD

- There's an accessible $0.01 minimum stake for new day traders with a small budget

- The broker's 24/7 customer support is fast and reliable, responding within 1 minute during tests

Cons

- IQCent charges a punitive $10 monthly inactivity fee if you fail to place at least 1 trade per month

- IQCent trails binary brokers like Quotex with its narrow investment offering of around 175 assets with limited stocks

- The market analysis is very basic with limited technical summaries and insights from analysts

Videforex

"Videforex will serve traders looking for an easy-to-use platform to speculate on the direction of popular financial markets through binaries, especially cryptos and stocks, with dozens of assets added. The integration of TradingView charts also caters to technical traders. However, it requires a trade-off – no regulatory oversight, making it a risky choice. "

William Berg, Reviewer

Videforex Quick Facts

| Demo Account | Yes |

|---|---|

| Instruments | Binary Options, CFDs, Forex, Indices, Commodities, Crypto |

| Platforms | TradingView |

| Minimum Deposit | $250 |

| Minimum Trade | $0.01 |

| Leverage | 1:2000 |

| Account Currencies | USD, EUR, GBP, AUD, RUB |

Pros

- Traders can earn up to 98% payouts on 150+ assets with the broker’s binary options, bringing it in line with competitors like IQCent.

- Videforex is one of the few brokers with 24/7 multilingual video support, providing comprehensive assistance for active traders.

- Videforex regularly runs trading contests, offering practice opportunities and cash prizes to beginners and experienced traders, with position sizes from just ¢0.01.

Cons

- Videforex lacks authorization from a trusted regulator, meaning traders may receive little to zero safeguards like segregated client accounts.

- The client terminal needs improvements based on our latest tests, sporting sometimes slow and unresponsive widgets which could dampen the experience for day traders.

- The absence of any educational tools is a serious drawback for newer traders who can find blogs, videos and live trading sessions at category leaders.

RaceOption

" RaceOption is amongst the best binary firms for its range of assets, notably US technology stocks and niche cryptocurrencies. With 5 second turbo contracts and tick charts through the TradingView-powered charting package, it’s well-suited to intraday traders. Regular contests also provide an extra layer to the binary trading experience. "

William Berg, Reviewer

RaceOption Quick Facts

| Demo Account | Yes |

|---|---|

| Instruments | Binary Options, CFDs |

| Platforms | TradingView |

| Minimum Deposit | $200 |

| Minimum Trade | $0.01 |

| Leverage | 1:500 |

| Account Currencies | USD, EUR, GBP, AUD, RUB |

Pros

- RaceOption makes account funding a breeze with fee-free and near-instant deposits via bank cards and cryptos, plus guaranteed withdrawals processing within 1 hour.

- Payouts on popular underlying assets like EUR/USD can reach 95%, beating out most alternatives based on our evaluations, and increasing potential returns, while the first 3 trades are risk-free in Silver and Gold accounts.

- RaceOption is in the less than 1% of brokers that offers video chat, available 24/7 in multiple languages, although the knowledge of agents about trading and regulatory issues needs improvement from our direct experience.

Cons

- RaceOption has an absence of decent educational resources for, making it a poorer choice for beginner binary traders who must understand the risks of these typically all-or-nothing contracts.

- While still affordable for many retail investors, the $200 minimum deposit raises the entry barrier, especially compared to Deriv and World Forex who are designed for budget traders.

- RaceOption is an unregulated, high-risk broker that doesn’t provide investor compensation or legal recourse options should you run into trading or withdrawal issues.

BinaryCent

"BinaryCent suits active binary traders willing to forego regulatory protections for a quick and easy sign up, deposit bonuses, and weekly trading competitions. With its $250 minimum deposit, among the industry’s highest, it’s geared towards experienced, well-funded traders."

Tobias Robinson, Reviewer

BinaryCent Quick Facts

| Demo Account | Yes |

|---|---|

| Instruments | CFDs, Forex, Stocks, Cryptos, Options, Commodities |

| Regulator | VFSC |

| Platforms | TradingView |

| Minimum Deposit | $250 |

| Minimum Trade | $0.01 |

| Leverage | 1:500 |

| Account Currencies | USD |

Pros

- Simple and straightforward proprietary platform for binary options trading

- Payouts up to 95% are higher than most competitors and increases profit potential

- Trade binary contracts from $0.10 allowing trading opportunities for all budgets

Cons

- Not overseen by any reputable regulator, raising risks and reducing customer protections

- The $250 minimum deposit is higher than most binary options brokers

- Not available to traders based in the US

World Forex

"World Forex is best for traders wanting to place all-or-nothing trades on currencies or metals through digital contracts. It’s also a stand-out option for traders wanting to use advanced third-party platforms like MetaTrader, plus mobile traders due to the dedicated binary options app via the FX BO Lite add-on."

Tobias Robinson, Reviewer

World Forex Quick Facts

| Demo Account | Yes |

|---|---|

| Instruments | Digital Contracts, Forex, CFD Stocks, Metals, Energies, Cryptos |

| Regulator | SVGFSA |

| Platforms | MT4, MT5 |

| Minimum Deposit | $1 |

| Minimum Trade | $1 (Binaries), 0.01 Lots (Forex/CFDs) |

| Leverage | 1:1000 |

| Account Currencies | USD, EUR, RUB |

Pros

- Demo account

- MT4, MT5 and a proprietary trading terminal

- Copy trading solution

Cons

- Weak regulation

- Withdrawal fees apply

- No negative balance protection

Deriv

"Deriv is ideal for active traders seeking alternative ways to speculate on global financial markets, from binaries, multipliers and accumulator options to its bespoke synthetic indices, which mimic real market movements and are available 24/7, allowing for continuous trading opportunities regardless of market hours. It remains one of the most trusted, longest-standing binary providers, earning the confidence of our team."

Christian Harris, Reviewer

Deriv Quick Facts

| Demo Account | Yes |

|---|---|

| Instruments | CFDs, Multipliers, Accumulators, Synthetic Indices, Forex, Stocks, Options, Commodities, ETFs |

| Regulator | MFSA, LFSA, BVIFSC, VFSC, FSC, SVGFSA |

| Platforms | Deriv Trader, Deriv X, Deriv Go, MT5, cTrader, TradingView |

| Minimum Deposit | $5 |

| Minimum Trade | 0.01 Lots |

| Leverage | 1:1000 (varies by region) |

| Account Currencies | USD, EUR, GBP |

Pros

- Although response times trail alternatives in our personal experience, Deriv offers 24/7 support and is one of the few brokers to offer WhatsApp assistance.

- Deriv revamped its app in 2025, now sporting a slicker interface alongside improved position management and streamlined contract details for smarter mobile trading, earning it DayTrading.com's 'Best Trading App' award.

- Deriv has doubled its leverage on ETFs, from 1:5 to 1:10, providing greater potential returns with the same outlay, though of course leverage cuts both ways - losses too are amplified.

Cons

- Although there’s a basic blog, there's little in terms of technical analysis or market reports which could help active traders identify potential opportunities.

- While the Academy launched in 2021 is a step in the right direction, there is limited education on advanced trading topics for seasoned traders and no live webinars to upskill new traders.

- Leverage up to 1:1000 will appeal to traders with a large risk appetite but frustratingly there is no ability to flex the leverage in the account area.

How We Chose The Best Brokers With Binary Options Copy Trading

We opened platforms and explored the copy trading features available at binary brokers in our database:

- We looked at ‘top trader’ leaderboards, investigating the level of transparency around traders’ historical performance.

- We explored the level to which you can auto copy trades vs set your own risk limits like percentage of capital invested.

- We considered how user friendly the copy trading tools were to use for beginners.

We documented the findings from our tests. Every provider was then ranked by their ratings.

How Copy Trading Works on Binary Platforms

On most binary platforms, copy trading is built directly into the interface. You choose a trader from a public list, set how much you want to allocate, and their trades are mirrored automatically on your account.

In theory, it’s simple. When the copied trader opens a binary position, the same asset, direction, and expiry are applied to your trade. Position size is usually scaled based on your balance or a fixed amount you choose.

Where binaries complicate things is timing. Expiry lengths are short, sometimes measured in seconds. Even a small delay between the original trade and the copied one can change the entry price enough to affect the outcome.

There’s also the issue of execution differences. The copied trader may be using different sizing, different settings, or even different market conditions if liquidity shifts. You’re copying the idea, not guaranteeing the same result. That distinction is crucial when evaluating whether binary copy trading is worth the risk.

An Example From Our Evaluations

Pocket Option is a valuable reference point because it offers built-in social and copy trading features directly on the platform, rather than through third-party tools.

Traders are displayed in a public ranking, with stats such as win rate, recent performance, and number of followers. From there, you can choose a trader to copy and set basic parameters like trade size or balance allocation.

What’s important to understand is what you’re not seeing. Performance stats are often short-term, drawdowns aren’t always obvious, and it’s not always clear whether results are from live or demo trading.

That doesn’t make the system misleading, but it does mean the data needs to be treated cautiously.

When we look at copy trading on platforms like Pocket Option, we see it as a mechanical tool, not a filter for skill. It handles execution, not risk assessment.The responsibility for choosing who to copy still sits firmly with the trader.

Getting Started

Use this step-by-step guide to start copy trading binaries:

- Find a brokerage that facilitates binary options copy trading and create an account. Look for trusted providers that have a track record of paying withdrawals. It’s worth exploring their platform in demo mode before opening a live account, though note most binary brokers we’ve tested only allow copy trading in a real money account.

- Connect a payment method or pre-fund your account so you can copy the expert’s trades as soon as they purchase a contract. Bank cards, e-wallets and cryptocurrencies are commonly supported from our platform evaluations. Position sizing should be small and capped to start with so you don’t necessarily need to deposit huge sums. Copy trading magnifies mistakes quickly, so limiting risk per trade matters more than chasing returns.

- Identify traders that you wish to watch or copy. Often, brokers will have a leaderboard-style page on their platform with details of different people to help you decide. Try and look at a master trader’s track record over a long period – some platforms promote ‘top performing traders over 24 hours’ or similar – this is not a long time to be truly indicative. Also remember that just because they have had wins previously doesn’t mean that future trades will.

- Sit back and wait for positions to expire and check their outcomes. Once you’ve pressed to ‘copy’ and added any settings, monitor the results. No scaling up just because a trader looks “hot”. We’d also avoid copying multiple traders at once. Mixing styles and expiries often increases noise rather than diversification. Finally, review performance regularly. If results drift or behavior changes, we’d stop copying, and any good platform should make that as simple as pressing a button.

What To Look For In A Master Trader

If you do decide to explore binary copy trading, master trader selection matters more than the platform:

- Start with longevity, not win rate. A trader with moderate results over several months is usually more reliable than one showing an eye-catching short-term streak. Consistency beats spikes.

- Next, look at trade frequency and expiry types. Traders who place dozens of rapid-fire trades with ultra-short expiries tend to rely on volume and variance, not edge. That style is hard to copy safely.

- Pay attention to risk per trade. Large position sizes relative to account balance are a warning sign, even if the win rate looks high. One bad run can undo weeks of gains.

- Finally, watch behavior during losing periods. Traders who slow down, reduce size, or step aside entirely are usually managing risk. Those who double down are often doing the opposite.

Risks of Binary Copy Trading

The biggest risk in binary copy trading is misaligned risk control. You’re inheriting someone else’s trading decisions, but not necessarily their risk tolerance, capital base, or objectives.

Short expiries amplify this problem. A copied trader might be comfortable taking frequent, aggressive positions because they’re trading a large account or resetting regularly. When those same trades are mirrored on a smaller account, drawdowns can escalate quickly.

There’s also copy lag to consider. Even small delays between the original trade and the copied one can lead to worse entry prices, especially in fast-moving markets. Over time, that slippage adds up.

Binary options providers are also restricted in some countries. For example, the FCA has banned providers from offering these products to retail clients in the UK. Some countries in Europe have done the same following ESMA’s initial product intervention. Residents can still sometimes open accounts with such firms but using a broker that’s not regulated locally raises the risks – you may lose protections like access to invest compensation in the event of broker insolvency.

Finally, performance data can be misleading. High win rates often mask poor risk–reward profiles, where a few losses wipe out many small wins. Without complete transparency on drawdowns and position sizing, it’s easy to underestimate the downside.

Why Binary Copy Trading Looks Easier Than It Really Is

Binary copy trading often looks deceptively simple because the hard decisions appear to be outsourced. You’re not choosing entries, timing expiries, or reacting to market noise – you’re just following someone else.

The problem is that binaries magnify small mistakes. Short expiries leave little margin for error, and even slight differences in entry price or timing can flip a winning trade into a loss. What works on one account doesn’t always translate cleanly to another.

There’s also a psychological trap. Seeing a high win rate can create a false sense of security, encouraging larger position sizes or blind trust in the copied trader. When the inevitable losing streak arrives, losses can compound quickly.

Copy trading doesn’t remove risk. It just changes where the risk comes from – and that’s often harder to spot until it’s too late.

Scams to Watch Out For

Binary copy trading attracts its share of bad actors, largely because results are easy to present selectively.

One common red flag is demo-only performance. Some top-ranked traders are trading on demo accounts, where fills are perfect, and losses carry no real consequence. Copying those trades with real money can produce very different results.

Another issue is martingale-style trading. These traders chase losses by increasing position size after each loss, which can inflate short-term win rates. It looks impressive until a single losing streak wipes out a large portion of the account.

Account resets are another tactic to watch for. Poor performance disappears, a new track record starts, and the cycle repeats.

Finally, be wary of traders who use platform rankings as a funnel into paid Telegram or Discord groups. If a strategy worked consistently, it wouldn’t need selling elsewhere.

Can Copy Trading Ever Make Sense for Binary Traders?

In limited cases, yes, but it’s rarely the shortcut it’s marketed as. Copy trading can be helpful as a learning tool, especially for newer traders who want to observe how others approach timing, asset selection, and expiries. Used cautiously, it can provide structure and exposure without constant decision-making.

What it doesn’t do well is replace skill. Binary options are sensitive to execution, discipline, and risk control. Copying someone else doesn’t remove those requirements – it just shifts them out of sight.

From our perspective, copy trading only makes sense when:

- Position sizes are kept small

- Performance is tested on demo first

- Expectations are realistic

As a long-term solution, relying entirely on copied trades leaves traders exposed to risks they don’t control. For most people, it works better as a supplement than a strategy in its own right.

To get going, see our selection of the top binary options copy trading providers.

FAQs

What Is Binary Options Copy Trading?

Binary options copy trading involves mimicking the positions taken by other clients on a platform. This can be done manually or automatically, assigning a portion of your account capital to copy the contract details purchased by expert traders.

This means that if they purchase a high/low option at a certain price, your account will do the same, taking away the effort of manually analyzing the markets.

Is Binary Options Copy Trading Safe?

It isn’t safe. While risk is capped per trade, short expiries, copy lag, and mismatched position sizing can quickly turn minor issues into meaningful losses. Copy trading reduces decision-making, not risk.

Can You Lose Money Copy Trading Binary Options?

Yes. Losses can happen quickly, mainly if the copied trader uses aggressive sizing, martingale-style strategies, or trades very short expiries where timing differences matter.

Can High Win Rates On Binary Copy Trading Platforms Be Trusted?

Not on their own. High win rates often hide poor risk control or short track records. Longevity, drawdowns, and position sizing are far more important than headline percentages.

Is Copy Trading A Good Way To Learn Binary Options?

It can help as an observation tool if used carefully on demo with small size. It shouldn’t replace learning how binaries work, managing risk, and understanding timing yourself.

Is Binary Copy Trading Better Than Trading Manually?

For most traders, no. Copy trading offers convenience, but manual trading offers control. Over the long run, understanding your own strategy tends to be more reliable than relying on someone else’s behavior.

How Do I Become An Expert Binary Options Trader?

Firstly, you need to be a trader that others will want to copy from. This means demonstrating that you know how to make profitable trades.

Once you are ready, you need to apply to your desired broker with a verified account. Ensure that you meet the platform’s criteria for expert traders. You will often need to provide a description to advertise yourself, including your chosen trading strategy and experience. Some software may let you set your own commission rates.