Best CFD Brokers In 2026

CFDs are generally not available to retail traders in the US under SEC and CFTC rules. Most CFD brokers do not accept US residents. As an alternative, consider exchange-traded futures or options.

Discover our list of the best CFD brokers with great CFD trading platforms. Every CFD provider we recommend has been tested by our research team, earning a high overall rating and the trust of our experts.

Top 6 CFD Brokers

In March 2026 we have reviewed 139 brokers and our hands-on tests show that these are the 6 best CFD brokers:

Why Are These Brokers the Best for CFD Trading?

Here is a short summary of why we think these are the best CFD brokers:

- Interactive Brokers is the best CFD broker in 2026 - Over 8,000 CFDs are offered on a vast array of instruments, encompassing stocks, indices, forex, and commodities. Moreover, the TWS platform lends itself to seasoned day traders, offering a comprehensive selection of over 100 order types and algorithms, alongside premium market data sourced from reputable sources such as Reuters and Dow Jones.

- xChief - You can trade a competitive range of CFDs encompassing crypto, indices, energies and metals, with very high leverage up to 1:1000. ECN pricing is available, with spreads from 0.0 pips and low commissions from $2.50. A Cent account is also available for those on a smaller budget.

- Focus Markets - Focus Markets has clearly been built for crypto traders, offering an impressive 90+ derivatives, including major tokens like Bitcoin, Ethereum and Ripple. With high leverage, a commission-free trading account and fast execution on MT5, it delivers a reliable environment for active crypto traders.

- InstaTrade - InstaTrade offers the flexibility to trade CFDs across various markets, from stocks and indices to forex and commodities. Where it excels is its dynamic leverage up to 1:1000, amplifying potential returns and losses with negative balance protection preventing accounts from falling below zero.

- RoboForex - RoboForex offers a growing suite of over 12,000 CFDs, encompassing forex, stocks, indices, commodities, futures and ETFs. With an initial deposit of $10 and micro lot trading through to very high leverage up to 1:2000, RoboForex caters to a broad range of derivative traders. On the downside, analysis reveals execution speeds of 1-3 seconds, noticeably slower than IC Markets at 0.35 seconds, and suboptimal for fast-paced strategies like scalping.

- XM - XM delivers for CFD traders with flexible leverage and a huge range of markets, including bespoke thematic indices for exposure to popular sectors like artificial intelligence. The MT4/MT5 platforms are also fast and dependable while a free VPS is available to qualifying XM traders running algo trading strategies.

Compare the Best CFD Brokers on Key Attributes

Find the best CFD broker for you based on our comparison of key features important to CFD traders:

| Broker | Minimum Deposit | Leverage | Platforms | Regulators |

|---|---|---|---|---|

| Interactive Brokers | $0 | 1:50 | Trader Workstation (TWS), IBKR Desktop, GlobalTrader, Mobile, Client Portal, AlgoTrader, OmniTrader, TradingView, eSignal, TradingCentral, ProRealTime, Quantower | FCA, SEC, FINRA, CFTC, CBI, CIRO, SFC, MAS, MNB, FINMA, AFM |

| xChief | $10 | 1:1000 | MT4, MT5 | ASIC |

| Focus Markets | $100 | 1:500 | MT5 | ASIC, SVGFSA |

| InstaTrade | $1 | 1:1000 | InstaTrade Gear, MT4 | BVI FSC |

| RoboForex | $10 | 1:2000 | R StocksTrader, MT4, MT5, TradingView | IFSC |

| XM | $5 | 1:1000 | MT4, MT5, TradingCentral | CySEC, DFSA, SCA, FSCA, FSA, FSC Belize, FSC Mauritius, CMA |

How Safe Are These CFD Brokers?

How dependable are the top CFD brokers and do they have features that help safeguard your funds?

| Broker | Trust Rating | Guaranteed Stop Loss | Negative Balance Protection | Segregated Accounts |

|---|---|---|---|---|

| Interactive Brokers | ✘ | ✔ | ✔ | |

| xChief | ✘ | ✘ | ✔ | |

| Focus Markets | ✘ | ✔ | ✔ | |

| InstaTrade | ✘ | ✔ | ✔ | |

| RoboForex | ✘ | ✔ | ✔ | |

| XM | ✘ | ✔ | ✔ |

Compare Mobile CFD Trading

Are these brokers good for mobile CFD Trading?

| Broker | Mobile Apps | iOS Rating | Android Rating | Smart Watch App |

|---|---|---|---|---|

| Interactive Brokers | iOS & Android | ✔ | ||

| xChief | iOS & Android | ✘ | ||

| Focus Markets | iOS & Android | ✘ | ||

| InstaTrade | iOS & Android | ✘ | ||

| RoboForex | iOS & Android, R StocksTrader | ✘ | ||

| XM | iOS, Android & Windows | ✘ |

Are the Top CFD Brokers Good for Beginners?

CFD trading beginners should use brokers that allow trading with virtual money (a demo account) and have other features that new traders need:

| Broker | Demo Account | Minimum Deposit | Minimum Trade | Education Rating | Support Rating |

|---|---|---|---|---|---|

| Interactive Brokers | ✔ | $0 | $100 | ||

| xChief | ✔ | $10 | 0.01 Lots | ||

| Focus Markets | ✔ | $100 | 0.01 Lots | ||

| InstaTrade | ✔ | $1 | 0.01 | ||

| RoboForex | ✔ | $10 | 0.01 Lots | ||

| XM | ✔ | $5 | 0.01 Lots |

Are the Top CFD Brokers Good for Advanced Traders?

Experienced CFD traders should look for sophisticated tools to enhance the trading experience:

| Broker | Automated Trading | VPS | AI | Pro Account | Leverage | Low Latency | Extended Hours |

|---|---|---|---|---|---|---|---|

| Interactive Brokers | Capitalise.ai, TWS API | ✘ | ✔ | ✘ | 1:50 | ✔ | ✔ |

| xChief | Expert Advisors (EAs) on MetaTrader | ✘ | ✘ | ✘ | 1:1000 | ✘ | ✘ |

| Focus Markets | Expert Advisors (EAs) on MetaTrader | ✘ | ✘ | ✘ | 1:500 | ✘ | ✘ |

| InstaTrade | Experts Advisors (EAs) on MetaTrader | ✔ | ✘ | ✘ | 1:1000 | ✘ | ✘ |

| RoboForex | Expert Advisors (EAs) on MetaTrader, Strategy Builder in R StocksTrader | ✔ | ✘ | ✘ | 1:2000 | ✘ | ✘ |

| XM | Expert Advisors (EAs) on MetaTrader | ✔ | ✔ | ✘ | 1:1000 | ✔ | ✘ |

Compare the Ratings of Top CFD Brokers

See how the top CFD brokers compare in all key areas according to our hands-on tests:

| Broker | Trust | Platforms | Assets | Mobile | Fees | Accounts | Research | Education | Support |

|---|---|---|---|---|---|---|---|---|---|

| Interactive Brokers | |||||||||

| xChief | |||||||||

| Focus Markets | |||||||||

| InstaTrade | |||||||||

| RoboForex | |||||||||

| XM |

Compare CFD Trading Fees

The cost of trading with a CFD broker will make a big difference over time. Here's how the top CFD providers stack up on costs:

| Broker | Cost Rating | Fixed Spreads | Inactivity Fee | CFD FTSE Spread | CFD GBP/USD Spread | CFD Oil Spread | CFD Stocks Spread |

|---|---|---|---|---|---|---|---|

| Interactive Brokers | ✘ | $0 | 0.005% (£1 Min) | 0.08-0.20 bps x trade value | 0.25-0.85 | 0.003 | |

| xChief | ✘ | - | 70 | 0.9 | 12 | 50 | |

| Focus Markets | ✘ | $0 | 1.2 | 0.0 | 0.03 | Variable | |

| InstaTrade | ✘ | - | 660 | 0.2 | 0.0 | 8 (Apple Inc) | |

| RoboForex | ✘ | $0 | - | 0.4 | 1.7 | 0.01 | |

| XM | ✘ | $5 | 1.4 | 0.8 | 0.03 | 0.002 |

How Popular Are These CFD Brokers?

Many traders prefer the most popular CFD brokers, i.e those with the most signed up clients:

| Broker | Popularity |

|---|---|

| XM | |

| InstaTrade | |

| Interactive Brokers | |

| xChief | |

| RoboForex |

Why Trade CFDs with Interactive Brokers?

"Interactive Brokers is one of the best brokers for advanced day traders, providing powerful charting platforms, real-time data, and customizable layouts, notably through the new IBKR Desktop application. Its superb pricing and advanced order options also make it highly attractive for day traders, while its diverse range of equities is still among the best in the industry."

Christian Harris, Reviewer

Interactive Brokers Quick Facts

| FTSE Spread | 0.005% (£1 Min) |

|---|---|

| GBPUSD Spread | 0.08-0.20 bps x trade value |

| Stocks Spread | 0.003 |

| Leverage | 1:50 |

| Regulator | FCA, SEC, FINRA, CFTC, CBI, CIRO, SFC, MAS, MNB, FINMA, AFM |

| Platforms | Trader Workstation (TWS), IBKR Desktop, GlobalTrader, Mobile, Client Portal, AlgoTrader, OmniTrader, TradingView, eSignal, TradingCentral, ProRealTime, Quantower |

| Account Currencies | USD, EUR, GBP, CAD, AUD, INR, JPY, SEK, NOK, DKK, CHF, AED, HUF |

Pros

- With low commissions, tight spreads and a transparent fee structure, IBKR delivers a cost-effective environment for short-term traders.

- There's a vast library of free or paid third-party research subscriptions catering to all types of traders, plus you can enjoy commission reimbursements from IBKR if you subscribe to Toggle AI.

- The TWS platform has clearly been built for intermediate and advanced traders and comes with over 100 order types and a reliable real-time market data feed that rarely goes offline.

Cons

- Support can be slow and frustrating based on tests, so you might find it challenging to reach customer service representatives promptly or encounter delays in resolving issues.

- IBKR provides a wide range of research tools, but their distribution across trading platforms and the web-based 'Account Management' page lacks consistency, leading to a confusing user experience.

- TWS’s learning curve is steep, and beginners may find it challenging to navigate the platform and understand all the features. Plus500's web platform is much better suited to new traders.

Why Trade CFDs with xChief?

"xChief continues to prove popular with investors looking to trade highly leveraged CFDs on the popular MetaTrader platforms. The broker's rebate scheme and investment accounts will particularly appeal to seasoned traders. However, the lack of top-tier regulatory oversight is a major drawback."

William Berg, Reviewer

xChief Quick Facts

| FTSE Spread | 70 |

|---|---|

| GBPUSD Spread | 0.9 |

| Stocks Spread | 50 |

| Leverage | 1:1000 |

| Regulator | ASIC |

| Platforms | MT4, MT5 |

| Account Currencies | USD, EUR, GBP, JPY, CHF |

Pros

- The broker offers several account types to suit different traders, including a Cent account for beginners and pro-level hedging/netting accounts

- xChief offers STP/ECN execution with low spreads from 0.0 pips and low commission rates starting from $2.50 per side

- The low minimum deposit of $10 will appeal to beginners, as well as the beginners’ guides in the Library

Cons

- The total range of 150+ assets is much lower than most competitors who typically offer hundreds

- Fees and minimums are imposed on most withdrawal methods, including a €60 minimum for SWIFT bank transfers

- The broker trails competitors when it comes to research tools and educational resources

Why Trade CFDs with Focus Markets?

"Focus Markets is perfect for experienced traders familiar with MetaTrader 5, offering flexible crypto transactions (USDT and BTC) and access to over 90 cryptocurrencies for seamless speculation, deposits, and withdrawals."

Christian Harris, Reviewer

Focus Markets Quick Facts

| FTSE Spread | 1.2 |

|---|---|

| GBPUSD Spread | 0.0 |

| Stocks Spread | Variable |

| Leverage | 1:500 |

| Regulator | ASIC, SVGFSA |

| Platforms | MT5 |

| Account Currencies | USD, EUR, GBP, CAD, AUD, NZD, JPY, SGD |

Pros

- Focus Markets is regulated by ASIC – one of the most respected regulatory bodies in the financial industry with robust safeguards like negative balance protection, ensuring you can’t lose more than your balance in volatile markets.

- Focus Markets excelled in the deposit and withdrawal category during testing, offering more base currencies than most competitors, including USD, CAD and EUR - and a range of traditional and popular crypto payment options, including BTC and USDT.

- While its meagre four commodities won’t meet the needs of some serious traders interested in softs and metals, Focus Markets offers a huge suite of 90+ cryptos, providing short-term opportunities on high-reward, high-risk assets.

Cons

- Regulatory protection is a location lottery at Focus Markets – Australian traders benefit from strong ASIC oversight, but those using the SVGFSA-registered entity face limited recourse options in disputes.

- A significant drawback of Focus Markets is the lack of platform variety. It only support MT5, excluding popular platforms like MT4, cTrader, and TradingView, plus it hasn't developed its own software that could better meet the needs of beginners.

- Focus Markets still has a long way to go to compete with the best brokers - with virtually zero research tools and education, plus limited value-add features like VPS hosting, copy trading and swap-free accounts.

Why Trade CFDs with InstaTrade?

"Although InstaTrade offers active trading on a comprehensive platform, it stands out with its fairly unique Fixed Income Structured Product (FISP), providing passive investment opportunities with up to 50% returns in 6 months if conditions are met. "

Christian Harris, Reviewer

InstaTrade Quick Facts

| FTSE Spread | 660 |

|---|---|

| GBPUSD Spread | 0.2 |

| Stocks Spread | 8 (Apple Inc) |

| Leverage | 1:1000 |

| Regulator | BVI FSC |

| Platforms | InstaTrade Gear, MT4 |

| Account Currencies | USD, EUR, RUB |

Pros

- VPS hosting caters to algo trading strategies with a dedicated physical server providing rapid execution speeds as low as 9 milliseconds.

- InstaTrade delivers an excellent suite of charting tools for day traders with its web trader comprising 250+ indicators, 11 chart types and a user-friendly design.

- InstaTrade claims to "guarantee" returns through the structured element of its passive trading solution (FISP), with applications approved within 24 hours.

Cons

- InstaTrade sports one of the most cluttered websites and client cabinets in the industry, potentially overwhelming new traders, especially compared to XTB’s intuitive trading journey and resources.

- Marketing of the FISP, especially phrasing around the “guarantee of profitability” and the “elimination of risks of trading on financial markets” raises concerns.

- InstaTrade is registered in the offshore jurisdiction of the British Virgin Islands, resulting in limited regulatory safeguards for retail investors.

Why Trade CFDs with RoboForex?

"RoboForex is great if you want a vast range of 12,000+ day trading markets with ECN accounts, powerful charting and loyalty promotions. It also stands out for stock traders with its user-friendly R StocksTrader platform, featuring 3,000+ shares, fees from $0.01 and sophisticated watchlists."

Christian Harris, Reviewer

RoboForex Quick Facts

| GBPUSD Spread | 0.4 |

|---|---|

| Stocks Spread | 0.01 |

| Leverage | 1:2000 |

| Regulator | IFSC |

| Platforms | R StocksTrader, MT4, MT5, TradingView |

| Account Currencies | USD, EUR |

Pros

- RoboForex offers over 12,000 instruments, providing more short-term trading opportunities than the vast majority of online brokers, with forex, stocks, indices, ETFs, commodities, and futures.

- RoboForex secured the 'Best Forex Broker 2025' title in DayTrading.com's Awards after broadening their FX offering, cutting spreads and opening up services in various countries.

- RoboForex is known for its tight spreads starting from 0 pips and low minimum deposits from $10, making it accessible to those on a budget. The ability to trade with micro lots further lowers the barrier to entry for new traders.

Cons

- RoboForex provides a variety of account types, which, while offering flexibility, can be overwhelming for newer traders trying to choose the most suitable option for their trading style. Alternatives, notably eToro, provide a smoother entry into online trading with one retail account.

- Despite offering a range of platforms, RoboForex still doesn't support the increasingly popular cTrader. This might deter traders who prefer this specific platform for their day trading activities and is available at firms like Fusion Markets.

- While RoboForex offers competitive spreads, some of its account types come with high trading commissions up to $20 per lot, trailing the cheapest brokers, such as IC Markets.

Why Trade CFDs with XM?

"With a low $5 minimum deposit, advanced charting platforms in MT4 and MT5, expanding range of markets, and a Zero account offering spreads from 0.0, XM provides all the essentials for active traders, even earning our ‘Best MT4/MT5 Broker’ award in recent years."

Christian Harris, Reviewer

XM Quick Facts

| FTSE Spread | 1.4 |

|---|---|

| GBPUSD Spread | 0.8 |

| Stocks Spread | 0.002 |

| Leverage | 1:1000 |

| Regulator | CySEC, DFSA, SCA, FSCA, FSA, FSC Belize, FSC Mauritius, CMA |

| Platforms | MT4, MT5, TradingCentral |

| Account Currencies | USD, EUR, GBP, JPY |

Pros

- XM secured a category 5 license from the Securities and Commodities Authority (SCA) of the United Arab Emirates in late 2025, strengthening its regulatory credentials and making it a strong option for traders in the Middle East.

- XM’s customer support has delivered over years of testing, with 24/5 assistance in 25 languages, response times of under 2 minutes and a growing Telegram channel.

- XM stands out for its commitment to trader education, with a wealth of well-presented resources, including webinars, tutorials, and even real-time trading sessions through XM Live.

Cons

- XM is falling behind the curve by not offering cTrader and TradingView which are increasingly being favored over MetaTrader for their smoother user experience and superior charting packages.

- XM relies solely on the MetaTrader platforms for desktop trading, so there’s no in-house downloadable or web-accessible solution for a more beginner-friendly user experience with unique features.

- Although trusted and generally well-regulated, the XM global entity is registered with weak regulators like FSC Belize and UK clients are no longer accepted, reducing its market reach.

How To Choose A Top CFD Broker

Contracts for difference (CFDs) are a high-risk product available from hundreds of online brokers, however not all firms can be trusted and trading conditions vary. That’s why we, and you, should look at several factors to find the right CFD provider for your needs:

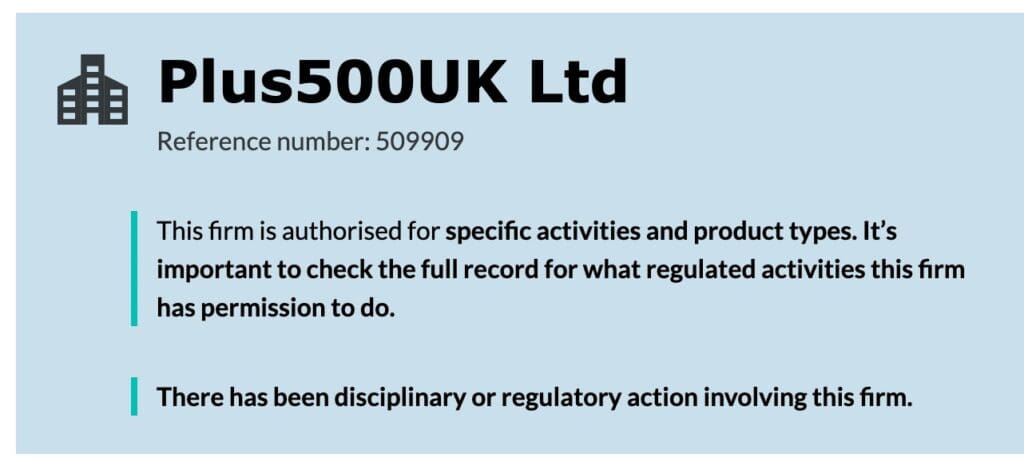

Trust

The most important consideration is choosing a trusted CFD broker.

You risk losing money in scams or from business failure if you sign up with an unreliable broker. This was demonstrated in 2023 when a seemingly credible CFD broker, EverFX, was found to be operating a scam where account managers encouraged traders to move capital to high-risk, unregulated entities, leaving clients with little to no regulatory protection.

The best sign that a CFD broker can be trusted is oversight from a top-rate regulator like the UK Financial Conduct Authority (FCA), Australian Securities & Investments Commission (ASIC), or Cyprus Securities & Exchange Commission (CySEC).

That’s why we review each CFD broker’s licensing details to ensure they have the regulatory authorizations they advertise.

We also test each broker carefully to check for unethical practices and only recommend providers that earn the confidence of our in-house experts, who have reviewed hundreds of brokers over many years.

- Plus500 maintains a very high trust score of 4.9/5 thanks to its oversight from the likes of the FCA, ASIC and CySEC, listing on the London Stock Exchange, 15+ years of industry experience, transparent trading conditions, and excellent reputation.

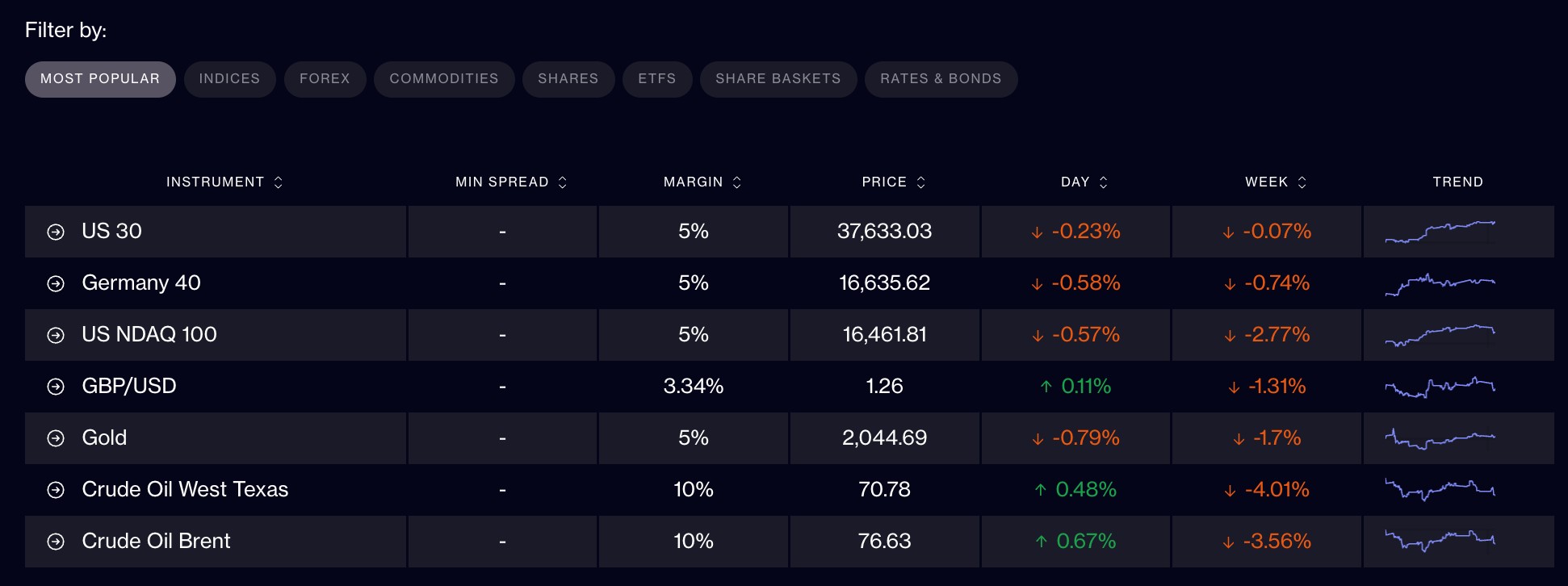

Markets

Selecting a CFD broker that offers access to the financial markets you want to speculate on is key.

CFDs are a versatile trading vehicle that can be used to trade a wide range of asset classes, including stocks, forex, commodities and cryptocurrencies, and we look for brokers that provide enough variety for traders to build a diverse portfolio.

- CMC Markets continues to excel for its above-average selection of 12,000+ CFDs, including 300+ currency pairs – more than every other CFD provider we have tested to date.

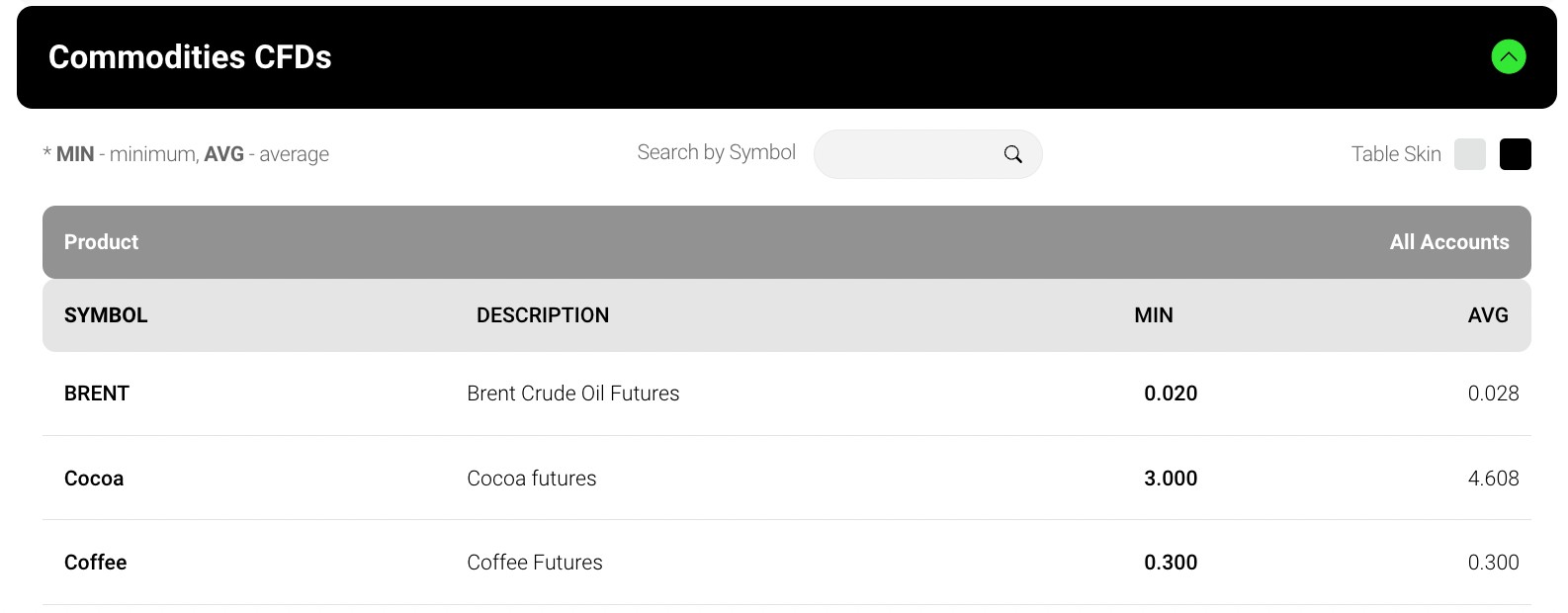

Fees

Picking a CFD broker with competitive fees is an important consideration, especially for active day traders for whom frequent costs can cut into profits.

Most CFD platforms make money through spreads. This is the difference between the quoted buy and sell prices, and real market prices. It’s essentially a markup for the broker’s services.

Fees also come in the form of commissions which take a percentage of each trade. The good news is that to stay competitive, many of the best CFD brokers are waiving commission fees.

CFD brokers also make money through financing. When you trade using margin or leverage, you essentially borrow funds from the brokerage to increase your position size. Most firms factor in a fee for these financing services.

We monitor the trading fees of our top CFD brokers each year to ensure they maintain their edge by continuing to offer tight spreads with low or no commission fees.

We also weigh the trading and non-trading fees (deposit/withdrawal charges and inactivity penalties) against the total package available, including market access and trading tools, on the basis that value for money is more important than simply having the lowest fees.

- IC Markets consistently ranks as one of our cheapest CFD brokers. The Standard account is great for beginners with commission-free CFDs and spreads from 0.8 pips, while the Raw account will serve intermediate and advanced traders with spreads from 0.0, a low commission of $3.50, plus rebates for high-volume traders.

Leverage

Given the risk of high losses with derivatives like CFDs, choosing a broker with transparent leverage and margin requirements is key.

Leverage allows you to greatly increase the potential profitability of trades with a relatively small amount of capital. Leverage is often written as a ratio, for example 1:10. Here, a $100 outlay would give you $1,000 in buying power ($100 x 10).

Importantly, the amount of leverage available can vary greatly among CFD providers. If your broker is regulated by a top-tier body like the FCA, ASIC or CySEC, then it is likely to be restricted to a maximum of 1:30 for forex and lower amounts for more volatile instruments like crypto.

These regulators also require CFD brokers to provide negative balance protection, ensuring you cannot lose more than your account balance.

Still, many traders choose to sign up with offshore CFD brokers who can offer higher amounts of leverage, sometimes reaching 1:3000.

I do not recommend beginners trade CFDs with high leverage given the risk of substantial losses. And if you do, make use of risk management tools in your broker’s platform like stop-loss orders. These can limit potential losses.

- FXCC is a good example of a reliable CFD broker that offers leverage up to 1:500 for traders who sign up with its global entity.

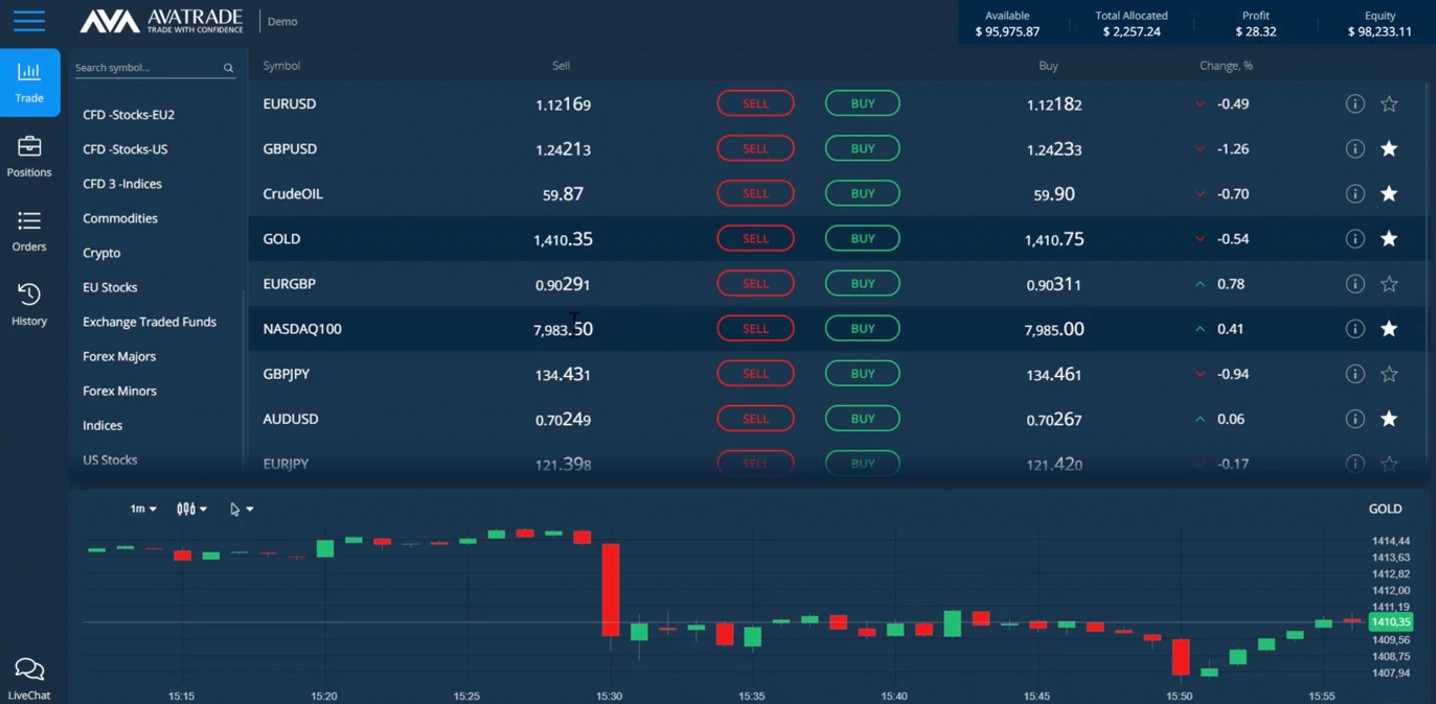

Platforms and Apps

Choosing a broker with a user-friendly CFD trading platform and the features you need to analyze the markets is essential.

Based on our extensive experience, the top CFD providers offer popular third-party software like MetaTrader 4, which is great for advanced traders interested in technical analysis and algo trading, alongside user-friendly proprietary platforms and mobile apps that deliver an intuitive user experience for beginners.

- AvaTrade stands out for its excellent platform line-up, from MT4 and MT5 to the in-house WebTrader that performed well during testing with an intelligent design, smooth user experience and a strong charting package comprising 60+ indicators, 14 drawing tools and 10 timeframes.

Value-Add Features

With many CFD brokers offering competitive packages today, considering the additional features available can be a great way to find a firm that best caters to your experience level and strategy.

We’ve seen that the best CFD providers offer a variety of extra tools to give traders the best chance at success. This can include engaging educational materials and social investing platforms to support new traders, market research tools like Trading Central to help you discover opportunities and virtual private server (VPS) hosting to give advanced day traders the fastest execution speeds with low latency.

- Pepperstone excels for its large suite of extra tools that elevate the CFD trading experience, from daily market news, code-free automation tools like Capitalise.ai, and top-rate education with guides to CFDs for beginners.

Bottom Line

The best CFD platforms provide a secure environment where you can speculate on global financial markets with user-friendly tools and low fees. Choose from our list of top CFD brokers to find the right platform for your needs.

Find out more about how we test CFD brokers.

FAQ

What Is A CFD Broker?

A CFD broker is a financial intermediary that enables you to speculate on price movements in various financial markets without owning the underlying assets.

They facilitate the trading process through an online platform. You sign up for an account, deposit funds, trade CFD products and then withdraw any profits.

Are All CFD Brokers Regulated?

CFDs are legal financial instruments that are tightly regulated in many jurisdictions. That said, brokers are banned from offering CFDs in some countries, including the United States.

For Specific Countries

Article Sources

The writing and editorial team at DayTrading.com use credible sources to support their work. These include government agencies, white papers, research institutes, and engagement with industry professionals. Content is written free from bias and is fact-checked where appropriate. Learn more about why you can trust DayTrading.com