Best CFD Trading Platforms and Brokers in the Netherlands 2026

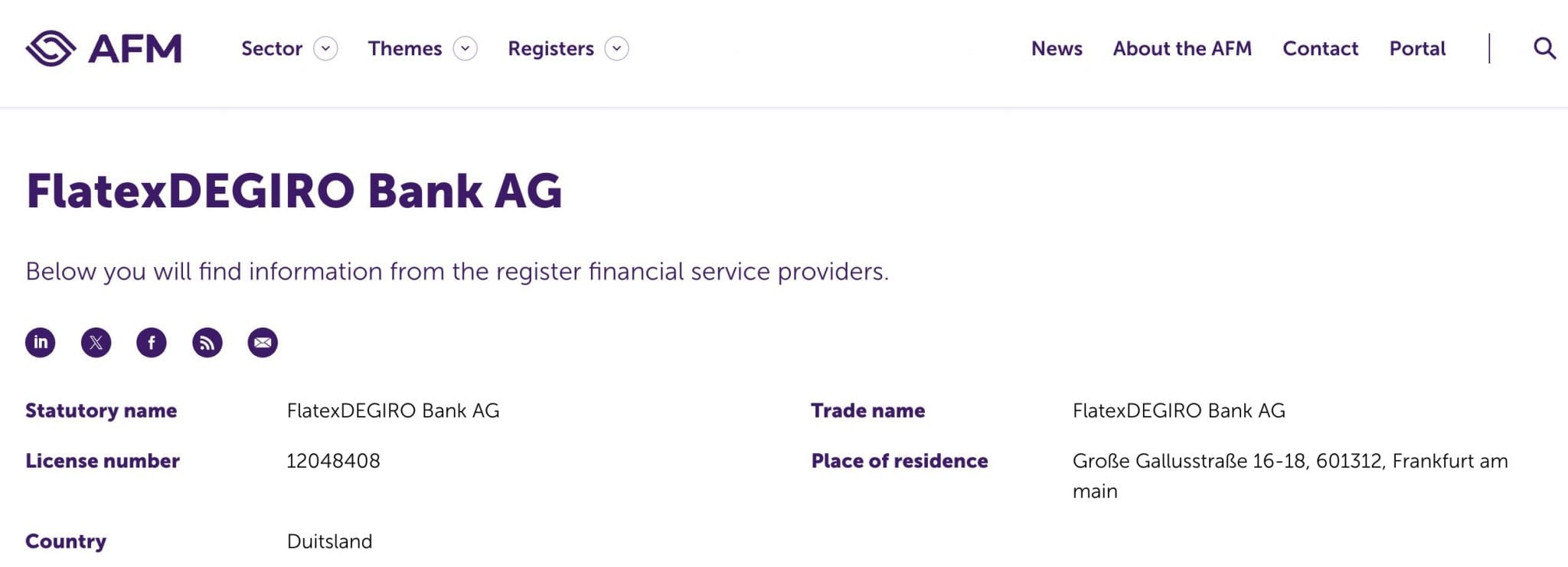

CFD trading is popular in the Netherlands, though brokers must follow the regulations of the Dutch Authority for the Financial Markets (AFM), including its 2019 rules regarding the sale and marketing of CFDs to retail investors.

Explore the best CFD trading platforms and brokers in the Netherlands, chosen after thorough tests, evaluations, and comparisons.

Top 6 CFD Trading Platforms in the Netherlands

After analyzing 139 brokers, we've identified the top 6 platforms that consistently stand out for CFD traders in the Netherlands:

-

1

XTB75% of accounts lose money when trading CFDs with this provider.

XTB75% of accounts lose money when trading CFDs with this provider. -

2

Eightcap71% of retail traders lose money when trading CFDs

Eightcap71% of retail traders lose money when trading CFDs -

3

XM

XM -

4

AvaTrade

AvaTrade -

5

Trade Nation

Trade Nation -

6

IC Trading

IC Trading

Here is a short summary of why we think each broker belongs in this top list:

- XTB - XTB offers a huge selection of CFDs spanning forex, indices, commodities, stocks, ETFs, and cryptos (location-dependent). Leverage up to 1:30 is available in the EU and UK, while global clients and pro traders can access up to 1:500. XTB stands out for its CFD trading resources and tutorials to assist traders in developing short-term trading strategies.

- Eightcap - Eightcap offers a wide range of trading options with 800+ CFDs across stocks, indices, bonds, commodities, and cryptocurrencies (depending on location), with leverage up to 1:30/1:500. It excels in its tools, notably the AI-enabled economic calendar covering 25+ countries with impact filters (high, medium, low). However, its commodities offering, particularly in softs like cotton and wheat, as well as the limited precious metal and energy assets, is its weakest area.

- XM - XM delivers for CFD traders with flexible leverage and a huge range of markets, including bespoke thematic indices for exposure to popular sectors like artificial intelligence. The MT4/MT5 platforms are also fast and dependable while a free VPS is available to qualifying XM traders running algo trading strategies.

- AvaTrade - AvaTrade's 1250+ leveraged CFD products span a wide range of asset classes including stocks, indices, commodities, bonds, crypto, and ETFs. What we love is that you can speculate on rising and falling prices in the broker’s feature-rich web and mobile platforms with market-leading research tools to help you discover short-term trading opportunities.

- Trade Nation - Trade leveraged CFDs on over 1000 assets with low-cost spreads. You can also take advantage of the broker's integrated signals to help you determine when to enter and exit positions.

- IC Trading - IC Trading specializes in CFD trading with over 2,250 tradable assets spanning sought-after markets including forex, commodities, indices, stocks, and bonds. Utilizing deep liquidity and cutting-edge bridge technology, the broker provides excellent trading conditions for short-term traders looking for leveraged derivatives.

Best CFD Trading Platforms and Brokers in the Netherlands 2026 Comparison

| Broker | CFD Trading | EUR Account | Minimum Deposit | Markets | Platforms | Leverage |

|---|---|---|---|---|---|---|

| XTB | ✔ | ✔ | $0 | CFDs on shares, Indices, ETFs, Raw Materials, Forex currencies, cryptocurrencies, Real shares, Real ETFs | xStation | 1:30 (EU) 1:500 (Global) |

| Eightcap | ✔ | ✔ | $100 | CFDs, Forex, Stocks, Indices, Commodities, Crypto | MT4, MT5, TradingView | 1:30 |

| XM | ✔ | ✔ | $5 | CFDs, Forex, Stocks, Commodities, Indices, Thematic Indices, Precious Metals, Energies | MT4, MT5, TradingCentral | 1:30 |

| AvaTrade | ✔ | ✔ | $100 | CFDs, Forex, Stocks, Indices, Commodities, ETFs, Bonds, Crypto, Spread Betting, Futures | WebTrader, AvaTradeGO, AvaOptions, AvaFutures, MT4, MT5, AlgoTrader, TradingView, TradingCentral, DupliTrade | 1:30 (Retail) 1:400 (Pro) |

| Trade Nation | ✔ | ✔ | $0 | Forex, CFDs, Indices, Shares, Commodities, Futures, Bonds, Spread Betting, Cryptos (Bahamas Entity Only) | TN Trader, MT4 | 1:500 (entity dependent) |

| IC Trading | ✔ | ✔ | $200 | CFDs, Forex, Stocks, Indices, Commodities, Bonds, Cryptos, Futures | MT4, MT5, cTrader, AutoChartist, TradingCentral | 1:500 |

XTB

"XTB stands out as a top choice for new day traders with the terrific xStation platform, low trading costs, no minimum deposit, and excellent educational tools, many of which are seamlessly integrated into the platform. "

Christian Harris, Reviewer

XTB Quick Facts

| FTSE Spread | 1.8 |

|---|---|

| GBPUSD Spread | 1.4 |

| Stocks Spread | 0.2% |

| Leverage | 1:30 (EU) 1:500 (Global) |

| Regulator | FCA, CySEC, KNF, DFSA, FSC |

| Platforms | xStation |

| Account Currencies | USD, EUR, GBP |

Pros

- The xStation platform continues to impress with its user-friendly interface and intuitive features, including customizable news feeds, sentiment heatmaps, and trader calculator, reducing the learning curve for newer traders.

- Opening an XTB account is a hassle-free, entirely online process that takes just a few minutes, making the entry into day trading smooth for new traders.

- XTB offers fast withdrawals with payment within 3 business days, depending on the method and amount.

Cons

- The demo account expires after just four weeks, a serious limitation for traders who wish to thoroughly test the xStation platform and practice short-term strategies before committing real funds.

- Not being able to adjust the default leverage level of XTB products is frustrating, as manual adjustment can significantly mitigate trade risk, especially in forex and CFD trading.

- Trading fees are competitive with average spreads of around 1 pip on the EUR/USD but still trail the cheapest brokers like IC Markets, plus there's an inactivity fee after 12 months.

Eightcap

"Eightcap delivers in every area for day traders with a growing selection of charting platforms, education via Labs, and AI-powered tools. Now sporting 120+ crypto CFDs, it's also become a stand-out choice for crypto trading, winning our 'Best Crypto Broker' award two years in a row."

Christian Harris, Reviewer

Eightcap Quick Facts

| FTSE Spread | 1.2 |

|---|---|

| GBPUSD Spread | 0.1 |

| Stocks Spread | 0.03 (Apple Inc) |

| Leverage | 1:30 |

| Regulator | ASIC, FCA, CySEC, SCB |

| Platforms | MT4, MT5, TradingView |

| Account Currencies | USD, EUR, GBP, CAD, AUD, NZD, SGD |

Pros

- Having excelled across all key areas for day traders, Eightcap outperformed every competitor to win our 'Best Overall Broker' award for 2024, also securing our 'Best Crypto Broker' title for 2025 and 'Best TradingView Broker' for 2025.

- Eightcap added TradeLocker in 2026, marking it out as the best regulated TradeLocker broker, while still delivering Eightcap's ultra-fast execution and low fees for active traders on the charting software.

- After bolstering its roster in 2021, Eightcap offers one of the most extensive selections of cryptocurrency CFDs in the market, with crypto/fiat pairs, crypto/crypto pairs, plus crypto indices for broader exposure to the market.

Cons

- Eightcap needs to continue bolstering its suite of 800+ instruments to match category leaders like Blackbull Markets with its 26,000+ assets, featuring a particularly weak selection of commodities.

- Despite a useful library of educational guides and e-books in Labs, Eightcap still trails IG’s comprehensive toolkit for aspiring traders with its dedicated IG Academy app and 18 course categories.

- In spite of an increasing variety of tools, Eightcap doesn't offer industry favorites like Autochartist or Trading Central, which offer cutting-edge charting analytics, live news, and market insights for short-term traders.

XM

"With a low $5 minimum deposit, advanced charting platforms in MT4 and MT5, expanding range of markets, and a Zero account offering spreads from 0.0, XM provides all the essentials for active traders, even earning our ‘Best MT4/MT5 Broker’ award in recent years."

Christian Harris, Reviewer

XM Quick Facts

| FTSE Spread | 1.4 |

|---|---|

| GBPUSD Spread | 0.8 |

| Stocks Spread | 0.002 |

| Leverage | 1:30 |

| Regulator | CySEC, DFSA, SCA, FSCA, FSA, FSC Belize, FSC Mauritius, CMA |

| Platforms | MT4, MT5, TradingCentral |

| Account Currencies | USD, EUR, GBP, JPY |

Pros

- XM’s customer support has delivered over years of testing, with 24/5 assistance in 25 languages, response times of under 2 minutes and a growing Telegram channel.

- XM has rolled out platform upgrades with integrated TradingView charts and an XM AI assistant, delivering faster execution, smarter analysis, and a sleeker, more intuitive trading experience.

- XM’s growing roster of 1,000+ instruments provides diverse short-term trading opportunities, with unique turbo stocks, fractional shares, and more recently thematic indices.

Cons

- XM is falling behind the curve by not offering cTrader and TradingView which are increasingly being favored over MetaTrader for their smoother user experience and superior charting packages.

- While the XM app stands out for its usability and exclusive copy trading products, the selection of technical analysis tools needs to be improved to meet the needs of advanced traders.

- Although trusted and generally well-regulated, the XM global entity is registered with weak regulators like FSC Belize and UK clients are no longer accepted, reducing its market reach.

AvaTrade

"AvaTrade offers active traders everything they need: an intuitive WebTrader, powerful AvaProtect risk management, a smooth 5-minute sign-up process, and dependable support you can rely on in fast-moving markets."

Jemma Grist, Reviewer

AvaTrade Quick Facts

| FTSE Spread | 0.5 |

|---|---|

| GBPUSD Spread | 1.5 |

| Stocks Spread | 0.13 |

| Leverage | 1:30 (Retail) 1:400 (Pro) |

| Regulator | ASIC, CySEC, FSCA, ISA, CBI, JFSA, FSRA, BVI, ADGM, CIRO, AFM |

| Platforms | WebTrader, AvaTradeGO, AvaOptions, AvaFutures, MT4, MT5, AlgoTrader, TradingView, TradingCentral, DupliTrade |

| Account Currencies | USD, EUR, GBP, CAD, AUD |

Pros

- Support at AvaTrade performed excellently during testing, with response times of 3 minutes and localized support in major trading jurisdictions, including the UK, Europe and the Middle East.

- The WebTrader excelled in our hands-on tests, sporting a user-friendly interface for beginners, complete with robust charting tools like 6 chart layouts and 60+ technical indicators.

- Years on, AvaTrade remains one of the few brokers offering a bespoke risk management tool, AvaProtect, that insures losses up to $1M for a fee and is easy to activate on the platform.

Cons

- AvaTrade’s WebTrader has improved, but work is still needed in terms of customizability – frustratingly widgets like market watch and watchlists can’t be hidden, moved, or resized.

- Although the deposit process itself is smooth, AvaTrade still doesn’t facilitate crypto payments, a feature increasingly offered by brokers like TopFX, which caters to crypto-focused traders.

- While signing up is a breeze, AvaTrade lacks an ECN account like Pepperstone or IC Markets, which provides the raw spreads and ultra-fast execution many day traders are looking for.

Trade Nation

"Trade Nation is a good choice for newer traders looking for a wide range of financial markets on a user-friendly platform. There is no minimum deposit, free funding options and strong education."

William Berg, Reviewer

Trade Nation Quick Facts

| FTSE Spread | From 0.4 |

|---|---|

| GBPUSD Spread | From 0.6 |

| Stocks Spread | Variable |

| Leverage | 1:500 (entity dependent) |

| Regulator | FCA, ASIC, FSCA, SCB, FSA |

| Platforms | TN Trader, MT4 |

| Account Currencies | USD, EUR, GBP, AUD, ZAR, SEK, NOK, DKK |

Pros

- Full range of investments via leveraged CFDs for long and short opportunities

- There is a low minimum deposit for beginners

- Multiple account currencies are accepted for global traders

Cons

- Fewer legal protections with offshore entity

IC Trading

"With superior execution speeds averaging 40 milliseconds, deep liquidity, and powerful charting software, IC Trading delivers an optimal trading environment tailored for scalpers, day traders, and algorithmic traders. "

Christian Harris, Reviewer

IC Trading Quick Facts

| FTSE Spread | 2.133 |

|---|---|

| GBPUSD Spread | 0.23 |

| Stocks Spread | Variable |

| Leverage | 1:500 |

| Regulator | FSC |

| Platforms | MT4, MT5, cTrader, AutoChartist, TradingCentral |

| Account Currencies | USD, EUR, GBP, CAD, AUD, NZD, JPY, CHF, HKD, SGD |

Pros

- The simplified and digital account opening process saves time and effort, allowing traders to start trading sooner without extensive paperwork, taking just minutes during testing.

- IC Trading provides industry-leading spreads, including 0.0-pip spreads on major currency pairs such as EUR/USD, making it ideal for day traders.

- IC Trading offers unusual flexibility in its accounts, enabling traders to open up to 10 live and 20 demo accounts, meaning you can run separate profiles for different activities, such as manual trading and algo trading.

Cons

- Despite being part of the trusted IC Markets group, IC Trading is authorized by a weak regulator - the FSC of Mauritius, with limited financial transparency and regulatory safeguards.

- Customer support performed woefully during testing with multiple attempts to connect via live chat and no one available to assist, plus unanswered emails, raising concerns about its ability to address urgent trading concerns.

- The educational resources are greatly in need of improvement, unless you navigate to the IC Markets website, posing a limitation for beginners in search of a comprehensive learning journey, especially compared to category leaders like eToro.

How We Chose The Best CFD Trading Platforms In The Netherlands

To identify the top CFD trading platforms in the Netherlands, we sifted through our comprehensive database of 139 brokers, all of which have undergone extensive testing over the years. We focused on those accepting Dutch traders and ranked them based on their overall rating, taking into account critical factors such as:

We Picked Trusted Brokers

We chose CFD brokers we trust, drawing on our direct experiences using their platforms, weighing their regulatory credentials, and considering their industry standing.

The chief regulator in the Netherlands is the Authority for Financial Markets (AFM). As an EU nation, the country is also subject to European directives and regulations. MiFID II and the European Securities and Markets Authority (ESMA) have a particularly strong influence over the investment landscape.

MiFID II means CFD providers who have permission under the EU passporting scheme can be used by traders in other European countries, including those based in the Netherlands.

Importantly, since 2019 brokers must adhere to the following rules to offer CFD trading to retail investors in the Netherlands:

- The CFD trading platform requires retail investors to put down margin.

- The CFD trading platform offers margin close-out protection.

- The CFD trading platform provides negative balance protection.

- The CFD trading platform does not offer bonuses to encourage trading.

- The CFD trading platform used appropriate risk warnings about using CFDs.

- XTB shines as one of the most trusted CFD brokers in the Netherlands – it’s licensed by 5 ‘Green-tier’ regulators, including those in the EU, plus it’s listed on the Warsaw Stock Exchange, demonstrating a high degree of financial transparency.

We Selected Brokers With An Excellent Investment Offering

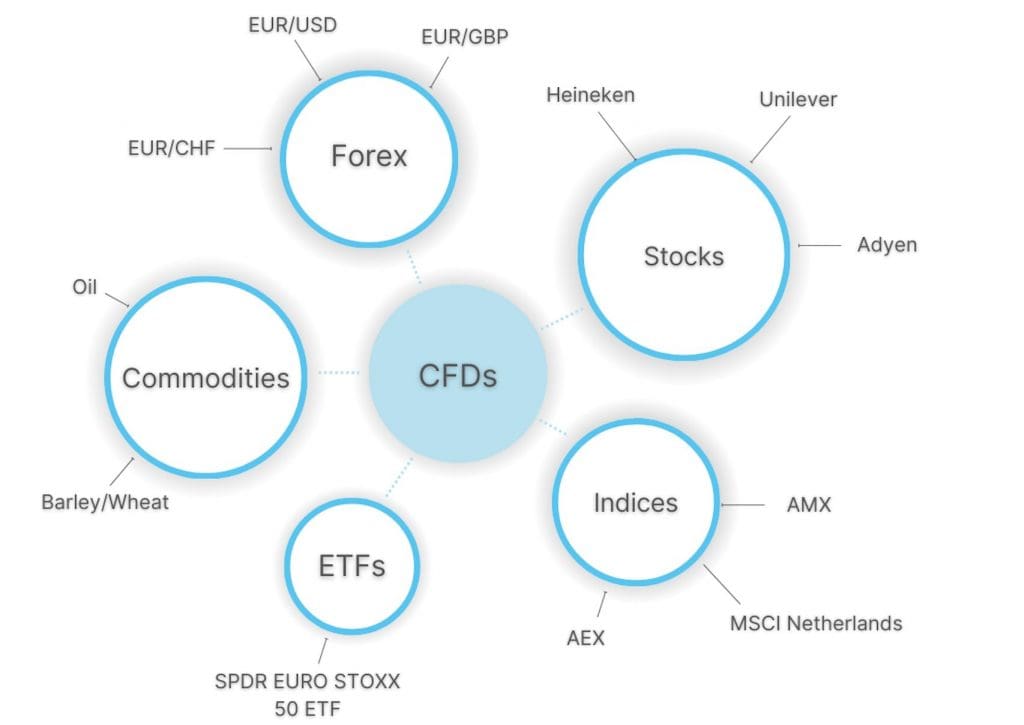

We prioritized brokers that offer CFD trading on a wide range of asset classes, catering to an array of strategies and trading preferences.

The Netherlands is among the 20 largest economies in the world by GDP and is home to Europe’s largest seaport in Rotterdam. It is also the location of the world’s oldest stock exchange – the Amsterdam Stock Exchange, now the Euronext Amsterdam, which was founded in 1602.

It is also the European headquarters for many global companies, including IBM, Netflix and Cisco, making it a fantastic opportunity for trading CFDs on stocks and indices.

The Netherlands is also the third biggest exporter of refined petroleum, such as gasoline – behind only the US and India, and the second largest exporter of agricultural goods. For its relative size, it’s a huge player in the commodities scene, making it very influential in the pricing of these assets.

- Saxo’s investment suite is almost unparalleled, with over 8,800 CFDs offering a diverse range of short-term trading opportunities, including the Netherlands 25 index, comprising the 25 largest firms on the Euronext Amsterdam, plus over 20 commodities.

We Picked Brokers With Transparent Margin Trading Opportunities

Margin trading is one of the primary benefits of CFDs, as it enables traders to leverage more than just their deposit value and capitalize on potential gains.

For Dutch traders, EMSA restricts margin trading to 1:30 for major forex pairs, such as the EUR/USD, 1:10 for commodities such as gold, and 1:2 for cryptocurrencies, such as Bitcoin.

For example, if I want to speculate the price of gasoline is about to rise due to issues with a Dutch processing plant, I can place a trade for €100 at 10x leverage. This would mean my profits (or losses) are multiplied by 10, minus any fees.

- AvaTrade is a great option if you want transparent leverage requirements in line with rules from ESMA and the Dutch AFM. It’s also one of a limited number of CFD providers to offer a helpful margin calculator so you can establish the cash you need to open a position.

We Selected Brokers With Competitive CFD Trading Fees

Picking a CFD trading platform with low fees is critical to protect profit margins. That’s why we assess spreads on popular assets, notably CFDs on indices, currencies, and commodities, helping us identify the lowest-cost CFD brokers.

We also weigh non-trading fees, such as deposit/withdrawal charges, plus conversion fees. That said, because many platforms offer EUR accounts, Dutch traders can often minimize the costs associated with funding an account denominated in another currency, such as the US Dollar.

- Pepperstone consistently offers low CFD fees, especially if you opt for its Razor account with tight spreads and a €2.60 commission. There are also no inactivity fees for less active traders.

We Selected Trading Platforms With The Best Functionality

The tools of the CFD trade are vital in helping you implement your strategy, that’s why we’ve tried and tested many of the top platforms with demo accounts or real money, to bring you our view on the best-in-class.

Dutch traders are fortunate to have a wide selection of European-based brokers at their fingertips – and this means the pick of the bunch of trading platforms too.

The MetaTrader 4 and MetaTrader 5 platforms remain the most widely available solutions for CFDs, despite an increasingly outdated design.

However, we’re seeing modern platforms with more intuitive interfaces, notably TradingView, increasingly rival the MetaTrader suite, sporting over 100 indicators and 12 chart types.

Equally, the CFD trading terminals designed in-house have also improved in recent years.

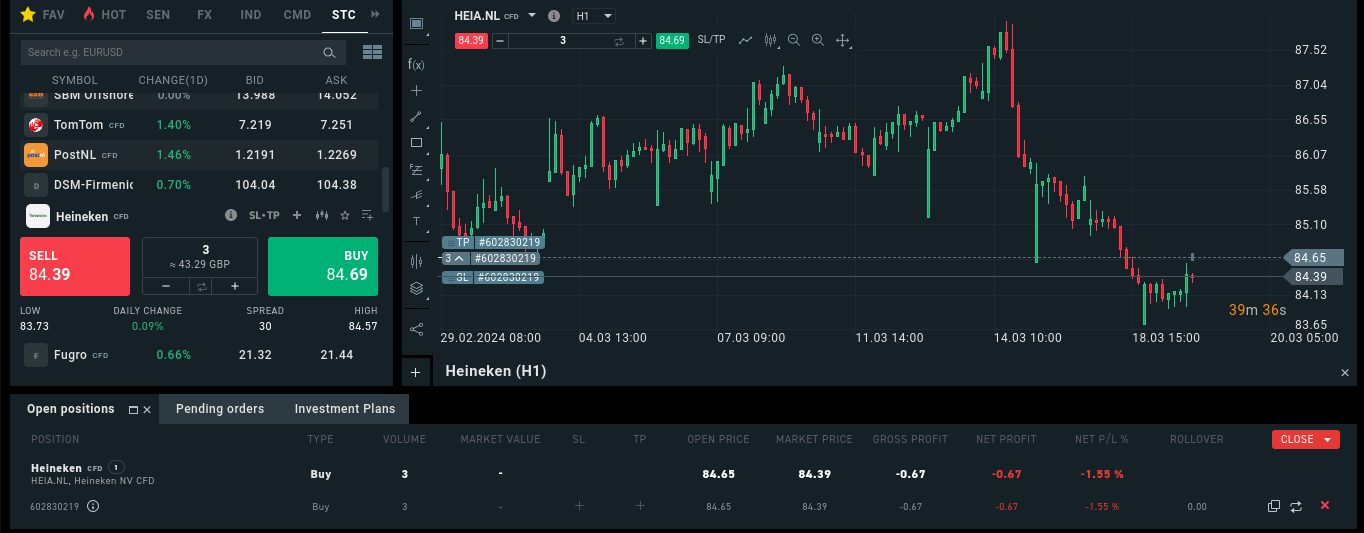

I recommend testing a broker’s CFD trading platform using a demo account to check it has the features you need in a user-friendly format before investing funds. You can place simulated CFD trades on popular Dutch stocks, such as Adyen.

- Blackbull maintains its status as a first-rate pick if you want powerful, dependable CFD platforms with MT4, MT5, TradingView and cTrader, alongside its own in-house app and web trader.

We Chose Brokers Accepting Popular Payment Methods In The Netherlands

Our experts have compared platforms based on their offering of the top account funding methods used by CFD traders, including those from the Netherlands.

For example, iDEAL is a popular method due to the ease with which it enables online payments from Dutch bank accounts.

We also weigh the minimum deposit, ensuring CFD trading platforms are accessible to investors at all levels. Our exhaustive analysis shows the vast majority of brokers require up to €250 to get started.

- eToro caters to Dutch traders with convenient payment options like iDEAL, plus an accessible starting deposit of €50. Our experts have also used eToro for real-money trading and praise its excellent offering for CFD traders.

FAQ

Who Regulates CFD Trading Platforms And Brokers In The Netherlands?

Netherlands-based CFD brokers must be regulated by the Authority for Financial Markets (AFM), however, Dutch traders are also accepted by European brokers under regulations from ESMA’s MiFID II, and these brokers can be regulated by any regonized European authority.

How Much Money Do I Need To Open A CFD Trading Account In The Netherlands?

Dutch traders will need to meet the minimum deposit for the broker they’re looking to trade with.

That said, our highest-rated CFD broker accepting traders from the Netherlands, notably Pepperstone, have no minimum deposit.

Recommended Reading

Article Sources

- Dutch Authority for the Financial Markets

- AFM Measures On CFDs - Regulation Tomorrow

- Euronext Amsterdam

- The Netherlands Global Ranking For Oil Exports - International Energy Agency

- Market Share Of Payment Methods In The Netherlands - Statista

The writing and editorial team at DayTrading.com use credible sources to support their work. These include government agencies, white papers, research institutes, and engagement with industry professionals. Content is written free from bias and is fact-checked where appropriate. Learn more about why you can trust DayTrading.com