Best Day Trading Platforms and Brokers in the Netherlands 2026

To day trade Dutch markets like stocks listed on the Euronext Amsterdam, the AEX Index, or currency pairs containing the euro, you’ll need to register with an online broker.

The Authority for the Financial Markets (AFM) regulates online trading in the Netherlands, though other European-regulated brokers can offer short-term trading products to Dutch investors through the EU’s cross-border initiative. In any case, traders should continue to adhere to their local tax rules.

We’ve ranked the best day trading platforms in the Netherlands following our hands-on assessments. Many of our recommended brokers offer services that will appeal to Dutch traders, including opportunities on financial markets in the Netherlands and across Europe, alongside popular local funding solutions like iDEAL.

Top 6 Platforms For Day Trading In The Netherlands

Following our extensive tests of hundreds of online brokers, these 6 platforms stand out as the best for short-term traders in the Netherlands:

-

1

XTB75% of accounts lose money when trading CFDs with this provider.

XTB75% of accounts lose money when trading CFDs with this provider. -

2

Eightcap71% of retail traders lose money when trading CFDs

Eightcap71% of retail traders lose money when trading CFDs -

3

XM

XM -

4

AvaTrade

AvaTrade -

5

Trade Nation

Trade Nation -

6

IC Trading

IC Trading

Here is a summary of why we recommend these brokers in March 2026:

- XTB - Founded in 2002 in Poland, XTB now serves more than 1 million clients. The forex and CFD broker combines a heavily regulated trading environment with an extensive selection of assets and a commitment to trader satisfaction, featuring an intuitive in-house platform with superb tools to support aspiring day traders.

- Eightcap - Eightcap is a multi-regulated forex and CFD broker established in Australia in 2009. The broker has proven popular with active day traders, providing 800+ instruments with tight spreads and notable improvements in recent years, integrating the leading TradingView platform, alongside AI-powered financial calendars and algo trading tools with zero coding experience required.

- XM - XM is a globally recognized forex and CFD broker with 15+ million clients in 190+ countries. Since 2009, this trusted broker has been delivering low trading fees across its growing roster of 1000+ instruments. It’s also highly regulated, including by ASIC, CySEC and DFSA and SCA in the UAE, and offers a comprehensive MetaTrader experience.

- AvaTrade - Established in 2006, AvaTrade is a leading forex and CFD broker trusted by over 400,000 traders. Operating under regulation in 9 jurisdictions, AvaTrade processes an impressive 2+ million trades each month. Through like MT4, MT5, and its proprietary WebTrader, the broker provides a growing selection of 1,250+ instruments. Whether it’s CFDs, AvaOptions, or the more recent AvaFutures, short-term traders at all levels will find opportunities. With terrific education and 24/5 multilingual customer support, AvaTrade delivers the complete trading experience.

- Trade Nation - Trade Nation is a top FX and CFD broker regulated in multiple jurisdictions including the UK and Australia. The firm offers low-cost fixed and variable spreads on 1000+ assets with robust trading platforms and training materials. The Signal Centre can also be used for trade ideas.

- IC Trading - IC Trading is part of the established IC Markets group. Built for serious traders, it boasts some of the most competitive spreads, reliable order execution, and advanced trading tools. The catch is that it’s registered in the offshore financial centre of Mauritius, enabling it to offer high leverage but in a weakly regulated trading setting.

Best Day Trading Platforms and Brokers in the Netherlands 2026 Comparison

| Broker | EUR Account | Minimum Deposit | Markets | Platforms | Leverage | Regulator |

|---|---|---|---|---|---|---|

| XTB | ✔ | $0 | CFDs on shares, Indices, ETFs, Raw Materials, Forex currencies, cryptocurrencies, Real shares, Real ETFs | xStation | 1:30 (EU) 1:500 (Global) | FCA, CySEC, KNF, DFSA, FSC |

| Eightcap | ✔ | $100 | CFDs, Forex, Stocks, Indices, Commodities, Crypto | MT4, MT5, TradingView | 1:30 | ASIC, FCA, CySEC, SCB |

| XM | ✔ | $5 | CFDs, Forex, Stocks, Commodities, Indices, Thematic Indices, Precious Metals, Energies | MT4, MT5, TradingCentral | 1:30 | CySEC, DFSA, SCA, FSCA, FSA, FSC Belize, FSC Mauritius, CMA |

| AvaTrade | ✔ | $100 | CFDs, Forex, Stocks, Indices, Commodities, ETFs, Bonds, Crypto, Spread Betting, Futures | WebTrader, AvaTradeGO, AvaOptions, AvaFutures, MT4, MT5, AlgoTrader, TradingView, TradingCentral, DupliTrade | 1:30 (Retail) 1:400 (Pro) | ASIC, CySEC, FSCA, ISA, CBI, JFSA, FSRA, BVI, ADGM, CIRO, AFM |

| Trade Nation | ✔ | $0 | Forex, CFDs, Indices, Shares, Commodities, Futures, Bonds, Spread Betting, Cryptos (Bahamas Entity Only) | TN Trader, MT4 | 1:500 (entity dependent) | FCA, ASIC, FSCA, SCB, FSA |

| IC Trading | ✔ | $200 | CFDs, Forex, Stocks, Indices, Commodities, Bonds, Cryptos, Futures | MT4, MT5, cTrader, AutoChartist, TradingCentral | 1:500 | FSC |

XTB

"XTB stands out as a top choice for new day traders with the terrific xStation platform, low trading costs, no minimum deposit, and excellent educational tools, many of which are seamlessly integrated into the platform. "

Christian Harris, Reviewer

XTB Quick Facts

| Demo Account | Yes |

|---|---|

| Instruments | CFDs on shares, Indices, ETFs, Raw Materials, Forex currencies, cryptocurrencies, Real shares, Real ETFs |

| Regulator | FCA, CySEC, KNF, DFSA, FSC |

| Platforms | xStation |

| Minimum Deposit | $0 |

| Minimum Trade | 0.01 Lots |

| Leverage | 1:30 (EU) 1:500 (Global) |

| Account Currencies | USD, EUR, GBP |

Pros

- The xStation platform continues to impress with its user-friendly interface and intuitive features, including customizable news feeds, sentiment heatmaps, and trader calculator, reducing the learning curve for newer traders.

- First-class 24/5 customer support is available, including a friendly live chat with response times of under two minutes during testing.

- XTB offers fast withdrawals with payment within 3 business days, depending on the method and amount.

Cons

- The demo account expires after just four weeks, a serious limitation for traders who wish to thoroughly test the xStation platform and practice short-term strategies before committing real funds.

- Trading fees are competitive with average spreads of around 1 pip on the EUR/USD but still trail the cheapest brokers like IC Markets, plus there's an inactivity fee after 12 months.

- XTB does not offer a raw spread account, which is becoming increasingly common among competitors like Pepperstone, and may disappoint day traders looking for the tightest spreads.

Eightcap

"Eightcap delivers in every area for day traders with a growing selection of charting platforms, education via Labs, and AI-powered tools. Now sporting 120+ crypto CFDs, it's also become a stand-out choice for crypto trading, winning our 'Best Crypto Broker' award two years in a row."

Christian Harris, Reviewer

Eightcap Quick Facts

| Demo Account | Yes |

|---|---|

| Instruments | CFDs, Forex, Stocks, Indices, Commodities, Crypto |

| Regulator | ASIC, FCA, CySEC, SCB |

| Platforms | MT4, MT5, TradingView |

| Minimum Deposit | $100 |

| Minimum Trade | 0.01 Lots |

| Leverage | 1:30 |

| Account Currencies | USD, EUR, GBP, CAD, AUD, NZD, SGD |

Pros

- After bolstering its roster in 2021, Eightcap offers one of the most extensive selections of cryptocurrency CFDs in the market, with crypto/fiat pairs, crypto/crypto pairs, plus crypto indices for broader exposure to the market.

- Having excelled across all key areas for day traders, Eightcap outperformed every competitor to win our 'Best Overall Broker' award for 2024, also securing our 'Best Crypto Broker' title for 2025 and 'Best TradingView Broker' for 2025.

- With tight spreads from 0 pips, low commission fees, and high leverage up to 1:500 for certain clients, Eightcap provides cost-effective and flexible trading conditions that can accommodate an array of strategies, including day trading and scalping.

Cons

- In spite of an increasing variety of tools, Eightcap doesn't offer industry favorites like Autochartist or Trading Central, which offer cutting-edge charting analytics, live news, and market insights for short-term traders.

- The demo account expires after 30 days and can only be extended upon request - a notable inconvenience compared to the likes of XM with its unlimited demo mode.

- Eightcap needs to continue bolstering its suite of 800+ instruments to match category leaders like Blackbull Markets with its 26,000+ assets, featuring a particularly weak selection of commodities.

XM

"With a low $5 minimum deposit, advanced charting platforms in MT4 and MT5, expanding range of markets, and a Zero account offering spreads from 0.0, XM provides all the essentials for active traders, even earning our ‘Best MT4/MT5 Broker’ award in recent years."

Christian Harris, Reviewer

XM Quick Facts

| Demo Account | Yes |

|---|---|

| Instruments | CFDs, Forex, Stocks, Commodities, Indices, Thematic Indices, Precious Metals, Energies |

| Regulator | CySEC, DFSA, SCA, FSCA, FSA, FSC Belize, FSC Mauritius, CMA |

| Platforms | MT4, MT5, TradingCentral |

| Minimum Deposit | $5 |

| Minimum Trade | 0.01 Lots |

| Leverage | 1:30 |

| Account Currencies | USD, EUR, GBP, JPY |

Pros

- XM has rolled out platform upgrades with integrated TradingView charts and an XM AI assistant, delivering faster execution, smarter analysis, and a sleeker, more intuitive trading experience.

- XM secured a category 5 license from the Securities and Commodities Authority (SCA) of the United Arab Emirates in late 2025, strengthening its regulatory credentials and making it a strong option for traders in the Middle East.

- XM’s growing roster of 1,000+ instruments provides diverse short-term trading opportunities, with unique turbo stocks, fractional shares, and more recently thematic indices.

Cons

- Although trusted and generally well-regulated, the XM global entity is registered with weak regulators like FSC Belize and UK clients are no longer accepted, reducing its market reach.

- While the XM app stands out for its usability and exclusive copy trading products, the selection of technical analysis tools needs to be improved to meet the needs of advanced traders.

- XM relies solely on the MetaTrader platforms for desktop trading, so there’s no in-house downloadable or web-accessible solution for a more beginner-friendly user experience with unique features.

AvaTrade

"AvaTrade offers active traders everything they need: an intuitive WebTrader, powerful AvaProtect risk management, a smooth 5-minute sign-up process, and dependable support you can rely on in fast-moving markets."

Jemma Grist, Reviewer

AvaTrade Quick Facts

| Demo Account | Yes |

|---|---|

| Instruments | CFDs, Forex, Stocks, Indices, Commodities, ETFs, Bonds, Crypto, Spread Betting, Futures |

| Regulator | ASIC, CySEC, FSCA, ISA, CBI, JFSA, FSRA, BVI, ADGM, CIRO, AFM |

| Platforms | WebTrader, AvaTradeGO, AvaOptions, AvaFutures, MT4, MT5, AlgoTrader, TradingView, TradingCentral, DupliTrade |

| Minimum Deposit | $100 |

| Minimum Trade | 0.01 Lots |

| Leverage | 1:30 (Retail) 1:400 (Pro) |

| Account Currencies | USD, EUR, GBP, CAD, AUD |

Pros

- Support at AvaTrade performed excellently during testing, with response times of 3 minutes and localized support in major trading jurisdictions, including the UK, Europe and the Middle East.

- AvaTrade launched AvaFutures to offer low-margin access to global markets, then expanded in 2025 as one of the first brokers to add CME’s Micro Grain Futures, and then later in the year went further by integrating with TradingView.

- The WebTrader excelled in our hands-on tests, sporting a user-friendly interface for beginners, complete with robust charting tools like 6 chart layouts and 60+ technical indicators.

Cons

- The AvaSocial app is good but not great – the look and feel, plus the navigation between finding strategy providers and account management needs upgrading to rival category leaders like eToro.

- Although the deposit process itself is smooth, AvaTrade still doesn’t facilitate crypto payments, a feature increasingly offered by brokers like TopFX, which caters to crypto-focused traders.

- While signing up is a breeze, AvaTrade lacks an ECN account like Pepperstone or IC Markets, which provides the raw spreads and ultra-fast execution many day traders are looking for.

Trade Nation

"Trade Nation is a good choice for newer traders looking for a wide range of financial markets on a user-friendly platform. There is no minimum deposit, free funding options and strong education."

William Berg, Reviewer

Trade Nation Quick Facts

| Demo Account | Yes |

|---|---|

| Instruments | Forex, CFDs, Indices, Shares, Commodities, Futures, Bonds, Spread Betting, Cryptos (Bahamas Entity Only) |

| Regulator | FCA, ASIC, FSCA, SCB, FSA |

| Platforms | TN Trader, MT4 |

| Minimum Deposit | $0 |

| Minimum Trade | 0.1 Lots |

| Leverage | 1:500 (entity dependent) |

| Account Currencies | USD, EUR, GBP, AUD, ZAR, SEK, NOK, DKK |

Pros

- A choice of trading platforms and apps, including MT4, make the brand a good fit for savvy traders

- Multiple account currencies are accepted for global traders

- There is a low minimum deposit for beginners

Cons

- Fewer legal protections with offshore entity

IC Trading

"With superior execution speeds averaging 40 milliseconds, deep liquidity, and powerful charting software, IC Trading delivers an optimal trading environment tailored for scalpers, day traders, and algorithmic traders. "

Christian Harris, Reviewer

IC Trading Quick Facts

| Demo Account | Yes |

|---|---|

| Instruments | CFDs, Forex, Stocks, Indices, Commodities, Bonds, Cryptos, Futures |

| Regulator | FSC |

| Platforms | MT4, MT5, cTrader, AutoChartist, TradingCentral |

| Minimum Deposit | $200 |

| Minimum Trade | 0.01 Lots |

| Leverage | 1:500 |

| Account Currencies | USD, EUR, GBP, CAD, AUD, NZD, JPY, CHF, HKD, SGD |

Pros

- IC Trading provides industry-leading spreads, including 0.0-pip spreads on major currency pairs such as EUR/USD, making it ideal for day traders.

- Trading Central and Autochartist are valuable tools for in-depth technical summaries and actionable trading ideas and are accessible from within the account area or the cTrader platform.

- IC Trading offers unusual flexibility in its accounts, enabling traders to open up to 10 live and 20 demo accounts, meaning you can run separate profiles for different activities, such as manual trading and algo trading.

Cons

- The educational resources are greatly in need of improvement, unless you navigate to the IC Markets website, posing a limitation for beginners in search of a comprehensive learning journey, especially compared to category leaders like eToro.

- Despite being part of the trusted IC Markets group, IC Trading is authorized by a weak regulator - the FSC of Mauritius, with limited financial transparency and regulatory safeguards.

- Customer support performed woefully during testing with multiple attempts to connect via live chat and no one available to assist, plus unanswered emails, raising concerns about its ability to address urgent trading concerns.

Methodology

To identify the best day trading platforms in the Netherlands, we scoured our directory of 140 online brokers, focused on those that accept Dutch traders, and ranked them by their rating.

Our ratings are derived from over 100 data points and first-hand insights from our broker analysts.

- We confirmed that each broker accepts Dutch traders.

- We verified each broker’s regulatory status and trust score.

- We prioritized brokers with competitive trading fees.

- We favored brokers with a diverse range of markets.

- We focused on brokers with powerful charting platforms.

- We checked the leverage and margin requirements of each broker.

- We ensured each broker offers reliable order execution.

How To Choose A Day Trading Broker In The Netherlands

Based on our years of experience in the day trading industry, there are several factors to consider when choosing a brokerage:

Trust

Choose a secure and regulated broker.

This will ensure that you receive robust safeguards like negative balance protection so you can’t lose more than your balance while using popular short-term products like derivatives from CFD providers in the Netherlands. It also means you should be better protected from trading scams.

The Noord-Holland District Court, for example, sentenced two Dutch nationals to up to 4 years in prison for a large-scale trading scam in which they convinced victims to invest large sums of money on two fake websites. This incident underscores the importance of a trusted and regulated brokerage.

In the Netherlands, the Authority for the Financial Markets (AFM) regulates online trading, although very few day trading brokers hold a license directly with the AFM.

Instead, brokers regulated by other European ‘green-tier’ authorities are permitted to onboard Dutch traders through the EU’s cross-border initiative. If you choose this option, make sure you comply with the AFM’s regulations and tax rules in the Netherlands.

- AvaTrade is a highly trusted brand, operating since 2006 and holding multiple licenses with green-tier authorities, including the Central Bank of Ireland (CBI) which oversees the European branch. The firm also offers negative balance protection and a unique risk management tool, AvaProtect.

Day Trading Fees

Choose a broker with excellent pricing.

This is especially important for fast-paced traders executing frequent transactions per day.

Notably, we assess the broker’s spreads on popular markets, including those in Europe like the EUR/USD, as well as non-trading fees like account funding or inactivity charges.

Our firsthand observations also show that some brokers offer superior services in return for slightly higher fees. For example, getting free access to political updates or economic releases from De Nederlandsche Bank (DNB) may be particularly valuable for Dutch investors.

- Pepperstone continues to offer industry-leading pricing including spreads from 0.0 on EUR/USD and from 0.6 on the AEX Index, plus fee-free account funding. You also get access to a live economic calendar where you can filter events by ‘Netherlands’.

Market Coverage

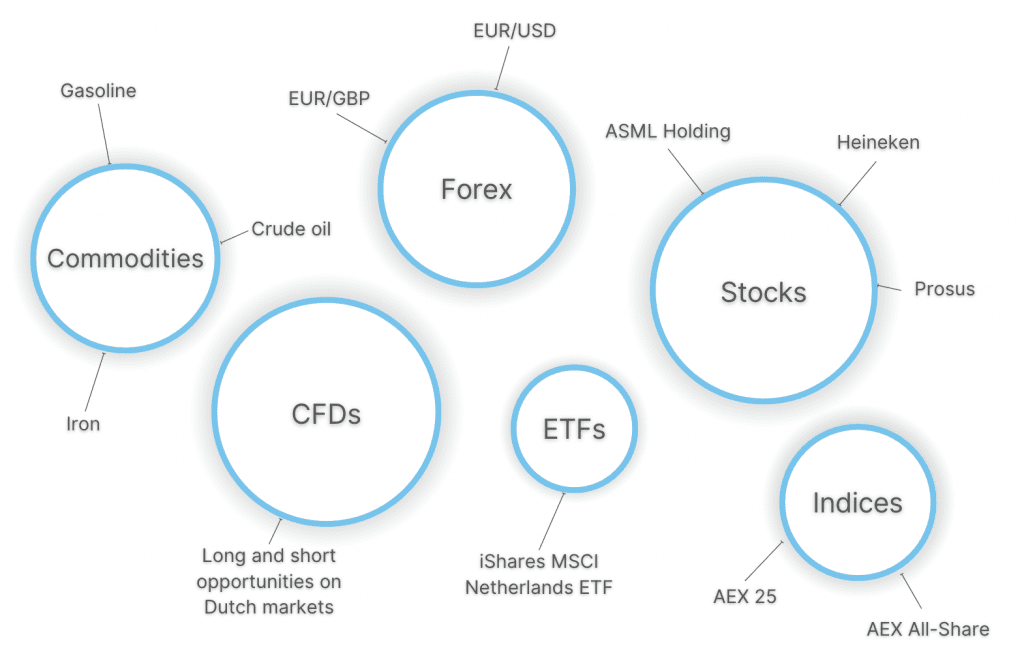

Choose a broker with a diverse range of day trading markets.

It’s important to select a broker that offers the assets you want to trade. For Dutch traders, these might be popular currency pairs involving the EUR, as well as the AEX Index and stocks listed on the Euronext Amsterdam.

- XTB stands out for its wide range of markets, with over 5600+ instruments, including the Netherlands 25 Index, numerous EUR currency pairs and a superb range of real shares and stock CFDs, including ASML Holding and Heineken.

Platforms & Tools

Choose a broker with reliable charting platforms.

A powerful charting platform will allow you to perform technical analysis – one of the most popular approaches used to identify short-term trading opportunities.

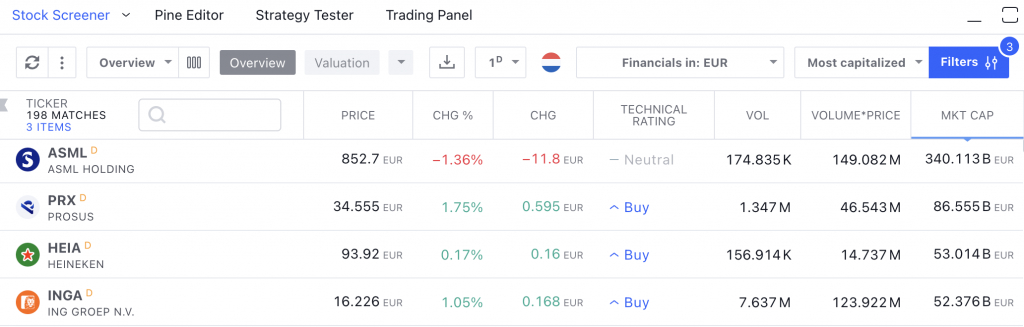

While MetaTrader 4 and MetaTrader 5 remain the most widely offered to retail traders, sleeker alternatives like cTrader and TradingView are rapidly catching up, with a growing number of brokers offering these alternatives.

My favorite feature on TradingView is the in-platform stock screener, which makes it a breeze to filter Dutch stocks and view useful data like market cap and buy/sell signals.

The dependability and functionality of day trading apps have also made significant strides in recent years. We’ve used dozens of apps and more than ever they offer a comprehensive mobile trading experience.

- Eightcap offers a range of flexible platforms to suit all needs, including both MetaTrader terminals plus TradingView. With the addition of supplementary tools like Capitalise.ai and the AI-powered economic calendar, the brand offers the full package for short-term traders.

Leverage & Margin

Choose a broker with clear leverage and margin requirements.

You may need leverage if you want to maximize your potential profit, though beginners should be particularly cautious since the risk of losses is also increased.

Leverage allows you to amplify the value of your trade with just a small outlay (margin).

So if I put down €250 for a trade on the Ned 25 Index with a leverage of 1:5, my position would be worth €1,250,

My profits and losses would be multiplied by 5.

- Deriv offers very high leverage up to 1:1000 for experienced traders and multipliers up to 30x for beginners, with all rates provided upfront. The margin calculator is also a really useful feature that allows you to calculate how much you need to open and maintain a position.

Execution Quality

Choose a broker with fast and reliable order execution.

The quality of order execution determines how quickly and efficiently your positions are filled. In our experience, the best brokers for day trading deliver execution speeds of less than 100 milliseconds.

They will help ensure that orders are filled at the requested price, or a better price (positive slippage) and keep latency low, ensuring minimal time delay.

- Skilling boasts incredibly impressive execution speeds of 5 milliseconds, making it a terrific choice for traders using fast-paced strategies like scalping and day trading.

Account Funding

Choose a broker with a minimum deposit that suits your budget.

Most day trading platforms we evaluate offer beginner-friendly minimum investments from €0 to €250.

It’s also worth considering brokers that offer popular payment methods in the Netherlands which can help to minimize transaction costs and reduce processing times while ensuring hassle-free deposits and withdrawals.

According to research by PPRO, the most popular digital payment method in the Netherlands is iDEAL which has a 58% market share, though Klarna and Trustly are also widely used.

- eToro is an excellent choice if you’re looking for accessible accounts and funding options in the Netherlands. The firm offers EUR accounts with a low $100 first deposit for Dutch traders, plus a range of convenient funding methods, including iDEAL.

FAQ

Who Regulates Day Trading Brokers In The Netherlands?

The Authority for the Financial Markets (AFM) is responsible for regulating brokers that offer day trading products in the Netherlands.

That said, Dutch traders can also register with brokers regulated by other European authorities under the EU’s passporting scheme – one of the most prevalent is the Cyprus Securities & Exchange (CySEC). You should still comply with your local regulations and tax rules.

Which Is The Best Broker That Accepts Day Traders From The Netherlands?

Refer to our list of the top day trading brokers in the Netherlands to find one that best suits your needs.

If you’re looking for opportunities in local markets, for example, XTB offers 5600+ instruments including EUR currency pairs and Dutch securities. It’s also got a slick trading app that our experts love using.

Recommended Reading

Article Sources

- Authority for the Financial Markets (AFM)

- Euronext Amsterdam

- De Nederlandsche Bank (DNB)

- Netherlands 25 Index (AEX)

- ASML Holding (ASML) - Euronext

- Heineken (HEIA) - Euronext

- Payment Methods In The Netherlands - PPRO

- Large-Scale Investment Scam - De Rechtspraak

The writing and editorial team at DayTrading.com use credible sources to support their work. These include government agencies, white papers, research institutes, and engagement with industry professionals. Content is written free from bias and is fact-checked where appropriate. Learn more about why you can trust DayTrading.com