Skilling Review 2026

See the best Skilling alternatives in your location.

Awards

- Best Forex Trading Platform - Global Forex Awards 2022

Pros

- The broker has a solid global reputation and is regulated by top-tier authorities including the CySEC

- The broker offers smooth account funding with a good range of payment methods with zero deposit fees

- The €100 deposit and zero commissions in the Standard account are accessible for beginners

Cons

- Skilling trails alternatives like IG when it comes to research tools that can help day traders make informed decisions

- You can only access shares in the Skilling Trader platform and fewer instruments are available overall in the MT4 accounts

Skilling Review

Skilling is a Scandinavian-owned CFD, forex, stock, commodity and crypto broker. The company offers trading opportunities via the industry-recognized MT4, cTrader and an in-house browser-based platform, also available on iOS and Android.

This Skilling review looks at the investing apps, live spreads, account types, social trading services, customer support and more. Find out whether to open a Skilling.com account in 2026.

Company Details

Skilling was established in 2016 with a purpose to make trading simple and accessible to all. Today, the fintech broker operates from headquarters in Cyprus with additional offices in Spain and Malta.

Created with the goal of developing a comprehensive, easy-to-understand trading platform and investing solution for everyone, the Skilling group has a team of dedicated developers, specialists and marketers working to ensure the best experience for traders. 50 employees help provide cutting-edge technology, 1200+ financial instruments and transparent pricing.

The company operates via:

- Skilling Ltd – regulated by the Cyprus Securities & Exchange Commission (CySEC)

Platforms

Skilling Trader

Skilling’s in-house platform is a good option for beginners. It features multiple indicators, including moving average and MACD, allowing for convenient technical analysis. A range of chart styles are also available, plus complete order management with access to previous trades, account balances and brokerage withdrawal history.

One particularly useful feature is being able to analyze historical trading patterns versus other portfolios. By looking at historical data, traders can make better predictions, such as 5, 7 or 10 day forecasts.

When compared to other platforms, investors have faster access to data, more customizable elements, a range of filters and the ‘Explore Markets’ function – helping clients find the right trades quickly.

Thanks to its browser-based format, Skilling’s trading platform is available on every major browser. It also functions on mobile, with specific iOS and Android apps.

How To Download

- Log into your Skilling account

- Click on the menu button in the top left-hand corner

- Select ‘My Accounts’ and then ‘Account’

- In the dashboard select ‘Open an Account’

- Enter the requested on-screen information

- Choose a download option (Web, Android or iOS)

MetaTrader 4

The popular MT4 platform is available to download from the broker’s website. The webtrader version is also provided, alongside a mobile app.

MT4 offers 200+ instruments alongside fast execution speeds, Expert Advisors (EAs) for automated trading, plus ample charting tools including 2000 customizable indicators.

MetaTrader 4 is the most popular investing platform on the market and will meet the needs of most traders. For traders already familiar with MT4, it makes sense to stick with this platform and app.

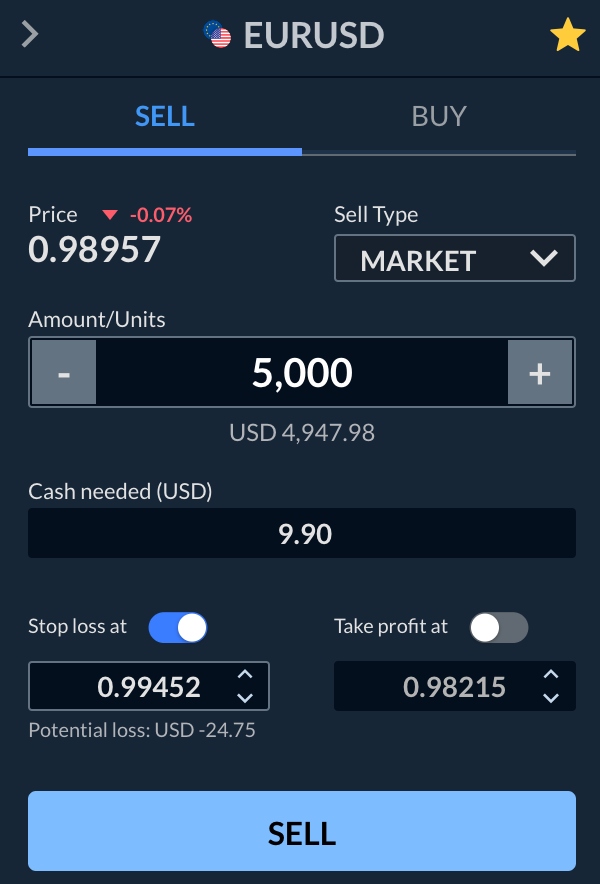

How To Place A Trade

- Click the ‘New Order’ icon in the platform menu (or press F9)

- Choose the order type

- Enter the volume in lots

- Add any comments (optional)

- Add a stop loss or take profit (optional)

- Click on ‘Buy’ or ‘Sell’ to confirm the trade

cTrader

cTrader is a sophisticated platform designed to satisfy the needs of beginners and experienced investors alike. It provides fast entry and execution, advanced charting tools, order types, level II pricing and more.

Additionally, it has a user-friendly interface and clients can invest via web browser, mobile phone, or by downloading the software from the broker’s website.

When compared to MT4, cTrader provides three different levels of market depth, whereas MT4 only has one.

Assets & Markets

Skilling provides access to an impressive list of global assets:

- Commodities – 21 commodities including gold, silver, oil and natural gas

- Cryptocurrency – 63 digital currency CFDs including Bitcoin, Ethereum, Litecoin and Ripple (not available in China)

- Currencies – 70+ currency pairs including USD/CAD, GBP/PLN, EUR/JPY and GBP/AUD (53 available on MetaTrader).

- Stocks – Speculate on hundreds of global companies including Amazon, Apple, Facebook, Google, Tesla and Uber

- Indices – 23 different indices including S&P 500, Nasdaq, AUS200, VIX, Germany 40 and SPA35. Users that wish to trade HKComp and DE30 can instead invest in HK50 and DE40

The broker also recently introduced around-the-clock forex trading on 7 currency pairs (AUD/USD, EUR/USD, GBP/USD, NZD/USD, USD/CAD, USD/CHF, USD/JPY), providing weekend trading opportunities not found at most brokers.

On the downside, our experts found that some products, including bonds, are not available. Direct share dealing is also not offered.

Spreads & Commission

Spreads start from a reasonable 0.7 pips on Standard accounts, while Premium accounts, with a minimum deposit of $5000+ can access spreads from 0.1 pips.

Commissions are not charged on the Standard account, however the Premium option incurs a fee of $35/million dollar volume traded on forex and spots metals. The commission on cryptos is 0.1%.

A full list of fees is provided for all assets on the broker’s website, along with swap rates which are charged at the end of the trading day (22:00 GMT).

We also found that if you request a withdrawal with no trading activity that Skilling reserves the right to charge 2.5% of the withdrawal value.

Skilling Leverage

As per ESMA regulations, the maximum leverage for retail traders is 1:30. As such, forex majors are available at 1:30, forex minors at 1:20, metals at 1:20, major indices at 1:20, minor indices and commodities at 1:10, and shares go up to 1:5.

Importantly, leverage increases your exposure to the markets, but it also brings risk, so risk management is necessary.

Mobile Apps

The broker offers the Skilling Trader, MetaTrader 4 and cTrader platforms on iOS and Android devices. You can find the download links on the official website, or by going directly to the Apple App Store or Google Play.

The applications allow investors to access all features and functionality of the desktop platforms. This includes mobile compatible graph views, one-click trading to open and close positions on the go and historical price analysis. Users can also make deposits and withdrawals and contact the Skilling customer support team.

All mobile apps are free to live account holders.

Deposits & Withdrawals

The minimum deposit in the EU is 100 EUR, GBP, USD or 1000 NOK, SEK for Standard Skilling accounts, while Premium accounts have a higher minimum requirement of 5,000 EUR, GBP, USD or 50,000 NOK, SEK.

Payment methods supported by Skilling include bank transfer, Visa or Mastercard debit and credit cards, plus e-payment options such as Skrill, Klarna, and Neteller. On the downside, the firm does not currently support cryptocurrency payments.

In general, deposits and withdrawals are free, but the broker reserves the right to charge a fee of up to 2.9% for transactions using Neteller and Skrill. Third party charges may apply for other payment methods.

Most deposits are processed instantly while withdrawals take one working day. The exception to this is bank wire transfers which can take 2-7 business days.

Demo Account

The online broker also provides a demo account. The practice account is equipped with a virtual balance of $10,000 and allows potential customers to get a feel for what real investing with Skilling is like.

This account is risk-free and provides a safe virtual location for testing strategies, improving knowledge and introducing newcomers to exactly how trading works.

The demo account is available for 90 days following registration. Interested potential customers can sign up via the website, and can easily upgrade from a demo profile to a Standard account by completing account verification.

Deals & Promotions

Due to the regulatory measures laid out by the CySEC, brokers cannot offer bonuses or promotions to new customers in EU / EEA countries. Traders from several other countries also cannot participate in offers.Instead, Skilling.com focuses on providing transparency in its payments, functionality and design. The selection of third-party tools and copy trading functionality is also a plus versus competitors.

Regulation & Licensing

Skilling Ltd is fully regulated and authorized by the Cyprus Securities and Exchange Commission (CySEC), license number 357/18.

Skilling provide negative balance protection (may not be offered to Elective Professional Clients under the CySEC-regulated entity) and client funds are kept in segregated accounts.

Overall, our experts are comfortable that Skilling.com is a legitimate trading brokerage and not a scam.

Additional Features

When we used Skilling, we found the broker stands out for its selection of useful tools:

- Skilling Trade Assistant – provides questions newbies should ask when opening a trade

- The Help Centre – clients can have their questions answered on payment methods and account usability, among others

- Explore Markets – gives investors swift access to the most important markets via a range of filters – risers, fallers, volatility and volume lists

- News – the dashboard features an easy-to-follow user interface, including the Skilling Academy, in addition to relevant selected news stories to provide further insight into trading markets

- Notifications & Alerts – weekly market reports, trade of the day, economic event alerts via Autochartist and more via the notification panel

- The Watchlist – a clear view of financial instruments, including their country of origin and popularity. The inclusion of a search bar allows for additional functionality. The Watchlist can also be customized by the investor to monitor specific assets or types of trade

Skilling’s broker and trading guides can be accessed upon login. However, the majority of blog articles are available to anyone.

Skilling Accounts

Our experts found that Skilling offers three live account types:

- Standard Account – the most popular account for new traders registering with Skilling. A minimum deposit requirement is applicable of at least 100 EUR/USD/GBP or 1000 NOK, SEK to open. The standard spread starts at 0.7 pips.

- Premium Account – this account is designed for experienced traders, and must be requested directly through Skilling. The minimum deposit is 5,000 EUR/USD/GBP or 50,000 NOK, SEK. Spreads start from 0.1 pips.

- MT4 & MT4 Premium – these options are only available on the MT4 platform and mirror the conditions of the previous accounts. For example, the MT4 account has the same trading conditions as the Standard account in terms of spreads and minimum deposits; and the MT4 Premium duplicates the conditions of the Premium account. Note, the MT4 accounts also come with fewer stocks and shares, plus fewer commodities.

Several account variations are also provided: Corporate (Entity), Swap-Free/Islamic, and MAM / PAMM (Multi Account Manager / Percentage Allocation Management Module).

How To Open A Skilling Account

New users can sign up and start trading at Skilling.com in a few simple steps:

- Register for an account using the registration link (the sign-up form takes a few minutes)

- Verify your ID (upload your documents or register with BankID)

- Make a deposit using the list of supported payment options

- Download the platform you wish to use or open the web browser

- On the web platform, for example, select an asset from the menu in the top left

- An order window will appear where you can filter the trade parameters, including execution type, position size, plus stop loss and take profit levels

Trading Hours

Skilling’s trading platforms are available 24 hours a day, 7 days a week. However, keep in mind that certain markets are only opened at specific times. A full list is provided on the official website.

Customer Support

Contacting Skilling is easy, with readily available details and customer support lines open every weekday. The team can be contacted via instant web chat, WhatsApp, Telegram, Line, or through the help desk portal.

Alternatively, the following details are provided:

- Email – support@skilling.com

- UK Toll Free Telephone Number – + 44 208 080 6555

- Live chat – Available via the ‘Contact Us’ page, weekdays only

- Phone number for HQ office in Cyprus – +357 2227 6710

The broker is present on social media channels including Twitter, Facebook and Instagram.

Safety & Security

The brand conforms to regulatory requirements surrounding client account segregation. This means investors’ funds are kept separate from the company’s capital. In addition, Skilling.com holds an Investor Compensation Fund (ICF) membership.

Skilling’s online trading platforms are protected through a Secure Socket Layer (SSL), ensuring all customer and broker data is fully encrypted before transmission via the internet. This means customers are also kept safer from cybercrime and fraud in regards to both their trades and deposited money.

Skilling Verdict

Skilling is a good all-round broker that offers access to hundreds of global assets and spreads from 0.1 pips. Tight regulation by the CySEC adds to its appeal. However, the brand is best suited to beginners, owing to its user-friendly web platform and copy trading solution. Alongside these, the selection of educational materials will help new investors get started.

FAQ

Is Skilling Legit Or A Scam?

Skilling is a legitimate trading brokerage with a CySEC license and a client base that spans Nordic regions and beyond. The broker has also teamed up with reputable software providers, such as MetaQuotes and cTrader, and houses hundreds of strategy providers on its copy trading app. Overall, our team are comfortable that Skilling.com is not a scam.

Is Skilling Good For Day Trading?

The Premium account is the best choice for active day traders with spreads from 0.1 pips and execution speeds of under 5ms. On the downside, a €5000 minimum deposit is required, which is higher than some alternatives.

Is Skilling The Best Broker?

The ‘best’ broker for you will depend on your trading style and requirements. With that said, Skilling offers competitive spreads and commissions, a choice of platforms and apps, regulatory oversight, plus access to hundreds of instruments. Yet its user-friendly web platform make it the best pick for beginner traders.

How Does Skilling Broker Get Paid?

Skilling’s business model (STP and market maker) means it makes most of its money through spreads and commissions. This is in line with competitors and importantly, the brokerage still offers low-cost trading opportunities. Spreads start from 0.1 pips while commissions come in at $35 per million traded on forex and spot metals.

Does Skilling Broker Have Certification?

Yes, the company is regulated by the Cyprus Securities & Exchange Commission (CySEC).

Does Skilling Broker Have The Lowest Fees?

The firm has relatively low spreads and fees alongside a multitude of free deposits and withdrawal options. See our list of top brokers with low fees to see how Skilling compares to other big brokerages.

Where Can I Find More Skilling Broker Information?

You can check the official website for the latest updates. Alternatively, head to their social media channels for news on promotions, platform upgrades and new investing tools.

Does Skilling Broker Have Contract For Difference (CFD) Trading?

Yes, Skilling offers CFDs on hundreds of instruments including forex, stocks, indices, crypto, plus hard and soft commodities. Clients can start trading CFDs with a €100 minimum deposit. Leverage is capped at 1:30 for EU retail clients and 1:1000 for global traders.

Best Alternatives to Skilling

Compare Skilling with the best similar brokers that accept traders from your location.

- Interactive Brokers – Interactive Brokers (IBKR) is a premier brokerage, providing access to 150 markets in 33 countries, along with a suite of comprehensive investment services. With over 40 years of experience, this Nasdaq-listed firm adheres to stringent regulations by the SEC, FCA, CIRO, and SFC, amongst others, and is one of the most trusted brokers for trading around the globe.

- FOREX.com – Founded in 1999, FOREX.com is now part of StoneX, a financial services organization serving over one million customers worldwide. Regulated in the US, UK, EU, Australia and beyond, the broker offers thousands of markets, not just forex, and provides excellent pricing on cutting-edge platforms.

Skilling Comparison Table

| Skilling | Interactive Brokers | FOREX.com | |

|---|---|---|---|

| Rating | 3.4 | 4.3 | 4.5 |

| Markets | Forex, CFDs, Stocks, Indices, Commodities and Cryptos | Stocks, Options, Futures, Forex, Funds, Bonds, ETFs, Mutual Funds, Cryptocurrencies | Forex, Futures and Options on Metals, Energies, Commodities, Indices, Bonds, Crypto |

| Demo Account | Yes | Yes | Yes |

| Minimum Deposit | $100 | $0 | $100 |

| Minimum Trade | 0.01 Lots | $100 | 0.01 Lots |

| Regulators | CySEC | FCA, SEC, FINRA, CFTC, CBI, CIRO, SFC, MAS, MNB, FINMA, AFM | NFA, CFTC |

| Bonus | – | – | VIP status with up to 10k+ in rebates – T&Cs apply. |

| Platforms | Skilling Trader, MT4, cTrader, TradingView | Trader Workstation (TWS), IBKR Desktop, GlobalTrader, Mobile, Client Portal, AlgoTrader, OmniTrader, TradingView, eSignal, TradingCentral, ProRealTime, Quantower | WebTrader, Mobile, MT4, MT5, TradingView |

| Leverage | 1:1000 | 1:50 | 1:50 |

| Payment Methods | 9 | 6 | 9 |

| Visit | – | Visit | Visit |

| Review | – | Interactive Brokers Review |

FOREX.com Review |

Compare Trading Instruments

Compare the markets and instruments offered by Skilling and its competitors. Please note, some markets may only be available via CFDs or other derivatives.

| Skilling | Interactive Brokers | FOREX.com | |

|---|---|---|---|

| CFD | Yes | Yes | No |

| Forex | Yes | Yes | Yes |

| Stocks | Yes | Yes | Yes |

| Commodities | Yes | Yes | Yes |

| Oil | Yes | No | Yes |

| Gold | Yes | Yes | Yes |

| Copper | Yes | No | No |

| Silver | Yes | No | Yes |

| Corn | Yes | No | No |

| Crypto | Yes | Yes | No |

| Futures | No | Yes | Yes |

| Options | No | Yes | Yes |

| ETFs | No | Yes | No |

| Bonds | No | Yes | No |

| Warrants | No | Yes | No |

| Spreadbetting | No | No | No |

| Volatility Index | No | No | No |

Skilling vs Other Brokers

Compare Skilling with any other broker by selecting the other broker below.

The most popular Skilling comparisons:

Customer Reviews

4 / 5This average customer rating is based on 1 Skilling customer reviews submitted by our visitors.

If you have traded with Skilling we would really like to know about your experience - please submit your own review. Thank you.

Submit Your Own Review of Skilling

Article Sources

The writing and editorial team at DayTrading.com use credible sources to support their work. These include government agencies, white papers, research institutes, and engagement with industry professionals. Content is written free from bias and is fact-checked where appropriate. Learn more about why you can trust DayTrading.com

So I’m still kinda new to the whole day trading game, but I jumped on Skilling cause I’d heard decent stuff and figured the learning side would help me out. I gotta say, their Trade Assist tool was a lifesaver early on, it literally holds your hand through the whole trade setup: picking what to trade, setting your stop loss, take profit, the works. It even places the trade for you. Super in the early days.

The platform itself is super smooth. Loads of tools (most of which I still haven’t touched), but it’s super easy to get the hang of ideal if you’re just getting started like me.

But the video news updates, Hilarious!The intro is straight outta a cheesy 90s promo and the voiceover sounds like an awkward AI robot reading from a script. Kinda goofy, but worth a watch just for laughs. They might wanna polish that bit up though 😂.