Interactive Brokers Review 2026

Awards

- Best US Broker 2025 - DayTrading.com

Pros

- Interactive Brokers has launched ForecastTrader, a unique, zero-commission product where users can trade yes/no Forecast Contracts on political, economic, and climate events, with fixed $1 payouts per contract, 24/6 market access, and 3.83% APY on held positions.

- There's a vast library of free or paid third-party research subscriptions catering to all types of traders, plus you can enjoy commission reimbursements from IBKR if you subscribe to Toggle AI.

- IBKR continues to deliver unmatched access to global stocks with tens of thousands of equities available from 100+ market centres in 24 countries, most recently the Saudi Stock Exchange.

Cons

- Support can be slow and frustrating based on tests, so you might find it challenging to reach customer service representatives promptly or encounter delays in resolving issues.

- You can only have one active session per account, so you can’t have your desktop program and mobile app running simultaneously, making for a sometimes frustrating trading experience.

- TWS’s learning curve is steep, and beginners may find it challenging to navigate the platform and understand all the features. Plus500's web platform is much better suited to new traders.

Interactive Brokers Review

In this review of Interactive Brokers (IBKR), we provide an in-depth analysis of the broker’s features, strengths and weaknesses, to help you make informed decisions for your trading journey.

Regulation & Trust

IBKR continues to earn our confidence as one of the most trusted brokers for several reasons:

- It’s one of the most established brokers with over four decades in the online trading industry and over two million clients.

- It’s got an excellent reputation for pricing transparency, security credentials and adherence to regulatory standards.

- It’s authorized by several green-tier regulators; the US Securities and Exchange Commission (SEC), Commodity Futures Trading Commission (CFTC) and Financial Industry Regulatory Authority (FINRA), the UK Financial Conduct Authority (FCA), the Canadian Investment Regulatory Authorization (CIRO), the Monetary Authority of Singapore (MAS), and the Hong Kong Securities Futures Commission (SFC).

- It’s publicly traded on the NASDAQ, enhancing its transparency through routine audits, amongst other requirements.

As with any financial institution, it’s essential to conduct your own research and consider factors such as your trading goals, risk tolerance, and specific regulatory requirements in your jurisdiction before entrusting your money to any broker.

| Interactive Brokers | FOREX.com | NinjaTrader | |

|---|---|---|---|

| Regulation & Trust Rating | |||

| Regulators | FCA, SEC, FINRA, CFTC, CBI, CIRO, SFC, MAS, MNB, FINMA, AFM | NFA, CFTC | NFA, CFTC |

| Visit | Visit | Visit | Visit |

| Review | Review | Review | Review |

Accounts & Banking

Trading Accounts

IBKR offers a market-leading range of accounts to cater to the diverse needs of traders and investors. Each account type has specific requirements, features, and benefits, so you should take some time to choose the one that best aligns with your trading objectives:

- Individual Account: A standard brokerage account owned and operated by a single individual. It allows for the trading of various financial instruments such as stocks, options, futures, forex, and more. It’s suitable for day trading.

- Joint Account: A joint account is owned and operated by two or more individuals, allowing them to trade and invest together. This type of account is often used by couples, family members, or business partners.

- Corporate Account: Designed for businesses, corporations, or other legal entities, a corporate account allows for trading and investing on behalf of the entity. It requires additional documentation to verify the business’s legal status and ownership.

- IRA Accounts: Only available to US clients, IBKR offers Traditional, Roth, and SEP IRA accounts for retirement savings. These accounts provide tax advantages and are subject to specific contribution limits and withdrawal rules outlined by the Internal Revenue Service (IRS).

- Trust Accounts: Trust accounts are designed for trustees to manage assets on behalf of beneficiaries according to the terms of a trust agreement.

- Advisor Accounts: These accounts are for registered investment advisors (RIAs) who manage portfolios on behalf of their clients. Advisors can access a range of tools and features to execute trades, manage client accounts, and monitor performance.

- Hedge Fund & Proprietary Trading Group Accounts: These are specialized account types tailored to the needs of hedge funds, proprietary trading groups, and other institutional clients. They offer advanced trading capabilities and institutional-grade services.

A complimentary demo account lets you practice trading strategies and familiarize yourself with the platform’s features and tools with $1,000,000 of virtual funds.

While you can access the same trading platforms and tools available with live accounts, news feeds can be delayed by up to 15 minutes in simulator mode.

Once you’re ready to start trading real money, there are more account types to choose from:

- Cash accounts: These are limited to entering long securities positions, long option positions, and covered short positions.

- Margin accounts: These enable you to purchase securities on margin, allowing for short security positions, futures positions, and naked options positions.

- Portfolio margin accounts: Similar to margin accounts, these permit the same positions but calculate margin requirements differently. While they may offer increased leverage, a minimum account balance of $100,000 is required. Additionally, foreign accounts may not qualify, limiting international trading opportunities with this account type.

For beginners who are unfamiliar with managing a margin account, opting for a cash account is advisable. Unlike margin accounts, cash accounts do not entail margin calls, and you are permitted only a brief period of time in margin violation before positions are liquidated.

The account opening procedure at Interactive Brokers is entirely digital, albeit somewhat intricate. Following online registration, my account verification took two business days, which is considerably longer than a few minutes or hours it typically takes me to open an account with another brokerage, such as Plus500.

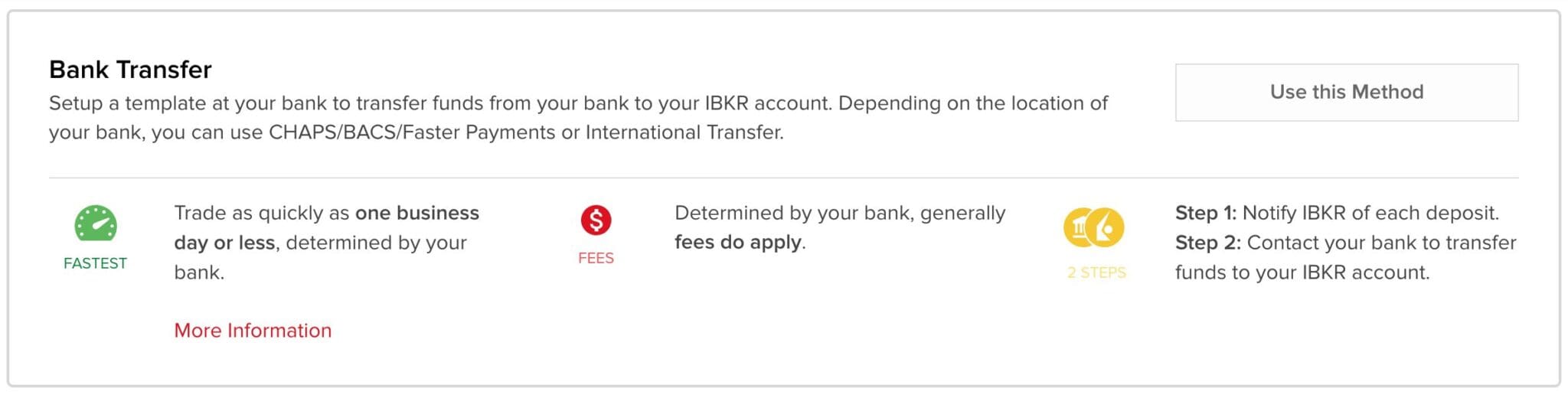

Deposits & Withdrawals

Depositing and withdrawing is limited to bank transfers and Wise Balances, eliminating the option to use bank cards or major electronic wallets including PayPal or Skrill. Not only are these funding options restrictive, but your bank may also apply a wire transfer fee.

US-based traders are better served with a few extra options including ACH (Automated Clearing House), check, online bill payment, direct rollover (IRA accounts only), trustee-to-trustee (IRA accounts only), and debit card deposits via the IBKR debit card provided with Integrated Investment Management accounts.

Withdrawals are subject to withdrawal limits, should take around two business days, and include a maximum daily withdrawal of $50,000 and a maximum total withdrawal of $100,000 within five business days.

The first withdrawal of each calendar month incurs no charges, but subsequent withdrawals are subject to platform withdrawal fees, which currently amount to around $10, depending on your location. Check payments are also available in USD and they carry a $4 fee.

If you wish to receive funds in a currency other than your base currency, conversion rates apply, with rates matching those used for forex trading conversions.

To help reduce currency conversion fees, you can choose from 27 base currencies, which is considerably more than most other brokers. Of course, the variety of currencies accessible to you will depend on the specific legal entity with which you are onboarded.

The account funding and withdrawal processes at IBKR are convoluted, time-consuming and limiting, which I find a big inconvenience when managing my funds. Brokers like eToro and IC Markets offer a much smoother funding process.

| Interactive Brokers | FOREX.com | NinjaTrader | |

|---|---|---|---|

| Accounts & Banking Rating | |||

| Payment Methods | ACH Transfer, Automated Customer Account Transfer Service, Cheque, Debit Card, TransferWise, Wire Transfer | ACH Transfer, Credit Card, Debit Card, Mastercard, Neteller, PayNow, Skrill, Visa, Wire Transfer | ACH Transfer, Cheque, Debit Card, Wire Transfer |

| Minimum Deposit | $0 | $100 | $0 |

| Visit | Visit | Visit | Visit |

| Review | Review | Review | Review |

Assets & Markets

IBKR continues to boast an almost overwhelming selection of markets, offering access to a diverse range of assets. From ETFs and bonds to more specialized options like warrants and structured products.

While its forex and CFD selection may not be as expansive as some competitors, the availability of products varies depending on the IBKR affiliate and your country of residence.

With access to approximately 150 exchanges worldwide, including its alternative services like Interactive Advisors – a blend of robo-advisory and social trading – there are ample options for diversification.

Additionally, IBKR has an Overnight Trading Hours service, giving you access to over 10,000 US stocks and ETFs nearly 24 hours a day, five days a week.

Also, there are fractional shares trading for both US and European stocks and ETFs, a welcome feature that enhances accessibility and flexibility for traders with smaller balances. This is a notable feature given that Interactive Brokers has historically best served advanced traders.

We’ve also increased its Assets & Markets Rating after it became the first international broker to offer foreign retail traders access to the Saudi Stock Exchange, known as Tadawul, providing fresh opportunities on the Middle East’s largest exchange.

2025 saw Interactive Brokers go further, introducing ForecastTrader, where you can trade yes/no Forecast Contracts on events like elections, inflation data, or climate trends.

Each contract pays $1 if correct (you can buy multiple for greater exposure). For example, you’d buy a YES contract on the Fed raising rates at $0.40, and earn $0.60 profit if it happens.

They are a bit like binary options in structure but what’s rare here is that they are being offered by a fully regulated broker. ForecastTrader also adds key advantages over binaries, such as early trade exit, transparent pricing, and a 3.83% APY yield on held positions.

| Interactive Brokers | FOREX.com | NinjaTrader | |

|---|---|---|---|

| Assets & Markets Rating | |||

| Trading Instruments | Stocks, Options, Futures, Forex, Funds, Bonds, ETFs, Mutual Funds, Cryptocurrencies | Forex, Futures and Options on Metals, Energies, Commodities, Indices, Bonds, Crypto | Futures, Forex, Stocks, Options, Commodities, Futures, Crypto (non-futures depend on provider) |

| Visit | Visit | Visit | Visit |

| Review | Review | Review | Review |

Fees & Costs

When it comes to costs, IBKR offers some of the most competitive forex spreads and fees. This is primarily because the majority of the broker’s clients consist of professional traders and institutions, necessitating the provision of low commission rates.

You can expect a low, fixed commission rate of $0.005 with a minimum of $1.00 on all products, including stocks, stock futures, options, futures options, forex bonds, and CFDs.

For European clients, there’s the option of a fixed-rate commission of 3 EUR/GBP for trades under 6,000 EUR/GBP in value, with the rate reducing to 0.005% for trades above this threshold.

IBKR employs a volume-based fee structure for stock trading, where fees are determined either per share or as a percentage of the trade value, with specified minimum and maximum thresholds. ETF trading fees mirror those of stocks.

On the downside, IBKR applies an exposure fee to a subset of high-risk margin clients, aiming to offset the costs associated with managing these accounts. The fee amount is determined through proprietary algorithms and varies based on individual circumstances and account activity.

| Interactive Brokers | FOREX.com | NinjaTrader | |

|---|---|---|---|

| Fees & Costs Rating | |||

| EUR/USD Spread | 0.08-0.20 bps x trade value | 1.2 | 1.3 |

| FTSE Spread | 0.005% (£1 Min) | 1.0 | |

| Oil Spread | 0.25-0.85 | 2.5 | |

| Stock Spread | 0.003 | 0.14 | |

| Visit | Visit | Visit | Visit |

| Review | Review | Review | Review |

It’s also worth noting that IBKR offers interest payments on cash balances, with rates reaching up to 4.83% for USD balances, provided you maintain a net asset value of $10,000 in your account. Beyond this threshold, interest is paid proportionally, with the maximum interest earned when the account value reaches $100,000.

There is no monthly inactivity fee, either – a bonus for casual traders.

Platforms & Tools

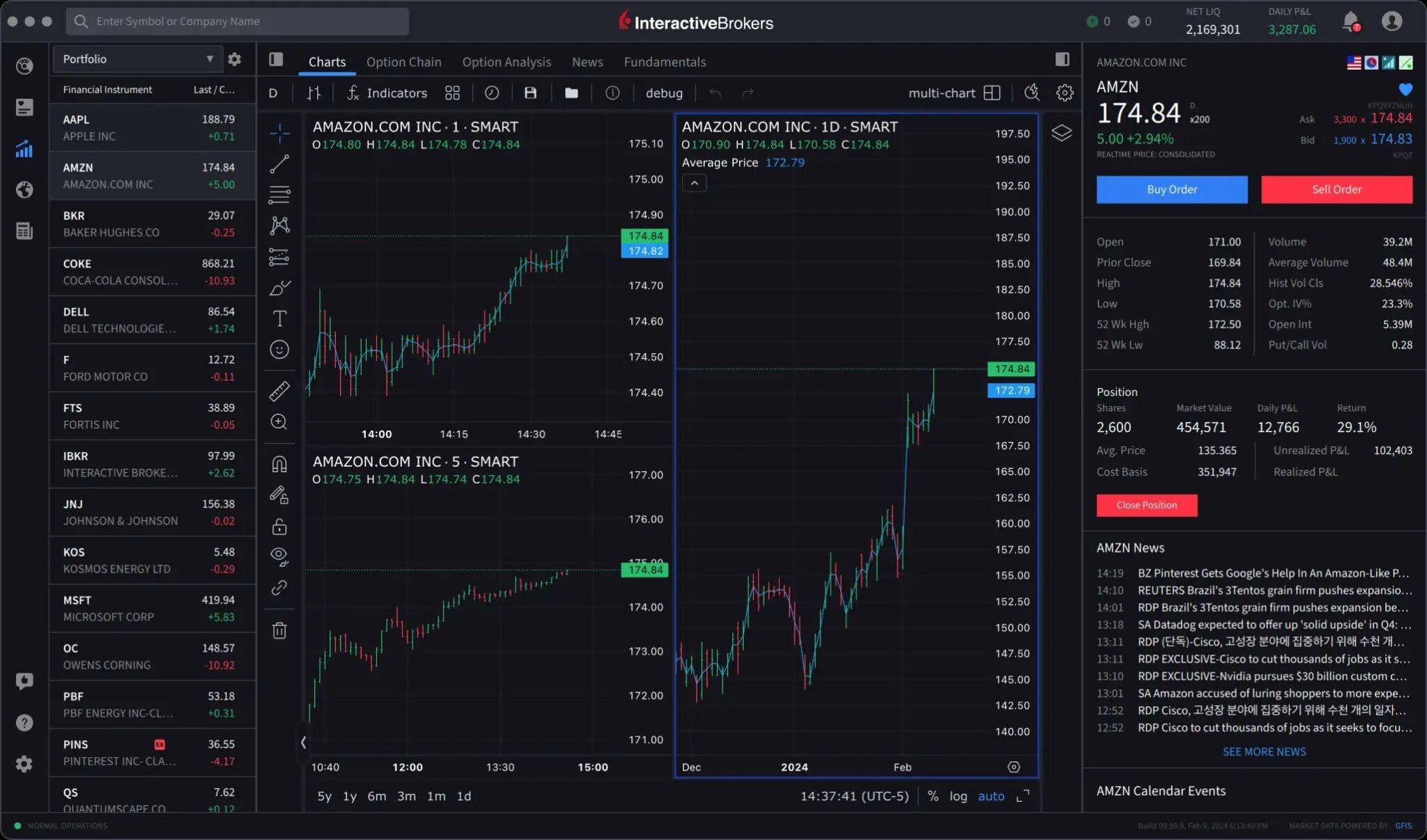

The flagship Trader Workstation (TWS) platform offers a vast array of trading instruments ranging from ETFs and futures to cryptocurrencies like Ethereum. Compatible with Mac, Windows, and Linux systems, the TWS provides essential functionalities such as backtesting and setting trailing stop limits.

You can choose between the default Mosaic setup or access the Classic TWS for the original platform experience. Watchlists are supported for managing numerous asset classes, with the platform generating a summary of available securities.

Customization is key, with a staggering 338 different columns available for personalized watchlists. The downside is that many users – myself included – may find themselves overwhelmed by long lists of real-time quotes or securities, requiring careful navigation.

In terms of charting capabilities, TWS is based on TradingView and offers 155 different studies for technical analysis. While fewer than some competitors, the platform provides essential tools like trendlines, notes, and Fibonacci analysis. Historical trades, alerts, and index overlays further enhance the charting experience.

Additional features include an impressive selection of 63 different order types, catering to diverse trading strategies. The ‘Options Strategy Lab’ lets you create and submit simple and complex multiple options orders, with the ability to compare up to five options strategies simultaneously. Algo trading functionalities are also available within TWS.

The Mutual Fund/ETF Replicator is worth noting as it assists in finding lower-cost ETF alternatives to mutual funds, aligning with IBKR’s commitment to offering a wide range of instruments and markets.

Regarding MetaTrader compatibility, IBKR does not actively support MetaTrader 4 or MetaTrader 5 platforms, as it prioritizes promoting its proprietary TWS platform. While the broker doesn’t provide direct assistance on integrating MetaTrader software with its platform, third-party software solutions are available to bridge the platforms.

| Interactive Brokers | FOREX.com | NinjaTrader | |

|---|---|---|---|

| Platforms & Tools Rating | |||

| Platforms | Trader Workstation (TWS), IBKR Desktop, GlobalTrader, Mobile, Client Portal, AlgoTrader, OmniTrader, TradingView, eSignal, TradingCentral, ProRealTime, Quantower | WebTrader, Mobile, MT4, MT5, TradingView | NinjaTrader Desktop, Web & Mobile, eSignal |

| Visit | Visit | Visit | Visit |

| Review | Review | Review | Review |

My biggest gripe with the TWS platform is that it puts features ahead of usability. The platform looks completely outdated, the amount of information on-screen is intimidating, and the frequent pop-up windows create an overwhelming feeling.

Beginners may prefer IBKR’s mobile app or the streamlined IBKR Desktop application, both of which offer a more intuitive approach to trading.

In fact, the 2024 iteration of IBKR Desktop offers a comprehensive trading experience. The broker has taken the first-rate tools in TWS and added bespoke features like option lattice and advanced screeners. Interactive Brokers have also clearly invested time in the user interface, which will work for beginners through to advanced day traders.

Moreover, with a proactive approach to seeking user feedback, plus many more features in the pipeline, including level II market data and enhanced search capabilities, IBKR looks set to pave the way in the next wave of desktop trading applications.

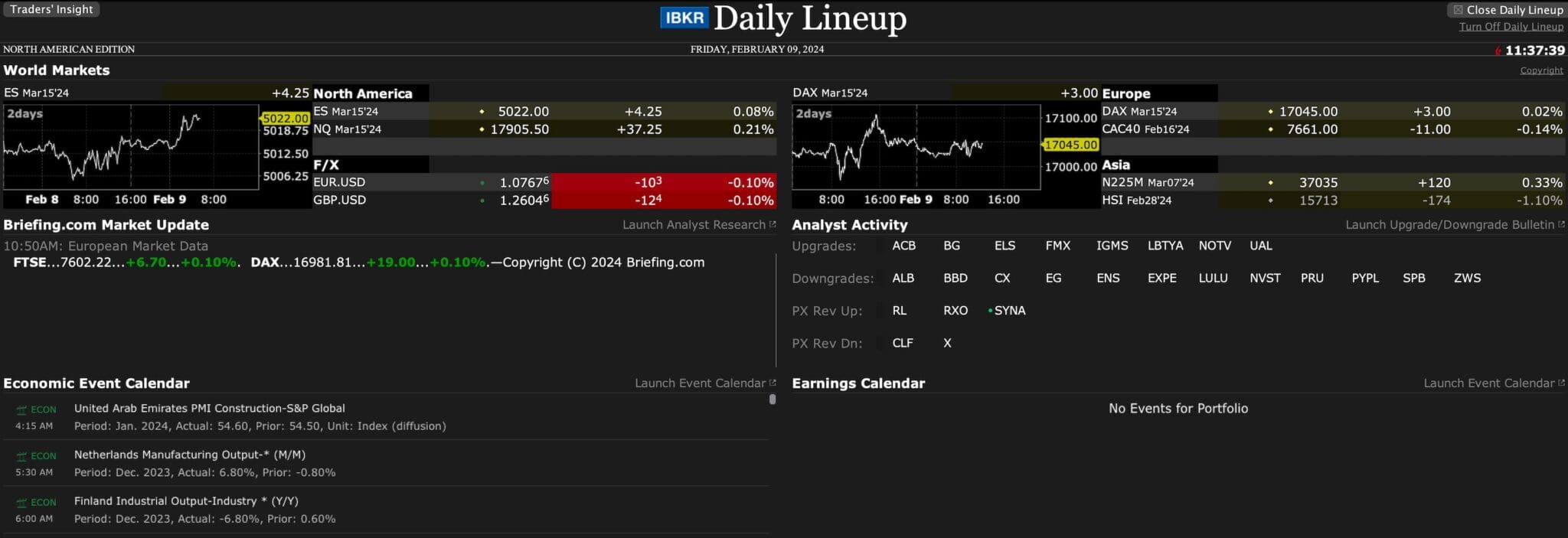

Research

IBKR offers a huge array of research tools, but it’s confusing how some tools are found within the trading platforms and others are on the web on your ‘Account Management’ page – there’s just no consistency with the user experience.

These tools include real-time and historical market data for various asset classes, as well as real-time news updates from leading financial news sources.

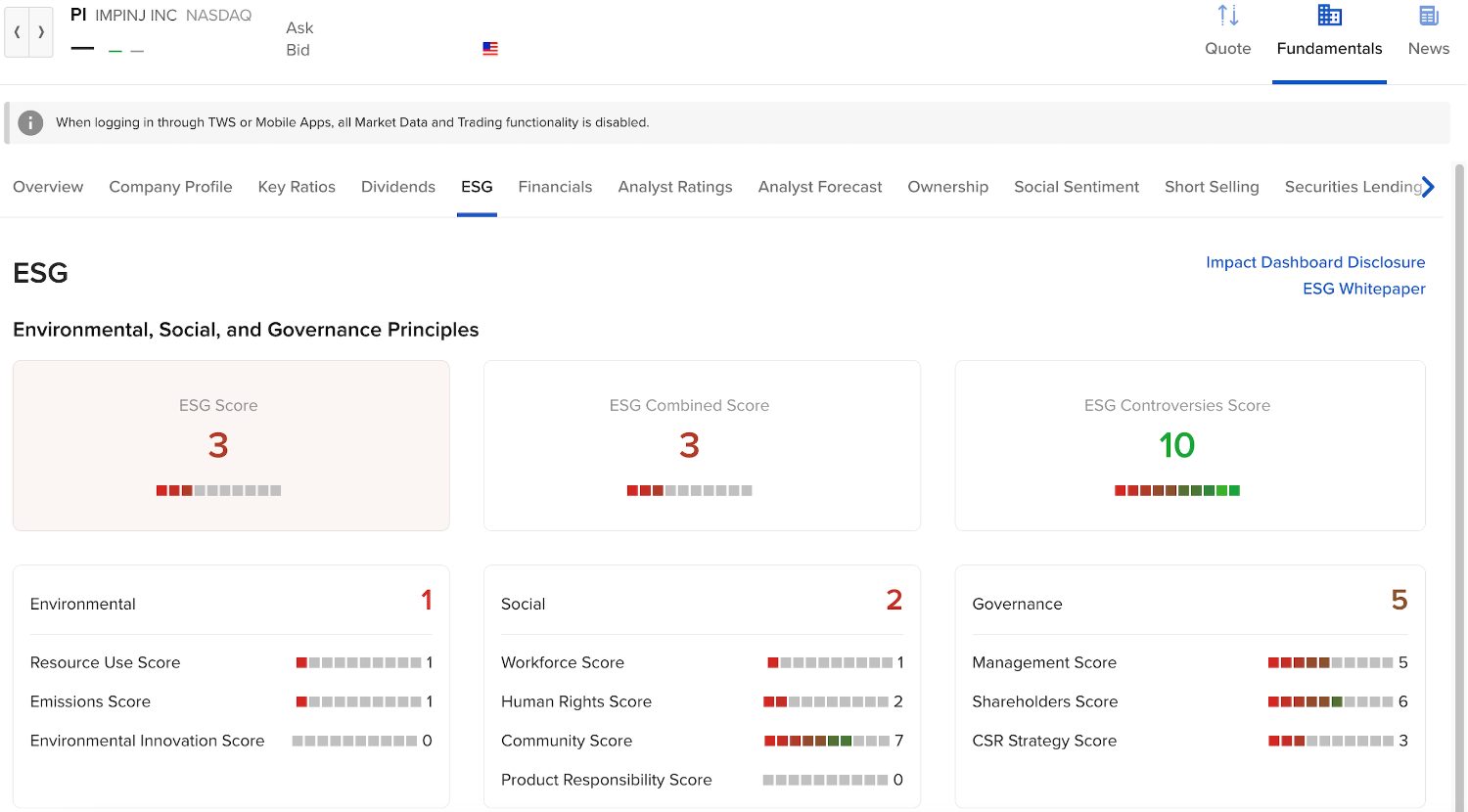

In particular, I found the fundamental analysis tools comprehensive for evaluating a company’s stock performance useful, as well as the economic calendar that helped me to track market-moving events.

Options analysis tools, research reports from financial institutions including Morningstar, trading ideas from TradingCentral, and portfolio analysis tools are also available to help evaluate options strategies.

An interesting tool is the ‘Market Buzz’ bubble, powered by Trading Central, which shows a visual representation of companies that are currently receiving attention. The size of the bubble corresponds to the frequency of mentions for a particular company. You can hover your cursor over a bubble to view the number of mentions and click on the bubble to explore details about the selected asset.

The standout tool for me is ‘PortfolioAnalyst’ which offers a comprehensive financial management system for both institutional and individual investors. This software streamlines the consolidation, tracking, and analysis of all financial accounts, ranging from checking and savings to debt and annuities.

Once you’ve linked your accounts, you can view a detailed overview of your entire financial landscape. PortfolioAnalyst provides a thorough portfolio checkup, encompassing total returns, risk assessments, and allocations across various categories such as geography, asset class, and sector. Additionally, socially conscious investors can assess their portfolio’s ESG ratings.

| Interactive Brokers | FOREX.com | NinjaTrader | |

|---|---|---|---|

| Research Rating | |||

| Visit | Visit | Visit | Visit |

| Review | Review | Review | Review |

Education

Under the ‘Education’ tab on the broker’s homepage, IBKR provides a plethora of well-presented and free resources for learning about trading and investing.

For beginners, the IBKR Campus and the Trader’s Academy offer a wide array of informative written materials, video content, webinars, podcasts, and quizzes, with progress tracking. More experienced traders should find the traders’ insight and commentary helpful, and even the quantitative code news.

IBKR and industry experts also host daily webinars covering a range of topics such as platform and tools tutorials, options education, trading international products, and more.

All the content is professionally produced and will certainly help you to better understand asset classes, markets, currencies, tools, and functionality available on IBKR’s trading platforms.

| Interactive Brokers | FOREX.com | NinjaTrader | |

|---|---|---|---|

| Education Rating | |||

| Visit | Visit | Visit | Visit |

| Review | Review | Review | Review |

Customer Support

IBKR offers multiple ways to get in contact with the company. For security-related issues like resets or security tokens, you need to phone the contact telephone number provided on the website.

Although phone support is available 24 hours a day, it may be challenging to reach during overnight hours due to the service shifting to foreign venues.

You should also expect standard wait times on live chat – available from within the trading platform or website – with occasional outages. If you don’t want to wait for a live agent, you can try your luck with an automated ‘iBot’. If you’re not in a rush, there’s a secure message center available from within the trading platform or website for sending inquiries.

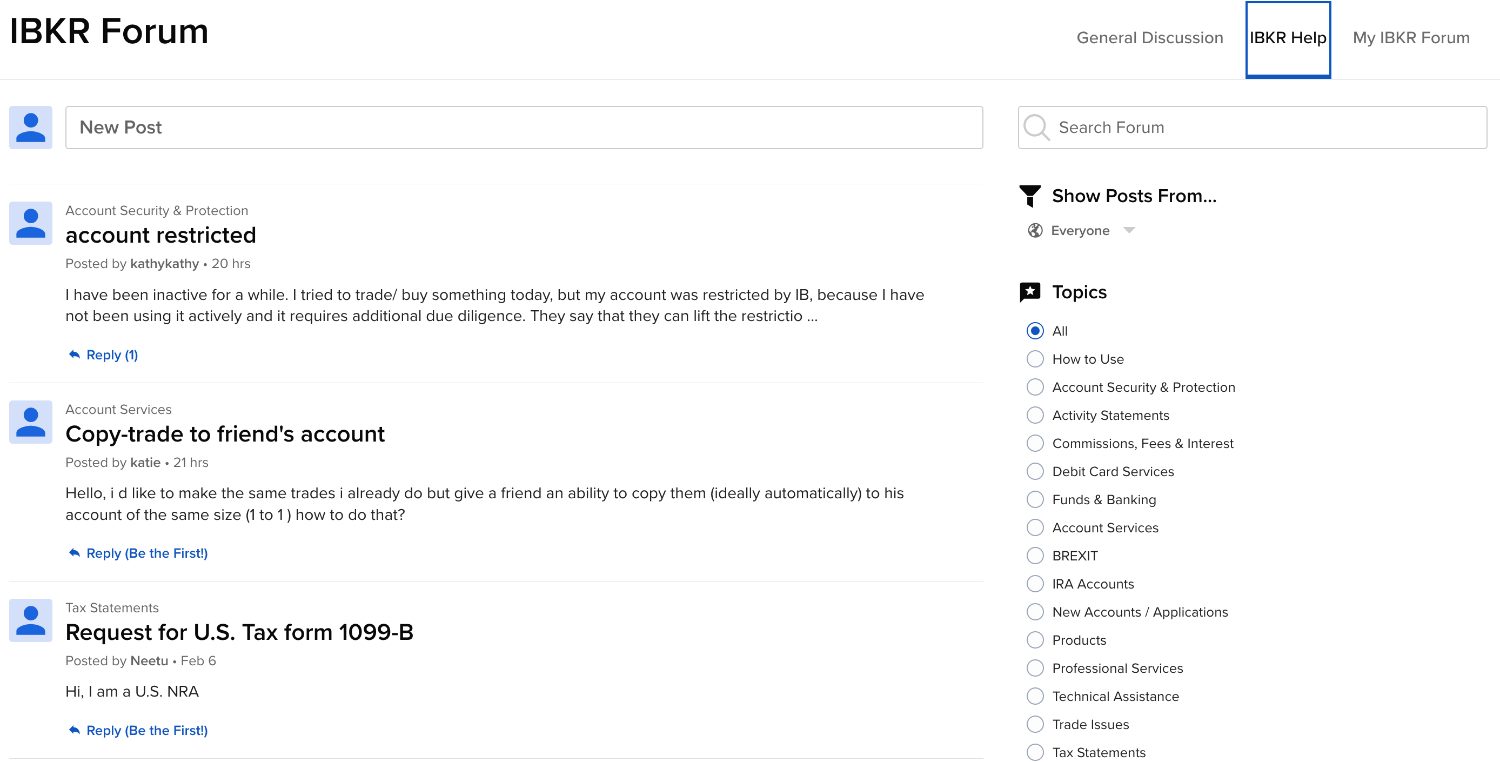

Fortunately, chat rooms and forum personnel are relatively prompt and helpful. They can provide information on account promotions, assist with upgrading to a margin account, and direct you to useful research and user guides. Additionally, they offer guidance on viewing interest rates and recent trade history.

Overall, while there are multiple means of contacting IBKR, wait times can be lengthy, which is frustrating if you have an issue that’s preventing you from trading.

| Interactive Brokers | FOREX.com | NinjaTrader | |

|---|---|---|---|

| Customer Support Rating | |||

| Visit | Visit | Visit | Visit |

| Review | Review | Review | Review |

Should You Trade With Interactive Brokers?

IBKR enables trading on a global scale and offers exceptionally low commissions and competitive spreads. It also distinguishes itself with its extensive array of assets, tools, research, global market access, and educational materials. In fact, individual and professional investors will struggle to find a more all-encompassing platform.

While this breadth of products and services is undoubtedly advantageous, it will pose a challenge for beginner traders, as navigating through IBKR’s wealth of information and outdated trading platform may at times prove too overwhelming.

As a result, IBKR is most suitable for experienced traders with significant capital. Beginner traders should look elsewhere for a simpler, more intuitive trading experience with more flexible banking facilities.

The inclusion of Interactive Brokers’ (IBKR) name, logo or weblinks is present pursuant to an advertising arrangement only. IBKR is not a contributor, reviewer, provider or sponsor of content published on this site, and is not responsible for the accuracy of any products or services discussed.

FAQ

Is Interactive Brokers Legit Or A Scam?

We consider Interactive Brokers a legitimate broker. In fact, it earned a very high trust score of during our latest tests for several reasons:

- It’s highly regulated (FCA, SEC, FINRA, CFTC, CBI, CIRO, SFC, MAS, MNB, FINMA, AFM)

- It’s traded on the NASDAQ (suggesting financial transparency with routine audits)

- It’s been operational for over 40 years (great track record with over two million clients)

Is Interactive Brokers A Regulated Broker?

Yes, Interactive Brokers is regulated by reputable authorities including the Securities and Exchange Commission (SEC), Commodity Futures Trading Commission (CFTC), and Financial Industry Regulatory Authority (FINRA) in the US. In the UK it is regulated by the Financial Conduct Authority (FCA). There are lots of other worldwide regulatory bodies overseeing IBKR, too.

Is Interactive Brokers Suitable For Beginners?

IBKR’s platform and features are way more complex compared to most other brokers, which could potentially be overwhelming for beginner traders. And while there are comprehensive educational resources and customer support, beginners may find the learning curve too steep.

Does Interactive Brokers Offer Low Fees?

IBKR has a competitive fee structure, offering low commissions and tight spreads across various asset classes. It charges commissions based on a tiered pricing model, where fees decrease as trading volume increases. Furthermore, IBKR offers a range of account types and fee schedules tailored to different trading preferences and account sizes.

Is Interactive Brokers A Good Broker For Day Trading?

IBKR is an excellent choice for day trading due to its advanced trading platforms, offering real-time data and customizable interfaces. With access to a wide range of assets including stocks, options, futures, and forex across global markets, skilled traders can capitalize on short-term opportunities. Competitive pricing and a variety of advanced order types further enhance the appeal for day traders.

Does Interactive Brokers Have A Mobile App?

The IBKR Mobile app, available for both iOS and Android devices, provides access to your IBKR accounts on the go so you can monitor portfolios, place trades, view real-time quotes and charts, and manage your account activity from your mobile devices. The app is relatively user-friendly and caters better to beginner traders than the TWS terminal.

Best Alternatives to Interactive Brokers

Compare Interactive Brokers with the best similar brokers that accept traders from your location.

- FOREX.com – Founded in 1999, FOREX.com is now part of StoneX, a financial services organization serving over one million customers worldwide. Regulated in the US, UK, EU, Australia and beyond, the broker offers thousands of markets, not just forex, and provides excellent pricing on cutting-edge platforms.

- NinjaTrader – NinjaTrader is a US-headquartered and regulated brokerage that specializes in futures trading. There are three pricing plans to suit different needs and budgets, as well as ultra-low margins on popular contracts. The brand’s award-winning charting software and trading platform also offers a high-degree of customization and superb technical analysis features.

Interactive Brokers Comparison Table

| Interactive Brokers | FOREX.com | NinjaTrader | |

|---|---|---|---|

| Rating | 4.3 | 4.5 | 4.5 |

| Markets | Stocks, Options, Futures, Forex, Funds, Bonds, ETFs, Mutual Funds, Cryptocurrencies | Forex, Futures and Options on Metals, Energies, Commodities, Indices, Bonds, Crypto | Futures, Forex, Stocks, Options, Commodities, Futures, Crypto (non-futures depend on provider) |

| Demo Account | Yes | Yes | Yes |

| Minimum Deposit | $0 | $100 | $0 |

| Minimum Trade | $100 | 0.01 Lots | 0.01 Lots |

| Regulators | FCA, SEC, FINRA, CFTC, CBI, CIRO, SFC, MAS, MNB, FINMA, AFM | NFA, CFTC | NFA, CFTC |

| Bonus | – | VIP status with up to 10k+ in rebates – T&Cs apply. | – |

| Platforms | Trader Workstation (TWS), IBKR Desktop, GlobalTrader, Mobile, Client Portal, AlgoTrader, OmniTrader, TradingView, eSignal, TradingCentral, ProRealTime, Quantower | WebTrader, Mobile, MT4, MT5, TradingView | NinjaTrader Desktop, Web & Mobile, eSignal |

| Leverage | 1:50 | 1:50 | 1:50 |

| Payment Methods | 6 | 9 | 4 |

| Visit | Visit | Visit | Visit |

| Review | – | FOREX.com Review |

NinjaTrader Review |

Compare Trading Instruments

Compare the markets and instruments offered by Interactive Brokers and its competitors. Please note, some markets may only be available via CFDs or other derivatives.

| Interactive Brokers | FOREX.com | NinjaTrader | |

|---|---|---|---|

| CFD | Yes | No | No |

| Forex | Yes | Yes | Yes |

| Stocks | Yes | Yes | Yes |

| Commodities | Yes | Yes | Yes |

| Oil | No | Yes | Yes |

| Gold | Yes | Yes | Yes |

| Copper | No | No | Yes |

| Silver | No | Yes | Yes |

| Corn | No | No | No |

| Crypto | Yes | No | Yes |

| Futures | Yes | Yes | Yes |

| Options | Yes | Yes | Yes |

| ETFs | Yes | No | No |

| Bonds | Yes | No | No |

| Warrants | Yes | No | No |

| Spreadbetting | No | No | No |

| Volatility Index | No | No | No |

Interactive Brokers vs Other Brokers

Compare Interactive Brokers with any other broker by selecting the other broker below.

The most popular Interactive Brokers comparisons:

- Webull vs Interactive Brokers

- Interactive Brokers vs Pepperstone

- Saxo Bank vs Interactive Brokers

- Interactive Brokers vs Exness

- CMC Markets vs Interactive Brokers

- Kraken vs Interactive Brokers

- Bybit vs Interactive Brokers

- NinjaTrader vs Interactive Brokers

- Interactive Brokers vs XM

- IC Markets vs Interactive Brokers

- Interactive Brokers vs Plus500

- IG Group vs Interactive Brokers

- eToro vs Interactive Brokers

- Moomoo vs Interactive Brokers

- XTB vs Interactive Brokers

Customer Reviews

4.3 / 5This average customer rating is based on 3 Interactive Brokers customer reviews submitted by our visitors.

If you have traded with Interactive Brokers we would really like to know about your experience - please submit your own review. Thank you.

Submit Your Own Review of Interactive Brokers

Article Sources

- Interactive Brokers (IBKR) Website

- NASDAQ: IBKR

- Interactive Brokers (U.K.) Limited - FCA License

- Interactive Brokers LLC - CFTC License

- Interactive Brokers LLC - FINRA License

- Interactive Brokers Ireland Limited - CBI License

- Interactive Brokers Canada Inc. - CIRO License

- Interactive Brokers Hong Kong Limited - SFC License

- Interactive Brokers Singapore Pte. Ltd. - MAS License

- Interactive Brokers Central Europe Zrt. - Central Bank of Hungary License

The writing and editorial team at DayTrading.com use credible sources to support their work. These include government agencies, white papers, research institutes, and engagement with industry professionals. Content is written free from bias and is fact-checked where appropriate. Learn more about why you can trust DayTrading.com

Available in United States

Available in United States

If you’re a proper day trader, and I’m talking executing multiple high-volume trades across stocks and futures markets then skip all the crappy brokers out there and sign up at IBKR. The TWS software is operating on another level from the likes of MT4, more indicators and drawing tools than you can shake a stick at and the level of customization is crazy. I myself haven’t even exhausted all the tools IBKR offers, but im getting a lot of value out of Portfolio Analyst. The spreads are low, the partnerships with third-party trading software providers are the best around. And margin fees are better than most firms I’ve traded with. Skip the amateur brokers and use IBKR if you’re serious about intraday trading.

IB is easily the best broker I’ve used for day trading. Trader Workstation offers a first-rate charting package with loads of indicators and technical studies, even if the interface isn’t the slickest. Being able to customise the market scanner is also helpful for finding potential opportunities.

I’ve found IB excellent for trading stocks. There are thousands of shares with low fees and commissions from zero. I don’t rate the platform though – it’s clunky with an outdated design, making it difficult to learn.