Fractional Shares

Imagine having the ability to own a slice of your favorite tech giant or a piece of a renowned company’s success, all without breaking the bank.

Welcome to trading fractional shares, a financial innovation that’s democratizing access to the stock market, and making once-unattainable investments accessible to all.

This beginner’s guide explains how fractional shares work, including their advantages and disadvantages. We also explain how to find, buy and analyze fractional shares.

Quick Introduction

- Trading fractional shares allows you to purchase a portion of a share, making it more affordable if you don’t have the capital to buy whole shares.

- You can diversify your portfolio by owning fractions of multiple stocks, spreading risk and potentially improving your performance.

- Fractional stocks can be purchased in various amounts, making it easy to invest small or large sums of money and adjust portfolio holdings.

- Fractional shares can still receive dividends, and the payout is proportionate to the fraction of the share owned.

Best Brokers For Fractional Shares

Following our latest tests in February 2026, these are the top trading platforms for fractional shares:

Best Brokers With Fractional Shares

Understanding Fractional Shares

Traditionally, investing in stocks required purchasing whole shares of a company, which posed a significant hurdle for individuals with limited capital.

Mutual funds emerged as a solution in the early 20th century, allowing investors to pool their funds and access diversified portfolios. However, mutual funds limited individual stock selection and control.

The digitalization of trading in the late 20th century marked a significant turning point. Online brokers made it easier for individuals to participate in financial markets, yet the practice of trading in whole shares persisted.

Fractional share trading came into prominence in the 21st century, particularly with the rise of fintech companies and innovative brokerage platforms. These platforms introduced the concept of buying and owning fractions of shares, thus expanding investment opportunities.

This democratizing approach has empowered retail investors, making it more affordable to invest in high-priced stocks and fostering portfolio diversification.

Fractional share trading has even extended beyond traditional stocks to encompass ETFs, cryptocurrencies, and a range of other asset classes, demonstrating its growing relevance in today’s financial landscape.

Fractional Shares Vs Full Shares

The main difference between fractional shares and full shares lies in the quantity of ownership in a company or asset.

Fractional shares represent a portion of a single share. You can buy and own fractions of shares, which can be less (or more) than a whole share. This enables you to invest in companies or assets with limited capital, as you are not required to purchase entire shares.

In other words, instead of indicating the number of shares you wish to purchase, you have the option to determine the amount of money you want to invest in a specific company. If your available cash doesn’t cover the cost of a whole share, you can still acquire a fractional portion of that share.

For example, you can own half a share of a company if you invest in a fractional share.

Fractional shares are particularly beneficial if you have limited capital and still wish to invest in companies with higher-priced shares.

Full shares, on the other hand, represent complete ownership of a single share of a company or asset. When you buy a full share, you own the entire unit of that particular security. It requires the investment of the full share price to become a shareholder in the company.

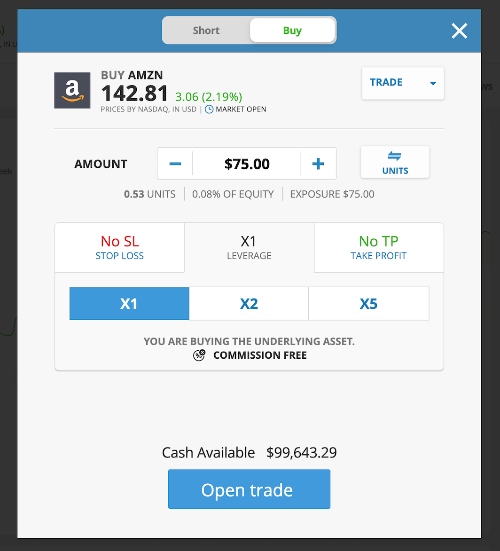

An Example Trade

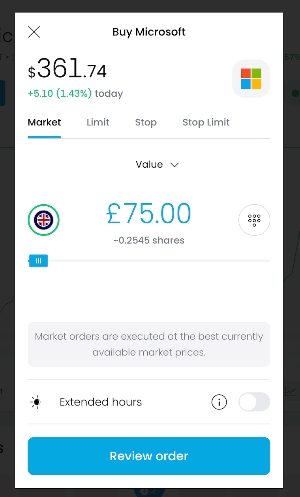

Suppose you’re interested in investing in the technology company Microsoft, but the current price of one whole share is $300, which is more than you want to spend. However, you have $100 that you’re willing to invest.

Instead of buying a whole share, you enter the amount you want to invest, which is $100. Your platform calculates that you can purchase 33% of a share (0.33 of a whole share) with your $100. You confirm the order, and the brokerage executes the trade.

After the trade is complete, you own 0.33 shares of Microsoft. Your fractional share still entitles you to a portion of any dividends paid by the company, and your investment will gain or lose value in proportion to the movements of the stock’s price.

This example demonstrates how fractional stock trading enable you to invest in a company like Microsoft without needing to buy a whole share, making it more accessible and cost-effective.

Pros & Cons Of Fractional Shares

Pros

- Fractional shares make it possible to invest in high-priced stocks or assets that may have otherwise been out of reach.

- Fractional stock trading offers a cost-effective way to invest, as you can allocate your available funds more efficiently, without the need to purchase entire shares.

- Fractional shares allow for flexible investing, enabling you to incrementally increase your investment over time. This flexibility caters to various budget sizes and allows for gradual wealth accumulation through consistent investments.

- Fractional share ownership grants you a proportional stake in a company’s ownership and entitles you to a share of dividends and potential capital gains, just like owning full shares.

- You can customize your portfolio by investing precise amounts in specific stocks, creating a personalized investment strategy that aligns with your financial goals and risk tolerance.

Cons

- Investing in fractional shares often means you have limited or no voting rights in company decisions, as these rights are typically associated with whole share ownership. So, you may not have a say in corporate governance matters.

- Some companies may not pay dividends on fractional shares, which can reduce your income potential, especially in the case of dividend-focused strategies.

- The market for fractional stocks can be less liquid than that of whole shares, potentially making it more challenging to buy or sell fractional shares at desired prices, especially for less popular stocks.

- Managing a portfolio of fractional shares can be more complex than holding whole shares, with multiple fractional positions in various stocks to track and manage.

- Due to the small size of fractional positions, returns on investment may be modest, which can be a drawback if you are seeking substantial gains. Gains and losses are proportional to the fraction of shares owned.

How To Buy Fractional Shares

Fractional shares can be obtained through a method known as dollar-based investing. In this approach, you designate the amount of money you intend to invest in a specific company, such as $20, and purchase as many shares as your investment amount permits.

Many brokerages that provide fractional shares also offer commission-free trading, meaning you won’t be charged transaction fees when buying or selling your shares.

The absence of commissions makes fractional investing more cost-effective, as paying a commission for such small transactions might require a substantial rate of return on your fractional share to offset the trading expenses.

Buying fractional shares is a straightforward process. Here’s a step-by-step guide:

1. Choose A Brokerage Account

Start by opening a trading account with a reputable firm that offers fractional stock trading. For our recommendations, see our list of the top brokers for fractional stock trading.

2. Fund Your Account

Deposit funds into your trading account. You can transfer money from your bank account or use existing funds in your brokerage account.

3. Research & Select Stocks

Research and identify the stocks or assets you want to purchase as fractional shares. Review the stock’s performance, financials, and any other relevant information.

4. Place An Order

Log in to your account and access the trading platform. Locate the stock or asset you wish to buy fractional shares of. You can typically do this by searching for the stock’s ticker symbol or name.

5. Specify The Investment Amount

Instead of indicating the number of shares you want to purchase, choose the option to invest a specific dollar amount. For example, if you want to invest $100 in a particular stock, enter this amount.

6. Review & Confirm

Review your order details, including the investment amount, and make any necessary adjustments. Once you’re satisfied, confirm the order.

7. Execute The Trade

After confirming the order, execute the trade. Your brokerage will process the transaction, and you’ll own a fraction of the chosen stock based on the amount you specified.

8. Track & Manage

Monitor your fractional share investments in your portfolio. Keep track of their performance and make adjustments as needed. You can buy more fractional shares or sell them as you see fit.

9. Dividends & Voting Rights

Be aware that owning fractional stocks means you may have limited voting rights and may not be eligible for dividends, depending on the policies of the specific company and the brokerage.

How Do I Find The Best Fractional Stocks To Buy?

Finding the best fractional stocks to buy is all about aligning your choices with your goals, risk tolerance, and market research.

Your goals will guide your focus – growth stocks, dividend-paying companies, or a mix of both.

Look At The Big Players

Fractional shares allow you to own a piece of some of the most valuable companies in the world. Consider blue-chip stocks like:

- Apple (AAPL): Known for its consistent growth and innovation.

- Amazon (AMZN): A leader in e-commerce and cloud computing.

- Tesla (TSLA): A pioneer in electric vehicles and renewable energy.

These stocks are often solid choices for long-term growth but still require careful analysis.

Consider ETFs For Built-In Diversification

Exchange-Traded Funds (ETFs) allow you to invest in a basket of stocks with a single purchase.

Look for ETFs that match your interests, like:

- Technology ETFs for exposure to top tech firms.

- Dividend ETFs for regular income.

- S&P 500 ETFs for a broad-market investment.

Analyze Stock Fundamentals

Before trading, check the key metrics:

- Revenue and Earnings Growth: Are they consistently increasing?

- P/E Ratio: Is the stock reasonably priced compared to its earnings?

- Debt Levels: Can the company manage its debt effectively?

- Industry Leadership: Is the company a top player in its field?

Follow Market Trends And News

Stay informed about sectors with growth potential, such as:

- Technology: AI, cloud computing, and renewable energy.

- Healthcare: Biotech and pharmaceutical advancements.

- Consumer Goods: Brands with strong customer loyalty.

News about emerging trends or economic shifts can help you spot opportunities early.

Use Tools

Many top trading platforms offering fractional shares provide powerful tools for research, such as:

- Stock Screeners: Filter stocks based on criteria like growth potential, dividends, or industry.

- Analyst Ratings: See what experts think about a stock’s prospects.

- Educational Resources: Dive into articles, tutorials, and market insights.

Check For Dividend Payers

If you want passive income, focus on companies with a strong track record of paying dividends. Even fractional shares earn proportional dividends, which can be reinvested to boost your portfolio’s growth.

Don’t Ignore Your Interests

Invest in companies or industries you understand and are passionate about. Your familiarity can give you an edge in spotting trends and making informed decisions.

Test The Waters

Use fractional shares to experiment with different stocks or sectors without committing a large amount. This way, you can identify what works best for your strategy.

Regularly Reassess Your Picks

Markets change, and so should your portfolio. Review your investments periodically to ensure they still align with your goals and are performing well.

How Do You Analyze Fractional Stocks?

Analyzing fractional stocks is the same as analysing full shares – the only difference is that you’re buying a portion rather than the whole thing.

Here’s a step-by-step guide to evaluating fractional stocks like a pro:

Understand Your Goals

Before diving into analysis, ask yourself:

- Are you looking for growth, dividends, or a mix of both?

- How long do you plan to hold the investment?

Evaluate Company Fundamentals

Dive into the company’s financial health and performance:

- Revenue and Earnings: Are they growing consistently? Look for steady or improving trends.

- Profit Margins: Higher margins mean the company efficiently turns revenue into profit.

- Debt Levels: Check if the company can handle its debts comfortably (look at the debt-to-equity ratio).

- Cash Flow: Positive cash flow signals a healthy business.

Assess The Industry And Market Position

- Industry Growth: Is the sector expanding? Emerging industries like tech, renewable energy, or healthcare often have high potential.

- Competitive Edge: Does the company have a unique advantage, like strong branding, patented technology, or market leadership?

- Risks: What challenges does the industry face, and how does this company handle them?

Check Valuation Metrics

Determine if the stock is fairly priced:

- P/E Ratio (Price-to-Earnings): Compare it to peers in the industry. A high P/E might signal overvaluation, while a low P/E could indicate a bargain or trouble ahead.

- P/B Ratio (Price-to-Book): This ratio is helpful for asset-heavy industries, showing how the stock price relates to the company’s book value.

- PEG Ratio (Price/Earnings to Growth): This ratio combines P/E with expected growth and is a good way to assess growth stocks.

Look At Historical Performance

Review how the stock has performed over the years:

- Stock Price Trends: Has it shown consistent growth, or is it highly volatile?

- Resilience: How did the stock handle economic downturns or market corrections?

Analyze Dividend Potential (If Applicable)

If you’re interested in income:

- Dividend Yield: Higher isn’t always better – make sure it’s sustainable.

- Dividend Growth: Has the company been increasing its dividends over time?

- Payout Ratio: A lower ratio (<60%) indicates the company isn’t overextending to pay dividends.

Understand The Bigger Picture

Factor in macroeconomic trends:

- Market Conditions: Bullish markets may boost growth stocks, while defensive stocks shine during economic downturns.

- Interest Rates and Inflation: These affect stock valuations and overall market behaviour.

Diversify Your Fractional Stock Portfolio

Don’t put all your eggs in one basket! Spread your investments across industries and regions to reduce risk. Fractional shares make diversification easier by allowing you to own portions of multiple high-priced stocks.

Track Your Investments Regularly

Monitor your portfolio’s performance and reassess your strategy if needed.

- Has the company met its growth expectations?

- Are your goals still aligned with your investments?

Fractional shares open the door to investing in some of the market’s biggest players, but success comes from understanding their value.Use these steps to analyze stocks carefully, and you’ll make confident, informed decisions – whether you’re buying a fraction or a full share.

Bottom Line

Investing in fractional shares lets you purchase portions of high-priced stocks or assets with smaller amounts of capital, providing greater accessibility and diversification.

But it doesn’t eliminate risk. Make sure the affordability of entry doesn’t lead you to conduct inadequate research and potentially make less informed decisions.

FAQ

What Are Fractional Shares?

A fractional share represents ownership of less than a complete share of a company. Investing in fractional shares is based on a dollar amount, enabling you to hold a portion of a share, one whole share, or even multiple shares in a stock.

Are Fractional Shares Safe?

As with any investment, there are factors to consider including brokerage safety, liquidity, and voting rights. It is also important not to risk more than you’re willing to lose.

Do Fractional Shares Pay Dividends?

Yes, fractional shares can receive dividends, and the dividend payout is proportionate to the fraction of the share owned. The specific procedures for handling fractional share dividends may vary by brokerage or platform, so review their individual policies.

Are Fractional Shares Available Worldwide?

Fractional shares are becoming increasingly available worldwide, but their availability can vary depending on the country and the brokerage or investment platform you use. Availability can also be influenced by regulatory and market factors.

Do You Pay Taxes On Fractional Shares?

Yes, you may be subject to taxes on fractional shares. The tax treatment of fractional stocks is generally similar to that of whole shares.

Are Fractional Shares Legal?

Although some regulators, including in India, do not allow fractional stock trading, it is accepted and legal across large parts of the world. US and UK-based investors can invest in fractional stocks, for example.

Recommended Reading

Article Sources

- Interactive Brokers - Trading Fractional Shares

- eToro - Trading Fractional Shares

- XTB - Trading Fractional Shares

The writing and editorial team at DayTrading.com use credible sources to support their work. These include government agencies, white papers, research institutes, and engagement with industry professionals. Content is written free from bias and is fact-checked where appropriate. Learn more about why you can trust DayTrading.com