Best Brokers For Commission-Free Trading In 2026

Zero commission brokers allow you to trade financial assets like stocks without paying traditional transaction fees. Popularized by apps like Robinhood in the US, this model is now widely adopted and particularly favored by aspiring mobile traders.

Explore our 5 best commission-free brokers, selected following extensive testing.

List Of Best Commission-Free Brokers For 2026

Here are our top 5 zero commission brokers:

- Moomoo: Superior app. Rich market data and research. Excellent security.

- Webull: Smooth sign-up. Advanced charting tools. Fractional shares.

- Ally Invest: Great screeners. Strong ETF offering. User-friendly package.

- Fidelity: Highly trusted. No payment for order flow. Good stock screener.

- Charles Schwab: Hugely respected. Extensive investment offering. 24/7 support.

Comparison of Best Commission-Free Trading Brokers

| Moomoo | Webull | Ally Invest | Fidelity | Charles Schwab | |

|---|---|---|---|---|---|

| Commission-Free Trading | Stocks, ETFs, Options | Stocks, ETFs, Options | Stocks, ETFs, Options | Stocks, ETFs, Options, Mutual Funds | Stocks, ETFs, Options |

| Margin Rate (Balances <$25K) | 6.8% | 9.74% | 13% | 13.6% | 13.6% |

| Trust Rating | 4.8/5 | 4.7/5 | 4.7/5 | 4.9/5 | 4.9/5 |

| App Rating | 4.9/5 | 4.7/5 | 4.7/5 | 4.5/5 | 4.8/5 |

| Minimum Deposit | $0 | $0 | $0 | $0 | $0 |

Note: Margin rates may change. Regulatory charges can apply to zero-commission offerings.

1. Moomoo

Why We Picked It

Moomoo secures our top spot as the best commission-free broker with an exceptional app that’s a delight to use for traders at all levels.

Moomoo provides a vast selection of US stocks, ETFs, and options at no commission, and eliminates account or deposit minimums, funding fees, and charges for level 2 market data, ensuring an affordable trading experience across the board.

Moomoo also stands out with its attractive welcome promotions, including up to 8.1% APY and 15 free stocks at the time of testing, surpassing that of almost every alternative.

Pros

- Our use of the Moomoo app reveals an extremely intuitive user experience with a sleek layout, putting essential trading tools just a few clicks away for any trader.

- Moomoo continues to shine with its rich market data and easy-to-digest research, including analyst ratings, revenue breakdowns, and an array of financial estimates and indicators, helping to inform decisions.

- The ‘Moomoo Token’ introduces innovative, dynamic password technology for enhanced security, offering peace of mind.

Cons

- Moomoo offers commission-free trades on US stocks, ETFs, and options, but charges for international investments, including a 0.03% commission on Hong Kong securities.

- Although Moomoo has extensive educational content for all levels and strategies, including day trading, it’s mostly in a text-heavy format, lacking the interactivity found at alternatives.

- Moomoo is excellent if you want to trade US equities with zero commissions, but its suite of additional investments is limited, especially compared to Schwab, which also provides futures, bonds, crypto and more.

2. Webull

Why We Picked It

Webull earns a runner-up position in our list of leading no-commission brokers, offering zero commissions on stocks, ETFs and options (excluding some index options).

We picked Webull because it offers a smooth sign-up process and a user-friendly app that will cater to beginners, distinguishing it from the sometimes complicated services offered by traditional brokerages.

Webull is trusted and authorized by the US SEC and FINRA, though it lacks the global oversight of our first choice, Moomoo, which is also licensed by the MAS in Singapore, SFC in Hong Kong, and ASIC in Australia.

Pros

- Webull offers advanced charting tools, including 50+ indicators and 8 chart types, plus excellent resources for fundamental analysis with data visualizations and quant ratings.

- The sign-up process is fast and fully digital, enabling you to register directly through your mobile in a few minutes while verification is normally completed <24 hours.

- Webull is one of the few commission-free brokers to offer fractional shares, enabling budget traders to invest from $5, while still benefiting from zero commissions.

Cons

- Although the Webull app delivers for beginner traders and sports interesting features like voice-controlled trading commands, it trails Moomoo in terms of usability and integrated research tools.

- While there’s a strong selection of over 2000 US equities, Webull does not offer access to international exchanges, a drawback compared to rivals like Moomoo and Schwab.

- Webull’s emphasis on trading lacks the broad financial services of traditional institutions, notably Fidelity, which offers a one-stop solution for trading, banking and wealth management.

3. Ally Invest

Why We Picked It

Ally Invest secures a podium finish in our list of top zero-commission brokers because it continues to offer a compelling package for beginners through to advanced traders, with no commissions on US stocks and ETFs.

It provides a smooth entry into self-directed trading with excellent trading tools that are easy to use and add value, standing out from rivals.

Launched in 2005, Ally Invest has earned the trust of over 11 million clients and authorization from respected regulators, including the SEC and FINRA in the US.

Pros

- Alongside commission-free stock trading, Ally Invest offers no commissions on ETFs from industry heavyweights like Vanguard, GlobalX, and iShares, helping traders build a diverse portfolio.

- Ally Invest leverages TipRanks’ Smart Score for simplified stock assessments, alongside intuitive screening tools for stocks and ETFs, comprehensive market stats, news, and detailed company metrics.

- While navigating the resources and sign-up process at Fidelity and Schwab feels like you’re travelling back in time, Ally Invest offers a seamless user experience with straightforward navigation that will appeal to newer traders.

Cons

- Despite improvements to its trading app, Ally Invest still hasn’t integrated features like the stock screener which would enhance the mobile trading experience.

- Although Ally Invest promotes no commission trading, traders interested in its Robo Portfolios or Forex products should note there are advisory fees and spreads to factor in.

- Interest isn’t paid on uninvested cash, which could put idle funds to work and is a feature available at both Moomoo and Webull.

4. Fidelity

Why We Picked It

Fidelity earns a spot in our top brokers for commission-free trading, featuring no commissions on US stocks, ETFs and options.

Fidelity distinguishes itself as one of the longest-standing brokerages, having been established in 1946, and serving clients through over 200 investor centres in the US and more than 25 regional locations further afield, including the UK and India, underscoring its reliability.

Pros

- Fidelity avoids the common commission-free broker practice of payment for order flow (PFOF) on stocks, aiming to eliminate potential conflicts of interest while ensuring higher trade execution quality.

- Alongside no commission trading on thousands of US securities, Fidelity ensures a low-cost trading environment by slashing a range of other account and investment service fees to zero, including real-time quotes and streaming news.

- Fidelity offers an intuitive stock screener that can help traders identify opportunities, featuring over 140 criteria, various market themes, and pre-built strategies from in-house experts.

Cons

- While Fidelity offers competitive margin rates of around 13.6% for balances of <$25,000, they trail Moomoo’s margin rates of 6.8%.

- The research, analysis and trading tools are spread across the platform, app and website, making for a frustrating user experience that may confuse new traders.

- Fidelity doesn’t provide a demo account, an excellent tool that can help prospective traders familiarize themselves with trading resources before investing money, and something provided by Moomoo.

5. Charles Schwab

Why We Picked It

Charles Schwab makes our top list because it’s a hugely respected US-based brokerage with zero commission trading on a massive selection of stocks, ETFs, options and mutual funds.

It offers the full package for investors, from no account minimums and excellent support to powerful platforms, stock screeners and research features to help traders analyze securities.

Similar to Fidelity, Charles Schwab is a long-standing and trusted brand, established in 1971 and regulated by respected bodies like the US SEC and FINRA.

Pros

- Charles Schwab’s investment offering surpasses most competitors with thousands of securities spanning stocks, options, ETFs, futures, bonds, crypto and more, with access to most publicly listed stocks.

- Schwab continues to provide superb 24/7 support, with response times of <2 minutes during tests and knowledgeable staff who could answer our queries about commission-free trading conditions.

- Schwab caters to budget investors by offering fractional shares from the S&P 500, providing exposure to large stocks like Microsoft and Apple from just $5.

Cons

- Despite offering commission-free online trades, Charles Schwab charges notable fees for broker-assisted trades, making it less economical for investors needing any degree of brokerage support.

- Schwab’s stock and research tools, while exhaustive, feature an outdated and clunky design that makes for an unpleasant user experience, especially compared to the slick design of Moomoo’s.

- While Schwab offers competitive margin rates of around 13.6% for balances <$25,000, similar to Fidelity, they trail Moomoo’s margin rates of 6.8%.

How Did We Choose The Best Commission-Free Brokers?

To reach our 5 top brokers for commission-free trading firms had to meet these benchmarks:

- Brokers had to offer no commissions on stocks and/or ETFs and options.

- Brokers had to be transparent about any limitations to the zero-commission model.

- Brokers had to have no minimum deposit given the draw of commission-free trading to beginners.

- Brokers needed apps rated at least 4/5 due to the popularity of this model with mobile traders.

- Brokers were required to score at least 4/5 in our Regulation & Trust Rating.

What Is Commission-Free Trading?

Commission-free trading means you will not pay a fee to place a trade.

Let’s say I want to buy shares in Tesla (NASDAQ: TSLA). While some brokers will charge me a flat fee, for example $10, commission-free brokers will not charge me a transaction fee to make the trade.

This type of pricing model was introduced by US brokers, notably Robinhood, and has since been adopted by dozens of online brokers and trading apps worldwide.

Does Commission-Free Really Mean ‘Free’?

Not quite. While the brokerage itself may not charge a transaction fee to buy or sell stocks, there may be charges elsewhere:

- A fee to trade on margin, the amount of which can vary significantly from around 6% to 15%+.

- A wider spread, the gap between the buying (bid) and selling (ask) prices, indicating the security’s liquidity.

- A charge to deposit to your account or withdraw profits, though many leading brokers waive such fees.

- A fee when trading securities in a different currency from your account, often the spot exchange rate plus a small percentage charge.

- A monthly inactivity fee, normally $10+, if you don’t use your account for a period, typically 3-12 months.

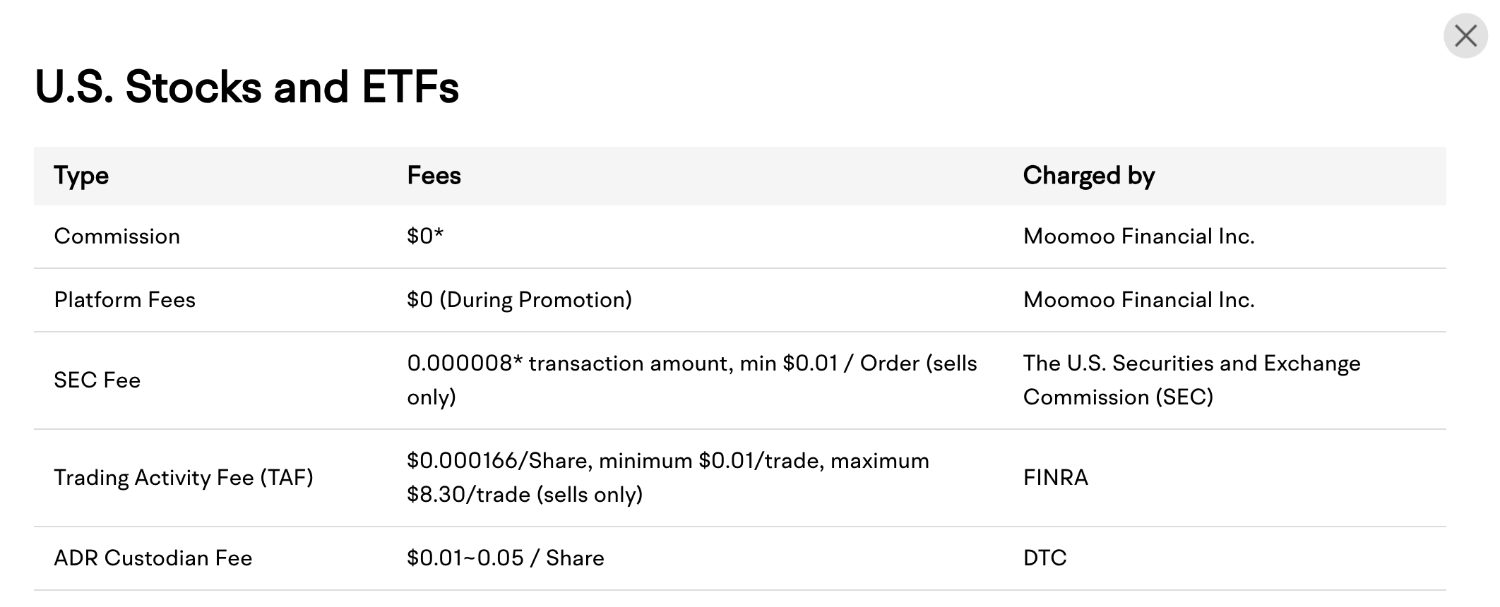

- Nominal regulatory charges. For example, there is often a SEC charge ($0.01 minimum) and a FINRA trading activity fee ($0.01 minimum) when dealing in US stocks.

What Are The Drawbacks Of Brokers With Zero Commissions?

The rise of commission-free trading has pushed brokers towards alternative revenue strategies like payment for order flow (PFOF), which can impede traders.

In zero-commission trading models, brokers primarily profit by selling their order flow to market makers, who then earn by trading against these orders.

This arrangement can lead to conflicts of interest, potentially resulting in less favorable execution for traders’ orders. Specifically, it might result in higher purchase prices and lower sale prices, as brokers and market makers optimize their profit margins.

Moreover, the practice can cause delays in order execution, allowing market makers to capitalize on the time lag to the detriment of the investor’s potential gains.

As a result, you must weigh the importance of saving on commissions against the possibility of receiving suboptimal trade execution and prices.

Day traders, for example, may benefit from paying for superior trade execution and pricing, as even minor differences can significantly impact their strategy’s success.

The potential gains from optimal execution can outweigh the cost savings offered by commission-free trading for those operating in markets where timing and price execution are critical.

Should I Choose A No Commission Broker?

It’s not for all traders, but a commission-free broker could be suitable if:

- You want to get started with a low or even no minimum deposit.

- You want simple, low-cost pricing where you don’t pay a brokerage fee to buy or sell stocks.

- You want to trade in low volumes of less than several hundred dollars, as you may avoid any minimum fees charged by brokers.

- You want to trade on the go as there are a growing number of commission-free trading apps specifically designed for mobile traders.

See our list of the best brokers with commission-free trading to find the right provider for you.