Best Crypto Brokers In 2026

Crypto brokers offer a way to trade cryptocurrencies like Bitcoin that’s safer than directly buying and selling tokens on exchanges, many of which we’ve seen go bankrupt following high-profile scandals.

We’ve evaluated dozens of platforms to find you the best cryptocurrency brokers, taking into account:

- The trustworthiness of the crypto broker

- The number of digital tokens available

- The usability of the trading platform and app

- The fees you will incur placing short-term crypto trades

- The unique selling points that distinguish the top crypto brokers

Best Brokers For Cryptocurrency Trading In 2026

Our exhaustive reviews show that these are the 6 top crypto brokers and trading platforms in February 2026. Every cryptocurrency broker listed we assessed using either a real money or test account.

-

1

Interactive Brokers

Interactive Brokers -

2

NinjaTrader

NinjaTrader -

3

Plus500USTrading in futures and options involves the risk of loss and is not suitable for everyone.

Plus500USTrading in futures and options involves the risk of loss and is not suitable for everyone. -

4

eToro USAeToro USA LLC and eToro USA Securities Inc.; Investing involves risk, including loss of principal; Not a recommendation

eToro USAeToro USA LLC and eToro USA Securities Inc.; Investing involves risk, including loss of principal; Not a recommendation -

5

OANDA USCFDs are not available to residents in the United States.

OANDA USCFDs are not available to residents in the United States. -

6

Focus Markets

Focus Markets

What Makes These Brokers The Best For Crypto Trading?

Here’s a fast overview of why these crypto brokers topped our rankings:

- Interactive Brokers is the best crypto broker in 2026 - IBKR lets you purchase and hold Bitcoin, Bitcoin Cash, Ethereum, and Litecoin at competitive commission rates and without needing a crypto wallet. Additionally, there is a range of other diverse assets to explore, such as crypto indices like the NYSE Bitcoin Index, as well as futures contracts like the BAKKT Bitcoin Futures.

- NinjaTrader - You can get exposure to micro Bitcoin futures through the CME Group’s centralized exchange, which is highly regulated by the US CFTC. Micro contracts allow you to trade a fractional size of one Bitcoin, giving you more risk control and order flexibility.

- Plus500US - Plus500’s Micro-Bitcoin and Micro-Ethereum futures only allow traders to scratch the surface of crypto trading with bets on the two most popular digital assets. Importantly, you cannot buy and own the cryptos with these derivative contracts - you are speculating on their price.

- eToro USA - eToro US offers 24 tradeable cryptoassets, with just a 1% buying/selling fee added to the spread. Additionally, there are 80 different coins available through the broker’s proprietary wallet service. You can also practice your crypto strategies easily by switching between live and demo mode. Crypto asset investing is highly volatile and unregulated. No consumer protection. Tax on profits may apply.

- OANDA US - Cryptocurrency trading is offered via Paxos, a separate entity from Oanda. You can speculate on the world’s biggest cryptos by market cap. Commissions are lower than many peers starting at 0.25%. Through the broker’s partnership with Paxos, clients can spot trade cryptocurrencies on the itBit exchange through the OANDA native platform.

- Focus Markets - Focus Markets has clearly been built for crypto traders, offering an impressive 90+ derivatives, including major tokens like Bitcoin, Ethereum and Ripple. With high leverage, a commission-free trading account and fast execution on MT5, it delivers a reliable environment for active crypto traders.

Compare The Top Crypto Brokers In Key Areas

Uncover the top crypto broker for you with our comparison of the factors critical to crypto traders:

| Broker | Bitcoin Trading | Crypto Spread | Crypto App | Minimum Deposit |

|---|---|---|---|---|

| Interactive Brokers | ✔ | 0.12%-0.18% | iOS & Android | $0 |

| NinjaTrader | ✔ | Floating | iOS & Android | $0 |

| Plus500US | ✔ | - | iOS & Android | $100 |

| eToro USA | ✔ | BTC 0.75% | iOS & Android | $100 |

| OANDA US | ✔ | $100 | iOS & Android | $0 |

| Focus Markets | ✔ | Variable | iOS & Android | $100 |

How Safe Are These Crypto Brokers?

The industry has been plagued with scandals, so check how our top crypto brokers safeguard your investments:

| Broker | Trust Rating | Guaranteed Stop Loss | Negative Balance Protection | Segregated Accounts |

|---|---|---|---|---|

| Interactive Brokers | ✘ | ✔ | ✔ | |

| NinjaTrader | ✘ | ✘ | ✘ | |

| Plus500US | ✘ | ✘ | ✔ | |

| eToro USA | ✘ | ✘ | ✔ | |

| OANDA US | ✘ | ✘ | ✘ | |

| Focus Markets | ✘ | ✔ | ✔ |

Compare Mobile Crypto Trading

Are these brokers good for trading crypto on mobile?

| Broker | Mobile Apps | iOS Rating | Android Rating | Smart Watch App |

|---|---|---|---|---|

| Interactive Brokers | iOS & Android | ✔ | ||

| NinjaTrader | iOS & Android | ✘ | ||

| Plus500US | iOS & Android | ✘ | ||

| eToro USA | iOS & Android | ✘ | ||

| OANDA US | iOS & Android | ✘ | ||

| Focus Markets | iOS & Android | ✘ |

Are the Top Crypto Brokers Good for Beginners?

Beginners should use firms that allow crypto trading with virtual money, alongside other features for novice investors:

| Broker | Demo Account | Minimum Deposit | Minimum Trade | Education Rating | Support Rating |

|---|---|---|---|---|---|

| Interactive Brokers | ✔ | $0 | $100 | ||

| NinjaTrader | ✔ | $0 | 0.01 Lots | ||

| Plus500US | ✔ | $100 | Variable | ||

| eToro USA | ✔ | $100 | $10 | ||

| OANDA US | ✔ | $0 | 0.01 Lots | ||

| Focus Markets | ✔ | $100 | 0.01 Lots |

Are the Top Crypto Brokers Good for Advanced Traders?

Experienced crypto traders need powerful tools to elevate the trading experience:

| Broker | Automated Trading | VPS | AI | Pro Account | Leverage | Low Latency | Extended Hours |

|---|---|---|---|---|---|---|---|

| Interactive Brokers | Capitalise.ai, TWS API | ✘ | ✔ | ✘ | 1:50 | ✔ | ✔ |

| NinjaTrader | NinjaScript or via Automated Trading Interface | ✘ | ✘ | ✘ | 1:50 | ✔ | ✘ |

| Plus500US | - | ✘ | ✘ | ✘ | Variable | ✔ | ✘ |

| eToro USA | ✘ | ✘ | ✘ | ✘ | - | ✔ | ✔ |

| OANDA US | Expert Advisors (EAs) on MetaTrader | ✘ | ✔ | ✘ | 1:50 | ✔ | ✘ |

| Focus Markets | Expert Advisors (EAs) on MetaTrader | ✘ | ✘ | ✘ | 1:500 | ✘ | ✘ |

Compare the Ratings of Top Crypto Brokers

See how the top crypto brokers compare in every core area following our latest tests:

| Broker | Trust | Platforms | Assets | Mobile | Fees | Accounts | Research | Education | Support |

|---|---|---|---|---|---|---|---|---|---|

| Interactive Brokers | |||||||||

| NinjaTrader | |||||||||

| Plus500US | |||||||||

| eToro USA | |||||||||

| OANDA US | |||||||||

| Focus Markets |

How Popular Are These Crypto Brokers?

With rising numbers of scams in the industry, traders often prefer the most popular crypto brokers (those with the most clients):

| Broker | Popularity |

|---|---|

| Plus500US | |

| Interactive Brokers | |

| eToro USA | |

| NinjaTrader |

Why Trade Crypto with Interactive Brokers?

"Interactive Brokers is one of the best brokers for advanced day traders, providing powerful charting platforms, real-time data, and customizable layouts, notably through the new IBKR Desktop application. Its superb pricing and advanced order options also make it highly attractive for day traders, while its diverse range of equities is still among the best in the industry."

Christian Harris, Reviewer

Interactive Brokers Quick Facts

| Coins | BTC, LTC, ETH, XRP |

|---|---|

| Crypto Mining | No |

| Auto Market Maker | No |

| Crypto Spread | 0.12%-0.18% |

| Crypto Lending | No |

| Crypto Staking | No |

| Platforms | Trader Workstation (TWS), IBKR Desktop, GlobalTrader, Mobile, Client Portal, AlgoTrader, OmniTrader, TradingView, eSignal, TradingCentral, ProRealTime, Quantower |

| Minimum Deposit | $0 |

| Regulator | FCA, SEC, FINRA, CFTC, CBI, CIRO, SFC, MAS, MNB, FINMA, AFM |

| Account Currencies | USD, EUR, GBP, CAD, AUD, INR, JPY, SEK, NOK, DKK, CHF, AED, HUF |

Pros

- Interactive Brokers has been named Best US Broker for 2025 by DayTrading.com, recognizing its long-standing commitment to US traders, ultra-low margin rates, and global market access at minimal cost.

- IBKR continues to deliver unmatched access to global stocks with tens of thousands of equities available from 100+ market centres in 24 countries, most recently the Saudi Stock Exchange.

- Interactive Brokers has launched ForecastTrader, a unique, zero-commission product where users can trade yes/no Forecast Contracts on political, economic, and climate events, with fixed $1 payouts per contract, 24/6 market access, and 3.83% APY on held positions.

Cons

- Support can be slow and frustrating based on tests, so you might find it challenging to reach customer service representatives promptly or encounter delays in resolving issues.

- TWS’s learning curve is steep, and beginners may find it challenging to navigate the platform and understand all the features. Plus500's web platform is much better suited to new traders.

- You can only have one active session per account, so you can’t have your desktop program and mobile app running simultaneously, making for a sometimes frustrating trading experience.

Why Trade Crypto with NinjaTrader?

"NinjaTrader continues to meet the demands of active futures traders looking for low fees and premium analysis tools. The platform hosts top-rate charting features including hundreds of indicators and 10+ chart types."

Tobias Robinson, Reviewer

NinjaTrader Quick Facts

| Coins | BTC |

|---|---|

| Crypto Mining | No |

| Auto Market Maker | No |

| Crypto Spread | Floating |

| Crypto Lending | No |

| Crypto Staking | No |

| Platforms | NinjaTrader Desktop, Web & Mobile, eSignal |

| Minimum Deposit | $0 |

| Regulator | NFA, CFTC |

| Account Currencies | USD |

Pros

- You can get thousands of add-ons and applications from developers in 150+ countries

- NinjaTrader is a widely respected and award-winning futures broker and is heavily authorized by the NFA and CFTC

- Traders can get free platform access and trade simulation capabilities in the unlimited demo

Cons

- Non forex and futures trading requires signing up with partner brokers

- The premium platform tools come with an extra charge

- There is a withdrawal fee on some funding methods

Why Trade Crypto with Plus500US?

"Plus500US stands out as an excellent choice for beginners, offering a very user-friendly platform, low day trading margins, and access to the Futures Academy to enhance trading skills. Its powerful tools and reliable service helped it scoop second place in DayTrading.com's annual 'Best US Broker' award."

Michael MacKenzie, Reviewer

Plus500US Quick Facts

| Coins | MicroBitcoin, MicroEthereum |

|---|---|

| Crypto Mining | No |

| Auto Market Maker | No |

| Crypto Lending | No |

| Crypto Staking | No |

| Platforms | WebTrader, App |

| Minimum Deposit | $100 |

| Regulator | CFTC, NFA |

| Account Currencies | USD |

Pros

- The trading app provides a terrific user experience with a modern design, a clean layout and mobile-optimized charts

- The Futures Academy is an excellent resource for new traders with engaging videos and easy-to-follow articles, while the unlimited demo account is great for testing strategies

- Plus500US excels for its low fees with very competitive day trading margins and no inactivity fees, live data fees, routing fees, or platform fees

Cons

- Plus500US does not offer social trading capabilities, a feature available at alternatives like eToro US which could strengthen its offering for aspiring traders

- The proprietary platform is user-friendly but lacks advanced technical analysis tools found in third-party solutions like MetaTrader 4

- Despite competitive pricing, Plus500US lacks a discount program for high-volume day traders, a scheme found at brokers like Interactive Brokers

Why Trade Crypto with eToro USA?

"eToro remains a top pick for traders looking for leading social investing and copy trading services. With a low deposit, zero commissions and an intuitive platform, the broker will meet the needs of newer day traders."

Jemma Grist, Reviewer

eToro USA Quick Facts

| Coins | BTC, ETH, BCH, DASH, LTC, ETC, MIOTA, XLM, EOS, NEO, ZEC, XTZ, MKR, COMP, LINK, UNI, YFI, DOGE, AAVE, ALGO, MANA, ENJ, BAT, MATIC, FLR, SHIBxM |

|---|---|

| Crypto Mining | No |

| Auto Market Maker | No |

| Crypto Spread | BTC 0.75% |

| Crypto Lending | No |

| Crypto Staking | No |

| Platforms | eToro Trading Platform & CopyTrader |

| Minimum Deposit | $100 |

| Regulator | SEC, FINRA |

| Account Currencies | USD |

Pros

- A free demo account means new users and prospective day traders can try the broker risk-free

- Investors can access Smart Portfolios for a more hands-off approach, covering a range of sectors and markets such as renewable energy and artificial intelligence

- The online broker offers an intuitive social investment network with straightforward copy trading on cryptos

Cons

- There's a narrower range of day trading instruments available compared to competitors, with only stocks, ETFs and cryptos

- There's no MetaTrader 4 platform integration for traders who are accustomed to using third-party charting tools

- The proprietary terminal doesn't support trading bots and there are no additional stock market analysis tools

Why Trade Crypto with OANDA US?

"OANDA remains an excellent broker for US day traders seeking a user-friendly platform with premium analysis tools and a straightforward joining process. OANDA is also heavily regulated with a very high trust score."

Jemma Grist, Reviewer

OANDA US Quick Facts

| Coins | BTC, ETH, LTC, BCH, PAXG, LINK, UNI, AAVE |

|---|---|

| Crypto Mining | No |

| Auto Market Maker | No |

| Crypto Spread | $100 |

| Crypto Lending | No |

| Crypto Staking | No |

| Platforms | OANDA Trade, MT4, TradingView, AutoChartist |

| Minimum Deposit | $0 |

| Regulator | NFA, CFTC |

| Account Currencies | USD, EUR, GBP, AUD, JPY, CHF, HKD, SGD |

Pros

- The proprietary OANDA web platform continues to deliver a highly competitive charting environment, including 65+ technical indicators powered by TradingView

- Seasoned day traders can access industry-leading tools, including an MT4 premium upgrade and advanced charting provided by MotiveWave

- There's a strong selection of 68 currency pairs for dedicated short-term forex traders

Cons

- It's a shame that customer support is not available on weekends

- The range of day trading markets is limited to forex and cryptos only

- There's only a small range of payment methods available, with no e-wallets supported

Why Trade Crypto with Focus Markets?

"Focus Markets is perfect for experienced traders familiar with MetaTrader 5, offering flexible crypto transactions (USDT and BTC) and access to over 90 cryptocurrencies for seamless speculation, deposits, and withdrawals."

Christian Harris, Reviewer

Focus Markets Quick Facts

| Coins | BTC, ETH, XRP, LTC |

|---|---|

| Crypto Mining | No |

| Auto Market Maker | No |

| Crypto Spread | Variable |

| Crypto Lending | No |

| Crypto Staking | No |

| Platforms | MT5 |

| Minimum Deposit | $100 |

| Regulator | ASIC, SVGFSA |

| Account Currencies | USD, EUR, GBP, CAD, AUD, NZD, JPY, SGD |

Pros

- Focus Markets’ MT5 platform delivered fast, seamless trade execution during testing with advanced charting, multiple timeframes, and useful tools like Depth of Market (DOM). Its clean interface made navigation easy, while clear risk/reward ratios ensures precise trading.

- While its meagre four commodities won’t meet the needs of some serious traders interested in softs and metals, Focus Markets offers a huge suite of 90+ cryptos, providing short-term opportunities on high-reward, high-risk assets.

- Focus Markets excelled in the deposit and withdrawal category during testing, offering more base currencies than most competitors, including USD, CAD and EUR - and a range of traditional and popular crypto payment options, including BTC and USDT.

Cons

- Regulatory protection is a location lottery at Focus Markets – Australian traders benefit from strong ASIC oversight, but those using the SVGFSA-registered entity face limited recourse options in disputes.

- Focus Markets’ 24/5 support lacks direct phone help and unresponsive live chat, while email replies took a full business day during our latest tests. This slow support is a major drawback for active traders who need quick resolutions.

- Focus Markets still has a long way to go to compete with the best brokers - with virtually zero research tools and education, plus limited value-add features like VPS hosting, copy trading and swap-free accounts.

Regulatory variations may result in the unavailability of specific crypto brokers in some regions.

How Did DayTrading.com Choose The Best Crypto Brokers?

- We selected crypto brokers that have earned the trust of our in-house experts year after year – helping to ensure your funds are secure. Regulation by respected bodies is a key component of that trust.

- We favoured online crypto brokers that offer an excellent range of cryptocurrencies, from major tokens like Bitcoin to up-and-coming tokens, ensuring you have a wide range of trading opportunities. XTB stands out with a list of 45+ digital currencies, including crypto-fiat pairs like BTC/USD and crypto-crypto pairs like ETH/BTC.

- We chose cryptocurrency brokers with platforms and apps that offer a terrific user experience with an easy-to-use design for beginners and excellent analysis tools for advanced traders. OANDA continues to tick these boxes for us, with OANDA Trade excelling for its ease of use and MetaTrader 4 serving advanced day traders.

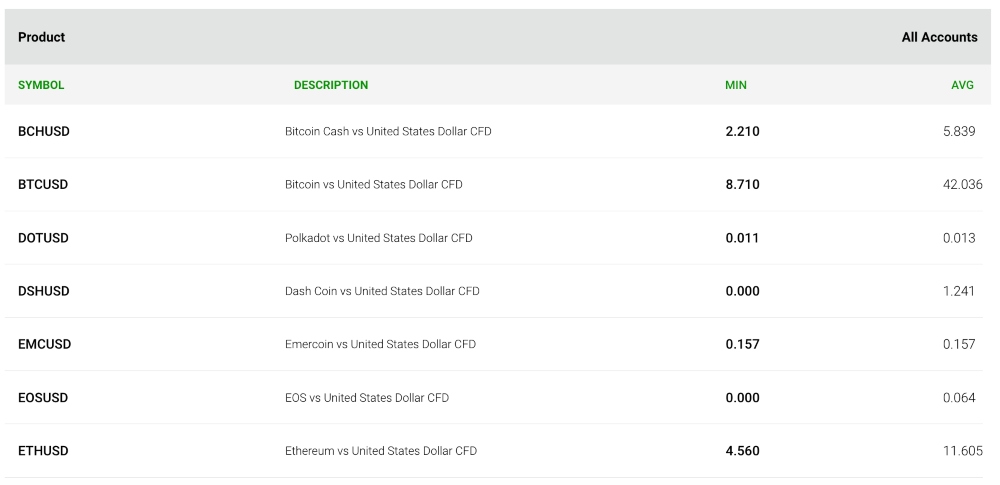

- We prioritized cryptocurrency brokers with low fees because we’ve seen that high costs can seriously erode the profits of active day traders, in particular. IC Markets routinely impresses for its low fees, with tight spreads from 8.710 on Bitcoin, as well as no inactivity fees that can penalize casual investors.

- We opted for crypto brokers with unique features that elevate the trading experience and your ability to discover market opportunities. Eightcap continues to impress here with its Crypto Crusher market scanner that’s great for finding live trading ideas.

Find out more about how we test brokers.

What Is A Crypto Broker?

Crypto brokers provide an online platform to trade cryptocurrencies such as Bitcoin (BTC).

Unlike crypto exchanges that are generally used to buy and sell digital currencies directly and often operate with little to no regulatory oversight, brokers can be established firms that deal in other asset classes and have obtained multiple regulatory licenses, so we consider them as a more reliable and trustworthy way to trade cryptocurrencies.

Some cryptocurrency brokers may allow traders to directly buy and sell the crypto tokens, but most will provide trading through derivatives like CFDs.

These derivatives typically allow for leveraged trading, meaning you can magnify your profits (or losses) by a factor, though this is often at levels far below those mandated for other assets due to crypto’s volatility.

For example, the majority of crypto brokers we’ve reviewed offer 1:2 leverage on cryptocurrencies, while retail trading on traditional currencies is often available up to 1:30 in major jurisdictions like Europe.

Should I Trade With A Crypto Broker Or Crypto Exchange?

Crypto exchanges offer popular ways to trade tokens, since their clients can place buy and sell orders in the same way as you would on a stock exchange.

In addition, some exchanges offer margin trading and decentralized finance (DeFi) functionality that lets you put your digital assets to work.

So, why sign up with crypto brokers?

There are many good reasons – and foremost among them is safety. From the 2014 collapse of the Mt. Gox exchange to 2022’s FTX fiasco, the largely unregulated exchanges have time and again fallen foul of poor management, unscrupulous business practices or bankruptcy, losing clients’ assets worth billions.

System hacks have also plagued crypto exchanges. Even larger providers have not been immune.

Brokers offer similar services to exchanges, but many are overseen by reputable regulators, reducing the risk factor in our view. Although, it’s important to note that not every cryptocurrency broker is regulated for their activities in digital currency trading.

Since they are generally not wholly invested in the crypto sector, online brokers are also usually better able to withstand the crypto markets’ wild swings. eToro, for example, offers stocks and commodities as well as cryptocurrencies.

Finally, many cryptocurrency brokers offer derivative products such as CFDs or binary options that can be difficult to find on an exchange. These allow you to make leveraged bets on crypto assets without having to actually purchase and hold them – meaning you don’t need to worry about an exchange being hacked or about keeping their crypto keys safe.

What Do I Need To Start Trading Crypto?

The first step is to open an account with brokers that offers cryptocurrency trading.

As part of the sign-up process, you will normally need to provide contact details, verify your identity and make a minimum deposit (typically ranging from $0 to $500).

Most cryptocurrency brokers then offer the opportunity to trade tokens using fiat currency through pairs such as USD/BTC.

When you have decided on a crypto you want to trade, you can place an order directly through your brokerage platform or mobile app.

Whether you make a profit or loss, and the size, will depend on the direction and extent the market moves when you close the trade, as well as any fees.

Bottom Line

Crypto brokers offer an excellent way to make short-term trades on digital assets, benefiting from the market’s notorious volatility while avoiding some of the risks associated with crypto exchanges.

Which crypto brokerage you choose to trade with is ultimately a personal decision. However, you can use our list of the best crypto brokers to find the right firm for your needs.

FAQ

Can Crypto Brokers Be Trusted?

We see crypto brokers as a step up from exchanges in terms of security since they tend to have better regulatory oversight and a longer track record.

That said, not all crypto brokers are necessarily regulated for their digital currency operations. Also, not all brokerages are equal in terms of service and security.

You should deal with one that is reputable and trusted.

Do Crypto Brokers Offer Leverage?

Yes, there are online crypto brokers that offer leverage. Rates are usually capped at around 2x (1:2) your deposit amount, however, some firms offer up to 5x (1:5) leverage on certain digital assets.

It’s worth noting that some regulators, including the UK’s FCA, have imposed blanket restrictions banning leverage for crypto markets.

Which Is The Best Crypto Broker For Day Trading?

Our analysis shows that AvaTrade, OANDA, Eightcap, IC Markets and NordFX are all excellent brokers for day trading cryptocurrencies. They offer a good range of digital currencies including Bitcoin, low fees, great charting tools, access to leverage, and are trusted.