Best Unregulated Crypto Brokers in 2026

Crypto remains the wild west of the trading world, with many brokers operating without regulatory oversight. Unlicensed platforms can be attractive, streamlining account opening with fewer compliance barriers, providing high leverage up to 200x on the likes of Bitcoin, and sometimes offering a larger suite of volatile cryptos.

However, unregulated platforms come with huge risks, notably zero protection if your broker goes bankrupt, which we saw when Cryptopia went under, while also leaving you open to scams like notorious ‘Pig Butchering’ schemes, which have cost investors millions. That’s why we mainly recommend regulated brokers.

For those willing to take the risk, discover DayTrading.com’s best unregulated crypto platforms. Each broker and exchange has been tested by our experts, many of whom trade or hold cryptocurrencies in their portfolios.

Top 6 Unregulated Crypto Brokers

Based on our latest evaluations, these 6 unauthorized brokers stand out as the best for trading cryptocurrency:

Here is a summary of why we recommend these brokers in February 2026:

- Nexo - Nexo offers trading on an impressive suite of around 70 tokens, including Bitcoin. Digital assets can be bought, sold and swapped directly on the exchange or traded in over 500 pairs. Digital assets can also be used as collateral for fiat loans or used to generate passive income with the ‘smart staking’ tool or from interest earned via peer-to-peer loans.

- PrimeXBT - Traders can speculate on popular cryptos with commissions as low as 0.05% and high leverage up to 1:200. Additionally, the broker continues to improve its offering by introducing Crypto Futures, with 101 new tokens added in 2025, as well as trading contests with real prizes.

- HeroFX - HeroFX’s crypto lineup of about a dozen pairs (BTC/USD, ETH/USD, ETH/EUR, ADA/USD, DOGE/USD and others) is reasonable but falls behind firms like Eightcap with over 100 cryptos. The crypto deposit and withdrawal solutions will appeal to dedicated digital currency enthusiasts who want to be able to deposit, trade and withdraw in tokens.

- Defcofx - Defcofx has work to do in the crypto department, offering trading on Bitcoin only. However, it does focus on crypto funding via popular tokens, making it a compelling option if you want to deposit, trade and withdraw in Bitcoin.

- Bybit - Buy dozens of crypto tokens with one click, or choose between hundreds of tokens to trade on spot markets, with more options than many alternatives. Crypto derivative products include perpetual futures and options.

- Bitfinex - Bitfinex provides access to an exceptional variety of crypto assets, encompassing over 180 tokens. In addition to spot trading, the platform supports perpetual swaps trading, enabling traders to engage in margin trading on crypto assets with leverage up to 1:10. With digital tokens frequently listed and delisted, Bitfinex provides diverse opportunities to participate in the dynamic cryptocurrency market.

Best Unregulated Crypto Brokers in 2026 Comparison

| Broker | Crypto Spread | Platforms | Minimum Deposit | Crypto Staking | Crypto Mining |

|---|---|---|---|---|---|

| Nexo | N/A | Nexo Pro | $10 | ✔ | ✘ |

| PrimeXBT | 0.05% BTC, 0.05% ETH | Own | $0 | ✘ | ✘ |

| HeroFX | 30.50 - BTC/USD (observed in HeroFX Zero account) | TradeLocker, MT5 | $5 | ✘ | ✘ |

| Defcofx | 110 (BTC) | MT5 | $50 | ✘ | ✘ |

| Bybit | Market maker, derivatives fee: 0.01%, spot fee: 0.1% Market taker: derivatives fee: 0.06%, spot fee: 0.1% | MT4, TradingView | $0 | ✔ | ✔ |

| Bitfinex | Taker (0.2% to 0.055%) and maker (0.1% to 0.0%) | Web Platform, Quantower | $0 | ✔ | ✘ |

Nexo

"Nexo gives crypto traders the capability to trade, invest, lend and borrow digital assets in one place, and it’s especially good for its credit functions that pay out very high yields to lenders. However, its fees are relatively high and many day traders will prefer a more tightly regulated crypto broker."

Michael MacKenzie, Reviewer

Nexo Quick Facts

| Coins | BTC, ETH, NEXO, USDT, USDC, AXS, RUNE, MATIC, DOT, APE, AVAX, KSM, ATOM, FTM, NEAR, BNB, ADA, SOL, XRP, LTC, LINK, BCH, TRX, XLM, EOS, PAXG, UNI, DOGE, MANA, SAND, GALA, SUSHI, AAVE, CRV, MKR, 1INCH, DAI, USDP, TUSD |

|---|---|

| Crypto Mining | No |

| Auto Market Maker | No |

| Crypto Spread | N/A |

| Crypto Lending | Yes |

| Crypto Staking | Yes |

| Platforms | Nexo Pro |

| Minimum Deposit | $10 |

| Account Currencies | USD, EUR, GBP |

Pros

- Traders can access perpetual futures to open long or short positions on crypto assets, increasing strategic opportunities

- Nexo’s crypto staking and credit features support crypto lending and borrowing, and the yields lenders receive are among the best going

- Traders benefit from bonuses and incentives including free trading funds paid to lenders and cashback in the form of the exchange’s native Nexo token

Cons

- Although Nexo has registered with some reputable watchdogs, it is riskier to trade with than established crypto brokers like AvaTrade and Vantage

- High deposit and withdrawal fees for cards and e-wallets will price many traders out of the most convenient payment methods

- High maker/taker fees mean day traders will pay more to trade derivatives than they would at some rival exchanges

PrimeXBT

"PrimeXBT is perfect for aspiring traders looking for crypto derivatives alongside traditional markets like forex and indices, all tradable on an intuitive, web-based platform. The copy trading solution is also ideal for hands-off traders with 5-star ratings and performance graphs to help you find the right trader."

William Berg, Reviewer

PrimeXBT Quick Facts

| Coins | BTC, LTC, ETH, XRP, EOS, ADA, DOT, SOL, UNI, LINK, DOGE, BNB, ICP, SAND, more |

|---|---|

| Crypto Mining | No |

| Auto Market Maker | No |

| Crypto Spread | 0.05% BTC, 0.05% ETH |

| Crypto Lending | No |

| Crypto Staking | No |

| Platforms | Own |

| Minimum Deposit | $0 |

| Account Currencies | USD, EUR, GBP |

Pros

- PrimeXBT seriously bolstered its suite of Crypto Futures in 2025 with over 100 tokens spanning AI, NFTs, Metaverse, Layer 1 &2, and more.

- The web platform and app were built for technical traders with advanced charting features, a customizable layout and multiple order types including one-cancels-the-other (OCO).

- Maker and taker fees of at 0.01% and 0.02%, respectively, for crypto futures contracts are highly competitive within the industry.

Cons

- While common in the crypto industry, PrimeXBT lacks authorization from a trusted regulator, seriously elevating the risk for retail traders.

- Despite improvements, the selection of around 100+ instruments still seriously trails competitors, notably OKX with its 400+ assets.

- The lack of integration with established platforms like MT4 will be limiting for traders familiar with the world’s most popular forex trading software.

HeroFX

"HeroFX is best for algo traders who want to deposit and withdraw in crypto and are willing to sacrifice regulatory protections for raw spreads from 0.0, high leverage up to 1:500, and access to the powerful charting package from TradeLocker or Expert Advisors on MT5. It also suits demo traders with competitions offering cash prizes and a $1M virtual balance – the highest we’ve seen."

Christian Harris, Reviewer

HeroFX Quick Facts

| Coins | BTC, BCH, ETH, LTC, ADA, DOGE, XLM, XMR, ZEC |

|---|---|

| Crypto Mining | No |

| Auto Market Maker | No |

| Crypto Spread | 30.50 - BTC/USD (observed in HeroFX Zero account) |

| Crypto Lending | No |

| Crypto Staking | No |

| Platforms | TradeLocker, MT5 |

| Minimum Deposit | $5 |

| Account Currencies | USD |

Pros

- The Raw Spread account delivered spreads from 0.0 pips with $1-per-lot commissions during our use, which undercuts the ~$3-per-lot charge we've seen at many mainstream brokers and noticeably outperformed the Zero Commission account on busy market days.

- The Hero10X account multiplies deposits by 10 (e.g. $50 to $500 tradable balance, up to a $1M ceiling), creating a prop-firm-style buffer for taking more positions without evaluation phases or profit splits.

- Free demo accounts allow for multiple simultaneous setups on MT5 or TradeLocker with Raw, Zero, Islamic or Contest configurations and up to $1,000,000 in virtual balance per account, letting high-leverage day trading ideas be trialled, though no stocks are available in the MT5 demo.

Cons

- Withdrawals require an internal transfer from the trading account back into the wallet area before a request, and with only crypto payouts available, moving profits to a bank means jumping through an extra hoop via a separate exchange, which feels slow and fiddly compared with brokers that allow direct fiat withdrawals.

- There’s no in-house economic calendar, news feed, market commentary or education hub, forcing all research and learning to be sourced externally and leaving newer traders with zero structured support.

- Customer support is limited to email tickets and a basic AI chatbot with no phone or human live chat, so platform or account issues during live market hours means waiting in a queue, which may deter day traders who might need urgent assistance. And while initial email replies were fast in our tests, at under 3 hours, follow-up replies took more than 12 hours.

Defcofx

"Defcofx is best suited for experienced traders who want ultra-high 1:2000 leverage, seamless MT5 execution, and crypto-based funding—with one-click trading and chart-based order placement that felt fast and intuitive in our hands-on tests."

Christian Harris, Reviewer

Defcofx Quick Facts

| Coins | BTC |

|---|---|

| Crypto Mining | No |

| Auto Market Maker | No |

| Crypto Spread | 110 (BTC) |

| Crypto Lending | No |

| Crypto Staking | No |

| Platforms | MT5 |

| Minimum Deposit | $50 |

| Account Currencies | USD, EUR, GBP |

Pros

- If you're into crypto, Defcofx makes it easy to fund your account via popular tokens like Bitcoin, Tether and Solana. It's a great option if you're looking for low-cost transactions without using traditional banking methods, with deposits credited to our account in under 1 hour during testing.

- With leverage up to 1:2000, Defcofx gives day traders serious exposure - we tested this ourselves with small balance trades and saw how quickly positions could grow (or shrink). It’s definitely not for beginners, but when used strategically, it offers powerful flexibility.

- Trades are completely commission-free, there are no overnight swap fees for holding positions, and you won’t get charged for leaving your account idle. It’s a very cost-effective setup for both casual and active traders.

Cons

- If you’re new to trading, don’t expect much help. We found no structured learning tools - just basic calculators. Compared to category leaders like IG, the lack of education resources makes Defcofx harder to recommend for beginners.

- While spreads are competitive based on our analysis, there’s no zero-spread account option, which will matter to scalpers or high-frequency traders. Over time, even a small spread can erode tight-margin strategies.

- Defcofx isn’t regulated by any major financial body. We couldn’t find much in terms of third-party fund protection or formal dispute resolution processes during our investigations - so it’s a case of 'trade at your own risk'.

Bybit

"Bybit is a good choice for active traders who want a fast and straightforward way to buy crypto tokens and trade crypto derivatives."

William Berg, Reviewer

Bybit Quick Facts

| Coins | BTC, ETH, EOS, XRP, USDT, BCH, LINK, XTZU, LUNA, SRM, TRX, RUNE, THETA, STRM, YFI, WAVES, DXPX, ENS, USDC, ADA, BEL, BIC, REN, MKR, LING, CN98, CAKE, CAPS, BUSD, BTT, CBX, CELO, BTG, BUSD, KLAY, BNB, DOT, AGLA, AGLD, LING and many more |

|---|---|

| Crypto Mining | Yes |

| Auto Market Maker | No |

| Crypto Spread | Market maker, derivatives fee: 0.01%, spot fee: 0.1% Market taker: derivatives fee: 0.06%, spot fee: 0.1% |

| Crypto Lending | Yes |

| Crypto Staking | Yes |

| Platforms | MT4, TradingView |

| Minimum Deposit | $0 |

| Account Currencies | EUR, GBP, TRY, RUB |

Pros

- Increased profit potential with leverage up to 1:100

- No limits on trades and withdrawals on any account

- Industry-leading cold wallet strengthens security and improves the safety of funds

Cons

- Bybit is not currently regulated in any country

- Residents of some countries are restricted from opening an account, including clients from the US

Bitfinex

"With its growing token selection, advanced charting tools and zero-fee model, Bitfinex is a compelling choice for frequent crypto traders. However, testing reveals a daunting platform for newer day traders, hit-and-miss education and regulatory fines that raise safety concerns."

Christian Harris, Reviewer

Bitfinex Quick Facts

| Coins | BTC, ETH, USDT, LTC, XRP, DOGE, ETC, EOS, LINK, BCHN, DOT, DASH, IOTA, SUSHI, NEO, ZEC, UNI, ADA, OMG, MDOGE, BSV, TRX, XTZ, SOL, XLM, YFI, USDC, ZRX, FIL, VET, XMR, COMP, BTG, DAI, LUNA, CEL, ALGO, ATOM, EGLD, FTT and many more |

|---|---|

| Crypto Mining | No |

| Auto Market Maker | No |

| Crypto Spread | Taker (0.2% to 0.055%) and maker (0.1% to 0.0%) |

| Crypto Lending | Yes |

| Crypto Staking | Yes |

| Platforms | Web Platform, Quantower |

| Minimum Deposit | $0 |

| Account Currencies | USD, EUR, GBP, JPY, TRY |

Pros

- Despite a steep learning curve, the Bitfinex trading platform delivers for experienced traders, featuring a comprehensive charting package with 12 timeframes, plus margin trading and various order types.

- Bitfinex is well-suited to algo traders, facilitating automated trading through its Honey terminal and API integration, enabling traders to program trading strategies efficiently.

- Bitfinex has moved to a zero trading fee model on spot, margin, derivatives, securities and OTC, appealing to traders looking for a straightforward pricing model.

Cons

- Despite enhancing its security measures with two-factor authentication, Bitfinex still hasn’t escaped its dogged history of major security breaches and regulatory fines.

- For occasional crypto traders and investors prioritizing simplicity, platforms like eToro, Gemini, or Kraken are superior options.

- Like many crypto exchanges, Bitfinex operates in a regulatory grey area, which may pose risks for traders, especially compared to trusted crypto trading platforms like eToro.

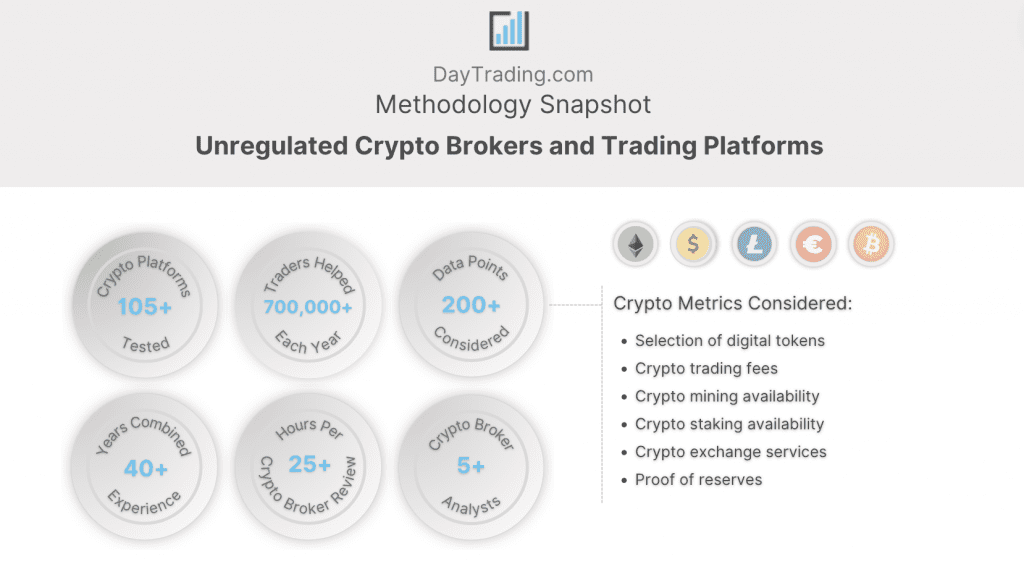

Our Methodology

To identify the top unlicensed crypto brokers, we followed three steps:

- We searched our database of over 105 crypto brokers, exchanges and trading platforms.

- We identified all those that are not regulated by a financial authority anywhere in the world.

- We sorted the unlicensed crypto providers by their rating, blending hard data with personal testing insights.

Choosing A Non-Regulated Crypto Trading Platform

Choosing the ‘right’ platform will depend on your individual requirements. However, we’ve pooled our years of experience and hundreds of hours evaluating unlicensed crypto providers to draw your attention to what we believe are the key considerations:

Trust

Find a brokerage you can trust.

This is the hardest part as unregulated crypto brokerages and exchanges won’t offer the same level of protection as providers authorized by regulators recognized in DayTrading.com’s Regulation and Trust Rating.

You may forfeit financial protections like compensation in the event of insolvency, which can be up to €20,000 in the EU, up to £85,000 in the UK, and up to $500,000 in the US.

This is significant given the number of crypto firms that have gone under (MT. Gox in 2014, Cryptopia in 2019, Celsius Network and FTX in 2022, to name but a few), with $8 billion in customer assets lost through FTX alone.

You may also lose negative balance protection, which could prevent your account from falling below zero, and you effectively becoming indebted to your brokerage, if say the price of Bitcoin quickly moves against you – something that’s very possible given the highly volatile nature of cryptocurrencies.

Still, there are hallmarks of a trustworthy crypto firm:

- A long history with a large client base

- A clean record with no regulatory fines

- Speedy, reliable support for any crypto trading issues

- Excellent reviews from other cryptocurrency traders and industry experts

- Nexo is among the most trustworthy unlicensed crypto providers we’ve tested. It has registered with financial bodies like ASIC and FinCEN, even if it’s not fully regulated to provide crypto trading products in all regions.

Cryptocurrencies

Choose a provider with the cryptos you want to trade, whether that’s Bitcoin, Ethereum, Ripple or lesser-known tokens.

You can check this by exploring the broker’s website before signing up for a live account or through a demo account (offered by most top firms).

A word of warning: Without the oversight of regulators, these companies are more likely to provide cryptocurrencies that could be poorly researched or even part of dodgy schemes, increasing the risks if tokens turn out to be scams or plummet in value.

- PrimeXBT’s selection of 100+ crypto products, including CFDs and futures, provides more trading opportunities than the vast majority of unlicensed providers we’ve examined. Alongside major tokens like Bitcoin and Ethereum, you can trade lesser-known altcoins like Tezor and Filecoin.

Tools

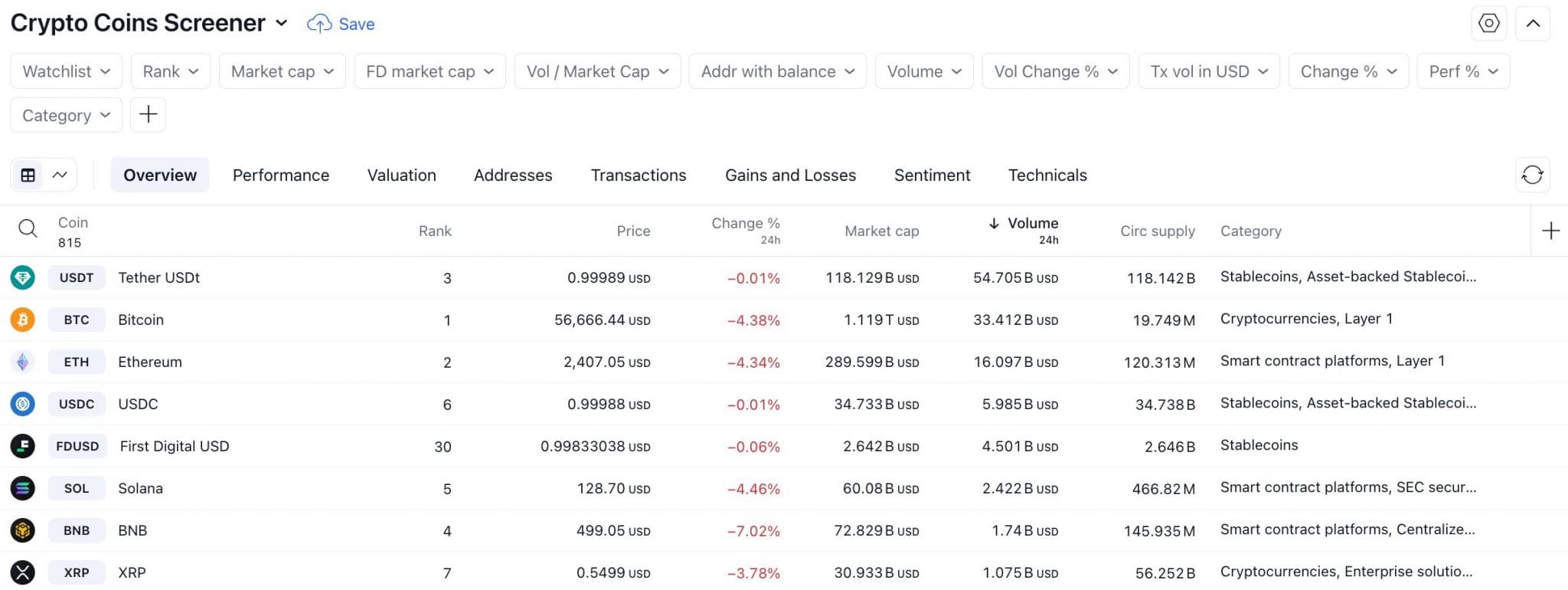

Select a broker with user-friendly tools that you need to trade cryptocurrencies, whether that’s a desktop client or a crypto trading app.

For day traders, an excellent charting package with a choice of charts, timeframes, indicators and drawing tools will be important.

You’ll find this if you opt for third-party solutions like MetaTrader 4 (MT4), MetaTrader 5 (MT5), cTrader and increasingly TradingView (which offers a slick crypto screener that you can filter by market cap, volume, social media sentiment and more).

However, our tests have found a slim platform selection at most unregulated crypto brokers.

In addition, the quality of the in-house terminals provided by unlicensed brokers can be poor. We’ve seen technical glitches, ugly interfaces and sparse technical tools for analyzing crypto markets, which can make for an extremely frustrating trading experience.

- Plexytrade delivers a reliable crypto trading environment to suit traders at all levels, with MT4 and MT5 available on desktop, web and mobile apps. Both solutions offer a terrific range of technical analysis tools for short-term crypto trading, plus a fast, stable workspace.

Trading Conditions

Pick a platform with transparent, competitive crypto transaction fees, which can mount up for active traders.

Importantly, we’ve seen many unlicensed crypto trading platforms offer ‘commission-free’ trading but levy higher costs elsewhere, such as deposit/withdrawal charges and access to premium market research and insights.

Unregulated crypto brokers also tend to offer high leverage of 1:200+, significantly more than the 1:2 available in tightly regulated jurisdictions like the EU and UK. But this greatly increases the risks of thumping losses so risk management is essential.

- Bitfinex is a great choice for those looking to buy, sell and trade cryptocurrencies, with transparent 0.10% maker fees and 0.20% taker fees. These drop to 0.02% and 0.065% for derivative transactions. You can also access competitive leverage up to 1:10. Additionally, you can deposit in cryptos for a smooth experience.

Customer Support

Choose a broker with reliable support who can answer your crypto trading queries quickly and efficiently.

However, be prepared to forego access to multilingual 24/7 support, local helplines or account managers. Our support experiences at unlicensed crypto brokers have been poor nearly across the board.

Our questions have been met with slow responses, frustrating chatbots, and agents who have a limited understanding of the crypto products on their platforms, which could be particularly problematic for beginners.

- Nexo’s customer support performed noticeably better during our tests than most other unlicensed cryptocurrency brokers, with fast and helpful responses through its 24/7 live chat. There’s also email assistance as well as active Telegram and Reddit chatrooms for those seeking community support.

Bottom Line

Unauthorized cryptocurrency trading brokers can be alluring for those looking for near-instant account opening, highly leveraged trading opportunities, trading bonuses, and access to niche, lesser-known digital tokens.

To find the right provider for you, see DayTrading.com’s pick of the top unregulated crypto trading platforms.

Unlicensed crypto firms are extremely risky. Most of the unregulated brokers we’ve evaluated do not provide investor protection and have limited transparency about trading conditions. You could lose your investment.

FAQ

Is It Safe To Trade Cryptocurrencies Through An Unregulated Broker?

No. Trading cryptocurrencies with an unlicensed broker will never be safe. Non-regulated crypto brokers are not subject to the same oversight nor offer the same level of financial protection as regulated firms, leaving your funds and personal data at risk.

Learn about the safest ways to trade crypto.

Article Sources

The writing and editorial team at DayTrading.com use credible sources to support their work. These include government agencies, white papers, research institutes, and engagement with industry professionals. Content is written free from bias and is fact-checked where appropriate. Learn more about why you can trust DayTrading.com