HeroFX Review 2026

See the Top 3 Alternatives in your location.

Pros

- The Raw Spread account delivered spreads from 0.0 pips with $1-per-lot commissions during our use, which undercuts the ~$3-per-lot charge we've seen at many mainstream brokers and noticeably outperformed the Zero Commission account on busy market days.

- Free demo accounts allow for multiple simultaneous setups on MT5 or TradeLocker with Raw, Zero, Islamic or Contest configurations and up to $1,000,000 in virtual balance per account, letting high-leverage day trading ideas be trialled, though no stocks are available in the MT5 demo.

- The Hero10X account multiplies deposits by 10 (e.g. $50 to $500 tradable balance, up to a $1M ceiling), creating a prop-firm-style buffer for taking more positions without evaluation phases or profit splits.

Cons

- HeroFX is an unregulated broker operating offshore from Saint Lucia broker with no access to a compensation scheme or resolution service, leaving deposits exposed to broker failure or disputes. It's a high-risk broker to trade with.

- Customer support is limited to email tickets and a basic AI chatbot with no phone or human live chat, so platform or account issues during live market hours means waiting in a queue, which may deter day traders who might need urgent assistance. And while initial email replies were fast in our tests, at under 3 hours, follow-up replies took more than 12 hours.

- There’s no in-house economic calendar, news feed, market commentary or education hub, forcing all research and learning to be sourced externally and leaving newer traders with zero structured support.

HeroFX Review

After being alerted to HeroFX by a fellow trader, we’ve run our own hands-on tests to evaluate whether it’s a good broker for active traders. We opened a HeroFX account, explored every corner of the platforms, and used the various trading products and tools to create this review.

Regulation & Trust

HeroFX launched in 2022 as an offshore forex and CFD broker based in Saint Lucia, registration number 2023-00356. It is unregulated, with zero licenses from credible bodies like the CFTC in the US, the FCA in the UK, or ASIC in Australia. Saint Lucia registration doesn’t count as a trustworthy licensing authority.

The FCA also lists HerosFX (note the “s”) as an unauthorised firm and warns UK consumers not to deal with it. And although the FCA warning is technically against ‘HerosFX’, some watchdogs link this to HeroFX-branded domains, treating it as a clone/unauthorised operation.

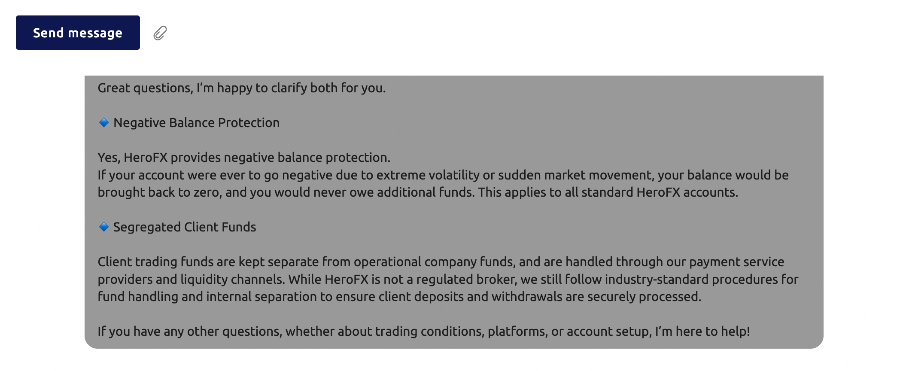

We contacted the support team via the ticketing system in the client area to clarify whether it segregates client funds, offers negative balance protection, and provides access to a compensation scheme in case the broker fails. The answer to the first two was yes, but there’s no access to an investor compensation scheme. This makes it a high-risk broker.

| HeroFX | Interactive Brokers | Plexytrade | |

|---|---|---|---|

| Regulation & Trust Rating | |||

| Regulators | FCA, SEC, FINRA, CFTC, CBI, CIRO, SFC, MAS, MNB, FINMA, AFM | ||

| Segregated Client Accounts | Yes | Yes | Yes |

| Negative Balance Protection | Yes | Yes | Yes |

| Visit | Visit | Visit | Visit |

| Review | Review | Review | Review |

Accounts & Banking

Live Accounts

HeroFX offers a handful of account types aimed at different traders. The standout for day traders is the Raw Spread account. It provides spreads as low as 0.0 pips and commissions starting at $1 per lot.

The minimum deposit is $5 in crypto (USDT) or €30 in fiat. Leverage hits 1:500 (much higher than is allowed in tightly regulated regions like the US, UK and Europe), and it works on both the supported platforms (TradeLocker and MT5), making it best suited for scalpers looking to trade quick moves.

Then there’s the Hero10X account, which multiplies your deposit by 10 – no challenges or splits – so, depositing $50 bags you $500, up to $1 million max, with no profit split like at a prop firm. But it caps drawdown at 10% static, so one trading slip could lock you out fast.

The Zero Commission account skips trading fees, but spreads start at 1 pip, which is high, eating into the profits of tight day trades.

Lastly, there’s an Islamic account for swap-free (no riba) overnight holds, should you qualify.

Compared to top forex and CFD brokers like IG or Pepperstone, HeroFX’s low entry and spreads look sharp for beginners. But those big names stick to audited spreads of 0.1 to 0.6 pips for major FX pairs, without gimmicks, and offer faster execution speeds on high-volume days in our experience.

Demo Accounts

When we first looked for HeroFX’s demo account, we couldn’t find it anywhere on its homepage – no ‘Try Demo’ button or quick signup link. Turns out, you need to jump through an annoying couple of hoops first.

I had to start by registering for a live account, verifying my email (within 30 seconds), and then logging into the client dashboard. From there, I headed to the ‘Accounts’ tab and hit the ‘Demo Account’ button to get my practice setup going.I was then able to set up a demo on either MT5 or TradeLocker using a Raw Spread account, Zero Commission account, Islamic account, or an MT5 Contest account ($10k starting balance to win real trading capital).

The virtual funds are essentially unlimited – you can load up to $1,000,000 at a time, run several demo accounts simultaneously, and reset the balance with just a few clicks.

The catch is that not all instruments are available. For instance, we noticed the MT5 demo mode doesn’t offer any stocks – just FX, currencies, commodities and indices.

Deposits & Withdrawals

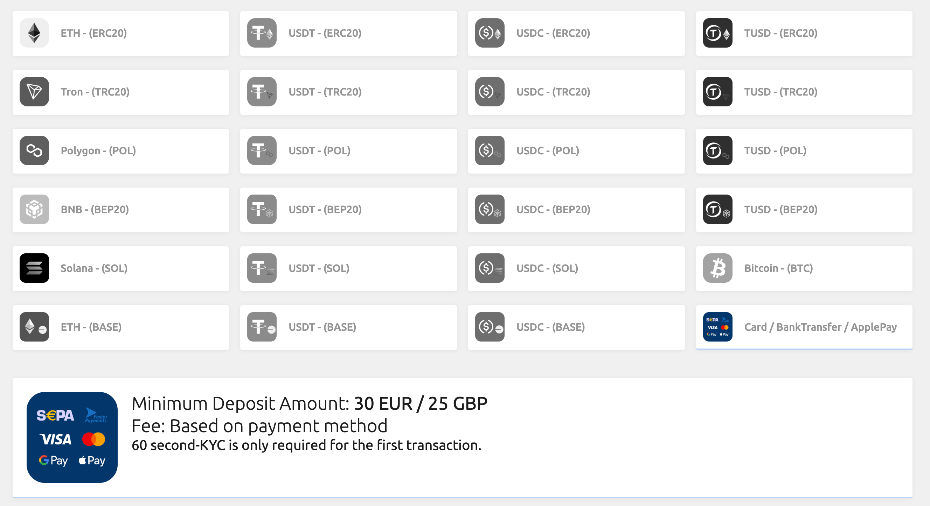

HeroFX’s deposit process is straightforward, especially for crypto. The broker supports USDT, USDC, Bitcoin, Ethereum, Solana, Polkadot, BNB Chain, Tron, and Polygon – with minimums as low as $5 for USDT and $15 for ETH.

During my time using HeroFX, funds were deposited into my account almost instantly after a quick KYC check and blockchain confirmation.

You can also use Apple Pay, Google Pay, debit cards, credit cards, or bank wires. Just log in to your dashboard, click ‘Deposit,’ select your method, and follow the steps. You need to verify your account first, however, so allow an hour or so for this.

HeroFX doesn’t charge funding fees, but watch for network or card charges.

Withdrawals are where it gets tricky. You can’t withdraw directly from your trading account. I had to first transfer funds back to my wallet using the ‘Internal transfer’ function, then process the withdrawal from there.

It’s an extra step that feels a bit clunky, especially when we’re used to brokers that let you pull funds straight from the trading balance. Just something to keep in mind when you’re planning your withdrawals – make sure you move your money to the wallet first, or you’ll be stuck wondering why the withdrawal option isn’t showing up.

There are no fiat withdrawal options either, so cashing out to your bank requires routing through a crypto exchange first.

For active day traders who need quick access to profits, this feels limiting. For traders with no crypto experience, it will probably be too much of an inconvenience.

| HeroFX | Interactive Brokers | Plexytrade | |

|---|---|---|---|

| Accounts & Banking Rating | |||

| Payment Methods | Apple Pay, Bitcoin Payments, Credit Card, Debit Card, Ethereum Payments, Google Pay, Wire Transfer | ACH Transfer, Automated Customer Account Transfer Service, Cheque, Debit Card, TransferWise, Wire Transfer | Bitcoin Payments, Ethereum Payments |

| Minimum Deposit | $5 | $0 | $50 |

| Fast Withdrawals | No | No | No |

| Islamic Account | Yes | No | Yes |

| Demo Account | Yes | Yes | Yes |

| Demo Competitions | Yes | No | No |

| Visit | Visit | Visit | Visit |

| Review | Review | Review | Review |

Assets & Markets

HeroFX covers the essentials, but the instrument range is limited compared to brokers with the most instruments.

We logged into the platform and counted around 70 forex pairs, including five majors – AUD/USD, EUR/USD, GBP/USD, NZD/USD, and USD/JPY. The majority of pairs are minors and exotics, such as CAD/JPY, AUD/CAD, and USD/PLN.

Top forex brokers like CMC Markets and City Index offer over 300 and 150 pairs, respectively, including all major pairs.

The index selection is pretty thin but provides good global coverage – nine CFDs include the Nasdaq-100, FTSE 100, S&P/ASX 200, and Nikkei 225.

Metals gives you seven options, mainly the usual suspects: gold and silver (XAU/USD, XAG/USD), plus platinum and palladium. There are just three energy markets though: USOIL, UKOIL, and NGAS.

For stocks, we found around 60 US and European stock CFDs – big names like Apple, Tesla, and Lufthansa – but nowhere near the thousands available at IG or Saxo.

Crypto is a decent side market, with about 12 pairs, including BTC/USD (Bitcoin), ETH/USD (Ethereum), LTC/USD (Litecoin), ADA/USD (Cardano), and DOGE/USD (Dogecoin).

Overall, HeroFX gives you enough to learn and scalp the main markets, but it feels basic next to top multi-asset brokers offering hundreds or even thousands of CFDs.

| HeroFX | Interactive Brokers | Plexytrade | |

|---|---|---|---|

| Assets & Markets Rating | |||

| Trading Instruments | CFDs, Forex, Stocks, Indices, Commodities, Crypto | Stocks, Options, Futures, Forex, Funds, Bonds, ETFs, Mutual Funds, CFDs, Cryptocurrencies | CFDs, Forex, Indices, Stocks, Commodities, Crypto |

| Extended Hours Trading | No | Yes | No |

| Fractional Shares | No | Yes | No |

| Margin Trading | Yes | Yes | Yes |

| Maximum Leverage | 1:500 | 1:50 | 1:2000 |

| Fast Execution | No | Yes | Yes |

| Visit | Visit | Visit | Visit |

| Review | Review | Review | Review |

Fees & Costs

HeroFX gives you three fee structures.

The Raw Spread account starts with spreads as low as 0.0 pips and commissions from $1 per lot, which is super competitive – commissions are usually around $3 per lot, even at the cheapest brokers we’ve tested like IC Markets.

The Zero Commission account ditches the commission but widens spreads to around 1 pip. In my experience, if you’re trading high volume, Raw Spread saves you money – those wider Zero Commission spreads really ate into my profits on active days.

Further good news is that HeroFX does not charge any inactivity fees for trading accounts. Therefore, there is no need to close your account or make intermittent trades due to inactivity concerns.

| HeroFX | Interactive Brokers | Plexytrade | |

|---|---|---|---|

| Fees & Costs Rating | |||

| Fixed Spreads | No | No | No |

| Inactivity Fee | $0 | $0 | |

| EUR/USD Spread | 1.1 (observed in HeroFX Zero account) | 0.08-0.20 bps x trade value | 0.7 |

| FTSE Spread | 3.30 (observed in HeroFX Zero account) | 0.005% (£1 Min) | 0.8 |

| Oil Spread | 0.035 (observed in HeroFX Zero account) | 0.25-0.85 | 5 |

| Crypto Spread | 30.50 - BTC/USD (observed in HeroFX Zero account) | 0.12%-0.18% | 1.1 |

| Visit | Visit | Visit | Visit |

| Review | Review | Review | Review |

Platforms & Tools

HeroFX gives you both MT5 and TradeLocker, and I spent time testing each to see how they handle real day trading scenarios.

MT5 packed everything I needed for technical analysis – 21 timeframes, market depth for reading order flow, and a built-in economic calendar that helped me time news trades on GBP/USD and the Nasdaq-100.

One-click trading sped up my scalping entries, and I could run EAs for automated setups without issues. That said, the interface feels dated. Charts loaded noticeably slower on my phone, and customizing the layout took more fiddling than I wanted. It’s solid for deep technical work but clunky for quick checks on the go.

TradeLocker impressed me right away with its TradingView-powered charts – over 100 indicators, drag-and-drop widgets, and on-chart trading that kept me locked in during Dow Jones breakouts.

The order panel’s instant risk calculator with SL/TP sliders made position sizing lightning-fast, which I loved when volatility picked up. Multi-device sync worked flawlessly – I switched from phone to desktop mid-trade without any lag. The catch? It’s not as broker-independent as TradingView.

Compared to big brokers like IC Markets, which fine-tune platforms with VPS hosting and copy trading via cTrader, HeroFX’s versions feel more basic.

| HeroFX | Interactive Brokers | Plexytrade | |

|---|---|---|---|

| Platforms & Tools Rating | |||

| Platforms | TradeLocker, MT5 | Trader Workstation (TWS), IBKR Desktop, GlobalTrader, Mobile, Client Portal, AlgoTrader, OmniTrader, TradingView, eSignal, TradingCentral, ProRealTime, Quantower | MT4, MT5 |

| Mobile App | iOS & Android | iOS & Android | iOS & Android |

| Automated Trading | Expert Advisors (EAs) on MetaTrader, TradeLocker Studio | Capitalise.ai, TWS API | Expert Advisors (EAs) on MetaTrader |

| Copy Trading | No | No | No |

| VPS | No | No | Yes |

| Guaranteed Stop Loss | No | No | No |

| Visit | Visit | Visit | Visit |

| Review | Review | Review | Review |

Research

HeroFX keeps research tools bare-bones. There’s access to MT5 and TradeLocker’s built-in charting, which works fine for spotting setups on forex majors and indices like NAS100. But that’s about where it ends.

I couldn’t find a dedicated economic calendar, live news feed, or any market analysis from the broker itself, so I had to pull up external sites for fundamental data every single day during testing.

What really stood out was the lack of regular market updates. Most top brokers we’ve evaluated offer some daily insight or third-party analysis through tools like Autochartist or Trading Central to help you stay informed. HeroFX doesn’t, which makes the learning curve feel steeper.

Compare this to IG or Interactive Brokers, where I’ve used built-in news feeds, economic calendars, trading signals, and tons of resources all in one place.

HeroFX works if you’re the type who brings your own analysis and doesn’t need hand-holding, but it definitely lacks the extras that help newer traders make smarter, more confident decisions.

| HeroFX | Interactive Brokers | Plexytrade | |

|---|---|---|---|

| Research Rating | |||

| Autochartist | No | No | No |

| Trading Central | No | Yes | No |

| Visit | Visit | Visit | Visit |

| Review | Review | Review | Review |

Education

When we looked for educational resources on HeroFX, we came up empty-handed – no courses, no webinars, no video tutorials – nothing. There’s literally no structured learning content to help you understand trading basics or the supported trading platforms.

If you’re new to day trading, you’re on your own here, which means hunting down external resources before you even think about risking real money.

I’ve traded with plenty of top brokers, including Interactive Brokers, Pepperstone, and eToro, and they all offer extensive educational libraries – live webinars, step-by-step tutorials, trading guides, and regular market breakdowns.

If having broker-supported education matters to you – and it should if you’re just starting – HeroFX’s offering is practically nonexistent.

My suggestion is to line up your own training resources before you open an account with HeroFX, or consider a broker that invests in helping you learn the game.

| HeroFX | Interactive Brokers | Plexytrade | |

|---|---|---|---|

| Education Rating | |||

| Visit | Visit | Visit | Visit |

| Review | Review | Review | Review |

Customer Support

HeroFX has disappointing customer support – a far cry from the top brokers for customer service.

Your main options are email or submitting tickets through the client portal. The website mentions ’24/7′ support, but in practice, you log in, open a ticket, and wait for someone to get back to you.

I found a contact page listing a Saint Lucia address, but there’s no phone support or priority lines for active traders – something I really missed during my time using the platforms.What frustrated me most was the lack of live chat with a real person. Most top brokers offer instant chat support where you can get honest answers fast.

HeroFX has a chatbot in the client portal that handles basic FAQs, but when I hit a snag during live trading hours, I needed a real person – not canned responses. For beginner day traders, especially, this lack of immediacy can be a dealbreaker when problems pop up at critical moments.

Also, it isn’t equipped to deal with many important answers. Before having to log a ticket, we tried to ask the chatbot about key safeguards like segregated accounts and it couldn’t answer them.

Overall, HeroFX’s support feels minimal and impersonal compared to what we’ve experienced with top brokers. If you value quick, direct help when things go sideways, this setup will leave you hanging.

| HeroFX | Interactive Brokers | Plexytrade | |

|---|---|---|---|

| Support Rating | |||

| Visit | Visit | Visit | Visit |

| Review | Review | Review | Review |

Should You Day Trade With HeroFX?

HeroFX looks appealing at first glance – low entry barriers, high leverage up to 1:500, and competitive raw spreads draw in beginners chasing quick day trades. But the lack of regulation leaves your funds vulnerable with no safeguards or compensation if issues arise.

Support relies on a basic chatbot and ticket system, which is fine for simple queries but useless in fast-moving markets when you need real-time fixes.

Both MT5 and TradeLocker platforms handle charts great, yet there’s zero education, thin research tools, and crypto-heavy funding.

For serious trading, pick regulated brokers instead – they offer proper help and investor protections HeroFX can’t match as of our last tests. Only use it with small amounts if you’re interested.

FAQs

Is HeroFX Legit Or A Scam?

From our investigations into HeroFX, we have some concerns. The main issue is regulation. HeroFX is not licensed by any of the ‘green tier’ bodies listed in DayTrading.com’s regulator database.

Instead, it’s registered in Saint Lucia – an offshore jurisdiction that some brokers use to sidestep the stricter oversight designed to protect retail traders from excessive risk and questionable trading practices.

For safer trading, it’s better to choose brokers with strong regulation and explicit protections.

Is HeroFX Suitable For Beginners?

HeroFX isn’t ideal for beginners in our assessment. Low deposits and high leverage tempt new traders, but zero regulation leaves funds unprotected – no safety net if problems hit.

No education, no research tools, and basic support via chatbot/tickets mean you’re on your own learning the ropes. The trading platforms work well, but crypto withdrawals are a hassle.

Best Alternatives to HeroFX

Compare HeroFX with the best similar brokers that accept traders from your location.

- Interactive Brokers – Interactive Brokers (IBKR) is a premier brokerage, providing access to 150 markets in 33 countries, along with a suite of comprehensive investment services. With over 40 years of experience, this Nasdaq-listed firm adheres to stringent regulations by the SEC, FCA, CIRO, and SFC, amongst others, and is one of the most trusted brokers for trading around the globe.

- Plexytrade – Established in 2024 and headquartered in Saint Lucia, Plexytrade is an ECN/STP broker. Geared towards active traders, it supports four account options, crypto deposits and withdrawals, plus very high leverage up to 1:2000 made possible by its unregulated status.

HeroFX Comparison Table

| HeroFX | Interactive Brokers | Plexytrade | |

|---|---|---|---|

| Rating | 2.5 | 4.3 | 3.5 |

| Markets | CFDs, Forex, Stocks, Indices, Commodities, Crypto | Stocks, Options, Futures, Forex, Funds, Bonds, ETFs, Mutual Funds, CFDs, Cryptocurrencies | CFDs, Forex, Indices, Stocks, Commodities, Crypto |

| Demo Account | Yes | Yes | Yes |

| Minimum Deposit | $5 | $0 | $50 |

| Minimum Trade | 0.01 Lots | $100 | 0.01 |

| Regulators | – | FCA, SEC, FINRA, CFTC, CBI, CIRO, SFC, MAS, MNB, FINMA, AFM | – |

| Bonus | 100% up to $25,000 | – | 120% Cash Welcome Bonus |

| Platforms | TradeLocker, MT5 | Trader Workstation (TWS), IBKR Desktop, GlobalTrader, Mobile, Client Portal, AlgoTrader, OmniTrader, TradingView, eSignal, TradingCentral, ProRealTime, Quantower | MT4, MT5 |

| Leverage | 1:500 | 1:50 | 1:2000 |

| Payment Methods | 7 | 6 | 2 |

| Visit | – | Visit | Visit |

| Review | – | Interactive Brokers Review |

Plexytrade Review |

Compare Trading Instruments

Compare the markets and instruments offered by HeroFX and its competitors. Please note, some markets may only be available via CFDs or other derivatives.

| HeroFX | Interactive Brokers | Plexytrade | |

|---|---|---|---|

| CFD | Yes | Yes | Yes |

| Forex | Yes | Yes | Yes |

| Stocks | Yes | Yes | Yes |

| Commodities | Yes | Yes | Yes |

| Oil | Yes | No | Yes |

| Gold | Yes | Yes | Yes |

| Copper | No | No | No |

| Silver | Yes | No | Yes |

| Corn | No | No | No |

| Crypto | Yes | Yes | Yes |

| Futures | No | Yes | No |

| Options | No | Yes | No |

| ETFs | No | Yes | No |

| Bonds | No | Yes | No |

| Warrants | No | Yes | No |

| Spreadbetting | No | No | No |

| Volatility Index | No | No | No |

HeroFX vs Other Brokers

Compare HeroFX with any other broker by selecting the other broker below.

Customer Reviews

There are no customer reviews of HeroFX yet, will you be the first to help fellow traders decide if they should trade with HeroFX or not?