Scalping Trading

Scalping trading involves executing a large volume of trades over a short period to take advantage of small price disparities. In this guide, we explain what scalping in trading is for beginners, weigh the pros and cons, and the steps to get started.

Quick Introduction

- Scalping is an ultra-short-term trading system that exploits minor changes in prices.

- Scalpers rely on rapid order execution to open and close positions over the course of minutes or seconds.

- Scalpers can make hundreds and sometimes even thousands of trades a day to accumulate a large number of small gains.

- Fast execution speeds, high liquidity, and tight spreads are critical for a successful scalping strategy.

Best Scalping Trading Brokers

These 4 brokers are the best for scalpers based on our tests:

-

1

Interactive Brokers

Interactive Brokers -

2

FOREX.com

FOREX.com -

3

OANDA USCFDs are not available to residents in the United States.

OANDA USCFDs are not available to residents in the United States. -

4

InstaTrade

InstaTrade

Download our free Scalping Trading For Beginners PDF.

What Is Scalping?

The simple definition is that scalping is where traders aim to skim profits from small price movements across a large number of trades.

Contrary to other forms of trading, the main goal of scalping is to accumulate multiple small wins over a few seconds to minutes, as opposed to a few larger winners over days or weeks.

Scalping requires greater emphasis on technical analysis than other strategies, where chart patterns and technical indicators are heavily used to inform trading decisions.

How Scalping Works

Scalping is a fast-paced system that, while offering the potential for large profits, can be challenging to perfect. It requires discipline, accuracy, quick thinking, an effective exit plan, and more often than not a high tolerance for stress. For these reasons, it is not always suited for beginners.

Scalpers look for small price movements in markets like forex, usually just a few pips (this stands for ‘percentage in point’ or ‘price interest point’). Foreign exchange markets are highly volatile, and so the chance to make a profit can come along often.

Scalping systems are most effective when trading volumes are especially high. They can also be profitable following the release of key economic data that can amplify market volatility. Such datasets include:

- Interest rate decisions, and notes from central banks’ rate-setting meetings

- Purchasing managers’ index (or PMI) releases

- Labour market statistics

- Trade balance reports

- Inflation reports

- GDP news

Political news (like election results and policy announcements) can also have a large impact on the movements of markets like currency pairs. Scalpers should be ready to act upon unexpected economic, political and other developments that can heighten market volatility.

Pros

- Due to the large number of trades they place in a small space of time, scalpers can rack up large profits extremely quickly. Scalpers may only need a forex pair to move one pip to reach their profit target.

- Since this strategy exploits small pip changes, traders can still profit during ranging markets when assets move broadly sideways. Scalping can also be an effective way to make money during trending markets, i.e. when asset prices are steadily moving in one direction.

- As scalpers hold positions for very brief periods, they have less exposure to market risks than say, swing traders and position traders.

- Like day trading, scalping requires positions to be closed before the end of the trading session. This means that traders are protected from price volatility that can happen overnight.

- Scalping can be perfect for energetic and active traders who prefer not to have to hold onto long positions.

Cons

- Successful scalping often requires good experience in technical analysis and a deep understanding of chart movements. This is a complex discipline that some individuals can struggle with.

- Scalping involves rapid decision-making and execution, and a close eye needs to be kept on market movements to spot trading opportunities.

- The ‘blink and you miss it’ nature of scalping means that long periods of sustained concentration are required. As a result, exhaustion can set in, which can lead to poor decision-making and eventually burnout.

- A focus on high volumes presents a constant risk of overtrading. Scalpers can open and exit positions on impulse and without conducting thorough analysis.

- The high level of trades compared with other techniques can mean higher costs, including spreads and commissions.

Scalping May Be Suitable If…

- You have lots of time to take positions in the markets

- You want fast-paced activity rather than waiting for longer-term positions to materialize

- You’re comfortable spending extended periods studying charts and conducting technical analysis

- You have a careful and considered approach to risk

Scalping May Not Be Suitable If…

- You prefer to make fewer trades with larger profit potential

- You don’t have the hours to commit to charts and investing

- You don’t like the stress of fast-moving markets

Guide To Getting Started

Opening An Account

Investors have a wide selection of brokers with whom they can choose to trade. However, not all platforms allow their clients to use scalping techniques. Some that do permit this method place a limit on the number of these short-term trades that an individual can make.

This is because scalpers tend to carry out a much higher number of trades compared to those who follow day trading, swing trading or position trading systems. When tallied up across a single platform, we are talking about jaw-dropping volumes that can overload a broker’s server and cause their services to crash.

Larger forex brokerages tend to have the infrastructure in place to handle rapid order execution, and so are happy to let scalpers go to work.

Our team have ranked the best scalping brokers to help you get started.

Getting The Technology

Scalpers need to ensure they have the tools and the technology to plan their trades and carry out buy and sell orders promptly.

A fast and stable internet connection, along with a reliable platform, are essential to get the best out of this system. Technology problems mean that orders can be delayed or rejected entirely, meaning the price at which a scalper intends to enter or exit a trade may be different from the executed price (known as slippage).

Given the fast-paced nature of the financial markets, slippage can significantly limit the profits a trader makes or even force a loss. Scalpers need to make fast and efficient trades, and having a DMA broker (Direct Market Access system) – which allows them to cut out the middleman – can help with this.

Automated bots (also known as expert advisors or EAs) are another useful weapon in a scalper’s arsenal. Based on pre-installed algorithms and trading rules, these scan the market and execute buy or sell orders without human involvement. As a result, trades can be executed quickly, while the emotional element of investing is also taken out of the process.

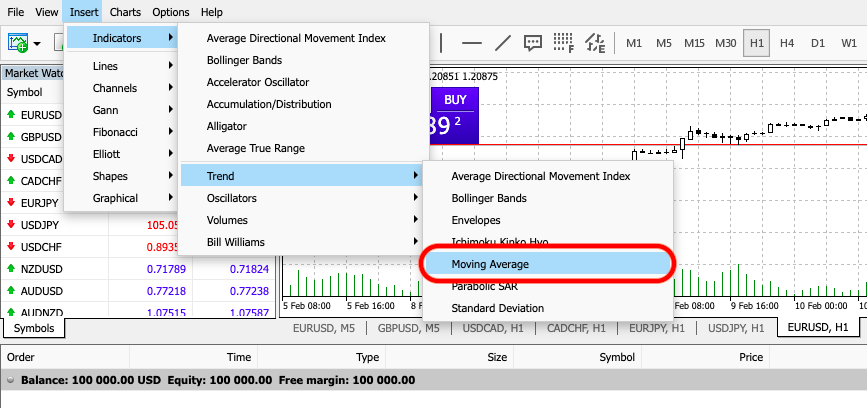

As I will explain later, technical analysis plays a critical role in scalping trading. So having chart-drawing and viewing systems is a must. Many scalping brokers provide charting tools on their platforms, though traders might also want to consider buying third-party software which offers more advanced and customizable options.

The Importance Of Liquidity

Scalpers can choose to operate across a range of financial markets including stocks and cryptocurrencies. However, the forex markets are a particularly popular choice due to the high levels of liquidity.

Higher liquidity can keep costs down by narrowing spreads. It also means that traders can nip in and out of trading positions more easily, providing better opportunities to make a profit.

Scalping activity can take place at any time of the trading session. However, short-term traders tend to favor particular times of the day when volumes are higher. These are usually when the London and New York markets are open.

Considering The Spreads

The profits that traders make can be significantly impacted by the size of the spreads. This measures what an individual can buy an asset for (known as the ask price) and what they can sell it for (termed the bid price).

The spread indicates how much money a broker makes through transactions. And whatever system one adopts, keeping this metric as narrow as possible is essential. Wide spreads can take a big bite out of profits.

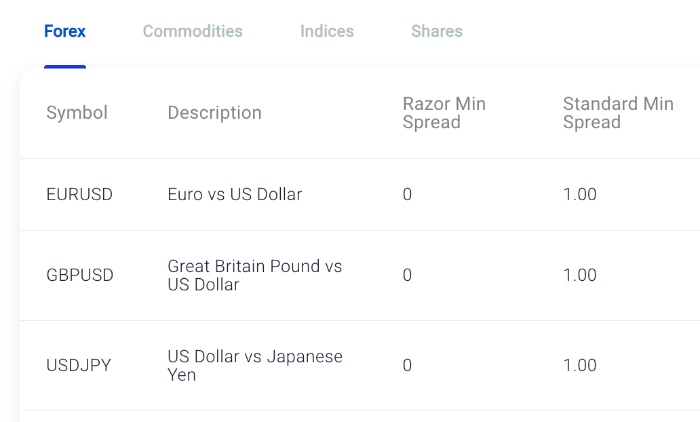

Tight spreads are especially important for scalpers given the large number of trades they tend to make each and every day. This is one reason why these traders tend to stick to major currency pairings like the EUR/USD, USD/JPY and GBP/USD.

The popularity (and therefore high liquidity) of these pairs means that spreads are narrower than for minor and exotic currency pairings.

Spread sizes aren’t the only thing to consider when assessing costs. A broker might offer a narrower spread on certain pairings, but they could make this up through higher commissions on trades. This could be particularly expensive for more active scalpers.

Talking About Technical Analysis

Many systems require some use of technical analysis. But the ultra-short-term nature of scalping places greater focus on price charts and indicators than, say, swing trading or position trading (where trading positions tend to remain open for a longer period and for which fundamental analysis therefore plays a far greater role in decision-making).

Technical analysis involves the study of line charts, bar charts, and candlestick charts for price changes of instruments over time. Scalpers pay special attention to one-minute and five-minute charts given the very short timeframes that positions tend to be held for.

Establishing support and resistance levels is one of the first things a chartist will do. The support line will show the level at which an instrument tends to attract buying interest, while the resistance line will indicate where selling pressure begins to take over. They are essential tools in helping a scalper decide when to enter or exit a position.

Traders will also use a wide range of indicators to help them identify price trends, momentum, trade volumes, market volatility and other phenomena. Moving averages, stochastic indicators, and the Relative Strength Index (RSI) are some of the more popular indicators that market participants use.

3 Tips For Scalping

1. Think Carefully About Using Leverage

Like with all systems, scalpers can make great use of leverage to supercharge returns. By trading on margin and using borrowed funds from a broker, a scalper can access larger positions with a relatively small amount of capital.

However, using leverage can be a double-edged sword. It can seriously magnify the profits one can make from those small price fluctuations. However, when markets move in the wrong direction losses can get out of control.

2. Manage Your Risk

Risk management is essential for scalpers. It ensures that one losing trade doesn’t wipe out gains elsewhere and erase a significant portion of a trader’s capital.

Scalpers frequently set tight stop-loss orders which determine the maximum loss they will be prepared to accept for each trade. This is especially important in the often-volatile forex market, and particularly around the time when key economic data is due.

3. Consider Taking A Technical Analysis Course

Technical analysis is a critical component of successful scalping. The problem is that getting up to speed can for some be as complicated and involved as learning another language.

Mysterious terms like “Bollinger Bands,” “cup and handle,” “diamond top” and “Fibonacci retracement” can leave scalpers staring blankly at their screens. But on the plus side, there are plenty of resources out there to help traders become experts.

On top of reading books and guides, enrolling on an online course can be a good idea. Firms like eToro also offer excellent courses.

Scalping vs Swing Trading

Swing trading is a popular system among investors. Swing trading can be applied to multiple markets, from stocks to forex and cryptocurrencies. However, there are some distinct differences when compared to scalping.

| Scalping Trading | Swing Trading | |

|---|---|---|

| Holding Period | Seconds to minutes | Typically days |

| Trading Volume | Hundreds or thousands a day | A few |

| Profit Target | Small but multiple | Few but large |

| Charts | Tick or 1-5 minutes | Daily or weekly |

| Monitoring | Constant | Standard |

| Characteristics | Impatience & discipline | Patience & precision |

| Stress | High | Moderate |

| Experience | Typically intermediate | All |

Scalping vs Day Trading

For beginners and investing dummies, scalping and day trading can be confused. Scalping is always a form of day trading, however, day trading is an umbrella term that encompasses any number of strategies that are used to enter and exit positions in the same trading day.

| Scalping Trading | Day Trading | |

|---|---|---|

| Use | Always day trading | Scalping optional |

| Timeframe | Seconds or minutes | Any duration during the day |

| Automated | Frequently | Optional |

| Monitoring | Constant | Standard |

| Experience | Typically intermediate | All |

Bottom Line

Scalping trading isn’t for everyone. It requires tremendous discipline and speed of thought. However, for traders who have these characteristics – as well as the means to invest in the required technology – it can be a great way to make big profits from financial markets.

FAQ

How Does Scalping In Trading Work?

Scalping systems capitalize on small fluctuations in prices. Scalpers aim to rapidly enter and exit the financial markets, skimming profits from a high volume of trades. They typically play the role of market makers ensuring liquidity.

Scalping strategies are most effective during periods of substantial trading volumes in conjunction with high leverage and low fees.

Is Scalping Trading Legal?

Scalping trading is generally not illegal as long as you don’t breach general investing regulations. But while scalping is legal, some platforms do not allow the practice. Bans are usually seen at brokers that have lagging price feeds that cannot meet the direct access demands of scalpers.

Some firms also define “scalping” differently. For example, if a trader aims to exploit:

- Internet latencies

- Delayed prices

- Off-market/bad prices

- High volumes of transactions targeting tick fluctuations (rather than price movements) where trades are opened and closed very quickly

…then some brokers will identify this as abuse of the platform and take actions to stop it (even voiding closed trades). Defining the motives of the trade is problematic however, which is why brokerages tend to tread carefully when scalping is discussed.

Is Scalping Trading Profitable?

Scalping can be profitable when a good strategy is used. However, scalpers will need a robust risk management system and a broker that offers powerful tools alongside competitive fees.

Does Scalp Trading Work?

Scalping trading systems do work for some traders. Success hinges on the effectiveness of the trading setup, from automated bots to market access and broker commissions.

Recommended Reading

Article Sources

- Scalping Trading - A Precise Guide for Beginners, Financial Edits

- The Profitable Scalper, Heiken Ashi Trader

- Scalping Trading Top 5 Strategies: Making Money With, Andrew Ellis

The writing and editorial team at DayTrading.com use credible sources to support their work. These include government agencies, white papers, research institutes, and engagement with industry professionals. Content is written free from bias and is fact-checked where appropriate. Learn more about why you can trust DayTrading.com