Defcofx Review 2026

See the Top 3 Alternatives in your location.

Pros

- With leverage up to 1:2000, Defcofx gives day traders serious exposure - we tested this ourselves with small balance trades and saw how quickly positions could grow (or shrink). It’s definitely not for beginners, but when used strategically, it offers powerful flexibility.

- If you're into crypto, Defcofx makes it easy to fund your account via popular tokens like Bitcoin, Tether and Solana. It's a great option if you're looking for low-cost transactions without using traditional banking methods, with deposits credited to our account in under 1 hour during testing.

- Trades are completely commission-free, there are no overnight swap fees for holding positions, and you won’t get charged for leaving your account idle. It’s a very cost-effective setup for both casual and active traders.

Cons

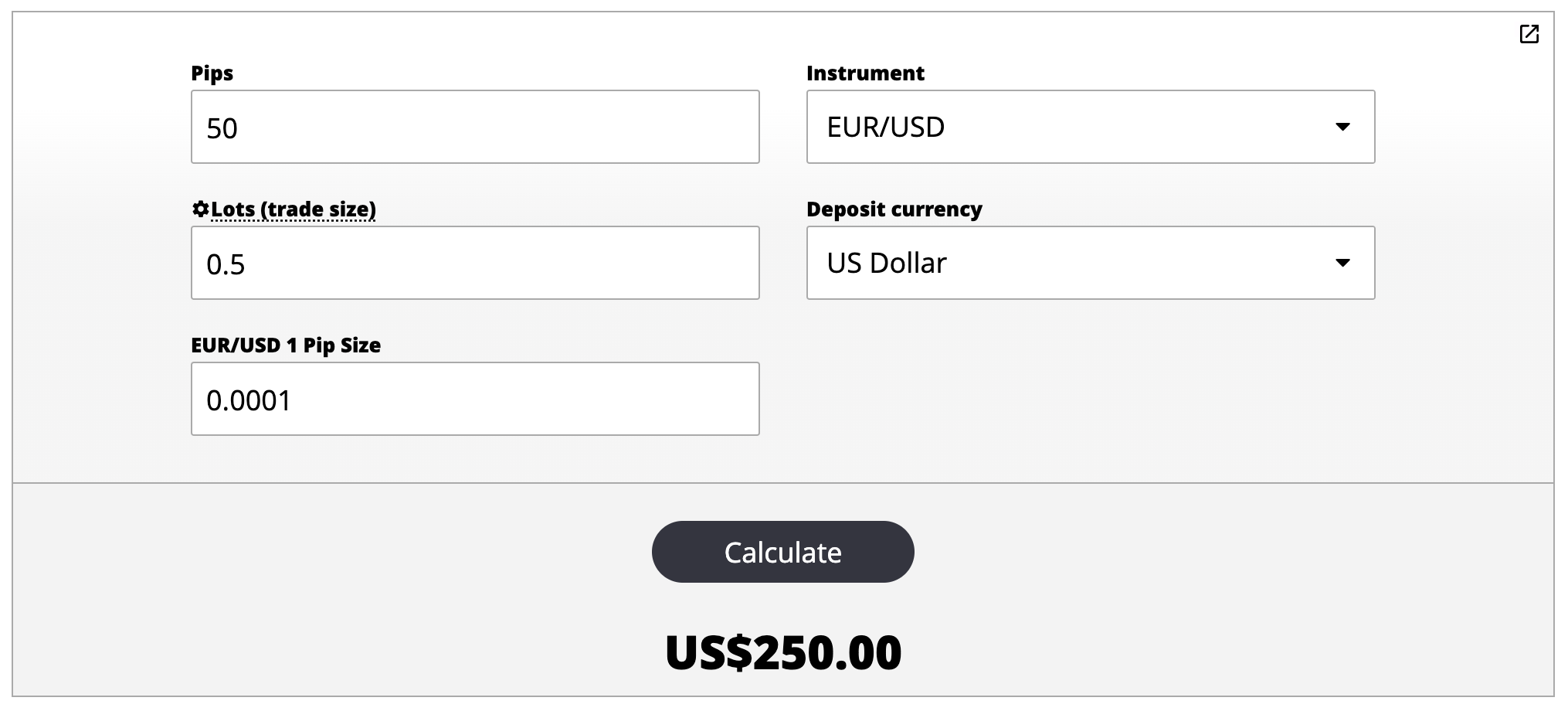

- If you’re new to trading, don’t expect much help. We found no structured learning tools - just basic calculators. Compared to category leaders like IG, the lack of education resources makes Defcofx harder to recommend for beginners.

- While spreads are competitive based on our analysis, there’s no zero-spread account option, which will matter to scalpers or high-frequency traders. Over time, even a small spread can erode tight-margin strategies.

- Defcofx isn’t regulated by any major financial body. We couldn’t find much in terms of third-party fund protection or formal dispute resolution processes during our investigations - so it’s a case of 'trade at your own risk'.

Defcofx Review

This comprehensive review of Defcofx offers an impartial look at the broker’s features, highlighting its strengths and limitations. Drawing from practical experience, we explore the platform’s offerings, focusing on aspects most relevant to active, short-term trading strategies.

Regulation & Trust

Defcofx is an offshore forex and CFD trading platform established in 2021 and registered in Saint Lucia. The company promotes itself by offering a streamlined trading experience, emphasizing minimal Know Your Customer (KYC) requirements, and focusing on client privacy.

While Defcofx is registered as a business in Saint Lucia, it is not regulated by any recognized financial authority. This lack of formal regulation means Defcofx operates without the oversight typically provided by financial regulatory bodies.

Operating without regulation carries significant risks for traders. Without regulatory oversight, there is no assurance of fund protection mechanisms, such as segregated accounts or compensation schemes, which are standard among regulated brokers. Additionally, dispute resolution mechanisms are limited, leaving you with few avenues for recourse in the event of issues.

In contrast, brokers regulated by established authorities—such as the UK’s Financial Conduct Authority (FCA) or the Australian Securities and Investments Commission (ASIC)—must adhere to strict standards and therefore provide a higher level of security and trust for traders.

While Defcofx offers certain features that may appeal to some traders, such as high leverage, minimal KYC procedures and negative balance protection, the absence of regulatory oversight presents considerable risks.

| Defcofx | Interactive Brokers | Dukascopy | |

|---|---|---|---|

| Regulation & Trust Rating | |||

| Regulators | FCA, SEC, FINRA, CFTC, CBI, CIRO, SFC, MAS, MNB, FINMA, AFM | FINMA, JFSA, FCMC | |

| Visit | Visit | Visit | Visit |

| Review | Review | Review | Review |

Accounts & Banking

Live Accounts

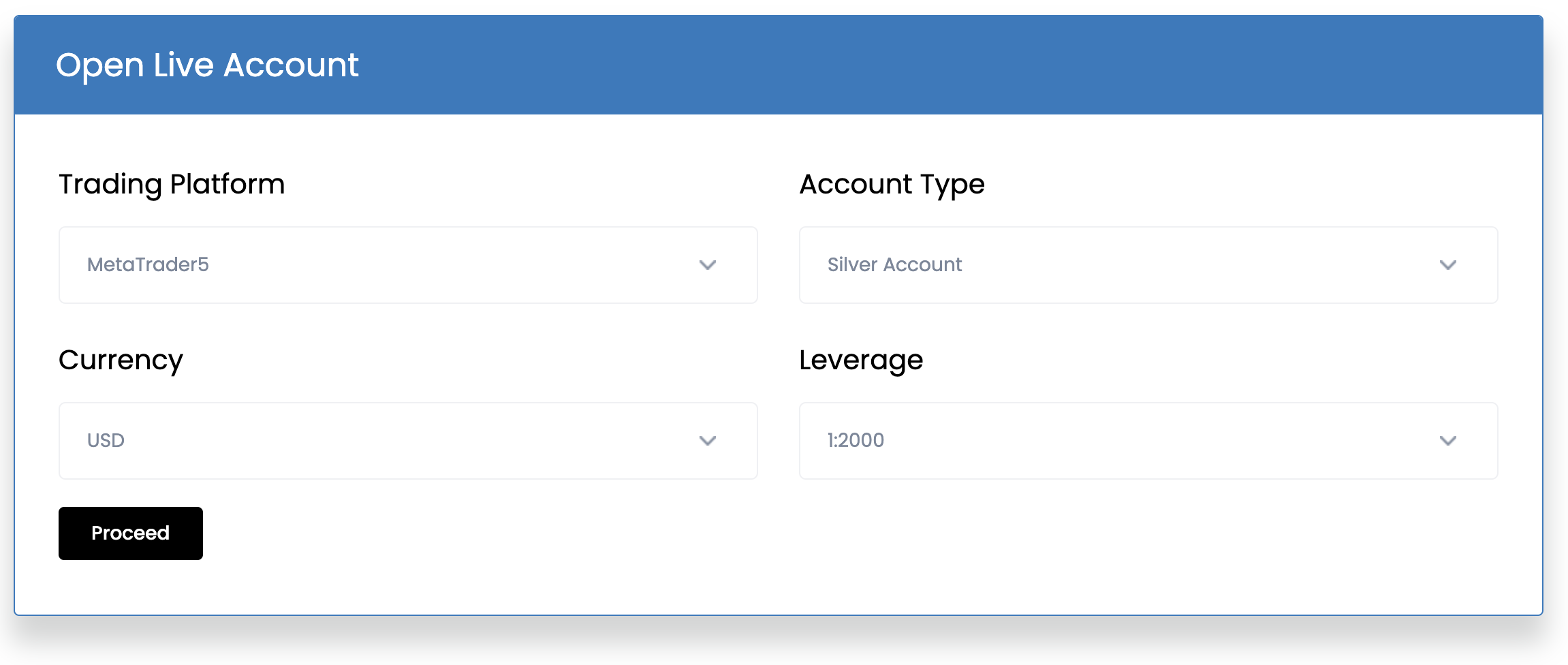

Defcofx offers two main account types—Silver and Gold—designed to suit different levels of trading experience and investment capacity.

- Silver Account: This entry-level account requires a minimum deposit of $50, leverage up to 1:2000, and spreads from 0.5 pips. You can open positions up to 2 lots per order and access all available currency pairs. However, US stock CFDs are not available with this account. It supports manual trading and scalping strategies and is swap-free.

- Gold Account: Aimed at more experienced traders, this account has a higher minimum deposit of $1,000. It provides a lower leverage cap of up to 1:500, but unlike the Silver Account, there is no maximum position size. In addition to the currency pairs, you also gain access to US stock CFDs. This account further supports the use of Expert Advisors (EAs). Like the Silver account, it is swap-free.

When compared to account offerings from top-tier, regulated brokers, Defcofx’s Silver and Gold accounts present a trade-off between accessibility and security.

On the plus side, the Silver Account’s low $50 entry point and high leverage up to 1:2000 make it attractive to traders with smaller balances. In contrast, the Gold Account expands access to US stock CFDs and supports automated trading through EAs.

However, both accounts lack several features commonly found among leading brokers like IC Markets and Pepperstone. Notably, there is no zero-spread account option for day traders relying on the tightest possible spreads for rapid, frequent trades.

Additionally, Defcofx does not offer PAMM accounts—an investment solution favored by traders who prefer to allocate funds to professional managers, which many well-established brokers support.

Demo Accounts

Defcofx’s demo account offers a smooth and realistic trading environment. It’s a great way to test strategies or explore the broker’s interface with up to $100,000 in virtual funds.

The demo mode helps get a feel for the broker’s MetaTrader 5 (MT5) platform using different leverage amounts (1:1 up to 1:2000), and the pricing and execution closely mirror what I expect in live conditions.

One thing I noticed is that demo accounts are valid for a year. At first, I thought that might be a hassle, but it’s pretty easy to work around. Through the client portal, you can delete the old demo account and create a new one instantly.I’ve done it several times and haven’t encountered any issues.

Deposits & Withdrawals

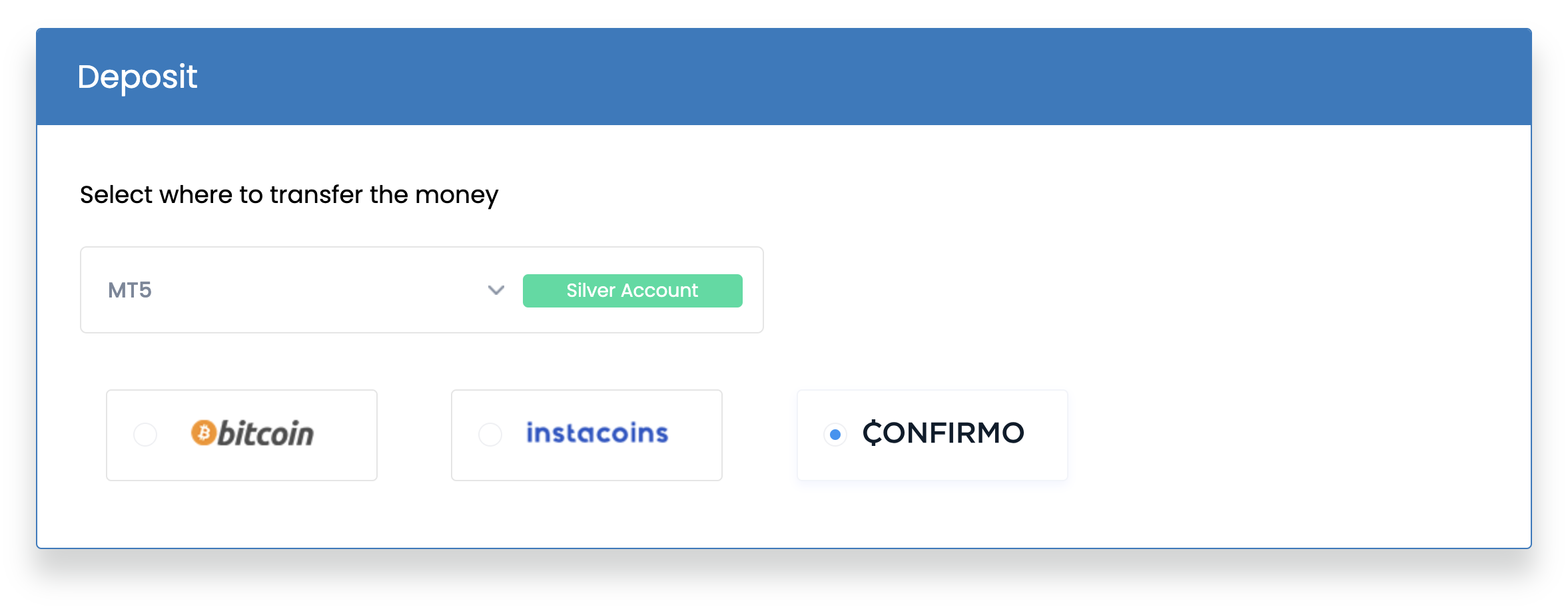

Compared to major regulated brokers, Defcofx takes a crypto-centric approach to funding. While this brings speed and cost-efficiency, it lacks some funding variety (like credit card, debit card, bank transfer, or e-wallet) that traditional brokers offer.

More importantly, leading brokers often provide extra layers of protection—such as transaction reversals, fraud prevention tools, and oversight from financial regulators. These safeguards aren’t present in Defcofx’s crypto-only system.

Funding is done directly using Bitcoin or via third-party gateways Instacoins and Confirmo. Supported crypto coins include Bitcoin (BTC), Ethereum (ETH), Tether (USDT), USD Coin (USDC), Litecoin (LTC), Solana (SOL), Tronix (TRX) and Polygon (POL).

During testing, deposits typically landed in my account within an hour.

One clear advantage is that Defcofx does not charge deposits or withdrawal fees. That said, it’s important to keep in mind that blockchain network fees from your crypto wallet provider still apply, as Defcofx does not cover them.

Withdrawals are generally processed within 12 hours, though I’ve noticed they can extend a bit when I withdraw on weekends. The platform also allows you to set your account base currency as USD, EUR, or GBP, offering reasonable flexibility depending on your preference.

| Defcofx | Interactive Brokers | Dukascopy | |

|---|---|---|---|

| Accounts & Banking Rating | |||

| Payment Methods | Bitcoin Payments | ACH Transfer, Automated Customer Account Transfer Service, Cheque, Debit Card, TransferWise, Wire Transfer | Bitcoin Payments, Credit Card, Debit Card, Ethereum Payments, Maestro, Mastercard, Neteller, Skrill, Visa, Wire Transfer |

| Minimum Deposit | $50 | $0 | $100 |

| Visit | Visit | Visit | Visit |

| Review | Review | Review | Review |

Assets & Markets

Defcofx offers a focused selection of trading instruments tailored for forex and CFDs, including currency pairs, global stock indices, US stocks, precious metals, and crypto.

- Forex: There are 42 currency pairs including majors (seven), minors (21) and exotics (14), with tight spreads starting from 0.5 pips and leverage up to 1:2000.

- Indices: The platform provides 11 global indices, such as the S&P 500, Nikkei 225 and FTSE 100, with spreads from 0.5 points and leverage up to 1:200.

- Stocks: Defcofx offers 55 large-cap US stock CFDs from the NYSE and Nasdaq exchanges. These are available exclusively to Gold Account holders, with leverage up to 1:10. The selection includes popular companies like Coinbase, Meta and Tesla, providing plenty of opportunities for equity trading.

- Metals: Four precious metals, including gold, silver, platinum, and palladium, have leverage up to 1:500. This allows for diversification and hedging strategies in the commodities market.

- Cryptocurrencies: There is just one cryptocurrency CFD (BTC/USD), allowing you to take long or short positions on Bitcoin with leverage up to 1:10. While the selection is extremely limited, it at least exposes you to the crypto market.

Compared to leading brokers like IG, Saxo Bank, or eToro, Defcofx’s asset range is more limited. Top brokers often offer thousands of instruments across worldwide markets and asset classes, including real stocks, ETFs, bonds, and a broader selection of cryptocurrencies.

Defcofx’s focus on core markets may appeal if you seek simplicity and high leverage, but if you are looking for extensive diversification, you might find the offerings restrictive.

| Defcofx | Interactive Brokers | Dukascopy | |

|---|---|---|---|

| Assets & Markets Rating | |||

| Trading Instruments | CFDs, Forex, Stocks, Indices, Commodities, Crypto | Stocks, Options, Futures, Forex, Funds, Bonds, ETFs, Mutual Funds, CFDs, Cryptocurrencies | CFDs, Forex, Stocks, Indices, Commodities, Crypto, Bonds, Binary Options |

| Margin Trading | Yes | Yes | Yes |

| Leverage | 1:2000 | 1:50 | 1:200 |

| Visit | Visit | Visit | Visit |

| Review | Review | Review | Review |

Fees & Costs

Defcofx offers a fee structure that’s very appealing, especially for traders who appreciate transparency and cost-effectiveness.

One of the standout features is that all trades are commission-free. This means you won’t incur additional costs per trade, which is a significant advantage for active traders.

Defcofx provides competitive spreads across various instruments. For instance, major forex pairs like EUR/USD, GBP/USD, USD/JPY and USD/CHF have average spreads as low as 0.5 pips.

Commodities such as gold and silver also feature tight spreads, with gold averaging around 0.40 and silver at 0.03 pips. These low spreads can enhance profitability, especially for short-term traders.

Another standout is that Defcofx doesn’t charge swap fees—also known as overnight financing fees. This means you won’t be charged interest if you hold positions overnight or even over multiple days, unlike most brokers. This can make a big difference over time for swing traders.

More great news is the absence of inactivity fees. Many brokers charge fees after a period of account dormancy, but with Defcofx, you won’t be penalized for taking a break from trading.

While the fee structure is favorable, it’s important to note that during periods of low liquidity, such as the closing sessions of major exchanges, spreads may widen, which is standard practice for ECN brokers.

| Defcofx | Interactive Brokers | Dukascopy | |

|---|---|---|---|

| Fees & Costs Rating | |||

| EUR/USD Spread | 0.5 | 0.08-0.20 bps x trade value | 0.1 |

| FTSE Spread | 5 | 0.005% (£1 Min) | 100 |

| Oil Spread | 0.05 | 0.25-0.85 | 0.1 |

| Stock Spread | 0.24 (Apple) | 0.003 | 0.1 |

| Visit | Visit | Visit | Visit |

| Review | Review | Review | Review |

Platforms & Tools

Defcofx supports one platform: MetaTrader 5 (MT5). MT5 is a powerful, well-respected trading platform that provides a fast and stable trading environment, supports advanced charting tools and built-in indicators, and allows for automated trading through EAs.

Using MT5 on Defcofx, placing and managing trades feels fluid and precise. I especially appreciate how easy it is to execute trades directly from the chart with one-click trading enabled—just a single tap, and the order is in.Modifying trades is just as seamless: dragging stop-loss and take-profit levels directly on the chart updates the position instantly. That visual, interactive control makes trade management a lot more intuitive than with other platforms I’ve used.

That said, the lack of platform variety stands out. Unlike top brokers such as Pepperstone and IC Markets, Defcofx does not offer MT4, cTrader or TradingView integration, or a proprietary web or mobile platform. These alternatives often come with unique features that appeal to different types of traders.

For example, MT4 is still preferred by many algorithmic traders due to its simplicity and extensive library of custom indicators, while cTrader has a sleek interface and excellent copy trading service.

At the same time, proprietary platforms like those from eToro often include social trading tools, advanced analytics, or intuitive mobile apps that appeal to newer traders.

If you’re comfortable with MT5 and don’t need additional platforms, Defcofx delivers a solid experience. But top-tier brokers offer a broader and more flexible platform ecosystem if you want platform diversity.

| Defcofx | Interactive Brokers | Dukascopy | |

|---|---|---|---|

| Platforms & Tools Rating | |||

| Platforms | MT5 | Trader Workstation (TWS), IBKR Desktop, GlobalTrader, Mobile, Client Portal, AlgoTrader, OmniTrader, TradingView, eSignal, TradingCentral, ProRealTime, Quantower | JForex, MT4, MT5 |

| Mobile App | iOS & Android | iOS & Android | iOS & Android |

| Visit | Visit | Visit | Visit |

| Review | Review | Review | Review |

Research

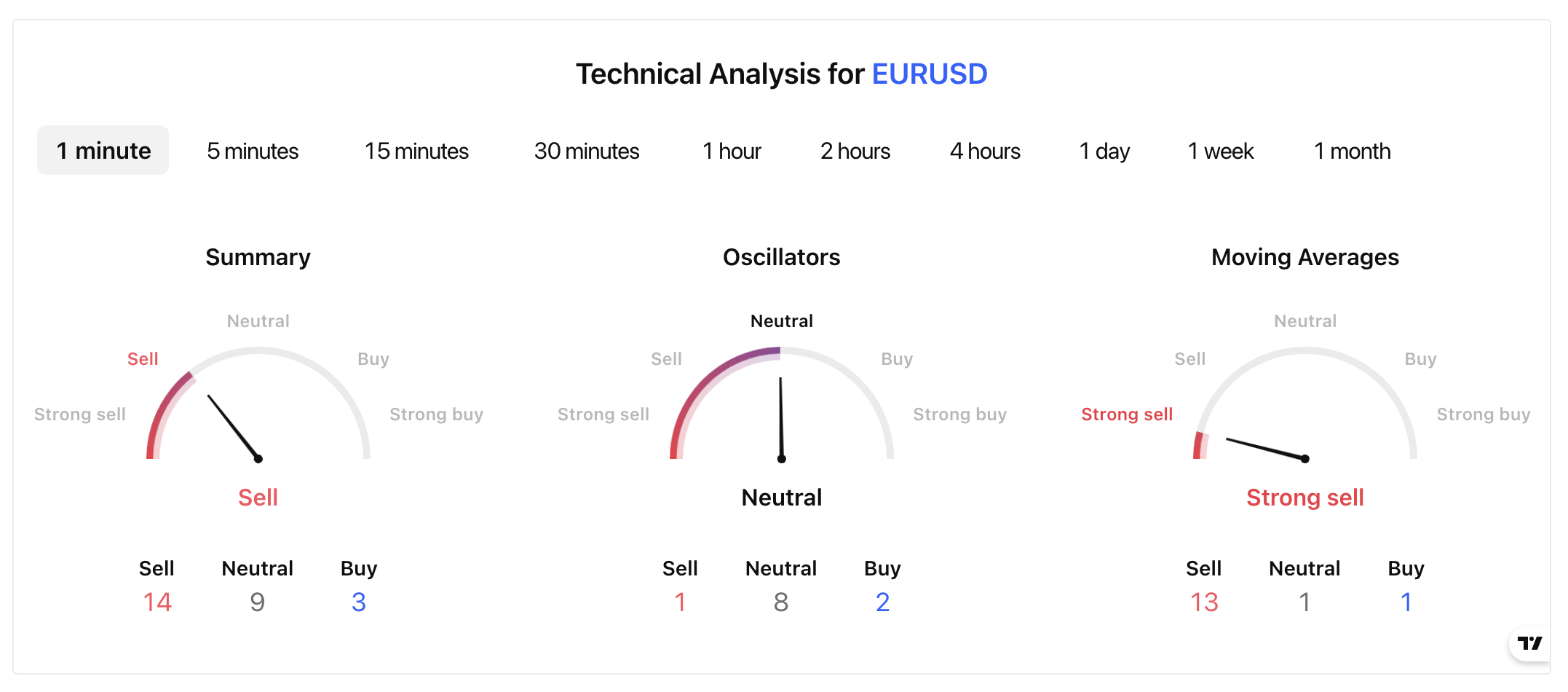

I find the collection of research tools in the client area functional and easy to use. Powered by TradingView, the market heatmaps for forex, stocks and crypto are especially helpful. They give a quick, clear overview of market movements, letting me easily spot trends across various asset classes.

Another feature I use regularly is the TradingView-powered economic calendar, indispensable for tracking key events that could affect the market. With market news and technical analysis built into the platform—also provided by TradingView—I have access to a solid foundation of real-time information.

One feature I especially like is the website’s Daily Financial News Videos. These short, to-the-point videos offer a snapshot of daily market movements and key developments. It is a nice way to stay in the loop without digging through many headlines.

However, I have noticed some shortcomings. While these tools are helpful, they don’t offer the same depth I’ve experienced with other brokers. For example, Defcofx doesn’t publish in-house analyses or integrate signals from third-party providers like Trading Central, Autochartist, or Signal Centre, which I use with other brokers.

These services offer pre-analyzed trade ideas, chart patterns, and automated insights, making it easier to spot opportunities quickly. Without these, I have to rely more on my analysis and the TradingView tools available, which is fine but doesn’t provide the same level of convenience or actionable insights.

| Defcofx | Interactive Brokers | Dukascopy | |

|---|---|---|---|

| Research Rating | |||

| Visit | Visit | Visit | Visit |

| Review | Review | Review | Review |

Education

Defcofx provides a few useful tools for traders, but it lacks educational resources compared to top brokers.

On the positive side, the client dashboard contains a set of calculators that can help with trade management. The Pip Calculator, Position Size Calculator, and Margin Calculator are all practical tools that I find helpful when calculating trade sizes and margin requirements before placing trades.

However, Defcofx doesn’t provide much beyond these tools when it comes to more comprehensive education. There are no structured courses, webinars, or podcasts—standard educational offerings from top brokers like FOREX.com and Swissquote.

This lack of educational material could be a significant drawback for beginners or those looking to expand their trading knowledge.

| Defcofx | Interactive Brokers | Dukascopy | |

|---|---|---|---|

| Education Rating | |||

| Visit | Visit | Visit | Visit |

| Review | Review | Review | Review |

Customer Support

Defcofx offers several support and contact options to assist traders:

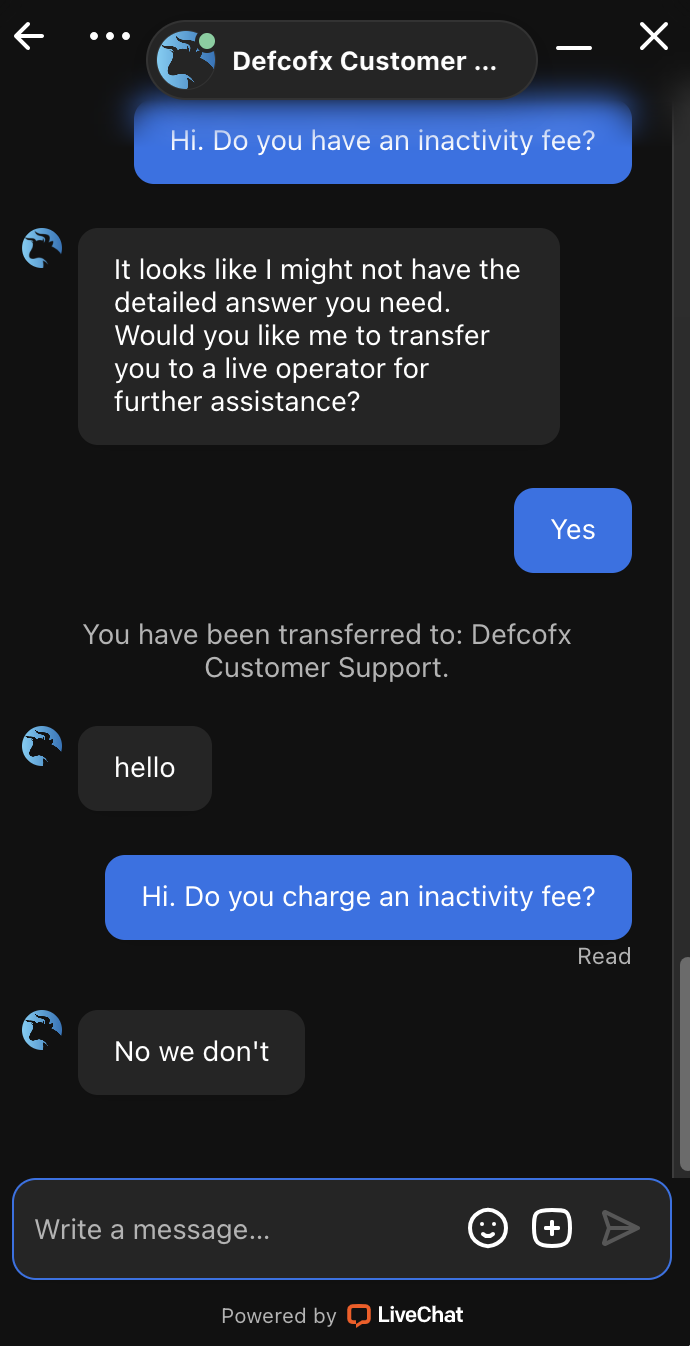

- Live Chat: The live chat feature provides real-time assistance on its website or the client dashboard. I’ve found support staff responses are always prompt and helpful, making it convenient for quick queries—although I have to work through the bot’s responses first. On one occasion, when I was having issues with MT5 WebTrader, support even created a Zoom video call to view my trading setup and help me sort the problem.

- Skype: Defcofx offers support via Skype, allowing for more personalized communication. I find this particularly useful for detailed discussions or troubleshooting.

- Email: There are dedicated email addresses for inquiries, including customer support, account support, and business and careers. From my experience, email responses are typically received within 24 hours, effectively addressing concerns, but I’d like to see a ticketing system integrated into the client dashboard for ease of use.

- Social Media: Defcofx maintains a presence on major social media platforms, including Facebook, Instagram, X, and YouTube. These channels are primarily used for updates, promotions, and community engagement.

Support is available 24/5, Monday through Friday. While the support options are functional and responsive, the absence of 24/7 support may be a drawback for traders in different time zones or those needing assistance outside these hours for issues related to crypto trading, for example.

| Defcofx | Interactive Brokers | Dukascopy | |

|---|---|---|---|

| Support Rating | |||

| Visit | Visit | Visit | Visit |

| Review | Review | Review | Review |

Should You Day Trade With Defcofx?

Whether or not you should day trade with Defcofx depends on your priorities and risk tolerance.

On the positive side, Defcofx offers attractive trading conditions, including low minimum deposit requirements, high leverage up to 1:2000, tight spreads, and a well-supported platform (MT5).

However, the main drawback is that Defcofx is an unregulated broker, which doesn’t offer the same protections as brokers governed by major financial authorities.

Defcofx might be suitable for more experienced traders who are comfortable with high-risk trading and using cryptocurrencies for deposits and withdrawals. But if you prioritize regulation, safety, and a wider range of payment options and platform choices, consider more established and regulated brokers.

FAQ

Is Defcofx Legit Or A Scam?

Defcofx is a relatively new, unregulated offshore forex and CFD broker based in Saint Lucia. While it offers attractive trading conditions, the lack of regulatory oversight is a significant concern.

Regulation provides essential protections for traders, such as ensuring the proper handling of client funds and offering recourse in disputes. Since Defcofx does not have such regulation, it poses potential risks, especially for traders prioritizing security and legal safeguards.

Is Defcofx Suitable For Beginners?

Defcofx can be a decent starting point for beginners, but it comes with some important caveats. On the plus side, the low $50 minimum deposit and access to an MT5 demo account make it easy to get started.

However, beginners should know that no financial authority regulates Defcofx, and educational resources are limited. The high leverage—up to 1:2000—can be tempting but risky without solid risk management skills. And since funding is crypto-only, it might be a barrier for those new to digital currencies.

Best Alternatives to Defcofx

Compare Defcofx with the best similar brokers that accept traders from your location.

- Interactive Brokers – Interactive Brokers (IBKR) is a premier brokerage, providing access to 150 markets in 33 countries, along with a suite of comprehensive investment services. With over 40 years of experience, this Nasdaq-listed firm adheres to stringent regulations by the SEC, FCA, CIRO, and SFC, amongst others, and is one of the most trusted brokers for trading around the globe.

- Dukascopy – Established in 2004, Dukascopy Bank SA is a Swiss online bank and brokerage providing short-term trading opportunities on 1,200+ instruments, including binaries. A choice of accounts (JForex, MT4/5, Binary Options) and sophisticated platforms (JForex, MT4/MT5) deliver powerful tools and market data for active traders.

Defcofx Comparison Table

| Defcofx | Interactive Brokers | Dukascopy | |

|---|---|---|---|

| Rating | 2.5 | 4.3 | 3.6 |

| Markets | CFDs, Forex, Stocks, Indices, Commodities, Crypto | Stocks, Options, Futures, Forex, Funds, Bonds, ETFs, Mutual Funds, CFDs, Cryptocurrencies | CFDs, Forex, Stocks, Indices, Commodities, Crypto, Bonds, Binary Options |

| Demo Account | Yes | Yes | Yes |

| Minimum Deposit | $50 | $0 | $100 |

| Minimum Trade | 0.01 Lots | $100 | $1 (Binaries), 0.01 Lots (Forex/CFD) |

| Regulators | – | FCA, SEC, FINRA, CFTC, CBI, CIRO, SFC, MAS, MNB, FINMA, AFM | FINMA, JFSA, FCMC |

| Bonus | 40% Welcome Deposit Bonus | – | 100% Anniversary Bonus |

| Platforms | MT5 | Trader Workstation (TWS), IBKR Desktop, GlobalTrader, Mobile, Client Portal, AlgoTrader, OmniTrader, TradingView, eSignal, TradingCentral, ProRealTime, Quantower | JForex, MT4, MT5 |

| Leverage | 1:2000 | 1:50 | 1:200 |

| Payment Methods | 1 | 6 | 10 |

| Visit | – | Visit | Visit |

| Review | – | Interactive Brokers Review |

Dukascopy Review |

Compare Trading Instruments

Compare the markets and instruments offered by Defcofx and its competitors. Please note, some markets may only be available via CFDs or other derivatives.

| Defcofx | Interactive Brokers | Dukascopy | |

|---|---|---|---|

| CFD | Yes | Yes | Yes |

| Forex | Yes | Yes | Yes |

| Stocks | Yes | Yes | Yes |

| Commodities | Yes | Yes | Yes |

| Oil | Yes | No | Yes |

| Gold | Yes | Yes | Yes |

| Copper | No | No | Yes |

| Silver | Yes | No | Yes |

| Corn | No | No | No |

| Crypto | Yes | Yes | Yes |

| Futures | No | Yes | No |

| Options | No | Yes | No |

| ETFs | No | Yes | Yes |

| Bonds | No | Yes | Yes |

| Warrants | No | Yes | No |

| Spreadbetting | No | No | No |

| Volatility Index | No | No | Yes |

Defcofx vs Other Brokers

Compare Defcofx with any other broker by selecting the other broker below.

Customer Reviews

4.3 / 5This average customer rating is based on 9 Defcofx customer reviews submitted by our visitors.

If you have traded with Defcofx we would really like to know about your experience - please submit your own review. Thank you.

Submit Your Own Review of Defcofx

Article Sources

The writing and editorial team at DayTrading.com use credible sources to support their work. These include government agencies, white papers, research institutes, and engagement with industry professionals. Content is written free from bias and is fact-checked where appropriate. Learn more about why you can trust DayTrading.com

went with a silver account…

massive leverage here, but I dont use fully of coz, too dangerous

idk, 🤔I think adding connection to TV would be a plus…it has many custom indicators there, and frankly I think pinescript is better than mql, friendlier

Ngl, I didn’t hear much about the broker before! Like an established, old, and popular trading platform, nah it didn’t apply to them… Still, I needed a service for my new forex trading strategy, very effective based on backtesting, but demanding in terms of trading conditions.

This is how I found defcofx and its sweet trading costs. Very low spreads, perfect for my trading time -new trading session open and the middle. In execution, they showed themself good too, though it seemed strange that they have only crypto for deposits and withdrawals. Anyway my doubts were cleared after getting $$$

The broker suits day trading well, especially since the fees are pretty tight. The spreads are starting from 0.5 pips for major forex pairs plus zero commission fees are making the job done,

I really like this platform and no regrets of choosin it so far… the welcome deposits, nice touch 😉

But the platform is srsly advanced in many aspects. DefcoFX TV is a great feature. This actually made me write this review. They publish a great USDJPY analysis and made a great win based on their technical setup. I have been trading for two weeks here, and manage to grow my initial account size of $200 to 450, which is wow… even more than i expected

The mt5 p;latform is good, but I have a feeling that something is missing there. Maybe adding a new mobile app would be handy because everyone wants to trade with a modern user interface.

Like the simplicity, two accounts, and not much difference between them either.

– SIlver

– Gold

tHe difference how I udnerstood is that you have lot restrictions on silver, and for gold there is not, so if you want to trade with more volume, youll need gold account. Right now I am on silver and ive been having a good trading experience so far.

Nice conditions, spreads, swaps, commissions, all of these are fine. Love trading here, lots of cryptocurrencies with high leverage available to trade here… 🙂

Well it’s been cool trading on a platform that is very well organized and regulated. The broker is worth joining!

For a second it felt like I was in Wall Street. The first time I joined, I thought it was gona kiss my lunch money goodbye. But then again I thought about it and dropped $100 and I somehow got $180 back. I still have no clue how it works, but hey, I guess profit is profit, lol…