Best Brokers With PAMM Accounts 2026

PAMM (Percentage Allocation Management Module) brokers allow you to invest a percentage of your money with a selected trader. This trader uses both their own and investors’ funds to trade, typically forex, with profits or losses shared based on each investor’s percentage of the total investment.

PAMM accounts appeal to investors with limited experience or time looking to profit from the forex market by leveraging the expertise of experienced traders.

Dig into our selection of the top forex brokers with PAMM accounts following our in-depth tests and expert-assigned ratings.

Best PAMM Account Brokers For 2026

Following our latest tests of brokers' PAMM account offerings, these 6 providers emerged as the absolute best:

-

1

xChief

xChief -

2

IC Markets

IC Markets -

3

AvaTrade

AvaTrade -

4

Pepperstone75-95% of retail investor accounts lose money when trading CFDs

Pepperstone75-95% of retail investor accounts lose money when trading CFDs -

5

Fusion Markets

Fusion Markets -

6

BlackBull

BlackBull

Why Are These The Top Forex PAMM Brokers?

Here is a snapshot explanation of why we think these are the top brokers with PAMM accounts:

- xChief is the best forex broker with a PAMM account in 2026 - During our tests, xChief’s PAMM accounts offered deep customization and precise investor-manager segmentation. Asset access includes forex, metals, and crypto, with spreads from 0.3 pips and commission starting at $2.5 per lot. The platform impressed with detailed reporting, fast execution, and flexible capital management suited for both new and experienced investors.

- IC Markets - During our last tests, IC Markets’ PAMM accounts delivered exceptional execution speed and transparency. Investors accessed a wide asset range - forex, indices, crypto, and commodities - with spreads from 0.0 pips and $6–$7 commission per lot. The system offers granular performance tracking, flexible allocations, and intuitive manager controls ideal for scalable strategies.

- AvaTrade - During our tests, AvaTrade’s PAMM accounts impressed with a wide asset range including forex, CFDs, and cryptocurrencies. The platform offers transparent performance reporting, flexible investment allocations, and strong customization for managers. Administration is smooth, with competitive spreads starting around 0.9 pips per lot, enhancing trader control and clarity.

- Pepperstone - During our evaluation of Pepperstone’s PAMM accounts, they delivered top-tier execution speed and transparency. Investors accessed a wide asset mix - forex, indices, crypto, and commodities - with razor account spreads from 0.0 pips and $3.5 commission per lot. The system allows detailed performance tracking, flexible capital allocation, and seamless integration for professional-grade strategy management.

- Fusion Markets - When we evaluated Fusion Markets’ PAMM accounts, they stood out for low commissions and tight spreads from 0.1 pips, paired with broad asset access across forex and indices. The system offers transparent, real-time reporting and flexible management tools, allowing personalized strategies and straightforward administration for investors and managers alike.

- BlackBull - When we tried BlackBull Markets’ PAMM accounts, they impressed with low spreads from 0.1 pips and transparent, real-time performance reporting. The platform offers a diverse asset range, including forex, indices, and commodities, with flexible investor allocations and efficient administration, making it well-suited for both novice and experienced fund managers.

Best Brokers With PAMM Accounts 2026 Comparison

Find the right PAMM account for your needs with our comparison of key features:

| Broker | PAMM Account | Minimum Deposit | Platforms | Regulators |

|---|---|---|---|---|

| xChief | ✔ | $10 | MT4, MT5 | ASIC |

| IC Markets | ✔ | $200 | MT4, MT5, cTrader, TradingView, TradingCentral, DupliTrade, Quantower | ASIC, CySEC, CMA, FSA |

| AvaTrade | ✔ | $100 | WebTrader, AvaTradeGO, AvaOptions, AvaFutures, MT4, MT5, AlgoTrader, TradingView, TradingCentral, DupliTrade | ASIC, CySEC, FSCA, ISA, CBI, JFSA, FSRA, BVI, ADGM, CIRO, AFM |

| Pepperstone | ✔ | $0 | MT4, MT5, cTrader, TradingView, AutoChartist, DupliTrade, Quantower | FCA, ASIC, CySEC, DFSA, CMA, BaFin, SCB |

| Fusion Markets | ✔ | $0 | MT4, MT5, cTrader, TradingView, DupliTrade | ASIC, VFSC, FSA |

| BlackBull | ✔ | $0 | BlackBull Invest, BlackBull CopyTrader, MT4, MT5, cTrader, TradingView, AutoChartist | FMA, FSA |

Compare The Ratings Of The Best Brokers For PAMM Trading

Uncover how the top PAMM account brokers scored in every key area after our extensive testing:

| Broker | Trust | Platforms | Assets | Mobile | Fees | Accounts | Research | Education | Support |

|---|---|---|---|---|---|---|---|---|---|

| xChief | |||||||||

| IC Markets | |||||||||

| AvaTrade | |||||||||

| Pepperstone | |||||||||

| Fusion Markets | |||||||||

| BlackBull |

Why Open A PAMM Account With xChief?

"xChief continues to prove popular with investors looking to trade highly leveraged CFDs on the popular MetaTrader platforms. The broker's rebate scheme and investment accounts will particularly appeal to seasoned traders. However, the lack of top-tier regulatory oversight is a major drawback."

William Berg, Reviewer

xChief Quick Facts

| Demo Account | Yes |

|---|---|

| Instruments | CFDs, Forex, Metals, Commodities, Stocks, Indices |

| Regulator | ASIC |

| Platforms | MT4, MT5 |

| Minimum Deposit | $10 |

| Minimum Trade | 0.01 Lots |

| Leverage | 1:1000 |

| Account Currencies | USD, EUR, GBP, JPY, CHF |

Pros

- Traders can access a copy trading solution via the MetaQuotes Signals service

- The low minimum deposit of $10 will appeal to beginners, as well as the beginners’ guides in the Library

- xChief offers STP/ECN execution with low spreads from 0.0 pips and low commission rates starting from $2.50 per side

Cons

- The broker trails competitors when it comes to research tools and educational resources

- xChief is an offshore broker with weak regulatory oversight from the VFSC, so traders will receive limited safeguards

- The Classic+ and Cent accounts provide access to fewer instruments than the other account types, at 50+ and 35+, respectively

Why Open A PAMM Account With IC Markets?

"IC Markets offers superior pricing, exceptionally fast execution and seamless deposits. The introduction of advanced charting platforms, notably TradingView, and the Raw Trader Plus account, ensures it remains a top choice for intermediate to advanced day traders."

Christian Harris, Reviewer

IC Markets Quick Facts

| Demo Account | Yes |

|---|---|

| Instruments | CFDs, Forex, Stocks, Indices, Commodities, Bonds, Futures, Crypto |

| Regulator | ASIC, CySEC, CMA, FSA |

| Platforms | MT4, MT5, cTrader, TradingView, TradingCentral, DupliTrade, Quantower |

| Minimum Deposit | $200 |

| Minimum Trade | 0.01 Lots |

| Leverage | 1:30 (ASIC & CySEC), 1:500 (FSA), 1:1000 (Global) |

| Account Currencies | USD, EUR, GBP, CAD, AUD, NZD, JPY, CHF, HKD, SGD |

Pros

- IC Markets offers among the tightest spreads in the industry, with 0.0-pip spreads on major currency pairs, making it especially cost-effective for day traders.

- IC Markets secured DayTrading.com's 'Best MT4/MT5 Broker' in 2025 for its seamless, industry-leading MetaTrader integration, refined over years to maximize the platform experience.

- You have access to over 2,250 CFDs across various markets, including forex, commodities, indices, stocks, bonds, and cryptocurrencies, allowing for diversified trading strategies.

Cons

- The breadth and depth of tutorials, webinars and educational resources still need work, trailing alternatives like CMC Markets and reducing its suitability for beginners.

- There are fees for certain withdrawal methods, including a $20 wire charge, which can eat into profits, especially for frequent withdrawals.

- Interest isn't paid on unused cash, an increasingly popular feature found at alternatives like Interactive Brokers.

Why Open A PAMM Account With AvaTrade?

"AvaTrade offers active traders everything they need: an intuitive WebTrader, powerful AvaProtect risk management, a smooth 5-minute sign-up process, and dependable support you can rely on in fast-moving markets."

Jemma Grist, Reviewer

AvaTrade Quick Facts

| Demo Account | Yes |

|---|---|

| Instruments | CFDs, Forex, Stocks, Indices, Commodities, ETFs, Bonds, Crypto, Spread Betting, Futures |

| Regulator | ASIC, CySEC, FSCA, ISA, CBI, JFSA, FSRA, BVI, ADGM, CIRO, AFM |

| Platforms | WebTrader, AvaTradeGO, AvaOptions, AvaFutures, MT4, MT5, AlgoTrader, TradingView, TradingCentral, DupliTrade |

| Minimum Deposit | $100 |

| Minimum Trade | 0.01 Lots |

| Leverage | 1:30 (Retail) 1:400 (Pro) |

| Account Currencies | USD, EUR, GBP, CAD, AUD |

Pros

- Support at AvaTrade performed excellently during testing, with response times of 3 minutes and localized support in major trading jurisdictions, including the UK, Europe and the Middle East.

- AvaTrade launched AvaFutures to offer low-margin access to global markets, then expanded in 2025 as one of the first brokers to add CME’s Micro Grain Futures, and then later in the year went further by integrating with TradingView.

- Years on, AvaTrade remains one of the few brokers offering a bespoke risk management tool, AvaProtect, that insures losses up to $1M for a fee and is easy to activate on the platform.

Cons

- Although the deposit process itself is smooth, AvaTrade still doesn’t facilitate crypto payments, a feature increasingly offered by brokers like TopFX, which caters to crypto-focused traders.

- While signing up is a breeze, AvaTrade lacks an ECN account like Pepperstone or IC Markets, which provides the raw spreads and ultra-fast execution many day traders are looking for.

- The AvaSocial app is good but not great – the look and feel, plus the navigation between finding strategy providers and account management needs upgrading to rival category leaders like eToro.

Why Open A PAMM Account With Pepperstone?

"Pepperstone stands out as a top choice for day trading, offering razor-sharp spreads, ultra-fast execution, and advanced charting platforms for experienced traders. New traders are also welcomed with no minimum deposit, extensive educational resources, and exceptional 24/7 support."

Christian Harris, Reviewer

Pepperstone Quick Facts

| Demo Account | Yes |

|---|---|

| Instruments | CFDs, Forex, Currency Indices, Stocks, Indices, Commodities, ETFs, Crypto, Spread Betting |

| Regulator | FCA, ASIC, CySEC, DFSA, CMA, BaFin, SCB |

| Platforms | MT4, MT5, cTrader, TradingView, AutoChartist, DupliTrade, Quantower |

| Minimum Deposit | $0 |

| Minimum Trade | 0.01 Lots |

| Leverage | 1:30 (Retail), 1:500 (Pro) |

| Account Currencies | USD, EUR, GBP, CAD, AUD, NZD, JPY, CHF, HKD, SGD |

Pros

- Pepperstone has scooped multiple DayTrading.com annual awards over the years, most recently 'Best Overall Broker' in 2025 and 'Best Forex Broker' runner up in 2025.

- Pepperstone boasts impressive execution speeds, averaging around 30ms, facilitating fast order processing and execution that’s ideal for day trading.

- There’s support for a range of industry-leading charting platforms including MT4, MT5, TradingView, and cTrader, catering to various short-term trading styles, including algo trading.

Cons

- Pepperstone’s demo accounts are active for only 30 days, which may not be not long enough to familiarize yourself with the different platforms and test trading strategies.

- Despite enhancements to its range of markets, crypto offerings are relatively limited compared to other brokers who focus on this area, with no option to invest in real coins.

- Pepperstone does not support cTrader Copy, a popular copy trading feature built into the excellent cTrader platform and available at alternatives like IC Markets, though it has introduced an intuitive copy trading app.

Why Open A PAMM Account With Fusion Markets?

"Fusion Markets is a standout option for forex traders looking for excellent pricing with spreads near zero, industry-low commissions and recently TradingView integration. It’s a particularly good broker for Australian traders where the company is headquartered and regulated by the ASIC."

Jemma Grist, Reviewer

Fusion Markets Quick Facts

| Demo Account | Yes |

|---|---|

| Instruments | CFDs, Forex, Stocks, Indices, Commodities, Crypto |

| Regulator | ASIC, VFSC, FSA |

| Platforms | MT4, MT5, cTrader, TradingView, DupliTrade |

| Minimum Deposit | $0 |

| Minimum Trade | 0.01 Lots |

| Leverage | 1:500 |

| Account Currencies | USD, EUR, GBP, CAD, AUD, NZD, JPY, CHF, HKD, SGD |

Pros

- The market analysis features, Market Buzz and Analyst Views, are great tools for discovering opportunities and conveniently integrated into the client dashboard.

- The range of charting platforms and social trading features is excellent, with MT4, MT5, cTrader and more recently TradingView, catering to a wide range of trader preferences.

- Fusion Markets is set up to support algo traders with a sponsored VPS solution and a 25% discount if you opt for the NYC Servers VPS for MT4 or cTrader.

Cons

- While the selection of currency pairs trumps most rivals, the broker's alternative investment offering is average with no stock CFDs beyond the US.

- The demo account expires after 30 days, limiting its potential as a useful trading tool alongside a real-money account.

- Fusion Market trails alternatives, notably IG, in the education department with limited guides and live video sessions to upskill new traders.

Why Open A PAMM Account With BlackBull?

"After improving its trading infrastructure with Equinix servers in New York, London, and Tokyo, reducing latency for traders, BlackBull is an obvious choice if you want to day trade stock CFDs with ECN pricing."

Christian Harris, Reviewer

BlackBull Quick Facts

| Demo Account | Yes |

|---|---|

| Instruments | CFDs, Stocks, Indices, Commodities, Futures, Crypto |

| Regulator | FMA, FSA |

| Platforms | BlackBull Invest, BlackBull CopyTrader, MT4, MT5, cTrader, TradingView, AutoChartist |

| Minimum Deposit | $0 |

| Minimum Trade | 0.01 Lots |

| Leverage | 1:500 |

| Account Currencies | USD, EUR, GBP, CAD, AUD, NZD, JPY, ZAR, SGD |

Pros

- With three ECN-powered accounts (Standard, Prime, and Institutional), BlackBull accommodates beginners, experienced traders, and professionals, offering flexibility based on trading needs and capital.

- BlackBull offers every ingredient for day traders; fast execution speeds of <100ms, leverage up to 1:500, and tight spreads from 0.0 pips.

- After partnering with ZuluTrade and Myfxbook, alongside improvements to its own CopyTrader, and finally enabling cTrader Copy, BlackBull offers one of the most comprehensive copy trading experiences we've seen.

Cons

- Unlike most top brokers, BlackBull charges an irritating $5 withdrawal fee, which can detract from the overall cost-effectiveness, especially for active traders who frequently move funds.

- Despite a growing selection of 26,000+ assets, including additions to its Asia Pacific indices, they are mainly stocks with an average selection of currency pairs and indices.

- Although the Education Hub now features improvements like webinars and tutorials, the courses we’ve explored need more focus on explaining the wider economic factors influencing prices.

How Did DayTrading.com Choose The Best PAMM Account Brokers?

To identify the top PAMM accounts, we conducted an exercise to specifically evaluate the PAMM offerings at a long row of brokers. We considered several elements:

- We confirmed brokers offer a PAMM account.

- We prioritized brokers we trust as security is paramount when entrusting your funds to another. Pepperstone is a highly reputable PAMM broker, holding multiple top-tier regulatory licenses.

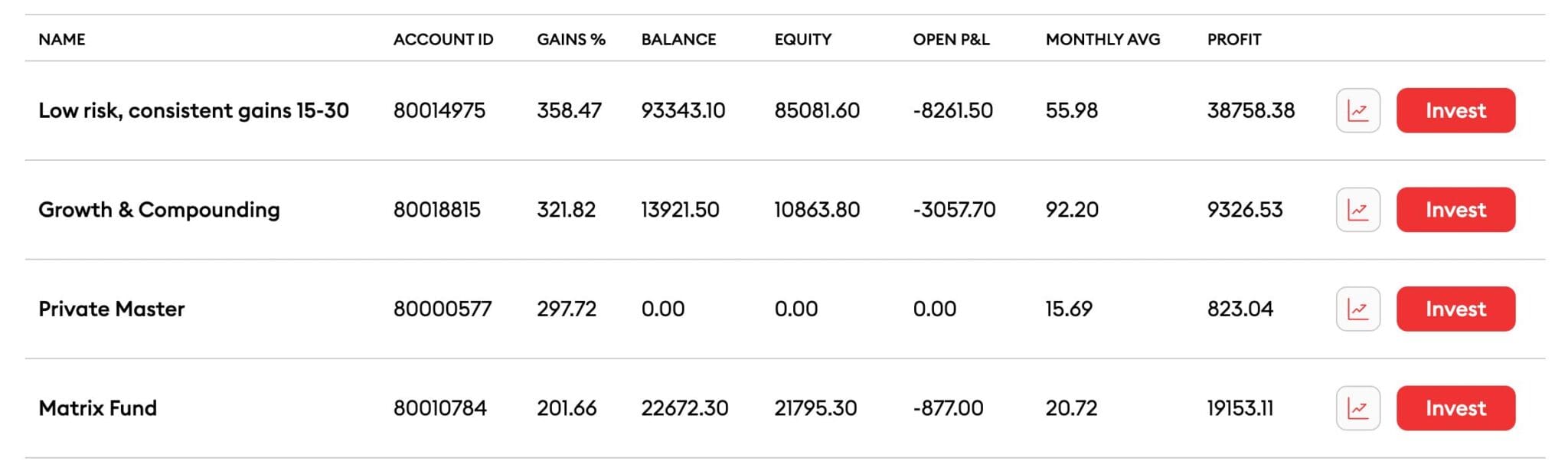

- We explored fund manager reports where available. Dukascopy excelled here with some of the most detailed reports and pro-level transparency on money managers, providing insights like account gains, P&L, and max drawdown.

- We favored brokers with an accessible minimum investment. GO Markets has a $500 deposit to activate a PAMM account, which is around the industry norm.

- We chose brokers with user-friendly dashboards and monitoring tools. Vantage stood out here, allowing investors to monitor their account’s performance via the PAMM dashboard with a click.

- We assessed the costs charged to use PAMM accounts. GO Markets operates a simple pricing structure where clients pay a performance fee, which is a percentage of profits.

- We opted for brokers with reliable customer service. M4Markets proved dependable during testing, with fast response in <2 minutes and helpful information about PAMM account details.

What Is A PAMM Account?

A PAMM (Percentage Allocation Management Module) account is a type of managed trading account where you assign your money to an experienced trader, allowing for proportional profit sharing based on the percentage of your capital in the pool.

There are two main parties involved in a PAMM account: the investors and the money manager. Both are registered with a brokerage, with the investors’ funds pooled together, and the total pot traded by the money manager.

Retail traders will normally take the role of the investor in a PAMM account – the responsibility for managing the account’s funds is generally left to experienced traders, though there may be some cases where talented amateurs qualify for this position.

Critically, there is no guarantee the money manager will make a profit. You could lose all your investment.

How Do PAMM Accounts Work?

Here is an example to show you how PAMM accounts work:

Initial Investment:

- Trader A: $1,500 (15%)

- Trader B: $3,500 (35%)

- Trader C: $2,000 (20%)

- Money Manager: $3,000 (30%)

- Total: $10,000

The money manager decides to invest in a mix of forex pairs, anticipating market movements based on geopolitical events. However, an unexpected political announcement significantly affects currency values, and the portfolio initially loses 10% of its value, reducing the pool to $9,000.

The money manager quickly adjusts the strategy, focusing on safe-haven currencies and leveraging short positions on affected pairs. This change in strategy not only recovers the loss but also generates a 20% profit on the original pool amount, leading to a final pool of $12,000.

Before distribution, the money manager takes a 15% performance fee from the profits ($2,000), leaving $11,700 ($12,000 – $300) to be distributed among the parties in line with their percentage contributions.

Final Distribution:

- Trader A: 15% of $11,700 = $1,755

- Trader B: 35% of $11,700 = $4,095

- Trader C: 20% of $11,700 = $2,340

- Money Manager: 30% of $11,700 = $3,510 (from pool) + $300 (performance fee) = $3,810

Bottom Line

PAMM brokers offer a type of managed account where you allocate a percentage of your funds to an experienced trader who will execute trades for you.

These accounts significantly reduce the effort needed for forex trading, allowing you to pick a manager who will handle trading activities on your behalf.

Nonetheless, profits are not guaranteed with PAMM trading, and finding a reliable broker with a good selection of fund managers is not always straightforward, as we know from compiling our rankings.

That’s why we recommend exploring our list of top brokers offering LAMM accounts, which have undergone thorough testing, analysis and reviews by our experts.

FAQ

What Are The Benefits Of PAMM Accounts?

PAMM accounts offer investors the opportunity to benefit from the forex market through experienced traders managing their investments, ensuring a hands-off approach while potentially generating returns.

They incentivize money managers through performance-based commissions and also allow investors to choose from a variety of managers to mitigate risk.

What Are The Risks Of PAMM Accounts?

Investing in PAMM accounts carries the inherent risk of capital loss, directly tied to the decisions of the money manager, over which investors have limited control.

Additionally, the lack of detailed information on a money manager’s strategy can make it challenging for investors to fully assess and understand the risks involved.

Are PAMM Accounts Only Available For Forex?

The PAMM system is predominantly used in forex. However, it isn’t just forex that can be traded using PAMM solutions, with brokers such as Alpari offering PAMM solutions where cryptos like Bitcoin can also be traded.