M4Markets Review 2026

See the best M4Markets alternatives in your location.

Awards

- Best Deposits & Withdrawals Broker, Fazzaco

- Most Transparent Broker, World Finance Awards

- Best Trading Conditions Broker Global, International Business Magazine

Pros

- Execution speeds are fast, averaging 30 ms (we consider anything below 100 ms as fast and suitable for active day traders)

- M4Markets is a low-cost broker, offering spreads from 0.0 pips and $0 commissions, plus an accessible $5 minimum deposit

- M4Markets holds multiple global licenses, including the CySEC and DFSA

Cons

- The educational resources trail the best brokers with only a small selection of eBooks and webinars offered

- The range of around 200 investments is slim compared to top brokers, who typically offer over 1000

- M4Markets doesn't offer any rebate schemes or rewards for active traders

M4Markets Review

M4Markets is a global CFD broker specialising in trading forex, commodities and indices on MT4 and MT5. The regulated brokerage also offers mobile investing alongside deposit bonuses. Our review covers the registration and login process, withdrawal fees, account options and more. Sign up and start trading today.

M4Markets Details

M4Markets, a trading name of Trinota Markets Global Limited, was established in 2019. The broker offers global services from its head office in the Seychelles and is licensed by the Financial Services Authority (FSA).

2022 also saw M4Markets secure a license from the Cyprus Securities & Exchange Commission (CySEC). This means European traders can sign up and speculate on the broker’s suite of trading instruments. The company behind M4Markets bought CySEC-regulated ICC Intercertus Capital Ltd, which will trade under the name Harindale Ltd, which will operate as M4Markets Europe.

The company strives to provide cutting-edge technology and ultra-fast executions in a fair and safe trading environment.

Platforms

M4Markets offers the industry-recognised MetaTrader 4 and MetaTrader 5 terminals. You can download both platform options to desktop devices or trade through major web browsers.

MetaTrader 4

Perfect for beginners, the customisable MT4 platform offers:

- 9 timeframes

- Interactive charts

- 30+ technical indicators

- Access to Expert Advisors

- Available in over 40 languages

- User-friendly and secure interface

MetaTrader 5

Aimed at experienced traders, the MT5 platform offers additional analysis and execution tools:

- 21 timeframes

- Hedging allowed

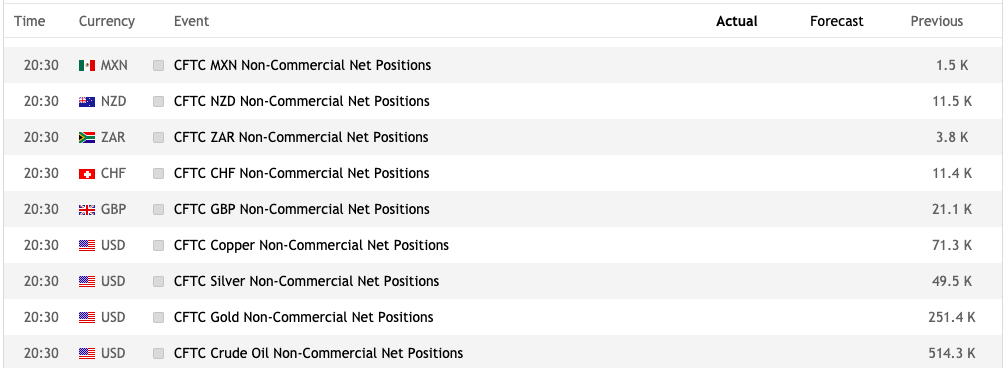

- Economic calendar

- Automated trading available

- Multiple pending order types

- 80+ built-in indicators and tools

Assets

M4Markets offers clients trading opportunities in the following:

- 13 indices – Including UK100, US30, and NAS100

- 50 forex pairs – Access to major, minor and exotic currency pairs

- 9 commodities – Access metals and energies, including gold and oil

- Share CFDs – Trade leading EU and US shares on the MT5 platform

- Cryptocurrencies – BTC, ETH etc

M4Markets Fees

The broker provides commission-free trading under the Standard account for forex and commodities. The Raw and Premium accounts are subject to commissions up to $3.50 and $2.50 per side. A small commission is charged for equities trading across all three accounts.

Spreads vary with market conditions. The Standard account offers spreads from 1.1 pips. Both the VIP and Elite accounts offer highly competitive raw spreads from zero pips across forex, commodities and indices.

The broker does charge swap rates for positions held overnight, further details of which can be found on the company website. Non-trading fees such as inactivity charges should also be considered.

Leverage Review

Forex leverage offered by the broker varies by account type. The Standard account offers leverage up to 1:1000. Note this is very high vs other brokers, especially for inexperienced traders. Although high leverage can increase profit potential, it also magnifies losses so ensure you have risk management strategies in place.

The Raw and Premium accounts offer forex leverage up to 1:500. Maximum leverage on commodities and indices is offered at 1:100 across all accounts except the High Leverage account (up to 1:1000 / 1:500).

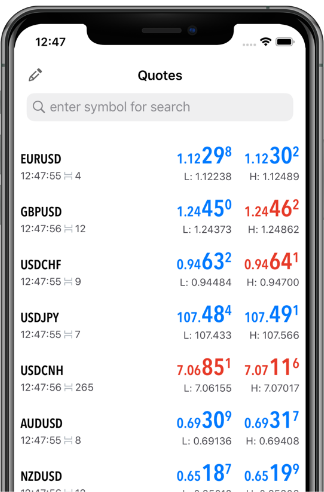

Mobile Apps

Both MT4 and MT5 are available as mobile applications, compatible with iOS and Android devices. The apps provide real-time quotes, full trading history, and access to all analytical functions so you can trade on the go. The same tight spreads and high leverage ratios are available to mobile traders as they are on the desktop platform. Built-in customer support and the full range of payment options are also available in the mobile apps.

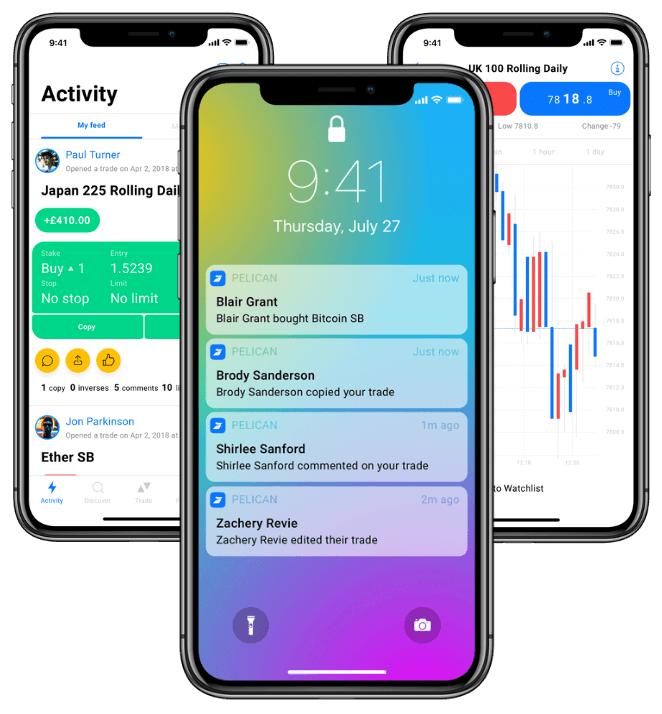

M4Markets also introduced a new social trading platform in 2022 – Copy Trader. The easy-to-use social trading application connects aspiring investors with experienced traders. Users can share market insights, swap tips and replicate positions across accounts. The free mobile app is a great tool for amateurs looking to find trading mentors and explore new markets.

Deposits

Minimum deposit requirements vary by account option, the lowest found with the Standard solution at $5. The broker accepts deposits in all currencies but they must be converted into one of the following; USD, GBP, EUR, JPY, and ZAR.

Payment methods include:

- Skrill – Instant

- Neteller – Instant

- Fasapay – Instant

- UnionPay – Within one business day

- Bank wire transfer – Within one business day

Note, minimum deposit amounts are subject to payment method requirements.

Withdrawals

M4Markets does not charge a fee for withdrawals but payments must be processed back to the original deposit method. All withdrawals are subject to a processing time of up to one business day. This is fast and means traders can get hold of profits promptly vs other forex brokers.

Demo Account

The broker offers a demo account on the MT4 platform. Virtual funds, real-time data, and live trading conditions are offered to become familiar with the platform and test strategies risk-free. Registration is required via a simple online form available from the broker’s website.

M4Markets Bonuses

As of 2023, M4Markets promoted a 50% deposit bonus up to $10,000 on all account types except High Leverage account. Traders simply need to deposit using one of the available payment options and the broker will automatically credit accounts with bonus funds. This is a great way to boost trading capital and explore new markets.

Note, always check bonus terms and conditions before signing up.

Regulation Review

M4Markets is regulated as a securities dealer by the Seychelles Financial Services Authority (FSA). The broker’s European trading entity also holds a license with the Cyprus Securities & Exchange Commission (CySEC).

The firm does offer Negative Balance protection, which brings them in line with the likes of the FCA.

Additional Features

The broker offers minimal additional features on its website. There is no education platform or training tools. An economic calendar is, however, integrated with the MetaTrader platforms. An extensive FAQ section is also available covering various topics such as registration and investing queries.

Trading Accounts

M4Markets offers three different account types. All accounts present low spreads, 0.01 minimum lot trade size, and varying leverage to suit the needs of clients with diverse investment experience. All account currencies use USD, GBP, EUR, JPY, and ZAR.

- Standard – $5 minimum deposit, leverage up to 1:1000, 20% stop out

- Raw Spreads – $500 minimum deposit, leverage up to 1:500, 40% stop out

- Premium – $10,000 minimum deposit, leverage up to 1:500, 40% stop out

- Dynamic Leverage – $5 minimum deposit, leverage up to 1:5000, 30% stop out

To open an account, an online form needs to be completed with identity documents and proof of residency to comply with M4Market’s AML and KYC policies.

Opening Hours

M4Markets follows standard office hours and 24-hour trading Monday to Friday. With that said, timings vary by instrument – visit the broker’s website for full details.

Customer Support

The broker offers a range of customer support options available 7 AM – 7 PM GMT:

- UK telephone – 02035197268

- Email – info@m4markets.com

- Live chat – Available from the homepage

- Address – JUC Building, Office no.F4, Providence Zone 18, Mahe, Seychelles

The website also offers a comprehensive FAQ page.

Security

M4Markets assures a safe and transparent trading environment. Client funds are held in segregated accounts. The broker also offers negative balance protection. Member areas and portal access are password-protected, with email verification steps for live account registration. The MetaTrader platforms also promise high-tech encryptions with secure logins and industry-standard data privacy.

M4Markets Verdict

M4Markets provides investing opportunities across the established MT4 and MT5 platforms. Traders also benefit from low minimum deposit requirements, bonuses and negative balance protection. The only major drawback is the relatively narrow product range. Still, the 1:5000 leverage and $5 Standard account requirement may attract beginners.

Best Alternatives to M4Markets

Compare M4Markets with the best similar brokers that accept traders from your location.

- Interactive Brokers – Interactive Brokers (IBKR) is a premier brokerage, providing access to 150 markets in 33 countries, along with a suite of comprehensive investment services. With over 40 years of experience, this Nasdaq-listed firm adheres to stringent regulations by the SEC, FCA, CIRO, and SFC, amongst others, and is one of the most trusted brokers for trading around the globe.

- xChief – xChief is a foreign exchange and CFD broker, established in 2014. The company is based offshore and registered with the VFSC and FMA. Users can choose between a wide selection of accounts and base currencies, making ForexChief accessible to global traders. The brand also stands out for its no deposit bonus and fee rebates for high-volume traders.

M4Markets Comparison Table

| M4Markets | Interactive Brokers | xChief | |

|---|---|---|---|

| Rating | 3.6 | 4.3 | 3.9 |

| Markets | Forex, CFDs, Indices, Shares, Commodities, Cryptos | Stocks, Options, Futures, Forex, Funds, Bonds, ETFs, Mutual Funds, Cryptocurrencies | CFDs, Forex, Metals, Commodities, Stocks, Indices |

| Demo Account | Yes | Yes | Yes |

| Minimum Deposit | $5 | $0 | $10 |

| Minimum Trade | 0.01 Lots | $100 | 0.01 Lots |

| Regulators | FSA, CySEC | FCA, SEC, FINRA, CFTC, CBI, CIRO, SFC, MAS, MNB, FINMA, AFM | ASIC |

| Bonus | 50% deposit bonus up to $10,000 | – | $100 No Deposit Bonus |

| Platforms | MT4, MT5 | Trader Workstation (TWS), IBKR Desktop, GlobalTrader, Mobile, Client Portal, AlgoTrader, OmniTrader, TradingView, eSignal, TradingCentral, ProRealTime, Quantower | MT4, MT5 |

| Leverage | 1:1000 | 1:50 | 1:1000 |

| Payment Methods | 11 | 6 | 12 |

| Visit | – | Visit | Visit |

| Review | – | Interactive Brokers Review |

xChief Review |

Compare Trading Instruments

Compare the markets and instruments offered by M4Markets and its competitors. Please note, some markets may only be available via CFDs or other derivatives.

| M4Markets | Interactive Brokers | xChief | |

|---|---|---|---|

| CFD | Yes | Yes | Yes |

| Forex | Yes | Yes | Yes |

| Stocks | Yes | Yes | Yes |

| Commodities | Yes | Yes | Yes |

| Oil | Yes | No | Yes |

| Gold | Yes | Yes | Yes |

| Copper | No | No | No |

| Silver | Yes | No | Yes |

| Corn | No | No | No |

| Crypto | Yes | Yes | Yes |

| Futures | No | Yes | No |

| Options | No | Yes | No |

| ETFs | No | Yes | No |

| Bonds | No | Yes | No |

| Warrants | No | Yes | No |

| Spreadbetting | No | No | No |

| Volatility Index | No | No | No |

M4Markets vs Other Brokers

Compare M4Markets with any other broker by selecting the other broker below.

Customer Reviews

3 / 5This average customer rating is based on 1 M4Markets customer reviews submitted by our visitors.

If you have traded with M4Markets we would really like to know about your experience - please submit your own review. Thank you.

Submit Your Own Review of M4Markets

FAQ

Is M4Markets regulated?

Yes, M4Markets is the trading name of Trinota Markets Global Limited, regulated as a Securities Dealer by the Seychelles Financial Services Authority (FSA), license SD035. M4Markets is also regulated by the CySEC for European traders.

What are the minimum deposit requirements for an M4Markets live account?

The minimum deposit requirement for the Standard and Dynamic High Leverage account is $5, the Raw Spread account is $500, for the Premium, traders need $10,000.

Does M4Markets offer a demo account?

Yes, a demo account is offered on trading platforms with virtual funds to test strategies risk-free. Head to the M4Markets website to register for a demo account.

What trading platforms does M4Markets offer?

The broker offers the industry-renowned MetaTrader 4 and MetaTrader 5, both available for desktop and mobile trading.

Does M4Markets offer negative balance protection?

Yes, the broker offers negative balance protection for all retail clients.

I started trading with M4Markets because I knew they were a fast execution platform with low spreads and high leverage. They do all those things so not can’t reall;y complain. What I would say is though that don;’t expect the cool, jazzy experience you see on their website. Once you sign up you’ll find the client area looks like something from last century and Mt4 isn’t far behind frankly. Yes that’s not the most important thing when you’re trading but it would be nice to see the investment carry through from the marketing to the actual user experience when you’re day to day trading.