Best Managed Trading Accounts in 2026

Managed trading accounts are investment vehicles that are typically overseen by experienced traders. These individuals will monitor the portfolio’s performance, and buy and sell assets on your behalf. Managed accounts are best if you want a hands-off approach to trading.

In this guide, we share our pick of the best managed trading accounts and explain the key things to consider when deciding which broker to use.

Top Managed Trading Account Providers 2026

These 6 brokers offer managed trading accounts and received the highest overall ratings in our in-depth reviews. All 6 managed trading account brokers are available .

-

1

Interactive Brokers

Interactive Brokers -

2

eToro USAeToro USA LLC and eToro USA Securities Inc.; Investing involves risk, including loss of principal; Not a recommendation

eToro USAeToro USA LLC and eToro USA Securities Inc.; Investing involves risk, including loss of principal; Not a recommendation -

3

xChief

xChief -

4

InstaTrade

InstaTrade -

5

Zacks Trade

Zacks Trade -

6

RoboForex

RoboForex

This is why we think these brokers are the best in this category in 2026:

- Interactive Brokers - When we evaluated IBKR’s managed account environment, transparency was unmatched - granular reporting, trade breakdowns, and compliance-ready statements stood out. Personalization was strong, with configurable fee structures, allocation models, and risk controls. Administration tools were professional-grade. Spreads on majors averaged 0.1–0.3 pips, with tiered commissions starting at $2 per lot.

- eToro USA - When we tested eToro’s managed account tools, transparency was excellent - real-time stats, risk scores, and portfolio breakdowns made oversight easy. Reporting was intuitive and regularly updated. However, personalization and customization were limited to trader selection only. Spreads averaged 1 pip on majors, with no admin fees or performance-based charges.

- xChief - When we tested xChief’s managed account setup, we found strong transparency in performance stats and allocation methods. Reporting was detailed and updated in real time. Customization options for risk levels and investor terms added flexibility. Administration tools were intuitive. Spreads on majors averaged 0.4–0.6 pips, plus commission of $3/lot.

- InstaTrade - When we tested InstaTrade’s managed account set up, transparency was solid - detailed stats on trader performance, drawdowns, and history were available. Customization options included flexible deposit terms and profit-share settings. Reporting was timely and easy to interpret. Administration tools worked smoothly. Spreads averaged 1.2 pips on EUR/USD, with no hidden management fees.

- Zacks Trade - Zacks Trade is a FINRA-regulated US broker offering trading on stocks, ETFs, cryptocurrencies, bonds and more through a proprietary terminal. The broker is geared toward active traders and offers very affordable fees on most assets as well as an app and a vast amount of market data.

- RoboForex - When we tried RoboForex’s CopyFX platform, we found excellent transparency - trader stats, risk levels, and historical performance were easy to track. Customization included flexible investment terms and risk filters. Reporting was detailed and refreshed regularly. Spreads on major pairs averaged 0.4–0.6 pips, with no commission for investors using CopyFX.

Best Managed Trading Accounts in 2026 Comparison

| Broker | Copy Trading | MAM Account | PAMM Account | Minimum Deposit |

|---|---|---|---|---|

| Interactive Brokers | ✘ | ✔ | ✘ | $0 |

| eToro USA | ✔ | ✘ | ✘ | $100 |

| xChief | ✔ | ✘ | ✔ | $10 |

| InstaTrade | ✔ | ✘ | ✘ | $1 |

| Zacks Trade | ✘ | ✘ | ✘ | $2500 |

| RoboForex | ✔ | ✔ | ✘ | $10 |

Interactive Brokers

"Interactive Brokers is one of the best brokers for advanced day traders, providing powerful charting platforms, real-time data, and customizable layouts, notably through the new IBKR Desktop application. Its superb pricing and advanced order options also make it highly attractive for day traders, while its diverse range of equities is still among the best in the industry."

Christian Harris, Reviewer

Interactive Brokers Quick Facts

| Demo Account | Yes |

|---|---|

| Instruments | Stocks, Options, Futures, Forex, Funds, Bonds, ETFs, Mutual Funds, Cryptocurrencies |

| Regulator | FCA, SEC, FINRA, CFTC, CBI, CIRO, SFC, MAS, MNB, FINMA, AFM |

| Platforms | Trader Workstation (TWS), IBKR Desktop, GlobalTrader, Mobile, Client Portal, AlgoTrader, OmniTrader, TradingView, eSignal, TradingCentral, ProRealTime, Quantower |

| Minimum Deposit | $0 |

| Minimum Trade | $100 |

| Leverage | 1:50 |

| Account Currencies | USD, EUR, GBP, CAD, AUD, INR, JPY, SEK, NOK, DKK, CHF, AED, HUF |

Pros

- The TWS platform has clearly been built for intermediate and advanced traders and comes with over 100 order types and a reliable real-time market data feed that rarely goes offline.

- With low commissions, tight spreads and a transparent fee structure, IBKR delivers a cost-effective environment for short-term traders.

- While primarily geared towards experienced traders, IBKR has made moves to broaden its appeal in recent years, reducing its minimum deposit from $10,000 to $0.

Cons

- Support can be slow and frustrating based on tests, so you might find it challenging to reach customer service representatives promptly or encounter delays in resolving issues.

- IBKR provides a wide range of research tools, but their distribution across trading platforms and the web-based 'Account Management' page lacks consistency, leading to a confusing user experience.

- TWS’s learning curve is steep, and beginners may find it challenging to navigate the platform and understand all the features. Plus500's web platform is much better suited to new traders.

eToro USA

"eToro remains a top pick for traders looking for leading social investing and copy trading services. With a low deposit, zero commissions and an intuitive platform, the broker will meet the needs of newer day traders."

Jemma Grist, Reviewer

eToro USA Quick Facts

| Demo Account | Yes |

|---|---|

| Instruments | Stocks, Options, ETFs, Crypto |

| Regulator | SEC, FINRA |

| Platforms | eToro Trading Platform & CopyTrader |

| Minimum Deposit | $100 |

| Minimum Trade | $10 |

| Account Currencies | USD |

Pros

- A free demo account means new users and prospective day traders can try the broker risk-free

- eToro USA Securities is a trustworthy, SEC-regulated broker that is a member of FINRA and SIPC

- The low minimum deposit and straightforward account opening process means beginners can get started quickly

Cons

- The proprietary terminal doesn't support trading bots and there are no additional stock market analysis tools

- There's no MetaTrader 4 platform integration for traders who are accustomed to using third-party charting tools

- Average fees may cut into the profit margins of day traders

xChief

"xChief continues to prove popular with investors looking to trade highly leveraged CFDs on the popular MetaTrader platforms. The broker's rebate scheme and investment accounts will particularly appeal to seasoned traders. However, the lack of top-tier regulatory oversight is a major drawback."

William Berg, Reviewer

xChief Quick Facts

| Demo Account | Yes |

|---|---|

| Instruments | CFDs, Forex, Metals, Commodities, Stocks, Indices |

| Regulator | ASIC |

| Platforms | MT4, MT5 |

| Minimum Deposit | $10 |

| Minimum Trade | 0.01 Lots |

| Leverage | 1:1000 |

| Account Currencies | USD, EUR, GBP, JPY, CHF |

Pros

- The broker offers a turnover rebate scheme geared towards active investors, as well as trading credits and several other occasional bonuses

- xChief offers STP/ECN execution with low spreads from 0.0 pips and low commission rates starting from $2.50 per side

- The broker offers several account types to suit different traders, including a Cent account for beginners and pro-level hedging/netting accounts

Cons

- xChief is an offshore broker with weak regulatory oversight from the VFSC, so traders will receive limited safeguards

- The broker trails competitors when it comes to research tools and educational resources

- The Classic+ and Cent accounts provide access to fewer instruments than the other account types, at 50+ and 35+, respectively

InstaTrade

"Although InstaTrade offers active trading on a comprehensive platform, it stands out with its fairly unique Fixed Income Structured Product (FISP), providing passive investment opportunities with up to 50% returns in 6 months if conditions are met. "

Christian Harris, Reviewer

InstaTrade Quick Facts

| Demo Account | Yes |

|---|---|

| Instruments | FISP, CFDs, Forex, Stocks, Indices, Commodities, Cryptos, Futures |

| Regulator | BVI FSC |

| Platforms | InstaTrade Gear, MT4 |

| Minimum Deposit | $1 |

| Minimum Trade | 0.01 |

| Leverage | 1:1000 |

| Account Currencies | USD, EUR, RUB |

Pros

- InstaTrade delivers an excellent suite of charting tools for day traders with its web trader comprising 250+ indicators, 11 chart types and a user-friendly design.

- InstaTrade TV, consisting of video interviews and valuable market insights spanning equities, cryptos and more, helps identify opportunities and inform short-term trades.

- Despite an average investment offering of around 300 assets, InstaTrade offers a particularly strong suite of currency pairs, catering to advanced traders seeking opportunities in volatile exotics.

Cons

- InstaTrade is registered in the offshore jurisdiction of the British Virgin Islands, resulting in limited regulatory safeguards for retail investors.

- Marketing of the FISP, especially phrasing around the “guarantee of profitability” and the “elimination of risks of trading on financial markets” raises concerns.

- InstaTrade’s growing educational tools provide valuable information for aspiring traders, but still trail category leaders like eToro with no structured course based on experience level.

Zacks Trade

"Zacks Trade will suit active day traders with experience using powerful platforms. Fees and margin rates are low while the market research is excellent."

Tobias Robinson, Reviewer

Zacks Trade Quick Facts

| Demo Account | Yes |

|---|---|

| Instruments | Stocks, ETFs, Cryptos, Options, Bonds |

| Regulator | FINRA |

| Platforms | Own |

| Minimum Deposit | $2500 |

| Minimum Trade | $3 |

| Account Currencies | USD, EUR, GBP, CAD, AUD, NZD, INR, JPY, ZAR, TRY, SEK, NOK, DKK, CHF, HKD, SGD, RUB, PLN, CZK, HUF |

Pros

- Regulated by FINRA with access to the Securities Investor Protection Corporation

- Comprehensive research and data

- Demo account

Cons

- Withdrawal fees apply if removing funds more than once per month

- Shortcomings regarding platform loading times and technical glitches

- No MT4 or MT5 platform integration

RoboForex

"RoboForex is great if you want a vast range of 12,000+ day trading markets with ECN accounts, powerful charting and loyalty promotions. It also stands out for stock traders with its user-friendly R StocksTrader platform, featuring 3,000+ shares, fees from $0.01 and sophisticated watchlists."

Christian Harris, Reviewer

RoboForex Quick Facts

| Demo Account | Yes |

|---|---|

| Instruments | CFDs, Forex, Stocks, Indices, Commodities, ETFs, Futures |

| Regulator | IFSC |

| Platforms | R StocksTrader, MT4, MT5, TradingView |

| Minimum Deposit | $10 |

| Minimum Trade | 0.01 Lots |

| Leverage | 1:2000 |

| Account Currencies | USD, EUR |

Pros

- RoboForex is known for its tight spreads starting from 0 pips and low minimum deposits from $10, making it accessible to those on a budget. The ability to trade with micro lots further lowers the barrier to entry for new traders.

- The R Stocks Trader platform rivals leading solutions like MT4, with netting and hedging capabilities, comprehensive backtesting, Level II pricing, and a flexible workspace.

- RoboForex offers over 12,000 instruments, providing more short-term trading opportunities than the vast majority of online brokers, with forex, stocks, indices, ETFs, commodities, and futures.

Cons

- While RoboForex offers competitive spreads, some of its account types come with high trading commissions up to $20 per lot, trailing the cheapest brokers, such as IC Markets.

- Despite 15+ years in the industry and registering with the Financial Commission, RoboForex is authorized by one ‘Red-Tier’ regulator – the IFSC in Belize, lowering the level of regulatory protections for traders.

- Despite offering a range of platforms, RoboForex still doesn't support the increasingly popular cTrader. This might deter traders who prefer this specific platform for their day trading activities and is available at firms like Fusion Markets.

What Are Managed Trading Accounts?

Managed trading accounts are portfolios that are owned by an individual but managed by a third party.

You give control – usually to a money manager – to trade assets such as forex without your prior approval. They should make decisions based on your risk appetite, personal wealth and financial goals.

Managers are usually compensated by a fee, often calculated as a percentage of assets under management (AUM). Alternatively, you may pay a routine subscription fee, for example monthly, and/or a percentage of any profits.

Importantly, they require you to take a leap of faith and put your trust (and money) in the lap of an external party. This can be uncomfortable for many individuals.

Managed account brokers should provide you with regular reports on your account, including a list of its holdings and its performance.

Types Of Managed Trading Accounts

These trading vehicles fall into several categories:

- Copy trading: This is the most straightforward managed account solution that has become increasingly popular in recent years. Copy trading platforms allow you to mirror the strategies of a wide range of experienced traders, with the best brokers providing performance leaderboards and risk ratings to help you find suitable strategy providers.

- Multi-account manager (MAM) accounts or percentage allocation management module (PAMM) accounts: PAMM accounts distribute profits or losses among traders based on their initial deposit. MAM, a variant of PAMM, offers flexibility by allowing non-proportional trade allocations, enabling traders to assume varying levels of risk, leading to potentially different returns.

- Separately managed accounts (SMAs): These are actively supervised by a human portfolio manager (or team of managers) who will monitor your account’s performance, conduct research, and buy or sell securities based on your preferences. These are popular with longer-term investors and high-net-worth individuals.

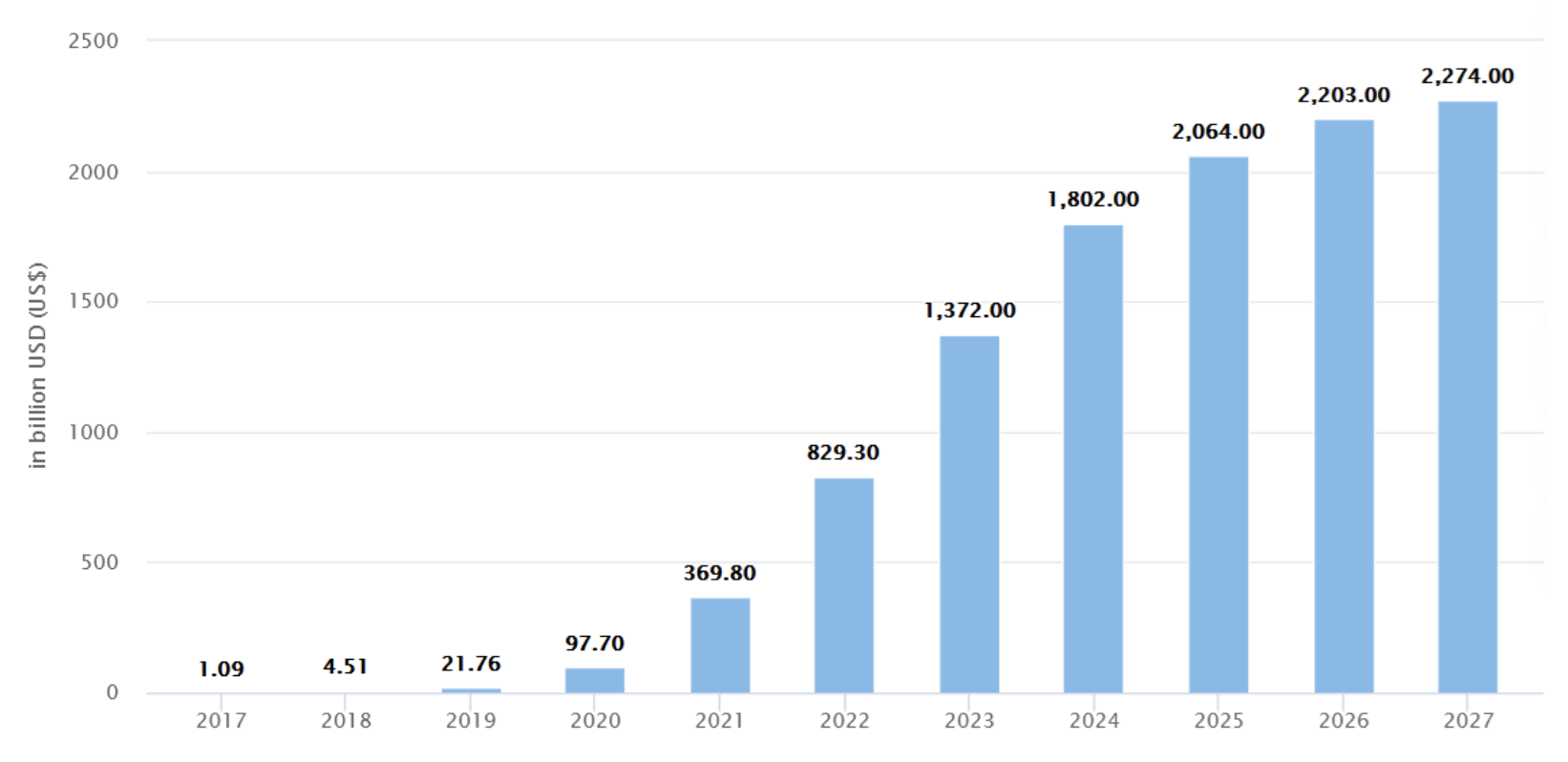

- Robo advisors: These are digital platforms that use algorithms to manage the portfolio. These automated systems are much cheaper to employ than human-managed SMAs, meaning that they have grown rapidly in popularity since being introduced in 2008. The downside is that the level of portfolio customization that you enjoy tends to be lower.

Analysts at Statista expect assets under management (AUMs) in the robo advisor market to continue growing steadily, as the chart below shows.

How To Compare Managed Trading Accounts

You have plenty of choice when it comes to deciding which managed account provider to go with. However, there are multiple factors we, and you, should consider:

Trading Performance

Reputable managed account brokers supply a wide range of information on who makes trading decisions, their philosophy, and other elements that influence their decision-making.

You should choose a company that provides comprehensive reports showing the historical performance of the accounts they supervise.

Total return, risk-adjusted return, volatility, and performance against key benchmarks are critical criteria that you should pore over carefully.

Capital Requirements

Managed account providers typically demand that you meet minimum investment amounts. The exact value differs from brokerage to brokerage, although they can be high (sometimes running into six-figure amounts).

If you want an accessible option, IG Smart Portfolios are available with a $500 minimum investment.

Commission and Fee Structure

Employing the expertise of a market professional involves taking on extra cost. In fact, the expense of using a managed account can be high.

Fees may be applied on an annual basis and charged as a percentage of total assets under administration (AUMs). These can vary considerably amongst account providers, but most charge between 1% and 3% of AUM.

Alternatively, some providers charge a monthly subscription fee and a cut of any profits, known as a performance fee.

That said, eToro is popular because it does not charge any additional fees to copy trades beyond the usual spreads and transaction fees. The downside is that the expertise and performance of master traders can vary dramatically.

Importantly, large fees can significantly erode investment returns. Keeping costs to a minimum is essential, although you may be willing to accept higher expenses if you expect to make a better return with a specific provider, for example.

Robo advisors tend to charge lower fees than account providers that employ money managers. I think these can be a good option for traders operating on a low budget.

Customer Support

The extra fees that you often pay for managed accounts should (in theory) guarantee a good level of customer service. You will want to be able to contact your provider quickly and easily, and to receive regular updates on your holdings and the performance of your portfolio.

You can consult user feedback on review websites like Trustpilot to assess the quality of a provider’s customer support.

Alternatively, we test the customer support of managed account brokers as part of our review process, with IG standing out for its 24/7 reliable assistance.

Technology and User Interface

Some money managers operate sophisticated in-house trading platforms, while others outsource their non-core functions to third-party providers.

It is important to select an account provider which has stable online technology and offers a user-friendly interface. After all, if you cannot understand any of the reports or information provided to you, how can you tell how close you are to meeting your financial goals?

FxPro offers a MAM account through the industry’s most popular platform – MetaTrader 4, so if you are already familiar with this forex trading software you can skip a steep learning curve.

I also recommend that you check that the managed account provider you are planning to use is recognized and approved by your local regulator.

In the UK, for example, clients can ascertain an account provider’s regulatory status through the Financial Conduct Authority (FCA).

Bottom Line

Managed trading accounts can be extremely useful if you have little time or energy to build and supervise your portfolio. They can also provide tax benefits, and allow you to benefit from the expertise of a professional.

However, these accounts may require high investment amounts and can attract elevated fees (though cheaper options are often provided by robo advisors).

When comparing brokers with managed trading accounts, it is important to consider customer support, interfaces and fees. It is also critical to evaluate the skill of the investment manager by considering past trading performance.

FAQ

What Is A Managed Trading Account?

A managed trading account is a financial product where a human (or automated) advisor is delegated day-to-day management of your portfolio.

This third party should execute transactions based on your risk tolerance, financial goals and economic circumstances, and closely monitor the portfolio’s performance.

What Is The Difference Between A Managed And Unmanaged Trading Account?

Managed trading accounts provide a hands-off approach to trading. You give control to a manager who will buy or sell securities and assets on your behalf.

Conversely, unmanaged accounts require you to take action and make trading decisions.

Are Managed Trading Accounts Worth The Fees?

Managed trading accounts may be worth it if you do not want to actively trade and have the capital to meet the sometimes large minimum investment requirements.

However, these accounts do not necessarily beat the market and returns can be below average due to the fees incurred.