Robo Advisors

As hands-off trading becomes more viable, many traders will be looking for the best brokers with Robo advisors. Brokers with Robo advisors are becoming more and more common, with billions in capital trusted to Robo advisors worldwide. Following this guide, you can join this widespread adoption of Robo advisors, discovering the best Robo brokerage accounts with which to trade.

Best Brokers With Robo Advisors

Here is a short overview of each broker's pros and cons

- Interactive Brokers - Under close examination, Interactive Brokers’ robo advisor — IBKR Automated Portfolio — stood out for its precision and low costs. The management fee was just 0.20%, among the lowest we’ve seen, with fully automated rebalancing and tax-loss harvesting built in. Portfolio allocation felt genuinely data-driven, adjusting intelligently to market shifts rather than following rigid model weights.

- Qtrade - When we tested Qtrade’s robo advisor, the focus on balanced, goal-based investing really stood out. Portfolios were diversified across ETFs with automatic rebalancing and a clean fee of around 0.35% annually. What impressed us most was the personalization — it adapts to life events and changing goals without needing manual intervention, making it a genuinely set-and-forget experience.

- Swissquote - When put to the test, Swissquote’s robo advisor impressed us with its level of personalization. Instead of cookie-cutter ETF mixes, it fine-tunes portfolios using real-time market data and user-defined themes like sustainability or tech focus. Fees averaged around 0.75% annually, but the adaptive rebalancing and transparency made it feel closer to a private-bank experience than an automated one.

- SimpleFX - During our tests, SimpleFX didn’t offer a full-scale robo advisor in the traditional sense — but its semi-automated portfolio tools came surprisingly close. Traders can set strategy templates that auto-adjust based on market momentum and risk appetite. It’s a lean, cost-efficient setup with no management fees, ideal for those who prefer hands-on control with algorithmic support.

Interactive Brokers

"Interactive Brokers is one of the best brokers for advanced day traders, providing powerful charting platforms, real-time data, and customizable layouts, notably through the new IBKR Desktop application. Its superb pricing and advanced order options also make it highly attractive for day traders, while its diverse range of equities is still among the best in the industry."

Christian Harris, Reviewer

Interactive Brokers Quick Facts

| Demo Account | Yes |

|---|---|

| Instruments | Stocks, Options, Futures, Forex, Funds, Bonds, ETFs, Mutual Funds, Cryptocurrencies |

| Regulator | FCA, SEC, FINRA, CFTC, CBI, CIRO, SFC, MAS, MNB, FINMA, AFM |

| Platforms | Trader Workstation (TWS), IBKR Desktop, GlobalTrader, Mobile, Client Portal, AlgoTrader, OmniTrader, TradingView, eSignal, TradingCentral, ProRealTime, Quantower |

| Minimum Deposit | $0 |

| Minimum Trade | $100 |

| Leverage | 1:50 |

| Account Currencies | USD, EUR, GBP, CAD, AUD, INR, JPY, SEK, NOK, DKK, CHF, AED, HUF |

Pros

- Interactive Brokers has launched ForecastTrader, a unique, zero-commission product where users can trade yes/no Forecast Contracts on political, economic, and climate events, with fixed $1 payouts per contract, 24/6 market access, and 3.83% APY on held positions.

- The new IBKR Desktop platform takes the best of TWS while adding bespoke tools like Option Lattice and Screeners with MultiSort to create a genuinely impressive trading experience for day traders at every level.

- Interactive Brokers has been named Best US Broker for 2025 by DayTrading.com, recognizing its long-standing commitment to US traders, ultra-low margin rates, and global market access at minimal cost.

Cons

- IBKR provides a wide range of research tools, but their distribution across trading platforms and the web-based 'Account Management' page lacks consistency, leading to a confusing user experience.

- Support can be slow and frustrating based on tests, so you might find it challenging to reach customer service representatives promptly or encounter delays in resolving issues.

- You can only have one active session per account, so you can’t have your desktop program and mobile app running simultaneously, making for a sometimes frustrating trading experience.

Qtrade

"Qtrade is a good match for Canadian traders who are looking for a reputable and regulated broker to make longer-term investments as well as leveraged trades."

William Berg, Reviewer

Qtrade Quick Facts

| Demo Account | Yes |

|---|---|

| Instruments | Stocks, ETFs, Bonds, Mutual Funds, Options, GICs |

| Regulator | CIRO |

| Platforms | TradingCentral |

| Minimum Deposit | $0 |

| Minimum Trade | Variable |

| Account Currencies | USD, CAD |

Pros

- Alongside 100+ commission-free ETFs, Qtrade has slashed its options fees, now coming in at $0.75 per options contract (down from $1.00).

- Qtrade’s new Options Lab, built with Trading Central provides trading ideas that match your goals, risk level, and experience - head to Investment Tools > Options Lab.

- After years of testing, Qtrade has cemented its place as one of the best trading platforms in Canada, with easy-to-use software and a growing range of US and Canadian stocks as well as funds, ETFs and other assets.

Cons

- Although Qtrade has added support for Interac e-Transfer, it still offers relatively limited funding options with no credit/debit card deposits.

- The transfer out fee is a nuisance and traders should be wary of the CAD to USD exchange charge.

- Commissions of $8.75 per equity can stack up for active stock traders, reducing its suitability for day traders.

Swissquote

"Swissquote is an excellent choice for active traders looking for a customizable platform, such as its CXFD, which integrates Autochartist for automated chart analysis to aid trading decisions. However, its average fees and steep $1,000 minimum deposit might make it less accessible for beginner traders."

Christian Harris, Reviewer

Swissquote Quick Facts

| Demo Account | Yes |

|---|---|

| Instruments | CFDs, Forex, Stocks, Indices, Bonds, Options, Futures, ETFs, Crypto (location dependent) |

| Regulator | FCA, FINMA, CSSF, DFSA, SFC, MAS, MFSA, CySEC, FSCA |

| Platforms | CFXD, MT4, MT5, AutoChartist, TradingCentral |

| Minimum Deposit | $1,000 |

| Minimum Trade | 0.01 Lots |

| Leverage | 1:100 (Retail), 1:400 (Pro) |

| Account Currencies | USD, EUR, GBP, CAD, AUD, NZD, JPY, ZAR, TRY, SEK, NOK, CHF, HKD, SGD, PLN, AED, SAR, HUF, THB, QAR, MXN |

Pros

- Swissquote is highly trusted owing to its position as a bank, its listing on the Swiss stock exchange, and authorization from trusted bodies like FINMA in Switzerland, FCA in the UK, and CSSF in Luxembourg.

- Swissquote provides advanced research services like Autochartist for technical analysis and integration of real-time news from Dow Jones. Its proprietary Market Talk videos and Morning News reports deliver expert analysis daily, appealing to active traders.

- Swissquote is built for fast-paced trading strategies like day trading, scalping and high-frequency trading with 9ms average execution speeds, a 98% fill ratio, and FIX API.

Cons

- Analysis shows Swissquote’s fees are on the high side, with forex spreads starting at 1.3 pips on Standard accounts, compared to 0.0 pips at brokers like Pepperstone or IC Markets. Transaction fees for non-Swiss stocks and ETFs can also add up for frequent traders.

- Swissquote primarily caters to pro and high-net-worth clients, with high minimum deposit requirements (eg $1,000 for Standard accounts), making it less suited for smaller traders who can find higher leverage at the growing number of brokers with no minimum deposit.

- Unlike brokers such as eToro with social trading features, Swissquote lacks tools for community engagement or copying successful traders, limiting its appeal for those who value peer-to-peer learning.

SimpleFX

"SimpleFX is ideal for users looking to deposit, trade and withdraw in popular cryptos such as Bitcoin and Ethereum. It also stands by offering its own SimpleFX Coin, providing rebates and exclusive perks to holders."

Christian Harris, Reviewer

SimpleFX Quick Facts

| Demo Account | Yes |

|---|---|

| Instruments | CFDs, Forex, Indices, Stocks, Commodities, Cryptos |

| Regulator | FSC |

| Platforms | WebTrader, MT4 |

| Minimum Deposit | $0 |

| Minimum Trade | 0.01 Lots |

| Leverage | 1:1000 |

| Account Currencies | USD, EUR, GBP |

Pros

- With MT4 support, experienced traders can access sophisticated charting tools, advanced technical indicators, customizable algorithms, and expert advisors (EAs) for automated strategies.

- SimpleFX underwent a revamp in 2021, now sporting a slicker client area with faster load times and a social trading community where you can exchange ideas.

- SimpleFX’s proprietary WebTrader - powered by TradingView - delivers a stable day trading environment with a user-friendly interface that’s accessible even to novice traders.

Cons

- The educational tools are okay but not great. The ‘Opinion’ section needs updating more frequently while video tutorials covering market analysis and risk management would be valuable additions for beginners.

- The availability of only a few non-crypto funding methods is a downside for traders seeking more diverse and convenient options for managing their accounts.

- While the Bloomberg TV news feed and economic calendar are valuable resources, the lack of research tools like Autochartist and Trading Central is a serious disadvantage for traders wanting support in identifying opportunities.

What Are Robo Advisors?

Traditionally, those looking to invest in stocks and shares would turn to financial advisors for assistance when planning a bespoke investment strategy based on their risk tolerance. However, there are significant barriers to entry when employing a human financial advisor, with many favouring high-value clients with upfront capital to invest. This is because financial advisors have a limited amount of time and want to make the most profit possible through fees.

This is where robo advisors come in. While automated portfolio management software has existed for commercial use since the millennium, the first publicly available robo advisor was developed for retail investors in 2008. Today, investors can use robo advisors with no upfront capital whatsoever and far lower fees than a human advisor. Many of the best brokers with robo advisors allow clients to harness the potential for low-cost investment planning help.

Robo advisors are digital platforms that provide automated trading and financial planning services through the use of algorithms. Often, robo advisors are set up to manage retirement or college tuition funds. After collecting data from clients on their level of investment, chosen risk tolerance, profit targets and withdrawal dates, a suitable balance of investments is suggested to assist clients to meet their financial goals. This is often between highly dependable major index funds, greater-risk-greater-reward emerging markets and guaranteed low-return government bonds.

Many robo advisors can be tasked with the full management of an investment portfolio, requiring no external input from investors whatsoever. Robo advisors can adapt to changing market conditions independently by adjusting the balance of a portfolio to reach the preset goals. Alternatively, users can adjust their strategies, changing acceptable risk exposure and moving goal dates closer or farther away.

Popular Robo Advisors

Here are a few of the most popular services and best brokers with robo advisors on the consumer market.

Betterment

Betterment was the first robo advisor to launch for consumer use and has expanded in popularity since its public release in 2010. Betterment manages over $20 billion in cash and assets for its customers, providing both robo and human advisors to its clients. Offering an entry-level and a premium account, Betterment caters to those with both simple and complex needs. An attractive option for investors and one of the best brokers with robo advisors, Betterment provides valuable features like fractional shares investing and has no minimum account balance.

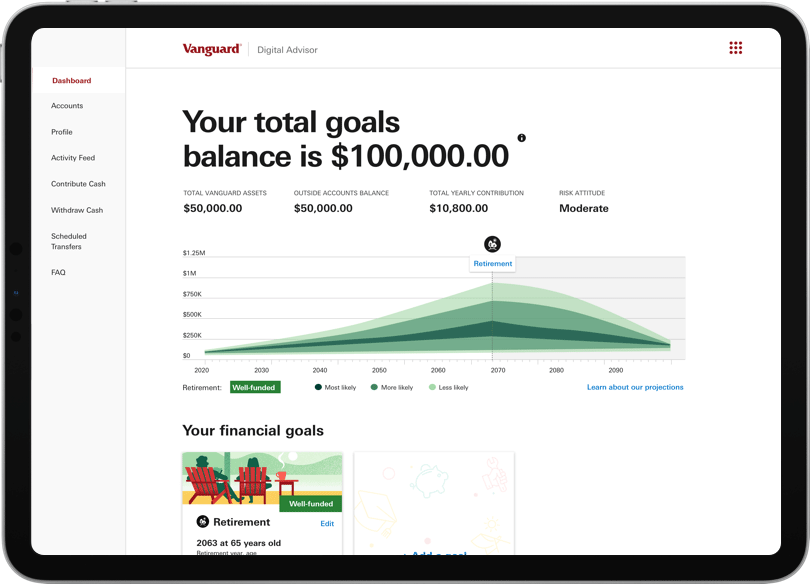

Vanguard Personal Advisor Services

A well known and experienced broker in the investment world, Vanguard provides the most popular robo advisor service, managing over $170 billion in client assets. Renowned for its low cost and simple to understand ETFs, Vanguard splits clients’ investments between four stock and bonds portfolios to meet their individual goals. While there is a $3,000 account minimum for those wishing to leverage Vanguard’s robo advisory services, its fees are very competitive.

Wealthfront

Wealthfront is a prominent firm and one of the best brokers with robo advisors, specialising in tax optimisation services to help clients reduce the impact of taxation on their investments. With over $20 billion invested through Wealthfront’s robo advisor services, they are an experienced and trusted fund manager. Clients can opt for a wide range of accounts, including retirements funds, joint funds, IRA and ISA savings accounts as well as college and university fee accounts. Offering low fees and direct indexing, a feature where individual shares in an ETF are purchased separately, Wealthfront provides a robo advisor service suited to many investors.

How To Compare Robo Advisors

The aforementioned list is just the tip of the iceberg when considering the best brokers with robo advisors. We have compiled a list below of the top factors to consider when comparing brokers.

Fees & Management Costs

When deciding from the best brokers with robo trading advisors, the fees that a firm charges to manage your capital, as well as the cost of investing in an individual ETF or commodity, are of great importance.

While many brokerages will boast low annual management fees, it is also worth checking the expense ratios associated with each investment. These may be into ETFs, commodities, bonds or even cryptocurrencies. These fees can soon add up, so make sure brokers’ expense ratios are as competitive as their management fees.

Another cost-related aspect to look out for is discounts based on the amount of investment. To incentivise those with higher amounts of capital to invest with them, some brokerages offer scaling fee discounts.

Range Of ETFs & Assets Offered

An area where the best brokers with robo advisors can compete is the range of investment options available. While some brokers, such as Vanguard, keep things simple with assets split between a handful of broad and diversified ETFs, other brokers split into industry-specific ETFs, cryptocurrency funds, international market funds and real estate investment opportunities (REITs).

A broker with a greater range of investment options can allow for more aggressive investment strategies but this can come with added risks. More choice is never a bad thing, especially when setting specific financial goals but this can sometimes come at the cost of higher platform or management fees.

Fractional Shares

Investors that engage in dollar-cost averaging may look to regularly invest smaller amounts rather than infrequent lump sums. The ability to invest in fractional shares with a broker can be key to those looking to make smaller, incremental investments.

A robo broker that doesn’t support fractional shares will only make an investment when the minimum amount for one share is deposited. This can potentially lead to a wait of several months without investments, diminishing the power of dollar-cost averaging and depriving your capital of the chance for growth. Fractional shares allow investments to be made even when the funded amount is less than the cost of one share.

This feature is a distinct advantage for those investing smaller amounts at one time and should be valued highly by such investors.

Personalisation & Overridability

While some investors may feel more comfortable letting the robo advisor take complete control over their investment, the capacity to override decisions could be a key factor. Clients that have researched a particular field of investment, such as cryptocurrency or tech stocks, may want to include them in their investment portfolios. Having the ability to personalise your portfolio is a feature that those choosing from the best brokers with robo advisors should consider carefully.

Some brokers offer a feature known as tax-loss harvesting, an investment strategy that can significantly reduce capital gains taxes. In taxable accounts, the practice involves selling losing investments to offset the gains from winners. This involves a process known as direct indexing, in which individual stocks that make up an ETF are purchased separately. Direct indexing is fiddly and hard to keep on top of when trading manually, so this strategy is well suited for robo advisors.

Tax will not be a concern for those investing in tax-free accounts, such as a 401k retirement fund in the US or ISAs in the UK. However, for investors whose profits will be enhanced by reductions in capital gains tax, this is an essential feature.

Minimum Account Balances

Some brokers enforce minimum account balances for their robo advisor accounts, meaning that investors have to deposit a certain amount to create an account. This may not be an issue for clients with large sums to immediately deposit but, for those who wish to slowly add money to their accounts, this could be restrictive.

Pros Of Robo Advisors

There are plenty of benefits to enlisting the services of the best brokers with robo advisors:

- Hands-Off Investing – Robo advisors facilitate “set it and forget it” investments, where clients can set up their accounts with funds and/or regular payments and let the robo advisor take care of the rest. Robo advisors are one of the easiest ways for those not well versed in financial markets and trading to invest. The focus of brokers on simplicity and usability means that even someone with no financial background and little investment knowledge could enlist a robo advisor and make their money work for them.

- More Accessible Than Human Advisors – Robo advisors can beat human advisors for everyday investors for several reasons. Many traders seeking simple management will be better off with a robo advisor. Robo advisors have no upfront costs and lower fees than human advisors, making them more accessible to large parts of the population. Investments made with a robo advisor can also be tracked at all times via digital platforms, with tweaks to strategy not restricted by office hours or availability.

- Straightforward To Set Up And Monitor – Robo brokers reduce the likelihood of new investors feeling overwhelmed and lost. The advisors help guide clients by providing simple quizzes to ascertain clients’ preferred level of risk, time frame and capital. Too much choice can often be overwhelming for beginners, with thousands of individual stocks, ETFs, commodities and bonds available for trading. A robo advisor’s selection of hand-picked ETFs and assets prevents clients from feeling confounded. The best brokers with Robo advisors provide easy to use platforms with which to track and alter investments. Robo advisor platforms can be accessed at any time so that traders can monitor how their strategy is playing out.

Cons Of Robo Advisors

While the best brokers with robo advisors provide some great benefits, there are also some potential drawbacks:

- Client Independence – Robo advisors operate on the presumption that clients have realistic goals and a solid grasp of their financial situation. Without an intermediary on hand to check that clients have a complete picture of their circumstances, the aims and investment amounts that clients choose can lead to unanticipated real-world implications. Furthermore, it can be easy to crank up the risk solely believing in the power of a robo advisor to beat the market. Without anyone on hand to check potentially reckless investments, clients can make poor choices for their targets and chosen risk levels.

- Restrictive Investment Options – In order to reduce complexity for both investors and robo advisor software, even some of the best brokers with robo advisors have few investment funds to choose from. While these funds themselves are often well-diversified, clients that wish to invest in specific fields or assets may be disappointed by some brokers. Some firms may even insist on a minimum allocation of low-yielding bonds within a portfolio.

- Limited To A Long-Term Focus – Robo advisors are designed to grow capital over a longer time scale, such as for retirement or a child’s college tuition. Robo advisors are not set up to make short-term trading plays. Instead, they work by harnessing the dependable long-term growth of markets like the S&P 500 and the guaranteed returns of government bonds.

- No Consideration For Other Assets – An area where a human financial advisor will be hugely beneficial is when managing more than just capital. Managing assets such as land, property and alternate sources of income are beyond the scope of a robo advisor. When deciding what has long term earning or appreciation potential, the help of a human financial expert is needed. Indeed, while some brokers offer real estate fund investment trusts, the best solution for an individual investor may be to invest in property or other physical assets. Such advice can only come from human financial advisors.

Other Things To Consider

Socially Responsible & Environmentally Friendly Options

For investors that want to use their capital to enact positive change in the world, many brokers offer investment options for socially responsible or environmentally friendly companies. While returns may not match those of other markets, investors know that their money is supporting positive change. With the growing demand for these investment options, it is worth checking if a robo advisor broker offers these opportunities.

External Software Integration

Investors who wish their robo advisor brokerage to seamlessly work with other programs such as cryptocurrency exchanges or taxation software should check whether a broker’s platform supports external software. Many investors will see a benefit from tracking multiple investment assets in one place, as well as not needing to manually input tax information into external software.

Final Word

The best brokers with robo advisors can be great tools for investors who wish to set up investments and allow them to be balanced and mature automatically. They benefit from lower management fees than human advisors and the simplicity to be understood by novices. Robo advisors can be a great long-term, minimal-input investment strategy but investors that want short term returns or greater control over their investments might benefit from looking elsewhere.

When it comes to choosing the best brokers with robo advisors, there are many to choose from. Features such as tax-loss harvesting, support for fractional shares and external software integration will set brokers apart from the rest of the field. Low fees and minimum account balances will also be important aspects to pick out the best brokerage accounts with robo advisors for your needs.

FAQs

Are The Best Brokers With Robo Advisors Good For Beginners?

Robo advisors make long term investing easy for those unfamiliar with the financial markets. Investors need only fill out preferences such as time frame and risk and the system will do the rest.The best brokers with robo advisors will automatically manage investments to give them the best chance of reaching these set goals, taking the need for human interaction out of long-term investments.

What Are The Fees For The Best Brokers With Robo Advisors?

All brokers with robo advisors will offer their services for different fees. Some charge flat fees but, for most, management fees will tend to be lesss than 0.25% of your portfolio. AOn top of management fees, brokers may charge an expense ratio for purchasing individual assets through their platform. These can range from anywhere between 0.05% up to 1% for actively managed, riskier ETFs.

Can I Day Trade Using One Of The Best Brokers With Robo Advisors?

Robo advisors are designed to manage longer-term investments and, while they will make adjustments to portfolios in response to changing market situations, they will often not engage in short-term strategies such as day trading.

Are Robo Advisors Popular With Investors?

Many investors choose to trust their long term investment strategy to a robo advisor. Worldwide, over $300 billion is managed by robo advisors, with services offered by some of the most popular brokers like Vanguard, Schwab and Fidelity.

Should I Use A Robo Advisor?

If you are content to allow your investments to grow independently or do not want the hassle of researching and manually investing in assets for your portfolio, robo advisors are a perfect service. Easy to use and with very reasonable fees, it is hard to argue against the value provided by the best robo advisor brokers. However, for traders that want greater control over their investments or have assets to manage other than just capital, independent investing or enlisting a human advisor may be better.