GO Markets Review 2026

See the best GO Markets alternatives in your location.

Awards

- Most Trusted Forex Broker APAC 2025 - International Business Magazine

- Best Global Forex Broker 2025 - International Business Magazine

- Best Global Forex Broker, Asia 2024 - World Business Outlook Awards

- Top 100 Trusted Financial Institutions - Middle East 2023 - Middle East Financial Markets Awards

Pros

- GO Markets excels in making complex topics digestible and fostering a community-like learning environment. Its educational suite stands out with courses, webinars, podcasts, and even weekly live coaching sessions - ideal for newer traders.

- The introduction of PAMM accounts and multiple copy trading services cater to both beginner and advanced traders, while the rebate program rewards high-volume day traders looking to reduce costs.

- GO Markets has bolstered its offering, introducing 1000+ new stock CFDs in 2024 and localized payment solutions for traders in Latin America in 2025, including Pago Efectivo in Peru and Paynet in Mexico.

Cons

- During testing, we found that GO Markets restricts TradingView access in demo mode unless you first register a live account - a limitation that jars with firms offering full platform access in demo from the outset.

- Despite reasonable multi-asset coverage, our tests showed a limited choice in categories like commodities and indices, with only around 15 indices and 10 commodities.

- GO Markets' research tools are relatively basic, lacking the depth and frequency seen with larger competitors who offer daily insights, analyst commentary, and advanced forecasting tools.

GO Markets Review

This straight-to-the-point review cuts through the hype around GO Markets. Based on our real trading experience during extensive testing, it zeroes in on the essentials that short-term traders actually care about, revealing what this broker does well and where it falls short.

Regulation & Trust

Founded in 2006 in Melbourne, Australia, GO Markets quickly positioned itself as a trusted early provider of CFD trading services.

It’s regulated by several authorities:

- GO Markets Pty Limited is regulated by the Australian Securities & Investments Commission (ASIC) – a ‘green tier’ body in DayTrading.com’s Regulation & Trust Rating.

- GO Markets Ltd is regulated by the Cyprus Securities & Exchange Commission (CySEC) – ‘green tier’.

- GO Markets International Ltd is regulated by the Financial Services Authority (FSA) in Seychelles – ‘red tier’.

- GO Markets Pty Ltd (MU) is regulated by the Financial Services Commission (FSC) of Mauritius – ‘red tier’.

This multi-jurisdictional regulation means GO Markets operates under established rules and compliance requirements. ASIC and CySEC regulations, in particular, provide a strong measure of safety and transparency, though protection levels differ.

For example, CySEC clients are eligible for EU compensation funds up to €20,000, whereas ASIC does not directly pay compensation to individuals.

GO Markets segregates client funds and maintains solid security, but the specific protections you receive depend on which regional entity holds your account.

GO Markets no longer holds an active Financial Conduct Authority (FCA) license in the UK. From February 8, 2023, its authorization was officially revoked, meaning it is no longer permitted to offer regulated services in the UK.

GO Markets’ regulation under ASIC and CySEC is solid, but the safest trusted brokers, such as IG, are subject to even higher scrutiny (FCA, CFTC) and sometimes offer more robust investor compensation.

| GO Markets | Interactive Brokers | FOREX.com | |

|---|---|---|---|

| Regulation & Trust Rating | |||

| Regulators | ASIC, CySEC, FSC, FSA | FCA, SEC, FINRA, CFTC, CBI, CIRO, SFC, MAS, MNB, FINMA, AFM | NFA, CFTC |

| Visit | Visit | Visit | Visit |

| Review | Review | Review | Review |

Accounts & Banking

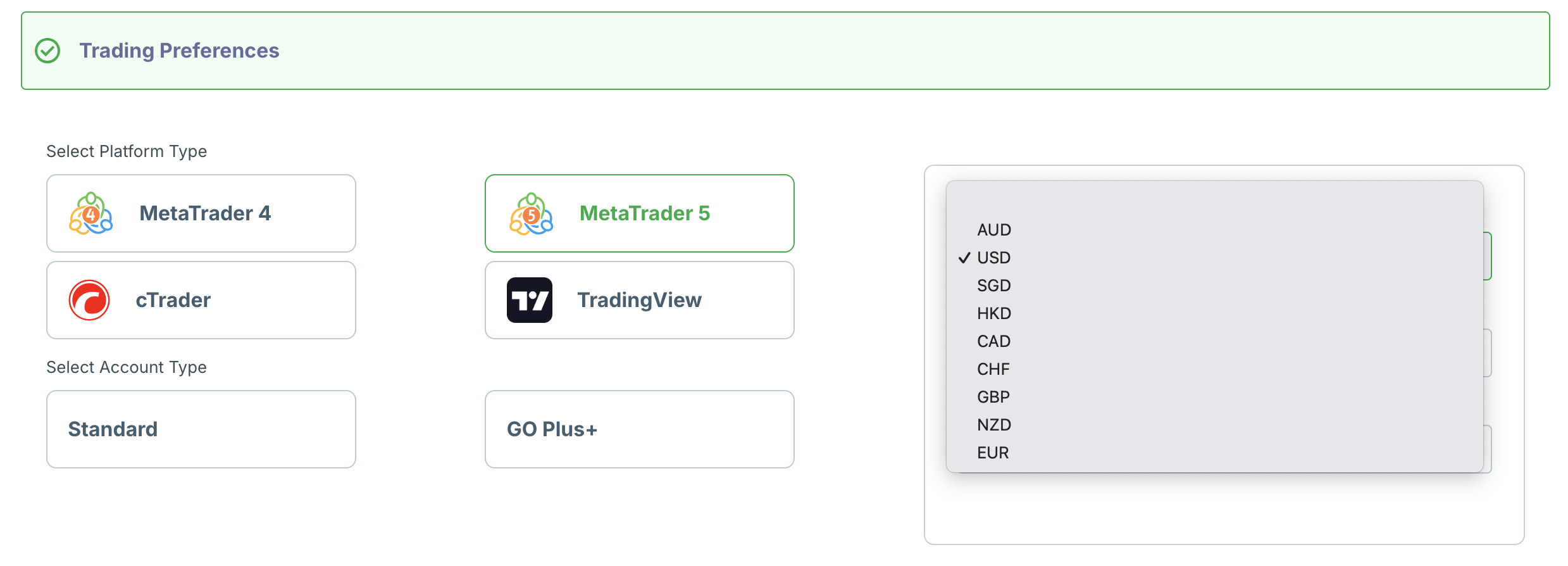

Live Accounts

Unlike many brokers that add complexity with multiple account variations or higher minimum deposits, GO Markets keeps it simple with two account options that match or sometimes beat the cost structures of major competitors we’ve examined, such as IC Markets and Axi.

- The Standard Account is commission-free and built for traders who value simplicity and predictability. All trading costs are included in the spread, which starts from around 0.8 pips. This account is best suited for beginner traders or those who prefer straightforward pricing without variable commission charges.

- The GO Plus+ Account targets more active or professional traders by offering raw spreads starting as low as 0.0 pips. Instead of building costs into the spread, this account charges a fixed commission per trade (for example, AUD 3.00 or USD 2.50 per side per lot). This setup provides lower overall trading costs for those trading larger volumes or who require the tightest pricing for certain day trading strategies, such as scalping or high-frequency trading.

A significant difference is the transparency and simplicity in pricing – GO Markets openly discloses costs and does not charge inactivity fees, unlike some top-tier brokers we’ve tested.

Still, if you seek the absolute tightest spreads or specific account customizations (such as tiered loyalty structures), you may find slightly more options with a few other brokers.

Demo Accounts

When I tried GO Markets’ demo account, I appreciated how quickly and easily it was to set up – I received USD 50,000 (or equivalent in 10 available currencies) in virtual funds and access to all the trading tools on MT4, MT5, and cTrader (not TradingView) platforms, with no pressure to open a live account.

However, I was disappointed to find that the demo account is only available for one month. Compared to other brokers that allow you to use demo accounts for a significantly more extended period – or even indefinitely like XM and XTB – this feels restrictive, particularly for someone who wants to practice or refine strategies over time.

Deposits & Withdrawals

GO Markets has made funding and withdrawing funds extremely straightforward, supporting a wide variety of methods, including bank transfers, credit cards, debit cards, and e-wallets such as Skrill and Neteller.

Deposits are generally instant with most methods, and there are no minimum deposit requirements. Withdrawals are also processed quickly, typically within one to two business days, and also there are no minimum withdrawal requirements.

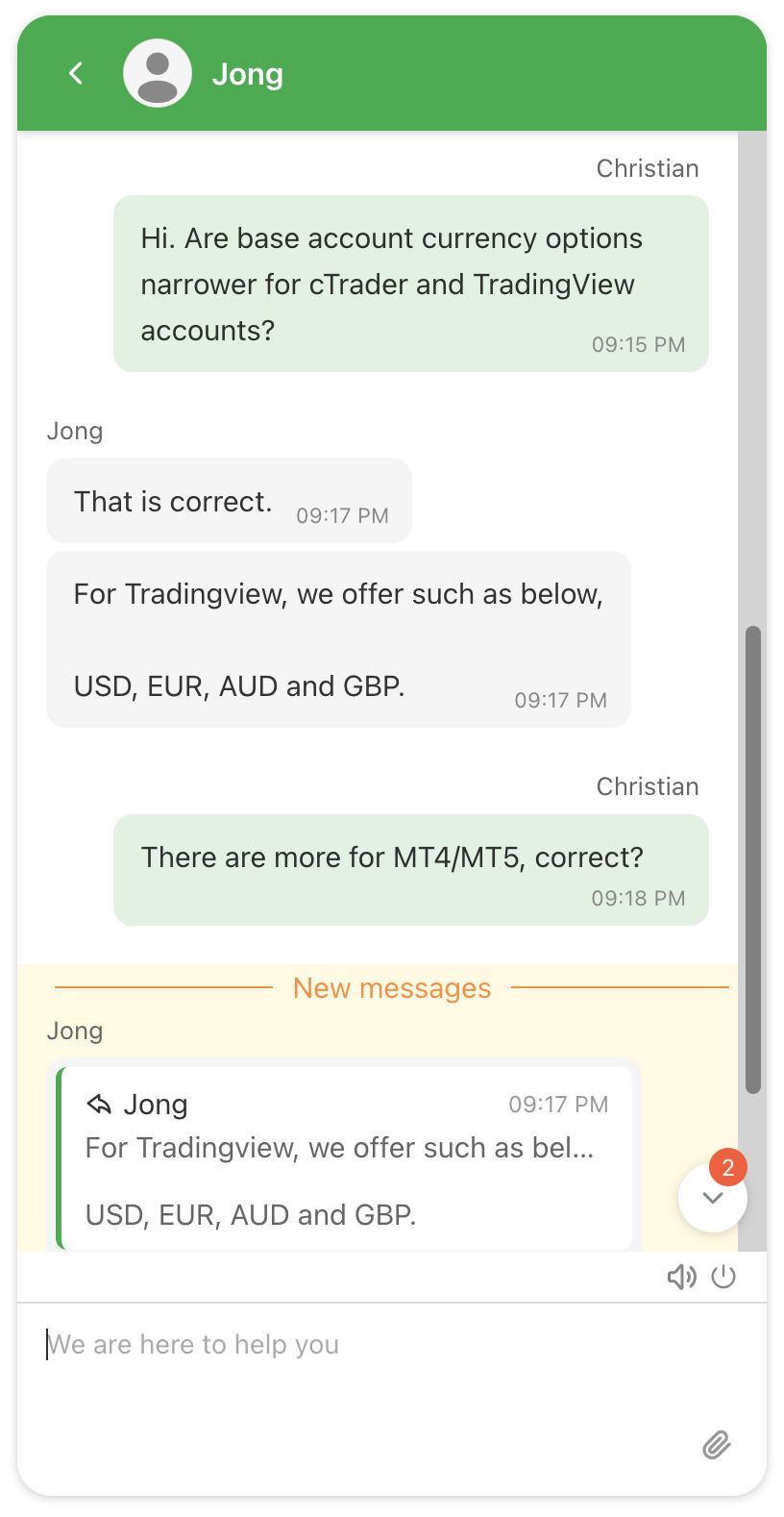

A key detail to note is that the accepted currencies depend on the funding method and platform you choose. If you fund via bank cards or bank wire to an MT4/MT5 account, you can transact in any of the nine supported currencies: AUD, USD, EUR, GBP, NZD, CAD, SGD, CHF, and HKD.

However, if you use alternative methods like Neteller or want to fund a cTrader or TradingView account, the currency options are narrower, typically limited to AUD, USD, GBP, and EUR.

In 2025, GO Markets also expanded its payment options for LATAM traders, adding local funding methods like PSE in Colombia, Pago Efectivo in Peru and Ecuador, and OXXO, SPEI, and Paynet in Mexico. This allows deposits in local currencies while keeping trading accounts in USD to simplify funding and avoid cross-border fees.

Significantly, GO Markets doesn’t charge internal fees for deposits or withdrawals. However, you may incur third-party or intermediary bank fees for international transactions, which is a standard industry practice.

From my own experience trading on GO Markets, both depositing and withdrawing are reliable and transparent. I haven’t encountered any hidden charges when transferring funds using my debit card, and requests are processed promptly.

That said, unlike some brokers that provide almost instant withdrawals or broader regional payment options, you may experience a slight delay, especially for first-time deposits and withdrawals, which can take a minimum of 1-3 business days.

| GO Markets | Interactive Brokers | FOREX.com | |

|---|---|---|---|

| Accounts & Banking Rating | |||

| Payment Methods | Credit Card, Debit Card, Mastercard, Neteller, Skrill, Visa, Wire Transfer | ACH Transfer, Automated Customer Account Transfer Service, Cheque, Debit Card, TransferWise, Wire Transfer | ACH Transfer, Credit Card, Debit Card, Mastercard, Neteller, PayNow, Skrill, Visa, Wire Transfer |

| Minimum Deposit | $0 | $0 | $100 |

| Visit | Visit | Visit | Visit |

| Review | Review | Review | Review |

Assets & Markets

GO Markets offers a comprehensive multi-asset lineup for most day trading strategies:

- Forex: Over 50 currency pairs including majors, minors, and exotics such as EUR/USD, GBP/JPY, AUD/USD, and USD/SGD.

- Indices: 15+ global indices CFDs including the S&P 500, FTSE 100, DAX, and ASX 200.

- Commodities: 10+ commodities including energies, metals, and agricultural products such as gold, silver, crude oil (WTI and Brent), natural gas, and wheat.

- Stocks: More than 600 CFDs from US, Australia, and Hong Kong exchanges, including Apple, Microsoft, Tesla, Westpac, and Alibaba.

- Cryptocurrencies: 40+ leading cryptocurrency CFDs, including Bitcoin, Ethereum, Litecoin, Ripple, and Bitcoin Cash.

- ETFs: 50+ CFDs including SPDR S&P 500 ETF (SPY), Invesco QQQ Trust, and iShares MSCI EAFE.

- Bonds: Five government bond CFDs, including the US 10-Year Treasury and the German 10-Year Bund.

This breadth gives most retail traders broad exposure to global markets and a reasonably diverse universe for strategy development, especially for crypto speculation. However, compared to some brokers we’ve examined, the depth and diversity of GO Markets’ offering show some notable limitations.

While brokers like IG or Saxo Bank provide access to thousands of individual stocks across dozens of global exchanges, including direct stock trading and options, GO Markets is focused solely on the CFD model, which restricts you to derivative products rather than physical ownership of assets.

Advanced traders will also notice a narrower list of ETFs and bonds compared to the substantial libraries available at prominent firms like eToro and Interactive Brokers.

The inclusion of niche options such as bond and ETF CFDs is a point in GO Markets’ favor, especially since many mid-tier brokers overlook these categories.

On the other hand, the relatively modest number of instruments in categories such as indices and commodities may be limiting for those seeking the best possible variety or access to less-traded markets.

| GO Markets | Interactive Brokers | FOREX.com | |

|---|---|---|---|

| Assets & Markets Rating | |||

| Trading Instruments | CFDs, Forex, Stocks, Indices, Commodities, Bonds, ETFs, Crypto | Stocks, Options, Futures, Forex, Funds, Bonds, ETFs, Mutual Funds, Cryptocurrencies | Forex, Futures and Options on Metals, Energies, Commodities, Indices, Bonds, Crypto |

| Margin Trading | Yes | Yes | Yes |

| Leverage | 1:500 | 1:50 | 1:50 |

| Visit | Visit | Visit | Visit |

| Review | Review | Review | Review |

Fees & Costs

GO Markets offers two main account types. The Standard Account is commission-free with spreads from 0.8–1.0 pips, while the GO Plus+ Account offers raw spreads from 0.0 pips with commissions of USD 2.50-3.50 per lot.

The pricing is clearly outlined and was easy for us to verify on both the website and within platforms like cTrader during hands-on testing.

When trading live, I noticed that typical total round-turn costs on core pairs like EUR/USD gravitate around USD 7.00 per standard lot on the GO Plus+ Account, combining spreads and commission – a level that matches or narrowly beats many well-known brokers such as IC Markets and FP Markets, though a few rivals from our cheapest brokers do post slightly tighter spreads during peak liquidity.

For stocks, indices, and commodities, fees follow a similar pattern – competitive, if not consistently cutting-edge – and are disclosed with no hidden markups. Swap/overnight rates are instrument-specific and easy to find, which helps me plan longer trades without surprise charges.

What stands out compared to some other brokers is that GO Markets charges no internal deposit or withdrawal fees for most payment methods and doesn’t penalize inactive accounts.

However, like most brokers, third-party or international bank transfer fees may apply and are outside GO Markets’ control.

The broker also offers a volume rebate program, allowing high-volume traders to recoup part of their costs – a perk not universally available elsewhere and one I found beneficial once my trading volumes increased at GO Markets.

The commission model for the GO Plus+ Account gave me complete clarity – my total cost per trade rarely varied from the published rate, unless market conditions became illiquid.That said, traders focused on squeezing out every last pip of savings may sometimes locate slightly lower round-turn costs at the most aggressively priced brokers, but the difference is marginal for most trading styles.

| GO Markets | Interactive Brokers | FOREX.com | |

|---|---|---|---|

| Fees & Costs Rating | |||

| EUR/USD Spread | 0.2 | 0.08-0.20 bps x trade value | 1.2 |

| FTSE Spread | 2.3 | 0.005% (£1 Min) | 1.0 |

| Oil Spread | 0.038 | 0.25-0.85 | 2.5 |

| Stock Spread | Variable | 0.003 | 0.14 |

| Visit | Visit | Visit | Visit |

| Review | Review | Review | Review |

Platforms & Tools

GO Markets offers a robust lineup of trading platforms, including MT4, MT5, cTrader, and, more recently, integration with TradingView. Each platform is available on desktop and mobile, with useful web-based versions for flexibility.

In my hands-on experience, accessing each platform was seamless. MT4 and MT5 offer a familiar environment that most forex traders expect, with robust support for algorithmic trading, custom indicators, and a variety of order types.

The charting feels solid, execution is responsive, and, crucially for more advanced users, the MT4/MT5 Genesis (Windows only) add-ons bring in extra analytics and trade management features – something I found genuinely improved my workflow when testing more sophisticated strategies.

The addition of cTrader stands out for those who value a clean, modern interface and want advanced order options, Level 2 depth of market, and robust automation through cAlgo.

I especially appreciate cTrader’s quick order entry and layout customization, which in practice puts it close to what you’d find at the best ECN brokers.

GO Markets also stands out for its comprehensive support of copy trading across both MetaTrader and cTrader platforms. With MetaTrader Copy Trader, you can easily follow and automatically replicate the trades of signal providers by analyzing their performance history, risk profiles, and trading strategies.

This makes MetaTrader Copy ideal not only for beginners who want to benefit from more experienced traders, but also for those looking to diversify their approach without manually managing every trade.

cTrader Copy works similarly, allowing you to mirror the trades of top-performing strategy providers with robust analytics and transparency into each trader’s results.

In my experience, both systems are straightforward to set up and integrate into your GO Markets account. The choice between MetaTrader Copy and cTrader Copy means you aren’t limited to one trading ecosystem, which is an advantage over some brokers who only support copy trading through third-party plugins or restrict it to a single platform.

TradingView integration is a big bonus, especially for traders (like me) who spend time on in-depth multi-asset charting and want to leverage community-driven scripts and visual studies directly within their broker account.

GO Markets is one of the few trusted brokers that offers PAMM accounts, letting investors allocate funds to experienced traders who manage positions on their behalf. Profits and losses are shared proportionally, with performance tracking and allocation handled transparently under regulatory oversight.

It’s a hands-off option, but success depends entirely on the manager’s skill – returns aren’t guaranteed, and investors have no control over trades.

There’s also VPS hosting, which is essential for running Expert Advisors (EAs) and automated strategies with maximum uptime – a feature usually reserved for the more premium tier at top brokers. The VPS servers are free if you trade at least 10 standard FX/gold lots (5 round-trip) per billing month. Otherwise, a USD 25 monthly fee applies.

Ultimately, GO Markets matches other big names in terms of platform breadth and core functionality. In testing, while execution speeds are competitive, IC Markets edges ahead in raw speed – an important consideration for day traders.

On the other hand, GO Markets’ range of included add-ons, absence of platform fees, and smooth onboarding process compensate for some of the missing features.

| GO Markets | Interactive Brokers | FOREX.com | |

|---|---|---|---|

| Platforms & Tools Rating | |||

| Platforms | GO TradeX™, MT4, MT5, cTrader, TradingView | Trader Workstation (TWS), IBKR Desktop, GlobalTrader, Mobile, Client Portal, AlgoTrader, OmniTrader, TradingView, eSignal, TradingCentral, ProRealTime, Quantower | WebTrader, Mobile, MT4, MT5, TradingView |

| Mobile App | iOS & Android | iOS & Android | iOS & Android |

| Visit | Visit | Visit | Visit |

| Review | Review | Review | Review |

Research

GO Markets offers a range of research tools, but compared to brokers like Exness and Swissquote, which provide regular videos or newsletters, the selection is limited.

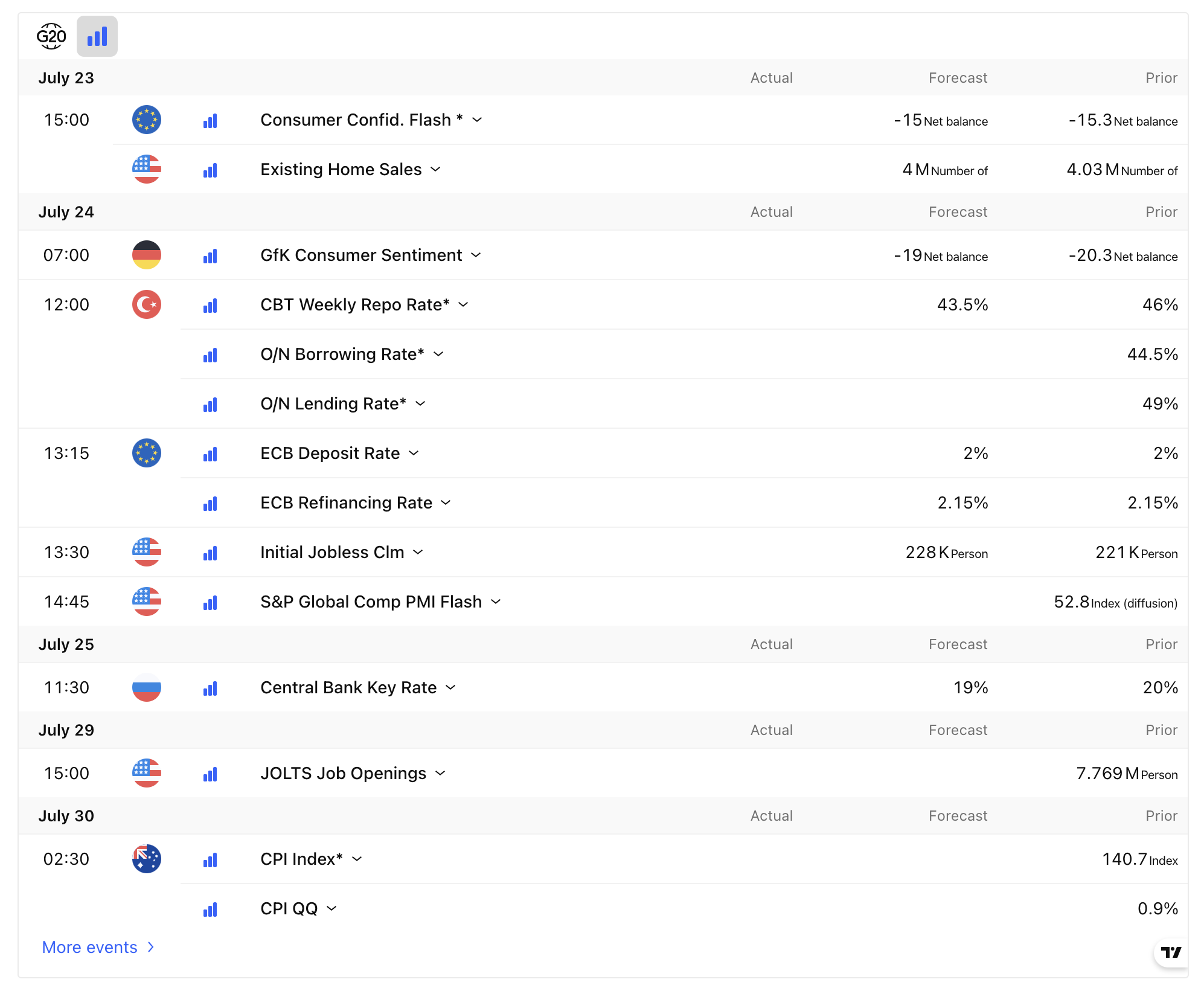

The TradingView-powered economic calendar is smooth and intuitive, making it easy to track high-impact events by country.

Economic calendars are also integrated directly into the cTrader, MetaTrader, and TradingView platforms themselves, allowing you to monitor upcoming market events and news without leaving your trading environment.

However, the earnings announcements page was down during our latest round of tests, which was frustrating, especially considering this is a time-sensitive resource that short-term traders rely on.

GO Markets also publishes basic market commentary and trading ideas, which are helpful but lack the depth and frequency of analysis offered by the industry’s biggest names.

Notably, the broker does not provide Autochartist or Trading Central, two powerful tools that many brokers include to help beginners identify trading opportunities. Without these, newer traders are left to do their own analysis, missing out on user-friendly pattern recognition and signals that ease the learning curve.

| GO Markets | Interactive Brokers | FOREX.com | |

|---|---|---|---|

| Research Rating | |||

| Visit | Visit | Visit | Visit |

| Review | Review | Review | Review |

Education

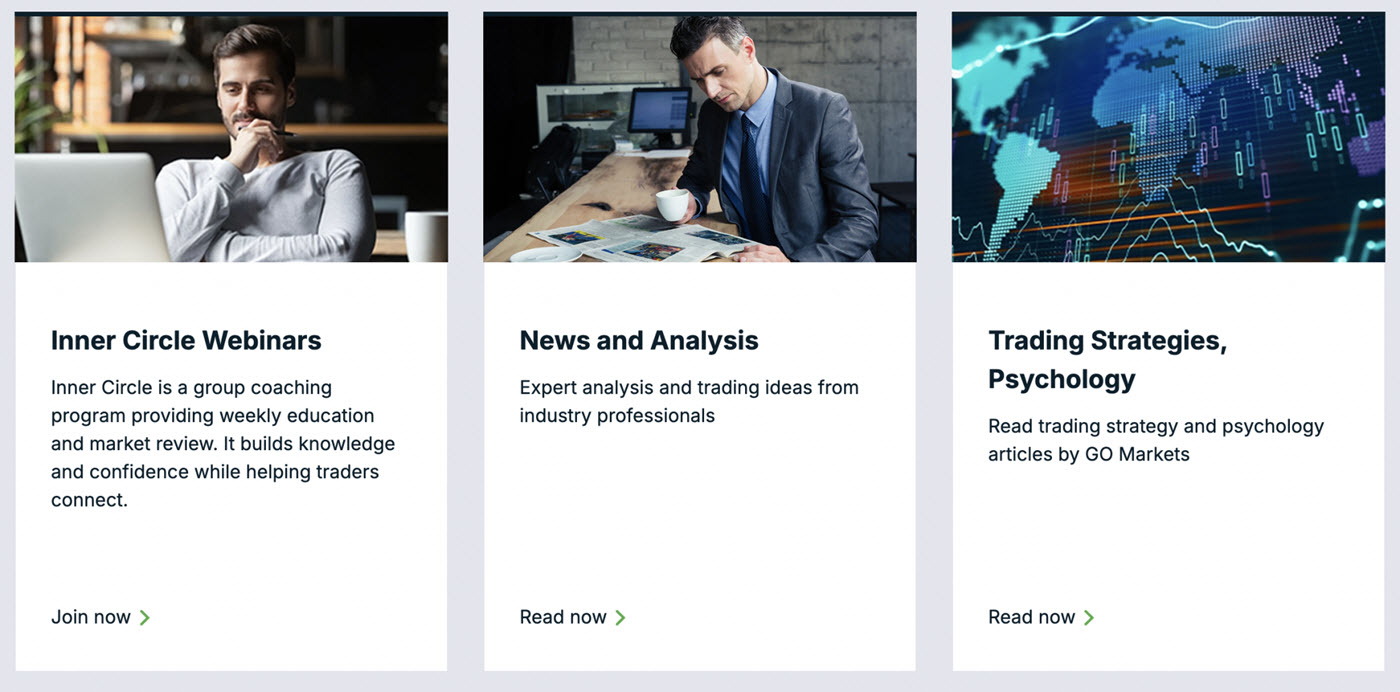

GO Markets offers a comprehensive Education Hub that is both well-structured and highly accessible.

It offers a range of resources, including beginner courses, webinars, podcasts, trading guides, and video tutorials, covering everything from platform basics to advanced trading psychology.

The inclusion of weekly live coaching sessions and market insights provides real-time learning opportunities, genuinely enhancing the user experience.

Even compared to larger brokers like IG or Interactive Brokers, GO Markets clearly prioritizes making education accessible, focusing on step-by-step guidance rather than just providing extensive, raw data.

While it might not offer the same depth in advanced research as some top-tier platforms, its strength lies in its interactive approach and consistently updated content.

For instance, I find the group coaching and regular live events to be invaluable for building confidence and applying new strategies.The educational materials are also well-organized and supportive for both new and intermediate traders.

| GO Markets | Interactive Brokers | FOREX.com | |

|---|---|---|---|

| Education Rating | |||

| Visit | Visit | Visit | Visit |

| Review | Review | Review | Review |

Customer Support

GO Markets offers multilingual customer support through multiple channels, including live chat, email, and phone (international number only, and no callback option), providing you with the flexibility to choose your preferred method of contact.

The support team is available 24/5 (and in some regions or branches, even 24/7), ensuring timely assistance across time zones.

In my experience interacting with customer service, live chat is high-speed and effective – I receive clear, relevant answers to technical and account-related questions, often within a few minutes and even on a Sunday.I also appreciate that the support staff occasionally solicited feedback on the interaction, showing a real commitment to service quality.

Compared to other brokers, GO Markets stands out with its quick response times, especially for live chat and email. Based on our tests, issues are resolved promptly, and replies are typically detailed and actionable.

However, we did notice that phone support can be hit or miss – sometimes our calls were disconnected, and there were occasional difficulties reaching an agent, which can be frustrating when dealing with urgent matters.

This is an area where some top-tier competitors, such as IC Markets and Pepperstone, may offer more consistent phone support.

GO Markets does not yet have dedicated user forums or internal communities for peer support, unlike a few global brokers that foster trader discussions. But it compensates with extensive FAQs, which are genuinely helpful for common platform or technical questions.

A unique aspect of GO Markets’ customer support is its QuickSupport feature, which leverages TeamViewer technology for remote assistance.

Suppose you’re facing a technical issue on your trading platform or device. In that case, GO Markets’ support staff can, with your permission, remotely access your screen to troubleshoot problems directly as you watch.

All that’s required is downloading the TeamViewer QuickSupport app and providing your one-time ID and password to the support team each time you need help.

From my experience, this approach is a significant advantage for resolving complex issues, such as platform errors or configuration problems, far more efficiently than by phone or email.

Knowing that a technician can securely view or control my screen (with my explicit consent every session) gave me confidence that problems wouldn’t drag out over multiple messages or calls.

This isn’t something every broker offers, and it sets GO Markets apart by providing hands-on, fast, and secure support with minimal hassle for the client.

| GO Markets | Interactive Brokers | FOREX.com | |

|---|---|---|---|

| Support Rating | |||

| Visit | Visit | Visit | Visit |

| Review | Review | Review | Review |

Should You Day Trade With GO Markets?

GO Markets is a solid choice for many day traders, combining strong regulation, especially in Australia and Europe, reliable customer support, and a well-supported suite of platforms.

Its fee structure is transparent and competitive, offering commission-free and low-commission options, while deposit and withdrawal processes are generally smooth.

Educational resources and demo accounts make it approachable for beginners, and the broad but not exhaustive asset list should satisfy most short-term trading strategies amongst retail investors.

However, if you seek access to thousands of physical stocks or the most in-depth market research, you may find larger, global brokers more suitable.

FAQ

Is GO Markets Legit Or A Scam?

Based on our assessment, GO Markets is a legitimate and well-regulated broker, licensed by reputable authorities like ASIC and CySEC.

It has been operating since 2006 and adheres to standard practices, including client fund segregation, audited financials, and adherence to strict conduct standards – factors that support its legitimacy.

If you’re considering it, verify you’re on the official domain, and test small deposits before scaling up.

Is GO Markets Suitable For Beginners?

GO Markets can be a solid choice for beginners thanks to its wide selection of platforms, low minimum deposit and withdrawals, and access to copy trading tools like MetaTrader Copy and cTrader Copy.

It also offers excellent educational resources, including webinars and market analysis, which help build foundational knowledge.

However, support for beginners isn’t as structured or in-depth as what some larger brokers offer, and there’s no tiered learning path.

Best Alternatives to GO Markets

Compare GO Markets with the best similar brokers that accept traders from your location.

- Interactive Brokers – Interactive Brokers (IBKR) is a premier brokerage, providing access to 150 markets in 33 countries, along with a suite of comprehensive investment services. With over 40 years of experience, this Nasdaq-listed firm adheres to stringent regulations by the SEC, FCA, CIRO, and SFC, amongst others, and is one of the most trusted brokers for trading around the globe.

- FOREX.com – Founded in 1999, FOREX.com is now part of StoneX, a financial services organization serving over one million customers worldwide. Regulated in the US, UK, EU, Australia and beyond, the broker offers thousands of markets, not just forex, and provides excellent pricing on cutting-edge platforms.

GO Markets Comparison Table

| GO Markets | Interactive Brokers | FOREX.com | |

|---|---|---|---|

| Rating | 4.6 | 4.3 | 4.5 |

| Markets | CFDs, Forex, Stocks, Indices, Commodities, Bonds, ETFs, Crypto | Stocks, Options, Futures, Forex, Funds, Bonds, ETFs, Mutual Funds, Cryptocurrencies | Forex, Futures and Options on Metals, Energies, Commodities, Indices, Bonds, Crypto |

| Demo Account | Yes | Yes | Yes |

| Minimum Deposit | $0 | $0 | $100 |

| Minimum Trade | 0.01 Lots | $100 | 0.01 Lots |

| Regulators | ASIC, CySEC, FSC, FSA | FCA, SEC, FINRA, CFTC, CBI, CIRO, SFC, MAS, MNB, FINMA, AFM | NFA, CFTC |

| Bonus | 50% Trading Bonus: Up To $7,500 Credit | – | VIP status with up to 10k+ in rebates – T&Cs apply. |

| Platforms | GO TradeX™, MT4, MT5, cTrader, TradingView | Trader Workstation (TWS), IBKR Desktop, GlobalTrader, Mobile, Client Portal, AlgoTrader, OmniTrader, TradingView, eSignal, TradingCentral, ProRealTime, Quantower | WebTrader, Mobile, MT4, MT5, TradingView |

| Leverage | 1:500 | 1:50 | 1:50 |

| Payment Methods | 7 | 6 | 9 |

| Visit | – | Visit | Visit |

| Review | – | Interactive Brokers Review |

FOREX.com Review |

Compare Trading Instruments

Compare the markets and instruments offered by GO Markets and its competitors. Please note, some markets may only be available via CFDs or other derivatives.

| GO Markets | Interactive Brokers | FOREX.com | |

|---|---|---|---|

| CFD | Yes | Yes | No |

| Forex | Yes | Yes | Yes |

| Stocks | Yes | Yes | Yes |

| Commodities | Yes | Yes | Yes |

| Oil | Yes | No | Yes |

| Gold | Yes | Yes | Yes |

| Copper | Yes | No | No |

| Silver | Yes | No | Yes |

| Corn | No | No | No |

| Crypto | Yes | Yes | No |

| Futures | Yes | Yes | Yes |

| Options | No | Yes | Yes |

| ETFs | Yes | Yes | No |

| Bonds | Yes | Yes | No |

| Warrants | No | Yes | No |

| Spreadbetting | No | No | No |

| Volatility Index | Yes | No | No |

GO Markets vs Other Brokers

Compare GO Markets with any other broker by selecting the other broker below.

The most popular GO Markets comparisons:

Customer Reviews

4 / 5This average customer rating is based on 1 GO Markets customer reviews submitted by our visitors.

If you have traded with GO Markets we would really like to know about your experience - please submit your own review. Thank you.

Submit Your Own Review of GO Markets

Article Sources

- GO Markets Website

- GO Markets Pty Limited - ASIC License

- GO Markets Ltd - CySEC License

- GO Markets International Ltd - FSA License

- GO Markets Pty Ltd (MU) - FSC License

The writing and editorial team at DayTrading.com use credible sources to support their work. These include government agencies, white papers, research institutes, and engagement with industry professionals. Content is written free from bias and is fact-checked where appropriate. Learn more about why you can trust DayTrading.com

As someone who’s been trading forex and indices for over six years, GO Markets has been a reliable staple in my broker lineup. The execution speed on MT4 is excellent, and I’ve rarely experienced slippage (even around news events). I especially like their raw spread account with tight EUR/USD spreads and reasonable commission per lot. Their ASIC regulation gives me peace of mind too, especially compared to some of the offshore names I’ve used in the past.

The one area I think they could improve is the client portal and general design (it feels a bit dated). Also the range of CFDs is solid but not the best if you’re looking for more exotic FX pairs or crypto.