Safest Brokers 2026

Whether you’re a beginner or an experienced trader seeking a new platform, choosing a trustworthy broker will help safeguard your trading experience and funds.

Discover our selection of the safest brokers, based on our first-hand experience trading at these platforms using real money. We also explain how to avoid untrustworthy brokers.

No broker can ever be fully ‘safe’. Unforeseen events can affect a firm’s viability. Trading is risky.

List Of Safest Brokers For 2026

Here are our 5 most trusted brokers following our analysis and direct experience with their platforms:

- IG: Excellent charting platform. Award-winning app. Top-tier research.

- Plus500: Beginner-friendly software. Reliable support. Rebates for active traders.

- eToro: First-class social trading network. Commission-free trading. TradingView charts.

- IC Markets: Low fees for day traders. Great charting package. 24/7 customer support.

- Trading 212: Fantastic mobile app. Beginner-friendly pricing. Fast account opening.

Comparison of Safest Trading Brokers

| IG | Plus500 | eToro | IC Markets | Trading 212 | |

|---|---|---|---|---|---|

| Trust Rating | 4.9/5 | 4.9/5 | 4.8/5 | 4.7/5 | 4/5 |

| Regulatory Licenses | 13 | 9 | 8 | 3 | 3 |

| Publicly Traded | Yes | Yes | No | No | No |

| Years of Experience | 50+ | 15+ | 17+ | 17+ | 20+ |

| Minimum Deposit | $0 | $100 | $50 | $200 | $1 |

1. IG

Why We Picked It

Year after year, IG earns our vote as the safest broker, boasting a 50-year track record as an industry leader.

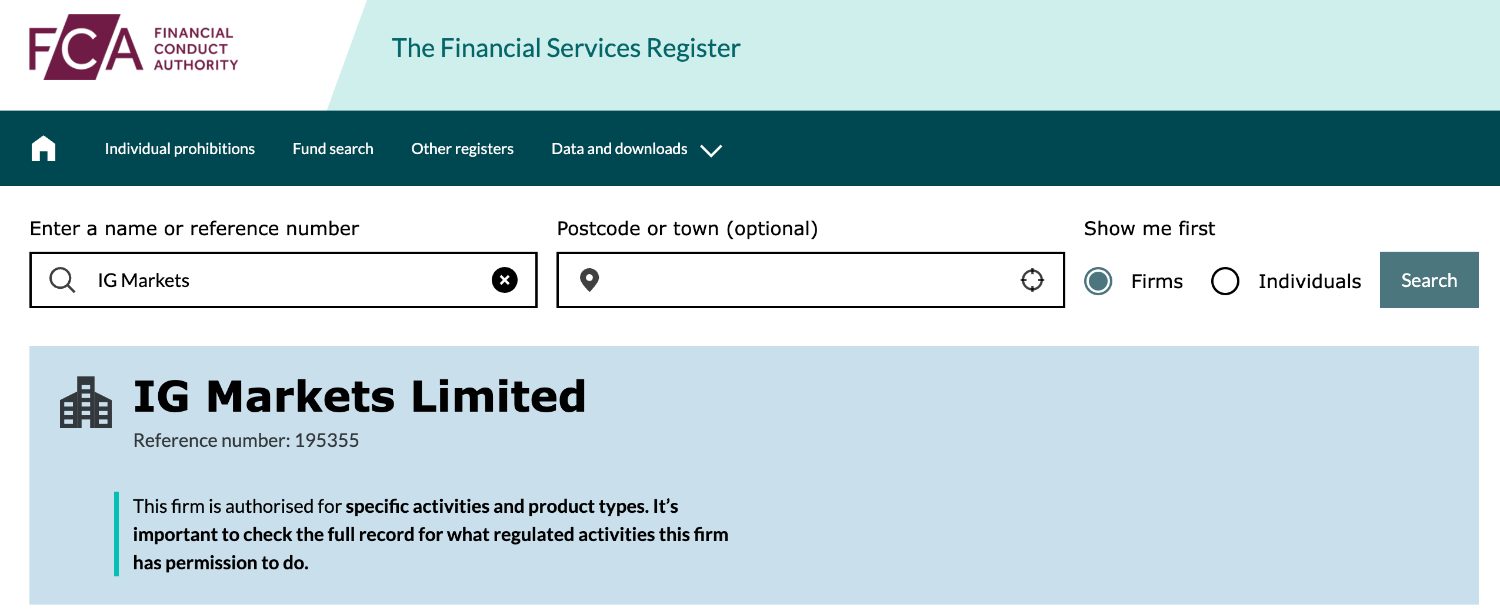

Operating under strict regulatory oversight in multiple jurisdictions, including the CFTC in the US, the FCA in the UK, and ASIC in Australia, IG offers a transparent trading environment.

IG Group Holdings Plc, its publicly traded parent company on the London Stock Exchange (LSE), also ensures financial transparency.

Importantly, we’ve traded with IG using real money and have not encountered any withdrawal issues.

Pros

- The platforms from IG consistently meet the needs of traders at all levels, providing sophisticated charting tools and real-time market data essential for day trading.

- Our use of the IG app reveals a reliable mobile trading experience featuring a sleek design, earning it the Runner-Up position in our Best Trading App award in recent years.

- IG continues to impress with a rich array of compelling educational resources, with webinars, articles, and analysis, supporting new traders in navigating the markets.

Cons

- Although there is negative balance protection in the UK and EU, there is no account protection or guaranteed stop losses for US traders.

- Beginners may find IG’s fee structure confusing, featuring various fees for different types of trades and products, possibly resulting in unexpected charges.

- Our tests show that stock and CFD spreads lag behind the industry’s cheapest brokers, such as CMC Markets.

2. Plus500

Why We Picked It

Chosen for its exemplary track record since 2008 and a user base exceeding 25 million across 50+ countries, Plus500 excels as a trusted trading broker.

With licenses from respected regulators like the FCA, ASIC, and CySEC, and a listing on the London Stock Exchange, Plus500 is a legitimate brokerage with an excellent reputation.

Importantly, we’ve traded with Plus500 using actual money and have not encountered any withdrawal issues.

Pros

- The platform delivers an excellent all-round trading experience with an intuitive interface for beginners and a strong charting package for seasoned traders with 100+ technical indicators.

- Plus500’s customer support team are available 24/7 via email, telephone, live chat, and WhatsApp and consistently deliver reliable assistance in our experience.

- Weekly fee rebates are a compelling feature that can help reduce costs for active day traders executing a high volume of trades.

Cons

- Experienced day traders seeking familiarity may find Plus500’s lack of support for MetaTrader or cTrader platforms a deterrent.

- Beginners may face a steeper learning curve due to the limited educational resources compared to alternatives like eToro.

- Plus500’s research and analysis tools are limited compared to alternatives like IG, making it harder to find opportunities.

3. eToro

Why We Picked It

eToro is a top-rated multi-asset platform launched in 2007, and has earned its place as one of our safest brokers with over 30 million users and a string of industry awards.

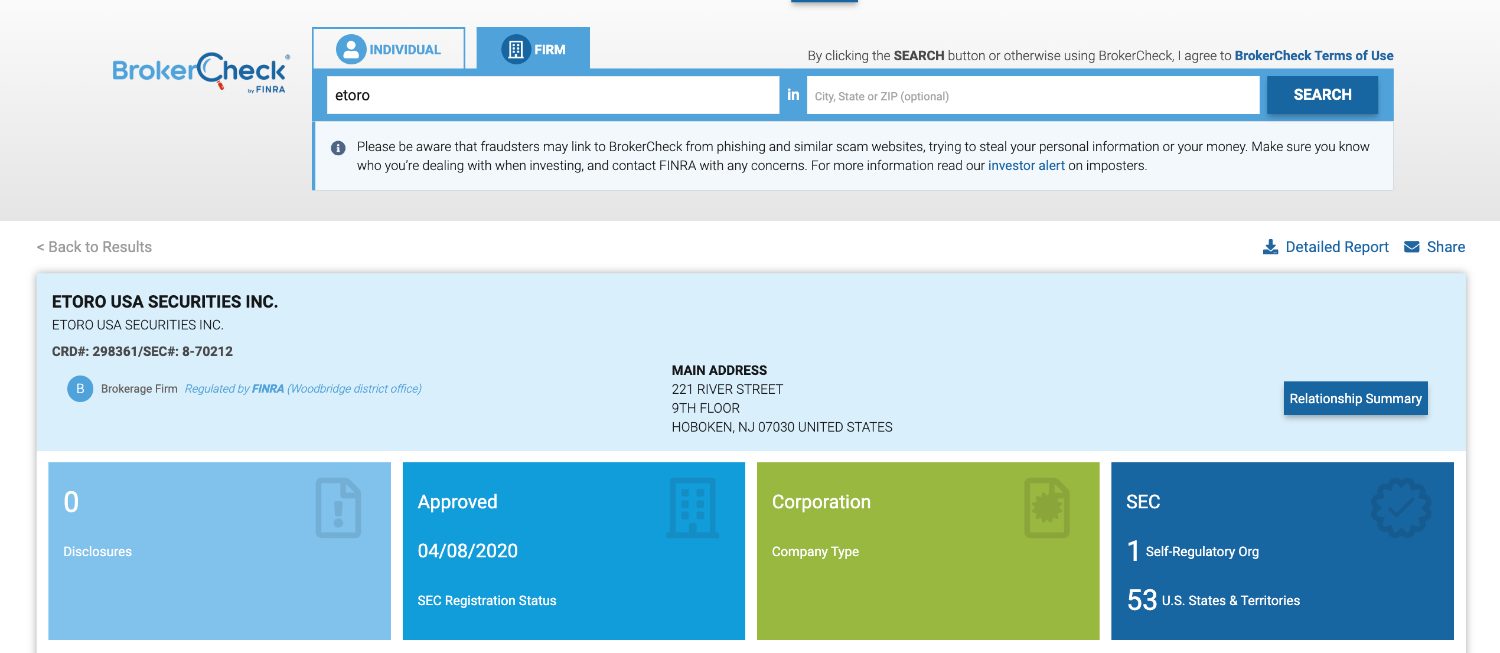

The broker’s commitment to security, compliance with industry standards, and authorization from top-tier regulatory authorities, including the FCA, CySEC, and ASIC, further solidify eToro as one of the safest trading platforms.

Importantly, we’ve traded with eToro using actual money and have not encountered any withdrawal issues.

Pros

- The copy trading app offers a best-in-class social investing environment, featuring an interactive social feed and community chat that’s perfect for aspiring traders.

- The broker’s full trading package has clearly been designed with beginners in mind, from commission-free stock trading to a low minimum deposit and an unlimited demo account.

- Powered by TradingView, the charts on the platform offer robust technical analysis capabilities for serious day traders, featuring 9 chart types and over 100 indicators.

Cons

- The lack of guaranteed stop-loss orders is a notable drawback, particularly for beginners who could benefit from this risk management feature.

- Traders with less capital may be impacted by the $30 minimum withdrawal amount and $5 fee, affecting their ability to manage and access funds efficiently.

- Experienced forex traders may consider the absence of additional charting platforms like MetaTrader 4 a deal-breaker.

4. IC Markets

Why We Picked It

With over 180,000 clients across 200 countries, the heavily regulated brand, licensed by the ASIC since 2009, is renowned as one of the most respected brokers for day traders.

The additional layer of protection provided by membership in the Financial Ombudsman Service offers extra peace of mind.

Importantly, we’ve traded with IC Markets using actual money and have not encountered any withdrawal issues.

Pros

- Active clients benefit from low fees, featuring spreads as low as 0.0 pips and zero commissions, coupled with forex rebates for high-volume traders.

- Our extensive use of the platforms highlights powerful charting packages, offering 70+ in-built indicators and access to 270+ trading bots in cTrader.

- IC Markets boasts responsive 24/7 customer support based on tests, coupled with an extensive help center, providing traders with comprehensive assistance should they encounter any issues.

Cons

- IC Markets trails alternatives like IG in terms of the breadth of market research and the quality of its educational content, reducing its appeal for beginners.

- The broker lacks a proprietary trading app, which is a notable disadvantage compared to firms like eToro and Trading 212.

- There is no two-factor authentication, limiting extra account security measures.

5. Trading 212

Why We Picked It

Trading 212 has built an excellent reputation over its 20+ years in the online trading industry.

It’s authorized by first-rate regulators, including the FCA in the UK and CySEC in Europe, and boasts a very strong 4.6/5 rating on TrustPilot, underscoring user satisfaction.

Importantly, we’ve traded with Trading 212 using actual money and have not encountered any withdrawal issues, with payments normally processed within two days.

Pros

- Trading 212 offers a superb mobile app with a custom design that we love. It offers easy navigation and rich features that provide a seamless, customizable trading experience.

- A highlight of Trading 212 is its zero-commission trading model which will appeal to beginners. Clients trade stocks, ETFs, and various financial assets without the usual brokerage costs.

- Trading 212 stands out with its fast sign-up and verification process which took us less than 24 hours. It can also be completed directly through the app.

Cons

- Seasoned day traders seeking advanced technical analysis tools will view Trading 212’s charting capabilities as basic, especially compared to IG.

- Trading 212 doesn’t support algorithmic trading or integrate with third-party applications like MT4, another drawback for advanced traders, and features available at IC Markets.

- The sudden hike in margin requirements in 2020, with limited warning, eroded user confidence. Leverage on stock CFDs dropped to 1:2, exposing clients to the risk of forced position closures if they lacked sufficient capital.

How Did We Choose The Safest Brokers?

To compile a list of the safest brokers we used the following benchmarks:

- Brokers had to achieve at least 4/5 in our Regulation & Trust Rating.

- Brokers had to hold licenses with at least 2 highly regarded regulators.

- Brokers had to have at least 15 years of experience in the online trading industry.

- Brokers had to be used by at least one of our team with real money and no withdrawal issues.

- Brokers had to have at least 4/5 on TrustPilot, taking into account other traders’ experiences.

Why Is Choosing A Trustworthy Broker Important?

There are three key reasons why you should choose a trusted trading broker:

- The safest trading brokers adhere to stringent regulatory standards set by recognized authorities, helping to ensure that they operate with transparency and integrity to protect the interests of traders. Among the most stringent regulators are the US Securities & Exchange Commission (SEC), the UK Financial Conduct Authority (FCA), and the Australian Securities & Investments Commission (ASIC).

- Trustworthy trading brokers prioritize the security of their clients’ funds and information, including the segregation of traders’ funds from company capital and providing access to compensation schemes in the event of broker insolvency. The UK Financial Services Compensation Scheme (FSCS), for example, covers British traders up to £85,000. The most trusted brokers will also ensure that your personal information is solely used for trading purposes and only when necessary.

- The safest brokers provide transparent information about their pricing, disclosing all relevant costs associated with trading, including spreads, commissions, and overnight financing charges. This transparency allows for informed decision-making, protecting you from hidden costs that dodgy brokers might impose.

How To Avoid Untrustworthy Brokers

Stay vigilant and conduct thorough research before choosing a broker to mitigate the risk of falling victim to scams.

Our many years in the industry and personal trading experience have taught us that 10 telltale signs can help you recognize unsafe brokers:

- Lack Of Regulation: Legitimate brokers are regulated by recognized financial authorities, such as the SEC, FCA, ASIC and CySEC. If a brokerage operates without proper regulation or provides vague information about its regulatory status, it could be a red flag.

- Unrealistic Promises: Be wary of brokers promising guaranteed profits, especially if the returns seem too good to be true. Scam brokers often use overly optimistic projections to lure unsuspecting traders.

- Poor Transparency: A reputable broker is transparent about its fees, spreads, and trading conditions. If a brokerage is vague or reluctant to provide clear information about costs, it might be concealing hidden fees.

- Unresponsive Customer Support: Untrustworthy brokers often have unresponsive or inadequate customer support. If you encounter difficulties reaching the support team or receive generic responses, it may indicate a lack of commitment to client satisfaction.

- High-Pressure Tactics: Dodgy brokers may use aggressive sales tactics, pushing you to deposit more funds quickly. Legitimate brokers respect your decision-making process and do not employ high-pressure strategies.

- Negative Reviews & Complaints: Research the broker thoroughly, and pay attention to reviews from other traders. Numerous negative reviews or complaints about withdrawal issues and unfulfilled promises should raise concerns.

- Undefined Ownership & Background: Legitimate brokers provide clear information about their ownership, management, and history. If a broker’s background is unclear or its ownership is difficult to trace, it may be a sign of an illegitimate and unsafe operation.

- Lack Of Security Measures: Untrustworthy brokers may neglect essential security measures. Ensure that the broker uses two-factor authentication (2FA), alongside secure and encrypted connections, protecting your personal and financial information.

- Fake Regulatory Claims: Some scam brokers may display false regulatory affiliations or certifications. Verify the broker’s regulatory status independently through official regulatory websites.

- Withdrawal Issues & Delays: Unsafe brokers often create obstacles when it comes to withdrawing funds. If you encounter frequent delays, stringent withdrawal conditions, or face difficulties accessing your money without plausible explanations, it could be a warning sign.

Bottom Line

Opting for a safe, trustworthy broker is paramount for a secure and transparent trading experience. Backed by regulatory compliance, transparent pricing, robust security measures, and a positive reputation, a reputable broker safeguards your funds so you can concentrate on the complexities of trading the financial markets.

Use our list of the safest, most trusted brokers to trade with peace of mind.

FAQ

How Can I Tell If A Broker Is Safe Or Not?

You can assess a broker’s trustworthiness by checking its regulatory compliance, ensuring it is licensed by reputable financial authorities, and reviewing feedback from other traders to gauge its reputation and reliability within the trading community.

Additionally, transparent communication about fees, security measures, and a history of timely fund withdrawals are indicative of a safe broker.

Every broker we recommend in this guide we’ve actually traded at with no withdrawal issues.

Should I Choose A Regulated Broker?

Choosing a regulated broker is important as it ensures your funds are held securely, follows transparent and ethical practices, and provides a regulatory framework that safeguards your interests, reducing the risk of fraud or malpractices in the financial markets.

Regulation instills confidence in the broker’s operations, offering you a higher level of security and reliability in your trading experience.

Every broker we recommend in this guide is authorized by multiple top-tier regulators.

No broker can ever be fully ‘safe’. Unforeseen events can affect a firm’s viability. Trading is risky.