Australian Securities and Investments Commission (ASIC) Brokers 2026

Are you an Aussie looking for a secure online trading environment? If so, choosing a broker regulated by the Australian Securities & Investments Commission (ASIC) is a vital first step.

Since launching in 1991, it’s proven a robust financial regulator, increasingly holding brokers to a high standard, adding an Investor Alert List, and securing ‘green tier’ status in DayTrading.com’s Regulation & Trust Rating.

Day trade with an ASIC-regulated broker and you can expect:

- Segregation of client funds through firms like Commonwealth Bank of Australia to prevent brokerage misuse.

- Risk transparency for informed decision-making, including the percentage of losing clients CFD trading.

- Execution transparency for competitive and fair deal execution that’s essential for short-term trading.

- Negative balance protection to prevent losses for retail investors beyond their initial investment.

- Strict leverage limits to minimize risk, notably 1:30 for major forex pairs like AUD/USD.

- Dispute resolution through the Australian Financial Complaints Authority (AFCA).

Best ASIC Brokers

Since evaluating AvaTrade, our first ASIC-regulated broker in 2017, we’ve personally tested 140 trading platforms, and these 6 stand out as the superior options if you want an ASIC broker in February 2026:

-

1

Moomoo

Moomoo -

2

xChief

xChief -

3

Focus Markets

Focus Markets -

4

IC Markets

IC Markets -

5

AvaTrade

AvaTrade -

6

Pepperstone75-95% of retail investor accounts lose money when trading CFDs

Pepperstone75-95% of retail investor accounts lose money when trading CFDs

Here is a short summary of why we think each broker belongs in this top list:

- Moomoo - Moomoo is an SEC-regulated app-based investment platform that offers a straightforward and affordable way to invest in Chinese, Hong Kong, Singaporean, Australian and US stocks, ETFs and other assets. Margin trading is available and the brand offers a zero-deposit account as well as several bonuses.

- xChief - xChief is a foreign exchange and CFD broker, established in 2014. The company is based offshore and registered with the VFSC and FMA. Users can choose between a wide selection of accounts and base currencies, making ForexChief accessible to global traders. The brand also stands out for its no deposit bonus and fee rebates for high-volume traders.

- Focus Markets - Established in 2019, Focus Markets is an Australian-based MetaTrader broker offering access to over 1,000 tradable instruments, including forex, commodities, indices, stocks, and a particularly large selection of crypto derivatives.

- IC Markets - IC Markets is a globally recognized forex and CFD broker known for its excellent pricing, comprehensive range of trading instruments, and premium trading technology. Founded in 2007 and headquartered in Australia, the brokerage is regulated by the ASIC, CySEC and FSA, and has attracted more than 180,000 clients from over 200 countries.

- AvaTrade - Established in 2006, AvaTrade is a leading forex and CFD broker trusted by over 400,000 traders. Operating under regulation in 9 jurisdictions, AvaTrade processes an impressive 2+ million trades each month. Through like MT4, MT5, and its proprietary WebTrader, the broker provides a growing selection of 1,250+ instruments. Whether it’s CFDs, AvaOptions, or the more recent AvaFutures, short-term traders at all levels will find opportunities. With terrific education and 24/5 multilingual customer support, AvaTrade delivers the complete trading experience.

- Pepperstone - Established in Australia in 2010, Pepperstone is a top-rated forex and CFD broker with over 400,000 clients worldwide. It offers access to 1,300+ instruments on leading platforms MT4, MT5, cTrader and TradingView, maintaining low, transparent fees. Pepperstone is also regulated by trusted authorities like the FCA, ASIC, and CySEC, ensuring a secure environment for day traders at all levels.

ASIC Brokers Comparison

| Broker | ASIC Regulated | AUD Account | Minimum Deposit | Markets | Platforms | Leverage |

|---|---|---|---|---|---|---|

| Moomoo | ✔ | - | $0 | Stocks, Options, ETFs, ADRs, OTCs | Desktop Platform, Mobile App | 1:2 |

| xChief | ✔ | - | $10 | CFDs, Forex, Metals, Commodities, Stocks, Indices | MT4, MT5 | 1:1000 |

| Focus Markets | ✔ | ✔ | $100 | CFDs, Forex, Stocks, Indices, Commodities, Crypto | MT5 | 1:500 |

| IC Markets | ✔ | ✔ | $200 | CFDs, Forex, Stocks, Indices, Commodities, Bonds, Futures, Crypto | MT4, MT5, cTrader, TradingView, TradingCentral, DupliTrade, Quantower | 1:30 (ASIC & CySEC), 1:500 (FSA), 1:1000 (Global) |

| AvaTrade | ✔ | ✔ | $100 | CFDs, Forex, Stocks, Indices, Commodities, ETFs, Bonds, Crypto, Spread Betting, Futures | WebTrader, AvaTradeGO, AvaOptions, AvaFutures, MT4, MT5, AlgoTrader, TradingView, TradingCentral, DupliTrade | 1:30 (Retail) 1:400 (Pro) |

| Pepperstone | ✔ | ✔ | $0 | CFDs, Forex, Currency Indices, Stocks, Indices, Commodities, ETFs, Crypto, Spread Betting | MT4, MT5, cTrader, TradingView, AutoChartist, DupliTrade, Quantower | 1:30 (Retail), 1:500 (Pro) |

Moomoo

"Moomoo remains an excellent choice for new and intermediate stock traders who want to build a diverse investment portfolio. What really stands out is the broker's user-friendly app and the low trading fees."

Jemma Grist, Reviewer

Moomoo Quick Facts

| Demo Account | Yes |

|---|---|

| Instruments | Stocks, Options, ETFs, ADRs, OTCs |

| Regulator | SEC, FINRA, MAS, ASIC, SFC |

| Platforms | Desktop Platform, Mobile App |

| Minimum Deposit | $0 |

| Minimum Trade | $0 |

| Leverage | 1:2 |

| Account Currencies | USD, HKD, SGD |

Pros

- There are reduced options contract fees from $0.65 to $0

- Moomoo is a Member of FINRA and the Securities Investor Protection Corporation (SIPC), adding another level of security for prospective clients

- The ‘Moomoo Token’ generates dynamic passwords for transaction security - a unique and helpful safety feature

Cons

- It's a shame that there is no 2 factor authentication (2FA), despite the other security features on offer

- There is no negative balance protection, which is a common safety feature at top-tier-regulated brokers

- There is no phone or live chat support - common options at most other brokers

xChief

"xChief continues to prove popular with investors looking to trade highly leveraged CFDs on the popular MetaTrader platforms. The broker's rebate scheme and investment accounts will particularly appeal to seasoned traders. However, the lack of top-tier regulatory oversight is a major drawback."

William Berg, Reviewer

xChief Quick Facts

| Demo Account | Yes |

|---|---|

| Instruments | CFDs, Forex, Metals, Commodities, Stocks, Indices |

| Regulator | ASIC |

| Platforms | MT4, MT5 |

| Minimum Deposit | $10 |

| Minimum Trade | 0.01 Lots |

| Leverage | 1:1000 |

| Account Currencies | USD, EUR, GBP, JPY, CHF |

Pros

- The low minimum deposit of $10 will appeal to beginners, as well as the beginners’ guides in the Library

- The broker offers a turnover rebate scheme geared towards active investors, as well as trading credits and several other occasional bonuses

- xChief delivers a high-quality day trading environment via the MT4 and MT5 platforms, with market-leading charts, indicators and tools

Cons

- The broker trails competitors when it comes to research tools and educational resources

- The total range of 150+ assets is much lower than most competitors who typically offer hundreds

- The Classic+ and Cent accounts provide access to fewer instruments than the other account types, at 50+ and 35+, respectively

Focus Markets

"Focus Markets is perfect for experienced traders familiar with MetaTrader 5, offering flexible crypto transactions (USDT and BTC) and access to over 90 cryptocurrencies for seamless speculation, deposits, and withdrawals."

Christian Harris, Reviewer

Focus Markets Quick Facts

| Demo Account | Yes |

|---|---|

| Instruments | CFDs, Forex, Stocks, Indices, Commodities, Crypto |

| Regulator | ASIC, SVGFSA |

| Platforms | MT5 |

| Minimum Deposit | $100 |

| Minimum Trade | 0.01 Lots |

| Leverage | 1:500 |

| Account Currencies | USD, EUR, GBP, CAD, AUD, NZD, JPY, SGD |

Pros

- While its meagre four commodities won’t meet the needs of some serious traders interested in softs and metals, Focus Markets offers a huge suite of 90+ cryptos, providing short-term opportunities on high-reward, high-risk assets.

- Focus Markets’ MT5 platform delivered fast, seamless trade execution during testing with advanced charting, multiple timeframes, and useful tools like Depth of Market (DOM). Its clean interface made navigation easy, while clear risk/reward ratios ensures precise trading.

- Focus Markets is regulated by ASIC – one of the most respected regulatory bodies in the financial industry with robust safeguards like negative balance protection, ensuring you can’t lose more than your balance in volatile markets.

Cons

- Focus Markets’ 24/5 support lacks direct phone help and unresponsive live chat, while email replies took a full business day during our latest tests. This slow support is a major drawback for active traders who need quick resolutions.

- A significant drawback of Focus Markets is the lack of platform variety. It only support MT5, excluding popular platforms like MT4, cTrader, and TradingView, plus it hasn't developed its own software that could better meet the needs of beginners.

- Regulatory protection is a location lottery at Focus Markets – Australian traders benefit from strong ASIC oversight, but those using the SVGFSA-registered entity face limited recourse options in disputes.

IC Markets

"IC Markets offers superior pricing, exceptionally fast execution and seamless deposits. The introduction of advanced charting platforms, notably TradingView, and the Raw Trader Plus account, ensures it remains a top choice for intermediate to advanced day traders."

Christian Harris, Reviewer

IC Markets Quick Facts

| Demo Account | Yes |

|---|---|

| Instruments | CFDs, Forex, Stocks, Indices, Commodities, Bonds, Futures, Crypto |

| Regulator | ASIC, CySEC, CMA, FSA |

| Platforms | MT4, MT5, cTrader, TradingView, TradingCentral, DupliTrade, Quantower |

| Minimum Deposit | $200 |

| Minimum Trade | 0.01 Lots |

| Leverage | 1:30 (ASIC & CySEC), 1:500 (FSA), 1:1000 (Global) |

| Account Currencies | USD, EUR, GBP, CAD, AUD, NZD, JPY, CHF, HKD, SGD |

Pros

- IC Markets secured DayTrading.com's 'Best MT4/MT5 Broker' in 2025 for its seamless, industry-leading MetaTrader integration, refined over years to maximize the platform experience.

- You have access to over 2,250 CFDs across various markets, including forex, commodities, indices, stocks, bonds, and cryptocurrencies, allowing for diversified trading strategies.

- As a tightly regulated and widely respected broker, IC Markets prioritizes client security and transparency, helping to ensure a reliable trading experience globally.

Cons

- While IC Markets offers a selection of metals and cryptos for trading via CFDs, the range is not as extensive as brokers like eToro, limiting opportunities for traders interested in these asset classes.

- Despite four industry-leading third-party platforms, there is no proprietary software or trading app built with new traders in mind.

- Interest isn't paid on unused cash, an increasingly popular feature found at alternatives like Interactive Brokers.

AvaTrade

"AvaTrade offers active traders everything they need: an intuitive WebTrader, powerful AvaProtect risk management, a smooth 5-minute sign-up process, and dependable support you can rely on in fast-moving markets."

Jemma Grist, Reviewer

AvaTrade Quick Facts

| Demo Account | Yes |

|---|---|

| Instruments | CFDs, Forex, Stocks, Indices, Commodities, ETFs, Bonds, Crypto, Spread Betting, Futures |

| Regulator | ASIC, CySEC, FSCA, ISA, CBI, JFSA, FSRA, BVI, ADGM, CIRO, AFM |

| Platforms | WebTrader, AvaTradeGO, AvaOptions, AvaFutures, MT4, MT5, AlgoTrader, TradingView, TradingCentral, DupliTrade |

| Minimum Deposit | $100 |

| Minimum Trade | 0.01 Lots |

| Leverage | 1:30 (Retail) 1:400 (Pro) |

| Account Currencies | USD, EUR, GBP, CAD, AUD |

Pros

- Support at AvaTrade performed excellently during testing, with response times of 3 minutes and localized support in major trading jurisdictions, including the UK, Europe and the Middle East.

- Years on, AvaTrade remains one of the few brokers offering a bespoke risk management tool, AvaProtect, that insures losses up to $1M for a fee and is easy to activate on the platform.

- AvaTrade launched AvaFutures to offer low-margin access to global markets, then expanded in 2025 as one of the first brokers to add CME’s Micro Grain Futures, and then later in the year went further by integrating with TradingView.

Cons

- While signing up is a breeze, AvaTrade lacks an ECN account like Pepperstone or IC Markets, which provides the raw spreads and ultra-fast execution many day traders are looking for.

- AvaTrade’s WebTrader has improved, but work is still needed in terms of customizability – frustratingly widgets like market watch and watchlists can’t be hidden, moved, or resized.

- The AvaSocial app is good but not great – the look and feel, plus the navigation between finding strategy providers and account management needs upgrading to rival category leaders like eToro.

Pepperstone

"Pepperstone stands out as a top choice for day trading, offering razor-sharp spreads, ultra-fast execution, and advanced charting platforms for experienced traders. New traders are also welcomed with no minimum deposit, extensive educational resources, and exceptional 24/7 support."

Christian Harris, Reviewer

Pepperstone Quick Facts

| Demo Account | Yes |

|---|---|

| Instruments | CFDs, Forex, Currency Indices, Stocks, Indices, Commodities, ETFs, Crypto, Spread Betting |

| Regulator | FCA, ASIC, CySEC, DFSA, CMA, BaFin, SCB |

| Platforms | MT4, MT5, cTrader, TradingView, AutoChartist, DupliTrade, Quantower |

| Minimum Deposit | $0 |

| Minimum Trade | 0.01 Lots |

| Leverage | 1:30 (Retail), 1:500 (Pro) |

| Account Currencies | USD, EUR, GBP, CAD, AUD, NZD, JPY, CHF, HKD, SGD |

Pros

- Pepperstone boasts impressive execution speeds, averaging around 30ms, facilitating fast order processing and execution that’s ideal for day trading.

- Pepperstone has greatly improved the deposit and withdrawal experience in recent years, adding Apple Pay and Google Pay in 2025, as well as PIX and SPEI for clients in Brazil and Mexico in 2024.

- Pepperstone has scooped multiple DayTrading.com annual awards over the years, most recently 'Best Overall Broker' in 2025 and 'Best Forex Broker' runner up in 2025.

Cons

- Despite enhancements to its range of markets, crypto offerings are relatively limited compared to other brokers who focus on this area, with no option to invest in real coins.

- Pepperstone’s demo accounts are active for only 30 days, which may not be not long enough to familiarize yourself with the different platforms and test trading strategies.

- Pepperstone does not support cTrader Copy, a popular copy trading feature built into the excellent cTrader platform and available at alternatives like IC Markets, though it has introduced an intuitive copy trading app.

Methodology

To pinpoint the top trading platforms regulated by the ASIC, we:

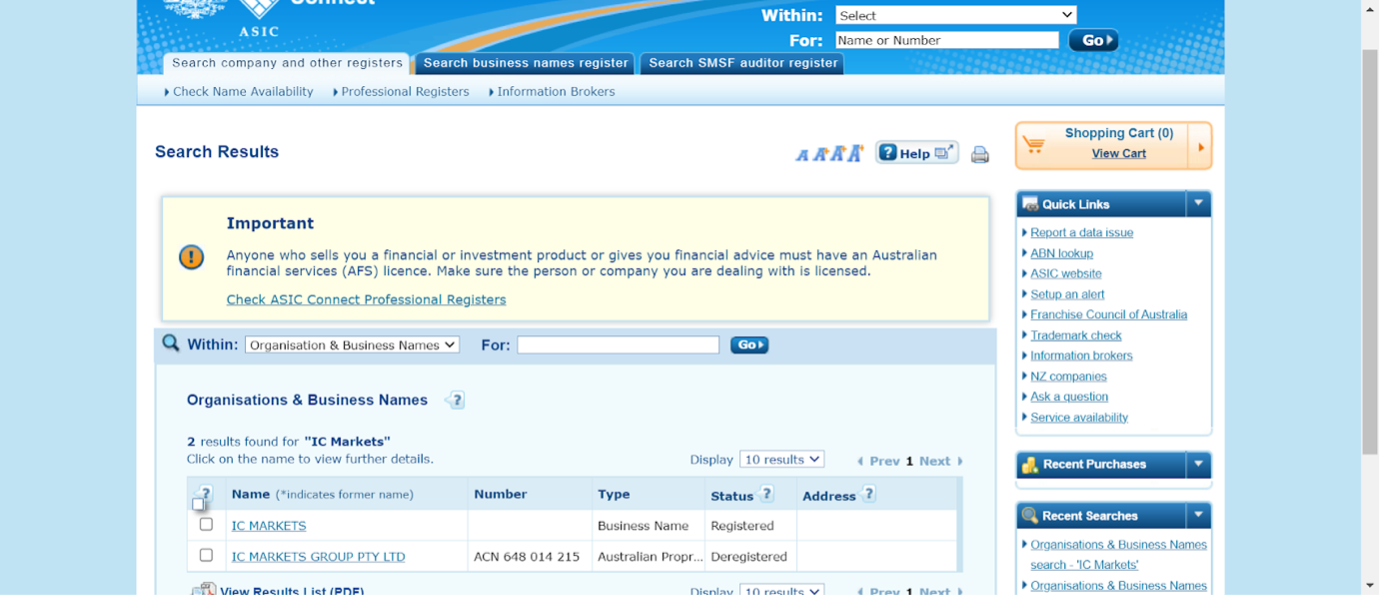

- Took our evolving directory of 140 brokers to find those claiming ASIC authorization.

- Ran their details through ASIC Connect to confirm they are indeed authorized.

- Combined the results with findings from our own tests and 200+ data entries to rank the best ASIC brokers.

How Can I Check If My Broker Is Regulated By ASIC?

To confirm if your brokerage is ASIC-regulated, follow these simple steps:

- Visit the ASIC Connect Website: Go to ASIC Connect and click “Search our registers.”

- Choose the prompt “Search ASIC’s registers”: This option opens a new window which allows you to search specifically for brokers and financial services providers authorized to operate in Australia.

- Identify the brokerage: In the new page/window below enter the broker’s name, company name, or AFS licence number if you have it. This will help you pull up the provider’s details.

- Verify their status and details: Check that the broker’s name matches and that their licence status is “Registered” or “Active.” This indicates they are currently regulated by ASIC. You’ll also see their licence conditions and any disciplinary actions, if applicable.

- Check the details on your broker’s website: A legitimate ASIC-regulated broker will often display their licence number on their website (usually in the footer). Cross-reference this number with the ASIC register to make sure it’s valid and active.

Broker Verification Example

I’ll walk you through how I searched IC Markets.

Established in 2007, IC Markets has a reputation as one of Australia’s longest-serving and most reputable brokers. Still, it only took a few minutes to verify they were ASIC-regulated and immediately delivered peace of mind.

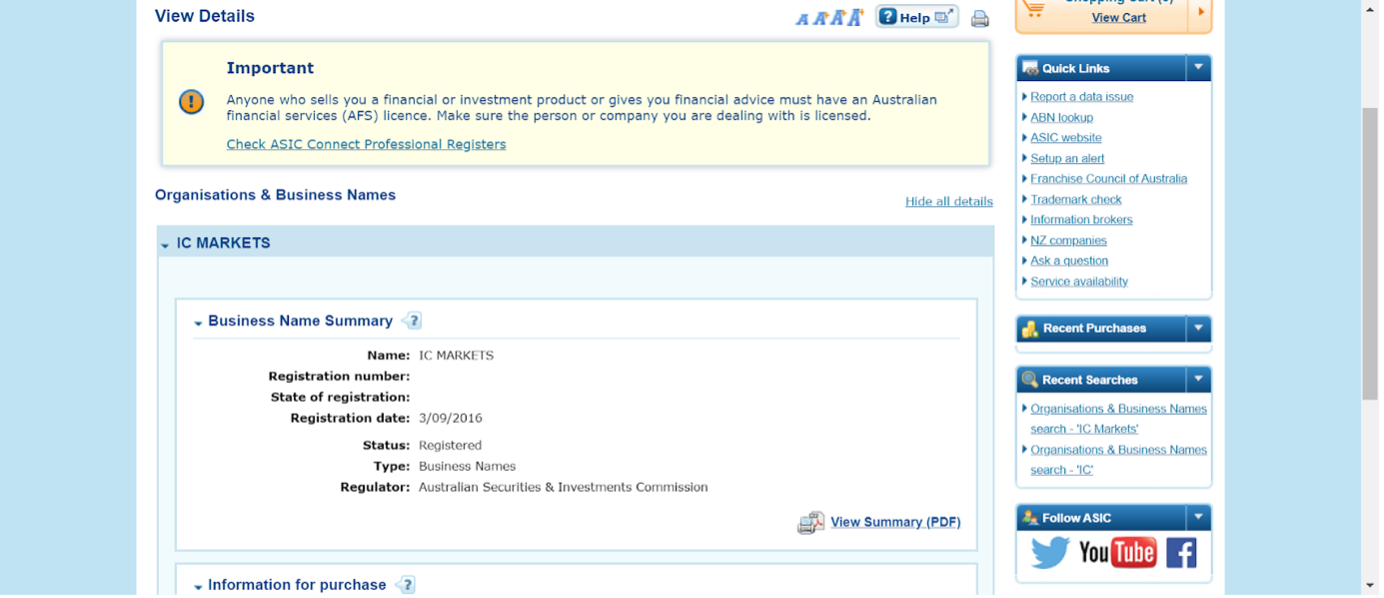

I visited ASIC Connect and clicked “Search our registers”. Then I selected the “Australian Financial Services Licensee” Register to ensure I was definitely searching for financial services providers licensed to operate in Australia.

A new website window opened. I searched for IC Markets by entering “IC Markets” or their legal name, “International Capital Markets Pty Ltd,” into the search bar.

I could have also used their Australian Financial Services (AFS) licence number, which is 335692.

I checked the registration status and saw that International Capital Markets Pty Ltd is registered with ASIC. I verified the licence status to ensure it was “Registered” or “Active,” confirming that ASIC regulates them.

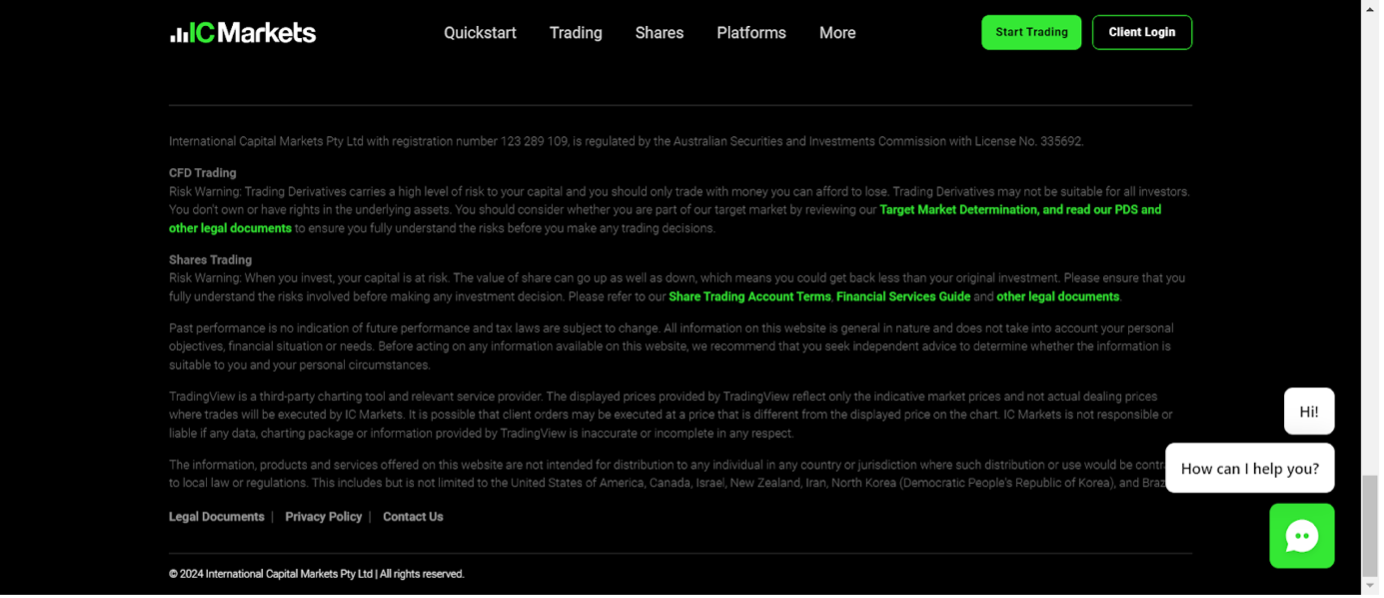

Finally, I cross-checked the Information on IC Markets’ website by scrolling to the footer, where they display their ASIC licence number.

I verified that the number matched the one I found on the ASIC register (335692), ensuring the broker I’m dealing with is indeed the one regulated by ASIC.

What Is The ASIC?

The Australian Securities and Investments Commission (ASIC) was established in 1991 under the Australian Securities and Investments Commission Act to promote fair and transparent financial markets across Australia.

Following a string of corporate collapses and rising financial misconduct, Australia needed a single body with comprehensive regulatory powers to oversee financial markets. ASIC was born to fill that gap.

ASIC’s powers are broad. It licences financial services businesses and enforces compliance with the Corporations Act, which regulates how companies operate, report, and engage with investors.

ASIC also investigates complaints, such as those from retail traders, and has the authority to prosecute misconduct, impose fines, and even deregister businesses that break the rules.

ASIC’s core mission is consumer protection, ensuring everyone, from individual investors to large corporations, have a fair shot in a secure financial system.By holding companies like online brokers accountable, ASIC aims to protect consumers, prevent fraud, and maintain trust in the Australian financial market.

What Powers Does ASIC Have?

ASIC has a range of powerful tools to enforce financial laws and keep Australia’s markets in check:

- Licensing Power: ASIC issues licences to financial service providers and credit providers, ensuring that only qualified and compliant businesses can operate. Brokers cannot legally provide financial services in Australia without an ASIC licence.

- Investigative Power: ASIC has the authority to investigate any suspected misconduct or breach of financial laws. It can gather evidence, interview witnesses, and demand records from individuals or businesses if there’s reasonable suspicion of wrongdoing.

- Enforcement Power: If ASIC finds misconduct, it can take several actions: issuing fines, suspending or revoking a licence, and imposing penalties. In more serious cases, it can pursue civil or criminal charges, leading to court proceedings.

- Regulatory Power: ASIC sets and enforces standards for company conduct, corporate governance, financial reporting, and disclosures. It can impose conditions on business operations and make sure companies follow ethical and legal guidelines.

- Banning and Disqualification: ASIC can ban individuals from managing companies or providing financial services if they’re found to be dishonest or unethical. This prevents repeat offenders from staying in the industry.

- Consumer Protection Initiatives: ASIC actively creates and enforces policies to protect consumers. It can demand that brokers improve their practices, disclose clearer information, and stop offering risky or misleading products.

What Rules Must An ASIC Broker Follow?

Brokers regulated by ASIC must follow strict rules to maintain transparency, protect consumers, and ensure ethical behaviour in the financial markets.

- Licensing and Authorization: Brokers must hold an Australian Financial Services (AFS) licence to operate legally. To obtain and maintain this licence, they must meet ASIC’s criteria, including financial stability, qualifications, and competency standards.

- Client Money Handling: Brokers are required to keep client funds separate from company funds, holding them in segregated accounts. This helps protect client funds from being used for business operations or other improper purposes.

- Disclosure Obligations: Brokers must provide clients with clear, upfront information about their products, services, fees, and potential risks. This includes issuing a Product Disclosure Statement (PDS) so clients understand what they’re getting into.

- Compliance With Market Conduct Standards: ASIC trading platforms must operate honestly and fairly, avoiding deceptive practices like price manipulation, insider trading, or false advertising. They’re expected to follow high ethical standards and maintain market integrity.

- Risk Warnings: Brokers must provide transparent risk warnings, especially for high-risk products like CFDs which are popular with day traders. This means clients are informed of potential losses, not just potential gains before they start trading.

- Financial Reporting and Auditing: ASIC requires brokers to submit regular financial reports, proving their financial health and compliance. ASIC may also conduct audits to verify the broker’s practices and ensure ongoing adherence to rules.

- Client Dispute Resolution: ASIC mandates that brokerages have a transparent dispute resolution process in place. They must be part of an external dispute resolution scheme, such as the Australian Financial Complaints Authority (AFCA), to address client complaints promptly.

- Ongoing Training and Development: Brokers must ensure their representatives are properly trained and qualified to give financial advice. This rule ensures that clients receive reliable and accurate information and advice.

How Does ASIC Protect Active Traders?

CFD trading in Australia is very popular with active traders, and ASIC has stepped up its restrictions on brokers offering these products in recent years to protect retail investors:

- Leverage Limits: ASIC limits the amount of leverage brokers can offer retail traders. For example, the maximum leverage for major forex pairs is capped at 1:30. For cryptocurrencies, it’s 1:2. This reduces the risk of significant losses by preventing traders from borrowing excessively to fund their trades.

- Negative Balance Protection: ASIC mandates that brokers provide negative balance protection, meaning traders can’t lose more money than initially invested. If a trade goes against a client significantly, their account won’t fall into a negative balance, preventing debt above the initial investment.

- Standardised Risk Warnings: ASIC requires brokers to display clear, standardized risk warnings on CFD products. This ensures that traders know the risks involved, including the high probability of losses, and can make informed decisions before entering the market.

- Margin Close-Out Rules: To prevent excessive losses, ASIC enforces a margin close-out rule. If a trader’s funds fall to 50% of the required margin, the broker must close out the trade automatically. This helps prevent traders from sustaining more substantial losses than necessary.

- Ban on Inducements: ASIC prohibits brokers from offering incentives like bonuses, cash rebates, or “free” trading schemes to attract CFD traders. This discourages brokers from using high-pressure sales tactics or enticing promotions to bring in less-informed traders.

- Enhanced Disclosures: ASIC requires brokers to provide detailed disclosures on CFD products, including information on trading fees, spreads, risks, and how CFDs work. This transparency helps traders understand all aspects of CFD trading, not just the potential rewards.

Has ASIC Fined Any Brokers?

While ASIC may occasionally be criticised for not acting fast enough in some cases, it has a strong track record of enforcement and has acted against several brokers for various regulatory breaches over the years. Essentially, ASIC has increasingly big teeth.

Here are some notable examples where it has flexed its regulatory muscles:

- Interactive Brokers (2023): ASIC took action against the Australian branch of Interactive Brokers, levying a $832,500 fine for negligent and reckless conduct related to suspicious trading by a client.

- Openmarkets (2023): ASIC handed out a $4.5 million fine to Openmarkets for failing to have suitable systems for identifying whether the orders of a client were intended to manipulate prices or create a false impression of active trading.

- Forex Capital Trading (2020): ASIC fined Forex CT $20 million for various breaches, notably unconscionable conduct, conflicted remuneration for sales staff, and failure to act in its clients’ best interests.

Bottom Line

Year after year, ASIC introduces and enforces strict safeguards that online brokers must follow, with the aim of protecting retail investors.

Verifying that a broker is ASIC-regulated is a crucial step to protect your investments and ensure you’re dealing with a reputable and compliant company.

To get started, check out DayTrading.com’s pick of the best ASIC-regulated day trading brokers.

Article Sources

- Australian Securities & Investments Commission (ASIC)

- Australian Financial Complaints Authority (AFCA)

- Australian Securities and Investments Commission Act

- Australian Financial Services (AFS) Licence

- Product Disclosure Statement (PDS)

- ASIC Warns Brokers Considering High-Risk Offers To Retail Investors

- Corporations Act

- Investor Alert List

- ASIC Connect

- Interactive Brokers - ASIC Fine

- Openmarkets - ASIC Fine

- Forex CT - ASIC Fine

The writing and editorial team at DayTrading.com use credible sources to support their work. These include government agencies, white papers, research institutes, and engagement with industry professionals. Content is written free from bias and is fact-checked where appropriate. Learn more about why you can trust DayTrading.com