Best Brokers With High Leverage 2026

Brokers with the highest leverage unlock the potential for bigger profits – but also greater risks. With maximum leverage, you can control larger positions than your initial deposit allows, amplifying gains but also losses.

We’ve seen a growing number of mainly offshore forex brokers cater to this high-risk, high-reward style of trading, making it key to pick a trusted provider. Dig into our top brokers for highly leveraged trading.

Top 6 Forex Brokers With Highest Leverage 2026

We've recorded the leverage at 139 brokers, and these 6 platforms have the highest leverage in March 2026:

-

1

InstaTradeLeverage: 1:1000

InstaTradeLeverage: 1:1000 -

2

xChiefLeverage: 1:1000

xChiefLeverage: 1:1000 -

3

Focus MarketsLeverage: 1:500

Focus MarketsLeverage: 1:500 -

4

Interactive BrokersLeverage: 1:50

Interactive BrokersLeverage: 1:50 -

5

NinjaTraderLeverage: 1:50

NinjaTraderLeverage: 1:50 -

6

FOREX.comLeverage: 1:50

FOREX.comLeverage: 1:50

Why Are These Brokers The Best If You Want To Trade With High Leverage?

Here is a quick rundown of why we think these high leverage forex, stock and CFD trading platforms are the best:

- InstaTrade is the top-rated high-leverage broker in 2026 - InstaTrade, based in the British Virgin Islands, is an online broker specializing in fixed income structured products and active trading through CFDs. Its zero-spread accounts, excellent research notably through InstaTrade TV, and access to the popular MT4 alongside its own web-accessible InstaTrade Gear, make it an attractive option for short-term traders at every level.

- xChief - xChief is a foreign exchange and CFD broker, established in 2014. The company is based offshore and registered with the VFSC and FMA. Users can choose between a wide selection of accounts and base currencies, making ForexChief accessible to global traders. The brand also stands out for its no deposit bonus and fee rebates for high-volume traders.

- Focus Markets - Established in 2019, Focus Markets is an Australian-based MetaTrader broker offering access to over 1,000 tradable instruments, including forex, commodities, indices, stocks, and a particularly large selection of crypto derivatives.

- Interactive Brokers - Interactive Brokers (IBKR) is a premier brokerage, providing access to 150 markets in 33 countries, along with a suite of comprehensive investment services. With over 40 years of experience, this Nasdaq-listed firm adheres to stringent regulations by the SEC, FCA, CIRO, and SFC, amongst others, and is one of the most trusted brokers for trading around the globe.

- NinjaTrader - NinjaTrader is a US-headquartered and regulated brokerage that specializes in futures trading. There are three pricing plans to suit different needs and budgets, as well as ultra-low margins on popular contracts. The brand's award-winning charting software and trading platform also offers a high-degree of customization and superb technical analysis features.

- FOREX.com - Founded in 1999, FOREX.com is now part of StoneX, a financial services organization serving over one million customers worldwide. Regulated in the US, UK, EU, Australia and beyond, the broker offers thousands of markets, not just forex, and provides excellent pricing on cutting-edge platforms.

Compare The Highest Leverage Brokers On Key Attributes

Find the right high-leverage trading platform for you with our comparison of core features:

| Broker | Maximum Leverage | Trading Instruments | Trading Software |

|---|---|---|---|

| InstaTrade | 1:1000 | FISP, CFDs, Forex, Stocks, Indices, Commodities, Cryptos, Futures | InstaTrade Gear, MT4 |

| xChief | 1:1000 | CFDs, Forex, Metals, Commodities, Stocks, Indices | MT4, MT5 |

| Focus Markets | 1:500 | CFDs, Forex, Stocks, Indices, Commodities, Crypto | MT5 |

| Interactive Brokers | 1:50 | Stocks, Options, Futures, Forex, Funds, Bonds, ETFs, Mutual Funds, Cryptocurrencies | Trader Workstation (TWS), IBKR Desktop, GlobalTrader, Mobile, Client Portal, AlgoTrader, OmniTrader, TradingView, eSignal, TradingCentral, ProRealTime, Quantower |

| NinjaTrader | 1:50 | Futures, Forex, Stocks, Options, Commodities, Futures, Crypto (non-futures depend on provider) | NinjaTrader Desktop, Web & Mobile, eSignal |

| FOREX.com | 1:50 | Forex, Futures and Options on Metals, Energies, Commodities, Indices, Bonds, Crypto | WebTrader, Mobile, MT4, MT5, TradingView |

How Safe Are These Brokers Allowing Maximum Leverage?

When trading with high margin, it's vital to understand how a broker will safeguard your funds:

| Broker | Trust Rating | Guaranteed Stop Loss | Negative Balance Protection | Segregated Accounts |

|---|---|---|---|---|

| InstaTrade | ✘ | ✔ | ✔ | |

| xChief | ✘ | ✘ | ✔ | |

| Focus Markets | ✘ | ✔ | ✔ | |

| Interactive Brokers | ✘ | ✔ | ✔ | |

| NinjaTrader | ✘ | ✘ | ✘ | |

| FOREX.com | ✘ | ✔ | ✔ |

Compare Mobile Trading

See how these brokers catering to high-leverage traders perform on mobile after we tested their trading apps:

| Broker | Mobile Apps | iOS Rating | Android Rating | Smart Watch App |

|---|---|---|---|---|

| InstaTrade | iOS & Android | ✘ | ||

| xChief | iOS & Android | ✘ | ||

| Focus Markets | iOS & Android | ✘ | ||

| Interactive Brokers | iOS & Android | ✔ | ||

| NinjaTrader | iOS & Android | ✘ | ||

| FOREX.com | iOS & Android | ✘ |

Are The Top Brokers For High Leverage Good For Beginners?

Beginners should avoid using high leverage unless testing this risky strategy in a demo with tools for new traders:

| Broker | Demo Account | Minimum Deposit | Minimum Trade | Education Rating | Support Rating |

|---|---|---|---|---|---|

| InstaTrade | ✔ | $1 | 0.01 | ||

| xChief | ✔ | $10 | 0.01 Lots | ||

| Focus Markets | ✔ | $100 | 0.01 Lots | ||

| Interactive Brokers | ✔ | $0 | $100 | ||

| NinjaTrader | ✔ | $0 | 0.01 Lots | ||

| FOREX.com | ✔ | $100 | 0.01 Lots |

Are The Top Brokers For High Leverage Good For Advanced Traders?

Ultra-leverage brokers are geared towards advanced traders, but still look for tools to maximize opportunities:

| Broker | Automated Trading | VPS | AI | Pro Account | Leverage | Low Latency | Extended Hours |

|---|---|---|---|---|---|---|---|

| InstaTrade | Experts Advisors (EAs) on MetaTrader | ✔ | ✘ | ✘ | 1:1000 | ✘ | ✘ |

| xChief | Expert Advisors (EAs) on MetaTrader | ✘ | ✘ | ✘ | 1:1000 | ✘ | ✘ |

| Focus Markets | Expert Advisors (EAs) on MetaTrader | ✘ | ✘ | ✘ | 1:500 | ✘ | ✘ |

| Interactive Brokers | Capitalise.ai, TWS API | ✘ | ✔ | ✘ | 1:50 | ✔ | ✔ |

| NinjaTrader | NinjaScript or via Automated Trading Interface | ✘ | ✘ | ✘ | 1:50 | ✔ | ✘ |

| FOREX.com | Expert Advisors (EAs) on MetaTrader | ✔ | ✔ | ✘ | 1:50 | ✔ | ✘ |

Compare The Ratings Of The Highest Leverage Trading Brokers

See how the top forex brokers with highest leverage leverage scored in every category in our latest tests:

| Broker | Trust | Platforms | Assets | Mobile | Fees | Accounts | Research | Education | Support |

|---|---|---|---|---|---|---|---|---|---|

| InstaTrade | |||||||||

| xChief | |||||||||

| Focus Markets | |||||||||

| Interactive Brokers | |||||||||

| NinjaTrader | |||||||||

| FOREX.com |

Compare Trading Fees

The fees for trading with substantial leverage can erode profits, so here's how providers measure up on costs:

| Broker | Cost Rating | Fixed Spreads | Inactivity Fee |

|---|---|---|---|

| InstaTrade | ✘ | - | |

| xChief | ✘ | - | |

| Focus Markets | ✘ | $0 | |

| Interactive Brokers | ✘ | $0 | |

| NinjaTrader | ✘ | $25 | |

| FOREX.com | ✘ | $15 |

How Popular Are These Brokers With The Highest Leverage?

Many traders gravitate toward high-leverage brokers with the largest client bases:

| Broker | Popularity |

|---|---|

| InstaTrade | |

| Interactive Brokers | |

| NinjaTrader | |

| xChief | |

| FOREX.com |

Why Use InstaTrade To Trade With Higher Leverage?

"Although InstaTrade offers active trading on a comprehensive platform, it stands out with its fairly unique Fixed Income Structured Product (FISP), providing passive investment opportunities with up to 50% returns in 6 months if conditions are met. "

Christian Harris, Reviewer

InstaTrade Quick Facts

| Demo Account | Yes |

|---|---|

| Instruments | FISP, CFDs, Forex, Stocks, Indices, Commodities, Cryptos, Futures |

| Regulator | BVI FSC |

| Platforms | InstaTrade Gear, MT4 |

| Minimum Deposit | $1 |

| Minimum Trade | 0.01 |

| Leverage | 1:1000 |

| Account Currencies | USD, EUR, RUB |

Pros

- InstaTrade claims to "guarantee" returns through the structured element of its passive trading solution (FISP), with applications approved within 24 hours.

- InstaTrade delivers an excellent suite of charting tools for day traders with its web trader comprising 250+ indicators, 11 chart types and a user-friendly design.

- Despite an average investment offering of around 300 assets, InstaTrade offers a particularly strong suite of currency pairs, catering to advanced traders seeking opportunities in volatile exotics.

Cons

- Marketing of the FISP, especially phrasing around the “guarantee of profitability” and the “elimination of risks of trading on financial markets” raises concerns.

- Profits are only guaranteed in the FISP if investors do not reach the 50% profit level and attract other users with a total sum of $4 for each dollar in compensation.

- InstaTrade is registered in the offshore jurisdiction of the British Virgin Islands, resulting in limited regulatory safeguards for retail investors.

Why Use xChief To Trade With Higher Leverage?

"xChief continues to prove popular with investors looking to trade highly leveraged CFDs on the popular MetaTrader platforms. The broker's rebate scheme and investment accounts will particularly appeal to seasoned traders. However, the lack of top-tier regulatory oversight is a major drawback."

William Berg, Reviewer

xChief Quick Facts

| Demo Account | Yes |

|---|---|

| Instruments | CFDs, Forex, Metals, Commodities, Stocks, Indices |

| Regulator | ASIC |

| Platforms | MT4, MT5 |

| Minimum Deposit | $10 |

| Minimum Trade | 0.01 Lots |

| Leverage | 1:1000 |

| Account Currencies | USD, EUR, GBP, JPY, CHF |

Pros

- xChief delivers a high-quality day trading environment via the MT4 and MT5 platforms, with market-leading charts, indicators and tools

- The broker offers several account types to suit different traders, including a Cent account for beginners and pro-level hedging/netting accounts

- Traders can access a copy trading solution via the MetaQuotes Signals service

Cons

- The broker trails competitors when it comes to research tools and educational resources

- The Classic+ and Cent accounts provide access to fewer instruments than the other account types, at 50+ and 35+, respectively

- The total range of 150+ assets is much lower than most competitors who typically offer hundreds

Why Use Focus Markets To Trade With Higher Leverage?

"Focus Markets is perfect for experienced traders familiar with MetaTrader 5, offering flexible crypto transactions (USDT and BTC) and access to over 90 cryptocurrencies for seamless speculation, deposits, and withdrawals."

Christian Harris, Reviewer

Focus Markets Quick Facts

| Demo Account | Yes |

|---|---|

| Instruments | CFDs, Forex, Stocks, Indices, Commodities, Crypto |

| Regulator | ASIC, SVGFSA |

| Platforms | MT5 |

| Minimum Deposit | $100 |

| Minimum Trade | 0.01 Lots |

| Leverage | 1:500 |

| Account Currencies | USD, EUR, GBP, CAD, AUD, NZD, JPY, SGD |

Pros

- While its meagre four commodities won’t meet the needs of some serious traders interested in softs and metals, Focus Markets offers a huge suite of 90+ cryptos, providing short-term opportunities on high-reward, high-risk assets.

- Focus Markets excelled in the deposit and withdrawal category during testing, offering more base currencies than most competitors, including USD, CAD and EUR - and a range of traditional and popular crypto payment options, including BTC and USDT.

- Focus Markets’ MT5 platform delivered fast, seamless trade execution during testing with advanced charting, multiple timeframes, and useful tools like Depth of Market (DOM). Its clean interface made navigation easy, while clear risk/reward ratios ensures precise trading.

Cons

- Regulatory protection is a location lottery at Focus Markets – Australian traders benefit from strong ASIC oversight, but those using the SVGFSA-registered entity face limited recourse options in disputes.

- A significant drawback of Focus Markets is the lack of platform variety. It only support MT5, excluding popular platforms like MT4, cTrader, and TradingView, plus it hasn't developed its own software that could better meet the needs of beginners.

- Focus Markets’ 24/5 support lacks direct phone help and unresponsive live chat, while email replies took a full business day during our latest tests. This slow support is a major drawback for active traders who need quick resolutions.

Why Use Interactive Brokers To Trade With Higher Leverage?

"Interactive Brokers is one of the best brokers for advanced day traders, providing powerful charting platforms, real-time data, and customizable layouts, notably through the new IBKR Desktop application. Its superb pricing and advanced order options also make it highly attractive for day traders, while its diverse range of equities is still among the best in the industry."

Christian Harris, Reviewer

Interactive Brokers Quick Facts

| Demo Account | Yes |

|---|---|

| Instruments | Stocks, Options, Futures, Forex, Funds, Bonds, ETFs, Mutual Funds, Cryptocurrencies |

| Regulator | FCA, SEC, FINRA, CFTC, CBI, CIRO, SFC, MAS, MNB, FINMA, AFM |

| Platforms | Trader Workstation (TWS), IBKR Desktop, GlobalTrader, Mobile, Client Portal, AlgoTrader, OmniTrader, TradingView, eSignal, TradingCentral, ProRealTime, Quantower |

| Minimum Deposit | $0 |

| Minimum Trade | $100 |

| Leverage | 1:50 |

| Account Currencies | USD, EUR, GBP, CAD, AUD, INR, JPY, SEK, NOK, DKK, CHF, AED, HUF |

Pros

- With low commissions, tight spreads and a transparent fee structure, IBKR delivers a cost-effective environment for short-term traders.

- Interactive Brokers has been named Best US Broker for 2025 by DayTrading.com, recognizing its long-standing commitment to US traders, ultra-low margin rates, and global market access at minimal cost.

- While primarily geared towards experienced traders, IBKR has made moves to broaden its appeal in recent years, reducing its minimum deposit from $10,000 to $0.

Cons

- You can only have one active session per account, so you can’t have your desktop program and mobile app running simultaneously, making for a sometimes frustrating trading experience.

- Support can be slow and frustrating based on tests, so you might find it challenging to reach customer service representatives promptly or encounter delays in resolving issues.

- TWS’s learning curve is steep, and beginners may find it challenging to navigate the platform and understand all the features. Plus500's web platform is much better suited to new traders.

Why Use NinjaTrader To Trade With Higher Leverage?

"NinjaTrader continues to meet the demands of active futures traders looking for low fees and premium analysis tools. The platform hosts top-rate charting features including hundreds of indicators and 10+ chart types."

Tobias Robinson, Reviewer

NinjaTrader Quick Facts

| Demo Account | Yes |

|---|---|

| Instruments | Futures, Forex, Stocks, Options, Commodities, Futures, Crypto (non-futures depend on provider) |

| Regulator | NFA, CFTC |

| Platforms | NinjaTrader Desktop, Web & Mobile, eSignal |

| Minimum Deposit | $0 |

| Minimum Trade | 0.01 Lots |

| Leverage | 1:50 |

| Account Currencies | USD |

Pros

- NinjaTrader continues to deliver comprehensive charting software for active day traders with bespoke technical indicators and widgets

- NinjaTrader is a widely respected and award-winning futures broker and is heavily authorized by the NFA and CFTC

- Traders can get free platform access and trade simulation capabilities in the unlimited demo

Cons

- There is a withdrawal fee on some funding methods

- The premium platform tools come with an extra charge

- Non forex and futures trading requires signing up with partner brokers

Why Use FOREX.com To Trade With Higher Leverage?

"FOREX.com remains a best-in-class brokerage for active forex traders of all experience levels, with over 80 currency pairs, tight spreads from 0.0 pips and low commissions. The powerful charting platforms collectively offer over 100 technical indicators, as well as extensive research tools."

Christian Harris, Reviewer

FOREX.com Quick Facts

| Demo Account | Yes |

|---|---|

| Instruments | Forex, Futures and Options on Metals, Energies, Commodities, Indices, Bonds, Crypto |

| Regulator | NFA, CFTC |

| Platforms | WebTrader, Mobile, MT4, MT5, TradingView |

| Minimum Deposit | $100 |

| Minimum Trade | 0.01 Lots |

| Leverage | 1:50 |

| Account Currencies | USD, EUR, GBP, CAD, AUD, JPY, CHF, PLN |

Pros

- There’s a wealth of educational resources including tutorials, webinars, and a stacked YouTube channel to help you get educated in the financial markets.

- The in-house Web Trader continues to stand out as one of the best-designed platforms for aspiring day traders with a slick design and over 80 technical indicators for market analysis.

- FOREX.com offers industry-leading forex pricing starting from 0.0 pips, alongside competitive cashback rebates of up to 15% for serious day traders.

Cons

- There’s no negative balance protection for US clients, so you may find yourself owing more money than your initial deposit into your account.

- Demo accounts are frustratingly time-limited to 90 days, which doesn’t give you enough time to test day trading strategies effectively.

- FOREX.com's MT4 platform offers approximately 600 instruments, significantly fewer than the over 5,500 available on its non-MetaTrader platforms.

How Did DayTrading.com Rank The Top Brokers For High Leverage?

We investigated and recorded the maximum leverage available at every broker in our evolving database, which includes 139 providers as of March 2026.

From there, we ranked them by the highest leverage while also considering overall broker quality, using a mix of:

- Hard Data: Over 200 metrics, including maximum leverage, pricing, execution, and regulation.

- Real Testing Insights: Hands-on testing by our experienced traders and industry experts, evaluating platform usability, reliability, and trading conditions.

What Is High Leverage?

Higher leverage allows you to control much larger trades with a small deposit, multiplying both profits and risks. This makes it popular with day traders looking to grow their accounts.

Based on our analysis of 139 trading platforms, we consider anything above 1:500, or 500x, as ‘high’ leverage, with some brokers offering 1:1000 or more. There are even brokers with unlimited leverage.

Here’s how it works:

If you deposit $100 and your broker offers 1:1000 leverage, you can control $100,000 in trading capital.

- If you buy $100,000 worth of gold and its price rises by 1%, your profit is $1,000.

- Without leverage, the same 1% price move on a $100 trade would yield just $1 in profit.

What Are The Rules On Trading With High Leverage?

Since high-leverage trading carries significant risk, financial regulators impose leverage limits on online brokers to protect retail traders. However, these restrictions vary by region and asset class, meaning leverage caps differ depending on where a brokerage is based.

Leverage Limits By Major Regulators

Many ‘green tier’ bodies in DayTrading.com’s Regulation & Trust Rating, such as ASIC (Australia), CySEC (Europe), and the FCA (UK), impose strict limits on leveraged CFD trading for retail traders, with the typical maximum 1:30.

Meanwhile, the CFTC and SEC in the US impose even stricter rules, banning leveraged CFD trading for American retail traders.

Retail Vs Professional Leverage

The limits above only apply to retail traders. Professional trading accounts – available to those who meet high financial and experience requirements – can access much greater leverage, often up to 1:500.

To qualify as a professional, you must meet stringent criteria, such as proving a high trading volume, industry experience, or holding significant financial assets.

High-Leverage Offshore Brokers = Higher Risk

Many brokers advertising leverage above 1:500 or even 1:1000 are often weakly regulated offshore entities. These providers may operate under lax oversight, exposing traders to:

- Higher counterparty risk: Fewer investor protections in case of fraud or bankruptcy

- No negative balance protection: Potential for losses exceeding deposits

- Weaker legal recourse: Limited ability to recover funds in disputes

FAQ

What Is The Highest Leverage Available At Forex Brokers?

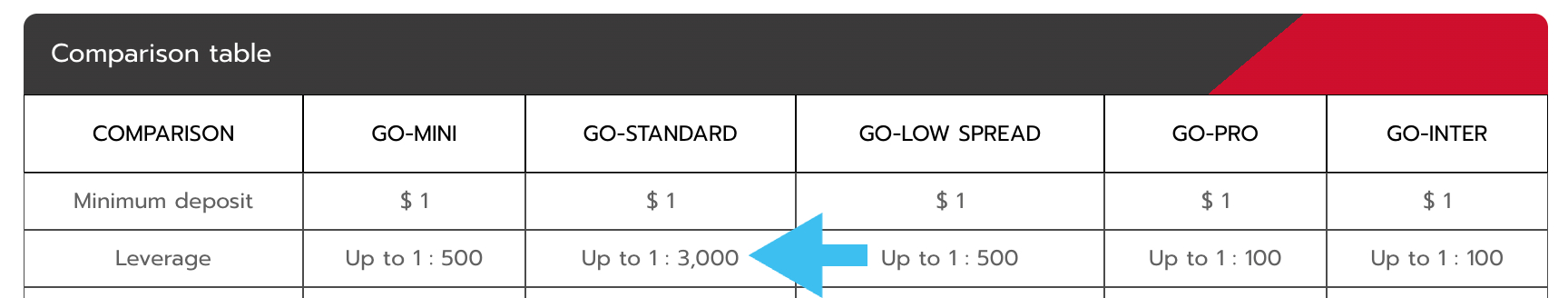

Based on our latest research, the maximum leverage you can trade forex with is 1:3000 on some platforms, though we don’t recommend these firms. Instead, stick to our recommended brokers that still offer very high leverage that can hit 1:1000.

Is Trading With High Leverage Safe?

No. Trading with high leverage is extremely high risk as both profit and loss are multiplied.

Our investigations also reveal that most of the highest-leverage trading platforms operate offshore in weakly regulated jurisdictions, raising further safety concerns. Some of these brokers don’t offer key protections, such as negative balance protection, which should prevent your account from falling below zero.