UnitedPips Review 2026

Pros

- Although being handed off mid-chat due to shift changes during testing was frustrating, customer support is generally good with quick, helpful responses, and 24/7 support via phone and email for regional teams is a definite advantage.

- UnitedPips offers impressive leverage up to 1:1000 with zero swap fees or commissions, which can enhance potential returns for day traders and swing traders looking to control prominent positions with less capital.

- UnitedPips’ platform performs well, with an intuitive design that will appeal to beginners, while the TradingView integration delivers powerful charting tools without overwhelming users, making it straightforward to execute trades efficiently.

Cons

- Unlike brokers such as IG, UnitedPips is an offshore broker not regulated by any 'green tier' financial authorities, raising concerns for traders seeking assurance and protection under well-established regulatory frameworks.

- UnitedPips lacks comprehensive research, while the educational content for beginner traders is woeful. Compared to brokers like eToro, which offers tutorials, webinars, and advanced courses, UnitedPips offers minimal resources to help new traders understand key concepts.

- UnitedPips' selection of tradable instruments is still minimal, comprising a bare minimum selection of forex, metals and crypto. There are no equities, indices or ETFs, which may be a drawback for experienced traders looking for diverse opportunities.

UnitedPips Review

Regulation & Trust

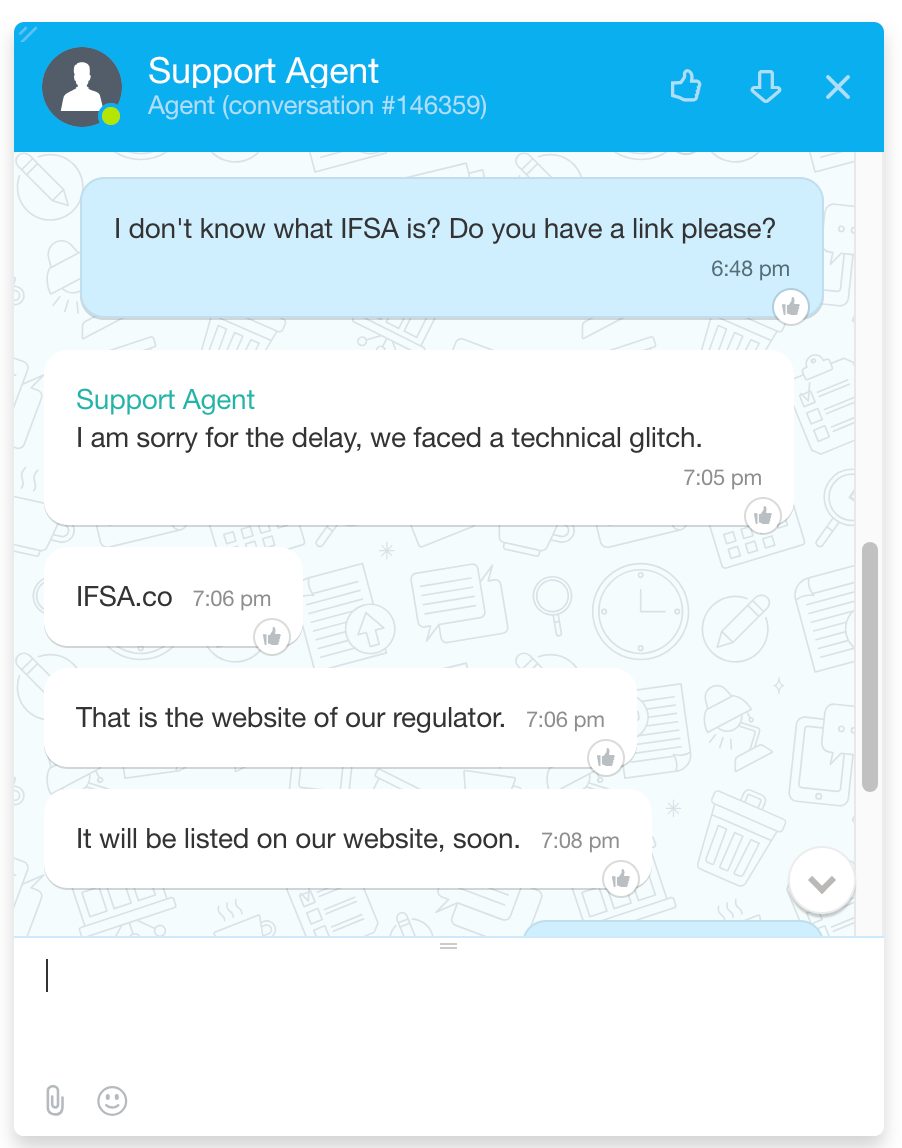

Established in 2016 and registered in Saint Lucia, UnitedPips is an offshore broker under regulation solely by the International Financial Services Authority (IFSA). However, this regulatory information is not published on its website, which is a red flag.

IFSA provides a basic level of regulatory oversight that is less stringent than ‘green tier’ bodies, as per DayTrading.com’s Regulation & Trust Rating, which has much higher standards for protecting clients.

Furthermore, while negative balance protection offers some reassurance by limiting potential losses, UnitedPips lacks a compensation scheme to safeguard client funds in the event of broker insolvency.

| UnitedPips | Interactive Brokers | FOREX.com | |

|---|---|---|---|

| Regulation & Trust Rating | |||

| Regulators | IFSA | FCA, SEC, FINRA, CFTC, CBI, CIRO, SFC, MAS, MNB, FINMA, AFM | NFA, CFTC |

| Visit | Visit | Visit | Visit |

| Review | Review | Review | Review |

Accounts & Banking

Live Accounts

UnitedPips offers three account types, with each tier having increasing minimum deposit requirements but tighter spreads:

- Standard Plan: Minimum deposit: $10. Spreads: From 2 pips. Leverage: Up to 1:1000. Minimum/Maximum lot size: 0.01/1. Margin call/Stop out: 60%/30%

- Premium Plan: Minimum deposit: $2,000. Spreads: From 1.5 pips. Leverage: Up to 1:500. Minimum/Maximum lot size: 0.01/10. Margin call/Stop out: 50%/30%

- VIP Plan: Minimum deposit: $10,000. Spreads: From 0.7 pips. Leverage: Up to 1:200. Minimum/Maximum lot size: 0.01/100. Margin call/Stop out: 30%/10%.

Expanding the account types to include a zero-spread option, found at alternatives like IC Markets and Pepperstone, would enhance UnitedPips’ appeal to serious day traders.

On a positive note, the broker offers swap-free accounts for all clients, not just those adhering to Sharia law.

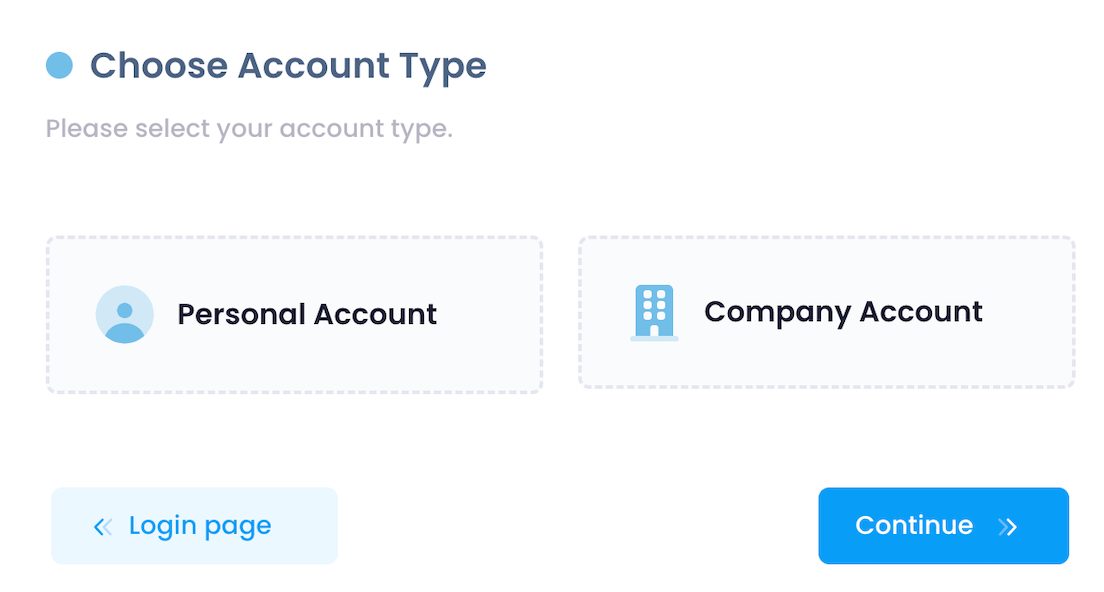

The streamlined digital account opening process at UnitedPips took me less than 15 minutes.To access all features and remove any limits on deposits, trading, and withdrawals, you must verify your identity and address, which can take up to 24 hours.

Demo Accounts

UnitedPips offers a demo trading account that allows you to practice in a simulated environment without risking real money.

What’s great is that there is an indefinite time limit, a rare feature among brokers we’ve evaluated, which gives you the flexibility to practice at your own pace.

This feature is especially beneficial for beginners looking to understand forex trading mechanics and platform tools before transitioning to live trading.

Deposits & Withdrawals

UnitedPips accepts deposits via debit cards, credit cards, PayPal, Perfect Money, and cryptocurrencies (Bitcoin, Ethereum, USDT), with a 5-10% bonus on crypto deposits to offset exchange fees.

Minimum deposit requirements vary by payment method, and some withdrawals may incur fees. While UnitedPips doesn’t charge for deposits or withdrawals, external fees (eg 5-10%) may apply for e-wallets, crypto exchanges, or currency conversions.

To better serve global clients, UnitedPips could:

- Support more base account currencies beyond USD, starting with EUR and GBP

- Expand payment options, notably wire transfers and e-wallets like Skrill

- Offer consistently low minimum deposits across its accounts, like Deriv’s $5 minimum

From my experience using UnitedPips, funds are generally processed efficiently. Most withdrawal methods are completed within an hour. However, bank cards take a little longer to process. Deposits are typically processed instantly.

The minimum withdrawal is $50 for PayPal and card transactions, provided your balance is over $50. If the balance is lower, the minimum withdrawal amount is equal to the remaining balance.

| UnitedPips | Interactive Brokers | FOREX.com | |

|---|---|---|---|

| Accounts & Banking Rating | |||

| Payment Methods | Bitcoin Payments, Credit Card, Debit Card, Ethereum Payments, PayPal, Perfect Money | ACH Transfer, Automated Customer Account Transfer Service, Cheque, Debit Card, TransferWise, Wire Transfer | ACH Transfer, Credit Card, Debit Card, Mastercard, Neteller, PayNow, Skrill, Visa, Wire Transfer |

| Minimum Deposit | $10 | $0 | $100 |

| Visit | Visit | Visit | Visit |

| Review | Review | Review | Review |

Assets & Markets

UnitedPips offers only a tiny range of CFDs, which will disappoint advanced traders seeking diverse trading opportunities.

- Forex: Currency options are limited to 40+ major, minor, and exotic pairs, with high leverage up to 1:1000 – appealing for high-risk traders with modest starting capital.

- Precious Metals: Includes gold, silver, platinum, and palladium, all with leverage up to 1:1000. These assets allow traders some diversification beyond forex.

- Cryptocurrency: Supports popular cryptocurrencies like Bitcoin, Ethereum, Ripple, and Litecoin. However, crypto leverage is capped at 1:5 due to volatility, restricting position size compared to other asset classes.

UnitedPips still lags behind competitors like Blackbull Markets, which offers 26,000+ instruments. Expanding to include stocks, indices, ETFs, options, and even bonds would make it more competitive.

Unlike brokers such as eToro, UnitedPips does not offer copy trading or interest on idle cash, which limits options for passive investors seeking more well-rounded trading features.

| UnitedPips | Interactive Brokers | FOREX.com | |

|---|---|---|---|

| Assets & Markets Rating | |||

| Trading Instruments | CFDs, Forex, Precious Metals, Crypto | Stocks, Options, Futures, Forex, Funds, Bonds, ETFs, Mutual Funds, Cryptocurrencies | Forex, Futures and Options on Metals, Energies, Commodities, Indices, Bonds, Crypto |

| Margin Trading | Yes | Yes | Yes |

| Leverage | 1:1000 | 1:50 | 1:50 |

| Visit | Visit | Visit | Visit |

| Review | Review | Review | Review |

Fees & Costs

Despite fixed spreads that offer a degree of price certainty, day traders will find their hard-earned profits chipped away by fees that just aren’t competitive.

Spreads on major pairs like EUR/USD hover around 2 pips – far above the industry standard of 1.2 pips.

To qualify for UnitedPips’ better spreads, you must deposit $2,000 for a Premium account or $10,000 for VIP status – thresholds that put competitive rates out of reach for many beginners.

UnitedPips could attract advanced traders by introducing a rebate system for active traders and following the lead of brokers like Fusion Markets and IC Markets in fee competitiveness.

On the bright side, UnitedPips doesn’t charge commissions, swap fees, or inactivity fees on any accounts – a significant benefit for swing and high-volume traders looking to avoid these common expenses.

| UnitedPips | Interactive Brokers | FOREX.com | |

|---|---|---|---|

| Fees & Costs Rating | |||

| EUR/USD Spread | 0.7 | 0.08-0.20 bps x trade value | 1.2 |

| FTSE Spread | NA | 0.005% (£1 Min) | 1.0 |

| Oil Spread | NA | 0.25-0.85 | 2.5 |

| Stock Spread | NA | 0.003 | 0.14 |

| Visit | Visit | Visit | Visit |

| Review | Review | Review | Review |

Platforms & Tools

UnitedPips’ trading platform, UniTrader, is a streamlined, white-labeled version of TradingView, giving users a familiar interface with basic charting tools and technical indicators.

However, my firsthand testing shows it lacks key features that make TradingView popular among many traders, notably fewer customizable indicators, limited social trading features, and restricted access to community resources for strategy sharing.

When it comes to the design, the UnitedPips platform boasts a user-friendly interface that I enjoy using, making it easy to navigate instruments, set price alerts, create watchlists, and manage open positions.Check out my video tour of the platform below to get a sense of its design and functionality.

The UnitedPips platform supports standard order types, which offer flexibility but may not suit every strategy:

- Market Orders: Instant execution, best for trades needing immediate action

- Limit Orders: Execute at a specific price, offering price control but no guarantee of fill

- Stop Orders: Trigger at a set price, converting to a market order for risk management

However, it’s missing advanced order types like trailing stops, “move stop loss to break even,” partial exits, and OCO (one-cancels-the-other), which would benefit traders needing more complex options.

While the UnitedPips platform works well on desktop and mobile (no dedicated app – mobile-optimized web access), it’s frustratingly the only available option.

Active traders like me who prefer MetaTrader 4 (MT4), MetaTrader 5 (MT5) or cTrader may find this restrictive, as these platforms offer more indicators, customization tools and automated trading features.

Competitors like Pepperstone support these third-party platforms as well as its own proprietary terminals, allowing traders more flexibility and specialized features.

Automated trading is also hampered by the absence of a VPS, which is essential for stable, high-speed connections. Furthermore, no API access restricts traders from developing custom applications or connecting to third-party tools.

| UnitedPips | Interactive Brokers | FOREX.com | |

|---|---|---|---|

| Platforms & Tools Rating | |||

| Platforms | UniTrader | Trader Workstation (TWS), IBKR Desktop, GlobalTrader, Mobile, Client Portal, AlgoTrader, OmniTrader, TradingView, eSignal, TradingCentral, ProRealTime, Quantower | WebTrader, Mobile, MT4, MT5, TradingView |

| Mobile App | Web Access Only | iOS & Android | iOS & Android |

| Visit | Visit | Visit | Visit |

| Review | Review | Review | Review |

Research

UnitedPips’ research resources are sparse, which weakens the overall trading experience.

The main feature is a single daily market analysis focused on major forex pairs like AUD/USD and EUR/USD, covering basic technicals (Fibonacci, Parabolic SAR, MACD) and fundamental insights.

While these reports are useful, the limited scope on a few major pairs feels restrictive. Broader coverage – extending to asset classes like precious metals and cryptocurrencies – would make this research far more valuable.

UnitedPips could enhance its research to compete with leading brokers like FOREX.com and IG, which offer rich resources such as economic calendars, comprehensive market reports, and expert video analysis.

I’d love to see UnitedPips integrate tools from third-party providers like Trading Central or Autochartist, which provide visually engaging, multi-market analysis that opens up more trading opportunities.

| UnitedPips | Interactive Brokers | FOREX.com | |

|---|---|---|---|

| Research Rating | |||

| Visit | Visit | Visit | Visit |

| Review | Review | Review | Review |

Education

UnitedPips offers no dedicated educational content – zero tutorials, courses, or webinars – to help beginners build a solid trading foundation. This glaring gap is frustrating, especially since it makes starting out much harder for newcomers on the platform.

Compared to top brokers I trade with, like IG and eToro, UnitedPips is miles behind. Most brokers provide robust educational support for beginners, including video lessons, live webinars, and interactive courses on essentials like technical analysis, risk management, and fundamental analysis.

To catch up, UnitedPips should invest in a well-rounded educational section, with resources such as:

- Video tutorials and trading guides

- Regular live webinars hosted by market experts

- Interactive learning tools like simulators, quizzes, and e-books

| UnitedPips | Interactive Brokers | FOREX.com | |

|---|---|---|---|

| Education Rating | |||

| Visit | Visit | Visit | Visit |

| Review | Review | Review | Review |

Customer Support

UnitedPips offers good but not great customer service.

My personal experience with the 24/7 live chat has been positive overall, with quick responses to inquiries about withdrawals or platform features, typically resolved within minutes.

One frustration: I’ve been handed off to a new representative mid-chat more than once due to shift changes, which can be annoying and disrupts the flow of support.Despite this, the team is generally clear, responsive, and patient, staying on the chat until all my questions are addressed.

UnitedPips offers basic support via email and phone (UK, Europe, US), but it lacks a call-back option and multilingual support found at brokers like FXTM.

To elevate its customer service, UnitedPips should:

- Add communication channels like WhatsApp, Telegram, and active social media.

- Expand its FAQ and glossary of terms for added depth and correct spelling errors to improve professionalism.

These enhancements would make support more accessible and polished for a global user base.

| UnitedPips | Interactive Brokers | FOREX.com | |

|---|---|---|---|

| Support Rating | |||

| Visit | Visit | Visit | Visit |

| Review | Review | Review | Review |

Should You Day Trade With UnitedPips?

If you want crypto funding/trading, an unlimited demo account for practising short-term trading and a user-friendly platform enhanced with TradingView charts, then you may want to sign up with UnitedPips.

However, the broker has a long way to go to rival the best brokers for day trading. For one, it is registered in Saint Lucia under the IFSA, which does not offer the same security and client protection level as regulators like the FCA or ASIC.

And while the broker’s trading platform is excellent, its research and education resources still need to be improved, and a copy trading feature should be added.

FAQ

Is UnitedPips Legit Or A Scam?

We have concerns about the legitimacy of UnitedPips, primarily due to its registration in Saint Lucia – a jurisdiction known for lenient financial oversight.

Yet although UnitedPips has yet to establish itself as a highly trusted broker, particularly for beginners, it is not a scam.

Is UnitedPips Suitable For Beginners?

UnitedPips offers some features that could be attractive for beginners, such as a low $10 minimum deposit on its Standard Plan, access to a non-expiring demo account, and fixed spreads.

However, UnitedPips needs better regulatory oversight, higher-quality educational resources, and social trading features – all essential ingredients for many aspiring traders.

Best Alternatives to UnitedPips

Compare UnitedPips with the best similar brokers that accept traders from your location.

- Interactive Brokers – Interactive Brokers (IBKR) is a premier brokerage, providing access to 150 markets in 33 countries, along with a suite of comprehensive investment services. With over 40 years of experience, this Nasdaq-listed firm adheres to stringent regulations by the SEC, FCA, CIRO, and SFC, amongst others, and is one of the most trusted brokers for trading around the globe.

- FOREX.com – Founded in 1999, FOREX.com is now part of StoneX, a financial services organization serving over one million customers worldwide. Regulated in the US, UK, EU, Australia and beyond, the broker offers thousands of markets, not just forex, and provides excellent pricing on cutting-edge platforms.

UnitedPips Comparison Table

| UnitedPips | Interactive Brokers | FOREX.com | |

|---|---|---|---|

| Rating | 3.8 | 4.3 | 4.5 |

| Markets | CFDs, Forex, Precious Metals, Crypto | Stocks, Options, Futures, Forex, Funds, Bonds, ETFs, Mutual Funds, Cryptocurrencies | Forex, Futures and Options on Metals, Energies, Commodities, Indices, Bonds, Crypto |

| Demo Account | Yes | Yes | Yes |

| Minimum Deposit | $10 | $0 | $100 |

| Minimum Trade | 0.01 Lots | $100 | 0.01 Lots |

| Regulators | IFSA | FCA, SEC, FINRA, CFTC, CBI, CIRO, SFC, MAS, MNB, FINMA, AFM | NFA, CFTC |

| Bonus | 40% Deposit Bonus | – | VIP status with up to 10k+ in rebates – T&Cs apply. |

| Platforms | UniTrader | Trader Workstation (TWS), IBKR Desktop, GlobalTrader, Mobile, Client Portal, AlgoTrader, OmniTrader, TradingView, eSignal, TradingCentral, ProRealTime, Quantower | WebTrader, Mobile, MT4, MT5, TradingView |

| Leverage | 1:1000 | 1:50 | 1:50 |

| Payment Methods | 6 | 6 | 9 |

| Visit | Visit | Visit | Visit |

| Review | – | Interactive Brokers Review |

FOREX.com Review |

Compare Trading Instruments

Compare the markets and instruments offered by UnitedPips and its competitors. Please note, some markets may only be available via CFDs or other derivatives.

| UnitedPips | Interactive Brokers | FOREX.com | |

|---|---|---|---|

| CFD | Yes | Yes | No |

| Forex | Yes | Yes | Yes |

| Stocks | No | Yes | Yes |

| Commodities | Yes | Yes | Yes |

| Oil | No | No | Yes |

| Gold | Yes | Yes | Yes |

| Copper | No | No | No |

| Silver | Yes | No | Yes |

| Corn | No | No | No |

| Crypto | Yes | Yes | No |

| Futures | No | Yes | Yes |

| Options | No | Yes | Yes |

| ETFs | No | Yes | No |

| Bonds | No | Yes | No |

| Warrants | No | Yes | No |

| Spreadbetting | No | No | No |

| Volatility Index | No | No | No |

UnitedPips vs Other Brokers

Compare UnitedPips with any other broker by selecting the other broker below.

Customer Reviews

4.7 / 5This average customer rating is based on 14 UnitedPips customer reviews submitted by our visitors.

If you have traded with UnitedPips we would really like to know about your experience - please submit your own review. Thank you.

Submit Your Own Review of UnitedPips

Article Sources

The writing and editorial team at DayTrading.com use credible sources to support their work. These include government agencies, white papers, research institutes, and engagement with industry professionals. Content is written free from bias and is fact-checked where appropriate. Learn more about why you can trust DayTrading.com

I like it the most among different brokers available with high leverage.

The platform is so easy and it is not complicated.

I also made a few deposits and withdrawals with unitedpips and there were no delays or such things

Different aspects are perfect, but not having us stocks is something that needs to be taken care of.

Perfect trading conditions for those who seek fixed spread in the news time

I think it can be even better if they add stocks

Unitrader is now one of my favorites, from the very first I was not a fan of MT4 and Mt5 so I tried many of different platforms, this one is one of the best ones, the spreads are also lower when you check it with other fixed ones, I love it.

I tried a few of the high leverage brokers in Europe, this one is better than the other.

They have to add stocks too, 4 stars for now.

leverage is really good for polish clients, paypal is offered and also cripto currencies.

I also love the platfrom too.

I need more cryptos specially some of the trend meme coins.

Deposit and withdrawals are greatly fast with them, I also love the mobile platform, it is so smooth on my iphone.

If you can afford a premium account, it will come with great advantages.

I believe the fees are great, no commission and no swap as well. Good for now.

I have experienced smooth trading with their platform. Still can’t run my EAs on it; the rest is honestly great.

Good and smooth platform, 24/7 support and support paypal and crypto and creditcards for deposits.

they only need to add stocks and they will become the best.