Precious Metals Brokers 2026

Thanks to their aesthetic qualities, cultural significance, and wide range of applications, trading precious metals has maintained an enduring appeal throughout history. Trading volumes on precious metals markets are also huge, and this gives traders opportunities to make a profit.

This guide will talk through the various precious metals and discuss how they can be traded. It will also explain what drives price movements and reveal how traders can get started.

Best Precious Metals Trading Brokers

Based on our assessment, these are the top brokers for trading precious metals:

-

1

Interactive Brokers

Interactive Brokers -

2

AvaTrade

AvaTrade -

3

Pepperstone75-95% of retail investor accounts lose money when trading CFDs

Pepperstone75-95% of retail investor accounts lose money when trading CFDs -

4

eToro

eToro

What Are Precious Metals?

Precious metals are high-value, naturally occurring elements that are relatively rare in quantity. There are eight different commodities that fall into this category. These are gold, silver, platinum, palladium, rhodium, ruthenium, osmium, and iridium.

With the exception of gold and silver, the metals on this list also come under the umbrella of platinum group metals (or PGMs). This is because they have similar physical and chemical characteristics, and are usually found within the same mineral deposits.

Gold, silver, platinum and palladium dominate the trading of these expensive commodities. Precious metals trade at a premium to most other commodities because of how scarce they are versus, say, base metals such as copper and aluminium and the ferrous element iron ore.

Take copper, for example. At the time of writing*, spot contracts (which I’ll cover in detail below) for the red metal stood at $7,910 per tonne at the London Metal Exchange. Meanwhile, spot gold in the UK capital was changing hands at $1,820 per ounce.

That’s quite a premium when you consider that there are 35,274 ounces in one tonne, and reflects just how much more abundant copper is. Gold makes up 4 parts per billion of the earth’s crust compared with 70,000 parts per billion for the red metal**.

Physical gold, silver and other precious metals can vary greatly when it comes to quality. So to ensure consistency and accuracy in trading, gold exchanges and markets issue specifications for the acceptable fineness of gold products.

In the US, for example, rules at The Commodity Exchange (or COMEX) specify that gold bars delivered against its gold futures contracts must have a minimum fineness of 995 (or 99.5%).

* Gold and copper prices as of 5 October, 2023

** Data taken from The Royal Mint and Berkeley Rausser College of Natural Resources

What Influences Precious Metals Prices?

Like that of any natural resource, the price of precious metals is influenced by the laws of supply and demand. When the market picks up on possible shortages prices can go through the roof, while signs of excess supply can send them sharply lower.

This was the case with palladium prices following Russia’s invasion of Ukraine in 2022. Investors were spooked after the country – which produced around 40% of the world’s palladium the year before – was hit with sanctions that threatened supply flows. The white metal price soared to record peaks around $3,340 per ounce in the aftermath.

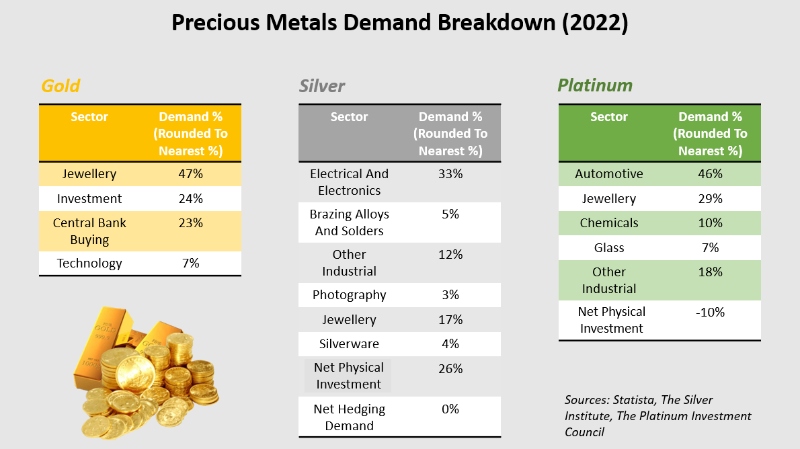

Traders and investors also carefully monitor key macroeconomic news for clues as to demand conditions. As the charts below show, gold, silver, and the PGMs all have a wide range of applications, so the state of the global economy has a significant bearing on price movements.

Individuals with trading positions in certain metals will also keep a close watch on developments in critical industries. Those who trade platinum, for instance, will monitor car production data in markets like China and the US. The metal is a critical component in catalytic converters where they are used to clean up exhaust emissions.

Gold prices are also dependent upon strong jewellery demand, especially in China and India (these are the world’s number one and two gold markets respectively). Unlike other precious metals, central banks can also account for a large proportion of yellow metal purchases and sales.

Precious metals – and in particular gold – are perhaps best known as popular safe-haven assets. In other words, when any sort of bad news happens, investment demand for these sentimental commodities can go through the roof.

Investor demand for gold tends also to peak during inflationary periods (though it can also rise when deflation becomes a problem). These so-called hard currencies come into favour when high inflation causes the market to question the true value of paper currencies.

Having said that, gold values can be constrained during times of elevated inflation if central banks respond aggressively to cool rising prices. Higher interest rates can cause unfavorable currency movements (which I’ll discuss shortly), making products like bonds and savings accounts look more attractive, and raising concerns about low inflation over the longer term.

Silver and PGMs are known as dual-role metals because of their investment and industrial applications. While they have safe-haven appeal, their prices can also decline during difficult economic periods when demand indicators from the automotive and electrical sectors for instance worsen.

Trading precious metals can take place using a variety of different currencies. However, the lion’s share of trades are settled using the world’s reserve currency, the US dollar.

As a consequence, changes in the value of the buck can have significant consequences on metal markets. When the dollar rises, it costs more money to buy the same amount of say gold than it would have done beforehand.

As you can see below, the value of three-month gold futures contracts has moved in an inverse direction to the ICE US Dollar Index during the 12 months to 5 October. The latter measures the value of the greenback against a basket of other major currencies.

Monetary policy decisions by the Federal Reserve can have a massive impact on the direction of the dollar and, by extension, precious metals trading markets. Safe haven buying of the greenback can also damage demand (and therefore prices) of other flight-to-safety metals including gold.

Different Ways To Trade Precious Metals

Spot Trading

The term spot contract refers to an agreement for the immediate purchase or sale of an asset at its prevailing market price. Once the transaction is completed delivery of the asset will take place rather quickly, usually within a 48-hour window.

Precious metal spot rates are used as a benchmark to value futures contracts, which are agreements to take delivery further out in time.

Backwardation occurs when spot prices are higher than futures rates, while contango happens when spot prices are lower. Investors use different trading strategies to make money in both of these scenarios. For example, they can buy futures contracts during backwardation periods, take delivery of the asset, and then sell it back at the greater spot price.

Futures Trading

These contracts involve buying or selling a specified amount of precious metal at a certain price and within a pre-set period. They enable traders and investors to trade the commodities without having to worry about taking physical delivery.

Futures contracts can be traded on various exchanges such as COMEX, the Multi Commodity Exchange (MCX) in India, and the Shanghai Futures Exchange (SHFE) in China.

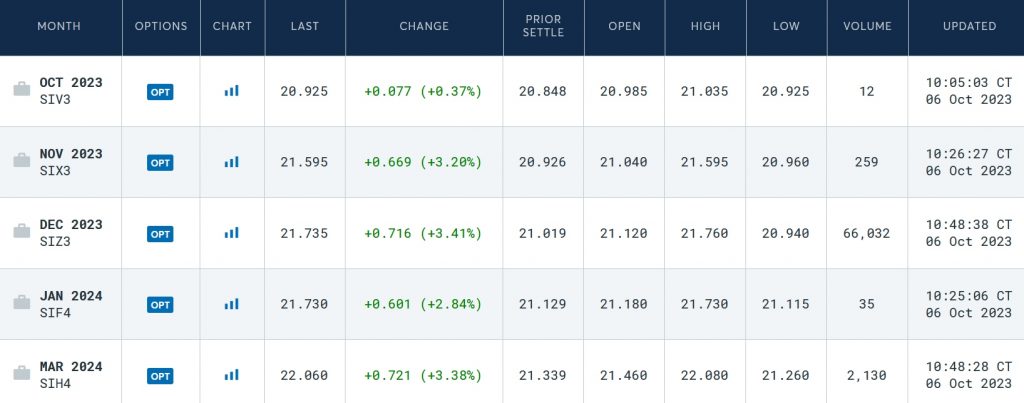

Here you can see several silver futures contracts traded on COMEX. Traders are given information on expiration dates, the latest prices, the day’s highs and lows, and trading volumes.

Precious metals traders can extend their futures position past the expiration date of their contracts by rolling them over. This process involves closing the existing contract and initiating a new one with a later expiry date.

Precious Metals Stocks

Investors can also profit from rising metal prices by buying shares in companies that produce high-value commodities. When the likes of gold rise in value, the share prices of these businesses also tend to increase as revenues ascend.

Purchasing precious metal stocks has one big advantage over buying the metal itself. Many of these commodity producers also reward shareholders with regular dividend payments. Physical metal doesn’t provide an income at all, and only produces a positive return if prices appreciate.

The share prices of these businesses are correlated to the value of the commodities they dig for. However, they can outperform the likes of gold if their operating performance impresses the market. Unfortunately, the opposite is also true and they can slump if they encounter operational problems.

Here you can see how US gold producer Newmont Mining’s share price performed during the year to 5 October compared with that of three-month gold futures at COMEX.

The chart shows only a slight correlation between Newmont – the world’s biggest gold producer – and metal prices over the period. In fact, prices diverged sharply from April 2023 as strikes at its Penasquito mine in Mexico pulled production lower and higher costs damaged earnings.

As the chart shows, Newmont shares slumped almost 20% in value while gold futures were up by mid-single-digit percentages. Mining is an exceptionally high-risk business and profit-sapping problems like industrial action, disappointing ore grades and power outages can be common.

One way that individuals can sidestep this risk is to invest in so-called pick and shovel stocks. These are named after the companies that sprung up during the California Gold Rush of the mid-1800s and supplied the tools that miners used to haul the metal from the ground.

Pick and shovel companies thrive when commodity prices are moving northwards and exploration, development and production budgets are rising. Companies in this bracket include truck and digger manufacturer Caterpillar, and Renold which makes parts for mining conveyor belts.

Such companies protect traders from the day-to-day problems that can affect miners’ profits. But it’s important to remember that demand for their products and services can also suffer during broader industry downturns.

Exchange-Traded Funds

Purchasing an exchange-traded fund (ETF) is another popular way to start trading precious metals. Unlike mutual funds which are only traded once a day, these investment funds are available to buy and sell whenever the stock market is open for business.

The purpose of an ETF is to track the performance of a particular index, sector, commodity, or asset class. Some, like the SPDR Gold Shares fund, hold gold metal bars in vaults and are created to track the yellow metal price.

Others allow investors to reduce risk by tracking the price movements of various precious metals. The abrdn Physical Precious Metals Basket Shares ETF, for instance, provides diversification by owning physical gold, silver, platinum and palladium.

Some ETFs also contain a basket of precious metals mining stocks. The Sprott Gold Miners ETF holds shares in a wide spectrum of different diggers, as the table below shows.

Options Contracts

These financial instruments provide buyers with the right (but critically not the obligation) to purchase or sell a prescribed quantity of precious metals by or on a set date.

Call options and put options are the most popular types of options. When a trader expects gold prices to rise, for example, they will buy a call option that allows them to acquire the yellow metal at a certain price (known as the strike price).

If all goes to plan and gold prices rise, they will exercise the contract, acquire the gold at the strike price, and profit by selling back at the higher value. Put options work in the opposite direction, offering a price at which traders can sell the precious metal if they expect prices to drop.

Contracts For Difference (CFDs) And Spread Bets

Like options, these financial instruments are popular forms of derivatives. These investment vehicles – which derive their value from precious metals prices – allow individuals to speculate on how commodity markets will move without owning any underlying assets.

CFDs and spread bets differ in various ways. Trading restrictions in certain geographies, different tax rules, trading hours and fees are just a few things traders need to consider. Both of these financial vehicles are popular because they allow the use of leverage, or funds that are borrowed from a broker.

Some brokerages allow leverage of up to 1:500. This means that traders can have as much as $500 to trade with for every $1 in their account. While this can allow them to build greater positions and make bigger profits than by using just their own funds, losses can also get out of control when things go wrong.

Physical Metal

Traders and investors can also choose to buy physical metal in the form of bars or coins. Many bullion brokers sell the commodity and offer the option of vaulting it for their clients.

Organizations like the London Bullion Market Association (LBMA) supply lists of accredited ‘good delivery’ refineries for brokers to buy their metal from. The LBMA also plays a critical role in assessing precious metal purity, weight, and physical appearance.

Holding physical metal means that owners usually have to incur storage and insurance costs. Selling gold, silver and PGMs in physical form is also less convenient than using a financial instrument like a futures contract, and selling large quantities can be especially challenging.

How To Trade Precious Metals

Modern investors have more choice when it comes to trading precious metals than ever before. Whether it’s futures, stocks, ETFs or any other investment vehicle I’ve mentioned, there are many brokerages out there for one to select.

There are a number of questions traders need to ask when choosing which precious metals broker to use to trade. These include:

- Is the broker’s trading platform simple to use, and does it offer a range of features (like advanced charting tools and filtering instruments) and customization options?

- How robust are the precious metals broker’s security protocols?

- Does the firm provide a mobile app to let you trade metals on the move?

- Is it charging reasonable trading commissions and charges compared to its competitors?

- Does the metals broker provide the option to trade with leverage?

- Is the precious metals brokerage regulated by a creditable financial authority (such as the Financial Conduct Authority in the UK)?

- Are resources like demo accounts, educational information and research tools available to help new metals investors?

Before you start trading, it’s essential to have a strong knowledge of precious metals markets and what moves them. It’s also a good idea to bone up on other financial markets that can impact the prices of these expensive commodities (like foreign exchange and stock markets).

The brokerage you select may offer a range of learning resources to help you get started. But don’t worry if not. A large assortment of investment websites, online courses, webinars and discussion boards exist online to get you up to speed. It’s also a good idea to take a technical analysis course to help you track price movements, identify trends and manage risk.

At this point, you’ll also need to consider what kind of trading strategy you’d like to use. The technological revolution means that there are many game plans that traders and investors can utilize based on factors like risk tolerance, trading goals, and whether they wish to prioritize fundamental or technical analysis.

Once you’re up and running, you’ll need to keep a close eye on mainstream news, financial channels and websites. This way you’ll stay on top of key macroeconomic and geopolitical news that will directly and indirectly drive gold, silver and PGM prices.

Staying abreast of precious metals-specific news is also essential. This includes reading dedicated websites such as Kitco and Metals Daily, studying production updates from major miners like Newmont, and digesting reports from industry bodies like The World Gold Council, The Silver Institute and The Platinum Investment Council.

Pros and Cons of Trading Precious Metals

- Expensive metals are timeless. Unlike new-age assets like cryptocurrencies and non-fungible tokens (NFTs), gold and silver have been prized for thousands of years, which gives investors peace of mind over their long-term value.

- Reducing risk. Owning precious metals or related financial instruments can help limit losses across an investor’s portfolio due to their safe-haven status.

- Many ways to trade. Speculators and investors have multiple ways to make money from trading precious metals including futures, stocks, ETFs, and even physical metals.

- The option to go short. Many of these financial instruments also allow traders to take a short position, meaning they also have a chance to make money when precious metals prices or mining stocks fall in value.

- Use of leverage. Traders can use products like CFDs and spread bets to amplify gains from precious metals, though remember that losses can also be magnified if markets move in an unexpected direction.

- Obtaining cross-commodity exposure. Gold and silver mining can also produce abundant amounts of other metals like copper, lead and zinc, allowing investors in precious metals stocks to also capitalize on rising base metal prices.

- Lack of income. Physical gold and instruments like futures don’t provide income, although investors can get around this problem by purchasing dividend-paying mining stocks.

- Low volatility. Precious metals values tend to be less choppy than say forex or stocks, which lessens the opportunity for short-term traders to make profits.

- Storage costs. Keeping physical metal safely stored incurs a fee, though traders can avoid this by buying financial instruments where delivery is not required.

Bottom Line

Precious metals have an important role in today’s modern society. They serve as a safe-haven investment that can protect people’s wealth in periods of recession and high inflation. These commodities also have a wide range of industrial applications which means they can also rise in value during the good times.

This all means that precious metals trading volumes are extremely high, which in turn provides excellent liquidity for traders and investors. A wide range of related financial instruments – from futures contracts and mining stocks to CFDs and options – means that individuals have excellent choices as to how they want to trade, too.

Investor interest in gold, silver, platinum and palladium should remain strong for years to come.

Use our ranking of the best brokers for trading precious metals to get started.

FAQ

How Can I Trade Precious Metals?

Investors and traders can profit from rising (or falling) gold, silver, and platinum group metals prices using a variety of financial vehicles, including CFDs, futures, options and stocks in companies involved in the production of precious metals and related products.

What Drives Precious Metals Prices?

Like any commodity, prices of these expensive raw materials are driven by supply and demand indicators. They can also soar in value during challenging periods, as they are flight-to-safety assets that investors flock to in order to preserve their wealth.

What Prices Are Precious Metals Trading At Now?

There are many prices that relate to precious metals depending on what financial instrument one chooses to use. Investors can check these out using platforms and websites such as TradingView and Yahoo! Finance.

Is Precious Metals Trading Just A Fad?

Thanks to their aesthetic appeal and safe-haven role, a market has existed for these expensive commodities for centuries, and they will likely remain popular assets long into the future.

Do I Have To Pay A Precious Metals Trading Tax?

Tax laws around trading precious metals can be complicated based on your jurisdiction. While some forms of trading such as spread betting can shield traders from tax in some parts of the world, precious metals investment in bullion can be subject to higher bands of capital gains tax in countries such as the US.

What Are The Precious Metals Trading Hours?

Due to the multiple exchanges operating in their distinct time zones across the globe, commodities markets can be accessed 24 hours a day, 7 days a week. Individual brokers or exchanges that trade options or other derivatives may only trade in their local market hours, however.

Article Sources

- London Bullion Market Association

- London Metal Exchange

- Multi Commodity Exchange

- Shanghai Futures Exchange

- Precious Metals Trading: How To Profit from Major Market Moves, Philip Gotthelf, 2005

- The Complete Guide to Investing in Gold and Precious Metals, Alan Northcott, 2011

The writing and editorial team at DayTrading.com use credible sources to support their work. These include government agencies, white papers, research institutes, and engagement with industry professionals. Content is written free from bias and is fact-checked where appropriate. Learn more about why you can trust DayTrading.com