Copper Brokers 2026

Copper trading refers to the buying and selling of financial products that allow you to speculate on copper prices. This guide explains the key characteristics of copper, detailing the role it plays within global markets, outlining popular trading instruments, and discussing how to get started.

Quick Introduction

- Unlike its metal cousins, gold and silver, copper is traded as a commodity, not a precious metal. This is because of its wide use in large quantities worldwide.

- Copper is often referred to as ‘Doctor Copper’ because its price is closely tied to economic activity. Understanding industrial demand trends is crucial when trading copper.

- Copper supply dynamics, including mining production, labor strikes, and geopolitical events in major copper-producing countries can significantly impact prices.

- Macroeconomic indicators like GDP growth, manufacturing data, and infrastructure spending, can provide insights into future copper demand.

- Copper is commonly traded through contracts for difference (CFDs) and exchange-traded funds (ETFs) that track copper prices, or via stocks of copper mining companies. These products provide exposure to the copper market without directly trading the physical commodity.

Best Copper Trading Brokers

Based on our findings, these 4 brokers stand out as the best for trading copper:

-

1

NinjaTrader

NinjaTrader -

2

Plus500USTrading in futures and options involves the risk of loss and is not suitable for everyone.

Plus500USTrading in futures and options involves the risk of loss and is not suitable for everyone. -

3

InstaTrade

InstaTrade -

4

Optimus Futures

Optimus Futures

Understanding Copper

Copper is a versatile metal with extensive industrial applications. It’s used in construction (wiring, plumbing), manufacturing (electronics, appliances), transportation (cars, trains), and infrastructure (power grids).

Because it’s so widely used across various sectors, the demand for copper is closely tied to economic activity. When economies are growing, there’s typically an increased need for copper.

Copper prices are highly sensitive to economic cycles. During periods of economic expansion and increased industrial production, the demand for copper rises, driving up its price.

Conversely, during economic downturns or recessions, copper demand drops, causing its price to decline. This sensitivity to economic trends makes copper an excellent gauge of economic health.

Central banks and policymakers often pay attention to copper prices because they provide insights into inflation and monetary policy. Rising copper prices can indicate inflationary pressures in an economy, which may prompt central banks to consider tightening monetary policy by raising interest rates to control inflation.

Conversely, falling copper prices may suggest economic weakness and potential deflationary risks, leading to stimulus measures and lower interest rates.

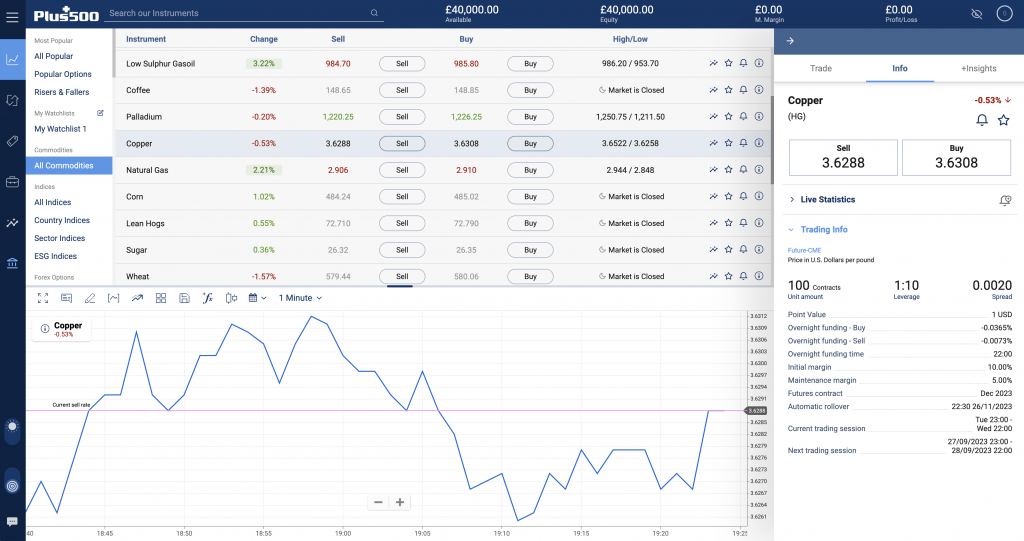

Copper Chart

What Influences Copper Prices?

Trading copper requires a combination of technical and fundamental analysis to make informed trading decisions. Additionally, staying updated on global economic and geopolitical developments is essential for understanding the broader context in which copper prices are determined.

Copper prices are influenced by a wide range of factors, including:

Supply And Demand

The most fundamental factor impacting copper prices is the balance between supply and demand.

Increases or decreases in copper production, disruptions in mining operations (e.g., strikes or natural disasters), and changes in industrial consumption patterns all play a significant role.

Economic Indicators

Economic data such as GDP growth, manufacturing output, construction activity, and infrastructure spending affect pricing.

Strong economic indicators often lead to increased copper demand, while weak indicators can have the opposite effect.

Global Trade And Tariffs

Trade tensions and tariffs between major economies can disrupt copper supply chains and influence prices.

Changes in trade policies and geopolitical events can create uncertainty and affect market sentiment.

Currency Exchange Rates

Copper is priced in U.S. dollars, so fluctuations in currency exchange rates can impact its price.

A stronger U.S. dollar typically puts downward pressure on copper prices, making it more expensive for foreign buyers.

Monetary Policy

Central bank policies, especially interest rate decisions, can affect copper prices.

Higher interest rates can make commodities like copper less attractive as an investment, potentially leading to lower prices.

Inventories And Stockpiles

Copper stockpile levels in warehouses and inventories held by producers and consumers can influence market sentiment.

High inventory levels may suggest oversupply, while declining inventories can signal increased demand.

Weather And Natural Disasters

Weather-related events, such as hurricanes or droughts, can disrupt mining operations and transportation, affecting copper supply.

Energy Prices

The cost of energy, particularly crude oil, can impact mining and production costs.

Higher energy prices can squeeze profit margins for copper producers and potentially lead to higher prices.

Technological Advances

Advances in copper-related technologies, such as more efficient electrical transmission systems, can affect long-term demand for copper.

Speculative Trading

The futures market for copper involves a significant amount of speculative trading.

Traders’ perceptions of future price movements, based on technical analysis, sentiment, and market speculation, can have a short-term impact on prices.

How Does Copper Trading Work?

Copper trading differs from stocks, forex, or cryptocurrency primarily in terms of what is being traded and the factors influencing the market.

While stocks represent ownership in a company and are influenced by company-specific news and earnings, copper trading involves a physical commodity driven by global supply and demand dynamics, economic indicators, and industrial trends.

Forex trading involves speculating on currency pairs influenced by central bank policies and macroeconomic data, while cryptocurrency trading deals with digital assets driven by sentiment, technology developments, and market adoption.

Copper trading, on the other hand, is often linked to broader economic cycles and infrastructure investments, making it more sensitive to economic trends and geopolitical events.

Additionally, the use of leverage and margin requirements can vary significantly between these asset classes, impacting the level of risk and potential rewards.

Spot Trading

The simplest form of commodities speculation, spot trading is where an asset is either purchased or sold at the current market rate, sometimes with margin or leverage provided by the broker to increase available capital and possible position size.

This is a form of copper trading that almost all traders and investors will be familiar with, though spot markets for commodities can differ slightly.

In some cases, spot market buyers are required to take physical delivery of a commodity, especially if held for an extended period. For long-term investors, a copper ETF offers a far more practical solution.

ETF Trading

ETF trading involves buying and selling shares of exchange-traded funds that track the performance of copper prices or copper-related indexes. Copper ETFs provide an indirect way for you to gain exposure to the copper market without trading physical copper or futures contracts.

These ETFs hold copper futures contracts, copper mining stocks, or related assets in their portfolios, and their share prices correlate with changes in copper prices.

Popular copper ETFs include United States Copper Index Fund (NYSE:CPER), Global X Copper Miners ETF (NYSE:COPX) and Sprott Junior Copper Miners ETF (NYSE:COPJ).

Trading copper ETFs gives you the flexibility to speculate on copper price movements or add diversification to your portfolios by participating in the copper market’s performance, all with the ease and convenience of trading on traditional stock exchanges.

Stock Trading

Stock trading involves buying and selling shares of publicly traded companies that are primarily engaged in copper mining, production, exploration, or related activities.

These stocks represent ownership in copper mining firms and are traded on stock exchanges. Examples of these organizations include BHP Group (NYSE:BHP), Freeport-McMoRan (NYSE:FCX), Southern Copper (NYSE:SCCO) and Rio Tinto (NYSE:RIO).

Trading stocks allows you to participate in the copper industry’s performance and potential profits from copper production and sales, along with exposure to factors that influence mining companies, such as commodity prices, operational efficiency, and geopolitical developments.

It provides an avenue for you to trade directly in copper-related businesses, each with their own financial performance and risk profiles, as opposed to trading copper itself or related financial derivatives.

Futures Trading

Copper futures trading involves the buying or selling of standardized contracts representing a specified amount of copper, with delivery at a predetermined future date and price.

You can go long or short on these contracts. Copper futures provide a transparent and regulated way to speculate on or hedge against future copper price movements.

Unlike spot trading, where physical copper is exchanged immediately, you typically settle your positions by offsetting them with opposite positions before the delivery date, making it a popular choice for speculators and hedgers looking to manage risk or profit from anticipated copper price changes.

Options Trading

Copper options trading involves the buying and selling of contracts that grant the holder the right, but not the obligation, to buy (call option) or sell (put option) a specific amount of copper at a predetermined price (strike price) before a specified expiration date.

Options provide a flexible way to participate in copper price movements, whether by betting on price increases, protecting against price declines, or employing various strategies to capitalize on market conditions.

Copper options can be used for speculation, hedging, or portfolio diversification, offering the ability to manage risk and potentially profit from copper price fluctuations without the obligation to buy or sell the actual commodity.

CFDs

Contracts for difference (CFDs) are a popular trading instrument available for copper speculation. CFDs are used to predict whether the price of an asset will rise or fall.

Differences between the open and close trade prices are settled in cash, multiplied by the often significant leverage employed. Importantly, CFDs do not have set expiry times.

Spread Betting

Spread betting is a financial derivative trading method that allows you to speculate on the price movements of copper without owning the physical commodity.

In spread betting, you make wagers on whether copper prices will rise (go long) or fall (go short) relative to a specific reference point. The profit or loss is determined by the difference between the opening and closing prices of the copper contract.

Spread betting provides leverage, enabling you to control larger positions with a smaller upfront capital requirement, but it also comes with significant risk as losses can exceed the initial deposit.

This trading method is popular with traders seeking to profit from copper price fluctuations without the need to physically own or store copper.

Pros And Cons Of Copper Trading

Pros

- Versatile Trading: Commodities such as copper offer a wide range of trading instruments, including CFDs, ETFs, spread betting, futures contracts and spot market trading.

- High Leverage: Through many available instruments, copper trading often supports positions with high leverage or margin, allowing you to generate far greater potential profits than your staked capital would otherwise.

- Liquidity: Copper futures and ETFs are highly liquid, making it relatively easy to enter and exit positions. This liquidity can result in narrow bid-ask spreads, thereby reducing trading costs.

- Price Transparency: Copper futures markets are highly transparent, with readily available pricing information and real-time data. This transparency allows you to make informed decisions based on current market conditions and price movements, enhancing trading efficiency and reducing information asymmetry.

- Diversification: Copper provides diversification in a trading portfolio as it often has a low correlation with other asset classes, such as stocks and bonds. This can help spread risk.

Cons

- Volatility: Copper prices can be highly volatile, subject to rapid and significant price swings. This volatility can result in substantial trading losses for those unprepared for market fluctuations.

- Speculative Trading: The copper market sees a significant amount of speculative trading, which can lead to short-term price distortions and make it difficult to predict price movements based solely on fundamentals.

- Margin Requirements: Futures trading involves margin requirements, and these requirements can change based on market conditions. Maintaining sufficient margin in a volatile market can be challenging and may require additional capital.

- Market Hours: Copper futures markets have specific trading hours, and they may not align with your preferred time zone. This can lead to overnight risk and the inability to react to important news or events during off-hours.

- Complexity: Futures trading can be complex, especially for beginners. It requires an understanding of futures contracts, market mechanics, and risk management strategies. You may find it challenging to navigate this complexity effectively.

Bottom Line

Copper trading offers opportunities for profit, portfolio diversification, and exposure to global economic trends. It serves as a reliable barometer of economic health and has the potential for long-term growth, particularly in industries like renewable energy and infrastructure.

However, it comes with significant risks, including high volatility, leverage, and margin requirements. You must possess a solid understanding of market dynamics, employ effective risk management strategies, and stay informed about global factors influencing copper prices.

FAQ

How Can I Trade Copper?

You can trade copper by engaging in various financial markets, including futures, options, ETFs, or CFDs. You can take positions based on your outlook for copper prices, whether to buy (long) or sell (short), and use these instruments to speculate on price movements or hedge against copper price risks.

What Moves The Copper Market?

The copper market is primarily influenced by supply and demand dynamics, driven by factors such as economic growth, infrastructure spending, and industrial production. Additionally, external factors like geopolitical events, currency fluctuations, and global trade policies can significantly impact copper prices.

Can You Make Money If Copper Prices Rise Or Fall?

Yes, you can make money whether copper prices rise or fall. Going long when anticipating price increases and going short when expecting price declines can result in profits, depending on the direction of the market and the effectiveness of your trading strategy.

Is Trading Copper Difficult?

Trading copper can be complicated for beginners due to its sensitivity to economic factors, price volatility, and the use of leverage, which can magnify losses. However, with proper education, risk management, and practice, you can navigate the copper market effectively and potentially profit from its price movements.

Article Sources

- Plus500 - Copper Trading Conditions

- Trading Economics - Copper Data

- Copper: Its Trade, Manufacture, Use, and Environmental Status, Günter Joseph, 1998

The writing and editorial team at DayTrading.com use credible sources to support their work. These include government agencies, white papers, research institutes, and engagement with industry professionals. Content is written free from bias and is fact-checked where appropriate. Learn more about why you can trust DayTrading.com