Cannabis Brokers 2026

Cannabis trading is on the rise following legalization in the US and Canada. Public sentiment and medical research have stimulated market growth, making it an increasingly popular commodity to trade via stocks, indices and ETFs. This guide covers how the industry works, trading products, factors that move prices, and the best cannabis brokers.

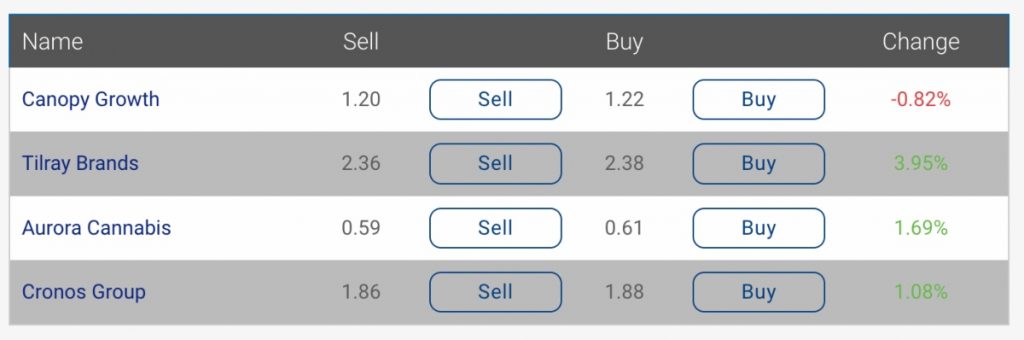

Top Brokers For Trading Cannabis

These are the 4 best brokers for trading Cannabis:

Cannabis Trading Basics

Cannabis (Marijuana) refers to the dried components of the Cannabis plant. The plant is known for its psychoactive compounds, CBD and THC, which are used to treat various conditions including pain, anxiety and nausea.

These cannabis products are commonly sold in the form of oils, gels, gummies, teas, supplements and extracts.

The cannabis industry has surged over the last few decades due to increased legalisation, alongside the general decriminalization of marijuana use. Research estimates that the US cannabis market will exceed $31.8 billion in annual sales in 2023 and $50.7 billion by 2028.

The cannabis industry is made up of three main components:

- Cultivators and retailers – actively grow and sell marijuana

- Biotech companies – use cannabis to manufacture prescription drugs

- Ancillary companies – provide services to the cannabis industry

Cannabis is commonly traded online through related stocks, ETFs and indices, available at several online brokers.

As an emerging market, the factors that influence prices vary, though government regulations, public sentiment and medical research are the main players.

History

Cannabis usage dates back thousands of years to the Neolithic age in China and Japan. The plant was originally used for fabric, rope, food and medicine, as well as religious and recreational use. It is unclear when cannabis was first used for its psychoactive properties.

Cannabis was introduced to the New World in the 16th Century by the Spaniards, but it wasn’t until the 19th century that physicians began studying the psychological effects of cannabis. By the 20th century, cannabis was illegal in most countries.

Today, cannabis is legal in Canada for both medicinal and recreational purposes, whilst in the US, the legalization of cannabis has divided states.

Cannabis Price Today

How To Trade Cannabis

Cannabis is not sold on commodity exchanges, so price speculation of the plant itself (or its derivative products) are not available. Instead, you can speculate on cannabis stocks, indices and ETFs:

- Stocks/Shares – Traders can invest in firms that are involved in the cultivation, production and distribution of cannabis-related products. With the continuing growth of the market, there is now a range of stocks available, such as Tilray Brands Inc and Cronos Group Inc. Leading cannabis brokers also offer CFDs on shares so traders can go long or short with leverage.

- Indices – Cannabis indices offer more generalized exposure to the industry. Brokers like IG and AvaTrade offer the Global Cannabis Giants Index which tracks the top 20 listed companies with involvement in the cannabis industry.

- ETFs – Exchange-traded funds can give traders broad exposure to the industry, following the performance of a group of cannabis-related assets. Popular ETFs include Han Medical Cannabis and Wellness ETF (CBDX), ETFMG Alternative Harvest (MJ) and AdvisorShares Pure Cannabis (YOLO).

Top Cannabis Stocks

The NASDAQ and NYSE facilitate the trading of several major American cannabis-related firms, though most stocks are traded on OTC markets.

Major North American cannabis cultivators and biotech companies include:

- AbbVie Inc (ABBV)

- Tilray Brands Inc (TLRY)

- Cronos Group INC. (CRON)

- Canopy Growth Corp (CGC)

- Aurora Cannabis Inc (ACB)

- Corbus Pharmaceuticals (CRBP)

What Drives Cannabis Trading Prices?

The cannabis market is impacted by factors that are fairly unique compared to most other tradable assets.

Legalization

Positive attitudes towards the medical and recreational use of marijuana have led to increased legalization in certain countries and is expected to grow further.

However, the legalization of marijuana does face opposition, with some US states, for example, still voting against the legalization of recreational cannabis.

Medical Research

Research indicates that cannabis products may help to treat the symptoms of numerous conditions and diseases, including chronic pain and Alzheimer’s.

As such, sentiment towards marijuana use may change over time through further studies.

Financial Obstacles

Cannabis companies are subject to special taxation, as well as banking restrictions, limiting their access to capital.

As a result, firms may struggle to operate successfully in the long run.

New Products & Stores

Medical research and legalization also lead to the development of new cannabis-derivative products, such as CBD oils and supplements which are already popular among consumers.

Pros Of Trading Cannabis

- Emerging market – The cannabis market is still arguably in its infancy and is expected to grow rapidly over the coming decades. The expansion could benefit early investors who can take advantage of upcoming price swings.

- Opportunities to diversify – Although the cannabis market is not yet as diverse as others, several investment avenues are already available, including stocks, ETFs and indices.

- Traded on leading exchanges – Cannabis-related assets such as company stocks are tradable on some of the world’s major exchanges, including the NYSE and NASDAQ.

Cons Of Trading Cannabis

- Volatile market – The legalization and sentiment towards the cannabis market are still unpredictable and highly risky. For example, the market suffered a considerable bear market in 2019.

- Supply and demand – The cannabis industry is subject to imbalances between supply and demand, which may cause prices to fall.

- Risk of OTC stocks – Many cannabis companies trade on over-the-counter markets, which can result in lower market liquidity. This can make stocks difficult to trade.

Comparing Cannabis Brokers

Available Assets

As outlined above, cannabis cannot be traded as a commodity on global exchanges. Instead, you can speculate on cannabis-related stocks, indices, and ETFs at several brokers.

IG, for example, offers the Cannabis Index which tracks the performance of the top 20 publicly listed US and Canadian companies, among other stocks and ETFs.

Fees

Look out for the broker’s spreads and commissions on cannabis assets, as well as non-trading fees such as swaps, withdrawal charges or inactivity fees.

For example, CMC Markets offers a decent minimum spread of 1.0 on the Aurora Cannabis Inc CFD with a commission of 2 cents per share. Alternatively, Plus500 offers share CFDs with tight spreads:

Note that Cannabis stocks are mostly traded on North American exchanges, so traders looking to invest with a currency other than USD may be liable for foreign exchange fees.

Market Updates

Pharmaceutical research and regulations have a strong impact on the cannabis industry.

Top cannabis trading brokers offer the latest industry news and developments, so you can keep track of key events.

Trading Platform

Most cannabis brokers offer reputable platforms, such as MetaTrader 4 and TradingView, though some may provide their own bespoke platforms which offer specialist tools and features.

Tip: demo accounts are an excellent way to test out the platforms and practice CBD online trading strategies.

Regulation

Regulated brokers can offer greater financial protection when trading risky products. Top-tier agencies such as the Australian Securities and Investments Commission (ASIC) and the UK Financial Conduct Authority (FCA) restrict leverage and ensure retail brokers offer negative balance protection to reduce heavy losses

Amongst our favorite brokers that offer cannabis-related assets and are regulated by these agencies are AvaTrade and eToro.

Final Word

Trading cannabis online can be an exciting way to access a growing market via stocks, indices and ETFs. The political and social views on cannabis use are changing, resulting in legalization and rising public sentiment.

With that said, the outlook for the cannabis market is still unpredictable and imbalances in supply and demand pose large risks to traders and investors.

To start trading today, see our ranking of the top cannabis brokers.

FAQ

Is It Legal To Trade Cannabis?

Trading cannabis through reputable online brokers is legal. There are several stocks that trade on the NYSE, NASDAQ and Toronto Stock Exchange that offer exposure to the cannabis industry. These include AbbVie, Tilray and Aurora Cannabis.

Can Cannabis Be Traded As A Commodity?

Cannabis does not trade on official commodity exchanges. Instead, traders can gain exposure to the market through cannabis-related assets, such as the stocks of cannabis firms, ETFs or indices.

Why Is The Cannabis Industry Growing?

The main factors contributing to industry growth are government regulations, medical research leading to the rollout of new products, and supply and demand. More countries are beginning to accept the use of medical marijuana and positive attitudes toward recreational use are generally improving.

As a result, retail traders are increasingly able to speculate on the industry through online cannabis brokers.

Article Sources

- Research And Markets Cannabis Cannabis Market Insights

- Plus500 Cannabis Stock & Index Conditions

- CMC Markets Aurora Cannabis Conditions

- IG Cannabis Index Conditions

The writing and editorial team at DayTrading.com use credible sources to support their work. These include government agencies, white papers, research institutes, and engagement with industry professionals. Content is written free from bias and is fact-checked where appropriate. Learn more about why you can trust DayTrading.com