Ethereum Trading

Day trading Ethereum has boomed alongside wider cryptocurrency growth. Our tutorial explains Ethereum (ETH) and how to trade it. We offer tips, analysis and day trading strategies. We also explain how and where to find the best exchanges to trade Ethereum. With trading hours, volume and volatility all suiting intraday trades, Ethereum offers great opportunities for active traders.

Top Ethereum Trading Platforms

-

1

Interactive Brokers

Interactive Brokers -

2

NinjaTrader

NinjaTrader -

3

eToro USAeToro USA LLC and eToro USA Securities Inc.; Investing involves risk, including loss of principal; Not a recommendation

eToro USAeToro USA LLC and eToro USA Securities Inc.; Investing involves risk, including loss of principal; Not a recommendation -

4

Plus500USTrading in futures and options involves the risk of loss and is not suitable for everyone.

Plus500USTrading in futures and options involves the risk of loss and is not suitable for everyone.

What Is Ethereum?

Ethereum is the second most valuable form of digital currency (after Bitcoin). But despite the Ethereum market being supported by a lot of the same exchanges and infrastructure that the Bitcoin network has been built on, there remains an important difference.

Ethereum was created primarily as a smart-contract platform, with its native token (ETH) used to pay “gas” fees for transactions and computations on the network, as explained in the official Ethereum documentation on gas fees. Over time, ETH has also come to be used as a store of value, collateral in DeFi, and a medium of exchange in its own right. Pseudonymous and highly traceable purchases can be transferred all over the world, and transactions are stored in a decentralised ledger, the blockchain. As a result, Ethereum is accepted by thousands of online merchants and some physical stores around the world, with support growing via payment processors and crypto gateways.

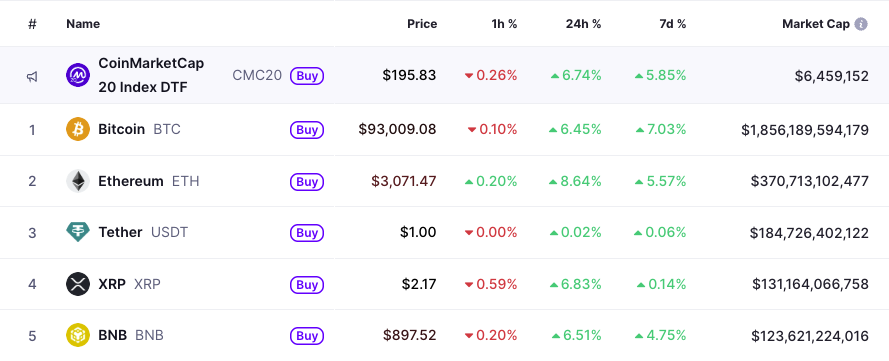

There are now hundreds of tradable cryptocurrencies, and a sizable portion of them trade at prices above $1. The exact number fluctuates as markets move and new coins are listed or delisted. As the table below shows, Ethereum is one of the big players, offering day traders attractive financial opportunities. You can see its current ranking and market capitalization on reputable data trackers like CoinMarketCap.

Why Trade Ethereum?

- Cost – Trading fees vary by platform and by your trading volume. Many major exchanges charge well under 0.5% per trade, with some offering even lower maker/taker fees for high-volume accounts or native-token discounts. Because Ethereum can be bought in very small fractions, traders can participate with relatively modest amounts of capital. That said, ETH is highly volatile, and leveraged trading carries significant risk, so it’s generally more suitable for experienced traders who understand those risks. In the UK, the Financial Conduct Authority (FCA) treats crypto as a high-risk speculative investment, while US regulators warn that digital asset investments are highly speculative and frequently targeted by fraudsters.

- Accessibility – Ethereum trading hours are 24 hours a day, 365 days a year, plus you can trade it from anywhere on the planet. All you need is an internet connection.

- Leverage – Some platforms offer leveraged products on Ethereum, which can magnify both gains and losses. In many jurisdictions, regulators restrict or ban certain leveraged crypto derivatives for retail traders, and even where they’re available, they are very high-risk. Treat leverage with extreme caution and assume you could lose all of the capital you put at risk.

- Knowledge – You don’t need to be a protocol engineer to day trade Ethereum, but you should understand how your exchange, orders, fees, and wallets work before risking real capital.

Before you trade, make sure you understand the common risks and scams highlighted in the official Ethereum security resources.

Comparing Ethereum Exchanges

With the increasing choice of trading platforms to choose from, what should you look for in Ethereum brokers?

Financial Factors

- Fees – Ethereum trading fees vary drastically amongst providers. Unlike buying stocks or bonds, your platform will probably charge you a percentage. Look for platforms with transparent, competitive fee structures – typically low percentage-based maker/taker fees and tight spreads – rather than simply chasing the lowest headline rate.

- Margin – You can find websites that offer generous Ethereum trading margins. This will enable you to borrow capital, maximising profits on a potential move. Look for brokerages that offer low interest rates when you trade on margin.

- Account types – The type of Ethereum trading account you have can seriously impact your success. Many providers will offer several account options. Look for companies that offer customisability, competitive spreads, and straightforward withdrawals. Going for the cheapest account may cost you profit in the long term.

- Liquidity – In the Ethereum market, day traders are looking to buy or sell, so it’s important to take into account the amount of liquidity the Ethereum trading exchange can have. Liquidity enables you to sell without the price being substantially impacted.

Other Factors

- Trading robots – An Ethereum trading bot could save you a lot of painstaking hours staring at a computer screen. An increasing number of firms offer these automated services, where once you’ve programmed in your rules, the bot will do all the heavy lifting. If you go down this route, find a company offering a continuously updated Ethereum trading algorithm. It’s imperative that their calculator bot changes along with market conditions.

- Customer service – With Ethereum trading times running 24 hours a day, you need to choose a website that will be there to remedy any problems, whatever the time. Check a brand’s customer service reviews before you sign up. Some will even promise a wait time of less than one minute for phone support.

- Trading platform – The Ethereum trading platform you use will be your door to the market. Make sure you opt for a provider with a user-friendly and powerful platform. You can test drive your company first to ensure their Ethereum trading software will cut the mustard. But before you even do that, check Ethereum trading platform reviews.

- Deposits – There is an increasing number of brokers that accept Ethereum payments. This can make it easier to trade and finance ETH positions. Alternatively, the top sites support deposits and withdrawals via other cryptos and fiat currencies.

- Mobile apps – The successful day trader is always connected to the market, but you can’t always be at your computer. Many Ethereum exchanges offer intelligent and easy-to-use trading apps. These may save you serious money one day when the kettles are boiling, and the market starts to plunge.

- Regulation – You may find Ethereum trading in Pakistan to be riskier than Ethereum trading in the UK. This is because you need a well-regulated exchange. A strong regulator aims to protect the market and retail traders, reducing the risk of fraud and abuse – though it cannot eliminate losses or guarantee your money.

Everyone’s day trading needs are different, so there is no such thing as the ‘perfect universal platform.’ Instead, decide which of the factors above are most important to you and go about your research with those in mind.

Ethereum Trading Forecast

Ethereum has blossomed from the cryptocurrency boom in recent years. After the gigantic profits of some of the early bitcoin followers, cryptocurrencies have gone viral. Shortly after its launch in 2015, Ethereum’s market capitalization was around $80 million. At its peak in November 2021, its market cap had skyrocketed to over $500 billion. You can see how Ethereum’s valuation has changed over time using historical market cap data.

Everyone wants a slice of the action, and that has led to extraordinary market valuations that some argue are difficult to justify. Due to the unpredictable future of Ethereum and other virtual currencies, they remain a relatively risky asset to trade.

Maybe Tim Draper, venture capitalist, will be proved right when he asserted, “this is much like the internet was early on. It could be bigger than anything we’ve ever seen.” Draper made these comments in an interview discussing the Silicon Valley cryptocurrency boom. However, perhaps it will be Jamie Dimon, chief executive of JPMorgan, who will be closer to the mark when he called cryptocurrencies little more than a “fraud” (sending bitcoin prices plummeting by 10%).

Who will be correct is likely to be determined in the coming years as governments and corporations scramble to regulate and find a place for cryptocurrencies in the modern world. Whilst this makes placing a long-term bet on Ethereum risky, the volatility and exceptional Ethereum trading volume make it a rich hunting ground for the day trader.

Video – Ethereum Explained

Ethereum Trading Tips

The price inflation that has come with Ethereum’s success means your mistakes could be extremely costly. One tip for the Ethereum day trader is to be aware of momentum.

Ethereum picks up momentum extremely quickly, and if you don’t react swiftly, you can lose more than you make simply by missing out on price jumps. Timing is everything. It could jump up to $6, and then you might price it to buy $3 lower again, but it only comes down to $4 before jumping another $10. Then it may not even come back down to the price you sold it at, so you have to buy it back for several dollars more than you sold it for, if you want to hit the next price jump.

Trading News & Discussion Boards

Ethereum trading 101 – the world of virtual currencies is fragile, so keeping abreast of new developments is essential. When day trading Ethereum, you need to do everything you can to find and maintain an edge. Below are links to news resources and discussion boards that will help you stay up to date on all things Ethereum.

- Coindesk

- The Street

- Coin Telegraph

- Cryptocoin News

- CNBC

- Brave New Coin

- Crypto Insider

Hands-On Education

With such a competitive market, simply keeping up with the news is no longer enough. You need to look to other resources for an edge. Consider Ethereum trading forums and blogs to guide you through the trading process.

Strategies

Capitalise On Volatility

Volatility measures the price difference of a specific financial instrument (e.g. Ethereum), within a certain period of time. History shows us Ethereum’s price has swung by double-digit percentages within a single day. European regulators similarly highlight that many crypto-assets are highly speculative and subject to sudden and extreme price swings.

Although this brings with it more risk, it also offers the smart day trader greater opportunities to turn a profit. So, make sure you look at data, patterns for signals that indicate volatility.

Technical Analysis

Those who make a profit day trading are those who hone their edge. To solidify that edge, you need to be able to make market decisions based primarily on price charts. Mastering Ethereum trading analysis takes time and practice. Set up a demo account to get familiar with the basics of charts and patterns. These simulator accounts are funded with virtual money, allowing you to flesh out any mistakes before you put real money on the line.

Money Management

An essential component of your day trading Ethereum strategy needs to be money management. You can never predict with total accuracy what will happen in the market, so you need an effective money management strategy at all times. This will minimise your losses when you make mistakes and maximise your profits when you get it right.

Price

The price of Ethereum fluctuates massively, which is part of the reason it makes for a dynamic and exciting instrument to trade in. Look for the Ethereum trading symbol in the price chart below. Here you will be able to view the Ethereum trading price and rate before you start day trading.

Regional Differences

Regulation

Ethereum trading rules may vary depending on the jurisdiction. This is mainly down to regulation. As countries and companies rush to react to the emerging market, cryptocurrencies are susceptible to serious knocks. For example, in September of 2017, the Chinese government stated they were banning the raising of funds through Initial Coin Offering (ICO). As a result, trading in Ethereum fell sharply, with prices dropping by over 20% around the time of the ban.

So, before you start trading, find out what your local regulations are on virtual currencies; otherwise, you may find yourself in an expensive predicament. In the EU, for example, ESMA has rolled out its dedicated MiCA regime for crypto-assets and emphasises that they remain high-risk products.

Once you’ve got the green light, look at specialist trading platforms. Certain Ethereum trading sites and platforms in India, for example, have been streamlined for Ethereum trading. You may find that a specialist platform will give you faster execution speeds and more competitive spreads if you want to make Ethereum your bread and butter.

Taxes

The other varying factor to be aware of is taxes, which vary depending on your country. If you’re going to start day trading Ethereum, you must look at that country’s tax regulations first, otherwise you might lose an unnecessary amount of profit to unfavourable tax rules. Find out what sort of tax you will have to pay and in what quantities. In the US, for example, taxpayers should review the IRS’s rules on digital assets and virtual currency transactions. In the UK, traders must refer to the detailed guidance on the tax treatment of cryptoassets published by HM Revenue & Customs.

Take Away Points

Ethereum is a volatile and unpredictable asset class to start day trading. However, whilst its future remains uncertain, there’s plenty of opportunity to yield substantial profits. With technical analysis, news, and an effective money management strategy, you’re in a strong position to start trading Ethereum today.

Day trading cryptoassets such as Ethereum is highly speculative and involves a significant risk of loss. Multiple EU authorities have jointly warned that virtual currencies are unregulated, highly risky, and unsuitable for many retail investors. Never risk more than you can afford to lose.