Best Ethereum Brokers & Exchanges 2026

Ethereum brokers provide a platform or app where traders can take advantage of short-term trading opportunities in Ether (ETH), one of the largest digital currencies by market capitalization.

Dig into our pick of the best brokers for trading Ethereum brokers, selected by our experts as the most reliable providers with competitive pricing and trading tools geared toward ETH traders.

Top 6 Ethereum Brokers & Exchanges In 2026

After testing 139 providers, we’ve identified the 6 best for secure Ethereum trading :

-

1

Interactive Brokers

Interactive Brokers -

2

eToro USAeToro USA LLC and eToro USA Securities Inc.; Investing involves risk, including loss of principal; Not a recommendation

eToro USAeToro USA LLC and eToro USA Securities Inc.; Investing involves risk, including loss of principal; Not a recommendation -

3

OANDA USCFDs are not available to residents in the United States.

OANDA USCFDs are not available to residents in the United States. -

4

FOREX.com

FOREX.com -

5

CEX.IO

CEX.IO -

6

xChief

xChief

Why Are These Brokers The Best For Trading Ethereum?

Here’s a brief rundown of why we believe these firms stand out for Ethereum trading:

- Interactive Brokers is the best broker for trading Ethereum in 2026 - IBKR lets you purchase and hold Bitcoin, Bitcoin Cash, Ethereum, and Litecoin at competitive commission rates and without needing a crypto wallet. Additionally, there is a range of other diverse assets to explore, such as crypto indices like the NYSE Bitcoin Index, as well as futures contracts like the BAKKT Bitcoin Futures.

- eToro USA - eToro US offers 24 tradeable cryptoassets, with just a 1% buying/selling fee added to the spread. Additionally, there are 80 different coins available through the broker’s proprietary wallet service. You can also practice your crypto strategies easily by switching between live and demo mode. Crypto asset investing is highly volatile and unregulated. No consumer protection. Tax on profits may apply.

- OANDA US - Cryptocurrency trading is offered via Paxos, a separate entity from Oanda. You can speculate on the world’s biggest cryptos by market cap. Commissions are lower than many peers starting at 0.25%. Through the broker’s partnership with Paxos, clients can spot trade cryptocurrencies on the itBit exchange through the OANDA native platform.

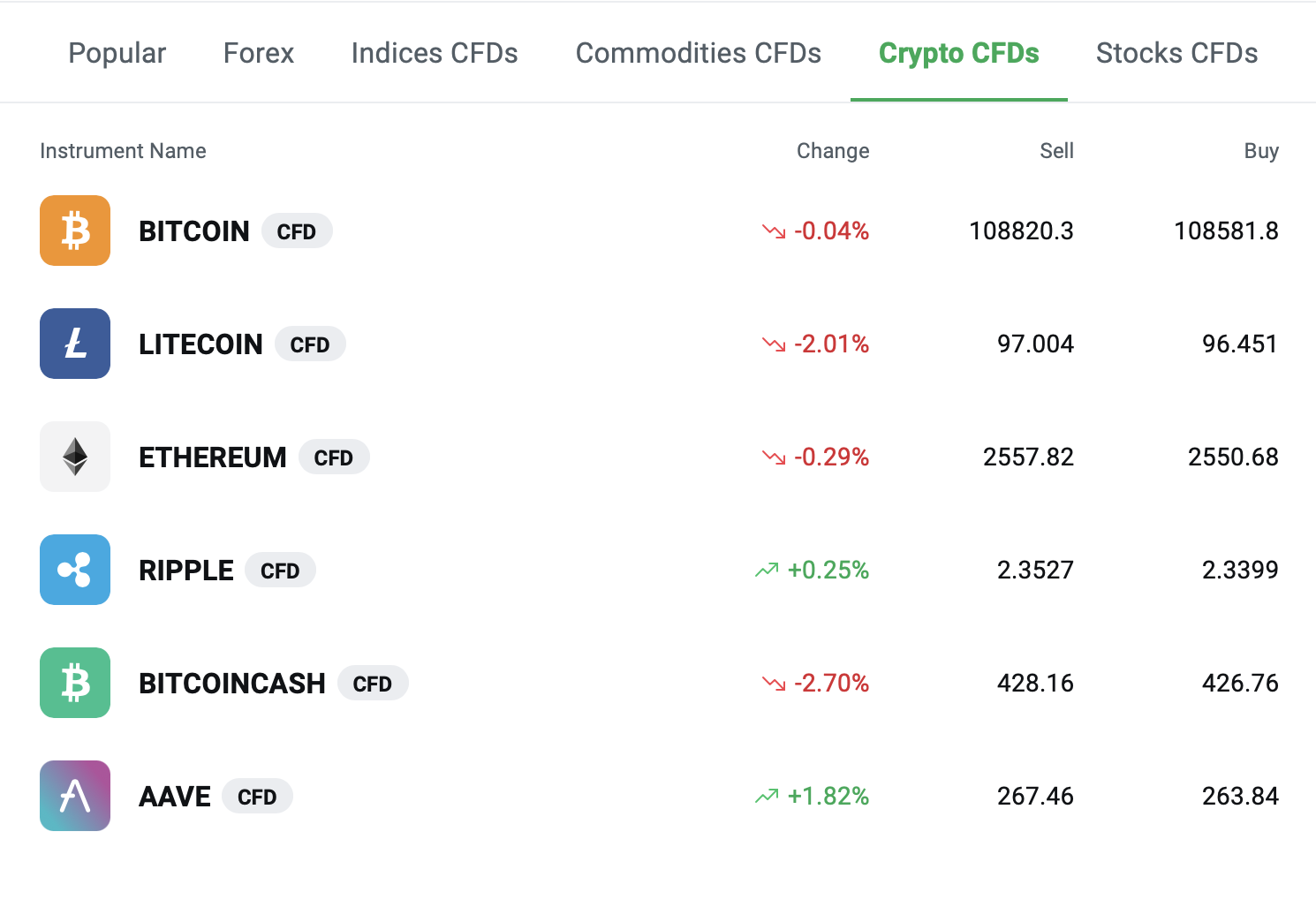

- FOREX.com - You can trade a small range of 8+ cryptos against USD, EUR, GBP and AUD with tight spreads and no virtual wallet required. Algo traders can also utilize Expert Advisors (EAs) to automate their crypto trades.

- CEX.IO - CEX.IO offers hundreds of popular cryptocurrencies including big names like Bitcoin, Ethereum and Litecoin. The trading platform is well-designed with sophisticated charting and analysis tools, including 50+ in-built indicators. Traders can also reduce their monthly volumes through the tiered pricing structure.

- xChief - xChief’s range of 5 cryptocurrencies paired with USD is smaller than most competitors. In addition, the average BTCUSD spread of 30 pips is not the cheapest. That said, the broker does offer some useful crypto trading guides for beginners.

Compare The Top Ethereum Brokers And Exchanges In Key Areas

Find the right Ethereum provider for you based on our comparison of core features important to day traders:

| Broker | Margin Trading | Payment Methods | Regulators |

|---|---|---|---|

| Interactive Brokers | ✔ | ACH Transfer, Automated Customer Account Transfer Service, Cheque, Debit Card, TransferWise, Wire Transfer | FCA, SEC, FINRA, CFTC, CBI, CIRO, SFC, MAS, MNB, FINMA, AFM |

| eToro USA | ✔ | ACH Transfer, Debit Card, PayPal, Wire Transfer | SEC, FINRA |

| OANDA US | ✔ | ACH Transfer, Debit Card, Mastercard, Visa, Wire Transfer | NFA, CFTC |

| FOREX.com | ✔ | ACH Transfer, Credit Card, Debit Card, Mastercard, Neteller, PayNow, Skrill, Visa, Wire Transfer | NFA, CFTC |

| CEX.IO | ✔ | Apple Pay, Bitcoin Payments, Credit Card, Debit Card, Google Pay, Mastercard, Neteller, PayPal, Skrill, Swift, Visa, Wire Transfer | GFSC |

| xChief | ✔ | Bitcoin Payments, Credit Card, Debit Card, Ethereum Payments, FasaPay, Neteller, Perfect Money, Skrill, UnionPay, Volet, WebMoney, Wire Transfer | ASIC |

How Safe Are These Leading Ethereum Trading Providers?

In a market known for volatility and risks, consider how the top Ethereum trading platforms protect your funds:

| Broker | Trust Rating | Guaranteed Stop Loss | Negative Balance Protection | Segregated Accounts |

|---|---|---|---|---|

| Interactive Brokers | ✘ | ✔ | ✔ | |

| eToro USA | ✘ | ✘ | ✔ | |

| OANDA US | ✘ | ✘ | ✘ | |

| FOREX.com | ✘ | ✔ | ✔ | |

| CEX.IO | ✘ | ✔ | ✔ | |

| xChief | ✘ | ✘ | ✔ |

Compare Mobile Ether Trading Apps

With the crypto market always on the move, here’s how these Ethereum brokers perform on mobile following our tests of their apps:

| Broker | Mobile Apps | iOS Rating | Android Rating | Smart Watch App |

|---|---|---|---|---|

| Interactive Brokers | iOS & Android | ✔ | ||

| eToro USA | iOS & Android | ✘ | ||

| OANDA US | iOS & Android | ✘ | ||

| FOREX.com | iOS & Android | ✘ | ||

| CEX.IO | iOS & Android | ✘ | ||

| xChief | iOS & Android | ✘ |

Are The Top ETH Providers Good For Beginners?

Ethereum trading beginners need brokers with the right tools for learning - here’s what the top platforms offer:

| Broker | Demo Account | Minimum Deposit | Minimum Trade | Education Rating | Support Rating |

|---|---|---|---|---|---|

| Interactive Brokers | ✔ | $0 | $100 | ||

| eToro USA | ✔ | $100 | $10 | ||

| OANDA US | ✔ | $0 | 0.01 Lots | ||

| FOREX.com | ✔ | $100 | 0.01 Lots | ||

| CEX.IO | ✘ | $20 | $1 | ||

| xChief | ✔ | $10 | 0.01 Lots |

Are The Top ETH Providers Good For Advanced Traders?

Experienced Ethereum traders need professional-grade features - here’s what the leading brokerages deliver:

| Broker | Automated Trading | VPS | AI | Pro Account | Leverage | Low Latency | Extended Hours |

|---|---|---|---|---|---|---|---|

| Interactive Brokers | Capitalise.ai, TWS API | ✘ | ✔ | ✘ | 1:50 | ✔ | ✔ |

| eToro USA | ✘ | ✘ | ✘ | ✘ | - | ✔ | ✔ |

| OANDA US | Expert Advisors (EAs) on MetaTrader | ✘ | ✔ | ✘ | 1:50 | ✔ | ✘ |

| FOREX.com | Expert Advisors (EAs) on MetaTrader | ✔ | ✔ | ✘ | 1:50 | ✔ | ✘ |

| CEX.IO | API | ✘ | ✘ | ✘ | - | ✘ | ✘ |

| xChief | Expert Advisors (EAs) on MetaTrader | ✘ | ✘ | ✘ | 1:1000 | ✘ | ✘ |

Compare The Ratings Of Top Ethereum Brokers And Exchanges

See how the top Ethereum trading platforms rate in vital categories following our expert-assigned scores:

| Broker | Trust | Platforms | Assets | Mobile | Fees | Accounts | Research | Education | Support |

|---|---|---|---|---|---|---|---|---|---|

| Interactive Brokers | |||||||||

| eToro USA | |||||||||

| OANDA US | |||||||||

| FOREX.com | |||||||||

| CEX.IO | |||||||||

| xChief |

How Popular Are The Top Ethereum Brokers And Exchanges?

Many Ethereum traders trust providers with the largest user bases - here’s how many clients the top platforms have:

| Broker | Popularity |

|---|---|

| CEX.IO | |

| Interactive Brokers | |

| eToro USA | |

| xChief | |

| FOREX.com |

Why Trade ETH With Interactive Brokers?

"Interactive Brokers is one of the best brokers for advanced day traders, providing powerful charting platforms, real-time data, and customizable layouts, notably through the new IBKR Desktop application. Its superb pricing and advanced order options also make it highly attractive for day traders, while its diverse range of equities is still among the best in the industry."

Christian Harris, Reviewer

Interactive Brokers Quick Facts

| Coins | BTC, LTC, ETH, XRP |

|---|---|

| Crypto Mining | No |

| Auto Market Maker | No |

| Crypto Spread | 0.12%-0.18% |

| Crypto Lending | No |

| Crypto Staking | No |

| Platforms | Trader Workstation (TWS), IBKR Desktop, GlobalTrader, Mobile, Client Portal, AlgoTrader, OmniTrader, TradingView, eSignal, TradingCentral, ProRealTime, Quantower |

| Minimum Deposit | $0 |

| Regulator | FCA, SEC, FINRA, CFTC, CBI, CIRO, SFC, MAS, MNB, FINMA, AFM |

| Account Currencies | USD, EUR, GBP, CAD, AUD, INR, JPY, SEK, NOK, DKK, CHF, AED, HUF |

Pros

- IBKR continues to deliver unmatched access to global stocks with tens of thousands of equities available from 100+ market centres in 24 countries, most recently the Saudi Stock Exchange.

- Interactive Brokers has launched ForecastTrader, a unique, zero-commission product where users can trade yes/no Forecast Contracts on political, economic, and climate events, with fixed $1 payouts per contract, 24/6 market access, and 3.83% APY on held positions.

- There's a vast library of free or paid third-party research subscriptions catering to all types of traders, plus you can enjoy commission reimbursements from IBKR if you subscribe to Toggle AI.

Cons

- TWS’s learning curve is steep, and beginners may find it challenging to navigate the platform and understand all the features. Plus500's web platform is much better suited to new traders.

- Support can be slow and frustrating based on tests, so you might find it challenging to reach customer service representatives promptly or encounter delays in resolving issues.

- You can only have one active session per account, so you can’t have your desktop program and mobile app running simultaneously, making for a sometimes frustrating trading experience.

Why Trade ETH With eToro USA?

"eToro remains a top pick for traders looking for leading social investing and copy trading services. With a low deposit, zero commissions and an intuitive platform, the broker will meet the needs of newer day traders."

Jemma Grist, Reviewer

eToro USA Quick Facts

| Coins | BTC, ETH, BCH, DASH, LTC, ETC, MIOTA, XLM, EOS, NEO, ZEC, XTZ, MKR, COMP, LINK, UNI, YFI, DOGE, AAVE, ALGO, MANA, ENJ, BAT, MATIC, FLR, SHIBxM |

|---|---|

| Crypto Mining | No |

| Auto Market Maker | No |

| Crypto Spread | BTC 0.75% |

| Crypto Lending | No |

| Crypto Staking | No |

| Platforms | eToro Trading Platform & CopyTrader |

| Minimum Deposit | $100 |

| Regulator | SEC, FINRA |

| Account Currencies | USD |

Pros

- The low minimum deposit and straightforward account opening process means beginners can get started quickly

- The online broker offers an intuitive social investment network with straightforward copy trading on cryptos

- Investors can access Smart Portfolios for a more hands-off approach, covering a range of sectors and markets such as renewable energy and artificial intelligence

Cons

- Average fees may cut into the profit margins of day traders

- There's a narrower range of day trading instruments available compared to competitors, with only stocks, ETFs and cryptos

- The proprietary terminal doesn't support trading bots and there are no additional stock market analysis tools

Why Trade ETH With OANDA US?

"OANDA remains an excellent broker for US day traders seeking a user-friendly platform with premium analysis tools and a straightforward joining process. OANDA is also heavily regulated with a very high trust score."

Jemma Grist, Reviewer

OANDA US Quick Facts

| Coins | BTC, ETH, LTC, BCH, PAXG, LINK, UNI, AAVE |

|---|---|

| Crypto Mining | No |

| Auto Market Maker | No |

| Crypto Spread | $100 |

| Crypto Lending | No |

| Crypto Staking | No |

| Platforms | OANDA Trade, MT4, TradingView, AutoChartist |

| Minimum Deposit | $0 |

| Regulator | NFA, CFTC |

| Account Currencies | USD, EUR, GBP, AUD, JPY, CHF, HKD, SGD |

Pros

- The broker's API facilitates access to 25 years of deep historical data and rates from 200+ currencies

- Beginners can get started easily with $0 minimum initial deposit

- OANDA is a reliable, trustworthy and secure brand with authorization from tier-one regulators including the CFTC

Cons

- The range of day trading markets is limited to forex and cryptos only

- There's only a small range of payment methods available, with no e-wallets supported

- It's a shame that customer support is not available on weekends

Why Trade ETH With FOREX.com?

"FOREX.com remains a best-in-class brokerage for active forex traders of all experience levels, with over 80 currency pairs, tight spreads from 0.0 pips and low commissions. The powerful charting platforms collectively offer over 100 technical indicators, as well as extensive research tools."

Christian Harris, Reviewer

FOREX.com Quick Facts

| Coins | BTC, BCH, ETH, LTC, XRP |

|---|---|

| Crypto Mining | No |

| Auto Market Maker | No |

| Crypto Spread | BTC 1.4%, ETH 2% |

| Crypto Lending | No |

| Crypto Staking | No |

| Platforms | WebTrader, Mobile, MT4, MT5, TradingView |

| Minimum Deposit | $100 |

| Regulator | NFA, CFTC |

| Account Currencies | USD, EUR, GBP, CAD, AUD, JPY, CHF, PLN |

Pros

- There’s a wealth of educational resources including tutorials, webinars, and a stacked YouTube channel to help you get educated in the financial markets.

- FOREX.com offers industry-leading forex pricing starting from 0.0 pips, alongside competitive cashback rebates of up to 15% for serious day traders.

- With over 20 years of experience, excellent regulatory oversight, and multiple accolades including runner-up in our 'Best Forex Broker' awards, FOREX.com boasts a global reputation as a trusted brokerage.

Cons

- FOREX.com's MT4 platform offers approximately 600 instruments, significantly fewer than the over 5,500 available on its non-MetaTrader platforms.

- Demo accounts are frustratingly time-limited to 90 days, which doesn’t give you enough time to test day trading strategies effectively.

- There’s no negative balance protection for US clients, so you may find yourself owing more money than your initial deposit into your account.

Why Trade ETH With CEX.IO?

"CEX.IO continues to serve a range of crypto investors looking to buy, sell, trade, hold and earn with low fees. The tiered pricing structure will appeal to active traders while rookie investors will enjoy the straightforward platform interface and excellent education."

Tobias Robinson, Reviewer

CEX.IO Quick Facts

| Coins | ZRX, 1INCH, AAVE, BTC, BCH, ADA, LINK, COMP, ATOM, DAI, DOGE, ETH, GUSD, ICP, LTC, LRC, MATIC, MKR, DOT, SHIB, SOL, XLM, SUSHI, SNX, USDT, XTZ, USDC, UNI, WBTC, ZIL |

|---|---|

| Crypto Mining | No |

| Auto Market Maker | No |

| Crypto Spread | 0.15% maker & 0.25% taker (Standard) |

| Crypto Lending | Yes |

| Crypto Staking | Yes |

| Platforms | TradingView |

| Minimum Deposit | $20 |

| Regulator | GFSC |

| Account Currencies | USD, EUR, GBP |

Pros

- High quality educational materials are available through the University feature

- Crypto leverage is available up to 1:3

- There's a wide range of global payment methods available including PayPal

Cons

- The Exchange Plus platform delivers a cluttered interface compared to competitor platforms

- The broker has limited regulatory oversight

- It's a shame that there's no demo account for traders looking to practice strategies

Why Trade ETH With xChief?

"xChief continues to prove popular with investors looking to trade highly leveraged CFDs on the popular MetaTrader platforms. The broker's rebate scheme and investment accounts will particularly appeal to seasoned traders. However, the lack of top-tier regulatory oversight is a major drawback."

William Berg, Reviewer

xChief Quick Facts

| Coins | BTC, BCH, ETH, LTC, XRP |

|---|---|

| Crypto Mining | No |

| Auto Market Maker | No |

| Crypto Spread | Variable |

| Crypto Lending | No |

| Crypto Staking | No |

| Platforms | MT4, MT5 |

| Minimum Deposit | $10 |

| Regulator | ASIC |

| Account Currencies | USD, EUR, GBP, JPY, CHF |

Pros

- xChief offers STP/ECN execution with low spreads from 0.0 pips and low commission rates starting from $2.50 per side

- The broker offers a turnover rebate scheme geared towards active investors, as well as trading credits and several other occasional bonuses

- Traders can access a copy trading solution via the MetaQuotes Signals service

Cons

- The total range of 150+ assets is much lower than most competitors who typically offer hundreds

- The broker trails competitors when it comes to research tools and educational resources

- The Classic+ and Cent accounts provide access to fewer instruments than the other account types, at 50+ and 35+, respectively

How Did DayTrading.com Choose The Best Ethereum Trading Platforms?

We ranked Ethereum brokers and exchanges based on total ratings after evaluating over 200 metrics across eight core categories. Our analysis included data points specific to Ethereum trading.

Our rigorous testing process – led by industry professionals, including those who trade Ethereum – offers real-world insights you won’t find in surface-level reviews.

The result? A carefully curated list of the best Ethereum trading platforms, optimized for security, performance, and user experience.

What To Look For In A Top Broker For Trading Ethereum

Trust

Cryptocurrencies are a relatively new way of trading and the regulatory framework has not yet caught up with traditional markets, so you need to take great care when selecting a broker.

In 2022 the fate of FTX, the third-largest crypto exchange at the time, highlighted the risk. Client funds were mixed with business funds and a spike in withdrawals led to the exchange’s collapse and customers unable to retrieve billions in deposits.

We’ve found that crypto brokers tend to be more reliable because they are more likely to have regulation from a green-tier body on DayTrading.com’s Regulation & Trust Rating like the Australian Securities and Investments Commission (ASIC).

Since brokers need to implement stringent measures such as client fund segregation to obtain a licence from one of these organizations, the level of protection is often higher.

- Our experts consistently turn to Pepperstone for ETH traders thanks to its sterling record as a reliable broker, with regulation by seven bodies including green-tier regulators like the FCA, ASIC and CySEC. Since it was founded in 2010, it’s accrued a slew of awards, including DayTrading.com’s Best Overall Broker Award, and it serves more than half a million traders worldwide.

Trading Vehicles

You should choose a broker that offers trading a trading vehicle to suit your style, whether that involves buying and selling ETH tokens directly or trading derivatives such as crypto CFDs and perpetual swaps.

In our experience, the more reliable crypto brokers tend to offer trading via CFDs or by trading ETH tokens directly.

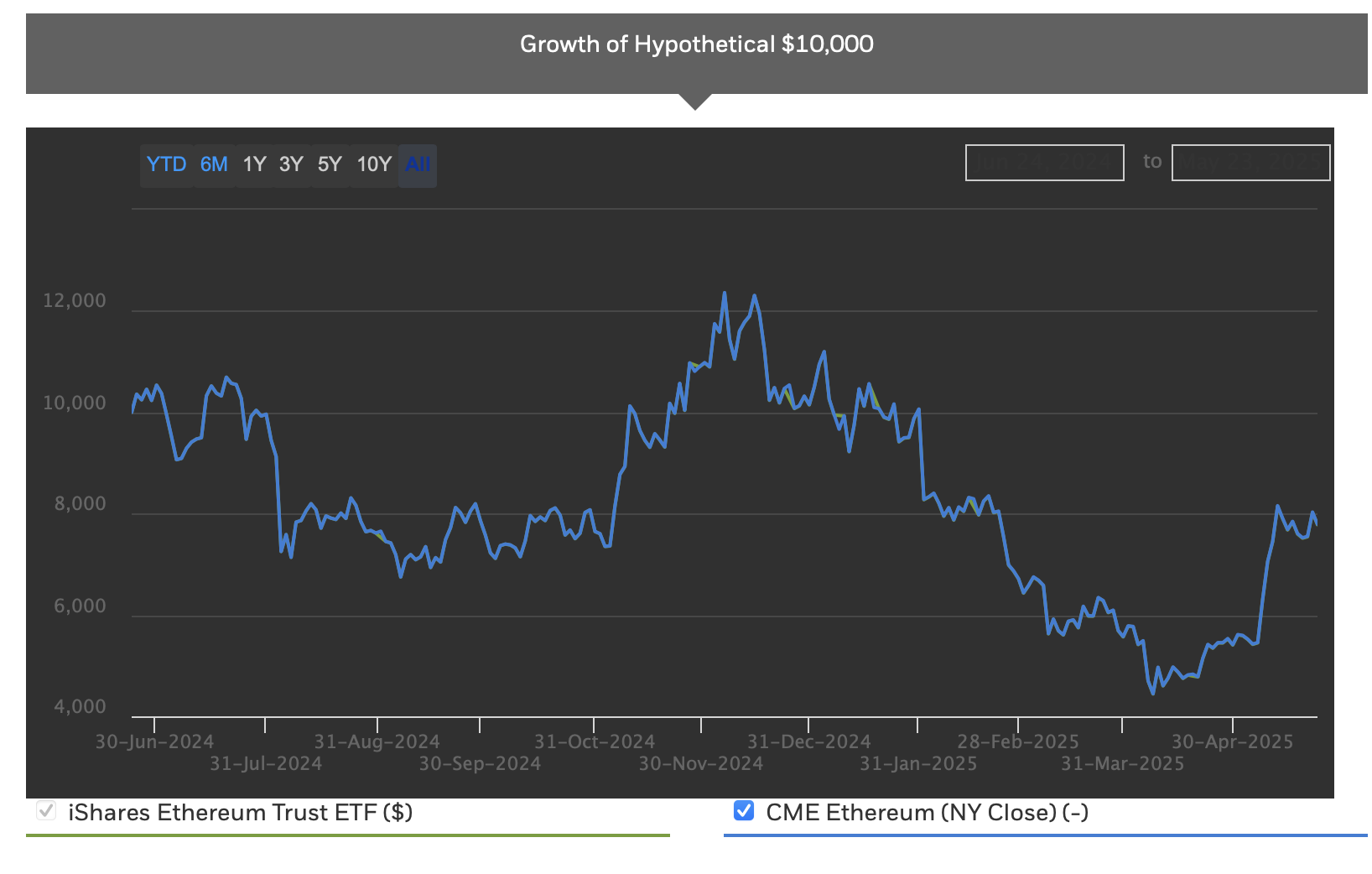

You may also be able to make short-term ETH trades via Ethereum ETFs on these brokers – the iShares Ethereum Trust ETF, for example.

We’ve more often found derivatives like options, futures and perpetual swaps available on crypto exchanges such as OKX.

While these exchanges are crypto specialists and may have more ETH markets available, bear in mind that the regulatory framework is less developed and many traders have lost money from exchanges due to scams or business failure.

- CMC Markets continues to lead the market for its huge range of trading instruments, including cryptocurrencies. As well as trading ETH pairs with USD, you can also access crypto indices for a broader slice of crypto markets including ETH and other tokens.

Fees

Choose an ETH broker with low fees to avoid the frustration of watching your hard-earned money siphoned away during your short-term trades.

You should research the specific fees for trading ETH as these will vary among brokers.

We’ve found that many brokers advertise their most optimistic case by quoting the minimum spread – but you should try to find out the average spread on ETH as well as any additional commission fees charged per trade.

Other fees to consider include costs for funding your account (withdrawal and deposit fees), charges for tools such as data feeds, and hidden costs like account inactivity fees.

One of the things I look out for when trading crypto tokens like ETH is gas fees. These are the costs of making transactions on the Ethereum network, and they increase during periods when traffic is high.Since ETH derivatives like CFDs are not subject to gas fees, I’m often drawn to these when making short-term trades.

- XTB’s transparent and competitive ETH CFD pricing continues to impress us, with no commissions and spreads starting at 0.22% of the market price and not exceeding 0.3% during our latest tests. There are also fee-free deposits and withdrawals, minimizing the additional costs for regular traders.

- 72% of retail investor accounts lose money when trading CFDs with this provider.

Leverage

You should trade with an ETH broker that is transparent about the amount of leverage on offer and the rules around using it.

Leverage allows you to increase the size of your trading position with borrowed funds. The leverage will either be provided by the broker or exchange, or in some cases like leveraged ETFs it is built into the investment product.

This is a powerful tool as it amplifies your gains – 1:10 leverage will increase a 5% to a 50% gain, for example – but be warned: losses are increased to the same degree, multiplying your risk.

In volatile crypto instruments like ETH, this can lead to large losses, so you should implement strict risk management and consider every leveraged play carefully.

I’ve found that high leverage is rarely necessary when trading crypto, because the price movements already tend to be larger than in other markets I trade.

- If you want to make leveraged trades with ETH, FXCC remains a reliable port of call with transparent pricing and regulation by the CySEC. That means that EU-based customers can trade ETH CFDs with 1:2 leverage, while traders based elsewhere can access leverage up to 1:5 through FXCC’s offshore entity.

Platforms & Tools

You may need to spend significant time analyzing charts and researching fundamentals for success trading ETH, so selecting Ethereum brokers with powerful but user-friendly platforms is important.

Whether that be the industry-established MetaTrader 4 (MT4) or bespoke proprietary terminals, traders of all experience levels should be able to find a system that meets their needs.

Integrated price analysis tools and interactive charts and graphs will support your transaction decisions, so look for a platform such as TradingView that offers intuitive services.

You can also utilize demo accounts to get a feel for features before opening a live account and depositing capital.

The best Ethereum brokers provide additional features, such as access to information on strategies or other educational resources. These can be particularly useful if you’re new to crypto investing.

- Our experts are regularly drawn to IC Markets to trade ETH because it has one of the best trading platform offerings of any broker we’ve used. The choice between MT4, MT5, cTrader and TradingView already provides great flexibility for traders, but throw in access to tools like DupliTrade, Trading Central and IC Insights and you’ve got a powerful and fully rounded suite for planning your Ethereum trades.

Account Options

Choose a broker with account options that suit your circumstances and preferences.

We’ve found that a low minimum deposit is an important consideration for many traders who want to try out brokers without a large initial outlay.

Accepted deposit methods are another important consideration, as many traders wish to use e-wallets or other digital methods as well as the standard card and wire transfers.

Crypto traders especially tend to look for brokers that accept deposits in ETH payments or another token.

- FXPro’s account options remain among the best out there for Ethereum traders, who can use ETH, BTC, e-wallets like PayPal and Skrill or classic card and wire transfers to fund their accounts. The $100 minimum deposit is accessible, and there are no deposit or withdrawal charges account funding imposed when you fund or empty your account.

FAQ

Why Is An Ether Broker?

Ethereum brokers are online platforms that facilitate the purchase, sale and exchange of Ethereum (ETH). This could be in the form of spot and leveraged investing, futures, CFDs or other derivatives.

What Is The Difference Between An Ethereum Broker And An Exchange?

An exchange provides an online platform for users to buy and sell Ethereum with each other. Ethereum brokers, on the other hand, set the price themselves or sources it from liquidity providers, and often provides trading via derivatives like CFDs rather than directly buying and selling the crypto tokens.

Article Sources

The writing and editorial team at DayTrading.com use credible sources to support their work. These include government agencies, white papers, research institutes, and engagement with industry professionals. Content is written free from bias and is fact-checked where appropriate. Learn more about why you can trust DayTrading.com