Momentum Trading

Momentum trading is a popular strategy for forex, stocks and other assets that aims to take advantage of strong price trends. Below we uncover the key definitions and learn about some popular strategies, indicators and software. We also review whether momentum intraday trading works and provide some ideas and tips to boost your education.

Momentum Trading Brokers

-

1

Interactive Brokers

Interactive Brokers -

2

NinjaTrader

NinjaTrader -

3

eToro USAeToro USA LLC and eToro USA Securities Inc.; Investing involves risk, including loss of principal; Not a recommendation

eToro USAeToro USA LLC and eToro USA Securities Inc.; Investing involves risk, including loss of principal; Not a recommendation -

4

Plus500USTrading in futures and options involves the risk of loss and is not suitable for everyone.

Plus500USTrading in futures and options involves the risk of loss and is not suitable for everyone. -

5

OANDA USCFDs are not available to residents in the United States.

OANDA USCFDs are not available to residents in the United States. -

6

FOREX.com

FOREX.com

Here is a short summary of why we think each broker belongs in this top list:

- Interactive Brokers - Interactive Brokers (IBKR) is a premier brokerage, providing access to 150 markets in 33 countries, along with a suite of comprehensive investment services. With over 40 years of experience, this Nasdaq-listed firm adheres to stringent regulations by the SEC, FCA, CIRO, and SFC, amongst others, and is one of the most trusted brokers for trading around the globe.

- NinjaTrader - NinjaTrader is a US-headquartered and regulated brokerage that specializes in futures trading. There are three pricing plans to suit different needs and budgets, as well as ultra-low margins on popular contracts. The brand's award-winning charting software and trading platform also offers a high-degree of customization and superb technical analysis features.

- eToro USA - eToro is a social investing platform that offers short-term and long-term trading on stocks, ETFs, options and crypto. The broker is well-known for its user-friendly community-centred platform and competitive fees. With FINRA and SIPC oversight and millions of users across the world, eToro is still one of the most respected brands in the industry. eToro securities trading is offered by eToro USA Securities, Inc.

- Plus500US - Plus500US is a well-established broker that entered the US market in 2021. Authorized by the CFTC and NFA, it provides futures trading on forex, indices, commodities, cryptocurrencies, and interest rates. With a 10-minute sign-up, a manageable $100 minimum deposit, and a straightforward web platform, Plus500 continues to strengthen its offering for traders in the US.

- OANDA US - OANDA is a popular brand offering exceptional execution, low deposit requirements and advanced charting and trading platform features. The top-rated brand has over 25 years of experience and is regulated by trusted agencies, including the NFA/CFTC. Around the clock support is available for short-term traders, alongside flexible contract sizes and automated trade executions.

- FOREX.com - Founded in 1999, FOREX.com is now part of StoneX, a financial services organization serving over one million customers worldwide. Regulated in the US, UK, EU, Australia and beyond, the broker offers thousands of markets, not just forex, and provides excellent pricing on cutting-edge platforms.

Interactive Brokers

"Interactive Brokers is one of the best brokers for advanced day traders, providing powerful charting platforms, real-time data, and customizable layouts, notably through the new IBKR Desktop application. Its superb pricing and advanced order options also make it highly attractive for day traders, while its diverse range of equities is still among the best in the industry."

Christian Harris, Reviewer

Interactive Brokers Quick Facts

| Demo Account | Yes |

|---|---|

| Instruments | Stocks, Options, Futures, Forex, Funds, Bonds, ETFs, Mutual Funds, CFDs, Cryptocurrencies |

| Regulator | FCA, SEC, FINRA, CFTC, CBI, CIRO, SFC, MAS, MNB, FINMA, AFM |

| Platforms | Trader Workstation (TWS), IBKR Desktop, GlobalTrader, Mobile, Client Portal, AlgoTrader, OmniTrader, TradingView, eSignal, TradingCentral, ProRealTime, Quantower |

| Minimum Deposit | $0 |

| Minimum Trade | $100 |

| Leverage | 1:50 |

| Account Currencies | USD, EUR, GBP, CAD, AUD, INR, JPY, SEK, NOK, DKK, CHF, AED, HUF |

Pros

- The new IBKR Desktop platform takes the best of TWS while adding bespoke tools like Option Lattice and Screeners with MultiSort to create a genuinely impressive trading experience for day traders at every level.

- The TWS platform has clearly been built for intermediate and advanced traders and comes with over 100 order types and a reliable real-time market data feed that rarely goes offline.

- IBKR is one of the most respected and trusted brokerages and is regulated by top-tier authorities, so you can have confidence in the integrity and security of your trading account.

Cons

- You can only have one active session per account, so you can’t have your desktop program and mobile app running simultaneously, making for a sometimes frustrating trading experience.

- TWS’s learning curve is steep, and beginners may find it challenging to navigate the platform and understand all the features. Plus500's web platform is much better suited to new traders.

- IBKR provides a wide range of research tools, but their distribution across trading platforms and the web-based 'Account Management' page lacks consistency, leading to a confusing user experience.

NinjaTrader

"NinjaTrader continues to meet the demands of active futures traders looking for low fees and premium analysis tools. The platform hosts top-rate charting features including hundreds of indicators and 10+ chart types."

Tobias Robinson, Reviewer

NinjaTrader Quick Facts

| Demo Account | Yes |

|---|---|

| Instruments | Forex, Stocks, Options, Commodities, Futures, Crypto |

| Regulator | NFA, CFTC |

| Platforms | NinjaTrader Desktop, Web & Mobile, eSignal |

| Minimum Deposit | $0 |

| Minimum Trade | 0.01 Lots |

| Leverage | 1:50 |

| Account Currencies | USD |

Pros

- Traders can get free platform access and trade simulation capabilities in the unlimited demo

- You can get thousands of add-ons and applications from developers in 150+ countries

- Low fees are offered, with $50 day trading margins & commissions from $.09 per micro contract

Cons

- There is a withdrawal fee on some funding methods

- The premium platform tools come with an extra charge

- Non forex and futures trading requires signing up with partner brokers

eToro USA

"eToro remains a top pick for traders looking for leading social investing and copy trading services. With a low deposit, zero commissions and an intuitive platform, the broker will meet the needs of newer day traders."

Jemma Grist, Reviewer

eToro USA Quick Facts

| Demo Account | Yes |

|---|---|

| Instruments | Stocks, Options, ETFs, Crypto |

| Regulator | SEC, FINRA |

| Platforms | eToro Trading Platform & CopyTrader |

| Minimum Deposit | $100 |

| Minimum Trade | $10 |

| Account Currencies | USD |

Pros

- Investors can access Smart Portfolios for a more hands-off approach, covering a range of sectors and markets such as renewable energy and artificial intelligence

- The online broker offers an intuitive social investment network with straightforward copy trading on cryptos

- A free demo account means new users and prospective day traders can try the broker risk-free

Cons

- The proprietary terminal doesn't support trading bots and there are no additional stock market analysis tools

- There's a narrower range of day trading instruments available compared to competitors, with only stocks, ETFs and cryptos

- There's no MetaTrader 4 platform integration for traders who are accustomed to using third-party charting tools

Plus500US

"Plus500US stands out as an excellent choice for beginners, offering a very user-friendly platform, low day trading margins, and access to the Futures Academy to enhance trading skills. Its powerful tools and reliable service helped it scoop second place in DayTrading.com's annual 'Best US Broker' award."

Michael MacKenzie, Reviewer

Plus500US Quick Facts

| Demo Account | Yes |

|---|---|

| Instruments | Futures on Cryptocurrencies, Metals, Agriculture, Forex, Interest rates, Energy, Equity Index future contracts |

| Regulator | CFTC, NFA |

| Platforms | WebTrader, App |

| Minimum Deposit | $100 |

| Minimum Trade | Variable |

| Leverage | Variable |

| Account Currencies | USD |

Pros

- The Futures Academy is an excellent resource for new traders with engaging videos and easy-to-follow articles, while the unlimited demo account is great for testing strategies

- Plus500 is a publicly traded company with a good reputation, over 24 million traders, and a sponsor of the Chicago Bulls.

- The straightforward account structure, pricing model and web platform offer an easier route into futures trading than rivals like NinjaTrader

Cons

- While Plus500US continues to broaden its investment offering, it's currently restricted to around 50+ futures with no stocks

- The proprietary platform is user-friendly but lacks advanced technical analysis tools found in third-party solutions like MetaTrader 4

- Although support response times were fast during tests, there is no telephone assistance

OANDA US

"OANDA remains an excellent broker for US day traders seeking a user-friendly platform with premium analysis tools and a straightforward joining process. OANDA is also heavily regulated with a very high trust score."

Jemma Grist, Reviewer

OANDA US Quick Facts

| Demo Account | Yes |

|---|---|

| Instruments | Forex, Crypto with Paxos (Cryptocurrencies are offered through Paxos. Paxos is a separate legal entity from OANDA) |

| Regulator | NFA, CFTC |

| Platforms | OANDA Trade, MT4, TradingView, AutoChartist |

| Minimum Deposit | $0 |

| Minimum Trade | 0.01 Lots |

| Leverage | 1:50 |

| Account Currencies | USD, EUR, GBP, CAD, AUD, JPY, CHF, HKD, SGD |

Pros

- The broker offers a transparent pricing structure with no hidden charges

- There's a strong selection of 68 currency pairs for dedicated short-term forex traders

- The broker's API facilitates access to 25 years of deep historical data and rates from 200+ currencies

Cons

- It's a shame that customer support is not available on weekends

- The range of day trading markets is limited to forex and cryptos only

- There's only a small range of payment methods available, with no e-wallets supported

FOREX.com

"FOREX.com remains a best-in-class brokerage for active forex traders of all experience levels, with over 80 currency pairs, tight spreads from 0.0 pips and low commissions. The powerful charting platforms collectively offer over 100 technical indicators, as well as extensive research tools."

Christian Harris, Reviewer

FOREX.com Quick Facts

| Demo Account | Yes |

|---|---|

| Instruments | Forex, Stock CFDs, Futures, Futures Options |

| Regulator | NFA, CFTC |

| Platforms | WebTrader, Mobile, MT4, MT5, TradingView |

| Minimum Deposit | $100 |

| Minimum Trade | 0.01 Lots |

| Leverage | 1:50 |

| Account Currencies | USD, EUR, GBP, CAD, AUD, JPY, CHF, PLN |

Pros

- The in-house Web Trader continues to shine as one of the best-designed platforms for aspiring day traders with a slick design and over 80 technical indicators for market analysis.

- With over 20 years of experience, excellent regulatory oversight, and multiple accolades including runner-up in our 'Best Forex Broker' awards, FOREX.com boasts a global reputation as a trusted brokerage.

- There’s a wealth of educational resources including tutorials, webinars, and a stacked YouTube channel to help you get educated in the financial markets.

Cons

- Despite increasing its range of instruments, FOREX.com's product portfolio is still limited to forex and CFDs, so there are no options to invest in real stocks, real ETFs or real cryptocurrencies.

- FOREX.com's MT4 platform offers approximately 600 instruments, significantly fewer than the over 5,500 available on its non-MetaTrader platforms.

- Demo accounts are frustratingly time-limited to 90 days, which doesn’t give you enough time to test day trading strategies effectively.

See top brokers for online trading

What Is Momentum Trading?

The definition of momentum is the rate of acceleration of an asset’s price, or, the speed at which the price changes. Momentum day trading is therefore an investment strategy that aims to capitalise on this.

The goal for investors is to react to market information by buying rising securities and selling them when they appear to have reached a peak. This herding strategy follows other participants in the market who seek buying opportunities in short-term uptrends. The trader then sells when momentum drops and repeats the process on the next uptrend.

Momentum trading requires a good level of technical analysis, specifically measuring trends using oscillators and other indicators. These can help analyse the three main factors in trading momentum:

- Volume – This is the number of assets traded in a given time frame (not the number of transactions). Entry and exit points rely on liquidity in the market, which is when there is a high number of buyers and sellers.

- Volatility – Volatility is the level of an asset’s price change. A highly volatile market is characterised by large price swings, whilst low volatility is more stable. Momentum traders take advantage of volatile markets, seeking profits from short-term rises and falls.

- Time Frame – Momentum trading generally works with short-term movements, though trades can be held for a long period of time if the trend is strong. This makes it suitable for both long-term position traders, as well as day traders or scalpers.

Now that we’ve covered the basics, let’s look at how to day trade momentum with some examples of popular strategies.

Momentum Trading Strategies

To start trading momentum, you will need to consider the asset that you are interested in. You can trade momentum with any market, including forex, stocks, futures, mutual funds, ETFs, or using options. You can even do high-frequency momentum trading with cryptocurrencies. Since momentum relies on volume, it makes sense to consider more liquid markets, such as EUR/USD, gold or Bitcoin.

You’ll then need to develop a system based on a range of technical indicators and graphical tools. If you’re new to trading, don’t forget to take advantage of your broker’s demo account, where you can practice risk-free on real-time charts.

The momentum indicator is the obvious first choice for most traders. The indicator shows how strong a trend is by comparing the most recent closing price to the previous one. Since it’s an oscillator, it is characterised by a single line that ranges to and from a centre line. The reading shows you how quickly the price is moving.

Let’s take a look at some strategies involving other popular indicators:

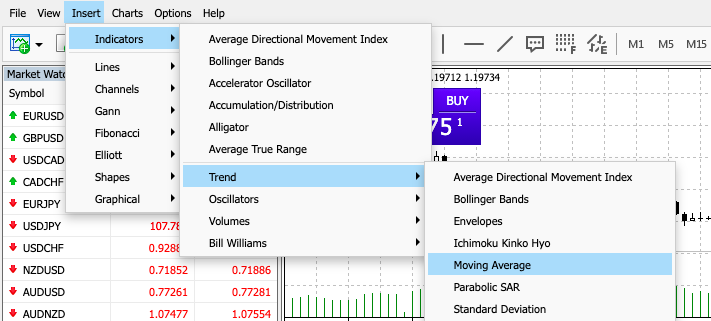

Moving Averages (MAs)

Moving averages allow you to identify price trends by filtering out market noise and short-term fluctuations. MA lines can be applied for different periods and can show traders whether a trend is accelerating. When the MAs crossover, this signifies a reversal in the trend.

Note that MAs tend to be lagging indicators, i.e. the signals occur after the price has already moved. It’s also important to combine MAs with other indicators to detect your exit points when momentum trading.

Alternatively, you could analyse the market with a moving average convergence divergence (MACD) to identify the relationship between the two MAs of an asset’s price. It’s also an excellent tool for playing breakouts as they can help to spot a reversal in a trend.

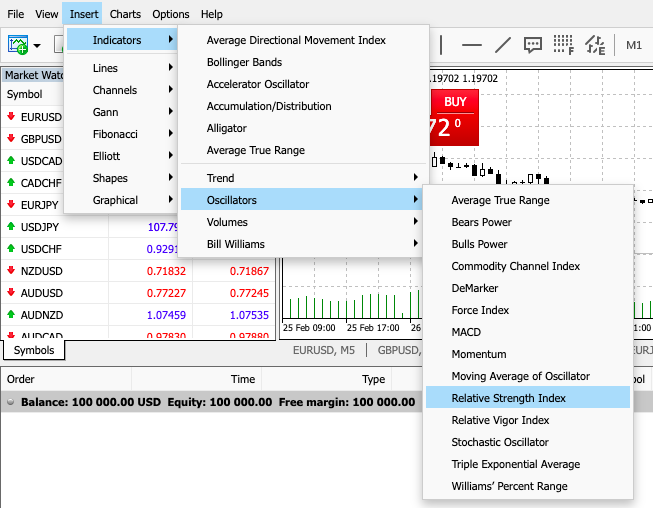

Relative Strength Index (RSI)

The RSI provides entry and exit signals based on whether the asset is overbought or oversold. This momentum trading strategy can therefore tell you when to buy and sell, by oscillating between 0 and 100. If it drops below 30, it is thought to be oversold, whilst a reading over 70 is considered overbought.

Momentum traders will look for opportunities within this range as it signifies a clear trend. Note that RSI is most effective when used with other indicators because trends can unexpectedly stay in overbought or oversold territories for long periods of time.

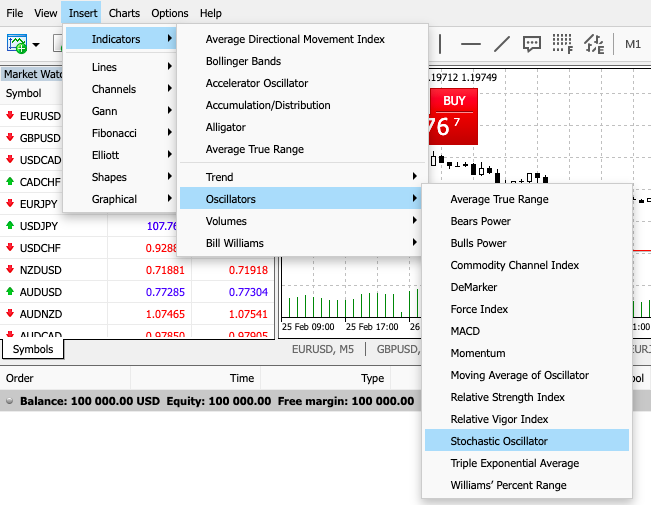

Stochastic Oscillator

This indicator tracks the speed of an underlying market by comparing the most recent closing price to the previous trading range. It’s therefore ideal for predicting price movements. The stochastic oscillator consists of two lines on the chart: the indicator line and the signal line.

The indicator line oscillates between 0 and 100 (with a reading over 80 signifying an overbought market and a reading below 20 representing an oversold market). The signal line will indicate to the trader a potential change in direction if it crosses with the indicator line.

In some cases, the stochastic might not fall back to 20, meaning the trend could continue upwards, despite pullbacks.

Regardless of which set-up you decide to master, proper risk management rules will help to protect your capital and ensure you don’t run into a disaster. It’s worth learning how to calculate your risk per trade and the position size formula before committing any funds.

Your broker might also be able to provide some advice and tips on good forex strategies to use, although PDF downloads and video guides are available from plenty of other sources too.

Momentum Trading Tools

Whether you’re developing your current method or picking up a new one, it could be worth employing some trading tools. These will depend on your own preferences and goals, so take some time to consider what these are before starting.

Automation

Automated tools and software are popular among traders who don’t have as much time to monitor trades throughout the trading day.

Trading bots, for example, are computer algorithm programs based on signals which can determine buy and sell points. Although they don’t suit all momentum trading strategies, they can act as quick market scanners that, when conditions are good, can automatically submit orders on the trader’s behalf.

You can recruit bots for virtually any strategy and algorithm, as they are widely available in most top platforms. The platforms use either proprietary or universal programming languages, such as Python or, in MetaTrader’s case, MQL4 and MQL5.

Such technology has already allowed traders to streamline their trading strategies, though we could see exciting future developments with the wider use of artificial intelligence and machine learning.

Software

The quality of the software you use will have a huge impact on your day-to-day trading models and setups. Once you sign up to a broker, you will usually have a choice of at least two different platforms to choose from.

Think carefully about the features of the platform and what you require to start your momentum trading. The platform should offer a range of technical analysis tools, chart time frames and risk management features. Today, most brokers will also offer a mobile trading app for those who prefer to trade on-the-go.

If you’re an advanced trader, some platforms such as MetaTrader or cTrader allow you to code your own custom bots and indicators, which you can also backtest within the platform. A community forum, economic calendar and help guides can also be useful.

Alerts

Trading alerts are customisable, automatic notifications that trigger when prices move or certain conditions change. They are usually pre-included within your platform and can be sent via email, SMS or push notification.

Alerts are extremely useful tools that ensure that you never miss an opportunity in the markets and can be used as part of your risk management strategy. For example, price alerts will tell you when there has been a certain percentage change, whilst technical indicator alerts notify you of any buy and sell points.

Some momentum trading platforms even allow you to set reminders about global events and central bank announcements directly from your economic calendar.

Signals

Trading signals trigger buy and sell suggestions when a pre-determined set of criteria has been met. These can vary from simple signals on earnings reports or volume changes to complex signals based on existing ones.

Signals can either be generated by another trader, or an automated forex robot, depending on the preference of the subscriber. You can get both free and paid momentum signals, but note that not all providers are reliable or robust.

In addition, be aware of any trading scams that claim ‘guaranteed’ success or unrealistic returns; these are especially targeted at beginners.

How Much Does Time Of Day Matter For Momentum Trades?

The time of day plays a significant role in short-term momentum trading, as market activity and volatility vary throughout the trading session.

To illustrate, let’s consider the US markets:

- Market Open (09:30 – 11:00 ET): This is one of the most volatile periods due to the influx of overnight news, earnings reports, and pre-market positioning. High volume and sharp price movements are ideal for momentum traders looking to capitalise on quick breakouts or reversals. Patterns like opening range breakouts and gap fills are common during this window.

- Midday Lull (11:00 – 13:30 ET): Trading activity often slows down as institutional traders take a break and market participants digest the morning’s moves. Lower volume can lead to choppier price action, making momentum strategies less effective. False breakouts and whipsaws are more likely during this quieter period.

- Afternoon Session (13:30 – 16:00 ET): Volatility typically picks up again as traders position themselves ahead of the close. This is another prime window for momentum strategies, especially when volume surges during the last hour (the ‘power hour’). Patterns like trend continuation or late-day breakouts are more likely to emerge.

Momentum strategies tend to be most effective at the open and in the final hours of trading, when volatility and volume are highest.

Is Momentum Trading Suitable For Beginners?

If we look at momentum trading vs scalping or day trading, the former is considered a more straightforward view of the markets. The aim is to take advantage of expected price changes and close positions when the trend loses strength.

Momentum trading allows you to follow market sentiment within liquid and popular markets. Herding strategies like this can create the potential for profits because you can use volatility to your advantage. You can also familiarise yourself with popular indicators and oscillators that can set you up for other strategies, including RSI, MAs and Stochastics.

However, momentum trading can be expensive, especially if you’re trading stocks with high turnover. If you compare this strategy vs trend-following or position trading, it can also be quite time-intensive for those who have busy lives outside of their trading platform.

It’s also worth noting that momentum trading focuses more on price action and technical analysis rather than long-term fundamentals, which might be a turn-off for some. Finally, since momentum trading works best in bull markets due to investor herding, this means that profit opportunities are reduced in bear markets, due to cautious investors.

Education

Different types of trading style and experience may require various forms of education, research tools and trading tips.

When trading with momentum strategies, much of your analysis will be based on quantitative data and price action rather than long-term economic developments. As such, we’ve provided a few ideas below that you could add to your technical learning checklist.

- YouTube video tutorials

- Online research papers

- Momentum trading podcasts

- Books (paper and digital PDFs)

- Broker or third-party blogs & newsletters

- Community group forum or trading chat room

- Momentum trading course or Forex Academy

Bottom Line

Now that we’ve explained a few potential strategies, popular indicators and useful trading tools, you should have a good idea of how to do momentum trading in the forex market. You may need to research which options would work best for you and look at online broker and trading platform reviews.

As with all strategies, momentum trading requires practice and dedication. Whether you’re a novice or an advanced trader, a demo account can help you to achieve your goals in your own time. Finally, always stick to your golden risk management rules to protect your capital.

FAQ

What Is A Momentum Trading Strategy?

A momentum strategy reacts to market information by buying when price trends are strong and selling when the assets appear to lose momentum. There are a variety of indicators needed for momentum trading, including moving averages and oscillators. You can also model your own strategy using custom bots or indicators if offered by your platform.

Does Momentum Trading Work?

Momentum trading is a herding strategy that aims to be ahead of the game by being the first to cash out and exit. This can work very well when markets are volatile and liquid but success is not always guaranteed. This is because the markets can change unexpectedly, causing investors to act more cautiously.

Is Momentum Trading Profitable?

Momentum trading can be profitable if you are experienced, patient and have robust risk management calculations in place. Nonetheless, just because you’re using risk management tools, it does not mean that you are immune to a losing streak. Risk tools help to minimise your losses but they are not bulletproof.

When Can I Trade With Momentum Strategies?

There are certain hours of the day where the market traded is more active. Whether you’re trading on the UK or Indian stock market, for example, the ideal trading hours will depend on the asset you are trading and the session times. Most brokers will post these trading hours and market holidays on their website.

Is Momentum Trading Legal?

Yes, momentum trading is legal. Restrictions to trading in general usually depend on your broker, so check with your jurisdiction and your provider’s domiciled location.