Plus500US Review 2026

Awards

- Best US Broker Runner Up 2025 - DayTrading.com

Pros

- Plus500 added prediction markets to its 'Plus500 Futures' platform in February 2026, with event-based trades covering 10 categories, from financials to politics, including short-term opportunities with intraday contracts that expire after just 15 minutes.

- The straightforward account structure, pricing model and web platform offer an easier route into futures trading than rivals like NinjaTrader

- The Futures Academy is an excellent resource for new traders with engaging videos and easy-to-follow articles, while the unlimited demo account is great for testing strategies

Cons

- Although support response times were fast during tests, there is no telephone assistance

- While Plus500US continues to broaden its investment offering, it's currently restricted to around 50+ futures with no stocks

- Plus500US does not offer social trading capabilities, a feature available at alternatives like eToro US which could strengthen its offering for aspiring traders

Plus500US Review

Our exhaustive review of Plus500US examines the broker’s instruments, trading terms, regulatory oversight and other key areas to assess how it stacks up against the competition.

Regulation & Trust

Plus500US is trusted for several reasons:

- Plus500US is overseen by the tier-one Commodity Futures Trading Commission (CFTC) and National Futures Association (NFA) through the registered company Plus500US Financial Services, LLC, license no: 0001398.

- The firm’s membership with the CME Group entails additional risk management and financial surveillance protocols.

- Plus500 Ltd is listed on the London Stock Exchange (LSE), ensuring a high degree of financial transparency.

Plus500US Financial Services brings over 20 years of experience to US investors.

Accounts & Banking

Plus500US has a single account type that’s quick and easy to set up with everything required clearly laid out on the broker’s website. Signing up is a streamlined process.

The trading account is geared toward the retail market and will appeal to newer investors looking for a straightforward route to online trading.

The $100 minimum deposit is higher than alternatives like Interactive Brokers which has no minimum, but it’s still accessible for most aspiring traders.

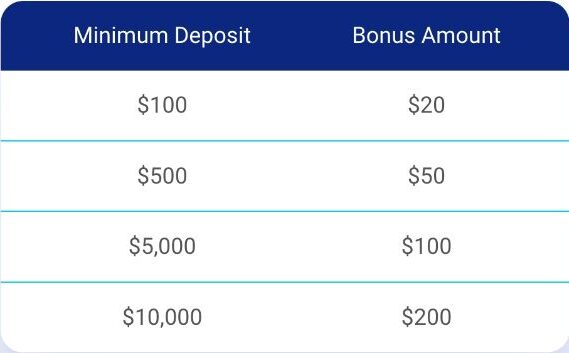

Plus500US also stands out with its welcome deposit bonus, with up to $200 in trading credit available depending on your initial investment:

Deposits & Withdrawals

Plus500US accepts funding via debit cards or ACH and bank transfers.

They are also the first brand to accept deposits from both Apple Pay and Google Pay.

Demo Account

Plus500US offers an unlimited demo account, and I enjoyed being able to use the simulator to develop a strategy before committing my own money.

The demo account registration is an extremely simple matter that takes just a few clicks from the Plus500 home page and can be finished in minutes.

I recommend that prospective clients start with the demo account to see how they enjoy the platform before signing up.

It’s also a great way to practice and improve in parallel with your live trading.

Assets & Markets

Plus500US offers a fairly limited product portfolio with primarily 50+ futures contracts spanning popular asset classes including forex, commodities, and cryptocurrencies.

The presence of some less common assets like interest rates stands out, and the broker’s e-mini and micro contracts make it easier for lower-budget traders to get involved.

The most glaring absence from the roster is stocks. This is due to futures trading not including equities.

The 10 global index futures offered by Plus500 are a consolation, and allow traders to access equity price changes another way.

Rivals such as Interactive Brokers and NinjaTrader, which specialises in 100+ futures – are also limited in their ability to offer direct access to stocks, as CFDs are not available in the US.

In terms of traditional financial markets, I was able to trade the following assets while using the platform:

- Crypto – Micro-Bitcoin and Micro-Ethereum

- Agriculture – Eight agricultural products such as wheat, live cattle and soybeans

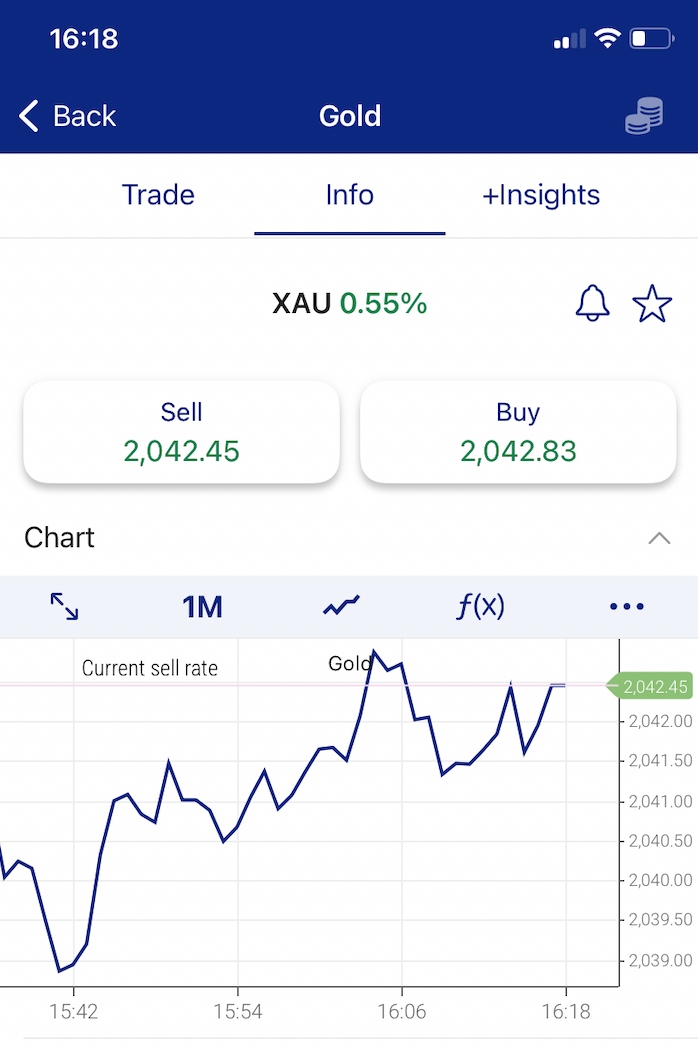

- Precious Metals – Four metals including gold and silver

- Forex – 10+ currency pairs such as GBP/USD and CAD/USD

- Interest Rates – Four interest rate futures such as US T-Bond and the Micro 10-Year Yield

- Energy – Eight energies including natural gas and Brent crude oil

- Equity Indices – 10 index funds such as NASDAQ 100 and S&P 500

I find the narrow investment offering to be a huge departure from Plus500’s other international entities, which offer thousands of assets including US stocks.

The major difference is that Plus500 is primarily a CFD broker, but these instruments are banned in the US.

However, we did up Plus500US’ Assets & Markets rating in February 2026 after it added prediction markets, providing binary-style opportunities on everything from US indices to sports, politics, music, and more. Traders can answer ‘yes’ or ‘no’ to questions like ‘Will the S&P 500 be above X by 4pm?’, with prices based on the likelihood that traders believe an event will happen.

We fired up the platform and tried it – it’s surprisingly straightforward, with useful charts and data to support decisions, while the short timeframes of some questions/events, sometimes just 15 minutes make it suitable for day traders.

Add in regulation from the CFTC to act an event-based contracts exchange, and Plus500 earned a place on our list of the top prediction market trading platforms.

Margin Trading

Plus500US is a futures broker and these derivatives are traded with margin with an initial investment opening a position worth a larger amount and further deposits made to cover ongoing margin requirements and losses.

The initial margin requirements for Plus500US’s contracts include:

| Gold | Micro Gold | Natural Gas | EUR FX | Australian Dollar | |

|---|---|---|---|---|---|

| Margin Requirement | $500 | $50 | $1000 | $300 | $400 |

Trading with leverage involves risk

Fees & Costs

By offering very competitive trading fees, Plus500US goes a long way toward making up for its limited investment offering.

With no inactivity fees, platform fees, live data fees, routing fees, or charges to deposit or withdraw funds, clients don’t have to worry about non-trading costs.

As for trading fees, there are both Micro and Standard contracts available, and these come with commissions per side of $0.49 and $0.89, respectively. This is a big advantage over E-Trade, which charges $1.50.

I can happily class Plus500US as a low-cost broker as a result, and its excellent pricing competes well against the likes of Interactive Brokers, one of our top picks in this department, which charges $0.85.

Plus500’s only real drawback in comparison is that it doesn’t have anything comparable to Interactive Brokers’ tier system which reduces the fees to a minimum of $0.25 for the highest volume traders.

This is another point where the brand is clearly geared toward the casual side of the retail market over seasoned, high volume day traders.

Platforms & Tools

Plus500US is known for its excellent proprietary software, and I find trading on this platform quick and intuitive. I enjoy the simplicity of the user-friendly interface with dynamic charts and helpful analytic tools.

As well as being clear and concise, the platform has a lot going on under the hood with sophisticated features including 100+ indicators alongside live price alerts and risk management features including take profit and stop-loss orders.

Simply put, it has everything you would expect from a modern trading platform, and Plus500US make it easy for anyone to start trading in a few clicks regardless of their experience.

That said, traders who are looking for more advanced tools will be frustrated as Plus500 lacks some cutting-edge functions such as in-depth performance analytics, and the platform is not customizable in the same way as some third-party platforms.

This is one reason that the lack of additional options like MetaTrader 4 hurts, though its absence is in itself frustrating simply because this platform is so popular and many experienced traders prefer using it for familiarity.

Nevertheless, the Plus500 platform is more than adequate and will be an especially good match for the newer traders that this brokerage is aimed at.

Mobile App

The Plus500 mobile app works well on both Apple and Android phones and has the same functionality as the desktop solution with no limits to the instruments on offer.

I find it quick and straightforward to trade on the move and there are none of the common frustrations of trading on a small screen.

Ultimately, Plus500US ensures seamless integration between iOS and Android desktop and mobile apps.

Research

While Plus500US does have some useful in-house analysis available on its website and via its platform, overall the range of research tools is lacklustre.

The economic and earnings calendars are always nice to see, as are the news feed and graphics showing current sentiment, which are handily displayed on the platform while you set up a trade.

However, this is about all there is, and I find the lack of expert commentary to be very limiting.

Compare this to Interactive Brokers, which provides access to a huge amount of research analysis sources, and Plus500 is left behind.

Education

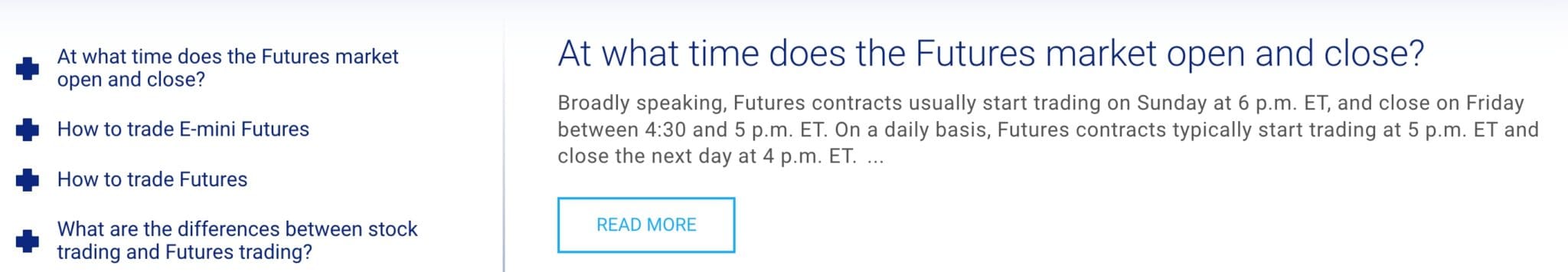

There are some excellent educational resources available at Plus500’s Futures Academy, including a wide range of articles and video resources with plenty of information to help beginners get started.

A highlight is the video tutorials, which cover a range of topics such as trading strategies and the benefits of investing in futures contracts.

I like that you can also filter educational resources by asset class, which makes the information more tailored to your interests and portfolio. The introductory videos are particularly strong, with all the basics of trading futures contracts covered.

Though I don’t find the information as extensive as the resources offered by alternative US brokers like IG, I feel there is enough content to suit novice traders, and I appreciate the information specific to trading futures with the firm.

Customer Support

I was initially disappointed with the Plus500US’s customer support, which provided me with no way to contact the broker by phone.

Fortunately Live chat has been added, offering direct access to the support teams.

In addition, I do think the comprehensive online help center, with FAQs and step-by-step guides, gives a good range of information on the fundamentals. Although I would prefer a search bar or to have questions split into categories/topics, I find that, overall, these work well for common queries.

There is also an email support option. I tested this service as part of my Plus500US review and received a response within just eight minutes, which is about as fast as you can expect from this contact method.

Most importantly, the agent was knowledgeable and provided clear answers to my questions, as well as responding swiftly and accurately to my follow-up questions.

Should You Trade With Plus500US?

Plus500US continues to offer a trustworthy trading environment, and its transparent trading conditions, user-friendly platform and responsive customer support are all big advantages.

Though the product lineup is not the most extensive and the platform lacks some advanced features, the mini and micro futures contracts and competitive fees make this a great stop for newer traders seeking to speculate on forex, commodity, crypto and interest rate markets.

FAQ

Is Plus500US Legit Or A Scam?

Plus500US is the United States entity of the respected Plus500 brokerage, backed by an established fintech company with a solid track record. The brand is trusted by more than 24 million traders globally, thanks to its smooth account opening, low fees and intuitive trading tools.

Is Plus500US Regulated?

Yes, Plus500US is licensed. The firm is a Futures Commission Merchant, registered with the US Commodity Futures Trading Commission (CFTC) and a member of the National Futures Association (NFA).

Is Plus500US Suitable For Beginners?

Plus500US is suitable for beginner traders. There is a range of training articles and video tutorials which are ideal to use alongside the demo account before opening a real-money profile. The broker’s customer support team are also helpful, which is reassuring for platform help and account guidance.

Does Plus500US Offer Low Fees?

Plus500US offers low trading, currency and funding fees. Micro contracts have a $0.49 commission per side, and standard contracts $0.89. Day trading margins are also competitive and vary depending on the market.

Is Plus500US Good For Day Trading?

Plus500US’s intuitive platform, low fees, margin trading and fast execution speeds make it suitable for day trading. That said, it trails our best-in-class day trading broker – Forex.com because it doesn’t offer advanced charting tools or support automated trading.

Best Alternatives to Plus500US

Compare Plus500US with the best similar brokers that accept traders from your location.

- Interactive Brokers – Interactive Brokers (IBKR) is a premier brokerage, providing access to 150 markets in 33 countries, along with a suite of comprehensive investment services. With over 40 years of experience, this Nasdaq-listed firm adheres to stringent regulations by the SEC, FCA, CIRO, and SFC, amongst others, and is one of the most trusted brokers for trading around the globe.

- NinjaTrader – NinjaTrader is a US-headquartered and regulated brokerage that specializes in futures trading. There are three pricing plans to suit different needs and budgets, as well as ultra-low margins on popular contracts. The brand’s award-winning charting software and trading platform also offers a high-degree of customization and superb technical analysis features.

Plus500US Comparison Table

| Plus500US | Interactive Brokers | NinjaTrader | |

|---|---|---|---|

| Rating | 4 | 4.3 | 4.5 |

| Markets | Futures on Cryptocurrencies, Metals, Agriculture, Forex, Interest rates, Energy, Equity Index future contracts | Stocks, Options, Futures, Forex, Funds, Bonds, ETFs, Mutual Funds, Cryptocurrencies | Futures, Forex, Stocks, Options, Commodities, Futures, Crypto (non-futures depend on provider) |

| Demo Account | Yes | Yes | Yes |

| Minimum Deposit | $100 | $0 | $0 |

| Minimum Trade | Variable | $100 | 0.01 Lots |

| Regulators | CFTC, NFA | FCA, SEC, FINRA, CFTC, CBI, CIRO, SFC, MAS, MNB, FINMA, AFM | NFA, CFTC |

| Bonus | Welcome Deposit Bonus up to $200 | – | – |

| Platforms | WebTrader, App | Trader Workstation (TWS), IBKR Desktop, GlobalTrader, Mobile, Client Portal, AlgoTrader, OmniTrader, TradingView, eSignal, TradingCentral, ProRealTime, Quantower | NinjaTrader Desktop, Web & Mobile, eSignal |

| Leverage | Variable | 1:50 | 1:50 |

| Payment Methods | 7 | 6 | 4 |

| Visit | Visit | Visit | Visit |

| Review | – | Interactive Brokers Review |

NinjaTrader Review |

Compare Trading Instruments

Compare the markets and instruments offered by Plus500US and its competitors. Please note, some markets may only be available via CFDs or other derivatives.

| Plus500US | Interactive Brokers | NinjaTrader | |

|---|---|---|---|

| CFD | No | Yes | No |

| Forex | Yes | Yes | Yes |

| Stocks | No | Yes | Yes |

| Commodities | Yes | Yes | Yes |

| Oil | Yes | No | Yes |

| Gold | Yes | Yes | Yes |

| Copper | Yes | No | Yes |

| Silver | Yes | No | Yes |

| Corn | Yes | No | No |

| Crypto | Yes | Yes | Yes |

| Futures | Yes | Yes | Yes |

| Options | No | Yes | Yes |

| ETFs | No | Yes | No |

| Bonds | No | Yes | No |

| Warrants | No | Yes | No |

| Spreadbetting | No | No | No |

| Volatility Index | No | No | No |

Plus500US vs Other Brokers

Compare Plus500US with any other broker by selecting the other broker below.

Customer Reviews

4 / 5This average customer rating is based on 3 Plus500US customer reviews submitted by our visitors.

If you have traded with Plus500US we would really like to know about your experience - please submit your own review. Thank you.

Submit Your Own Review of Plus500US

Article Sources

- Plus500US Website

- Plus500US Financial Services - NFA Membership

- Plus500US Financial Services - CME Group

The writing and editorial team at DayTrading.com use credible sources to support their work. These include government agencies, white papers, research institutes, and engagement with industry professionals. Content is written free from bias and is fact-checked where appropriate. Learn more about why you can trust DayTrading.com

Available in United States

Available in United States

I don’t usuaully write reviews like these but Plus500 does deserve some recognition for their cracking trading software and decent day trading margins on softs. I’ve also only had positive experiences with their support guys (they know they’re products and they can actually help if you have a question about your account or platform). I’ve used a lot of frankly disapointing trading firms over the years. Plus500 is not one of them.

I’ve used several trading apps and Plus500 definitely stands out as one of the better ones. It didn’t take me long to learn how the features work, which I did in the demo mode before depositing funds and trading with real money. I’d like to see them offer more instruments though, the lack of stocks is annoying and I’ve seen other brokers in the US offering shares.

I’ve been trading forex futures with Plus500 for several months and enjoy the trading platform – it’s easy to learn with all the basic charting tools I need. The day trading margins are low, just beware of the bank transfer fee.