Best Brokers For Prediction Markets In 2026

Prediction markets are like Wall Street for world events. Instead of trading oil, gold, or indices, you’re trading on outcomes – who wins the U.S. election, whether inflation hits a certain percentage this quarter, or even if a celebrity couple breaks up by year-end.

As a relatively novel product, new providers are popping up, while some established brokerages are introducing prediction market services. We’ve actively used a handful of real-money prediction platforms, including Interactive Brokers, NinjaTrader, Kalshi, Polymarket, and PredictIt, to reveal the very best.

Top Brokers With Prediction Markets

Interactive Brokers is the best broker for prediction markets. IBKR is the firm we’re most comfortable recommending to prediction market traders in January 2026. While new providers are emerging, most still lack the regulations, reputation and first-class user experience of IBKR from our hands-on tests.

NinjaTrader took our second spot for prediction-style trading because it’s become a go-to platform for expressing short-term macro views through futures – offering more flexibility, speed, and control than traditional event-based platforms during testing.

Crypto.com secured our final podium finish for its status as a US-regulated firm with a user-friendly app for trading prediction markets spanning politics, economics, finance, sports, and more. It’s especially good if you already use the firm for dealing crypto, with minimal learning curve.

1. Interactive Brokers

Why We Chose Interactive Brokers

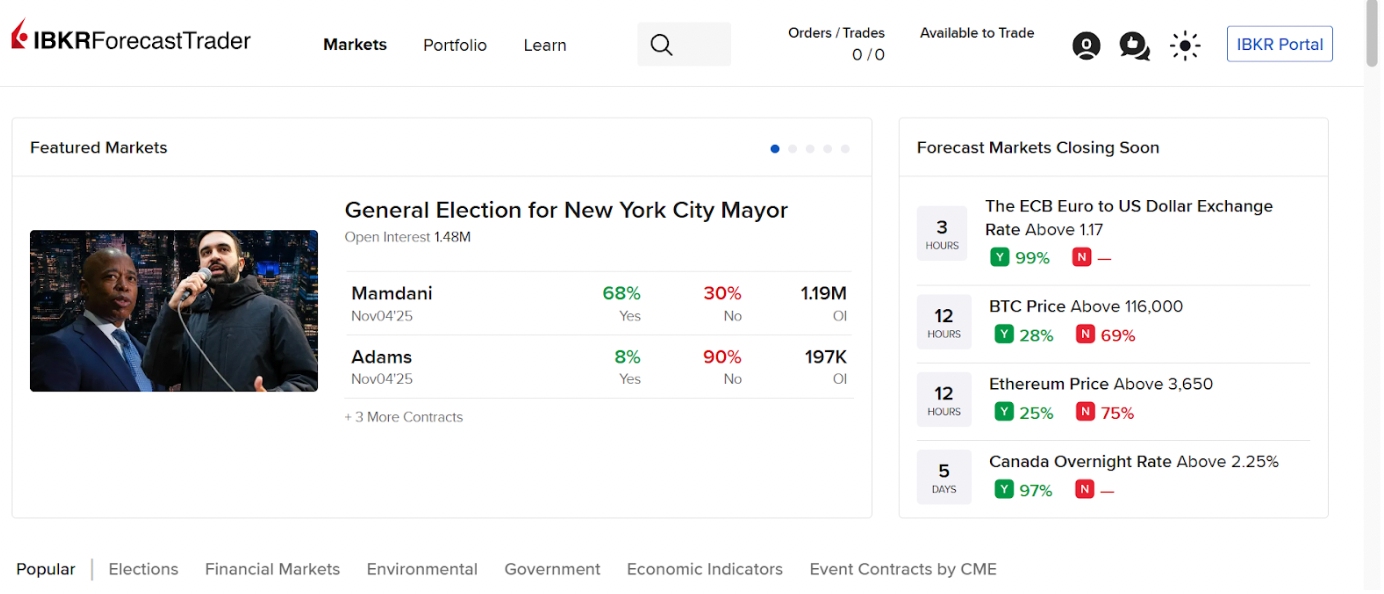

If you’ve got an Interactive Brokers (IBKR) account, you may have already noticed something quietly revolutionary: ForecastTrader.

It’s IBKR’s foray into event-based prediction markets, tucked right inside the Trader Workstation (TWS) platform. And unlike other retail-friendly prediction platforms, this one is built by traders, for traders.

We’ve tested it across multiple live trades, and while it’s not quite as flexible as Polymarket or Kalshi, it offers real-money exposure to world events – right from your IBKR account.

And crucially, it’s one of the most trusted brokers globally, authorized by seven ‘green tier’ bodies in DayTrading.com’s Regulation & Trust Rating, as well as being the only NASDAQ-listed firm to offer prediction markets, providing an unparalleled level of transparency.

Pros Of Trading Prediction Markets With Interactive Brokers

- Regulated: Fully compliant with IBKR’s standard risk controls.

- Data-driven events: Ideal for traders who track macro calendars.

- Zero learning curve: It’s a super easy platform to get up to speed with.

- No crypto wallets, no VPNs: Just log in and trade.

Cons Of Trading Prediction Markets With Interactive Brokers

- Limited selection: Although growing, the number of available events is still relatively small.

- No secondary market: Once you place a trade, you can’t sell it back before expiry. You’re locked in.

- No politics or pop culture: Strictly financial and macro topics only.

Where To Start

You can access ForecastTrader directly from the Trader Workstation (TWS) or Client Portal:

- Go to New Window > ToolBox > ForecastTrader

- Or, in the web portal: Trade > Forecasts

Inside, you’ll find a list of event-based contracts, ranging from macroeconomic releases to geopolitical outcomes. Think of it like a simplified options chain for the real world.

What You Can Trade

Most events are structured as binary outcome contracts, just like prediction markets elsewhere:

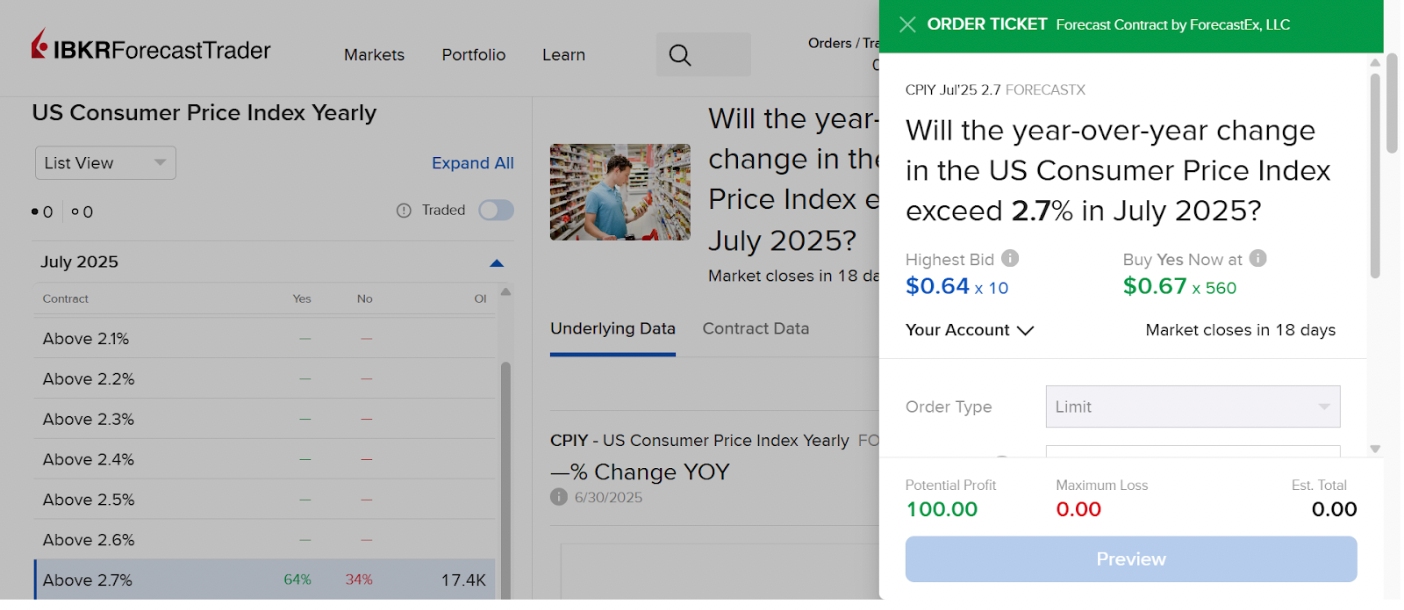

- “Will CPI be ≥ 2.7% this month?”

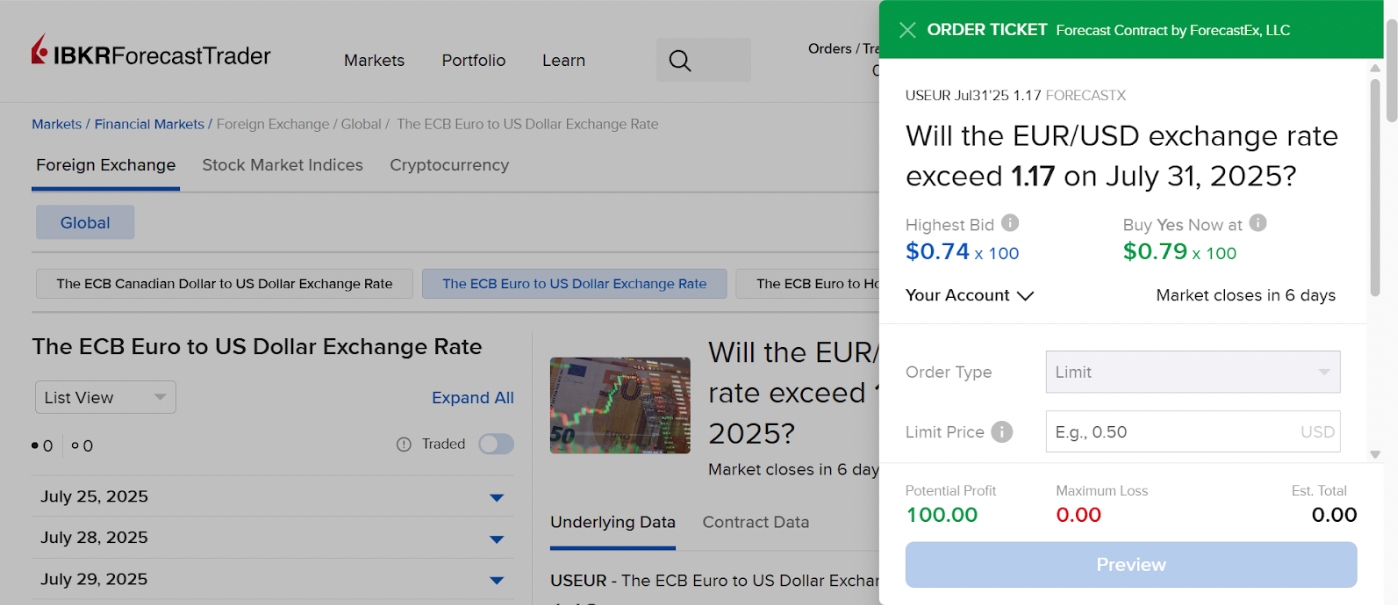

- “Will EUR/USD finish the month of July above 1.17?”

Each contract has:

- A Yes/No outcome

- A fixed payout of $1

- A listed expiry time (usually aligned with a data release)

The contract price reflects the market’s probability, and you can buy or sell either side, same as with Polymarket or Kalshi, but on a regulated brokerage platform.

A Real Trade I Made (Step-by-Step)

Let’s walk through a trade I made during a U.S. Non-Farm Payrolls (NFP) release:

- Contract: “Will the June NFP print be ≥ 110,000?”

- Trade Entry: Bought 50 ‘Yes’ contracts at $0.44

- Total risk: $22.00

- Potential payout: $50.00 if correct

- Rationale: I’d seen whisper numbers trending on Bloomberg and ADP data earlier in the week, beating the analyst consensus. So I took a directional short-term view, anticipating a market upside surprise.

Here’s what happened:

- Data released: NFP = 147,000

- Forecast contract settled: $1.00

- My payout: $50.00

- Net profit: $28.00

Trading prediction markets at Interactive Brokers is fast, low-stress, and feels more like placing a trade on a targeted, macro-level option than trading futures or currency pairs.Execution is smooth, with instant fills and visible bid/ask. It’s perfect for a quick, informed macro play.

Who It’s For

If you’re an active trader, Interactive Brokers’ ForecastTrader is a no-brainer, particularly if you enjoy playing economic prints, rate decisions, or surprise headline risks.

It’s ideal for traders who want to:

- Take structured short-term views without full exposure to the underlying

- Avoid rolling futures or managing leveraged forex positions

- Get exposure to “event edges” without setting up new accounts

2. NinjaTrader

Why We Chose NinjaTrader

NinjaTrader, as a prediction market platform, has become one of our favorite ways to predict short-term macro or event-driven movements, especially through micro futures and scalps based on economic data.

NinjaTrader offers a flexible, futures-first environment where you can turn economic forecasts into fast, tradeable opportunities, often with tighter execution and better leverage than anywhere else.

I’ve used NinjaTrader to trade around NFPs, CPI prints, FOMC minutes, and even geopolitical headlines.

Pros Of Trading Prediction Markets With NinjaTrader

- Faster and deeper markets: Futures move instantly when events drop.

- Scalable: Position sizing from micro to large contracts.

- Better tools: Full charting, DOM, bracket orders, hotkeys.

- You control the exit: No binary settle, you manage risk dynamically.

Cons Of Trading Prediction Markets With NinjaTrader

- No “set and forget”: Requires active management.

- Leverage risk: Futures are powerful, but cut both ways.

Where To Start

You don’t just get the opportunity to bet “yes or no” on an event; you’re in effect trading the market’s reaction to it. This offers more opportunity, not less.

If you know how CPI might impact rate expectations or how a hot NFP might move yields and equities, you’re essentially trading the same information edge that powers all prediction markets. But with NinjaTrader, you have more tools.

What You Can Trade

Prediction-style trading on NinjaTrader usually happens via:

- Micro E-mini Futures (MES, MNQ, M2K, etc.)

- Treasury Futures (ZT, ZF, ZN)

- Gold, Crude, and FX futures

A Real Trade I Made (Step-by-Step)

Here’s a short-term trade I ran around a July CPI release, using NinjaTrader and Micro E-mini S&P 500 futures (MES).

- Macro Setup: Consensus CPI was expected at 3.3%. I saw the Cleveland Fed’s Nowcast creeping toward 3.5%, and oil prices had been spiking. My read? Hot print = selloff.

- Trade Plan: Set up a short MES entry right before release, tight stop, small size – scalping the initial reaction

- Target: 15–20 point S&P drop

- Execution: Shorted 2 MES contracts at 5502.25. CPI printed 3.5% as I expected. S&P dropped around 19 points in the first 4 minutes. Covered at 5483.00.

Here’s the result:

- $192.50 after commissions

- Held for 7 minutes

- Risk: ~$75

This was classic prediction-market thinking in action. I had a defined event, a directional edge, a time window, and the right product through NinjaTrader to express it fast.

Who It’s For

If you’re a fast-thinking, short-term trader who already watches the calendar for big releases, NinjaTrader is a superior platform for reacting to economic news.

It lets you trade the exact consequence of that outcome, with scalping tools and liquidity that no other prediction platform can match.

In our own trading, we now split most event-driven trades between ‘pure play’ binary-style platforms like IBKR and those that include (what we’d classify as) reaction-based setups on NinjaTrader.

If you’re confident in your read on how markets should move after an event, Ninja is fast, sharp, and very customizable.

3. Crypto.com

Why We Chose Crypto.com

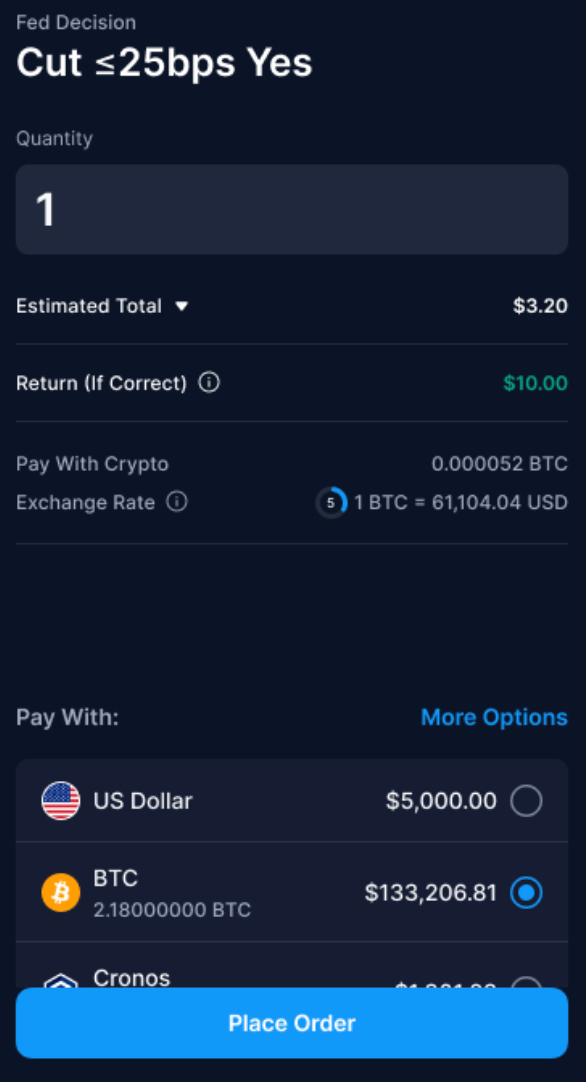

If you’re an active US trader curious about prediction markets, using Crypto.com could make sense – especially if you already use the app for crypto. Its Prediction Trading lets you bet on outcomes of global events (politics, economics, finance, and sports) using simple yes-or-no contracts.

You know your potential loss from the start, which keeps risk clear and manageable. It feels like placing a simple bet rather than juggling complex derivatives.

That said, compared with more specialised platforms like Kalshi or Polymarket, or a full-service broker such as IBKR, Crypto.com’s offering feels a bit basic, which is why it landed in third place.

IBKR’s ForecastTrader, in particular, ties its event contracts into a full-featured trading environment, which may appeal if you want more tools as you advance. But this also tends to come with more complexity, which may feel risky or confusing if you’re starting.

Pros Of Trading Prediction Markets With Crypto.com

- Regulated, transparent structure: Crypto.com is regulated by the CFTC, a ‘green tier’ body in DayTrading.com’s regulator classification system, so you know there are rules around the contracts and how they work – less guesswork than some unregulated, specialised prediction market firms.

- Flexible funding: You can fund your account with USD deposits or by converting crypto assets you already hold on the platform, providing convenience.

- Early-exit possibilities: The platform lets you exit a position before the event’s resolution in many cases, so you aren’t always ‘locked in’ until the outcome date.

Cons Of Trading Prediction Markets With Crypto.com

- Variety of markets is limited: You won’t find as many event-types or contract styles on Crypto.com as you will on a specialist platform like Kalshi or Polymarket.

- Fees can mount up: While entry can be low, the cost per contract (including technology and settlement fees) can add up and may eat into returns.

- Exit flexibility and liquidity may be weak: Some contracts may have thin liquidity or fewer exit options, making getting in or out less optimal than expected.

Where To Start

To start trading event-contracts on Crypto.com’s Prediction platform, you first need to download the Crypto.com app and create (or sign in to) your account, then complete identity verification.

You then need to fund your account via a USD deposit or crypto conversion, browse the ‘Predictions’ tab, pick a contract (yes/no outcome), choose how many contracts you want, then place your order.

Keep in mind that you’re still trading a derivative product, so while you know your maximum loss up front, you still need to manage risk and understand how the contract works.

What You Can Trade

When you place a trade, you pick the event you want to trade – things like inflation numbers, market moves, election outcomes, or other real-world yes/no questions. Then you choose the side you believe in and the number of contracts you want.

Unlike some other predication platforms we’ve evaluated, you can add to the trade or close it before the event ends.

If you exit early, your profit or loss is the price change between when you opened and closed the position, minus fees. It works the same way as any price-driven trade.

If you hold through resolution, the outcome decides your payout. Get it right, and each contract pays $1 or $10, depending on the contract type. Get it wrong, and it settles at zero.

Who It’s For

Crypto.com’s prediction markets should suit you if you want a simple way to trade on real-world events without dealing with heavy charts or complex futures.

If you already use the app for crypto, it feels like a natural add-on rather than a whole new platform to learn.

But if you’re a trader who wants tons of markets, deep liquidity, or pro-level tools, you might outgrow it pretty fast. That’s when we’d stick to our first place provider – Interactive Brokers.

What Are Prediction Markets?

At their core, prediction markets let you buy and sell shares in the outcome of future events. These “shares” rise or fall in value depending on what the crowd thinks will happen.

If you think the Fed will hike rates at the next meeting, you can “buy” that outcome. If you change your mind, you can sell before the decision drops.

That liquidity and pricing mechanism is what separates serious prediction markets from your average pub bet.

How Do Prediction Markets Work?

At a glance, prediction markets might look like simple yes-or-no bets, but spend enough investigating and using them like I have, and you’ll realise they’re really sophisticated.

If you’re familiar with simplified futures, you’ll feel right at home.

The Mechanics

Each market centers around a specific question with a binary outcome – usually framed as “Will X happen by Y date?”

For example:

- Will the Fed raise interest rates at the next FOMC meeting?

- Will Bitcoin reach 150,000 by December 31st?

- Will Taylor Swift attend the Super Bowl?

You can buy a “Yes” share or a “No” share, and that share settles at $1 if correct or $0 if wrong. That’s it.

The price you pay reflects the market-implied probability. If “Yes” is trading at $0.38, the crowd thinks there’s a 38% chance the event will occur.

And just like any tradeable instrument, the price moves over time. As new polls drop, inflation data gets released, or Taylor Swift boards a plane, the market adjusts. If you’re early to that shift, there’s money to be made.

You Can Trade In And Out Anytime

This is what really sets prediction markets apart from old-school gambling or betting exchanges: you don’t have to hold your position to the outcome.

Let’s say you bought “Yes” on a CPI of over 3.5% at $0.42. A day later, a Fed speaker drops a hawkish bombshell, and the price jumps to $0.65.

You don’t have to wait for the CPI print – you can sell right then and lock in your gain. It’s active, fluid, and rewards fast reactions.

That’s how I’ve been trading them in our own tests: scalping volatility, fading sentiment swings, and applying the same logic I’d use on short-dated options or economic calendar trades.

Where Do The Prices Come From?

Prediction markets are crowd-priced. There’s no central oracle, no fixed odds from a house. Instead, it’s supply and demand from every trader on the platform. That’s what makes them feel alive; prices react to sentiment in real-time.

I’ve seen pricing gaps emerge during major news events, and they’re often less efficient than financial markets. That’s a massive opportunity for active traders, especially if you’re plugged into newsfeeds, social sentiment, or early poll data.

Here’s an example from my own experience: during the early 2024 primaries, markets around Trump vs DeSantis swung heavily based on debate reactions. But sentiment lagged actual poll shifts by hours. That gave me an edge just by staying ahead of the news cycle.

Market Types: Not Just Yes/No

While binary setups are the most common, some prediction market platforms we evaluated also offer:

- Range markets: e.g., Where will inflation land? (2.5–3%, 3–3.5%, etc.)

- Multi-outcome markets: e.g., Who will win the midterms?

- Indexed events: e.g., How many rate hikes will we see this year?

These let you build more nuanced trades or hedge between overlapping outcomes. Think of it like trading election ETFs instead of single stocks.

An Example Trade

Let’s use a U.S. election and an extremely liquid event: the market on “Will the republican candidate win the next election?” Each outcome is represented as a simple contract: “Yes” or “No.”

If “Yes” shares traded at $0.60, the market is pricing in a 60% probability of a republican win. If I’m convinced that this is an underestimation, I could buy “Yes” at $0.60 and would profit $1 per share if they won.

The difference from traditional betting? I can trade in and out of positions as sentiment shifts. I can hedge, arbitrage, and even layer positions across different but related events (like “Democrats win Senate”).

Pros Of Prediction Markets

There’s a growing buzz around prediction markets for good reason:

- Low barrier to entry: No complex platforms, no leverage risk. You can start small.

- Fast-moving events: You’re often dealing in days or weeks, not months or years.

- A new kind of edge: If you’ve got a solid grasp of political cycles, macro data releases, or public sentiment (Reddit, Twitter, etc.), you might have an information advantage.

- Diversification: These markets don’t move with the S&P 500, oil, or bonds. They’re disconnected, and that’s rare.

I’m not saying this is a replacement for trading forex or futures. But if you trade on headlines, or love playing earnings, NFPs, and geopolitical curveballs, prediction markets can feel like home.

What Can You Use Prediction Markets For?

We’ve seen traders use prediction markets to:

- Hedge macro exposure: Think inflation hitting 4% hurting your bond longs? Buy “CPI above 4%” to offset.

- Play political volatility: If you believe Trump will take Iowa, but not the general election, you can construct that trade.

- Capitalize on calendar events: From student loan rulings to Fed minutes – some platforms offer very niche markets for fast thinkers.

These are short-term, event-driven opportunities that we know many of you live for. And unlike traditional markets, these don’t always price in news immediately, giving active traders a real edge.

Are Prediction Markets Legal?

The short answer? It depends where you live and what platform you’re using.

We’ve dug into this ourselves, including testing platforms directly (and carefully) from the US and UK, and the legal grey areas are real.

In The U.S.

In the U.S., prediction markets walk a tightrope between financial derivatives and regulated betting. The Commodity Futures Trading Commission (CFTC) oversees them when they’re structured like options or swaps, and historically it hasn’t been too keen on retail-facing event contracts, especially political ones.

However, there are a couple of notable exceptions: Interactive Brokers and Kalshi are the only prediction market platforms that are CFTC-regulated and legally available to U.S. residents.

Kalshi lets you trade on economic events (inflation, Fed moves, job reports), but not politics – at least, not yet. They’re actively lobbying the CFTC to allow political markets, but it’s a regulatory minefield.

Then there’s PredictIt, which used to be the go-to U.S. platform for political markets. It operated under a no-action letter from the CFTC, which was revoked in 2022. Legal challenges have kept it alive (in limited form), but new account sign-ups and markets were restricted during our last tests.

In contrast, Polymarket – a blockchain-based prediction market – is officially off-limits to U.S. users for now. U.S. residents will see access restrictions, and yes, we tested this. Even with a VPN, you’ll hit KYC barriers. The team settled with the CFTC in 2022 and geo-blocks U.S. traders to stay compliant.

In The UK, EU, And Beyond

In the UK and across much of Europe, it’s a little more flexible, but not without quirks. Prediction markets are generally treated as “betting,” which means they fall under gambling regulation, not financial regulation.

That means platforms like Smarkets or Betfair Exchange can offer markets on elections, weather, even TV shows, but they’re not built with serious traders in mind. During our investigations, we found wide spreads, low liquidity, and slow execution.

Kalshi and Polymarket aren’t regulated in the UK, so if you’re trading from there, you’re technically in a grey area, especially with crypto-based platforms like Polymarket.

In practice, many non-U.S. traders access platforms like Polymarket or Manifold with crypto wallets, no fiat funding, and without full KYC. But let’s be clear: you’re trading at your own risk, especially if you’re in a jurisdiction with strict gambling or securities rules.

We’ve tested both centralized and decentralized platforms, and the decentralized ones (like Polymarket) usually offer broader event selection and faster-moving markets, but come with less legal clarity and zero investor protection.

So, Are You Allowed to Trade?

Here’s a quick checklist we use when considering legality:

- Interactive Brokers: Authorized for account holders, including in the U.S., UK and EU

- NinjaTrader: Authorized and regulated in the U.S. through the CFTC

- Crypto.com: Regulated in the U.S. through the CFTC, legal to use

- Kalshi: Legal for U.S. users (on economic data only), CFTC-regulated

- Polymarket: Not for U.S. users, semi-legal elsewhere via crypto workarounds

- PredictIt: Semi-active, U.S.-focused, political-only, future unclear

- Betting Exchanges (e.g., Smarkets, Betfair): Legal in UK/EU, but low-grade for serious traders

- Decentralized protocols: Use with caution – regulation is mostly to be determined

If you’re a short-term trader looking to explore the edge in these markets, always read the T&Cs, and understand your local laws.

We’ve kept all our tests transparent, but if you’re unsure, it’s worth checking with a compliance adviser.