Best Copy Trading Platforms In 2026

Copy trading platform software lets you effortlessly mirror the trades of seasoned traders, turning expertise into opportunity. With countless options available, choosing the right platform can be overwhelming. That’s why we’ve rigorously tested and ranked the top copy trading brokers and platforms in this up-to-date 2026 review.

Top 6 Copy Trading Platforms

In our broker reviews we have found that these are the 6 best copy trading platforms:

-

1

eToro USAeToro USA LLC and eToro USA Securities Inc.; Investing involves risk, including loss of principal; Not a recommendation

eToro USAeToro USA LLC and eToro USA Securities Inc.; Investing involves risk, including loss of principal; Not a recommendation -

2

xChief

xChief -

3

Optimus FuturesCopy trading services are available across some of the broker's extensive range of platforms.

Optimus FuturesCopy trading services are available across some of the broker's extensive range of platforms. -

4

InstaTrade

InstaTrade -

5

Pionex

Pionex -

6

Exness

Exness

What Makes These Providers The Best For Copy Trading?

Here’s a snapshot overview of why these copy trading brokers top our ratings:

- eToro USA is the best copy trading platform in 2026 - You can mirror the positions and strategies of up to 100 other traders with the market-leading eToro US copy trading service. Unlike many competitors, eToro gives you more control over your portfolio, allowing you to stop or pause a copied trade at any time. Pricing is also fairly competitive, with only $1 required to copy a position. eToro copy trading is for crypto only.

- xChief - Clients can follow copy trading signals on the MetaTrader platform. Alternatively, signal providers can generate extra income by selling their positions. You can start copy trading in a few easy steps.

- Optimus Futures - Copy trading services are available across some of the broker's extensive range of platforms.

- InstaTrade - InstaTrade offers hands-off trading through its Fixed Income Structured Product, where clients automatically replicate the positions of active traders. What’s distinctive is InstaTrade’s offer to ensure clients make a 50% return by compensating any shortfall if other users are referred.

- Pionex - Pionex clients can find other successful investors and copy their trading bot setups. This allows users to buy and sell cryptos 24/7 from a user-friendly platform and app.

- Exness - Exness has introduced a unique copy trading feature on its web platform and mobile app. Its user-friendly based on our tests but the performance statistics for strategies could be more detailed to better guide investor decisions.

Top Copy Trading Platforms Comparison

Find the right copy trading broker for your requirements through our comparison of the areas critical to copy traders:

| Broker | Copy Trading | Social Investing | Instruments | Platforms | Regulators |

|---|---|---|---|---|---|

| eToro USA | ✔ | ✔ | Stocks, Options, ETFs, Crypto | eToro Trading Platform & CopyTrader | SEC, FINRA |

| xChief | ✔ | ✘ | CFDs, Forex, Metals, Commodities, Stocks, Indices | MT4, MT5 | ASIC |

| Optimus Futures | ✔ | ✘ | Futures on Indices, Metals, Energies, Softs, Bonds, Cryptos, Options on Futures, Event Contracts | Optimus Flow, Optimus Web, MT5, TradingView | NFA, CFTC |

| InstaTrade | ✔ | ✘ | FISP, CFDs, Forex, Stocks, Indices, Commodities, Cryptos, Futures | InstaTrade Gear, MT4 | BVI FSC |

| Pionex | ✔ | ✔ | Cryptos | Own | FinCEN |

| Exness | ✔ | ✔ | CFDs on Forex, Stocks, Indices, Commodities, Crypto | Exness Trade App, Exness Terminal, MT4, MT5, TradingCentral | FCA, FSCA, CMA, FSA, CBCS, BVIFSC, FSC, JSC |

How Safe Are These Copy Trading Providers?

Find out how secure our best copy trading platforms are and the steps they take to safeguard your investments:

| Broker | Trust Rating | Guaranteed Stop Loss | Negative Balance Protection | Segregated Accounts |

|---|---|---|---|---|

| eToro USA | ✘ | ✘ | ✔ | |

| xChief | ✘ | ✘ | ✔ | |

| Optimus Futures | ✘ | ✘ | ✔ | |

| InstaTrade | ✘ | ✔ | ✔ | |

| Pionex | ✘ | ✘ | ✘ | |

| Exness | ✘ | ✔ | ✔ |

Compare Mobile Copy Trading

Are these brokers good for copy trading on mobile and tablet devices?

| Broker | Mobile Apps | iOS Rating | Android Rating | Smart Watch App |

|---|---|---|---|---|

| eToro USA | iOS & Android | ✘ | ||

| xChief | iOS & Android | ✘ | ||

| Optimus Futures | iOS & Android | ✘ | ||

| InstaTrade | iOS & Android | ✘ | ||

| Pionex | iOS & Android | ✘ | ||

| Exness | iOS & Android | ✘ |

Are the Top Copy Trading Brokers Good for Beginners?

Investors new to copy trading should use brokers that offer a demo account, excellent education and reliable support:

| Broker | Demo Account | Minimum Deposit | Minimum Trade | Education Rating | Support Rating |

|---|---|---|---|---|---|

| eToro USA | ✔ | $100 | $10 | ||

| xChief | ✔ | $10 | 0.01 Lots | ||

| Optimus Futures | ✔ | $500 | $50 | ||

| InstaTrade | ✔ | $1 | 0.01 | ||

| Pionex | ✘ | $0 | 0.1 USDT | ||

| Exness | ✔ | Varies based on the payment system | 0.01 Lots |

Are the Top Copy Trading Brokers Good for Advanced Traders?

Experienced traders should look for sophisticated tools to enhance the trading experience, especially if they are master traders looking for copiers:

| Broker | Automated Trading | VPS | AI | Pro Account | Leverage | Low Latency | Extended Hours |

|---|---|---|---|---|---|---|---|

| eToro USA | ✘ | ✘ | ✘ | ✘ | - | ✔ | ✔ |

| xChief | Expert Advisors (EAs) on MetaTrader | ✘ | ✘ | ✘ | 1:1000 | ✘ | ✘ |

| Optimus Futures | TradingView Pine Script, API Features | ✘ | ✘ | ✘ | - | ✘ | ✘ |

| InstaTrade | Experts Advisors (EAs) on MetaTrader | ✔ | ✘ | ✘ | 1:1000 | ✘ | ✘ |

| Pionex | Crypto bots | ✘ | ✘ | ✘ | - | ✘ | ✘ |

| Exness | Expert Advisors (EAs) on MetaTrader | ✔ | ✘ | ✔ | 1:Unlimited | ✔ | ✘ |

Compare the Ratings of Top Copy Trading Platforms

Find out how our top copy trading providers compare in all key areas according to our hands-on tests:

| Broker | Trust | Platforms | Assets | Mobile | Fees | Accounts | Research | Education | Support |

|---|---|---|---|---|---|---|---|---|---|

| eToro USA | |||||||||

| xChief | |||||||||

| Optimus Futures | |||||||||

| InstaTrade | |||||||||

| Pionex | |||||||||

| Exness |

Compare Trading Fees

We know the cost of trading with a broker can add up over time, so here's how the best copy trading platforms measure up on fees:

| Broker | Cost Rating | Fixed Spreads | Inactivity Fee |

|---|---|---|---|

| eToro USA | ✔ | $10 | |

| xChief | ✘ | - | |

| Optimus Futures | ✘ | $0 | |

| InstaTrade | ✘ | - | |

| Pionex | ✘ | - | |

| Exness | ✘ | $0 |

How Popular Are These Copy Trading Brokers?

Many copy traders prefer established, widely-used brokers with the most clients:

| Broker | Popularity |

|---|---|

| InstaTrade | |

| Pionex | |

| eToro USA | |

| Exness | |

| xChief |

Why Copy Trade with eToro USA?

"eToro remains a top pick for traders looking for leading social investing and copy trading services. With a low deposit, zero commissions and an intuitive platform, the broker will meet the needs of newer day traders."

Jemma Grist, Reviewer

eToro USA Quick Facts

| Demo Account | Yes |

|---|---|

| Instruments | Stocks, Options, ETFs, Crypto |

| Regulator | SEC, FINRA |

| Platforms | eToro Trading Platform & CopyTrader |

| Minimum Deposit | $100 |

| Minimum Trade | $10 |

| Account Currencies | USD |

Pros

- Investors can access Smart Portfolios for a more hands-off approach, covering a range of sectors and markets such as renewable energy and artificial intelligence

- The low minimum deposit and straightforward account opening process means beginners can get started quickly

- The online broker offers an intuitive social investment network with straightforward copy trading on cryptos

Cons

- There's a narrower range of day trading instruments available compared to competitors, with only stocks, ETFs and cryptos

- The proprietary terminal doesn't support trading bots and there are no additional stock market analysis tools

- Average fees may cut into the profit margins of day traders

Why Copy Trade with xChief?

"xChief continues to prove popular with investors looking to trade highly leveraged CFDs on the popular MetaTrader platforms. The broker's rebate scheme and investment accounts will particularly appeal to seasoned traders. However, the lack of top-tier regulatory oversight is a major drawback."

William Berg, Reviewer

xChief Quick Facts

| Demo Account | Yes |

|---|---|

| Instruments | CFDs, Forex, Metals, Commodities, Stocks, Indices |

| Regulator | ASIC |

| Platforms | MT4, MT5 |

| Minimum Deposit | $10 |

| Minimum Trade | 0.01 Lots |

| Leverage | 1:1000 |

| Account Currencies | USD, EUR, GBP, JPY, CHF |

Pros

- The broker offers several account types to suit different traders, including a Cent account for beginners and pro-level hedging/netting accounts

- The broker offers a turnover rebate scheme geared towards active investors, as well as trading credits and several other occasional bonuses

- xChief delivers a high-quality day trading environment via the MT4 and MT5 platforms, with market-leading charts, indicators and tools

Cons

- The Classic+ and Cent accounts provide access to fewer instruments than the other account types, at 50+ and 35+, respectively

- The broker trails competitors when it comes to research tools and educational resources

- The total range of 150+ assets is much lower than most competitors who typically offer hundreds

Why Copy Trade with Optimus Futures?

"Optimus Futures is best for active futures day traders who want low per-contract costs and the flexibility to build a custom trading setup across platforms like Optimus Flow, TradingView, and Sierra Chart. Its fast order-routing, low day trading margins, depth-of-market and footprint analysis tools, plus the ability to select your own clearing firm, make it especially suited to high-volume traders focused on U.S. and global futures markets."

Christian Harris, Reviewer

Optimus Futures Quick Facts

| Demo Account | Yes |

|---|---|

| Instruments | Futures on Indices, Metals, Energies, Softs, Bonds, Cryptos, Options on Futures, Event Contracts |

| Regulator | NFA, CFTC |

| Platforms | Optimus Flow, Optimus Web, MT5, TradingView |

| Minimum Deposit | $500 |

| Minimum Trade | $50 |

| Account Currencies | USD |

Pros

- Optimus Futures has added event contracts from CME Group, allowing traders to express a daily market view with a simple yes-or-no position on major futures markets. Only offered by a handful of brokers, these fixed-risk products provide a straightforward way to speculate on a short-term basis.

- The brokerage provides the flexibility to choose your clearing firm, including Iron Beam, Phillip Capital, and StoneX, allowing for direct control over where your funds are held and the associated transaction costs - helpful for customizing the futures trading setup.

- Product and service upgrades, notably multi-bracket orders, an integrated trade journal, and a broader futures lineup, show Optimus Futures is making a clear effort to support active traders.

Cons

- There are limited payment options and no toll-free numbers for international support, while withdrawals cost $20 to $60, potentially making frequent withdrawals costly for active traders.

- There's no true 'all-in-one' account management dashboard - key functions like risk settings, software downloads, and subscriptions are split across different sections or platforms, so it required extra digging to set everything up during testing.

- Live chat support is handled entirely by a bot, so despite several attempts in our tests, it wasn't possible to get access to a human agent, which can be frustrating when urgent or complex questions arise.

Why Copy Trade with InstaTrade?

"Although InstaTrade offers active trading on a comprehensive platform, it stands out with its fairly unique Fixed Income Structured Product (FISP), providing passive investment opportunities with up to 50% returns in 6 months if conditions are met. "

Christian Harris, Reviewer

InstaTrade Quick Facts

| Demo Account | Yes |

|---|---|

| Instruments | FISP, CFDs, Forex, Stocks, Indices, Commodities, Cryptos, Futures |

| Regulator | BVI FSC |

| Platforms | InstaTrade Gear, MT4 |

| Minimum Deposit | $1 |

| Minimum Trade | 0.01 |

| Leverage | 1:1000 |

| Account Currencies | USD, EUR, RUB |

Pros

- InstaTrade TV, consisting of video interviews and valuable market insights spanning equities, cryptos and more, helps identify opportunities and inform short-term trades.

- InstaTrade claims to "guarantee" returns through the structured element of its passive trading solution (FISP), with applications approved within 24 hours.

- InstaTrade delivers an excellent suite of charting tools for day traders with its web trader comprising 250+ indicators, 11 chart types and a user-friendly design.

Cons

- InstaTrade’s growing educational tools provide valuable information for aspiring traders, but still trail category leaders like eToro with no structured course based on experience level.

- Marketing of the FISP, especially phrasing around the “guarantee of profitability” and the “elimination of risks of trading on financial markets” raises concerns.

- InstaTrade sports one of the most cluttered websites and client cabinets in the industry, potentially overwhelming new traders, especially compared to XTB’s intuitive trading journey and resources.

Why Copy Trade with Pionex?

"Pionex is an excellent option for crypto traders with an interest in cutting-edge AI like ChatGPT and automated trading."

William Berg, Reviewer

Pionex Quick Facts

| Demo Account | No |

|---|---|

| Instruments | Cryptos |

| Regulator | FinCEN |

| Platforms | Own |

| Minimum Deposit | $0 |

| Minimum Trade | 0.1 USDT |

Pros

- Powerful integrated AI chatbot 'PionexGPT' helps users programme trading bots on Pine script

- Supports crypto derivatives via futures trading

- Money Services Business (MSB) license by US FinCEN

Cons

- Withdrawal fees and limits may apply

- Weak regulatory oversight raises safety concerns

- No demo account

Why Copy Trade with Exness?

"After slashing its spreads, improving its execution speeds and support trading on over 100 currency pairs with more than 40 account currencies to choose from, Exness is a fantastic option for active forex traders looking to minimize trading costs."

Christian Harris, Reviewer

Exness Quick Facts

| Demo Account | Yes |

|---|---|

| Instruments | CFDs on Forex, Stocks, Indices, Commodities, Crypto |

| Regulator | FCA, FSCA, CMA, FSA, CBCS, BVIFSC, FSC, JSC |

| Platforms | Exness Trade App, Exness Terminal, MT4, MT5, TradingCentral |

| Minimum Deposit | Varies based on the payment system |

| Minimum Trade | 0.01 Lots |

| Leverage | 1:Unlimited |

| Account Currencies | USD, EUR, GBP, CAD, AUD, NZD, INR, JPY, ZAR, MYR, IDR, CHF, HKD, SGD, AED, SAR, HUF, BRL, NGN, THB, VND, UAH, KWD, QAR, KRW, MXN, KES, CNY |

Pros

- Highly competitive spreads, reduced for USOIL and BTCUSD in 2024, are available from 0 pips with low commissions from $2 per side.

- Excellent range of account types for all experience levels, including Cent, Pro plus the introduction of Raw Spread, ideal for day traders.

- Exness Terminal offers a streamlined experience for beginners with dynamic charts while setting up watchlists is a breeze.

Cons

- Apart from a mediocre blog, educational resources are woeful, especially compared to category leaders like IG which provide a more complete trading journey for newer traders.

- Retail trading services are unavailable in certain jurisdictions, such as the US, UK and EU, limiting accessibility compared to top-tier brokers like Interactive Brokers.

- MetaTrader 4 and 5 are supported, but TradingView and cTrader still aren’t despite rising demand from active traders and integration at alternatives like Pepperstone.

How Copy Trading Platforms Work

Copy trading brokers provide a platform that connects aspiring investors with experienced traders, enabling them to mirror positions and strategies in their own accounts. As a result, beginners can start trading with very limited effort.

On the downside, losing trades will also be reflected in the investor’s account, so selecting good traders to copy is essential.

A good copy trading platform offers trading on multiple markets, from forex and cryptos to stocks and commodities. Investors can often get started with just $10 and typically pay a small commission to the signal provider based on the volume traded.

Importantly, the best copy trading platforms make it easy to find a master trader, providing detailed insights into their returns, strategies, and risk ratings.

Leading copy trading providers also rank the highest-performing master traders so investors can quickly find a suitable signal provider based on their goals and risk tolerance.

Independent Copy Trading Platforms

Depending on the brokerage, copy trading can be offered through proprietary software or an independent, third-party platform such as those listed below.

Some brokers offer additional research tools or networking forums, such as Telegram or TradingView.

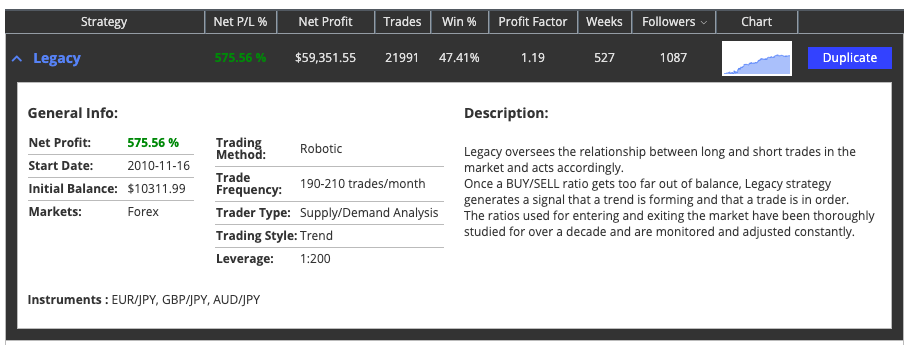

MetaTrader 4

MT4 has been set up so you can mirror the trades and automatically copy the strategies of traders. Select the Signals tab from within the platform for access to over 3,200 free and paid signals from top forex providers.

Traders are ranked in order of results, so it’s quick and easy to choose a provider and select your parameters. You can then start copying trades in both live and demo settings.

Best MT4 Copy Trading Brokers

The best brokers to use if you want to copy trade using MetaTrader 4 are:

How to start copy trading using MetaTrader 4:

- Open an account with a MT4 broker.

- Deposit money to your account.

- Download MetaTrader 4.

- Open MetaTrader 4.

- Go to the Signals Tab located at the bottom of the screen.

- Choose a signal provider.

- Select a free or paid subscription.

- Click the Subscribe button.

- Select trade parameters

You can see the trade statistics of the copy trading subscription by clicking the “My Statistics tab”. You can easily stop copying a trader at any time by clicking on the signal provider and then clicking the unsubscribe button.

MetaTrader 5

Similar to MT4, you can automatically replicate the trades of others on the MT5 platform. Masters and followers do not need to be signed up with the same broker – the MT5 platform connects traders across continents and brokerages.

Subscription prices are fixed in the MT5 market place, and rapid data exchanges help to reduce execution delays making the platform ideal for copy trading.

Best MT5 Copy Trading Brokers

The best brokers to use if you want to copy trade using Meta Trader 5 are:

How to Copy Trade Using MT5

How to start copy trading using MetaTrader 5:

- Open an account with a MT5 broker.

- Deposit money to your account.

- Download MetaTrader 5

- Open MetaTrader 5.

- Go to the Signals Tab in the “Toolbox” menu located on the bottom of the screen.

- Choose a signal provider.

- Select a free or paid subscription.

- Click the Subscribe button.

- Select trade parameters

You can see the trade statistics of the copy trading subscription by clicking the “My Statistics tab”. You can easily stop copying a trader at any time by clicking on the signal provider and then clicking the unsubscribe button.

| eToro USA | xChief | InstaTrade | |

|---|---|---|---|

| MetaTrader 4 | No | Yes | Yes |

| MetaTrader 5 | No | Yes | No |

| Copy Trading App | iOS & Android | iOS & Android | iOS & Android |

| App Rating | |||

| Visit | Visit eToro USA LLC and eToro USA Securities Inc.; Investing involves risk, including loss of principal; Not a recommendation |

Visit | Visit |

| Review | Review | Review | Review |

cTrader

Another popular platform is the integrated cTrader solution. Once clients have opened an account, they can navigate to the Copy area to explore available strategies and compare providers’ history, risk appetite, and fees.

Clients decide how much they want to allocate to mirror a particular trader, and are free to copy multiple providers simultaneously.

DupliTrade

DupliTrade offers leading automated copy trading technology. Users have the flexibility to select what proportion of trades they’d like to copy, and the option to scale up and down. Users can copy trades in forex, stocks, indices and commodities markets.

Those wishing to sell their trades have to pass a rigorous audit progress while clients are presented with all the facts and figures they need to make an informed decision.

| eToro USA | xChief | InstaTrade | |

|---|---|---|---|

| cTrader | No | No | No |

| DupliTrade | No | No | No |

| Copy Trading App | iOS & Android | iOS & Android | iOS & Android |

| App Rating | |||

| Visit | Visit eToro USA LLC and eToro USA Securities Inc.; Investing involves risk, including loss of principal; Not a recommendation |

Visit | Visit |

| Review | Review | Review | Review |

How To Choose A Platform For Copy Trading

With a growing list of copy trading softwares in 2026, here are the key factors to weigh up when choosing a provider:

Software

Some copy trading companies offer their own platform, such as AvaTrade’s AvaSocial, while many providers use popular third-party copy trading softwares, such as ZuluTrade and DupliTrade.

Importantly, look for a copy trading platform with an intuitive interface, easy access to the broker’s highest-performing traders, and straightforward tools to compare signal providers.

Apps

The best copy trading brokers also offer a mobile-compatible app softwares, available on iOS and Android devices.

The top-rated copy trading apps should offer seamless integration between the desktop software and mobile/tablet solution, allowing users to follow master traders and manage their accounts while on the go.

Quality & Quantity

The best copy trading platforms have thousands of signal providers spanning multiple asset classes.

Leading firms also offer detailed performance metrics so investors can analyze short, medium and long-term profits, drawdowns, risk ratings, strategies and systems, number of followers, and trade frequency.

Market Access

Top-rated copy trading brokers offer signals and opportunities on popular markets. This includes US and European stocks, global indices, major, minor and exotic forex pairs, precious metals and energies, plus cryptocurrencies like Bitcoin.

A good range of asset classes means more opportunities to build a diverse portfolio while learning about new markets.

Fees & Costs

Copy trading platforms have different pricing structures. Some will charge a flat fee based on the volume traded/copied while others only take a commission on profitable trades.

Importantly, any fee owed directly to the master trader should be transparent and known upfront.

Control & Flexibility

The best copy trading firms give you the flexibility to manually adjust trades and positions. The top providers allow you to filter trades based on returns, losses and costs.

Copy Period

The top copy trading companies allow you to immediately stop following the trades of signal providers. Firms should not lock you in for a fixed period which could lead to mounting losses.

Minimum Investment

The highest-rated copy trading platforms have a low minimum investment requirement, making it easy for beginners and those on a budget to get started.

This can be as low as $10 at some providers while other firms require several hundred dollars.

Demo Account

An effective way to test the quality of a copy trading broker’s signals and tools is through free demo accounts. These paper trading profiles allow you to trial a firm’s software before registering for a live account.

Traders usually need to provide basic contact details to get started.

Regulation

The top copy trading platforms are regulated by a reputable financial agency, such as the UK Financial Conduct Authority (FCA), the Cyprus Securities & Exchange Commission (CySEC), or the Australian Securities & Investments Commission (ASIC).

Signing up with a regulated copy trading brokerage means various customer safeguarding measures should be in place, such as the provision of negative balance protection, restrictions on excessive leverage and misleading promotions, plus access to compensation schemes should the brokerage go bankrupt.

Customer Support

The best copy trading companies have a responsive customer support team on-hand to help with any queries or issues. Leading copy trading firms offer support 24/5 via live chat, telephone, and email.

A growing list of copy trading platforms also provides assistance through social media channels, such as WhatsApp and Facebook Messenger.

Bottom Line

Good copy trading platforms make it easy for beginners to find and follow the strategies of experienced traders. Leading providers also offer an intuitive platform to master traders with the tools to reach a large base of potential followers and create a second revenue stream.

Use our ranking of the best copy trading platforms to find a broker that aligns with your financial goals and risk tolerance.

FAQ

What Is The Best Copy Trading Platform?

That depends on your location. See our list of copy trading platforms to find out which broker is ranked #1 in your country.