DupliTrade

DupliTrade is a copy trading platform that works with MT4 alongside partner brokers. Our review covers how DupliTrade brokers work, the login process, plus fees and strategy providers. Find out which brokers offer DupliTrade in 2026, as well as how to compare supporting brokerages.

DupliTrade Brokers

Here is a summary of why we recommend these brokers in February 2026:

- AvaTrade - Established in 2006, AvaTrade is a leading forex and CFD broker trusted by over 400,000 traders. Operating under regulation in 9 jurisdictions, AvaTrade processes an impressive 2+ million trades each month. Through like MT4, MT5, and its proprietary WebTrader, the broker provides a growing selection of 1,250+ instruments. Whether it’s CFDs, AvaOptions, or the more recent AvaFutures, short-term traders at all levels will find opportunities. With terrific education and 24/5 multilingual customer support, AvaTrade delivers the complete trading experience.

- IC Markets - IC Markets is a globally recognized forex and CFD broker known for its excellent pricing, comprehensive range of trading instruments, and premium trading technology. Founded in 2007 and headquartered in Australia, the brokerage is regulated by the ASIC, CySEC and FSA, and has attracted more than 180,000 clients from over 200 countries.

- Fusion Markets - Fusion Markets is an online broker established in 2017 and regulated by the ASIC, VFSC and FSA. It is best known for its low-cost forex and CFD trading, although its multiple account types and copy trading solutions cater to a range of traders. New clients can sign up and start trading in 3 easy steps.

- Vantage - Founded in 2009, Vantage offers trading on 1000+ short-term CFD products to over 900,000 clients. You can trade Forex CFDs from 0.0 pips on the RAW account through TradingView, MT4 or MT5. Vantage is ASIC-regulated and client funds are segregated. Copy traders will also appreciate the range of social trading tools.

- FxPro - Established in 2006, FxPro has emerged as a trusted non-dealing desk (NDD) broker offering trading on over 2,100 markets to more than 2 million clients worldwide. It has scooped over 100 industry awards and counting for its competitive conditions for active traders.

AvaTrade

"AvaTrade offers active traders everything they need: an intuitive WebTrader, powerful AvaProtect risk management, a smooth 5-minute sign-up process, and dependable support you can rely on in fast-moving markets."

Jemma Grist, Reviewer

AvaTrade Quick Facts

| Demo Account | Yes |

|---|---|

| Instruments | CFDs, Forex, Stocks, Indices, Commodities, ETFs, Bonds, Crypto, Spread Betting, Futures |

| Regulator | ASIC, CySEC, FSCA, ISA, CBI, JFSA, FSRA, BVI, ADGM, CIRO, AFM |

| Platforms | WebTrader, AvaTradeGO, AvaOptions, AvaFutures, MT4, MT5, AlgoTrader, TradingView, TradingCentral, DupliTrade |

| Minimum Deposit | $100 |

| Minimum Trade | 0.01 Lots |

| Leverage | 1:30 (Retail) 1:400 (Pro) |

| Account Currencies | USD, EUR, GBP, CAD, AUD |

Pros

- AvaTrade launched AvaFutures to offer low-margin access to global markets, then expanded in 2025 as one of the first brokers to add CME’s Micro Grain Futures, and then later in the year went further by integrating with TradingView.

- Support at AvaTrade performed excellently during testing, with response times of 3 minutes and localized support in major trading jurisdictions, including the UK, Europe and the Middle East.

- The WebTrader excelled in our hands-on tests, sporting a user-friendly interface for beginners, complete with robust charting tools like 6 chart layouts and 60+ technical indicators.

Cons

- AvaTrade’s WebTrader has improved, but work is still needed in terms of customizability – frustratingly widgets like market watch and watchlists can’t be hidden, moved, or resized.

- While signing up is a breeze, AvaTrade lacks an ECN account like Pepperstone or IC Markets, which provides the raw spreads and ultra-fast execution many day traders are looking for.

- Although the deposit process itself is smooth, AvaTrade still doesn’t facilitate crypto payments, a feature increasingly offered by brokers like TopFX, which caters to crypto-focused traders.

IC Markets

"IC Markets offers superior pricing, exceptionally fast execution and seamless deposits. The introduction of advanced charting platforms, notably TradingView, and the Raw Trader Plus account, ensures it remains a top choice for intermediate to advanced day traders."

Christian Harris, Reviewer

IC Markets Quick Facts

| Demo Account | Yes |

|---|---|

| Instruments | CFDs, Forex, Stocks, Indices, Commodities, Bonds, Futures, Crypto |

| Regulator | ASIC, CySEC, CMA, FSA |

| Platforms | MT4, MT5, cTrader, TradingView, TradingCentral, DupliTrade, Quantower |

| Minimum Deposit | $200 |

| Minimum Trade | 0.01 Lots |

| Leverage | 1:30 (ASIC & CySEC), 1:500 (FSA), 1:1000 (Global) |

| Account Currencies | USD, EUR, GBP, CAD, AUD, NZD, JPY, CHF, HKD, SGD |

Pros

- As a tightly regulated and widely respected broker, IC Markets prioritizes client security and transparency, helping to ensure a reliable trading experience globally.

- IC Markets secured DayTrading.com's 'Best MT4/MT5 Broker' in 2025 for its seamless, industry-leading MetaTrader integration, refined over years to maximize the platform experience.

- IC Markets offers among the tightest spreads in the industry, with 0.0-pip spreads on major currency pairs, making it especially cost-effective for day traders.

Cons

- Interest isn't paid on unused cash, an increasingly popular feature found at alternatives like Interactive Brokers.

- The breadth and depth of tutorials, webinars and educational resources still need work, trailing alternatives like CMC Markets and reducing its suitability for beginners.

- Despite four industry-leading third-party platforms, there is no proprietary software or trading app built with new traders in mind.

Fusion Markets

"Fusion Markets is a standout option for forex traders looking for excellent pricing with spreads near zero, industry-low commissions and recently TradingView integration. It’s a particularly good broker for Australian traders where the company is headquartered and regulated by the ASIC."

Jemma Grist, Reviewer

Fusion Markets Quick Facts

| Demo Account | Yes |

|---|---|

| Instruments | CFDs, Forex, Stocks, Indices, Commodities, Crypto |

| Regulator | ASIC, VFSC, FSA |

| Platforms | MT4, MT5, cTrader, TradingView, DupliTrade |

| Minimum Deposit | $0 |

| Minimum Trade | 0.01 Lots |

| Leverage | 1:500 |

| Account Currencies | USD, EUR, GBP, CAD, AUD, NZD, JPY, CHF, HKD, SGD |

Pros

- Fusion Markets is set up to support algo traders with a sponsored VPS solution and a 25% discount if you opt for the NYC Servers VPS for MT4 or cTrader.

- The range of charting platforms and social trading features is excellent, with MT4, MT5, cTrader and more recently TradingView, catering to a wide range of trader preferences.

- Fusion Markets continues to impress with its pricing that provides tight spreads with below-average commissions that will appeal to active day traders.

Cons

- Traders outside of Australia must sign up with weakly regulated global entities with limited safeguards and no negative balance protection.

- There is no proprietary trading platform or app built with beginners in mind, a notable drawback compared to AvaTrade.

- The demo account expires after 30 days, limiting its potential as a useful trading tool alongside a real-money account.

Vantage

"Vantage remains an excellent option for CFD traders seeking a tightly-regulated broker with access to the reliable MetaTrader platforms. The fast sign-up process and $50 minimum deposit make it very straightforward to start day trading quickly."

Jemma Grist, Reviewer

Vantage Quick Facts

| Demo Account | Yes |

|---|---|

| Instruments | CFDs, Forex, Stocks, Indices, Commodities, ETFs, Bonds |

| Regulator | FCA, ASIC, FSCA, VFSC |

| Platforms | ProTrader, MT4, MT5, TradingView, DupliTrade |

| Minimum Deposit | $50 |

| Minimum Trade | 0.01 Lots |

| Leverage | 1:500 |

| Account Currencies | USD, EUR, GBP, CAD, AUD, NZD, JPY, HKD, SGD, PLN |

Pros

- It’s quick and easy to open a live account – taking less than 5 minutes

- There’s an excellent suite of day trading software, including the award-winning platforms MT4 and MT5

- Vantage has bolstered its algorithmic trading tools for advanced traders with AutoFibo EA identifying reversal opportunities

Cons

- A steep $10,000 deposit is needed for the best trading conditions, which include the $1.50 commission per side

- The average execution speeds of 100ms to 250ms are slower than alternatives based on tests

- Unfortunately, cryptos are only available for Australian clients

FxPro

"FxPro is a stellar option for day traders, sporting exceptionally fast execution speeds under 12ms, competitive fees that were lowered in 2022, and terrific charting platforms in MT4, MT5, cTrader and FxPro Edge."

Christian Harris, Reviewer

FxPro Quick Facts

| Demo Account | Yes |

|---|---|

| Instruments | CFDs, Forex, Stocks, Indices, Commodities, Futures, Spread Betting |

| Regulator | FCA, CySEC, FSCA, SCB, FSA |

| Platforms | FxPro Edge, MT4, MT5, cTrader, AutoChartist, TradingCentral, DupliTrade, Quantower |

| Minimum Deposit | $100 |

| Minimum Trade | 0.01 Lots |

| Leverage | 1:30 (Retail), 1:500 (Pro), 1:1000 (Via Prime Ash Capital Limited) |

| Account Currencies | USD, EUR, GBP, AUD, JPY, ZAR, CHF, PLN |

Pros

- FxPro offers four reliable charting platforms, notably the intuitive FxPro Edge, with over 50 indicators, 7 chart types and 15 chart timeframes.

- FxPro's Wallet is a standout feature that allows traders to manage funds securely. By segregating unused funds from active trading accounts, the Wallet provides additional protection and convenience.

- FxPro operates under a 'No Dealing Desk' (NDD) model, ensuring fast and transparent order execution, often under 12 milliseconds, ideal for short-term trading strategies.

Cons

- While FxPro provides 24/5 customer support through multiple channels that performed well during testing, it lacks 24/7 availability, which can disadvantage traders needing assistance outside traditional market hours.

- Despite a growing Knowledge Hub and a $10M funded demo account, FxPro is geared towards advanced traders, with beginners potentially finding the account and fee structure complex.

- There are no passive investment tools like copy trading or interest paid on cash. While active traders may not miss these, competitors like eToro catering to active and passive investors have more comprehensive offerings.

How Does DupliTrade Work?

DupliTrade connects strategy providers with clients that have an account with one of their partner brokers. There are currently a dozen or so approved DupliTrade brokers and platforms.

After registering and receiving login details, clients can link their new copy trading account with their standard retail investing account, often through MetaTrader 4 (MT4).

Users can then pick the strategy providers they want to copy and decide on their preferred level of exposure before getting started. Traders can monitor profits and analyze performance in real-time at the best DupliTrade brokers.

This platform is browser-based, so no download is required. The brand does not offer a mobile app at present, however the top DupliTrade brokers may have their own mobile application.

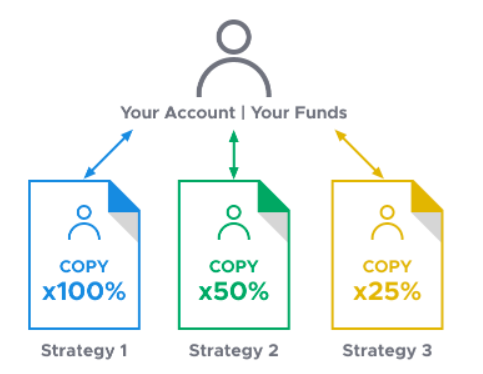

Clients can manually execute orders and can adjust the trades placed by their chosen strategy provider via the MT4 platform. Users can also choose the proportion of trades they wish to copy, for example, duplicating 100% of the expert’s positions vs 25%.

Fees

The brand does not charge monthly fees for its automated copy trading service. Instead, the company receives an Introducing Broker (IB) fee directly from DupliTrade brokers.

It is also worth noting that traders must deposit a minimum of $5,000 into their brokerage account to use the platform.

Strategy Providers

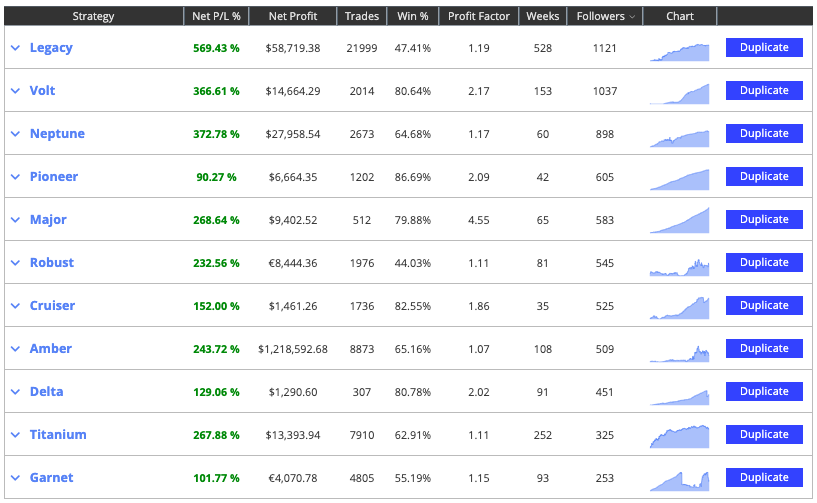

The platform offers copy trading on forex and CFDs in stocks, commodities, and indices. However, the majority of current providers trade forex exclusively.

The brand has a rigorous three-step audit process for its strategy providers. The company website offers a basic profile for each provider detailing:

- Markets and instruments traded

- Net profit/loss percentage, overall profit, and initial balance

- Method (e.g. automated or semi-automated) and type (e.g. technical or trend follow)

- Frequency and style (e.g. swing or trend)

- Win percentage, leverage, and profit factor

- Weeks traded and follower count

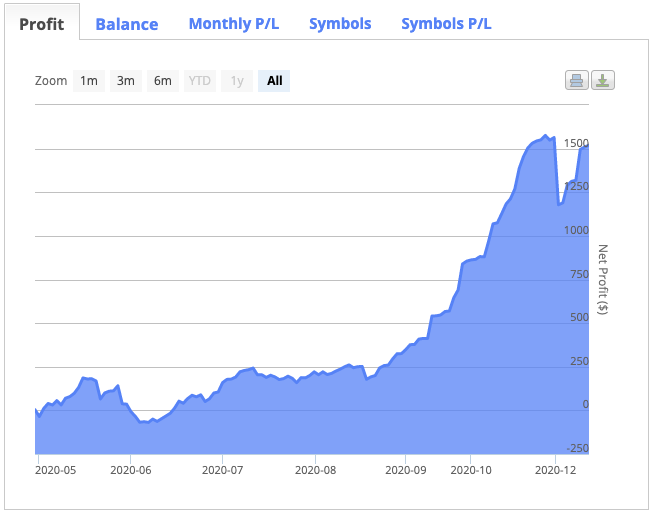

The technical trading statistics for each strategy provider are also available:

- Full trading history plus balance and equity

- Number of closed, winning and losing trades

- Profit/trade ratio, average profit and losing trade

- Gross profit and loss, maximum drawdown

- Best and worst trades and average trade time

Simulator

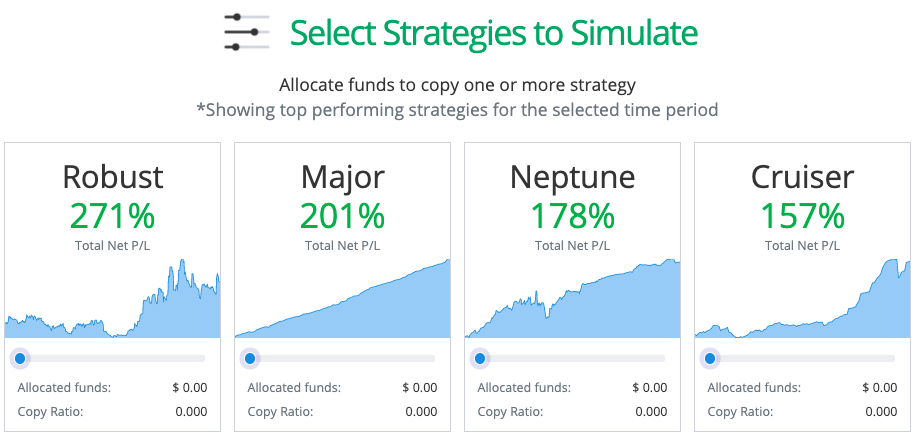

The platform website offers a simulator that allows clients to test the past performance of strategy providers. Selecting a funding amount, time frame, and provider will generate an expansive report with statistics including monthly P/L and balance over time, total profit, and the best performing provider in the specified simulation.

This feature is available at most of the top brokers that offer DupliTrade.

Demo Account

The company offers a free demo account for 30 days. The account displays the outcome of each trade placed by all the strategy providers followed by the client, as executed by the professional’s broker.

Users should note that in live accounts, the copied trades are executed by the client’s broker and therefore accuracy cannot be assured by DupliTrade.

How To Compare DupliTrade Brokers

With several leading brokers that support DupliTrade, knowing where to open an account can be challenging. To help you make the decision, we have compiled a list of the key considerations:

- Regulation – The top-rated DupliTrade brokers hold a license with a trusted regulator, such as the UK Financial Conduct Authority (FCA), the Cyprus Securities & Exchange Commission (CySEC), or the Australian Securities & Investments Commission (ASIC).

- MT4 add-ons – The best DupliTrade brokers offer other plug-ins and add-ons to enhance the MetaTrader 4 experience. These can include MultiTerminal to manage other accounts simultaneously, an alarm manager for real-time alerts, or stealth orders to make anonymous trades.

- Market access – While most strategy providers on DupliTrade focus on forex, are there other markets you would like to speculate on, for example, US technology stocks, European indices, or hard and soft commodities? Check the broker offers access to the instruments you wish to take positions on.

- Customer support – The best DupliTrade brokers offer 24/7 or 24/5 customer support via live chat, phone, or social media channels. Customer service representatives should be able to help with automated copy trading errors or point you in the direction of the team at DupliTrade.

- Demo accounts – The top DupliTrade brokers offer a free demo account so you can trial the firm’s tools and services before risking cash. You should be able to use thing alongside the DupliTrade test account.

Pros Of DupliTrade Brokers

There are several advantages to copy trading with DupliTrade brokers:

- Powerful simulator

- CySEC regulation

- Thorough auditing process for providers

- Detailed profile with statistics for each provider

- Over 10 leading brokers that support DupliTrade copy trading

Cons Of DupliTrade Brokers

- Limited number of strategy providers

- Predominantly forex markets

- $5,000 minimum deposit

- No guarantee you will make money

DupliTrade vs ZuluTrade

ZuluTrade is a copy and social trading platform. It is larger than DupliTrade, with a trade volume of over £1.2 trillion, more than one million users, and 1,000 strategy providers.

Traders are rated on maturity, exposure, and drawdown, but providers do not appear to undergo the same robust auditing process provided by DupliTrade.

The minimum deposit at ZuluTrade is broker-dependent so can be as low as $1, which makes it more accessible than DupliTrade’s $5,000 requirement.

ZuluTrade also offers a wider range of features, including social charts which display market movement, plus trader comments and insights.

Cryptocurrency markets are also offered at ZuluTrade.

DupliTrade Verdict

DupliTrade is a CySEC-regulated copy trading platform that integrates with MT4 to duplicate the orders of your chosen strategy provider via a partner broker like AvaTrade. Its providers undergo an in-depth auditing process and potential followers have access to a large volume of trading history data plus an advanced simulator. The downsides are the high minimum deposit requirement and the focus on forex markets.

See our list of the best DupliTrade brokers to start copy trading.

FAQs

What Brokers Are Partnered With DupliTrade?

The company has around 12 broker partners that clients can choose from. They include major firms like AvaTrade and Pepperstone. Head to our full list of DupliTrade brokers to find the right provider for your financial goals.

What Is The Minimum Deposit At DupliTrade Brokers?

Clients must have a minimum deposit of $5000 or currency equivalent in their broker account. This is fairly high and more than the requirement at other copy trading platforms, such as ZuluTrade. Note, some DupliTrade brokers may have a lower minimum deposit to open a live account, but you will still need to meet the DupliTrade minimum to use the brand’s copy trading service.

Is DupliTrade A Scam?

DupliTrade is a legitimate company with good reviews. It is regulated by the Cyprus Securities and Exchange Commission (CySEC), which closely monitors the activities of licensed firms. Many of the best DupliTrade brokers are also licensed by reputable financial agencies.

How Does DupliTrade Work?

DupliTrade works with your MT4 account to automatically copy the strategies of the providers you have chosen. Clients must have an account with a partner broker to use the service. We have reviewed the top DupliTrade brokers.

How Many Strategy Providers Are Available At DupliTrade Brokers?

The company has around a dozen strategy providers. These experienced investors have all been carefully investigated and their performance tested. When you sign up with DupliTrade brokers you will be able to view the full trading history, including profit and loss, before you start automated copy trading.