Plexytrade Review 2026

Pros

- Despite lacking regulation, Plexytrade provides negative balance protection and reinforces safety protocols by holding client funds in segregated accounts.

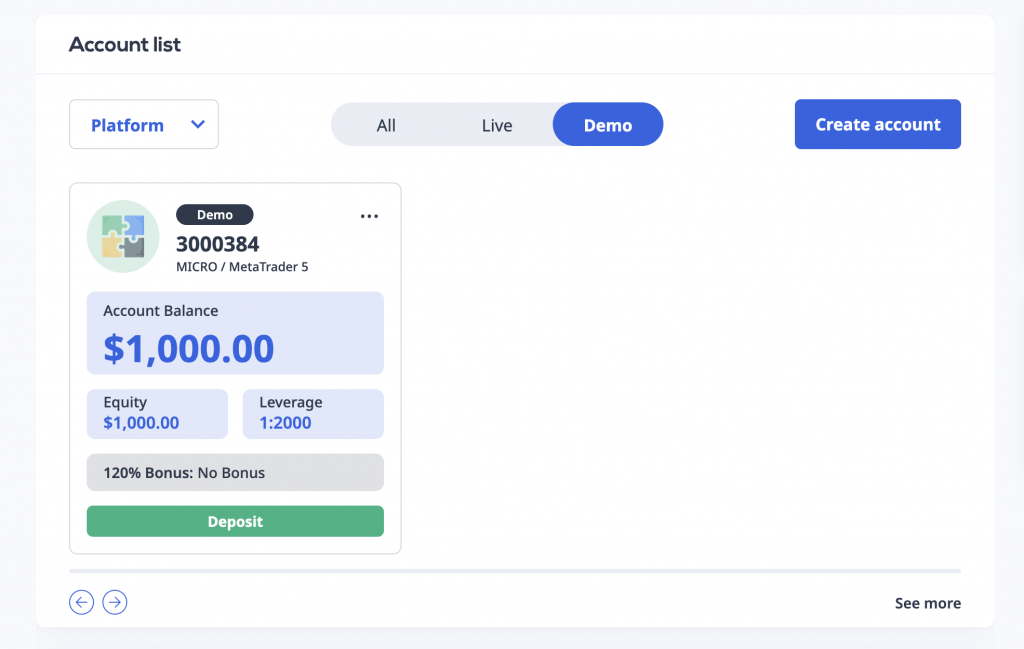

- Plexytrade offers among the highest leverage we’ve seen, up to 1:2000, catering to advanced traders willing to forego regulatory protections.

- US residents are accepted as clients, distinguishing Plexytrade as one of the rare offshore brokers that cater to US-based traders.

Cons

- There are no research and educational materials, falling short of alternatives like IG, while access to the economic calendar is restricted to clients with balances of $500.

- Plexytrade lacks regulation in major jurisdictions, significantly increasing the risks of opening an account and depositing funds.

- Deposits and withdrawals are exclusively facilitated through cryptocurrencies, as Plexytrade does not support bank cards, bank wire transfers, or e-wallets.

Plexytrade Review

This review of Plexytrade provides an in-depth analysis of the day trading journey, drawing from firsthand usage and comparisons with suitable alternatives extracted from our comprehensive database, comprising around 500 online brokers.

Regulation & Trust

With a short track record and weak regulatory credentials, Plexytrade trails the most trusted brokers.

Plexytrade’s registered address is in Rodney Bay, Saint Lucia, and they have a physical office located in Podgorica, Montenegro. Although their servers are reportedly in the UK, the broker operates without regulation, a significant factor to consider.

Trading with a regulated broker is paramount. Regulation ensures adherence to legal frameworks, safeguarding your funds and rights. Additionally, regulated brokers typically undergo regular audits and oversight, ensuring transparency and accountability.

And while Plexytrade claims to hold clients’ funds in segregated accounts and offers negative balance protection, its lack of regulation means it doesn’t provide public financial disclosures nor is it listed on a stock exchange, setting it apart from highly trusted brokers like Plus500 or IG.

Plexytrade

World Forex

Dukascopy

Regulation & Trust Rating

Regulators

SVGFSA

FINMA, JFSA, FCMC

Visit

Visit

Visit

Visit

Review

Review

Review

Review

Accounts & Banking

Live Accounts

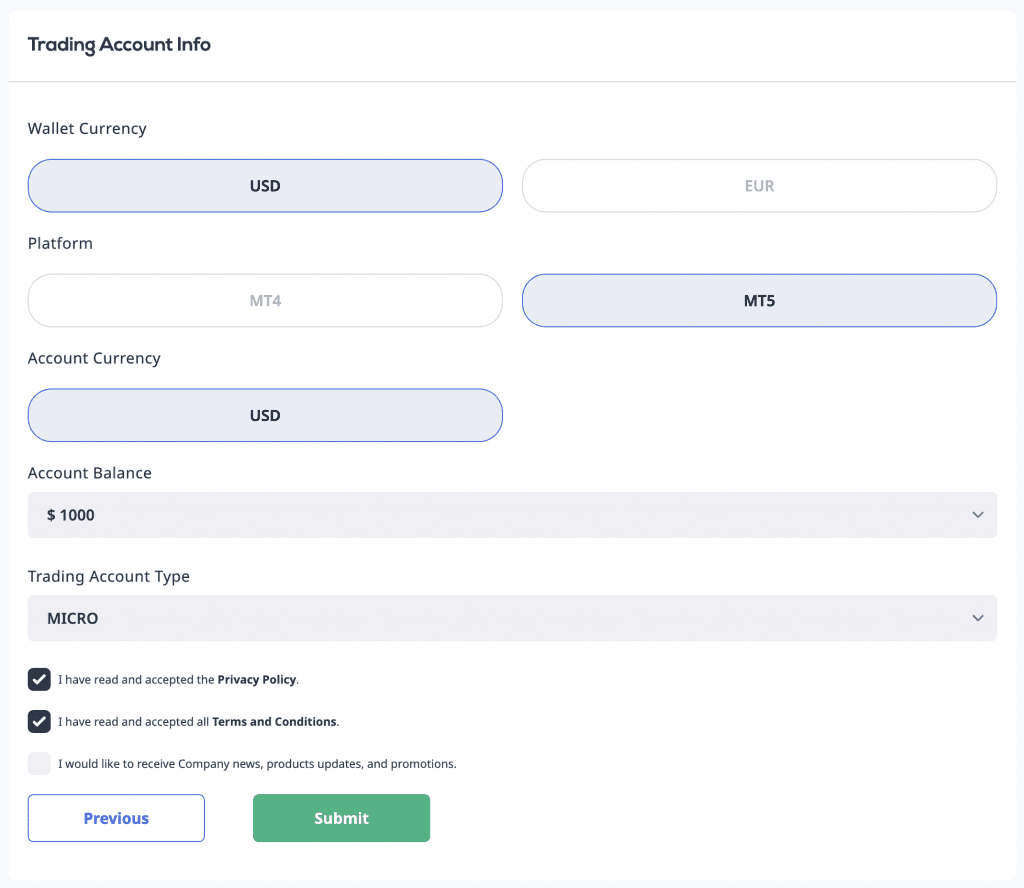

Plexytrade offers four account types. All accounts offer the same trading platform choice – MT4 and MT5 – but vary in their spreads, commissions and leverage.

- The Micro account is best suited to traders with small accounts. Available with a minimum deposit of just $50, this account offers the highest leverage available of 1:2000 with variable spreads from 0.7 pips, but a maximum lot size per order of 5. There’s no commission on this account, but this comes at the cost of a personal account manager.

- The Silver account is similar to the Micro account, but allows a maximum lot size per order of 50. However, the maximum leverage is reduced to 1:500 and the minimum deposit rises to $300.

- The Gold Raw account is the most appealing for scalpers and high-frequency traders because it offers zero spreads in exchange for a commission (per lot) of $2 ($4 round turn). Similar to Silver, the maximum leverage is 1:500 and the minimum deposit is increased to $300.

- The Platinum VIP account is similar to the Gold Raw account but offers a reduced commission (per lot) of $1 ($2 round turn). The maximum lot size per order is also increased to 80, there’s free yearly VPS included, and you get assigned a personal account manager. However, the maximum leverage is reduced to 1:400 and you need to fund your account with at least $10,000.

All accounts support EAs, scalping, hedging, and VPS hosting, and have a maximum stop-out level of 20%, which is a lot lower than regulated brokers which typically have more intrusive stop-out levels of around 50% to ‘protect’ client funds.

Regrettably, PAMM (Percentage Allocation Management Module) accounts, which enable money managers to supervise an unlimited number of accounts, are also presently not supported – although the website claims that they will be offered soon.

Islamic accounts are offered for eligible traders, however, for swap-free trading.

The account opening process at Plexytrade was problematic.I encountered an issue with the email authentication process and had to contact support. The broker resolved the issue by manually approving my email address, but the process frustratingly took around 48 hours to complete.

Demo Accounts

With Plexytrade’s demo account, you can test strategies without constraints right from the get-go, allowing you to build confidence in your strategies before putting real money on the line.

Demo accounts at Plexytrade don’t expire either, which is fantastic. However, they do get archived after a month of inactivity. This may pose an inconvenience for some traders. Swing traders, for example, may hold trades open for weeks, and having to create new accounts periodically could disrupt your flow.

Deposits & Withdrawals

Plexytrade’s payment options are limited compared to other brokers. They exclusively deal in cryptocurrencies like Bitcoin, Ethereum, Litecoin, Ripple, Cardano, and USDT.

While this may suit some traders, it can be a barrier for newcomers who aren’t familiar with crypto trading. For them, the absence of traditional methods like credit cards, bank wire transfers, or e-wallets may be a drawback.

On the plus side, processing times are near-instant and all fees/commissions are covered by Plexytrade, further helping to keep trading costs low.

The minimum deposit is also just $20/€20 using Confirmo and $30/€30 using crypto, which is ideal for those with small trading accounts.

One thing to note is that Plexytrade operates primarily in USD and EUR. When you deposit crypto, it’s automatically converted to one of these fiat currencies. Withdrawals follow the same route, returning funds to the same account and method used for funding.

Plexytrade

World Forex

Dukascopy

Accounts & Banking Rating

Payment Methods

Bitcoin Payments, Ethereum Payments

Bitcoin Payments, Credit Card, Debit Card, Mastercard, Visa, Volet, Wire Transfer

Bitcoin Payments, Credit Card, Debit Card, Ethereum Payments, Maestro, Mastercard, Neteller, Skrill, Visa, Wire Transfer

Minimum Deposit

$50

$1

$100

Visit

Visit

Visit

Visit

Review

Review

Review

Review

Assets & Markets

Plexytrade focuses on forex and CFD trading, omitting popular asset classes such as real stocks, ETFs, or options.

Its array of tradable products is also limited compared to most leading brokers, encompassing just 41 currency pairs along with CFDs in precious metals, commodities, indices, stocks, and cryptocurrencies.

By comparison, CMC Markets offers over 300 forex pairs and more than 10,000 instruments in total, while IG has over 100 currency pairs and more than 17,000 instruments in total.

Ultimately, Plexytrade presents a modest selection, encompassing 15 indices (such as the S&P 500, Nasdaq-100, and Dow Jones), 48 US stocks (including Apple, Alibaba, Tesla), 3 commodities (Brent oil, crude oil, natural gas), and 4 metals (gold, silver, palladium, platinum).

You can also capitalize on the inherent volatility of the cryptocurrency market by trading 5 popular cryptocurrencies with leverage (Bitcoin, Ethereum, Litecoin, Solana, Ripple).

The benefit of engaging in CFDs lies in the capacity for leverage trading, enabling you to speculate on price fluctuations without possessing the underlying asset.

Plexytrade lacks passive income avenues, such as earning interest on idle account balances. This sets it apart from competitors like eToro, which provides returns of up to 5.3% on cash balances.

There is also no copy trading, which may be a consideration for passive investors.

Plexytrade

World Forex

Dukascopy

Assets & Markets Rating

Trading Instruments

CFDs, Forex, Indices, Stocks, Commodities, Crypto

Digital Contracts, Forex, CFD Stocks, Metals, Energies, Cryptos

CFDs, Forex, Stocks, Indices, Commodities, Crypto, Bonds, Binary Options

Margin Trading

Yes

Yes

Yes

Leverage

1:2000

1:1000

1:200

Visit

Visit

Visit

Visit

Review

Review

Review

Review

Fees & Costs

Plexytrade emerges as a favorable choice when it comes to pricing, offering tight spreads and competitive fees.

It’s worth mentioning that the spreads vary depending on the type of account you have. For major currency pairs like EUR/USD and USD/JPY, spreads can start as low as 0.0 pips with the Gold Raw account. This comes with a commission of $2 per lot ($4 round turn).

Opting for the Platinum VIP account further reduces the commission to $1 per lot ($2 round turn).

One standout feature of Plexytrade is its absence of deposit or withdrawal fees. Moreover, the platform covers crypto conversion fees during both the deposit and withdrawal process. Additionally, there are no commissions on stocks, metals, and indices.

To sweeten the deal, Plexytrade offers a generous 120% cash welcome bonus, applicable to up to three trading accounts per client. However, there are conditions to meet, such as a minimum deposit of $200 and a minimum trading volume requirement (100,000 units round turn on forex and metals).

This bonus can provide a significant boost to your trading capital, but it’s essential to adhere to the specified terms and conditions.

| Plexytrade | World Forex | Dukascopy | |

|---|---|---|---|

| Fees & Costs Rating | |||

| EUR/USD Spread | 0.7 | From 0.6 | 0.1 |

| FTSE Spread | 0.8 | NA | 100 |

| Oil Spread | 5 | NA | 0.1 |

| Stock Spread | 5 | From 0.03 | 0.1 |

| Visit | Visit | Visit | Visit |

| Review | Review | Review | Review |

Platforms & Tools

Plexytrade doesn’t have its own proprietary platform, which might raise concerns, especially for those new to trading. However, they make up for this by offering support for two widely recognized third-party platforms: MetaTrader 4 (MT4) and MetaTrader 5 (MT5).

Both MT4 and MT5 can be easily accessed across various devices, whether it’s desktop or mobile, and they can even be run directly in web browsers.

For beginners, MT4 is the preferred choice due to its simplicity and extensive range of technical indicators and tools. It’s a user-friendly platform, though its asset selection is somewhat limited to forex and CFDs.

On the other hand, MT5 offers a more comprehensive set of features, supporting a broader range of assets including stocks and cryptocurrencies. It’s equipped with faster processing speeds and advanced backtesting capabilities. However, its interface may be slightly more complex for beginners, and its scripting language differs from that of MT4.

The ideal platform depends on your experience level and trading preferences. If you’re new to forex, MT4 provides a solid foundation, while MT5 caters to seasoned traders seeking a wider array of assets and advanced tools.

Unfortunately, Plexytrade doesn’t support other popular charting platforms like TradingView and cTrader, which will be a downside for day traders who prefer these tools.

Plexytrade

World Forex

Dukascopy

Platforms & Tools Rating

Platforms

MT4, MT5

MT4, MT5

JForex, MT4, MT5

Mobile App

iOS & Android

iOS & Android via mobile web trader

iOS & Android

Visit

Visit

Visit

Visit

Review

Review

Review

Review

Research

While many brokers, such as IG, license top-notch research from providers like Trading Central or Autochartist when they lack the resources to produce their own content, Plexytrade does not.

In fact, apart from a basic economic calendar accessible only after reaching a $500 deposit threshold, Plexytrade lacks essential research tools like blogs, technical and fundamental forecasts, or market sentiment indicators.

This absence will make it challenging for traders to make well-informed trading decisions, especially without the aid of these valuable resources.

| Plexytrade | World Forex | Dukascopy | |

|---|---|---|---|

| Research Rating | |||

| Visit | Visit | Visit | Visit |

| Review | Review | Review | Review |

Education

Plexytrade falls short by not offering any educational resources. As a result, new traders will be better served by platforms like eToro, which offers superb education for beginners.

Although there’s a ‘Coming Soon’ announcement in the Education section of the Plexytrade website, indicating the potential development of trading tutorials, webinars, and educational resources tailored for novice traders, it remains to be seen when these resources will be available.

| Plexytrade | World Forex | Dukascopy | |

|---|---|---|---|

| Education Rating | |||

| Visit | Visit | Visit | Visit |

| Review | Review | Review | Review |

Customer Support

In our thorough testing of Plexytrade, we found various areas that could use enhancement, and customer support stood out as a vital component needing attention.

Plexytrade offers a range of support options available around the clock, five days a week, including live chat, email, and a global telephone support hotline. However, there are limitations, such as the absence of multilingual assistance or a localized phone number. This means that in case of urgent assistance, you would need to contact the broker’s office in Montenegro.

I also encountered difficulties setting up my demo account. Although the live chat support team responded promptly and proved helpful with most of my inquiries, they were unable to address my account approval/authentication issues, requiring me to reach out via email.

Unfortunately, the response time for email support was approximately two days, which is very frustrating. Nevertheless, the issue was eventually resolved.

Plexytrade

World Forex

Dukascopy

Customer Support Rating

Visit

Visit

Visit

Visit

Review

Review

Review

Review

Should You Trade Plexytrade?

While trading fees are low and leverage options are high, Plexytrade leaves us wanting in terms of the range of financial instruments, regulatory compliance, the complete lack of research and educational materials, and the limited choice of trading platforms.

Overall, Plexytrade is best suited to active traders looking for tight spreads and high leverage. It is not really suitable for new traders.

FAQ

Is Plexytrade Legit Or A Scam?

Plexytrade is a new company. Their registered address is in Rodney Bay, Saint Lucia, but it has a physical office in Podgorica, Montenegro. They are unregulated and therefore offer incredibly high leverage to attract traders.

And as the broker is new, there is very little research a trader can undergo to assess their reputation. At this time, we advise traders to be very careful.

Is Plexytrade A Regulated Broker?

Plexytrade is not a regulated broker in any global jurisdiction. If regulation is important to you (and it should be), it’s best to look elsewhere.

Regulated brokers are typically overseen by reputable financial authorities, which helps ensure they adhere to strict financial standards and protect clients’ interests.

Is Plexytrade Suitable For Beginners?

Plexytrade is not the optimal selection for beginner traders due to its absence of a proprietary trading platform, limited educational and research resources, and reliance on cryptocurrencies to fund accounts.

It primarily serves experienced traders who value low trading expenses and require compatibility with their preferred third-party charting tools.

For new traders, platforms such as eToro may present a more fitting alternative.

Does Plexytrade Offer Low Fees?

Fees remain competitive for both forex and CFD trading with Plexytrade. The broker frequently implements minimal spreads, such as 0.0 pips on major currency pairs.

Additionally, Plexytrade provides commission-based pricing alternatives, allowing traders to choose the fee structure that best suits their trading preferences.

Is Plexytrade A Good Broker For Day Trading?

Plexytrade is a suitable broker for day trading due to its competitive pricing, swift execution speeds, and support for scalping and hedging strategies.

MT4 and MT5 are both advanced trading platforms, each equipped with robust charting tools, technical indicators, and order types tailored for executing day trading strategies.

Best Alternatives to Plexytrade

Compare Plexytrade with the best similar brokers that accept traders from your location.

- World Forex – World Forex is an offshore broker registered in St Vincent and the Grenadines, offering commission-free trading with a $1 minimum deposit and 1:1000 leverage. Digital contracts are also available, offering beginners a straightforward way to speculate on popular financial markets.

- Dukascopy – Established in 2004, Dukascopy Bank SA is a Swiss online bank and brokerage providing short-term trading opportunities on 1,200+ instruments, including binaries. A choice of accounts (JForex, MT4/5, Binary Options) and sophisticated platforms (JForex, MT4/MT5) deliver powerful tools and market data for active traders.

Plexytrade Comparison Table

| Plexytrade | World Forex | Dukascopy | |

|---|---|---|---|

| Rating | 3.5 | 4 | 3.6 |

| Markets | CFDs, Forex, Indices, Stocks, Commodities, Crypto | Digital Contracts, Forex, CFD Stocks, Metals, Energies, Cryptos | CFDs, Forex, Stocks, Indices, Commodities, Crypto, Bonds, Binary Options |

| Demo Account | Yes | Yes | Yes |

| Minimum Deposit | $50 | $1 | $100 |

| Minimum Trade | 0.01 | $1 (Binaries), 0.01 Lots (Forex/CFDs) | $1 (Binaries), 0.01 Lots (Forex/CFD) |

| Regulators | – | SVGFSA | FINMA, JFSA, FCMC |

| Bonus | 120% Cash Welcome Bonus | 100% Deposit Bonus | 100% Anniversary Bonus |

| Platforms | MT4, MT5 | MT4, MT5 | JForex, MT4, MT5 |

| Leverage | 1:2000 | 1:1000 | 1:200 |

| Payment Methods | 2 | 7 | 10 |

| Visit | Visit | Visit | Visit |

| Review | – | World Forex Review |

Dukascopy Review |

Compare Trading Instruments

Compare the markets and instruments offered by Plexytrade and its competitors. Please note, some markets may only be available via CFDs or other derivatives.

| Plexytrade | World Forex | Dukascopy | |

|---|---|---|---|

| CFD | Yes | Yes | Yes |

| Forex | Yes | Yes | Yes |

| Stocks | Yes | Yes | Yes |

| Commodities | Yes | Yes | Yes |

| Oil | Yes | Yes | Yes |

| Gold | Yes | Yes | Yes |

| Copper | No | No | Yes |

| Silver | Yes | Yes | Yes |

| Corn | No | No | No |

| Crypto | Yes | Yes | Yes |

| Futures | No | No | No |

| Options | No | No | No |

| ETFs | No | No | Yes |

| Bonds | No | No | Yes |

| Warrants | No | No | No |

| Spreadbetting | No | No | No |

| Volatility Index | No | No | Yes |

Plexytrade vs Other Brokers

Compare Plexytrade with any other broker by selecting the other broker below.

Customer Reviews

3 / 5This average customer rating is based on 1 Plexytrade customer reviews submitted by our visitors.

If you have traded with Plexytrade we would really like to know about your experience - please submit your own review. Thank you.

Submit Your Own Review of Plexytrade

Article Sources

The writing and editorial team at DayTrading.com use credible sources to support their work. These include government agencies, white papers, research institutes, and engagement with industry professionals. Content is written free from bias and is fact-checked where appropriate. Learn more about why you can trust DayTrading.com

So getting started with Plexytrade was a bit of a nightmare. You have to set up two-factor authentication, explain where you found them and tick what feels like hundreds of terms and conditions. Then I couldn’t find the server name to get into TradeLocker, though thankfuly the live chat guys gave me that pretty quickly. Once you get going though they’re a pretty reliable broker for day trading CFDs. You’ll notice spreads aren’t great during market opens but the TV package is familiar and easy to use. They’re also pretty good at adding new features like I way prefer that you can now change your stop loss or take profit to your entry price with one click.